Professional Documents

Culture Documents

Executive Summary On Financial Forecasts v2

Uploaded by

Miguel JreidyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Executive Summary On Financial Forecasts v2

Uploaded by

Miguel JreidyCopyright:

Available Formats

PRIVATE AND CONFIDENTIAL

Diriyah Development Project

Executive Summary on Financial Forecasts

Submitted by

GA Consult

Economic and Corporate Financial Consultants

August 07, 2009

GA Consult – Economic and Corporate Financial Consultants

Stephan Bldg., Riad El Solh Street, Solidere P.O.Box 11 - 1699 Beirut, Lebanon

Website: www.gaconsultgroup.com E-mail: info@gaconsultgroup.com

Tel: 961 1 97 39 38 / 9 Fax: 961 1 97 39 69

Diriyah Development Project, Executive Summary on Financial Forecasts

1. Introduction

The present summary highlights the results of GAC’s financial assessment of

KS/BW’s latest concept design as well as the impact of the recent value engineering

exercise completed by the Construction Division of SO on the Project’s foreseen

development costs and profitability.

2. Refresher on BUA Program

The table below shows the breakdown of the Project’s residential BUA among the

varied components for each phase along with their corresponding number of units.

BUA Breakdown, Residential Components

Number of Units

Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Total

Apartments 542 - - - 542

Attached Villas 161 102 110 125 498

Detached Villas 67 77 67 67 278

Total 770 179 177 192 1,318

BUA

sqm

Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Total

Apartments 49,120 - - - 49,120

Attached Villas 34,980 22,860 22,140 26,820 106,800

Detached Villas 21,120 24,290 21,220 21,250 87,880

Total 105,220 47,150 43,360 48,070 243,800

The table below shows the breakdown of the Project’s public BUA (amenities).

2|Page

GA Consult – Economic and Corporate Financial Consultants

Stephan Bldg., Riad El Solh Street, Solidere P.O.Box 11 - 1699 Beirut, Lebanon

Website: www.gaconsultgroup.com E-mail: info@gaconsultgroup.com

Tel: 961 1 97 39 38 / 9 Fax: 961 1 97 39 69

Diriyah Development Project, Executive Summary on Financial Forecasts

BUA Breakdown, Public Amenities

sqm Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Total

Neighborhood Center 592 198 198 198 1,186

Community Center 200 100 100 100 500

Swimming Pool 294 98 98 98 588

Gym 98 - - - 98

Shopping 3,000 - - - 3,000

Indoor Social/Recreational Facilities 7,150 - - - 7,150

Sports and Health Club 2,500 - - - 2,500

Movie Theater/ Entertainment Facilities 2,150 - - - 2,150

Natatorium 2,000 - - - 2,000

Spa 500 - - - 500

Rose Club 1,500 - - - 1,500

Pre-School 1,000 - 1,000 - 2,000

Facilities Management 6,700 - 2,500 1,000 10,200

Security Control Center 200 - - - 200

Parking 8,750 - - - 8,750

Total 28,892 198 3,698 1,198 33,986

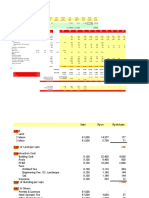

3. GAC’s Base-Case Development Costs (Budgeted Amounts)

The table below shows the Project’s foreseen development costs as per GAC’s base-

case scenario. Total development costs, including land value, are foreseen at SR3

billion.

Foreseen Development Costs, Base-Case Scenario

SR Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Consolidated

Total development costs 1,476,411,466 523,045,306 507,588,212 512,274,244 3,019,319,227

Land 213,972,000 95,913,863 88,204,137 82,410,000 480,500,000

Site clearance 75,000,000 - - - 75,000,000

Central plant, softscape, hardscape 207,346,200 49,384,440 45,414,832 42,431,528 344,577,000

Public amenities 142,457,790 1,211,760 22,631,760 7,331,760 173,633,070

Construction (hard and soft), residential units 837,635,476 376,535,243 351,337,482 380,100,956 1,945,609,157

4. GAC’s Base-Case Financing Needs and IRR

The table below shows the Project’s foreseen financing requirements as per GAC’s

base-case scenario and based on a 60% targeted leverage. Total equity contribution

in cash and debt financing are foreseen at SR728 million and SR1.81 billion

respectively.

