Professional Documents

Culture Documents

Tassal Intrinsic Value by Simply Wall Street

Uploaded by

William ForresterCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tassal Intrinsic Value by Simply Wall Street

Uploaded by

William ForresterCopyright:

Available Formats

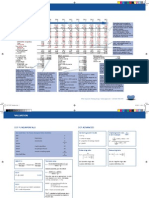

Below are the data sources, inputs and calculation used to determine the intrinsic value for

Tassal Group.

Data Point Source Value

2 Stage Free Cash Flow to

Valuation Model Equity

Average of 6 Analyst Estimates (S&P

Levered Free Cash Flow Global) See below

Discount Rate (Cost of

Equity) See below 8.6%

Perpetual Growth Rate 10-Year AU Government Bond Rate 2.8%

ASX:TGR Discounted Cash Flow Data Sources

An important part of a discounted cash flow is the discount rate, below we explain how it has

been calculated.

Data Point Calculation/ Source Result

Risk-Free Rate 10-Year AU Govt Bond Rate 2.8%

Equity Risk Premium S&P Global 7.2%

Food Unlevered Beta Simply Wall St/ S&P Global 0.48

= Unlevered beta (1 + (1- tax rate) (Debt/Equity))

Re-levered Beta = 0.477 (1 + (1- 30%) (17.52%)) 0.535

Levered Beta limited to 0.8 to 2.0

Levered Beta (practical range for a stable firm) 0.8

= Cost of Equity = Risk Free Rate + (Levered Beta * Equity

Discount Rate/ Cost of Risk Premium)

Equity = 2.77% + (0.8 * 7.23%) 8.55%

Calculation of Discount Rate/ Cost of Equity for ASX:TGR

Discounted Cash Flow Calculation for ASX:TGR using 2 Stage Free Cash Flow to Equity Model

The calculations below outline how an intrinsic value for Tassal Group is arrived at by

discounting future cash flows to their present value using the 2 stage method. We use analyst's

estimates of cash flows going forward 5 years for the 1st stage, the 2nd stage assumes the

company grows at a stable rate into perpetuity.

2019 2020 2021 2022 2023

Levered FCF (AUD, Millions) 36.90 51.10 59.30 71.40 75.10

Analyst Analyst Analyst Analyst Analyst

Source x1 x1 x1 x1 x1

Present Value 33.99 43.36 46.36 51.42 49.82

Discounted (@ 8.55%)

Present value of next 5 years cash

flows A$224.95

ASX:TGR DCF 1st Stage: Next 5 year cash flow forecast

Calculation Result

= FCF2023 × (1 + g) ÷ (Discount Rate – g)

= A$75.10 × (1 + 2.77%) ÷ (8.55% –

Terminal Value 2.77%) A$1,335.17

= Terminal Value ÷ (1 + r)5

Present Value of Terminal Value = A$1,335.17 ÷ (1 + 8.55%)5 A$885.71

ASX:TGR DCF 2nd Stage: Terminal Value

Calculation Result

= Present value of next 5 years cash flows + Terminal

Value

Total Equity Value = A$224.95 + A$885.71 A$1,110.65

Equity Value per

Share = Total value / Shares Outstanding

(AUD) = A$1,110.65 / 177.26 A$6.27

ASX:TGR Total Equity Value

Calculation Result

Value per share (AUD) From above. A$6.27

Discount to share price of

A$4.33

Current discount = -1 x (A$4.33 - A$6.27) / A$6.27 30.9%

ASX:TGR Discount to Share Price

Learn more about our DCF calculations in Simply Wall St’s analysis model .

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CHAPTER NO D Cost of Capital and Portfolio ManagementDocument124 pagesCHAPTER NO D Cost of Capital and Portfolio Managementzaheer shahzadNo ratings yet

- Wealth MGMT - FA ADocument19 pagesWealth MGMT - FA Achinmay manjrekarNo ratings yet

- Aswath Damodara - Talk - PPT PDFDocument34 pagesAswath Damodara - Talk - PPT PDFRavi OlaNo ratings yet

- Nike Case NotesDocument2 pagesNike Case NotesPrarthuTandonNo ratings yet

- Analysis of DLF (FINAL)Document31 pagesAnalysis of DLF (FINAL)Sumit SharmaNo ratings yet

- Corporate FinanceDocument8 pagesCorporate FinanceTraceNo ratings yet

- Fin 4600 Practice Mid Term Exam 1 Robert UptegraffDocument12 pagesFin 4600 Practice Mid Term Exam 1 Robert UptegraffNguyễn Thanh TùngNo ratings yet

- PeachTree Securities (B-2) FINALDocument45 pagesPeachTree Securities (B-2) FINALish june100% (1)

- Business Valuation ModelDocument14 pagesBusiness Valuation Modeldagagovind7No ratings yet

- Business Finance Assignment 2Document8 pagesBusiness Finance Assignment 2Akshat100% (1)

- Equity Analysis and Evaluation - II Assignment December 23Document14 pagesEquity Analysis and Evaluation - II Assignment December 23sachin.saroa.1No ratings yet

