Professional Documents

Culture Documents

Disney

Uploaded by

SeleneOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Disney

Uploaded by

SeleneCopyright:

Available Formats

Does Walt Disney's portfolio exhibit good strategic fit?

What value chain match-ups do you

see? What opportunities for skills transfer, cost sharing, or brand sharing do you see?

The four divisions business units: Parks, Experiences and Products, Media Networks, Direct-to-

Consumer & International, and Studio Entertainment in Walt Disney’s portfolio exhibit good

strategic fit. Fox 's purchase helped them to increase their market valuation and acquire a greater

customer base. They have now purchased Twentieth Century Fox and FX (from the 21st Century

Fox acquisition) both of which make for a better portfolio.

Since Disney has many business units in diverse areas and fields, it can use many of its assets and

competencies in a variety of ways. They reach out to get companies that add value to their

business, and they also end up reducing some competition. Through these acquisitions they

improved their role in the television and film industries. Disney and Lucas Films along with Disney

and Marvel Studios are value-chain matchups that I can identify. Lucas Films, with Star Wars, and

Marvel each have an overwhelming fan base, and by first purchasing these studios they add value

to their business, and then making higher-budget films to make a stronger, more profitable

commodity. Lucas Films and Marvel were able to share that ability with one another, but they

could also share this expertise in other Disney films. Costs sharing in producing the film comes into

play as each studio brings multiple resources, meaning that there are potentially bigger deals that

can now be made to save money.

Also, in many areas we can see opportunities for skills transfer and cost sharing. For example:

Disney’s Media Networks can advertise their theme parks, their studios can be used for movies,

and technology researched by Studio Entertainment can certainly be shared across the board.

Citing Thompson, Peteraf, Gamble and Strickland (2021) "The Walt Disney Company’s corporate

strategy also attempted to capture synergies existing between its business units. Two of the

company’s highest grossing films, Pirates of the Caribbean: On Stranger Tides and Cars 2 were also

featured at the company’s Florida and California theme parks. The company had leveraged ESPN’s

reputation in sports by building 230-acre ESPN Wide World of Sports Complex in Orlando that

could host amateur and professional events and boost occupancy in its 18 resort hotels and

vacation clubs located at the Walt Disney World resort.”

Thompson A., Peteraf M., Gamble J., & Strickland A. (2021). Crafting & Executing

Strategy: The Quest for Competitive Advantage: Concepts and Cases.

[VitalSource Bookshelf]. Retrieved from

https://bookshelf.vitalsource.com/#/books/9781264250165/

You might also like

- Disney Case ReportDocument14 pagesDisney Case Reportprsnt100% (1)

- Chapter 6 - Strategy Analysis and ChoiceDocument28 pagesChapter 6 - Strategy Analysis and ChoiceSadaqat AliNo ratings yet

- Internal and External Data Sources For MISDocument2 pagesInternal and External Data Sources For MISAlexNo ratings yet

- Memo 3 - Walt DisneyDocument6 pagesMemo 3 - Walt DisneyDolly_AmethystNo ratings yet

- Disney Pixar CaseDocument9 pagesDisney Pixar CaseUpveen Tameri100% (2)

- Schedule D SAFETY, HEALTH AND ENVIRONMENTAL REQUIREMENTSDocument26 pagesSchedule D SAFETY, HEALTH AND ENVIRONMENTAL REQUIREMENTSxue jun xiangNo ratings yet

- Walt Disney Case AnalysisDocument9 pagesWalt Disney Case AnalysisHassam BalouchNo ratings yet

- Assignment SMDocument13 pagesAssignment SMsimNo ratings yet

- Walt Disney - Strategy AnalysisDocument31 pagesWalt Disney - Strategy Analysisadityaseven84% (19)

- Walt Disney - BRAMDocument3 pagesWalt Disney - BRAMBramanto Adi NegoroNo ratings yet

- Ebook - IELTS WT1 (2021)Document14 pagesEbook - IELTS WT1 (2021)Trần Lê Uyên PhươngNo ratings yet

- Strategic Management - Disney AssignmentDocument6 pagesStrategic Management - Disney AssignmentRichard DuffNo ratings yet

- Disney AnalysisDocument5 pagesDisney AnalysisgessyghesiyahNo ratings yet

- The Walt Disney CompanyDocument19 pagesThe Walt Disney CompanyBMX2013100% (1)