3|Page

GA Consult – Economic and Corporate Financial Consultants

Stephan Bldg., Riad El Solh Street, Solidere P.O.Box 11 - 1699 Beirut, Lebanon

Website: www.gaconsultgroup.com E-mail: info@gaconsultgroup.com

Tel: 961 1 97 39 38 / 9 Fax: 961 1 97 39 69

Diriyah Development Project, Executive Summary on Financial Forecasts

Foreseen Financing Requirements, Base-Case Scenario

SR Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Consolidated

Financing requirements 1,476,411,466 523,045,306 507,588,212 512,274,244 3,019,319,227

Equity contribution in kind (Land) 213,972,000 95,913,863 88,204,137 82,410,000 480,500,000

Equity contribution in cash 376,592,586 113,304,260 114,831,147 122,499,697 727,227,691

Debt financing 885,846,879 313,827,184 304,552,927 307,364,546 1,811,591,536

The table below shows the Project’s foreseen profitability indicators, i.e., foreseen

equity IRR and operating profits as per GAC’s base-case scenario. The Project’s

Equity IRR is foreseen at 12.3%. However, if land value is excluded, foreseen equity

IRR would increase to 16%, i.e., by up to 3.7 percentage points.

Profitability Indicators, Base-Case Scenario

SR Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Consolidated

Equity IRR 12.0% 12.3% 11.7% 13.7% 12.3%

Equity IRR, excluding land value 15% 17% 16% 17% 16%

Operating profits

1st operating year 70,431,870 25,315,389 24,259,104 26,299,976 146,306,341

2nd operating year 127,216,361 45,155,949 42,856,005 46,889,414 262,117,728

3rd operating year 134,849,343 47,865,306 45,427,365 49,702,778 277,844,792

5. Results of Value Engineering Exercise

5.1. Dismissed Items

The district cooling and photovoltaic panels were dismissed during the latest

workshop undertaken in SO’s premises in Riyadh as these two items alone

necessitate an estimated budget of SR323 million, and would thus increase the

infrastructure’s figure way above the initially budgeted amount of GAC, yet without

adding significant value to the marketability or foreseen rental rates of the Project.

5.2. Development Costs Post-Value-Engineering versus GAC’s

Budgeted Figures

The comparative table below shows GAC’s budgeted development costs (excluding

land value) versus the post-value-engineering development costs of SO’s

Construction Division.

4|Page

GA Consult – Economic and Corporate Financial Consultants

Stephan Bldg., Riad El Solh Street, Solidere P.O.Box 11 - 1699 Beirut, Lebanon

Website: www.gaconsultgroup.com E-mail: info@gaconsultgroup.com

Tel: 961 1 97 39 38 / 9 Fax: 961 1 97 39 69

Diriyah Development Project, Executive Summary on Financial Forecasts

GAC’s base-case infrastructure costs are foreseen at SR593 million while the post-

value-engineering infrastructure costs estimated by SO’s Construction Division

amount to SR452 million, thus resulting in a negative variance of about SR140 million

or 24%.

On construction cost of residential units, GAC’s budgeted figures are foreseen at

SR1,945 million, about SR25 million less than the revised construction cost provided

by SO’s Construction Division which amount to SR1,970 million.

Based on above figures, GAC’s base-case development costs (excluding land value)

are foreseen at SR2.54 billion while the post-value-engineering development costs

estimated by SO’s Construction Division amount to SR2.42 billion, thus resulting in a

negative variance of about SR115 million or 4.6%.

Development Costs Post Value Engineering versus GAC's Budgeted Figures

Infrastructure Costs Post- GAC's Budgeted Variance to GAC's

SR

Value-Engineering Figures Budgeted Figures

Site clearance 75,000,000 75,000,000 0.0%

Public amenities* 154,446,660 173,633,070 -11.0%

Central plant, softscape, hardscape 222,236,982 344,577,000 -35.5%

Central plant 108,647,805 n.a. n.a.

Softscape 79,938,215 n.a. n.a.

Hardscape 29,421,177 n.a. n.a.

Construction (hard and soft), residential units 1,969,987,334 1,945,609,157 1.3%

Total 2,421,670,976 2,538,819,227 -4.6%

Excluding the residential stay apartments

5.3. Impact of Value Engineering on the Project’s Foreseen

Development Costs and Profitability

The tables below show the Project’s foreseen development costs, financing needs

and Equity IRR based on the post-value-engineering development costs. Foreseen

development costs amount to SR2.9 billion – about SR115 million lower than GAC’s

base-case figure – increasing the Project’s foreseen Equity IRR from 12.3% to 13.3%

and from 16% to 18% if value of land is excluded.

