Professional Documents

Culture Documents

Activity No. 4

Uploaded by

Adonis Gaoiran0 ratings0% found this document useful (0 votes)

10 views2 pagesactivity

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentactivity

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesActivity No. 4

Uploaded by

Adonis Gaoiranactivity

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

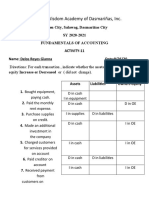

Account Titles Dr or Cr IS or SFP

1.8% one year bank loan of the Interest Expense Debit IS

company is dated July 15.

Interest Payable Credit SFP

2. Telephone Bill is received from PLDT Utilities Expense Debit IS

Utilities Payable Credit SFP

3. Prepaid insurance has expired Insurance Expense Debit IS

Prepaid Expense Credit SFP

4. Credit Customer is declared Bad Debts Expense Debit IS

insolvent

Accounts Receivable Credit SFP

5. Customer’s 5% one year note is Notes Receivable Debit SFP

dated December 1.

Service Income Credit IS

6. Advance collection from tenant is Cash Debit SFP

already earned. Unearned Service Income Credit SFP

7. Equipment has a life of 10 years Depreciation Expense Debit IS

Accumulated Depreciation Credit SFP

2.

A. Accrued Commission Income P10,000

Commission Receivable P10,000

Commission Income P10,000

B. Accrued Utility Expense of P5,000

Utilities Expense P5,000

Utilities Payable P5,000

C. Bad Debts of P2,000 under the direct- off method

Bad Debts Expense P2,000

Accounts Receivable P2,000

D. Depreciation of Equipment for P3,500

Depreciation Expense P3,500

Accumulate Depreciation P3,500

E. Used supplies for P350 under the asset method from total purchases of P500

Supplies Expense P350

Supplies P350

F. Earned commission of P2,500 under the liability method if advance collection amounted to P3,000

Cash P2,500

Unearned Commission P2,500

3. Refer to exercise 2

A. How much will be the additional operating expenses? P10,850

B. How much will be the additional revenues? P10,000

4.

A. December 1 for the note received

Note Receivable P900

Service Income P900

B. December 31 for the adjustment to accrued interest for 30 days.

Note Receivable P18,000

Service Income P18,000

5.

Salaries Expense P700

Salaries Payable P700

You might also like

- Liabilities BSA 5-2sDocument7 pagesLiabilities BSA 5-2sJustine GuilingNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- Lesson 2 Accounting Elements Answer KeyDocument17 pagesLesson 2 Accounting Elements Answer KeyJoshua Arjay V. ToveraNo ratings yet

- MODULE-1-AFNA-ACT - BSIT2A AnswerDocument2 pagesMODULE-1-AFNA-ACT - BSIT2A AnswerRowena Serrano100% (1)

- Accounting Process 3Document2 pagesAccounting Process 3Glen JavellanaNo ratings yet

- Adjustments Quiz 1Document7 pagesAdjustments Quiz 1Sheena GaborNo ratings yet

- MODULE 1 AFNA ACT2A AnswersDocument2 pagesMODULE 1 AFNA ACT2A AnswersRowena Serrano100% (3)

- (Tax) CPAR PreweekDocument4 pages(Tax) CPAR PreweekNor-janisah PundaodayaNo ratings yet

- Adjustments Quiz 1 - Answer KeyDocument7 pagesAdjustments Quiz 1 - Answer KeyAngelie JalandoniNo ratings yet

- Afar 2019Document10 pagesAfar 2019Richard VictoriaNo ratings yet

- P2 QuizDocument7 pagesP2 QuizJay Mark DimaanoNo ratings yet

- Module 3 - Caragan, Adriane Ronn B. (CORRESPONDENCE)Document8 pagesModule 3 - Caragan, Adriane Ronn B. (CORRESPONDENCE)WonnNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Midterm Quiz No. 2 - PreparationDocument2 pagesMidterm Quiz No. 2 - PreparationRonel CaagbayNo ratings yet

- ABM - 111 - Final ExaminationDocument2 pagesABM - 111 - Final ExaminationTimothy JamesNo ratings yet

- Practical Accounting Problems IIDocument12 pagesPractical Accounting Problems IIRodNo ratings yet

- Solutions To Recommended Questions - Chapter 1Document16 pagesSolutions To Recommended Questions - Chapter 1David Terran TangNo ratings yet

