Professional Documents

Culture Documents

Share Price

Uploaded by

Eduardo FigueiredoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Share Price

Uploaded by

Eduardo FigueiredoCopyright:

Available Formats

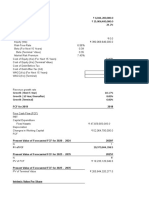

Share Price vs.

Fair Value

Below are the data sources, inputs and calculation used to determine the

intrinsic value for Ambev.

BOVESPA:ABEV3 Discounted Cash Flow Data Sources

Data Point Source Value

Valuation Model 2 Stage Free Cash Flow

to Equity

Levered Free Cash Flow Up to 2 Analyst Estimates on Average See below

(S&P Global)

Discount Rate (Cost of See below 17.4%

Equity)

Perpetual Growth Rate 5-Year Average of BR Long-Term 9.7%

Govt Bond Rate

An important part of a discounted cash flow is the discount rate, below we

explain how it has been calculated.

Calculation of Discount Rate/ Cost of Equity for BOVESPA:ABEV3

Data Point Calculation/ Source Result

Risk-Free Rate 5-Year Average of BR Long-Term Govt Bond Rate 9.7%

Equity Risk Premium S&P Global 9.6%

Beverage Unlevered Simply Wall St/ S&P Global 0.58

Beta

Re-levered Beta = 0.33 + [(0.66 * Unlevered beta) * (1 + (1 - tax rate) 0.726

(Debt/Market Equity))]

= 0.33 + [(0.66 * 0.584) * (1 + (1 - 34.0%) (1.88%))]

Levered Beta Levered Beta limited to 0.8 to 2.0 0.8

(practical range for a stable firm)

Calculation of Discount Rate/ Cost of Equity for BOVESPA:ABEV3

Data Point Calculation/ Source Result

Discount Rate/ Cost of = Cost of Equity = Risk Free Rate + (Levered Beta * 17.39%

Equity Equity Risk Premium)

= 9.73% + (0.800 * 9.57%)

Discounted Cash Flow Calculation for BOVESPA:ABEV3 using 2 Stage Free

Cash Flow to Equity

The calculations below outline how an intrinsic value for Ambev is arrived at by

discounting future cash flows to their present value using the 2 stage method.

We use analyst's estimates of cash flows going forward 10 years for the 1st

stage, the 2nd stage assumes the company grows at a stable rate into

perpetuity.

BOVESPA:ABEV3 DCF 1st Stage: Next 10 years cash flow forecast

Levered FCF (BRL, Millions) Source Present Value

Discounted (@ 17.39%)

2024 16.568,82 Analyst x3 14.114,82

2025 19.567,26 Analyst x3 14.200,3

2026 17.326 Analyst x1 10.711,48

2027 19.315 Analyst x1 10.172,54

2028 20.324,77 Est @ 5.23% 9.118,93

2029 21.661,84 Est @ 6.58% 8.279,37

2030 23.291,67 Est @ 7.52% 7.583,79

BOVESPA:ABEV3 DCF 1st Stage: Next 10 years cash flow forecast

Levered FCF (BRL, Millions) Source Present Value

Discounted (@ 17.39%)

2031 25.198,27 Est @ 8.19% 6.989,41

2032 27.377,68 Est @ 8.65% 6.469,19

2033 29.834,37 Est @ 8.97% 6.005,57

Present value of next 10 years cash flows R$93.645,4

BOVESPA:ABEV3 DCF 2nd Stage: Terminal Value

Calculation Result

Terminal Value FCF2033 × (1 + g) ÷ (Discount Rate – g) R$427.602,66

= R$29.834,375 x (1 + 9.73%) ÷ (17.39% -

9.73% )

Present Value of Terminal = Terminal Value ÷ (1 + r)10 R$86.075,06

Value R$427.603 ÷ (1 + 17.39%)10

BOVESPA:ABEV3 Total Equity Value

Calculation Result

Total Equity Value = Present value of next 10 years cash flows + R$179.720,47

Terminal Value

= R$93.645 + R$86.075

Equity Value per = Total value / Shares Outstanding R$11,41

Share = R$179.720 / 15.747

(BRL)

