Professional Documents

Culture Documents

Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV

Uploaded by

ignaciomannyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV

Uploaded by

ignaciomannyCopyright:

Available Formats

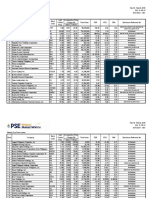

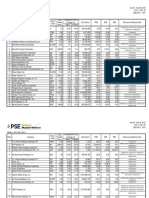

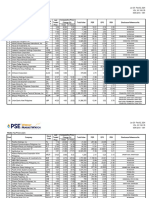

Jul 22 - Jul 26, 2019

VOL. VI NO. 30

ISSN 2013 - 1351

Weekly Top Price Gainers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Italpinas Development Corporation IDC 6.62 19.71 36.21 122,794,831 16.95 0.39 3.98 No Disclosure

2 Philippine Seven Corporation SEVN 160.00 11.11 17.65 8,851,340 83.27 1.92 16.84 CR04935-2019, CR04916-2019

3 Pryce Corporation PPC 5.47 8.53 7.47 5,002,848 8.42 0.65 1.38 C05128-2019, C05105-2019

4 Mabuhay Holdings Corporation MHC 0.70 7.69 6.06 27,841,680 (1.47) (0.48) 1.85 No Disclosure

5 Seafront Resources Corporation SPM 2.69 7.60 13.03 34,860 61.61 0.04 0.98 No Disclosure

6 AyalaLand Logistics Holdings Corp. ALLHC 4.26 6.23 11.81 275,727,700 48.63 0.09 2.85 C05140-2019, C05078-2019

7 National Reinsurance Corporation of the Philippines NRCP 1.15 5.50 18.56 7,606,800 8.56 0.13 0.47 No Disclosure

8 GT Capital Holdings, Inc. GTCAP 969.00 5.33 11.33 714,868,825 15.96 60.73 1.29 No Disclosure

9 Wilcon Depot, Inc. WLCON 15.94 5.28 (5.12) 538,963,848 34.22 0.47 4.99 No Disclosure

10 AbaCore Capital Holdings, Inc. ABA 1.04 5.05 (0.95) 151,451,130 1.00 1.04 0.40 C05206-2019

11 Asiabest Group International Inc. ABG 17.10 5.04 24.45 29,036,628 (2,199.94) (0.01) 19.23 No Disclosure

12 Sta. Lucia Land, Inc. SLI 2.12 4.95 8.72 17,370,960 15.26 0.14 1.18 No Disclosure

13 Imperial Resources, Inc. IMP 1.94 4.86 1.04 64,460 5.56 0.35 1.59 No Disclosure

14 Rockwell Land Corporation ROCK 2.42 4.76 8.52 12,643,870 5.40 0.45 0.76 No Disclosure

15 Anchor Land Holdings, Inc. ALHI 11.34 4.23 3.09 331,798 16.13 0.70 1.58 No Disclosure

15 Concrete Aggregates Corporation "A" CA 81.40 4.23 (38.93) 3,957,620 65.03 1.25 7.79 No Disclosure

CR04929-2019, CR04928-2019,

17 Roxas and Company, Inc. RCI 1.54 4.05 12.41 25,625,690 15.90 0.10 0.40 C05188-2019, C05121-2019

18 Rizal Commercial Banking Corporation RCB 28.50 4.01 1.42 16,379,005 12.28 2.32 0.66 C05104-2019, C05107-2019, C05113-2019