- G5WK38Document10 pagesG5WK38SeleneNo ratings yet

- Walt Disney Case StudyDocument6 pagesWalt Disney Case StudyJMIFBNo ratings yet

- 1 Executive-SummaryDocument6 pages1 Executive-SummaryJae GrandeNo ratings yet

- Kaplan AssignmentDocument7 pagesKaplan AssignmentAli100% (1)

- Walt Disney Case AnalysisDocument4 pagesWalt Disney Case AnalysisÁlvaroDeLaGarza50% (4)

- Walt Disney Company, Nabilah (FIB 2101)Document11 pagesWalt Disney Company, Nabilah (FIB 2101)Nabilah BakarNo ratings yet

- Strategy DisneyDocument8 pagesStrategy DisneyJatin Gupta100% (3)

- Client Agreement: Markets LTDDocument37 pagesClient Agreement: Markets LTDShuresh AlmasyNo ratings yet

- Disney FoxDocument19 pagesDisney FoxSagarika Jindal100% (1)

- Group 4 Strategy Case 'Disney' V 1.4Document10 pagesGroup 4 Strategy Case 'Disney' V 1.4Stijn Lfb50% (2)

- The Situation of Disney After The Acquisition of LucasfilmDocument3 pagesThe Situation of Disney After The Acquisition of LucasfilmSiddharth ShettyNo ratings yet

- Case Analysis Disney3Document8 pagesCase Analysis Disney3visvisnuvNo ratings yet

- Disney - Building Billion-Dollar FranchisesDocument18 pagesDisney - Building Billion-Dollar FranchisesMichael AndyNo ratings yet

- Walt Disney Case AnalysisDocument8 pagesWalt Disney Case AnalysisPauline Beatrice Sombillo100% (2)

- Walt DisneyDocument17 pagesWalt Disneyagrawalrohit_22838475% (4)

- IMAX CaseDocument5 pagesIMAX CaseMarkendey SahooNo ratings yet

- Research Paper On Walt Disney CompanyDocument4 pagesResearch Paper On Walt Disney Companyafmclccre100% (1)

- Zycus - P2P Benchmark StudyDocument32 pagesZycus - P2P Benchmark StudyIndu Shekhar100% (2)

- Pune IT Software Companies in Magarpatta City Pune ListDocument7 pagesPune IT Software Companies in Magarpatta City Pune ListRishi BachaniNo ratings yet

- Disney AnalysisDocument5 pagesDisney AnalysisAli FaycalNo ratings yet

- Final Case Memo - Mariam FaisalDocument7 pagesFinal Case Memo - Mariam FaisalMaryam FaisalNo ratings yet

- Disney Case StudyDocument3 pagesDisney Case StudyuroosaNo ratings yet

- Disney Industry CaseDocument6 pagesDisney Industry Caseapi-535570354No ratings yet

- Disney CaseDocument5 pagesDisney CaseckkuteesaNo ratings yet

- Disney CaseDocument11 pagesDisney CaseKevin WangNo ratings yet

- Strategic AlliancesDocument10 pagesStrategic Alliancesshikhagrawal100% (2)

- What Is The Theory ofDocument19 pagesWhat Is The Theory ofAna Maria MejoranoNo ratings yet

- Porter's Five ForcesDocument17 pagesPorter's Five ForcesTe TeeNo ratings yet

- Disney and DiversificationDocument4 pagesDisney and DiversificationMichelle MorrisonNo ratings yet

- Mini Case9 DisneyDocument7 pagesMini Case9 DisneyHasbi AsidikNo ratings yet

- Disney Vs TimeWarner Financial RatioDocument19 pagesDisney Vs TimeWarner Financial RatiopatternprojectNo ratings yet

- Unit 7 Lo1 AssignmentDocument3 pagesUnit 7 Lo1 Assignmentapi-294985398No ratings yet

- Core CompetenciesDocument8 pagesCore CompetenciesBasim ZiaNo ratings yet

- Case 3 Disneyand 21 StcenturyfoxDocument18 pagesCase 3 Disneyand 21 Stcenturyfoxtharun.dm254083No ratings yet

- The Walt Disney CompanyDocument10 pagesThe Walt Disney CompanyYves GuerreroNo ratings yet

- Experiential Exercise 6ADocument14 pagesExperiential Exercise 6AJohn Joshua Gaddi TanNo ratings yet

- Research Paper Topics DisneyDocument4 pagesResearch Paper Topics Disneyoppfaztlg100% (1)