BOVESPA:ABEV3 Discount to Share Price

BOVESPA:ABEV3 Total Equity Value

Calculation Result

Calculation Result

Value per share (BRL) From above. R$11.41

Current discount Discount to share price of -21.5%

R$13.87

= (R$11.41 - R$13.87) /

R$11.41

Learn more about our DCF calculations in Simply Wall St’s analysis model.

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Micr Code Meaning of ChequeDocument3 pagesMicr Code Meaning of Chequeमन्नू लाइसेंसीNo ratings yet

- 5.2 Discounted Cash Flows, Internal Rate of Return, ROI. Feb 8-12. 2Document13 pages5.2 Discounted Cash Flows, Internal Rate of Return, ROI. Feb 8-12. 2John GarciaNo ratings yet

- Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15Document9 pagesFree Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15MBA grievanceNo ratings yet

- Jib Cranes 20875644 Colour CatalogueDocument30 pagesJib Cranes 20875644 Colour Cataloguepsingh1996No ratings yet

- Mark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsDocument11 pagesMark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsbodaiNo ratings yet

- Nutanix OverviewDocument33 pagesNutanix OverviewDeepak JainNo ratings yet

- Artificial Intelligence - EdurekaDocument37 pagesArtificial Intelligence - EdurekaTechnical NoviceNo ratings yet

- Non Trailable2EnglishDocument6 pagesNon Trailable2EnglishSuman ThakurNo ratings yet

- Tundish RefractoryDocument15 pagesTundish RefractoryMashiur RahmanNo ratings yet

- Real Estate Excel Functions TutorialDocument14 pagesReal Estate Excel Functions Tutorialajohnson79100% (2)

- Flow Measurement With Orifice Meter 1Document79 pagesFlow Measurement With Orifice Meter 1Dedy Chasan Aflah Mutohar100% (2)

- CBA Exercise Sheet - English Revised Oct 2016Document15 pagesCBA Exercise Sheet - English Revised Oct 2016pravin mundeNo ratings yet

- CAIIB Financial ManagementDocument40 pagesCAIIB Financial Managementmonirba48No ratings yet

- Tassal Intrinsic Value by Simply Wall StreetDocument2 pagesTassal Intrinsic Value by Simply Wall StreetWilliam ForresterNo ratings yet

- DCF Model of Bharti Airtel: AssumptionsDocument4 pagesDCF Model of Bharti Airtel: AssumptionsHARSHIL RATHINo ratings yet

- EqmultDocument2 pagesEqmultPro ResourcesNo ratings yet

- 3.8. IM Answer Test 4Document13 pages3.8. IM Answer Test 4Gia LâmNo ratings yet

- Wealth MGMT - FA ADocument19 pagesWealth MGMT - FA Achinmay manjrekarNo ratings yet

- Equity Level II 2019 PracticeDocument119 pagesEquity Level II 2019 Practicehamza omar100% (2)

- Case Study ReportDocument7 pagesCase Study ReportHytham RiadNo ratings yet

- Free Cash Flow Estimate (In INR CRS)Document2 pagesFree Cash Flow Estimate (In INR CRS)Kapil KhannaNo ratings yet

- Chapter 2 - Theory - 3Document64 pagesChapter 2 - Theory - 3Diptish RamtekeNo ratings yet

- Cost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockDocument18 pagesCost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockFadhila HanifNo ratings yet

- Tugas Mankeu II - ChandraMalauDocument4 pagesTugas Mankeu II - ChandraMalauvinn albatraozNo ratings yet

- Extending Basic FunctionsDocument2 pagesExtending Basic FunctionsDreamer_ShopnoNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Bbca Buy TP 33.000Document5 pagesBbca Buy TP 33.000thoyibNo ratings yet