- FARDocument5 pagesFARoliveNo ratings yet

- Afar 2019Document10 pagesAfar 2019mameneses.upNo ratings yet

- Advanced Financial Reporting and AccountingDocument10 pagesAdvanced Financial Reporting and AccountingMary Rose RamosNo ratings yet

- Cash Flow Statement: Final ExamDocument4 pagesCash Flow Statement: Final ExamAiman Abdul QadirNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument4 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Cup 3 AFAR 1Document9 pagesCup 3 AFAR 1Elaine Joyce GarciaNo ratings yet

- (Module 3) ExerciseDocument5 pages(Module 3) ExerciseArriane Dela CruzNo ratings yet

- 3 ACCT 2AB P. DissolutionDocument6 pages3 ACCT 2AB P. DissolutionMary Angeline LopezNo ratings yet

- Acctg 101 Ass. #15,17,19&21Document8 pagesAcctg 101 Ass. #15,17,19&21Danilo Diniay Jr67% (6)

- JPIA CUP With AnswersDocument2 pagesJPIA CUP With AnswersDawn Rei DangkiwNo ratings yet

- Perf. 3Document2 pagesPerf. 3Lanny PerezNo ratings yet

- Entrepreneurship-1112 Q2 SLM WK7Document8 pagesEntrepreneurship-1112 Q2 SLM WK7April Jean Cahoy56% (9)

- Statement of AffairsDocument4 pagesStatement of AffairsCaliNo ratings yet

- Since 1977Document3 pagesSince 1977Wynona Balandra0% (1)

- Department of Accountancy: Holy Angel UniversityDocument14 pagesDepartment of Accountancy: Holy Angel UniversityJohn Edwinson Jara0% (1)

- Elimination Questions Elimination QuestionsDocument4 pagesElimination Questions Elimination QuestionsasffghjkNo ratings yet

- Adjusting Entries Activity SheetDocument1 pageAdjusting Entries Activity SheetRICARDO JOSE VALENCIANo ratings yet

- Angelu M. Villalobos-Problem #2&3Document3 pagesAngelu M. Villalobos-Problem #2&3JeluMVNo ratings yet

- Tutorial Work With SolutionsDocument73 pagesTutorial Work With SolutionsAlison Mokla100% (1)

- ABM 1 Adjustments and WorksheetDocument4 pagesABM 1 Adjustments and WorksheetChelsie Coliflores100% (1)

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Finals Exam For Non-Accountants IDocument2 pagesFinals Exam For Non-Accountants IWycliffe Luther RosalesNo ratings yet

- Government Accounting Quiz 4 Write The Letter Pertaining To Best AnswerDocument6 pagesGovernment Accounting Quiz 4 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- Afar 2019Document10 pagesAfar 2019Marjorie AmpongNo ratings yet

- Far Eastern University - Makati: Discussion ProblemsDocument2 pagesFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNo ratings yet

- Seatwork 2Document8 pagesSeatwork 2Nasiba M. AbdulcaderNo ratings yet

- Afar 2019Document10 pagesAfar 2019Roland CatubigNo ratings yet

- Nfjpia R11 Cup 1 - Fundamentals of Accounting EasyDocument9 pagesNfjpia R11 Cup 1 - Fundamentals of Accounting EasyBlessy Zedlav LacbainNo ratings yet

- NFJPIA - Mockboard 2011 - P2 PDFDocument6 pagesNFJPIA - Mockboard 2011 - P2 PDFLei LucasNo ratings yet

- PRELEC1 Final ExamDocument4 pagesPRELEC1 Final ExamAramina Cabigting BocNo ratings yet

- Deductions From Gross Income QuizDocument7 pagesDeductions From Gross Income Quizwind snip3r reojaNo ratings yet

- Chapter 4: Adjusting The Accounts and Preparing The Financial StatementsDocument5 pagesChapter 4: Adjusting The Accounts and Preparing The Financial Statementschi_nguyen_100No ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- ABM 1 Worksheet PreparationDocument2 pagesABM 1 Worksheet PreparationChelsie ColifloresNo ratings yet