- Disney - Building Billion-Dollar FranchisesDocument17 pagesDisney - Building Billion-Dollar FranchisesSarah Nabilla Yasmin Riza100% (2)

- Walt DisneyDocument25 pagesWalt DisneyLukmaan Rehmaan100% (1)

- Walt Disney - Shirish AparadhDocument10 pagesWalt Disney - Shirish AparadhShirish AparadhNo ratings yet

- Introduction and HistoryDocument4 pagesIntroduction and Historykhushboo kohadkarNo ratings yet

- A Comparative Analysis of The North American Media and Entertainment IndustryDocument28 pagesA Comparative Analysis of The North American Media and Entertainment IndustryMax ZhuNo ratings yet

- Case Analysis 1Document6 pagesCase Analysis 1Fu Maria JoseNo ratings yet

- Attachment 1Document6 pagesAttachment 1Nữ HoàngNo ratings yet

- Task 1Document8 pagesTask 1PataviNo ratings yet

- Brief Industry AnalysisDocument9 pagesBrief Industry AnalysisUzair SoomroNo ratings yet

- Unit 3 BTWDocument23 pagesUnit 3 BTWapi-710615397No ratings yet

- SM DisneyDocument3 pagesSM DisneyKirana SofeaNo ratings yet

- Mergers Acquisition CaseStudyDocument4 pagesMergers Acquisition CaseStudymanshi choudhuryNo ratings yet

- Mastering Strategic Management CH8Document27 pagesMastering Strategic Management CH8John Patrick AnyayahanNo ratings yet

- "The Art of Character Entertainment Licensing: A Guide to Licensing Success"From Everand"The Art of Character Entertainment Licensing: A Guide to Licensing Success"No ratings yet

- Space With A Private View: A Primer on Commercial Earth Observation & Remote SensingFrom EverandSpace With A Private View: A Primer on Commercial Earth Observation & Remote SensingNo ratings yet

- Connective Branding: Building Brand Equity in a Demanding WorldFrom EverandConnective Branding: Building Brand Equity in a Demanding WorldNo ratings yet

- What Are The Key Internal Environmental Factors Facing Whole FoodsDocument3 pagesWhat Are The Key Internal Environmental Factors Facing Whole FoodsSeleneNo ratings yet

- Cover LetterDocument1 pageCover LetterSeleneNo ratings yet

- RespuestasDocument5 pagesRespuestasSeleneNo ratings yet

- ResumeDocument2 pagesResumeSeleneNo ratings yet

- Discussion5.1 Social ResponsibilityDocument2 pagesDiscussion5.1 Social ResponsibilitySeleneNo ratings yet

- Assignment4 1spotifyDocument15 pagesAssignment4 1spotifySeleneNo ratings yet

- Business Review Lab NAUDocument2 pagesBusiness Review Lab NAUSeleneNo ratings yet

- Discussion 10.1 Expanding Your NetworkDocument1 pageDiscussion 10.1 Expanding Your NetworkSeleneNo ratings yet

- Assignment6.1 Midterm Case StudyDocument20 pagesAssignment6.1 Midterm Case StudySeleneNo ratings yet

- DocxDocument3 pagesDocxSeleneNo ratings yet

- PracticeActivity1 CommonInterviewQuestionsDocument1 pagePracticeActivity1 CommonInterviewQuestionsSeleneNo ratings yet

- Business Lab Review Financial StatementsDocument2 pagesBusiness Lab Review Financial StatementsSeleneNo ratings yet

- Assignment1.2 Gap AnalysistogoalSettingDocument4 pagesAssignment1.2 Gap AnalysistogoalSettingSeleneNo ratings yet

- Assignment4 1spotifyDocument3 pagesAssignment4 1spotifySeleneNo ratings yet

- Assignment 09marketing Plan Outline.Document8 pagesAssignment 09marketing Plan Outline.SeleneNo ratings yet

- Part II Goal & Habit TrackerDocument4 pagesPart II Goal & Habit TrackerSeleneNo ratings yet

- Assignment6.1 Case Scenario AnalysisDocument4 pagesAssignment6.1 Case Scenario AnalysisSeleneNo ratings yet

- Part 1 Short EssayDocument4 pagesPart 1 Short EssaySeleneNo ratings yet

- Goal & Habit TrackerDocument2 pagesGoal & Habit TrackerSeleneNo ratings yet

- LefkowitzDocument2 pagesLefkowitzSeleneNo ratings yet

- Course Review Guide-EkDocument23 pagesCourse Review Guide-EkSeleneNo ratings yet