19 ABS-CBN Corporation ABS 18.50 3.70 7.68 53,473,217 6.34 2.92 0.44 No Disclosure

20 Ayala Corporation AC 983.00 3.47 9.96 2,534,976,735 19.16 51.31 2.02 C05181-2019, C05204-2019

21 Universal Robina Corporation URC 171.00 3.01 3.01 703,122,191 40.57 4.22 4.73 No Disclosure

22 Robinsons Land Corporation RLC 28.00 2.94 6.26 664,852,395 17.10 1.64 1.52 CR04872-2019

23 D.M. Wenceslao & Associates, Incorporated DMW 10.20 2.41 4.62 29,036,180 17.74 0.57 1.86 No Disclosure

24 Republic Glass Holdings Corporation REG 3.00 2.39 6.76 1,824,250 64.79 0.05 1.16 No Disclosure

C05072-2019, CR04893-2019,

25 Philippine Infradev Holdings Inc. IRC 1.76 2.33 (5.38) 53,907,250 3.60 0.49 1.70 CR04894-2019, CR04903-2019

26 F & J Prince Holdings Corporation "A" FJP 4.00 2.30 (10.71) 400,000 59.94 0.07 1.03 CR04919-2019

27 Cemex Holdings Philippines, Inc. CHP 2.80 2.19 (4.11) 102,125,450 (17.52) (0.16) 0.50 C05161-2019, CR04924-2019, C05205-2019

28 First Gen Corporation FGEN 26.90 2.09 0.37 288,580,665 7.10 3.79 0.95 C05067-2019, C05127-2019, C05186-2019

29 SM Investments Corporation SM 1,010.00 2.02 4.23 1,420,310,660 30.96 32.63 3.30 C05139-2019

C05111-2019, C05112-2019,

30 Centro Escolar University CEU 7.14 2.00 2.29 1,647,908 16.67 0.43 0.83 C05124-2019, C05125-2019

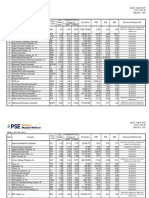

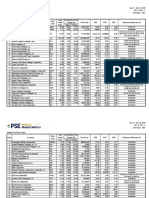

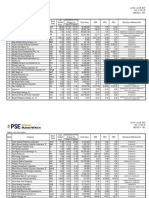

Jul 22 - Jul 26, 2019

VOL. VI NO. 30

ISSN 2013 - 1351

Weekly Top Price Losers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Prime Media Holdings, Inc. PRIM 1.42 (13.41) 4.41 24,744,740 (40.98) (0.03) (7.00) No Disclosure

2 Philippine Racing Club, Inc. PRC 8.23 (13.28) (8.56) 823 6.49 1.27 1.15 No Disclosure

3 Jollibee Foods Corporation JFC 252.00 (9.94) (10.57) 5,706,753,370 34.17 7.38 5.47 C05148-2019, CR04918-2019

CR04900-2019, C05135-2019, C05134-2019,

4 PHINMA Petroleum and Geothermal, Inc. PPG 5.49 (9.85) 16.81 107,138,478 (22.04) (0.25) 16.23 C05136-2019, C05137-2019, C05142-2019,