5|Page

GA Consult – Economic and Corporate Financial Consultants

Stephan Bldg., Riad El Solh Street, Solidere P.O.Box 11 - 1699 Beirut, Lebanon

Website: www.gaconsultgroup.com E-mail: info@gaconsultgroup.com

Tel: 961 1 97 39 38 / 9 Fax: 961 1 97 39 69

Diriyah Development Project, Executive Summary on Financial Forecasts

Foreseen Development Costs, Post Value Engineering

SR Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Consolidated

Total development costs 1,398,411,975 509,035,707 494,616,555 500,106,739 2,902,170,976

Land 213,972,000 95,913,863 88,204,137 82,410,000 480,500,000

Site clearance 75,000,000 - - - 75,000,000

Central plant, softscape, hardscape 134,567,595 31,350,574 29,272,680 27,046,134 222,236,982

Public amenities 123,938,277 1,054,231 23,075,520 6,378,631 154,446,660

Construction (hard and soft), residential units 850,934,102 380,717,040 354,064,218 384,271,974 1,969,987,334

Foreseen Financing Requirements, Post Value Engineering

SR Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Consolidated

Financing requirements 1,398,411,975 509,035,707 494,616,555 500,106,739 2,902,170,976

Equity contribution in kind (Land) 213,972,000 95,913,863 88,204,137 82,410,000 480,500,000

Equity contribution in cash 345,392,790 107,700,420 109,642,485 117,632,696 680,368,390

Debt financing 839,047,185 305,421,424 296,769,933 300,064,043 1,741,302,586

Profitability Indicators, Post Value Engineering

SR Phase 1 Phase 2 (A) Phase 2 (B) Phase 3 Consolidated

Equity IRR 13.4% 12.9% 12.3% 14.2% 13.3%

Equity IRR, excluding land value 17% 18% 17% 19% 18%

Operating profits

1st operating year 70,431,870 25,315,389 24,259,104 26,299,976 146,306,341

2nd operating year 127,216,361 45,155,949 42,856,005 46,889,414 262,117,728

3rd operating year 134,849,343 47,865,306 45,427,365 49,702,778 277,844,792

6|Page

GA Consult – Economic and Corporate Financial Consultants

Stephan Bldg., Riad El Solh Street, Solidere P.O.Box 11 - 1699 Beirut, Lebanon

Website: www.gaconsultgroup.com E-mail: info@gaconsultgroup.com

Tel: 961 1 97 39 38 / 9 Fax: 961 1 97 39 69

Diriyah Development Project, Executive Summary on Financial Forecasts

6. Appendix: Post-Value-Engineering Infrastructure Costs (Prior to

Contingencies and Cost Inflation)

