Professional Documents

Culture Documents

FINMAR - Time Value of Money

Uploaded by

Sean Patrick C. WONGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINMAR - Time Value of Money

Uploaded by

Sean Patrick C. WONGCopyright:

Available Formats

Discount – calculation of the present

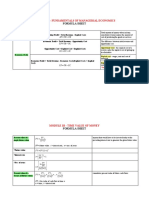

FINANCIAL MARKETS

Time Value of Money

value of some future amount.

J

Discount Rate – rate used to calculate the

Overview of the Handouts: present value of future cash flows. P

I.

II.

Definition of Terms

Formulas

Discounted Cash Flow Valuation –

calculating the present value of future

I

Time value of money is the concept that money

cash flow to determine its value today.

- process of valuing an investment

A

by discounting its future cash flows.

you have now is worth more than the identical

sum in the future due to its potential earning

A

capacity.

II. Formulas

-

I. Definition of Terms

Lump Sum Payment – A single cash

I. Present Value

U

payment or flow is received or occurs at

PV of 1 = (1+r)-n * PMT

the start and end of an investment horizon

1-(1+r)-n

with no other cash flows exchanged. PV of ordinary annuity = * PMT

r

o Present Value of a Lump Sum

o Future Value of a Lump Sum 1-(1+r)-n

PV of annuity due = * (1+r) * PMT

r

Annuity Payment – Series of equal cash 1-(1+r)-n

PV of deferred annuity = * (1+r)-d * PMT

flows received at fixed intervals over the r

entire investment horizon.

o Present Value of an Annuity II. Future Value

o Future Value of an Annuity

FV of 1 = (1+r)n * PMT

Future Value – also known as “compound

(1+r)n-1

value. It is the value of an investment after FV of ordinary annuity = * PMT

r

one or more periods of time.

(1+r)n-1

FV of annuity due = * (1+r) * PMT

Compounding – The accumulation of r

interest in an investment over time in (1+r)n-1

FV of deferred annuity = * (1+r)d * PMT

order to earn more interest. r

Interest on interest – interest gained on III. Perpetuity

prior interest payments reinvested

Cash flow

Perpetuity =

Simple Interest – interest earned only on Interest rate

the original principal amount invested.

IV. Interpolation

Compound Interest – interest generated

on both the original principle and interest PVr - PVLR

r = LR + * (HR-LR)

reinvested from previous periods. PVHR - PVLR

Present Value – current value of future Legend:

cash flows discounted at the appropriate

discount rate. r = rate

n = number of periods

PMT = annuity payment

Junior Philippine Institute of Accountants and Auditors – United

d = number of periods deferred

PVr = PV factor of the missing rate

PVHR = PV factor of higher rate

J

PVLR = PV factor of lower rate

HR = higher rate P

LR = lower rate

I

A

A

-

U

Junior Philippine Institute of Accountants and Auditors – United

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Nataliemoore Time Value of MoneyDocument4 pagesNataliemoore Time Value of MoneyMaurice AgbayaniNo ratings yet

- Time value of money cheat sheetDocument3 pagesTime value of money cheat sheetTechbotix AppsNo ratings yet

- Time Value - ADocument22 pagesTime Value - ANAVNIT CHOUDHARYNo ratings yet

- CA5102 Q1 FORMULA SHEETDocument12 pagesCA5102 Q1 FORMULA SHEETDyra Mae OmegaNo ratings yet

- FINA 7A10 - Review of ConceptsDocument2 pagesFINA 7A10 - Review of ConceptsEint PhooNo ratings yet

- Ignores Time Value of Money: Biased Towards LiquidityDocument1 pageIgnores Time Value of Money: Biased Towards LiquidityJordan ChizickNo ratings yet

- Time Value of Money ReviewerDocument1 pageTime Value of Money ReviewerCJ IbaleNo ratings yet

- Introduction To Valuation - The Time Value of MoneyDocument8 pagesIntroduction To Valuation - The Time Value of MoneyPia AlcantaraNo ratings yet