- COMM 324 A4 SolutionsDocument6 pagesCOMM 324 A4 SolutionsdorianNo ratings yet

- Valuation of SharesDocument23 pagesValuation of SharesRuchi SharmaNo ratings yet

- Final Practice Questions and SolutionsDocument12 pagesFinal Practice Questions and Solutionsshaikhnazneen100No ratings yet

- Wacc SolutionsDocument8 pagesWacc SolutionssrassmasoodNo ratings yet

- Finman - Ytm & Stock ValuationDocument5 pagesFinman - Ytm & Stock ValuationnettenolascoNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalVincitta MuthappanNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Tutorial 6 FAT SolutionDocument11 pagesTutorial 6 FAT SolutionAhmad FarisNo ratings yet

- NewcrestDocument10 pagesNewcrestJosh LimNo ratings yet

- Answer 1. The Correct Answers Are A and BDocument9 pagesAnswer 1. The Correct Answers Are A and BBadihah Mat SaudNo ratings yet

- Problem Set 3 (Duration II) With AnswersDocument5 pagesProblem Set 3 (Duration II) With Answerskenny013No ratings yet

- Ch10 3310Document17 pagesCh10 3310zeynepilNo ratings yet

- Valuation AnalysisDocument27 pagesValuation Analysisnimitjain10No ratings yet

- ATARAXIA FUND LP Inception August 2019Document8 pagesATARAXIA FUND LP Inception August 2019JBPS Capital ManagementNo ratings yet

- UntitledDocument6 pagesUntitledShuHao ShiNo ratings yet

- MAS Risk and Rates of Returns Practice Problems AnswerDocument29 pagesMAS Risk and Rates of Returns Practice Problems AnswerMJ YaconNo ratings yet

- Topic G ExercisesDocument8 pagesTopic G ExercisesAustin Joseph100% (1)

- Share PriceDocument4 pagesShare PriceEduardo FigueiredoNo ratings yet

- Damodaran On Valuation Lect5Document7 pagesDamodaran On Valuation Lect5Keshav KhannaNo ratings yet

- Chapter 7 Math SolutionDocument5 pagesChapter 7 Math SolutionRakib AhmedNo ratings yet

- Valuation of FirmDocument13 pagesValuation of FirmLalitNo ratings yet

- Risk Measures: Risk Analysis Distribution of ReturnsDocument7 pagesRisk Measures: Risk Analysis Distribution of ReturnsJBPS Capital ManagementNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Valn of CMN StockDocument18 pagesValn of CMN StockSushant Maskey0% (1)

- (Anand, Arun, Chris, Nirupama, Priyanka, Samhita, Sharat) : Assessment 2 - Business FinanceDocument5 pages(Anand, Arun, Chris, Nirupama, Priyanka, Samhita, Sharat) : Assessment 2 - Business Financearun gopalakrishnanNo ratings yet

- Legg Mason Value Fund - Dec 2022 PDFDocument2 pagesLegg Mason Value Fund - Dec 2022 PDFJeanmarNo ratings yet

- 6 CHP 13 14 15 SolutionDocument21 pages6 CHP 13 14 15 SolutionBijay AgrawalNo ratings yet

- Suggested Answer - Syl12 - Dec13 - Paper 14 Final Examination: Suggested Answers To QuestionsDocument18 pagesSuggested Answer - Syl12 - Dec13 - Paper 14 Final Examination: Suggested Answers To QuestionsMudit AgarwalNo ratings yet

- Lec 11 Cash Flow Estimation Risk Analysis Part 2 21102021 121652pmDocument62 pagesLec 11 Cash Flow Estimation Risk Analysis Part 2 21102021 121652pmosamaNo ratings yet

- 04 - Tutorial 4 - Week 6 SolutionsDocument8 pages04 - Tutorial 4 - Week 6 SolutionsJason ChowNo ratings yet

- VT PDFDocument6 pagesVT PDFSRGNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- Nike Cost of CapitalDocument23 pagesNike Cost of CapitalSaahil Ledwani100% (1)

- 4.chapter 8 - Stock ValuationDocument40 pages4.chapter 8 - Stock ValuationMohamed Sayed FadlNo ratings yet

- Managerial AccountingDocument8 pagesManagerial AccountingFelixNo ratings yet

- Exam Practice SolutionsDocument11 pagesExam Practice Solutionssir bookkeeperNo ratings yet

- Equity ValuationDocument4 pagesEquity ValuationSitiNadyaSefrilyNo ratings yet

- KR Valuation 28 Sept 2019Document54 pagesKR Valuation 28 Sept 2019ket careNo ratings yet

- TMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 YearDocument3 pagesTMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 Yearaekkasit.seNo ratings yet

- Stock SolutionDocument9 pagesStock Solution신동호No ratings yet

- Commercial Real Estate Valuation Model1Document6 pagesCommercial Real Estate Valuation Model1Sajib JahanNo ratings yet

- Tugas 3 CH 7 Dan 8 Up Date1Document5 pagesTugas 3 CH 7 Dan 8 Up Date1Bayu SilvatikaNo ratings yet