C05159-2019, C05168-2019

5 MRC Allied, Inc. MRC 0.335 (9.46) (1.47) 34,475,700 (50.04) (0.01) 5.97 No Disclosure

6 PTFC Redevelopment Corporation TFC 45.00 (9.09) (8.16) 22,500 19.94 2.26 4.52 No Disclosure

7 Vulcan Industrial & Mining Corporation VUL 1.26 (8.70) (17.11) 27,662,150 (2.15) (0.59) 7,454.16 No Disclosure

8 Chemical Industries of the Philippines, Inc. CIP 106.00 (8.30) (6.85) 74,756 (69.26) (1.53) 1.30 No Disclosure

9 Philex Mining Corporation PX 3.44 (8.27) (4.44) 10,350,680 33.18 0.10 0.71 C05172-2019

10 Marcventures Holdings, Inc. MARC 1.12 (8.20) 7.69 4,870,020 (8.57) (0.13) 0.89 CR04879-2019

11 Premiere Horizon Alliance Corporation PHA 0.79 (8.14) (4.82) 122,655,650 (5.63) (0.14) 6.41 C05062-2019

12 STI Education Systems Holdings, Inc. STI 0.74 (7.50) - 14,266,520 19.32 0.04 0.84 CR04889-2019, C05156-2019

13 Manila Bulletin Publishing Corporation MB 0.51 (7.27) (1.92) 994,300 96.93 0.01 0.49 No Disclosure

14 Alliance Select Foods International, Inc. FOOD 0.77 (7.23) (8.33) 4,665,860 28.03 0.03 0.95 No Disclosure

15 APC Group, Inc. APC 0.52 (7.14) 4.00 12,316,830 (357.71) (0.001) 22.38 No Disclosure

16 Lodestar Investment Holdings Corporation LIHC 0.485 (6.73) (3.00) 506,405 (6,087.97) (0.0001) 6.05 No Disclosure

17 Greenergy Holdings Incorporated GREEN 2.22 (6.72) (12.60) 61,075,670 1.63 1.36 1.15 CR04931-2019

18 Now Corporation NOW 2.53 (6.64) - 51,885,050 769.22 0.003 2.74 C05210-2019

19 Cirtek Holdings Philippines Corporation TECH 16.40 (6.61) (14.94) 44,742,226 20.47 0.80 0.93 No Disclosure

20 Global Ferronickel Holdings, Inc. FNI 1.45 (6.45) (3.33) 26,274,660 14.84 0.10 1.28 CR04926-2019

21 Euro-Med Laboratories Phil., Inc. EURO 1.60 (6.43) (8.57) 36,220 17.46 0.09 1.23 No Disclosure

22 Pepsi-Cola Products Philippines, Inc. PIP 1.67 (6.18) (8.24) 34,000,370 525.52 0.003 0.67 CR04897-2019

23 SSI Group, Inc. SSI 3.20 (6.16) (7.25) 86,604,850 16.38 0.20 0.96 No Disclosure

24 International Container Terminal Services, Inc. ICT 133.00 (6.07) (9.15) 833,398,348 20.24 6.57 2.79 C05083-2019

25 Philippine Estates Corporation PHES 0.480 (5.88) 4.35 3,405,690 49.31 0.01 0.64 No Disclosure

26 Waterfront Philippines, Inc. WPI 0.81 (5.81) 8.00 31,152,210 37.79 0.02 0.38 No Disclosure

27 Nickel Asia Corporation NIKL 2.55 (5.56) 13.33 142,122,110 12.92 0.20 1.17 No Disclosure

28 Oriental Peninsula Resources Group, Inc. ORE 0.86 (5.49) (2.27) 2,708,860 (6.15) (0.14) 0.38 No Disclosure

29 Xurpas Inc. X 1.04 (5.45) (10.34) 25,760,100 (2.56) (0.41) 0.74 No Disclosure

30 ISM Communications Corporation ISM 5.45 (5.38) (21.24) 138,363,856 (379.15) (0.01) 3.47 No Disclosure

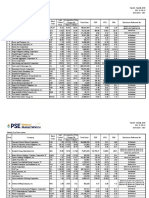

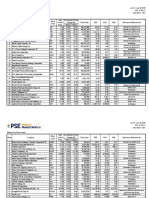

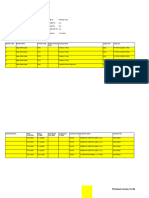

Jul 22 - Jul 26, 2019

VOL. VI NO. 30

ISSN 2013 - 1351

Weekly Market Statistics

(In pesos) July 15 - July 19 July 22 - July 26 Year-to-Date

Total Market Capitalization 17,683,574,250,866.10 17,493,460,474,050.30 17,493,460,474,050.30

Domestic Market Capitalization 15,033,592,834,112.30 14,872,131,377,061.30 14,872,131,377,061.30

Total Value Traded 36,652,687,728.32 33,322,324,826.44 1,062,163,457,285.10

Ave. Daily Value Traded 7,330,537,545.66 6,664,464,965.29 7,641,463,721.48

Foreign Buying 19,867,504,148.53 17,883,546,198.45 602,203,991,982.49

Foreign Selling 15,949,334,711.74 17,901,485,655.06 577,361,136,712.59

Net Foreign Buying/ (Selling) 3,918,169,436.78 (17,939,456.61) 24,842,855,269.91

% of Foreign to Total 49% 54% 56%

Number of Issues (Common shares):

