Professional Documents

Culture Documents

Assignment

Uploaded by

Djay SlyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment

Uploaded by

Djay SlyCopyright:

Available Formats

UNIVERSITY OF PUNJAB

SUBMITTED BY: Nimra Naveed

SUBMITTED TO: SIR ANAS

ROLL NUMBER: 411

ASSIGNMENT: 02

TOPIC: Comparative Study of Banks & insurance Companies for fresh Graduates

DATE: 12 Sep 2022

➢ Overview :

➢ What is Comparative study?

• Comparative Study analyses and compares two or more objects or ideas to examine,

compare and contrast them to show how two or more subjects are similar or different

perspectives.

• It can be defined as a method to compare similar items to one another and see their

differences and what they have in common.

• As related to assignment topic, banks and insurance companies comparative study is

elaborated:

➢ Introduction:

As a fresher, straight out of college, we look for opportunities to jump-start your career.

• If we are from the commerce background, banking and insurance are the hottest sectors

for job opportunities.

• The number above mentioned above say, this sector also promises the easiest

employment opportunities for fresher’s, making it a hotbed for job applications.

• Jobs in the banking and insurance sector have always been in demand among freshers.

➢ Top Career Options For Fresher’s

1. Telecaller

• Banks and insurance companies are constantly on the look-out for fresher’s to work in

their call-centre and sell their products through telesales.

• The eligibility criteria are simple – you just have to be a graduate with good

communication skills, and you are set to go.

• Besides a fixed monthly income, you can also earn commissions on the sales you

generate.

2. Bank Probationary Officers (PO)

• The bank PO job is highly sought after because it allows you a chance to grow your

career in banking.

• For this job, however, you need to pass an exam conducted by the Institute of Banking

Personnel Selection (IBPS) if you want placement in a public-sector bank.

• For private sector banks, the exam is not a criterion, but you might need other

qualifications. As a PO, you get a fixed monthly income and a chance at promotion.

3. Sales Representatives or Relationship Managers

• The job of sales representatives, relationship managers or sales managers is also available

for first time job seekers in banks and insurance companies.

• Needless to say, this is a sales-oriented position wherein you need to sell the products of

the bank or insurance company.

• There might be a monthly target, and this position is open for graduates fresh out of

universities.

4. Tellers and/or Cashiers

• Banks need tellers, individuals who sit at the ‘‘deposit’’ and ‘‘withdrawal’’ windows at

the branch.

• Freshers can apply to these positions and get placements.

5. Insurance Agents

• Another lucrative avenue is becoming an insurance agent.

• The beauty of an insurance agency is that it allows you to work full-time in another job

and sell insurance policies on a part-time basis for additional income.

➢ The Qualification Required

• Under most of the jobs, you need a graduate degree. Moreover, for the telecaller or sales

position, we don’t even need specialization in commerce.

• All we need to do is learn sales skills which can be done through a hands-on experience

on the job or through online courses before getting the job.

➢ The Expected Pay

• As a fresher, you might not have sky-high expectations when it comes to the salary

package. However, knowing the pay package ball-park is important.

o The pay package actually depends on the position you get placed in.

o Telecallers can earn around Rs. 15,000 to 20,000 per month (excluding

incentives) while POs and sales reps can have a salary starting from Rs. 25,000.

o Tellers and cashiers might earn somewhere between Rs. 20,000 to 30,000 while in

an insurance agency, there is no fixed payment.

o As an agent, your income depends on the number of policies that you sell and the

premium that you collect.

➢ The Growth Curve

• Everybody wants to grow their careers with experience, why shouldn’t we?

• Experience is an important qualification, and as you gain experience, you can grow your

insurance and banking career too.

• Banks and insurance companies look at internal promotions to fill their vacancies.

• We can become a manager and reach the top management levels with your performance

and experience.

➢ Conclusion:

• Though freshers are welcomed in insurance and banking sector jobs, additional courses

help in honing your skills.

• The job world is competitive, and the fittest ones survive.

• To stand out of the crowd, you need an extra feather in your cap. And how do you get

that extra feather? Through online course simply!!

