Professional Documents

Culture Documents

Ac412 Test 2 - Marking Scheme

Uploaded by

Ferdnance Chekai0 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

AC412_TEST_2_-_MARKING_SCHEME

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesAc412 Test 2 - Marking Scheme

Uploaded by

Ferdnance ChekaiCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

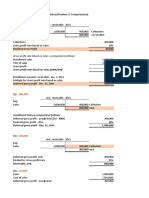

AC412 INCLASS TEST 2 – MARKING SCHEME

GUNHILL HOUSE- 2013 mark

Gross capital amount 250 000 1

Less: Cost of house (200 000) 1

Inflation allowance (200 000 x 2.5% x 5yrs) (25 000) 1

Potential capital gain 25 000 1

Less: Roll over relief (80 000/250 000) x 25 000 (8 000) 1

Actual Capital gain 17 000 1

Capital gains tax @ 20% (20% x 17 000) 3 400 1

Less withholding tax (15% x 250 000) (37 500) 1

Tax refund (34 100)

ZIMRE PARK HOUSE

2015 tax year

Gross capital amount 100 000 1

Less: Cost of house 80 000 1

Roll over relief (8 000) 2

New base cost (72 000) 1

Inflation allowance (72 000 x 2.5% x 3yrs) (5 400) 2

Potential capital gain 22 600 1

Less: Suspensive sale allowance ( 50 000/100 000) x 22 600 (11 300) 2

Actual Capital gain 11 300 1

Capital gains tax @ 20% 2 260 1

Less withholding tax (15% x 100 000) (15 000) 1

Tax refund (12 740) 1

Zimre Park house - 2016 Tax year

2015 Suspensive sale allowance b/d 11 300 1

Less 2016 suspensive sale allowance (20 000/100 000) x 22 600 4 520 1

Capital gain 6 780 1

Capital gains tax ( 20% x 6 780) 1 356 1

Zimre Park house - 2017 Tax year

2016 Suspensive sale allowance b/d 4 520 1

Capital gains tax ( 20% x 4 520) 904 1

WESTGATE HOUSE- 2017

Gross capital amount 90 000 2

Less: Cost of house (65 000) 1

Inflation allowance (65 000 x 2.5% x 5yrs) (8 125) 1

Capital gain 16 875 1

Capital gains tax @ 20% (20% x 16 875) 3 375 1

Less withholding tax (15% x 90 000) (13 500) 1

Tax refund (10 125)

35

You might also like

- TAX3761 EXAM PACK JPJBLFDocument146 pagesTAX3761 EXAM PACK JPJBLFMonica Deetlefs0% (1)

- Sol. Man. Chapter 10 Installment Sales Method 2020 EditionDocument13 pagesSol. Man. Chapter 10 Installment Sales Method 2020 EditionJam Surdivilla100% (1)

- Problem SolvingDocument10 pagesProblem SolvingRegina De LunaNo ratings yet

- Chapter 18 Govt GrantsDocument6 pagesChapter 18 Govt Grantsrobinady dollaga100% (2)

- Final Tax PDFDocument34 pagesFinal Tax PDFMary Denize100% (4)

- Webinar 6 and 7 Revision CGT and Tax Computation Indiv QuestionsDocument4 pagesWebinar 6 and 7 Revision CGT and Tax Computation Indiv QuestionsOlivia KhumaloNo ratings yet

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- Napoli TrumpetDocument3 pagesNapoli TrumpetSuso Coresvazquez100% (1)

- Ap1 02Document22 pagesAp1 02EricaNo ratings yet

- Solution - Mock Exam - 240120 - 142640Document6 pagesSolution - Mock Exam - 240120 - 142640lebiyacNo ratings yet

- Reviewer TAXDocument3 pagesReviewer TAXAnnabel MendozaNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- Special Incl & Exempt Income-SolutionDocument2 pagesSpecial Incl & Exempt Income-Solutiontetelomakgata1No ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2010 Question Paper For The Guidance of TeachersDocument7 pages9706 Accounting: MARK SCHEME For The October/November 2010 Question Paper For The Guidance of TeachersmarryNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- Answer Keys For Midterm Exam PART 2Document3 pagesAnswer Keys For Midterm Exam PART 2Angel MaghuyopNo ratings yet

- 2018 Tax2A Test 2 Suggested Solution Question 3Document2 pages2018 Tax2A Test 2 Suggested Solution Question 3molemothekaNo ratings yet

