Professional Documents

Culture Documents

GSIS Motorcycle Insurance Renewal

Uploaded by

LGU MAHINOG MTOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSIS Motorcycle Insurance Renewal

Uploaded by

LGU MAHINOG MTOCopyright:

Available Formats

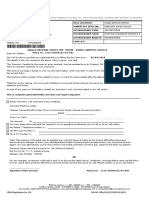

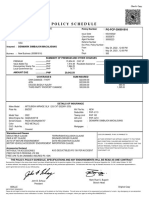

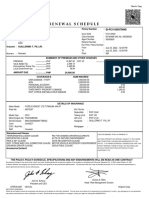

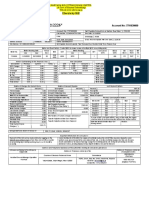

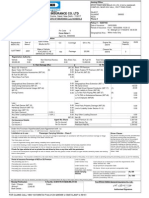

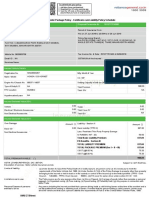

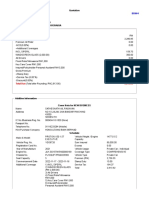

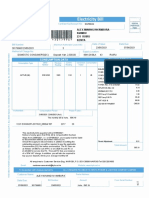

FRONTLINE SERVICES DIVISION

SPECIAL BUSINESS UNIT

MOTOR VEHICLE

[Manual Bill No.: MGOMAHINOG-06-21-01

NAME OF ASSURED: MGO MAHINOG, CAMIGUIN

ADDRESS: MAHINOG, CAMIGUIN 9101 DATE: June 21, 2021

WARRANTIES AMOUNT OF PREMIUM

PARTICULARS

& CLAUSES INSURANCE RATE AMOUNT

1. STDMV

TYPE OF VEHICLE: MC (MOTORCYCLE)

2. LOSSNOTIC1

3. MV MAKE HONDA

4. MVAE01 TYPE CFT125MRCA MOTORCYCLE 2011

5. AON

6. PSE MOTOR NO. XRM17E020023

7. GSISDST1 SERIAL NO. XRM17020016

8. RDPC/CV/MC

9. UPPA20K PLATE NO. SF-4647

10. UD20K COLOR RED/BLACK

11. ROADASSIST

12. CLAIMSDOC CTPL-BI…………………….. 100,000.00 199.60

Comprehensive Insurance: Business

Type: TG

Loss/Damage (LD)...………. 50,000.00 300.00

Additional Notes: TPL-Excess BI (EBI)……………. 250,000.00 100.00

TPL-Property Damage (PD) 250,000.00 530.00

Deductible [0.01 of LD/AON/S&T] 500.00 UPPA ……………………….. 20,000.00 50.40

Repair Limit [0.01 of LD/AoN/S&T] 500.00 Unnamed Driver (UD)…..….. 20,000.00 50.40

Towing 1,000.00 Acts of Nature (AON)……… 50,000.00 550.00

Other Peril 0.00 -

TOTAL COMPREHENSIVE 590,000.00 1,580.80

expiring policy:

PERIOD COVERED

From August 1, 2021 690,000.00 1,780.40

8100521466 To: August 1, 2022 ADD: Interconnectivity Fee (UB 14-13) 0.00

MORTAGED WITH: DST on Premiums 223.00

MV FILE #

102400000019726 NONE DST on Cert. of Cover (COC) 30.00

For Assureds (i.e. payor) who are withholding Agents (e.g. Government Agency): 12% VALUE ADDED TAX:

If payor opted to withhold 5% VAT, this amount shall be reflected in their CCTWS: (5%) 89.02 [per RR 13-2018 eff 1/1/2021]

If payor opted to withhold 5% VAT, the premiums plus the 7% VAT shall be paid to GSIS: (7%) 124.63 213.65

amount of payment to prepare if paying the premium due plus 12% VAT (and DST, if any) --> 2,247.05

amount of payment to prepare if paying the premium due w/ 7% VAT only, and agency withholds* 5% VAT (and DST, if any) --> 2,158.03

NOTES: Policy shall be issued upon payment of premium.

For comprehensive cover, flat rate for Acts of Nature (Earthquake, Typhoon, Flood, and other natural calamities) is applied.

Premium rate is based on Underwriting Bulletin Nos. 14-06, 16-01, 16-07, 17-01.

Documentary Stamp Tax (DST) effective 7/1/2017 (TG and ONLI); DST discontinued effective 4/3/2018 (TG only)

Documentary Stamp Tax (DST) re-implemented per BIR Ruling (OT-184-2021 dated 5/20/2021)

Imposition of 12% VAT is based on Republic Act (RA) No. 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) Act

Office Order on VAT implementation took effect on January 2020

REMINDERS: Please attach validated bank advice when paying through check, if applicable.