You might also like

- SWOT Analysis Self-AssessmentDocument18 pagesSWOT Analysis Self-AssessmentMD. JULFIKER HASANNo ratings yet

- Compensation ManagementDocument10 pagesCompensation ManagementJoone NisheiwatNo ratings yet

- Chapters 2 To 5 Complete PDFDocument87 pagesChapters 2 To 5 Complete PDFElizabeth N. BernalesNo ratings yet

- On Boarding Induction Training Programme for Directly Recruited OfficersDocument120 pagesOn Boarding Induction Training Programme for Directly Recruited OfficersKumar Shekhar100% (1)

- Analyzing A Career in Credit Analysis - InvestopediaDocument4 pagesAnalyzing A Career in Credit Analysis - InvestopediaPranjal GangurdeNo ratings yet

- Silkbank Internship ReportDocument16 pagesSilkbank Internship ReportNick Ali71% (7)

- How To Become A Bank ManagerDocument8 pagesHow To Become A Bank ManagersikandarNo ratings yet

- Case Study Ent Sarangi Ashish (197700592072)Document16 pagesCase Study Ent Sarangi Ashish (197700592072)Er SarangiNo ratings yet

- Recruitment Selection Placement PlanDocument6 pagesRecruitment Selection Placement PlanJaypee EchanoNo ratings yet

- Employability Assignment (Shaon Saha - 5802)Document6 pagesEmployability Assignment (Shaon Saha - 5802)Shaon Chandra Saha 181-11-5802No ratings yet

- Term Paper On Eastern Bank LimitedDocument8 pagesTerm Paper On Eastern Bank Limitedafmzhpeloejtzj100% (1)

- Aegon JDDocument3 pagesAegon JDEliee JohnNo ratings yet

- 5 Best Business To Get StartedDocument20 pages5 Best Business To Get StartedGulNo ratings yet

- Assignment On Job Description and Job SpecificationDocument5 pagesAssignment On Job Description and Job SpecificationDr-Farrukh Uddin67% (6)

- Consultant Industry Job Description - 2023Document2 pagesConsultant Industry Job Description - 2023David GomesNo ratings yet

- Outline For The Desired JobDocument8 pagesOutline For The Desired JobA StrangerNo ratings yet

- How To Include Salary Expectations in Cover LetterDocument8 pagesHow To Include Salary Expectations in Cover Lettertgpazszid100% (1)

- HRM Function of BopDocument25 pagesHRM Function of BopVirtual Help CenterNo ratings yet

- SDP Job Ad (002) .CleanedDocument2 pagesSDP Job Ad (002) .CleanedJaneNo ratings yet

- Banking As A ProfessionDocument7 pagesBanking As A ProfessionMehul JaniNo ratings yet

- ANZ Home Loan Origination Role in BengaluruDocument2 pagesANZ Home Loan Origination Role in BengaluruNITIN SINGHNo ratings yet

- Special Emphasis On Working Capital Finance of Jamuna Bank Ltd.Document18 pagesSpecial Emphasis On Working Capital Finance of Jamuna Bank Ltd.Imam Hasan Sazeeb100% (1)

- Sonali Bank Term PaperDocument6 pagesSonali Bank Term Paperafmzvaeeowzqyv100% (1)

- CB JDDocument1 pageCB JDPratish SomanNo ratings yet

- Banking ResumeDocument5 pagesBanking Resumeafmrhbpxtgrdme100% (1)

- BDO Unibank, IncDocument5 pagesBDO Unibank, IncNoemi Credito Mata0% (1)

- Max New York Life Insurance: Submitted To: Submitted byDocument12 pagesMax New York Life Insurance: Submitted To: Submitted byKalpan PatelNo ratings yet

- Careers 101 _ Investment BankingDocument14 pagesCareers 101 _ Investment BankingMuskan ThavananiNo ratings yet