- UntitledDocument2 pagesUntitledJessa Delos SantosNo ratings yet

- Learning Objectives for Adjusting Entries and Financial StatementsDocument6 pagesLearning Objectives for Adjusting Entries and Financial StatementsShane TorrieNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- Worksheet-Income Statement & Balance SheetDocument1 pageWorksheet-Income Statement & Balance SheetPark EunbiNo ratings yet

- Adjusting EntriesDocument3 pagesAdjusting EntriesSheena LeysonNo ratings yet

- FABM2 1st QTR Exam (2022)Document2 pagesFABM2 1st QTR Exam (2022)Noel CalicdanNo ratings yet

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESFrom EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- KUMPASDocument2 pagesKUMPASAdonis GaoiranNo ratings yet

- Activity EconmetDocument8 pagesActivity EconmetAdonis GaoiranNo ratings yet

- Midterm Reviewer Marketing ManagementDocument12 pagesMidterm Reviewer Marketing ManagementAdonis GaoiranNo ratings yet

- Operations Research Course Module OverviewDocument203 pagesOperations Research Course Module Overviewmedrek100% (1)

- Midterm Reviewer Marketing ManagementDocument12 pagesMidterm Reviewer Marketing ManagementAdonis GaoiranNo ratings yet

- Excuse LetterDocument1 pageExcuse LetterAdonis GaoiranNo ratings yet

- Lesson 1 The Power of A VisionDocument35 pagesLesson 1 The Power of A VisionAdonis GaoiranNo ratings yet

- Nationalism and PatriotismDocument2 pagesNationalism and PatriotismAdonis GaoiranNo ratings yet

- RESUMEDocument2 pagesRESUMEAdonis GaoiranNo ratings yet

- Applicant LetterDocument1 pageApplicant LetterAdonis GaoiranNo ratings yet

- Quarterly Term PaperDocument4 pagesQuarterly Term PaperAdonis GaoiranNo ratings yet

- Activity 1 SOL1Document3 pagesActivity 1 SOL1Adonis GaoiranNo ratings yet

- Asynchronous ActivityDocument1 pageAsynchronous ActivityAdonis GaoiranNo ratings yet

- Output (Financial Econ)Document3 pagesOutput (Financial Econ)Adonis GaoiranNo ratings yet

- SPEECHWRITINGDocument2 pagesSPEECHWRITINGAdonis Gaoiran100% (1)

- Activity #4Document1 pageActivity #4Adonis GaoiranNo ratings yet

- What is Economics? Understanding the BasicsDocument1 pageWhat is Economics? Understanding the BasicsAdonis GaoiranNo ratings yet

- 111Document5 pages111Adonis GaoiranNo ratings yet

- Gaoiran - Activity 1Document2 pagesGaoiran - Activity 1Adonis GaoiranNo ratings yet

- Gaoiran - Act #2Document2 pagesGaoiran - Act #2Adonis GaoiranNo ratings yet

- Nokia's Lack of InnovationDocument11 pagesNokia's Lack of InnovationAdonis GaoiranNo ratings yet

- GaoiranDocument3 pagesGaoiranAdonis GaoiranNo ratings yet

- Assignment No.1Document1 pageAssignment No.1Adonis GaoiranNo ratings yet

- ACTIVITY#1Document2 pagesACTIVITY#1Adonis GaoiranNo ratings yet

- Effect of Inflation Rate in Life of Grade 11 Abm Students of World Citti Collages AntipoloDocument12 pagesEffect of Inflation Rate in Life of Grade 11 Abm Students of World Citti Collages Antipolodarodawa85% (13)

- Identify Business Organization Forms - Sole Proprietorship, Partnership, CorporationDocument1 pageIdentify Business Organization Forms - Sole Proprietorship, Partnership, CorporationAdonis GaoiranNo ratings yet

- Assignment#2Document1 pageAssignment#2Adonis GaoiranNo ratings yet

- Case StudyDocument8 pagesCase StudyAdonis GaoiranNo ratings yet

- Fearless Love Devotional by Rob Joanna TeigenDocument24 pagesFearless Love Devotional by Rob Joanna TeigenAdonis GaoiranNo ratings yet

- 07 Safety Culture Informed Just and FairDocument49 pages07 Safety Culture Informed Just and FairDaniel Gaspar SilvaNo ratings yet

- Engleza Cls A 11 A A VarDocument4 pagesEngleza Cls A 11 A A VarMariusEc0No ratings yet