If Assured is a withholding agent and opts to withhold 5% VAT, *attach a Certificate of Creditable Tax Withheld at Source (CCTWS).

The CCTWS or BIR Form 2307 must be an original copy and without any alteration.

REMARKS: INCREASE SUM INSURED FOR EBI AND PD DUE TO HIGH EXPOSURE OF RISK

-

GOVERNMENT SERVICE INSURANCE SYSTEM

By: Received by: Date:

ANICETA G. JABIGUERO SIGNATURE OVER PRINTED NAME

Officer I, FSD

/RAEB

Office of the Branch Manager TeleFax (088) 858-5818 Mobile 09060097595 | Frontline Services TeleFax (088) 858-3035 Mobile 09060097594 [Claims, Special Business, Treasury, Medical]; (088) 858-3992 [Loans

and eServices] Mobile 09060327484 | Billing, Collection, and Reconciliation (088) 858-5801 Mobile 09274024747; 09186545272 | Legal (088) 858-5803

You might also like

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Quotation Motorcycle TVS Metro 31707.66Document1 pageQuotation Motorcycle TVS Metro 31707.66Trust Insurance BrokersNo ratings yet

- 59424276Document2 pages59424276anshiNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- Joint venture insurance renewal for goods carrying vehicleDocument2 pagesJoint venture insurance renewal for goods carrying vehiclecommission sompoNo ratings yet

- Versosarichard SindejasDocument1 pageVersosarichard SindejasDorothy NaongNo ratings yet

- TH190 ClaimsDocument28 pagesTH190 ClaimsEchague GjNo ratings yet

- Prem Comp 1717977820231115151059Document1 pagePrem Comp 1717977820231115151059adityaraj.mba2325cNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- Transit of Planets On Thy Birth ChartDocument2 pagesTransit of Planets On Thy Birth Chartanshi0% (1)

- Quotation WXT155 by IkhlasDocument1 pageQuotation WXT155 by IkhlasAhmad NubliNo ratings yet

- Policy MacalisangDocument3 pagesPolicy MacalisangCrush RockNo ratings yet

- Policy Schedule Certificate MotorDocument2 pagesPolicy Schedule Certificate MotorsssNo ratings yet

- I20 2023 PolicyDocument2 pagesI20 2023 PolicyMohammed AthiNo ratings yet

- A Joint Venture Between Indian Bank, Sompo Japan Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument3 pagesA Joint Venture Between Indian Bank, Sompo Japan Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsanshiNo ratings yet

- Limite D: Reliance Private Car Package Policy-ScheduleDocument9 pagesLimite D: Reliance Private Car Package Policy-Schedulesukhpreet singhNo ratings yet

- HDFC ERGO General Insurance Company Limited 2nd Floor, Potluri Castle, Dwarakanagar, VSP, 16, Vishakapatnam - 530 016Document2 pagesHDFC ERGO General Insurance Company Limited 2nd Floor, Potluri Castle, Dwarakanagar, VSP, 16, Vishakapatnam - 530 016Siva rajNo ratings yet

- New 1Document1 pageNew 1ss9324490794No ratings yet

- 59428283Document2 pages59428283anshiNo ratings yet

- Vdn5259 QuotationDocument1 pageVdn5259 QuotationMuhammad NazirulNo ratings yet

- Policyhome - 2023-10-11T122712.324 - 122820Document4 pagesPolicyhome - 2023-10-11T122712.324 - 122820Nikunj SavaliyaNo ratings yet

- HYS AUDI QuoteDocument1 pageHYS AUDI QuoteJovel RocafortNo ratings yet

- Motor Car Insurance Proposal SummaryDocument1 pageMotor Car Insurance Proposal SummaryRaymondArancilloNo ratings yet

- Sample Reliance PolicyDocument11 pagesSample Reliance Policyinsurance advisorNo ratings yet

- GUILLERMO T. PILI JR.-SI-PCV-500579648 - RN-500218633 - Schedule PDFDocument7 pagesGUILLERMO T. PILI JR.-SI-PCV-500579648 - RN-500218633 - Schedule PDFPearl JoyNo ratings yet

- Chola MS: Motor Policy Schedule Cum Certificate of InsuranceDocument2 pagesChola MS: Motor Policy Schedule Cum Certificate of InsurancemathanNo ratings yet

- Sep 22Document1 pageSep 22krishna tiwari (OHRWA TM)No ratings yet

- Komanduri Anantha CharyuluDocument1 pageKomanduri Anantha CharyuluAnanth KomanduriNo ratings yet

- Smart Drive Private Car Insurance Policy SummaryDocument2 pagesSmart Drive Private Car Insurance Policy Summaryvishal sharmaNo ratings yet