- Position Sales - Area Sales Manager Role & Responsibilities Key Highlights of The Role Are Listed Below (Purely Indicative and Not Limiting)Document2 pagesPosition Sales - Area Sales Manager Role & Responsibilities Key Highlights of The Role Are Listed Below (Purely Indicative and Not Limiting)Kamal AgarwalNo ratings yet

- Developing Your Capability For Finding A Job: What Are Employers Looking For?Document13 pagesDeveloping Your Capability For Finding A Job: What Are Employers Looking For?mukonosurreyNo ratings yet

- Assignment3 Gene 60 Fall 2023Document11 pagesAssignment3 Gene 60 Fall 2023api-704224154No ratings yet

- Best Resume Format For Bank ClerkDocument7 pagesBest Resume Format For Bank Clerkbdg8266a100% (2)

- HabibMetro Mera MustaqbilDocument15 pagesHabibMetro Mera MustaqbilRashid Shah100% (1)

- Associate, Everyday Banking-13845Document4 pagesAssociate, Everyday Banking-13845fredNo ratings yet

- HRM - Job Description & Job SpecializationDocument6 pagesHRM - Job Description & Job SpecializationNahida RipaNo ratings yet

- Objectives and limitations of study internship projectDocument3 pagesObjectives and limitations of study internship projectAashish Ritu GandhiNo ratings yet

- Corporate Banking 101Document55 pagesCorporate Banking 101MuskanDodejaNo ratings yet

- Recruitment Process and Qualities of a Successful Insurance AdvisorDocument30 pagesRecruitment Process and Qualities of a Successful Insurance AdvisorParul GuptaNo ratings yet

- Sunday PunchDocument7 pagesSunday PunchJasri SamadNo ratings yet

- Credit Union Teller ResumeDocument4 pagesCredit Union Teller Resumeeljaswrmd100% (1)

- Insurance Owner ResumeDocument8 pagesInsurance Owner Resumefhtjmdifg100% (2)

- Acknowledgement: Title "Document97 pagesAcknowledgement: Title "Soniya SehgalNo ratings yet

- Fund Management ReportDocument13 pagesFund Management ReportDIA CHAUDHRYNo ratings yet

- Credit Risk Management and Profitability ThesisDocument6 pagesCredit Risk Management and Profitability ThesisCanIPaySomeoneToWriteMyPaperSingapore100% (2)

- Updated JDDocument3 pagesUpdated JDDigvijay singh KhatiNo ratings yet

- Credit Management and Debt Collection StrategiesDocument5 pagesCredit Management and Debt Collection StrategiesRohanNo ratings yet

- A Prime Opportunity: Duties and ResponsibilitiesDocument2 pagesA Prime Opportunity: Duties and ResponsibilitiesMrinalDebNo ratings yet

- Finance As A CareerDocument7 pagesFinance As A Careerraj_kiradNo ratings yet

- Ignou Mba ThesisDocument8 pagesIgnou Mba Thesislaurajohnsonphoenix100% (2)

- Company OverviewDocument9 pagesCompany OverviewMj Nazario100% (1)

- Investment Banking 2020Document14 pagesInvestment Banking 2020Phạm Hồng HuếNo ratings yet

- CNB Sales Specialist Job DescriptionDocument3 pagesCNB Sales Specialist Job DescriptionJessielyn MadayagNo ratings yet

- NMB New JOBDocument2 pagesNMB New JOBkilewarahmaNo ratings yet

- StreetOfWalls - Question Set PDFDocument21 pagesStreetOfWalls - Question Set PDFEric LukasNo ratings yet

- Credit Worthiness: What Is A Corporate Credit RatingDocument23 pagesCredit Worthiness: What Is A Corporate Credit RatingSudarshan ChitlangiaNo ratings yet

- Bank ExamsDocument4 pagesBank ExamsRamkumar KumarNo ratings yet

- JD For POS Consultant Role PDFDocument3 pagesJD For POS Consultant Role PDFRahul AgrawalNo ratings yet

- ICICI Bank Interview Questions (Best Possible Answers)Document9 pagesICICI Bank Interview Questions (Best Possible Answers)Harsha50% (2)