- Corporate Finance and Formulas and Cheat Sheet Finance 300Document4 pagesCorporate Finance and Formulas and Cheat Sheet Finance 300quỳnh anh lươngNo ratings yet

- FV PV: LN LN (1)Document2 pagesFV PV: LN LN (1)Danneek BillingsNo ratings yet

- FINA 1310 - Lecture 3 NotesDocument6 pagesFINA 1310 - Lecture 3 NotesAayushi ReddyNo ratings yet

- Quantitative Analysis: © EdupristineDocument17 pagesQuantitative Analysis: © EdupristineANASNo ratings yet

- General Mathematics Reviewer s1 q2Document5 pagesGeneral Mathematics Reviewer s1 q2lancono86No ratings yet

- BF - Fourmulae - 2013Document3 pagesBF - Fourmulae - 2013AmiteshNo ratings yet

- FIN222 Equations NotesDocument49 pagesFIN222 Equations NotesSotiris HarisNo ratings yet

- BF2201 Investments CheatsheetDocument4 pagesBF2201 Investments CheatsheetRahman Md SaifurNo ratings yet

- FM Formula Sheet - Not GivenDocument4 pagesFM Formula Sheet - Not GivenSophie ChopraNo ratings yet

- 26 - Summary of MafaDocument3 pages26 - Summary of Mafahina1234No ratings yet

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

- Quants MMDocument65 pagesQuants MMTu DuongNo ratings yet

- Chapter3 EFA2 NPVDocument29 pagesChapter3 EFA2 NPVDương DươngNo ratings yet

- Financial Concepts and Corporate Finance DecisionsDocument28 pagesFinancial Concepts and Corporate Finance Decisionsguowen liNo ratings yet

- Ch. 5 The Time Value of Money: 5.1. Future Values and Compound InterestDocument2 pagesCh. 5 The Time Value of Money: 5.1. Future Values and Compound InterestShahid NaseemNo ratings yet

- Exam Cheat Sheet VSJDocument3 pagesExam Cheat Sheet VSJMinh ANhNo ratings yet

- (A+F) NYU Attack OutlineDocument8 pages(A+F) NYU Attack OutlineShawn BuskovichNo ratings yet

- Derivatives Futures FormulaeDocument3 pagesDerivatives Futures FormulaePraveen Reddy DevanapalleNo ratings yet

- 3_notes-receivableDocument2 pages3_notes-receivablejoneth.duenasNo ratings yet

- Corporate Finance Equations NotesDocument4 pagesCorporate Finance Equations NotesSotiris HarisNo ratings yet

- Lecture NotesDocument2 pagesLecture Notesbinhvn16.sicNo ratings yet

- Appendix A: Formula Sheet: The Following Are Useful Formulae 1. Simple Interest FormulaDocument53 pagesAppendix A: Formula Sheet: The Following Are Useful Formulae 1. Simple Interest FormulasilentNo ratings yet

- Case study notes on finance WACC, DCF and sensitivity analysisDocument27 pagesCase study notes on finance WACC, DCF and sensitivity analysiskarthik sNo ratings yet

- Optimize profits with managerial economicsDocument9 pagesOptimize profits with managerial economicsKang ChulNo ratings yet

- FNCE 100 FINAL CHEAT SHEET GUIDEDocument3 pagesFNCE 100 FINAL CHEAT SHEET GUIDEhung TranNo ratings yet

- Chapter 2Document3 pagesChapter 2Eyra MercadejasNo ratings yet

- FIN222 Lecture 4 Risk and Return: Recording 1: AnnouncementDocument12 pagesFIN222 Lecture 4 Risk and Return: Recording 1: AnnouncementStephanie BuiNo ratings yet

- Capital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalDocument2 pagesCapital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalMary Hazell Victori100% (1)

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- Time Value Money Formulas ExplainedDocument3 pagesTime Value Money Formulas ExplainedRahat IslamNo ratings yet

- Time Value of Money: CFA Level 1 2006 - Formula SheetDocument18 pagesTime Value of Money: CFA Level 1 2006 - Formula SheetGautam MehtaNo ratings yet