- Pankaj KumarDocument1 pagePankaj KumarKAHANI JINo ratings yet

- Electricity Bill: Account No: 7791830000Document1 pageElectricity Bill: Account No: 7791830000Jai Mata diNo ratings yet

- GJ5TT8087Document1 pageGJ5TT8087HAMTUM421No ratings yet

- Comprehensive Bike Insurance PolicyDocument1 pageComprehensive Bike Insurance Policykkundan52No ratings yet

- Include FloodDocument1 pageInclude FloodwdavidchristopherNo ratings yet

- 58213566Document2 pages58213566anshiNo ratings yet

- Maruti Vitara Brezza VxiDocument2 pagesMaruti Vitara Brezza VxiDak ArpNo ratings yet

- Premium CalculationDocument1 pagePremium CalculationArjun RajNo ratings yet

- Claims Adjustment Report: Description Price Parts Tinsmith PaintingDocument2 pagesClaims Adjustment Report: Description Price Parts Tinsmith PaintingMark Dave Joven Lamasan AlentonNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223120444927 Proposal/Covernote No: R09022242303Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223120444927 Proposal/Covernote No: R09022242303imtiyazNo ratings yet

- Tata AIG Motor Premium Quote - 3184 - QT - 23 - 6206165555Document2 pagesTata AIG Motor Premium Quote - 3184 - QT - 23 - 6206165555sarika sharmaNo ratings yet

- Premium Computation: Liberty General Insurance Limited Private Car - Package Policy Premium QuoteDocument1 pagePremium Computation: Liberty General Insurance Limited Private Car - Package Policy Premium QuoteishaqinvestNo ratings yet

- Policyhome - 2023-10-04T172457.626 - 052634Document4 pagesPolicyhome - 2023-10-04T172457.626 - 052634Nikunj SavaliyaNo ratings yet

- U Phyo Wai 3S-6917Document2 pagesU Phyo Wai 3S-6917stts motorNo ratings yet

- Scan Policy QR CodeDocument2 pagesScan Policy QR CodeAhsan KamalNo ratings yet

- Magma HDI General Insurance Company Limited: Development House, 24 P S, K - 700016 Website: Http://magma-Hdi - Co.inDocument1 pageMagma HDI General Insurance Company Limited: Development House, 24 P S, K - 700016 Website: Http://magma-Hdi - Co.inMATAJI EMITRANo ratings yet

- Iffco InsDocument2 pagesIffco Insgauravk00068No ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931MuraliMohanNo ratings yet

- Mh01aj5125 PDFDocument7 pagesMh01aj5125 PDFSELVEL SYNDICATENo ratings yet

- Policy Schedule Cum Certificate of InsuranceDocument2 pagesPolicy Schedule Cum Certificate of InsuranceROhit MalikNo ratings yet

- DOPrint PageDocument2 pagesDOPrint PageRahul PramanikNo ratings yet

- Policy DocumentDocument11 pagesPolicy DocumentAdish BhagwatNo ratings yet

- Tata Magic Final)Document1 pageTata Magic Final)ankitNo ratings yet

- Vgs6726 Ws SPDocument2 pagesVgs6726 Ws SPSathesnath RagavanNo ratings yet

- pdf&rendition=1Document2 pagespdf&rendition=1venkatreddys27.vrNo ratings yet

- Policy QuotationDocument1 pagePolicy QuotationGuruNo ratings yet

- PolicyDocument7 pagesPolicymanoj pandaNo ratings yet

- HDFC ERGO policy for Mercedes-Benz GLC SUVDocument3 pagesHDFC ERGO policy for Mercedes-Benz GLC SUVpratik ranaNo ratings yet

- DOPrint PageDocument2 pagesDOPrint Pagepratik.upadhyay950No ratings yet

- Motor Endorsement Advice - 2022-12-28T161747.022Document1 pageMotor Endorsement Advice - 2022-12-28T161747.022nelly winnieNo ratings yet

- AP07DR1510 EstDocument2 pagesAP07DR1510 EstSåí Kûmã RNo ratings yet

- GSIS Motorcycle Insurance RenewalDocument1 pageGSIS Motorcycle Insurance RenewalLGU MAHINOG MTONo ratings yet

- GSIS Motorcycle Insurance RenewalDocument1 pageGSIS Motorcycle Insurance RenewalLGU MAHINOG MTONo ratings yet

- CDO GSIS Payment OptionsDocument3 pagesCDO GSIS Payment OptionsLGU MAHINOG MTONo ratings yet

- GSIS Motorcycle Insurance RenewalDocument1 pageGSIS Motorcycle Insurance RenewalLGU MAHINOG MTONo ratings yet

- 5 - 2019 Updates To 2009 PSIC Rules of Classification - Statistical Unitsrev05292021Document22 pages5 - 2019 Updates To 2009 PSIC Rules of Classification - Statistical Unitsrev05292021LGU MAHINOG MTONo ratings yet