- TEST 3 SolutionDocument3 pagesTEST 3 SolutionlusandasithembeloNo ratings yet

- Income Taxes - Medix LTD MemoDocument3 pagesIncome Taxes - Medix LTD Memoandiswa zuluNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- F6zwe 2015 Dec ADocument8 pagesF6zwe 2015 Dec APhebieon MukwenhaNo ratings yet

- Test 3 2019 MemoDocument5 pagesTest 3 2019 MemoKoti KatishiNo ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- F6ZWE 2015 Jun ADocument8 pagesF6ZWE 2015 Jun APhebieon MukwenhaNo ratings yet

- Problem 6 (Determination of Earnings and Earnings Per Share)Document8 pagesProblem 6 (Determination of Earnings and Earnings Per Share)TABOCTABOC JOHN PHILIP M.No ratings yet

- Book 1Document2 pagesBook 1Shiela DimaculanganNo ratings yet

- DEFERRED TAX - TUTORIAL SOLUTION - Part 2Document4 pagesDEFERRED TAX - TUTORIAL SOLUTION - Part 2SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Group FinancialDocument8 pagesGroup FinancialNever GonondoNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Acc309 Sem 2Document7 pagesAcc309 Sem 2megankoh21No ratings yet

- 2021 - A2S2 Solution-OplossingDocument19 pages2021 - A2S2 Solution-OplossingmeghdyckNo ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument16 pagesSol. Man. - Chapter 16 - Accounting For DividendspehikNo ratings yet

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- Sol. Man. Chapter 18 Govt Grants Ia Part 1BDocument6 pagesSol. Man. Chapter 18 Govt Grants Ia Part 1BChrismae Monteverde Santos100% (1)

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- SOLMAN CHAPTER 14 INVESTMENTS IN ASSOCIATES - IA PART 1B - 2020edDocument27 pagesSOLMAN CHAPTER 14 INVESTMENTS IN ASSOCIATES - IA PART 1B - 2020edMeeka CalimagNo ratings yet

- HFMDocument1 pageHFMJPNo ratings yet

- IAS 28 Sol. Man.Document27 pagesIAS 28 Sol. Man.asher phoenixNo ratings yet

- TUTORIAL 1 CotxaDocument2 pagesTUTORIAL 1 Cotxafs5kxrcn2gNo ratings yet

- 2dd3c613 1670283438180Document8 pages2dd3c613 1670283438180Kyla Gacula NatividadNo ratings yet

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- R2. TAX ML Solution CMA January 2022 ExaminationDocument6 pagesR2. TAX ML Solution CMA January 2022 ExaminationPavel DhakaNo ratings yet

- Chapter-14 Intermediate AccountingDocument26 pagesChapter-14 Intermediate AccountingDanica Mae GenaviaNo ratings yet

- Tutorial 6 - Salaries TaxDocument5 pagesTutorial 6 - Salaries Tax周小荷No ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Tax 3702 Assignment 2Document3 pagesTax 3702 Assignment 2ngoloyintomboxoloNo ratings yet

- A. Goodwill, 12/31/20x6 (P330,000 - P19,300) P 310,700 B. FV of NCI, 12/31/20x6Document10 pagesA. Goodwill, 12/31/20x6 (P330,000 - P19,300) P 310,700 B. FV of NCI, 12/31/20x6Love FreddyNo ratings yet

- Acca110 Adorable Ac21 As03Document6 pagesAcca110 Adorable Ac21 As03Shaneen AdorableNo ratings yet

- 08chap 8 NP Farming Solutions 2020Document3 pages08chap 8 NP Farming Solutions 202044v8ct8cdyNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Sol. Man. - Chapter 10 - She (Part 1) - 2021Document18 pagesSol. Man. - Chapter 10 - She (Part 1) - 2021Ventilacion, Jayson M.No ratings yet

- IND AS 33 Addl QuestionsDocument6 pagesIND AS 33 Addl QuestionsTejas RaoNo ratings yet

- F1 Kaplan ADocument46 pagesF1 Kaplan Alameck noah zuluNo ratings yet

- Strategic Cost ManagementDocument7 pagesStrategic Cost ManagementAngeline RamirezNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document12 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimNo ratings yet

- Tampoa Ae211 Unit 1 Assessment ProblemsDocument12 pagesTampoa Ae211 Unit 1 Assessment ProblemsJahna Kay TampoaNo ratings yet

- Term Test-1 SolutionDocument6 pagesTerm Test-1 Solutionlalshahbaz57No ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Test 1 - VatDocument2 pagesTest 1 - VatFerdnance ChekaiNo ratings yet

- INclass 2&3-2013a-1Document4 pagesINclass 2&3-2013a-1Ferdnance ChekaiNo ratings yet