Infrastructure Costs Post Value Engineering

SR Area in sqm Total Amount

Site Clearance - 75,000,000

Total Site Clearance - 75,000,000

Hardscape

General Rough Grading (for entire Area) - 6,336,000

LCA1 3,151 6,943,200

LCA2 7,000 2,221,120

LCA3 16,160 15,029,630

LCA4 1,730 1,676,180

LCA5 7,000 7,373,626

LCA6 5,970 2,275,900

LCA7 105,910 23,166,165

LCA8 5,700 8,886,790

LCA9 5,390 1,504,800

Total Hardscape 158,011 75,413,411

Softscape

LCA1 28,359 7,158,357

LCA2 7,000 2,186,800

LCA3 4,040 893,564

LCA4 32,870 4,641,402

LCA5 10,500 2,322,382

LCA6 13,930 3,081,026

LCA7 18,690 4,133,840

LCA8 5,700 1,780,680

LCA9 2,310 583,088

Additional 2,500 974,688

Total Softscape 125,899 27,755,827

Public Amenities

Neighborhood Center 1,186 7,067,168

Shopping 3,000 15,060,600

Indoor Social/Recreational Facilities 7,150 56,686,212

Rose Club 1,500 8,970,000

Medical 200 1,863,000

Pre-School 2,000 11,202,000

Facilities Management 6,600 27,213,450

Security Controls Center 200 2,001,000

Parking 8,750 21,179,450

Total Public Amenities 30,586 151,242,880

Central Plant

Storm Water - 7,350,000

Fire - 1,980,000

Potable Water - 11,536,250

Potable Water Storage - 7,474,500

Grey/ Irrigation Water Piping - 2,087,250

Sanitary Piping - 5,855,438

Waste Water Treatment - 16,851,992

Electric Services - Site Loop / UG - 31,374,200

Infrastructure Facility - Management 3,600 17,988,300

Total Central Plant 3,600 102,497,929

Total Infrastructure Costs 318,096 431,910,047

7|Page

GA Consult – Economic and Corporate Financial Consultants

Stephan Bldg., Riad El Solh Street, Solidere P.O.Box 11 - 1699 Beirut, Lebanon

Website: www.gaconsultgroup.com E-mail: info@gaconsultgroup.com

Tel: 961 1 97 39 38 / 9 Fax: 961 1 97 39 69

You might also like

- Broadband Services: Business Models and Technologies for Community NetworksFrom EverandBroadband Services: Business Models and Technologies for Community NetworksImrich ChlamtacNo ratings yet

- Executive Summary On Financial ForecastsDocument7 pagesExecutive Summary On Financial ForecastsMiguel JreidyNo ratings yet

- GAC's Executive Summary 090731Document7 pagesGAC's Executive Summary 090731Miguel JreidyNo ratings yet

- Tables For Executive Summary On Financial Forecasts v2Document24 pagesTables For Executive Summary On Financial Forecasts v2Miguel JreidyNo ratings yet

- Tables For Executive Summary On Financial ForecastsDocument20 pagesTables For Executive Summary On Financial ForecastsMiguel JreidyNo ratings yet

- TSFP Phase I - II Annexure-2 Page-1/3: Budgetary Cost EstimatesDocument3 pagesTSFP Phase I - II Annexure-2 Page-1/3: Budgetary Cost EstimatesSolomon AlemuNo ratings yet

- TUTORIAL 2 - Development AppraisalDocument2 pagesTUTORIAL 2 - Development AppraisalMUHAMMAD DANIEL BIN MOHD SALIMNo ratings yet

- Kapil Assignment deDocument7 pagesKapil Assignment dedev73799No ratings yet

- APB FORMAT For CY2023Document16 pagesAPB FORMAT For CY2023Jayr NelbNo ratings yet

- Comparative Statement - Jamia Masjid - BOQ & Taking Off Sheets - 20-06-2020 - Revised & ReducedDocument1 pageComparative Statement - Jamia Masjid - BOQ & Taking Off Sheets - 20-06-2020 - Revised & ReducedImran AzizNo ratings yet

- Flare GasificationDocument25 pagesFlare Gasificationtimir ghoseNo ratings yet

- FarahDocument7 pagesFarahMijan RahmanNo ratings yet

- RFP-01353 - Price Update 2Document69 pagesRFP-01353 - Price Update 2the next miamiNo ratings yet

- Karwenyi Cert 4Document115 pagesKarwenyi Cert 4benonsunday9No ratings yet

- Basu Deb SharmaDocument1 pageBasu Deb SharmaBasudev SharmaNo ratings yet

- Book 1Document2 pagesBook 1Mary Jane Katipunan CalumbaNo ratings yet

- 1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Document2 pages1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Mary Jane Katipunan CalumbaNo ratings yet

- RPT2018Document2 pagesRPT2018Mary Jane Katipunan CalumbaNo ratings yet

- Girirao Hivrale-2Document7 pagesGirirao Hivrale-2ca.bandewarNo ratings yet

- HatdogDocument2 pagesHatdogamsdeleon.12No ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: December 27, 2021Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: December 27, 2021craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2021楊祖维No ratings yet

- Budget 2022Document14 pagesBudget 2022Krisna Criselda Simbre100% (1)

- SK Budget Forms 2023Document4 pagesSK Budget Forms 2023Djaenzel Ramos0% (1)

- 9th Pay't For Lot - 1Document18 pages9th Pay't For Lot - 1Yohannes DangachewNo ratings yet

- Itemized Quantities and Cost of RevisionDocument1 pageItemized Quantities and Cost of RevisionryanNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report June 21, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report June 21, 2021Jun GomezNo ratings yet