- Philippine PSIC Training for LGUs in Region XDocument2 pagesPhilippine PSIC Training for LGUs in Region XLGU MAHINOG MTONo ratings yet

- 1 - 2019 Updates To 2009 PSIC Section A - 06082021revDocument36 pages1 - 2019 Updates To 2009 PSIC Section A - 06082021revLGU MAHINOG MTONo ratings yet

- VoucherDocument1 pageVoucherLGU MAHINOG MTONo ratings yet

- Wizard of OzDocument3 pagesWizard of OzLGU MAHINOG MTONo ratings yet

- Grade 7 Student's Report on COVID-19 Symptoms CausesDocument2 pagesGrade 7 Student's Report on COVID-19 Symptoms CausesLGU MAHINOG MTONo ratings yet

- Petitioner vs. vs. Respondent: First DivisionDocument27 pagesPetitioner vs. vs. Respondent: First DivisionLeulaDianneCantosNo ratings yet

- Tally - ERP 9 Advance Video ContentsDocument6 pagesTally - ERP 9 Advance Video ContentsAjay MaheshwariNo ratings yet

- Excise Tax On AutomobileDocument5 pagesExcise Tax On Automobilejoanna reignNo ratings yet

- TraduhubDocument15 pagesTraduhubAdyotNo ratings yet

- Best of South AfricaDocument224 pagesBest of South Africasven67% (3)

- Your PLDT Statement for OctoberDocument6 pagesYour PLDT Statement for OctoberAkosi RizNo ratings yet

- Chinese Economic TermsDocument5 pagesChinese Economic TermschalisaNo ratings yet

- Sample Tax OrdinanceDocument13 pagesSample Tax OrdinanceJohven Centeno RamirezNo ratings yet

- Substantial EvidenceDocument15 pagesSubstantial EvidenceArahbells100% (1)

- Mid-Term-Day 1-Other Percentage Taxes (Opt)Document52 pagesMid-Term-Day 1-Other Percentage Taxes (Opt)Christine Joyce MagoteNo ratings yet

- An Enquiry Into The Effect of GST On Real Estate Sector of IndiaDocument5 pagesAn Enquiry Into The Effect of GST On Real Estate Sector of IndiaEditor IJTSRDNo ratings yet

- Kertas Kerja Siklus AkuntansiDocument13 pagesKertas Kerja Siklus AkuntansiNando Dista SaputraNo ratings yet

- CSR 16-17 AmtDocument283 pagesCSR 16-17 AmtgauravNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Keshav MishraNo ratings yet

- Concept of GST and How It Work On Logistics & TransportDocument31 pagesConcept of GST and How It Work On Logistics & TransportMubeenNo ratings yet

- Erpag ManualDocument103 pagesErpag ManualCarlos Alberto Castillo CespedesNo ratings yet

- international commercial invoice template đã chuyển đổiDocument2 pagesinternational commercial invoice template đã chuyển đổiVăn Tiến HồNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Om ParichhaNo ratings yet

- How To Start and Run A Successful Cleaning BusinessDocument193 pagesHow To Start and Run A Successful Cleaning Businessblueman900100% (4)

- Central Rly RVNL Geotech Agency RatesDocument6 pagesCentral Rly RVNL Geotech Agency RatesEticala RohithNo ratings yet

- Master Data Preparation For Magnetic Media Compliance ReportDocument8 pagesMaster Data Preparation For Magnetic Media Compliance ReportJohan GarciaNo ratings yet

- Alex KPLC BillDocument1 pageAlex KPLC BillTechyrack Capital100% (2)

- Guide To Mergers and Acquisitions in PhilippinesDocument50 pagesGuide To Mergers and Acquisitions in PhilippinesStingray_jar86% (7)

- Laws of Taxation in TanzaniaDocument508 pagesLaws of Taxation in TanzaniaRuhuro tetere100% (3)

- Tax Digest: Alas, Oplas & Co., CpasDocument4 pagesTax Digest: Alas, Oplas & Co., CpasNico NicoNo ratings yet

- Pranay - Darne Final Internship ReportDocument30 pagesPranay - Darne Final Internship ReportDhruv KumarNo ratings yet

- Sap and GST: Northern India Engineering CollegeDocument18 pagesSap and GST: Northern India Engineering CollegeGaurav GuptaNo ratings yet

- Current Affairs Q&A PDF - January 2018 by AffairsCloudDocument199 pagesCurrent Affairs Q&A PDF - January 2018 by AffairsCloudJEE REV RAJAULINo ratings yet

- Sbu Taxation Law 2021 XVDocument468 pagesSbu Taxation Law 2021 XVNaethan Jhoe L. Cipriano100% (1)

- RDMS ManualDocument2 pagesRDMS Manualkarlfriedrich11No ratings yet