- Bank Internship ReportDocument7 pagesBank Internship ReportWajeeha AslamNo ratings yet

- HRM NotesDocument36 pagesHRM NotesDjay SlyNo ratings yet

- Internship Report on Askari Bank LimitedDocument79 pagesInternship Report on Askari Bank LimitedDjay SlyNo ratings yet

- Performance Highlights 21Document3 pagesPerformance Highlights 21Djay SlyNo ratings yet

- HRM Aftr MidsDocument29 pagesHRM Aftr MidsDjay SlyNo ratings yet

- Loans and AdvanceDocument8 pagesLoans and AdvanceDjay SlyNo ratings yet

- Insurance Assignmnt Merits and DemeritsDocument8 pagesInsurance Assignmnt Merits and DemeritsDjay SlyNo ratings yet

- Islamic Banking Elements Prohibited in IslamDocument4 pagesIslamic Banking Elements Prohibited in IslamDjay SlyNo ratings yet

- What Is Business CommunicationDocument6 pagesWhat Is Business CommunicationDjay SlyNo ratings yet

- Essentials of Valid AcceptanceDocument4 pagesEssentials of Valid AcceptanceDjay SlyNo ratings yet

- Research Design Business Research Methods 6th Semester BBA Notes TUDocument13 pagesResearch Design Business Research Methods 6th Semester BBA Notes TUDjay Sly100% (1)

- Employee MotivationDocument5 pagesEmployee MotivationDjay SlyNo ratings yet

- Macroeconomics AssignmentDocument7 pagesMacroeconomics AssignmentDjay SlyNo ratings yet

- Business Communication VocabularyDocument8 pagesBusiness Communication VocabularyDjay SlyNo ratings yet

- REP158 SurveyOfTheDerivativesDocument30 pagesREP158 SurveyOfTheDerivativesDjay SlyNo ratings yet

- Untitled DocumentDocument1 pageUntitled DocumentDjay SlyNo ratings yet

- Nimra Fazal409 (HRM)Document4 pagesNimra Fazal409 (HRM)Djay SlyNo ratings yet

- How Social Media Can Benefit Supply Chain ManagementDocument14 pagesHow Social Media Can Benefit Supply Chain ManagementDjay SlyNo ratings yet

- Order From U.S. Disctrict Judge Jesus G. Bernal To Chino Valley UnifiedDocument9 pagesOrder From U.S. Disctrict Judge Jesus G. Bernal To Chino Valley UnifiedBeau YarbroughNo ratings yet

- Matrix 210N Reference Manual 2017 PDFDocument167 pagesMatrix 210N Reference Manual 2017 PDFiozsa cristianNo ratings yet

- Analyzing Air Asia in Business Competition Era: AirasiaDocument14 pagesAnalyzing Air Asia in Business Competition Era: Airasiashwaytank10No ratings yet

- Mechanical Engineering Semester SchemeDocument35 pagesMechanical Engineering Semester Schemesantvan jagtapNo ratings yet

- Affidavit Defends Wife's InnocenceDocument6 pagesAffidavit Defends Wife's InnocenceGreggy LawNo ratings yet

- 266DSH Differential Pressure TransmittersDocument36 pages266DSH Differential Pressure TransmittersSibabrata ChoudhuryNo ratings yet

- Ir 2101Document14 pagesIr 2101Willard DmpseyNo ratings yet

- Caed102: Financial MarketsDocument2 pagesCaed102: Financial MarketsXytusNo ratings yet

- Cash Flow Statement and Balance Sheet of A Solar Power Plant in APDocument35 pagesCash Flow Statement and Balance Sheet of A Solar Power Plant in APSriharsha Vavilala100% (1)

- Document 10Document5 pagesDocument 10Filza FatimaNo ratings yet

- Java Programming: Lab Assignment 2Document17 pagesJava Programming: Lab Assignment 2Sanjana chowdary50% (4)

- Indexed Addressing & Flow Rate AveragingDocument5 pagesIndexed Addressing & Flow Rate AveragingMestrecal MeloNo ratings yet