- Sessions 5 and 6Document69 pagesSessions 5 and 6Priyansh SinghNo ratings yet

- Exam Practice SolutionsDocument11 pagesExam Practice Solutionssir bookkeeperNo ratings yet

- Module 3 Chapter 15 DCF ModelDocument2 pagesModule 3 Chapter 15 DCF ModelMaulik JainNo ratings yet

- Ratio Analysis, DDM, Economical Analysis, IntroDocument7 pagesRatio Analysis, DDM, Economical Analysis, Introhbv0606132No ratings yet

- FIN 6060 Module 4 WorksheetDocument4 pagesFIN 6060 Module 4 Worksheetr.olanibi55No ratings yet

- Cryptoassets: The Financial MetaverseDocument125 pagesCryptoassets: The Financial MetaverseTom ChoiNo ratings yet

- Kieso InterAcctg IFRS 11e 01Document4 pagesKieso InterAcctg IFRS 11e 01Arini Geubri MaghfirahNo ratings yet

- Net Present Value and Other Investment CriteriaDocument72 pagesNet Present Value and Other Investment CriteriaAbdullah MujahidNo ratings yet

- Busi 331 Project 1 Marking Guide: HandbookDocument28 pagesBusi 331 Project 1 Marking Guide: HandbookDilrajSinghNo ratings yet

- Chapter One Introduction To Financial Modeling and ValuationDocument6 pagesChapter One Introduction To Financial Modeling and ValuationBobasa S AhmedNo ratings yet

- Intrinsic Value Calculator (Discounted Earnings Per Share Method 10 Years)Document6 pagesIntrinsic Value Calculator (Discounted Earnings Per Share Method 10 Years)Martin RodriguezNo ratings yet

- GSTL FM Project ReportDocument12 pagesGSTL FM Project Reportmuhammad shamsadNo ratings yet

- Bir NaDocument8 pagesBir NaForexliveNo ratings yet

- Exercise CH14 SolutionDocument11 pagesExercise CH14 SolutionThanawat PHURISIRUNGROJNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- Chap 018Document27 pagesChap 018Nazifah100% (1)

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- SBI - 3QFY19 - HDFC Sec-201902031901526172690Document14 pagesSBI - 3QFY19 - HDFC Sec-201902031901526172690HARDIK SHAHNo ratings yet

- 1Q17 Income Better Than Expected, FV Estimate Raised: Share DataDocument6 pages1Q17 Income Better Than Expected, FV Estimate Raised: Share DataJajahinaNo ratings yet

- Latihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Document7 pagesLatihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Yoga Cipta NugrahaNo ratings yet

- UntitledDocument8 pagesUntitledPravin AmirthNo ratings yet

- Final Paper - Sample 1Document13 pagesFinal Paper - Sample 1Abdo Mohammed AbdoNo ratings yet

- By: Vinit Mishra SirDocument109 pagesBy: Vinit Mishra SirgimNo ratings yet

- Equity Valuation Project: GroupDocument20 pagesEquity Valuation Project: Groupsushilgoyal86100% (1)

- Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15Document6 pagesFree Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15Raman ChawlaNo ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- Rudimentary Quantitative Analytics in Building A Financial Decision Support SystemDocument14 pagesRudimentary Quantitative Analytics in Building A Financial Decision Support SystemCollege08No ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida AmriNo ratings yet

- Capital Budgeting Techniques Capital Budgeting TechniquesDocument58 pagesCapital Budgeting Techniques Capital Budgeting TechniquesMuhammad ZeeshanNo ratings yet

- CiplaDocument9 pagesCiplaShivam GoelNo ratings yet

- Tutorial EPSDocument3 pagesTutorial EPSRil LlNo ratings yet

- FMO M5 Soln.sDocument16 pagesFMO M5 Soln.sVishwas ParakkaNo ratings yet

- HP-Compaq Merger AnalysisDocument15 pagesHP-Compaq Merger AnalysisAnubhav AroraNo ratings yet