- Draft - JOB EX Presentation - HOP PH2 - Villa Construction PMC - Aug 2023Document28 pagesDraft - JOB EX Presentation - HOP PH2 - Villa Construction PMC - Aug 2023mekhtarNo ratings yet

- Programmed Appropriation by Ppa, Expense Class, Object of Expenditure and Expected Result, Fy 2021Document3 pagesProgrammed Appropriation by Ppa, Expense Class, Object of Expenditure and Expected Result, Fy 2021Barangay SamputNo ratings yet

- Wfisd Esser BudgetsDocument3 pagesWfisd Esser BudgetsDenise NelsonNo ratings yet

- Page 3Document3 pagesPage 3Janelkris PlazaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report November 08, 2019Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report November 08, 2019craftersxNo ratings yet

- Proposed Sewage Treatment Plant 100CmD (Civil)Document1 pageProposed Sewage Treatment Plant 100CmD (Civil)John Axl LajomNo ratings yet

- Kainantu Urban Local Level Government: 2017 Village Services GrantDocument2 pagesKainantu Urban Local Level Government: 2017 Village Services GrantMichael MotanNo ratings yet

- Local Media8732017145129449152Document3 pagesLocal Media8732017145129449152Kent Aldwin MangalinoNo ratings yet

- Stockquotes 02222023Document13 pagesStockquotes 02222023Jonathan M.No ratings yet

- Abstract 1Document1 pageAbstract 1Bahram KhanNo ratings yet

- 06 Apr 2021 Program 4 Summary of Projected Annual SustainmentDocument24 pages06 Apr 2021 Program 4 Summary of Projected Annual Sustainmentarthur pascualNo ratings yet

- bks-0019 - Proposed Replacing Ceiling PVC at Canteen G5Document1 pagebks-0019 - Proposed Replacing Ceiling PVC at Canteen G5Rony SihombingNo ratings yet

- Convention CentreDocument21 pagesConvention CentrerootofsoulNo ratings yet

- Sno. Sections Amount (Inr) Sep-21 Civil and Structural ADocument4 pagesSno. Sections Amount (Inr) Sep-21 Civil and Structural AJay UseitNo ratings yet

- Please Pay To The National Power Corporation The Following:: Billing ParticularsDocument5 pagesPlease Pay To The National Power Corporation The Following:: Billing ParticularsJaapar HassanNo ratings yet

- Guntur Cost Estimate Rev 2 (New) With Cost ControlDocument68 pagesGuntur Cost Estimate Rev 2 (New) With Cost ControlKvm RajuNo ratings yet

- Global Cement - Financial Model 2019 05 12 PDFDocument19 pagesGlobal Cement - Financial Model 2019 05 12 PDFAamir AzizNo ratings yet

- Stockquotes 12012020 PDFDocument9 pagesStockquotes 12012020 PDFXander 4thNo ratings yet

- Dep Ed Quirino May 05 2022 2Document17 pagesDep Ed Quirino May 05 2022 2Jaspher BartolomeNo ratings yet

- September 29, 2023-EODDocument14 pagesSeptember 29, 2023-EODMJA MAMANo ratings yet

- F6mys 2012 Dec ADocument7 pagesF6mys 2012 Dec AMohd IrfanNo ratings yet

- Tupol Este 1.docx Landscape - DoneDocument23 pagesTupol Este 1.docx Landscape - DoneJoshua AssinNo ratings yet

- Jhanavi Noreste Cost Sheet-2Document1 pageJhanavi Noreste Cost Sheet-2prathvishetty48885No ratings yet

- Project Report Granite MineDocument11 pagesProject Report Granite MineSmriti GargNo ratings yet

- Projected Income and Expenditure Statement TemplateDocument1 pageProjected Income and Expenditure Statement TemplateCalyveNo ratings yet

- February 15, 2024-EODDocument14 pagesFebruary 15, 2024-EODMJA MAMANo ratings yet

- Managed Rite Construction: Budget Cost Hours by Div-CC wCO-9 Cost TypesDocument8 pagesManaged Rite Construction: Budget Cost Hours by Div-CC wCO-9 Cost TypesJim SchuettNo ratings yet

- 2022 Nep - Hgab - GaaDocument8 pages2022 Nep - Hgab - GaaEvaresto Cole MalonesNo ratings yet

- Cash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. MDocument26 pagesCash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. Mangg4interNo ratings yet

- FY2024 Proposed BudgetDocument17 pagesFY2024 Proposed BudgetArif EWSNo ratings yet