- Chapter 8 DerivativesDocument25 pagesChapter 8 DerivativesamamNo ratings yet

- Ch11 - Excel For StudentsDocument90 pagesCh11 - Excel For StudentsSimran Kaur100% (1)

- IFM PresentsiDocument4 pagesIFM PresentsiRezky Pratama Putra0% (1)

- Valuation of SecuritiesDocument19 pagesValuation of SecuritiesdelfrenajibinsonNo ratings yet

- You Have To Answer in The Question PaperDocument6 pagesYou Have To Answer in The Question PaperDavid ViksarNo ratings yet

- Key Metrics: Fortescue Metals Group LimitedDocument3 pagesKey Metrics: Fortescue Metals Group LimitedWilliam ForresterNo ratings yet

- PME Overview - ResearchDocument3 pagesPME Overview - ResearchWilliam ForresterNo ratings yet

- ALU Overview - ResearchDocument3 pagesALU Overview - ResearchWilliam ForresterNo ratings yet

- IDP Overview - ResearchDocument3 pagesIDP Overview - ResearchWilliam ForresterNo ratings yet

- IDP Annual Report FY20Document108 pagesIDP Annual Report FY20Md. Rezaul IslamNo ratings yet

- IDP FY16 Annual ReportDocument96 pagesIDP FY16 Annual ReportWilliam ForresterNo ratings yet

- Chapter 4 Cost of CapitalDocument19 pagesChapter 4 Cost of CapitalmedrekNo ratings yet

- Intraday Trading With The TickDocument5 pagesIntraday Trading With The Tickthecrew67100% (1)

- Wharton Finance1Document21 pagesWharton Finance1DaSkeptic100% (1)

- Unit 5 Trending Digital MarketingDocument12 pagesUnit 5 Trending Digital MarketingKamaliNo ratings yet

- MCR DemoDocument64 pagesMCR Demopramod78No ratings yet

- Risk Management (P3) : Forex - 01Document21 pagesRisk Management (P3) : Forex - 01moody84No ratings yet

- Mba SylbbDocument4 pagesMba SylbbJasmine AroraNo ratings yet

- Ethiopian Capital Market Fees DirectiveDocument11 pagesEthiopian Capital Market Fees DirectiveMehari MacNo ratings yet

- Morrissette ProfileAngelInvestors 2007Document16 pagesMorrissette ProfileAngelInvestors 2007pattitil.ppNo ratings yet

- Single Stock Futures - Evidence From The Indian Securities MarketDocument15 pagesSingle Stock Futures - Evidence From The Indian Securities Marketsip_pyNo ratings yet

- ACCT 302 Financial Reporting II Lecture 7Document63 pagesACCT 302 Financial Reporting II Lecture 7Jesse NelsonNo ratings yet

- MI Bab 1 Risk and ReturnDocument6 pagesMI Bab 1 Risk and ReturnBidari DhaifinaNo ratings yet

- 2018 FRM Practice Exam 2Document127 pages2018 FRM Practice Exam 2Hannah Cheng100% (2)

- Option SupertraderDocument10 pagesOption SupertraderJunedi dNo ratings yet

- Sip Report On Motilal Oswal Asset Management LTDDocument51 pagesSip Report On Motilal Oswal Asset Management LTDSudish SinghNo ratings yet

- FreddieDocument1 pageFreddieRomyna Faith Grace VillanuzNo ratings yet

- Comparative Analysis of HDFCDocument18 pagesComparative Analysis of HDFCgagandeepsingh86No ratings yet

- Sec Form Auf-002-R: Securities and Exchange CommissionDocument3 pagesSec Form Auf-002-R: Securities and Exchange CommissionRodolfo KhiaNo ratings yet

- ICICI Mutual Fund: Belgaum Institute of Management Studies MBADocument68 pagesICICI Mutual Fund: Belgaum Institute of Management Studies MBAPrasad KumbharNo ratings yet

- Investors Perception Towards Stock MarketDocument67 pagesInvestors Perception Towards Stock MarketHappy Singh36% (22)

- Financial Management: Friday 6 December 2013Document5 pagesFinancial Management: Friday 6 December 2013Nirmal ShresthaNo ratings yet

- ZH 1Document523 pagesZH 1Kaizer PéterNo ratings yet

- Icse 2024 Specimen 641 EcoDocument7 pagesIcse 2024 Specimen 641 EcoShweta SamantNo ratings yet

- Conrad Black To Move Out of Family Estate As Owner Decides What To Do With PropertyDocument1 pageConrad Black To Move Out of Family Estate As Owner Decides What To Do With PropertyGenieNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch08Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch08Kevin Molly KamrathNo ratings yet

- Price SkimmingDocument3 pagesPrice SkimmingleighannNo ratings yet

- FIN - 536 Assignment Group Otai IIIDocument15 pagesFIN - 536 Assignment Group Otai IIIazwan ayop100% (1)

- Product Construct MayDocument8 pagesProduct Construct MaynnsriniNo ratings yet

- Candlesticks Part2Document13 pagesCandlesticks Part2Mc SelvaNo ratings yet

- Assignment On Timpy Masala Case StudyDocument16 pagesAssignment On Timpy Masala Case StudyLavit MaheshwariNo ratings yet