142 - 71 - 34 64 - 158 - 23 146 - 109 - 2

Gainers - Losers - Unchanged

Weekly Index Performance

Comparative Change (%) YTD Change

Close PER

1 Week 4 Weeks (%)

PSEi 8,183.99 (1.04) 2.30 9.62 18.88

All Shares Index 4,955.60 (1.10) 1.26 9.69 15.44

Financials Index 1,848.49 (1.53) 7.47 3.86 14.29

Industrial Index 11,467.74 (2.02) (2.00) 4.72 17.12

Holding Firms Index 7,999.12 0.71 3.84 8.95 17.21

Property Index 4,347.09 (1.73) 1.72 19.82 20.32

Services Index 1,651.90 (1.77) (3.47) 14.50 17.77

Mining and Oil Index 7,870.97 (3.14) 3.69 (4.02) 14.20

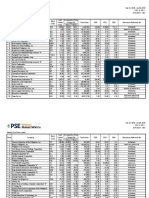

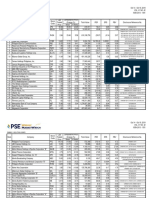

Notes:

- Top price gainers and losers only cover common shares.

- EPS (Earnings per Share) is computed as: Net Income

Outstanding Shares

PER (Price-Earnings Ratio) is computed as: Last Traded Price per Share

Earnings per Share

PBV (Price to Book Value Ratio) is computed as: Company Market Capitalization

Company Stockholders Equity (end of period)

EPS, PER and PBV use four-quarter trailing financial data.

- Total Value in Top Gainers and Losers tables refers to total value traded in the regular market.

- The disclosures cover those made from 3:31 pm, Friday of the previous week to 3:30 pm, Friday of the covered week. Information and disclosures made by the companies, as itemized in this report, may

be viewed by clicking on the links above. These may also be viewed in the “Disclosure” page of the company at the PSE website (www.pse.com.ph). To access the disclosure page, enter the stock symbol in

the symbol lookup field located at the upper right portion of the PSE website. The public is encouraged to regularly monitor subsequent developments as may be disclosed by the company in succeeding

weeks.

- Current week’s foreign transactions data are subject to amendments allowed until t+2. Previous week’s foreign transactions data have been adjusted accordingly for amendments.

- Domestic Market capitalization excludes the market capitalization of foreign domiciled companies.

The data contained in this file is collated by the Corporate Planning & Research Department of the Philippine Stock Exchange. The PSE does not make any representations or warranties, express or implied, on matters such as, but not limited to, the accuracy, timeliness, completeness, non-infringement, validity, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE

assumes no liability and responsibility for any loss or damage suffered as a consequence of any errors or omissions in this file, or any decision made or action taken in reliance upon information contained herein. This document is for information purposes only, and does not constitute legal, financial or investment advice, nor intended to influence investment decisions. Independent assessment should be undertaken, and

advice from a securities professional is strongly recommended. For inquiries or suggestions on the PSE Weekly MarketWatch, you may call (632) 688-7601 to 02, send a message through fax no. (632) 688-8818 or email pirs@pse.com.ph.

You might also like

- Becoming Market SmithDocument82 pagesBecoming Market SmithTu D.No ratings yet

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- Automobile IndustryDocument7 pagesAutomobile IndustryAniket VermaNo ratings yet

- UTIMCO Feb2023Document36 pagesUTIMCO Feb2023Manish Singh100% (3)

- Understanding the P/E RatioDocument8 pagesUnderstanding the P/E RatioVaidyanathan RavichandranNo ratings yet

- GMO Capital Q3 2013 Letter To InvestorsDocument15 pagesGMO Capital Q3 2013 Letter To InvestorsWall Street WanderlustNo ratings yet

- Powerinvesting: Trading Your Way To Financial FreedomDocument42 pagesPowerinvesting: Trading Your Way To Financial FreedomIvelisse Santana100% (2)

- REIT Plan - FinalDocument1,701 pagesREIT Plan - FinalChristian John RojoNo ratings yet

- Equity ValuationDocument46 pagesEquity ValuationShayne Simora100% (3)

- A PROJECT REPORT On Equity Analysis IT SectorDocument75 pagesA PROJECT REPORT On Equity Analysis IT SectorRobin Awathare57% (7)