- Franklin Resources Inc. $27.26 Rating: Very Positive Very PositiveDocument3 pagesFranklin Resources Inc. $27.26 Rating: Very Positive Very Positiveapdusp2No ratings yet

- Chevron Lubricants Lanka PLC LLUB Q1 FY 16 HOLD PDFDocument11 pagesChevron Lubricants Lanka PLC LLUB Q1 FY 16 HOLD PDFNuwan Tharanga LiyanageNo ratings yet

- Materi 1 Manajemen Keuangan II - ValuationDocument13 pagesMateri 1 Manajemen Keuangan II - Valuationvinn albatraozNo ratings yet

- DBBL FinalDocument8 pagesDBBL Finalnaziba aliNo ratings yet

- Feasibility Assignment 1&2 AnswersDocument12 pagesFeasibility Assignment 1&2 AnswersSouliman MuhammadNo ratings yet

- Colgate PalmoliveDocument8 pagesColgate PalmoliveRahul MaddikuntaNo ratings yet

- Kenelm Digby On Quantity As Divisibility PDFDocument28 pagesKenelm Digby On Quantity As Divisibility PDFvalexandrescuNo ratings yet

- Geotechnical Investigation Report at Ahelwari CorrectedDocument18 pagesGeotechnical Investigation Report at Ahelwari Correctedpradeepsharma62No ratings yet

- En Novatop ElementDocument32 pagesEn Novatop ElementLucian CiprianNo ratings yet

- 785 Truck Electrical System: 8GB418-UPDocument2 pages785 Truck Electrical System: 8GB418-UPEdwin Ruiz VargasNo ratings yet

- Franks 2009Document11 pagesFranks 2009bhanu0% (1)

- Wordpress The Right WayDocument62 pagesWordpress The Right WayAdela CCNo ratings yet

- D-Intro To Programming With RAPTORDocument13 pagesD-Intro To Programming With RAPTORmarkecbNo ratings yet

- ISO-14236-2000 Traducido EspañolDocument11 pagesISO-14236-2000 Traducido EspañolPablo A.100% (1)

- Ieee 802.11Document13 pagesIeee 802.11jeffy100% (1)

- Adr141c PDFDocument11 pagesAdr141c PDFNamrata Shetti100% (1)

- 634904411345780000Document24 pages634904411345780000chintan kapadiaNo ratings yet

- Danyar Et Al., 2020 - FinalDocument24 pagesDanyar Et Al., 2020 - FinalSardar SaleemNo ratings yet

- Fy CS Labbook 2019 20Document46 pagesFy CS Labbook 2019 20rajeshkanade121No ratings yet

- Siesta TutorialDocument14 pagesSiesta TutorialCharles Marcotte GirardNo ratings yet

- Minggu 5 Teori AktDocument69 pagesMinggu 5 Teori AktHILDANo ratings yet

- Res2dinvx32 PDFDocument173 pagesRes2dinvx32 PDFWahyu Sutrisno0% (1)

- A Tale of Two Cultures: Contrasting Quantitative and Qualitative Research - Mahoney e GoertzDocument24 pagesA Tale of Two Cultures: Contrasting Quantitative and Qualitative Research - Mahoney e Goertzandre_eiras2057No ratings yet

- Libros de Estructuras MetalicasDocument8 pagesLibros de Estructuras MetalicasNata277No ratings yet

- A30050-X6026-X-4-7618-rectifier GR60Document17 pagesA30050-X6026-X-4-7618-rectifier GR60baothienbinhNo ratings yet

- Coal Lab Assignment 2 - v5 - f2019266302Document12 pagesCoal Lab Assignment 2 - v5 - f2019266302Talha ChoudaryNo ratings yet

- IBM PVM Getting Started GuideDocument104 pagesIBM PVM Getting Started GuideNoureddine OussouNo ratings yet