- Board Resolution for Execution of Sale DeedDocument3 pagesBoard Resolution for Execution of Sale DeedRizwan GhafoorNo ratings yet

- SA-10/20 User ManualDocument31 pagesSA-10/20 User ManualJorgeLuis Anaya NúñezNo ratings yet

- Sand Patch TestDocument5 pagesSand Patch TestgreatpicNo ratings yet

- ESG PresentationDocument16 pagesESG Presentationsumit100% (1)

- Power Converters Simulation Lab Manual - (2015-2016)Document41 pagesPower Converters Simulation Lab Manual - (2015-2016)Leela KrishnaNo ratings yet

- Palacio VsDocument2 pagesPalacio VsRaymart SalamidaNo ratings yet

- PR100 Locks With Aperio Wireless Technology: Key FeaturesDocument2 pagesPR100 Locks With Aperio Wireless Technology: Key FeaturesMay SamboNo ratings yet

- Cost Acctg. Problems 1Document8 pagesCost Acctg. Problems 1Cheese ButterNo ratings yet

- 20NCT2 1784 SampleDocument12 pages20NCT2 1784 Samplekimjohn dejesusNo ratings yet

- Nuclear Engineering and Design: Koki Hibi, Kunihiro Itoh, Kazuo Ikeda, Kenji KonashiDocument11 pagesNuclear Engineering and Design: Koki Hibi, Kunihiro Itoh, Kazuo Ikeda, Kenji KonashiWalid BadrNo ratings yet

- Mobile Scaffold Inspection ChecklistDocument3 pagesMobile Scaffold Inspection Checklistanthony murphyNo ratings yet

- Threats: What Trends Could Harm You? What Threats Do Your Weaknesses Expose You To?Document3 pagesThreats: What Trends Could Harm You? What Threats Do Your Weaknesses Expose You To?Rufino Gerard MorenoNo ratings yet

- Department of Civil Engineering, Semester 7th: Different Types of BridgesDocument39 pagesDepartment of Civil Engineering, Semester 7th: Different Types of BridgesSiddhartha SahaNo ratings yet

- PPM Advance Android Application - User ManualDocument22 pagesPPM Advance Android Application - User ManualmayckerNo ratings yet

- Allison - Dp-8000 - Manual de Servicio - Pag-390Document390 pagesAllison - Dp-8000 - Manual de Servicio - Pag-390Manuales De Maquinaria Jersoncat100% (1)

- Quy Trình AgencyDocument4 pagesQuy Trình Agencyson nguyenNo ratings yet

- Setup Manual 0if-Plus B-64647en - 01 - 01Document400 pagesSetup Manual 0if-Plus B-64647en - 01 - 01Aloisio Gonzaga100% (1)

- Philippines Customs Law and ProceduresDocument70 pagesPhilippines Customs Law and ProceduresRojusandino Acevedo Ylagan50% (2)

- "Hybrid" Light Steel Panel and Modular Systems PDFDocument11 pages"Hybrid" Light Steel Panel and Modular Systems PDFTito MuñozNo ratings yet

- Carbozinc 11Document4 pagesCarbozinc 11DuongthithuydungNo ratings yet

- Edmonton Report On Flood MitigationDocument6 pagesEdmonton Report On Flood MitigationAnonymous TdomnV9OD4No ratings yet

- Group 8 - Case Analysis 2Document1 pageGroup 8 - Case Analysis 2Scholar AccountNo ratings yet

- Daniel OdunukweDocument1 pageDaniel OdunukweAbdul samiNo ratings yet

- Intel Optane Memory User InstallationDocument57 pagesIntel Optane Memory User InstallationAlonso LGNo ratings yet

- Insurance AppraisersDocument8 pagesInsurance AppraisersTanu Singh MBA-18No ratings yet

- Altair Flow Simulator 2021.2 Release Notes HighlightsDocument4 pagesAltair Flow Simulator 2021.2 Release Notes HighlightsOliver RailaNo ratings yet

- 2016 Students ch04 - Lovelock - Developing Service Products - 6e - STUDENTDocument36 pages2016 Students ch04 - Lovelock - Developing Service Products - 6e - STUDENTbold onyxNo ratings yet

- Office & Branches: Head Office PT Indosat Mega Media (IM2)Document4 pagesOffice & Branches: Head Office PT Indosat Mega Media (IM2)satriamesumNo ratings yet