- The Time Value of MoneyDocument2 pagesThe Time Value of Moneypier AcostaNo ratings yet

- Lect 17Document5 pagesLect 17filmon dissanNo ratings yet

- Profit Margin Total Assets Turnover Equity Multiplier: Formula AFDocument4 pagesProfit Margin Total Assets Turnover Equity Multiplier: Formula AFDiva Tertia AlmiraNo ratings yet

- Chapter 6 Notes ReceivablesDocument9 pagesChapter 6 Notes ReceivablesNicka NavarroNo ratings yet

- Time Value of Money PracticeDocument11 pagesTime Value of Money PracticeUmer ArshadNo ratings yet

- CH 2Document6 pagesCH 2Hemant GoyalNo ratings yet

- Fnce 443Document4 pagesFnce 443tranbui1709No ratings yet

- Introduction to Corporate Finance MOOC Module 1 NotesDocument1 pageIntroduction to Corporate Finance MOOC Module 1 NotesJose NavarroNo ratings yet

- Cong ThucDocument12 pagesCong ThucGiang Thái HươngNo ratings yet

- C2 Revision of Concepts v1Document11 pagesC2 Revision of Concepts v1Umer FarooqNo ratings yet

- Rules 2nd TermDocument4 pagesRules 2nd TermMohamed AbbasNo ratings yet

- 2022 LI QuantMethodsDocument109 pages2022 LI QuantMethodssharma02decNo ratings yet

- Finanical Management Ch4Document60 pagesFinanical Management Ch4Chucky ChungNo ratings yet

- Time Value of MoneyDocument2 pagesTime Value of Moneyphia triesNo ratings yet

- Sammy's Finance On A PageDocument1 pageSammy's Finance On A PageMoatasemMadianNo ratings yet

- Finmar FormulaDocument2 pagesFinmar FormulaCPAs AccountNo ratings yet

- Wharton On Coursera: Introduction To Corporate Finance: DiscountingDocument7 pagesWharton On Coursera: Introduction To Corporate Finance: Discountingjhon doeNo ratings yet

- Topic 4 Financial FunctionsDocument21 pagesTopic 4 Financial FunctionsLê Thiên Giang 2KT-19No ratings yet

- CF ResumeDocument2 pagesCF ResumejoanalinNo ratings yet

- FINMAR - Some Lessons From Capital Market HistoryDocument3 pagesFINMAR - Some Lessons From Capital Market HistorySean Patrick C. WONGNo ratings yet

- 200 BuslawregDocument14 pages200 BuslawregSean Patrick C. WONGNo ratings yet

- Threshold Assessment Threshold 8 and CONSCIENCEDocument1 pageThreshold Assessment Threshold 8 and CONSCIENCESean Patrick C. WONGNo ratings yet

- Tips and Tricks in Applying The FormatDocument2 pagesTips and Tricks in Applying The FormatSean Patrick C. WONGNo ratings yet

- Threshold 7 Agriculture and Globalization Overview and Workplan-1Document4 pagesThreshold 7 Agriculture and Globalization Overview and Workplan-1Sean Patrick C. WONGNo ratings yet

- Module 2 - Descriptive Statistics - Numerical MeasurementDocument4 pagesModule 2 - Descriptive Statistics - Numerical MeasurementSean Patrick C. WONGNo ratings yet

- THEO103 Final Exam Output Prayer Partner Synthesis PaperDocument4 pagesTHEO103 Final Exam Output Prayer Partner Synthesis PaperSean Patrick C. WONGNo ratings yet

- 6 APT Slides ch10Document53 pages6 APT Slides ch10Zoe RossiNo ratings yet

- Homework Week 4 TVMDocument9 pagesHomework Week 4 TVMJon FruitNo ratings yet

- Managerial Economics & Business Strategy: Quantitative Demand AnalysisDocument28 pagesManagerial Economics & Business Strategy: Quantitative Demand AnalysisReno Prima Dirgantara100% (1)