- Auditing Theory - Audit ReportDocument26 pagesAuditing Theory - Audit ReportCarina Espallardo-RelucioNo ratings yet

- Coordination in Distributed Agile Software Development: A Systematic ReviewDocument12 pagesCoordination in Distributed Agile Software Development: A Systematic ReviewAbdul Shakoor sabirNo ratings yet

- Veritas d1.6.1 FinalDocument28 pagesVeritas d1.6.1 FinalgkoutNo ratings yet

- D20 Q12Document7 pagesD20 Q12Luca PitocchiNo ratings yet

- 10 Steps To Dream Building: - A Publication of Center My CenterDocument19 pages10 Steps To Dream Building: - A Publication of Center My CenterRamalakshmi100% (2)

- Bayes Slides1Document146 pagesBayes Slides1Panagiotis KarathymiosNo ratings yet

- Aproximaciones Al Concepto de Grupos y Tipos de GruposDocument16 pagesAproximaciones Al Concepto de Grupos y Tipos de GruposM. CNo ratings yet

- Live Sound 101: Choosing Speakers and Setting Up a Sound SystemDocument14 pagesLive Sound 101: Choosing Speakers and Setting Up a Sound Systemohundper100% (1)

- Comments PRAG FinalDocument13 pagesComments PRAG FinalcristiancaluianNo ratings yet

- Carpenter Company MarketingDocument14 pagesCarpenter Company Marketingsladex17No ratings yet

- Group Assignment For Quantitative: Analysis For Decisions MakingDocument45 pagesGroup Assignment For Quantitative: Analysis For Decisions Makingsemetegna she zemen 8ተኛው ሺ zemen ዘመንNo ratings yet

- DNV Casualty Info 2011 #3Document2 pagesDNV Casualty Info 2011 #3Sureen NarangNo ratings yet

- Pilkington Profilit Techn Info enDocument12 pagesPilkington Profilit Techn Info enSalmonelo Abdul RamosNo ratings yet

- Federal Ombudsmen Institutional Reforms Act, 2013Document8 pagesFederal Ombudsmen Institutional Reforms Act, 2013Adv HmasNo ratings yet

- ADUHAI @herman & Rhoca - Lyrics and Music by Rhoma Irama Arranged by - HERMAN - BOY - SmuleDocument4 pagesADUHAI @herman & Rhoca - Lyrics and Music by Rhoma Irama Arranged by - HERMAN - BOY - SmuleHERMAN BOYNo ratings yet

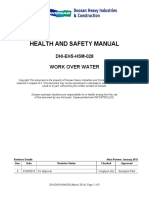

- Dhi-Ehs-Hsm-028 Work Over Water Rev0Document5 pagesDhi-Ehs-Hsm-028 Work Over Water Rev0Phạm Đình NghĩaNo ratings yet

- Copyblogger Content Marketing Research 2 PDFDocument44 pagesCopyblogger Content Marketing Research 2 PDFvonnig100% (1)

- In Millions USD: Balance Sheet 2020 2021 2022Document4 pagesIn Millions USD: Balance Sheet 2020 2021 2022Trần Ngọc Quỳnh ChiNo ratings yet

- Steal the Show: From Speeches to Job Interviews to Deal-Closing Pitches, How to Guarantee a Standing Ovation for All the Performances in Your LifeFrom EverandSteal the Show: From Speeches to Job Interviews to Deal-Closing Pitches, How to Guarantee a Standing Ovation for All the Performances in Your LifeRating: 4.5 out of 5 stars4.5/5 (39)

- The Proximity Principle: The Proven Strategy That Will Lead to the Career You LoveFrom EverandThe Proximity Principle: The Proven Strategy That Will Lead to the Career You LoveRating: 4.5 out of 5 stars4.5/5 (93)

- The 7 Habits of Highly Effective People: The Infographics EditionFrom EverandThe 7 Habits of Highly Effective People: The Infographics EditionRating: 4 out of 5 stars4/5 (2475)