- FinAcc2 Tut 102 Group Accounting Revision - CAA SlidesDocument174 pagesFinAcc2 Tut 102 Group Accounting Revision - CAA SlidesFerdnance ChekaiNo ratings yet

- Financial Instruments Updated VersionDocument46 pagesFinancial Instruments Updated VersionFerdnance ChekaiNo ratings yet

- FinAcc 1 - Tut 102 CAA SlidesDocument221 pagesFinAcc 1 - Tut 102 CAA SlidesFerdnance ChekaiNo ratings yet

- Application Forms For Trainee Professional MembersDocument6 pagesApplication Forms For Trainee Professional MembersSilas Nana-Baah Mensah100% (3)

- Written Notes of ArgumentDocument5 pagesWritten Notes of ArgumentMohit ChugNo ratings yet

- The Third Victim in Der Vorleser PDFDocument17 pagesThe Third Victim in Der Vorleser PDFSimarprit KaurNo ratings yet

- Villikunar CaseDocument5 pagesVillikunar CaseViyyashKumarNo ratings yet

- Arvind Kejriwal & Ors Vs Amit Sibal & Anr On 16 January, 2014Document13 pagesArvind Kejriwal & Ors Vs Amit Sibal & Anr On 16 January, 2014Madhur GoelNo ratings yet

- CPE312 Final 1Document5 pagesCPE312 Final 1Ferly SeptiansyahNo ratings yet

- Labour II Case SummariesDocument10 pagesLabour II Case SummariesShubhi AgrawalNo ratings yet

- Property Law PDFDocument12 pagesProperty Law PDFAmartya Vikram SinghNo ratings yet

- 12th Accountancy Formula-TamilnaduDocument8 pages12th Accountancy Formula-TamilnadubasgsrNo ratings yet

- Criminal Justice System of RussiaDocument14 pagesCriminal Justice System of RussiaIsaac Joshua AganonNo ratings yet

- Um Tagum College Department of Accounting Education: Daily Accomplishment ReportDocument10 pagesUm Tagum College Department of Accounting Education: Daily Accomplishment ReportRose Ann Juleth LicayanNo ratings yet

- Due Diligence ExerciseDocument6 pagesDue Diligence Exercisevrushaliubale21No ratings yet

- Title 4. Public InterestDocument22 pagesTitle 4. Public Interestmichelle jane reyesNo ratings yet

- Application Summary Form PDFDocument2 pagesApplication Summary Form PDFR&D Printing ShopNo ratings yet

- Irac Analysis: Namra Nishtha Upadhyay PRN N0-20010421084Document4 pagesIrac Analysis: Namra Nishtha Upadhyay PRN N0-20010421084Nishtha UpadhyayNo ratings yet

- Effect of Happening of ConditionDocument1 pageEffect of Happening of ConditionMary Jane SiyNo ratings yet

- Application For Business Permit: Business Permits and Licensing OfficeDocument6 pagesApplication For Business Permit: Business Permits and Licensing OfficeKaren Grace DumangcasNo ratings yet

- Labor Case Digests Week 2Document64 pagesLabor Case Digests Week 2Non Est Inventus100% (1)

- Forms of Business Organisation: Chapter - 2Document34 pagesForms of Business Organisation: Chapter - 2Tanmay AroraNo ratings yet

- Civil Writ Jurisdiction Case No. 13160 of 2018 Rudra Pratap Singh v. State of BiharDocument2 pagesCivil Writ Jurisdiction Case No. 13160 of 2018 Rudra Pratap Singh v. State of Biharshivam guptaNo ratings yet

- Bucks County Community College-Transcript Errors-Neil J Gillespie-Pres Stephanie ShanblattDocument14 pagesBucks County Community College-Transcript Errors-Neil J Gillespie-Pres Stephanie ShanblattNeil GillespieNo ratings yet

- Blaw 101 Group 10Document8 pagesBlaw 101 Group 10ADJEI MENSAH TOM DOCKERYNo ratings yet

- Ethical & Legal Dimensions of HealthcareDocument9 pagesEthical & Legal Dimensions of HealthcareMark MadridanoNo ratings yet

- Documents To Check While Buying A Property in BengaluruDocument2 pagesDocuments To Check While Buying A Property in BengaluruSujeshNo ratings yet

- Local Autonomy in The PhilippinesDocument8 pagesLocal Autonomy in The PhilippinesRonn Briane AtudNo ratings yet

- ReservationDocument14 pagesReservationLakshanmayaNo ratings yet

- PR4345 Government TransportDocument4 pagesPR4345 Government TransportZairulNo ratings yet