- Time Series Analysis and Forecasting With MinitabDocument3 pagesTime Series Analysis and Forecasting With MinitabDevi Ila OctaviyaniNo ratings yet

- Tugas Af Chapter 13Document5 pagesTugas Af Chapter 13Nana NurhayatiNo ratings yet

- TestbankDocument41 pagesTestbankTrang TrầnNo ratings yet

- Weighted Regression in ExcelDocument1 pageWeighted Regression in Exceldardo1990No ratings yet

- End-Term Questions and AnswersDocument3 pagesEnd-Term Questions and AnswersBharat MalikNo ratings yet

- Regression Analysis Using StatgraphicsDocument58 pagesRegression Analysis Using StatgraphicsCUCUTA JUAN DIEGO HERNANDEZ LALINDENo ratings yet

- Option GreeksDocument7 pagesOption GreeksNIDHI ANN FRANCIS 20121024No ratings yet

- Understand Randomized Complete Block Designs (RCBDDocument13 pagesUnderstand Randomized Complete Block Designs (RCBDyagnasreeNo ratings yet

- IBM SPSS Statistics license expiration in over 6,000 daysDocument6 pagesIBM SPSS Statistics license expiration in over 6,000 daysANNISANo ratings yet

- Decision Theory: Uncertainty at NMIMSDocument8 pagesDecision Theory: Uncertainty at NMIMSgvspavan0% (1)

- Tables - Hypothesis Testing FormulaDocument7 pagesTables - Hypothesis Testing FormulaecirecirNo ratings yet

- Course 4 Examination Questions And Illustrative SolutionsDocument58 pagesCourse 4 Examination Questions And Illustrative Solutionsirsad100% (1)

- BM2102 Lecture 7Document48 pagesBM2102 Lecture 7shahnaz chNo ratings yet

- Chapter 3 ForecastingDocument87 pagesChapter 3 ForecastingTabassum BushraNo ratings yet

- Causal Inference, Michael E. SobelDocument3 pagesCausal Inference, Michael E. SobelcarlosusassNo ratings yet

- A-Cat CorpDocument26 pagesA-Cat Corpvaibhavjain512No ratings yet

- Spurious Reg and Co IntegrationDocument22 pagesSpurious Reg and Co IntegrationKaran MalhotraNo ratings yet

- Deco504 Statistical Methods in Economics HindiDocument409 pagesDeco504 Statistical Methods in Economics HindiyolosNo ratings yet

- 1quiz - Game TheoryDocument4 pages1quiz - Game TheoryRaunak Agarwal0% (3)

- BIOSTAT Random Variables & Probability DistributionDocument37 pagesBIOSTAT Random Variables & Probability DistributionAnonymous Xlpj86laNo ratings yet

- Back To Assignment: 1. Characteristics of OligopolyDocument16 pagesBack To Assignment: 1. Characteristics of OligopolyBLESSEDNo ratings yet

- Preliminary test or not: When to use assumption testsDocument11 pagesPreliminary test or not: When to use assumption testsJose MourinhoNo ratings yet

- C 09 S 4Document12 pagesC 09 S 4Ruwina Ayman100% (2)

- CAPM Recap Exercises 2023 SolutionDocument15 pagesCAPM Recap Exercises 2023 SolutionMirela KafalievaNo ratings yet

- A Guide to Statistical Methods for Hydrology AnalysisDocument27 pagesA Guide to Statistical Methods for Hydrology AnalysisJohn E Cutipa LNo ratings yet

- Materi 5.1-Inference in Simple Linear RegressionDocument15 pagesMateri 5.1-Inference in Simple Linear RegressionarismansyahNo ratings yet

- Test Bank For Principles of Corporate Finance 10th Edition Brealey, Myers, AllenDocument53 pagesTest Bank For Principles of Corporate Finance 10th Edition Brealey, Myers, Allena682182415100% (2)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Streetsmart Financial Basics for Nonprofit Managers: 4th EditionFrom EverandStreetsmart Financial Basics for Nonprofit Managers: 4th EditionRating: 3.5 out of 5 stars3.5/5 (3)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)