- From Paycheck to Purpose: The Clear Path to Doing Work You LoveFrom EverandFrom Paycheck to Purpose: The Clear Path to Doing Work You LoveRating: 4.5 out of 5 stars4.5/5 (39)

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (61)

- Work Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkFrom EverandWork Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkRating: 4.5 out of 5 stars4.5/5 (12)

- The Confidence Code: The Science and Art of Self-Assurance--What Women Should KnowFrom EverandThe Confidence Code: The Science and Art of Self-Assurance--What Women Should KnowRating: 4.5 out of 5 stars4.5/5 (175)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsFrom EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsRating: 4.5 out of 5 stars4.5/5 (90)

- The 30 Day MBA: Your Fast Track Guide to Business SuccessFrom EverandThe 30 Day MBA: Your Fast Track Guide to Business SuccessRating: 4.5 out of 5 stars4.5/5 (19)

- Company Of One: Why Staying Small Is the Next Big Thing for BusinessFrom EverandCompany Of One: Why Staying Small Is the Next Big Thing for BusinessRating: 3.5 out of 5 stars3.5/5 (14)

- Start.: Punch Fear in the Face, Escape Average, and Do Work That MattersFrom EverandStart.: Punch Fear in the Face, Escape Average, and Do Work That MattersRating: 4.5 out of 5 stars4.5/5 (56)

- The Dictionary of Body Language: A Field Guide to Human BehaviorFrom EverandThe Dictionary of Body Language: A Field Guide to Human BehaviorRating: 4.5 out of 5 stars4.5/5 (95)

- The Healthy Virtual Assistant: How to Become a Virtual Assistant for the Health and Wellness IndustryFrom EverandThe Healthy Virtual Assistant: How to Become a Virtual Assistant for the Health and Wellness IndustryRating: 4 out of 5 stars4/5 (2)

- The Power of Body Language: An Ex-FBI Agent's System for Speed-Reading PeopleFrom EverandThe Power of Body Language: An Ex-FBI Agent's System for Speed-Reading PeopleRating: 5 out of 5 stars5/5 (9)

- Write It Down, Make It Happen: Knowing What You Want And Getting It!From EverandWrite It Down, Make It Happen: Knowing What You Want And Getting It!Rating: 4 out of 5 stars4/5 (103)

- The First 90 Days: Proven Strategies for Getting Up to Speed Faster and SmarterFrom EverandThe First 90 Days: Proven Strategies for Getting Up to Speed Faster and SmarterRating: 4.5 out of 5 stars4.5/5 (122)

- The Ultimate Sales Letter, 4th Edition: Attract New Customers, Boost Your SalesFrom EverandThe Ultimate Sales Letter, 4th Edition: Attract New Customers, Boost Your SalesRating: 4.5 out of 5 stars4.5/5 (98)

- The Search for Self-Respect: Psycho-CyberneticsFrom EverandThe Search for Self-Respect: Psycho-CyberneticsRating: 4.5 out of 5 stars4.5/5 (10)

- Happy at Work: How to Create a Happy, Engaging Workplace for Today's (and Tomorrow's!) WorkforceFrom EverandHappy at Work: How to Create a Happy, Engaging Workplace for Today's (and Tomorrow's!) WorkforceNo ratings yet

- Ultralearning: Master Hard Skills, Outsmart the Competition, and Accelerate Your CareerFrom EverandUltralearning: Master Hard Skills, Outsmart the Competition, and Accelerate Your CareerRating: 4.5 out of 5 stars4.5/5 (359)

- Real Artists Don't Starve: Timeless Strategies for Thriving in the New Creative AgeFrom EverandReal Artists Don't Starve: Timeless Strategies for Thriving in the New Creative AgeRating: 4.5 out of 5 stars4.5/5 (197)

- The Purpose Path: A Guide to Pursuing Your Authentic Life's WorkFrom EverandThe Purpose Path: A Guide to Pursuing Your Authentic Life's WorkNo ratings yet

- Designing Your Life - Summarized for Busy People: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life - Summarized for Busy People: How to Build a Well-Lived, Joyful LifeRating: 4 out of 5 stars4/5 (4)