- Discussion5.1 Social Responsibility NestleDocument3 pagesDiscussion5.1 Social Responsibility NestleSeleneNo ratings yet

- Personal Balance SheetDocument2 pagesPersonal Balance SheetSeleneNo ratings yet

- Discussion6.1 Business LawDocument3 pagesDiscussion6.1 Business LawSeleneNo ratings yet

- Assignment3.1 Financial AnalysisDocument5 pagesAssignment3.1 Financial AnalysisSeleneNo ratings yet

- Discussion2.1 SMART GoalsDocument1 pageDiscussion2.1 SMART GoalsSeleneNo ratings yet

- Goal & Habit TrackerDocument4 pagesGoal & Habit TrackerSeleneNo ratings yet

- Applying Ethical Decision Making ModelsDocument4 pagesApplying Ethical Decision Making ModelsSeleneNo ratings yet

- Cover LetterDocument1 pageCover LetterSeleneNo ratings yet

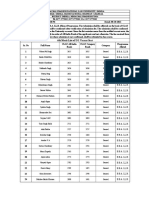

- 6th Merit List of UG Vacant SeatDocument4 pages6th Merit List of UG Vacant SeatRavindra RathoreNo ratings yet

- Outstanding: I/We Hereby Confirm Having Understood and Accepted The Terms/ Conditions of ForeclosureDocument1 pageOutstanding: I/We Hereby Confirm Having Understood and Accepted The Terms/ Conditions of ForeclosureVikas sales CorporationNo ratings yet

- SBI Ad FinalDocument1 pageSBI Ad Finalsrirammadhira88No ratings yet

- Ias 12-Income TaxesDocument2 pagesIas 12-Income Taxesbeth alviolaNo ratings yet

- Lean and Industry 4.0Document9 pagesLean and Industry 4.0lucas washingtonNo ratings yet

- Arms Length PrincipleDocument18 pagesArms Length PrincipleMARY IRUNGUNo ratings yet

- Elfrida Hazna P.M - S1 Farmasi - (Thursday 13.40-15.20)Document5 pagesElfrida Hazna P.M - S1 Farmasi - (Thursday 13.40-15.20)Elfrida HaznaNo ratings yet

- 2.-Anexos - Informe - Gas FNE FinalDocument160 pages2.-Anexos - Informe - Gas FNE FinalFrancisco AgüeroNo ratings yet

- Registration of SocietyDocument48 pagesRegistration of SocietySachin JainNo ratings yet

- Temporary Modification of Licensed Premises July 22 2020 5pDocument3 pagesTemporary Modification of Licensed Premises July 22 2020 5pAnonymous Pb39klJNo ratings yet

- Case Study 5Document1 pageCase Study 5DawitNo ratings yet

- Title Insurance in Real Estate ProjectsDocument10 pagesTitle Insurance in Real Estate ProjectsjjainNo ratings yet

- Automation Solution Guide PDFDocument282 pagesAutomation Solution Guide PDFTariq SaeedNo ratings yet

- Assignment#2 ADRIANOCAÑADADocument3 pagesAssignment#2 ADRIANOCAÑADAADRIANO, Glecy C.No ratings yet

- Managing The Sales Training ProcessDocument5 pagesManaging The Sales Training ProcessGerlene DinglasaNo ratings yet

- Nifty 50: Index MethodologyDocument16 pagesNifty 50: Index MethodologyObhiejitNo ratings yet

- Mutual FundsDocument8 pagesMutual FundsHarmanSinghNo ratings yet

- Module 6Document34 pagesModule 6Brian Daniel BayotNo ratings yet

- Financial of The Balance Sheet: BOOK - II (20 Marks)Document13 pagesFinancial of The Balance Sheet: BOOK - II (20 Marks)sanskriti kathpaliaNo ratings yet

- JD For Marketing Manager - ICICI BankDocument1 pageJD For Marketing Manager - ICICI BankPrachi AroraNo ratings yet

- ENGIE Services Thailand Menus V2Document20 pagesENGIE Services Thailand Menus V2ฐานพล ภาสวัตNo ratings yet

- Opsession GD-PI CompendiumDocument10 pagesOpsession GD-PI CompendiumvidishaniallerNo ratings yet

- Controlling PLPDocument17 pagesControlling PLPclaire yowsNo ratings yet