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Philippine Stock Price Gainers and LosersDocument3 pagesWeekly Philippine Stock Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Philippine stock market price gainers and losersDocument5 pagesWeekly Philippine stock market price gainers and losersignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers and Losers in the PhilippinesDocument3 pagesWeekly Top Price Gainers and Losers in the PhilippinesignaciomannyNo ratings yet

- WEEKLY PRICE MOVERSDocument3 pagesWEEKLY PRICE MOVERScraftersxNo ratings yet

- wk05 Jan2024mktwatchDocument3 pageswk05 Jan2024mktwatchMacxie Baldonado QuibuyenNo ratings yet

- WEEKLY TOP MOVERSDocument3 pagesWEEKLY TOP MOVERScraftersxNo ratings yet

- QuarterlyTop50 4Q 2009Document5 pagesQuarterlyTop50 4Q 2009Franz Carla NavarroNo ratings yet

- QuarterlyTop50 1Q 2008Document5 pagesQuarterlyTop50 1Q 2008Franz Carla NavarroNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Nylinad Calubayan EstrellaNo ratings yet

- Investment GuideDocument2 pagesInvestment Guidegundam busterNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxNo ratings yet

- U.S. Dividend Champions: End-Of-Month Update atDocument26 pagesU.S. Dividend Champions: End-Of-Month Update atALFONSO ARREOLANo ratings yet

- Industry Peer 2016Document13 pagesIndustry Peer 2016cherylmanapolNo ratings yet

- 2019 11 20 PH D PDFDocument5 pages2019 11 20 PH D PDFJNo ratings yet

- RCBDocument26 pagesRCBbsu.gurlsNo ratings yet

- Lab 110609Document6 pagesLab 110609Andre SetiawanNo ratings yet

- Fund Performance ActiveDocument12 pagesFund Performance ActiveFortuneNo ratings yet

- Fundcard: Franklin India Smaller Companies FundDocument4 pagesFundcard: Franklin India Smaller Companies FundChiman RaoNo ratings yet

- CFD - November 5th 2009Document3 pagesCFD - November 5th 2009Andre SetiawanNo ratings yet

- U S DividendchampionsDocument196 pagesU S DividendchampionsRobert RippeyNo ratings yet

- Ark Next Generation Internet Etf Arkw HoldingsDocument2 pagesArk Next Generation Internet Etf Arkw HoldingsCheah ChenNo ratings yet

- Anglo American PLCDocument12 pagesAnglo American PLCSiegmund LorenzNo ratings yet

- Investment GuideDocument2 pagesInvestment GuideJustGentleNo ratings yet

- Gross To Net RI Report - 01182024 080036Document6 pagesGross To Net RI Report - 01182024 080036abineshabi0123No ratings yet

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)AlexHunterNo ratings yet

- CFD - November 6th 2009Document3 pagesCFD - November 6th 2009Andre SetiawanNo ratings yet

- Banks and Financials: As Of: 2/2/2018Document2 pagesBanks and Financials: As Of: 2/2/2018JanNo ratings yet

- Investment GuideDocument2 pagesInvestment GuideMiecoMoralesNo ratings yet

- InvestmentGuide PDFDocument2 pagesInvestmentGuide PDFMon CuiNo ratings yet

- Top Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupDocument4 pagesTop Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupkristineNo ratings yet

- India's most valuable companies ranked by average market capitalisationDocument15 pagesIndia's most valuable companies ranked by average market capitalisationHarsh DabasNo ratings yet

- February 16-17, 2011 - UpdateDocument2 pagesFebruary 16-17, 2011 - UpdateJC CalaycayNo ratings yet

- CFD - October 30th 2009Document3 pagesCFD - October 30th 2009Andre SetiawanNo ratings yet

- 10.05.22 ArkkDocument2 pages10.05.22 ArkkSalih GurdalNo ratings yet

- Nifty 50Document3 pagesNifty 50Arjun BhatnagarNo ratings yet

- Stocks AC ALI BDO: ValuationsDocument15 pagesStocks AC ALI BDO: ValuationsRicarr ChiongNo ratings yet

- QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODEDocument73 pagesQUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODEignaciomannyNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- CNVRG Performance PlummetsDocument7 pagesCNVRG Performance PlummetsignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- Power sector pairs trading: AP favored over FGENDocument6 pagesPower sector pairs trading: AP favored over FGENignaciomannyNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- Weekly Philippine stock market price gainers and losersDocument5 pagesWeekly Philippine stock market price gainers and losersignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- Top Gainer 02.18.2017Document3 pagesTop Gainer 02.18.2017ignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers and Losers in the PhilippinesDocument3 pagesWeekly Top Price Gainers and Losers in the PhilippinesignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Final ReportDocument90 pagesFinal ReportSaad QayyumNo ratings yet

- READING 9 Relative (Market) Based Equity ValuationDocument52 pagesREADING 9 Relative (Market) Based Equity ValuationDandyNo ratings yet

- Equity Analysis of SBI Bank-1Document69 pagesEquity Analysis of SBI Bank-1mustafe ABDULLAHINo ratings yet

- Financial Markets Tutorial and Self Study Questions All TopicsDocument17 pagesFinancial Markets Tutorial and Self Study Questions All TopicsTan Nguyen100% (1)

- Investments An Introduction 12Th Edition Mayo Test Bank Full Chapter PDFDocument31 pagesInvestments An Introduction 12Th Edition Mayo Test Bank Full Chapter PDFninhletitiaqt3100% (10)

- The 2020 Story: Ceramic TilesDocument44 pagesThe 2020 Story: Ceramic TilesArchit SarafNo ratings yet

- Tutorial - Week 11 - Slide QuestionsDocument14 pagesTutorial - Week 11 - Slide QuestionsJared HerberNo ratings yet

- Forecasting FCFF & FCFEDocument26 pagesForecasting FCFF & FCFEAstrid TanNo ratings yet

- Mergers and AcquisitionsDocument4 pagesMergers and AcquisitionsAmbrish (gYpr.in)No ratings yet

- CMS Info Systems IPO detailsDocument8 pagesCMS Info Systems IPO detailsPanktiNo ratings yet

- Unit 4: Relative ValuationDocument47 pagesUnit 4: Relative ValuationMadhvendra BhardwajNo ratings yet

- Problem Set 1Document5 pagesProblem Set 1PaulNo ratings yet

- Berger Paints BangladeshDocument16 pagesBerger Paints BangladeshAyman Rahman Arghyo50% (2)

- Gurufocus User Manual: All-In-One Guru ScreenerDocument33 pagesGurufocus User Manual: All-In-One Guru ScreenerAliNo ratings yet

- Fu Wang Ceramic Debt Management RatioDocument4 pagesFu Wang Ceramic Debt Management RatioMd Abil KhanNo ratings yet

- Mohd Yousuf Project ReportDocument83 pagesMohd Yousuf Project ReportKaran Veer SinghNo ratings yet

- 14th Annual Wealth Creation Study Motilal OswalDocument59 pages14th Annual Wealth Creation Study Motilal Oswalsankap11100% (1)

- Workshop Equity Securities STAFFDocument42 pagesWorkshop Equity Securities STAFFIshan MalakarNo ratings yet

- Phân Tích Tài Chính Pepsi Vs Coca-ColaDocument49 pagesPhân Tích Tài Chính Pepsi Vs Coca-ColaLập PhanNo ratings yet

- Module - Financial Statement AnalysisDocument3 pagesModule - Financial Statement AnalysisCATHERINE FRANCE LALUCISNo ratings yet

- Black Book - Mohsin - A Study On Equity Analysis - Finance and Banking SectorDocument69 pagesBlack Book - Mohsin - A Study On Equity Analysis - Finance and Banking SectorMohammed Mohsin ShaikhNo ratings yet

- Kuliah 12 Analisis Ekuitas Dan PenilaianDocument38 pagesKuliah 12 Analisis Ekuitas Dan PenilaianElsha FitriNo ratings yet