- Stockquotes 02012023Document13 pagesStockquotes 02012023Jonathan M.No ratings yet

- Stockquotes 01302023Document13 pagesStockquotes 01302023Jonathan M.No ratings yet

- Real Estate Investments Europe 2020 and q1 2021Document10 pagesReal Estate Investments Europe 2020 and q1 2021Miguel JreidyNo ratings yet

- BNP Paribas Real Estate - at A Glance Investment Q2 2022Document7 pagesBNP Paribas Real Estate - at A Glance Investment Q2 2022Miguel JreidyNo ratings yet

- FM - Phase 1 (Post Riyadh)Document113 pagesFM - Phase 1 (Post Riyadh)Miguel JreidyNo ratings yet

- FM - Phase 2 A (Post Riyadh)Document117 pagesFM - Phase 2 A (Post Riyadh)Miguel JreidyNo ratings yet

- Form p650Document1 pageForm p650Jun LiewNo ratings yet

- House Hearing, 113TH Congress - Limitless Surveillance at The Fda: Protecting The Rights of Federal WhistleblowersDocument276 pagesHouse Hearing, 113TH Congress - Limitless Surveillance at The Fda: Protecting The Rights of Federal WhistleblowersScribd Government DocsNo ratings yet

- Colonial Records of Virginia by VariousDocument99 pagesColonial Records of Virginia by VariousGutenberg.orgNo ratings yet

- Math Club ConstitutionDocument2 pagesMath Club ConstitutionboboNo ratings yet

- Research Findings: How WSJ Lied To The World: WSJ Direction Changed Under Rupert MurdochDocument6 pagesResearch Findings: How WSJ Lied To The World: WSJ Direction Changed Under Rupert MurdochHanif AbdullahNo ratings yet

- Animal Farm Unit TestDocument3 pagesAnimal Farm Unit TestMary A Kudla100% (1)

- Labor - Prelim - CBTC Employees Union Vs ClaveDocument5 pagesLabor - Prelim - CBTC Employees Union Vs ClavekatchmeifyoucannotNo ratings yet

- Brief Int'l CommDocument43 pagesBrief Int'l CommAkinrotimi OmotayoNo ratings yet

- A Feminist View of The Democratic and Liberty Union Candidates - Chittenden Magazine - Sept. 1972Document4 pagesA Feminist View of The Democratic and Liberty Union Candidates - Chittenden Magazine - Sept. 1972Seven Days VermontNo ratings yet

- Libro Rethinking America 2Document235 pagesLibro Rethinking America 2eddiegeolNo ratings yet

- Music Video Analysis 1Document7 pagesMusic Video Analysis 1api-528796259No ratings yet

- 00capítulo - The Routledge Handbook of Henri Lefebvre, The City and Urban SocietyDocument12 pages00capítulo - The Routledge Handbook of Henri Lefebvre, The City and Urban SocietyJeronimoNo ratings yet

- Dwnload Full Biopsychology 8th Edition Pinel Test Bank PDFDocument35 pagesDwnload Full Biopsychology 8th Edition Pinel Test Bank PDFnoahmya6100% (14)

- Bill Summary: The Protection of Human Rights (Amendment) Bill, 2019Document1 pageBill Summary: The Protection of Human Rights (Amendment) Bill, 2019rkgrahulNo ratings yet

- Invitation For Participation in Online National Level NSS Quiz To Be Organized On 31.10.2023Document7 pagesInvitation For Participation in Online National Level NSS Quiz To Be Organized On 31.10.2023Chris PresleyNo ratings yet

- Role of Employees Empowerment On TQMDocument7 pagesRole of Employees Empowerment On TQMTahir BilalNo ratings yet

- Respondent Memorial - FL15Document26 pagesRespondent Memorial - FL15Karan RajNo ratings yet

- DPJ Company v. FDIC, 1st Cir. (1994)Document17 pagesDPJ Company v. FDIC, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Sr. No. Name & Address of The CompanyDocument81 pagesSr. No. Name & Address of The CompanyBusiness PsychologistNo ratings yet

- Essay On Internet PrivacyDocument2 pagesEssay On Internet PrivacyshahazeerNo ratings yet

- MQAC Training Content - HACCP (Level3)Document1 pageMQAC Training Content - HACCP (Level3)Info Maven Quality Assurance CounselNo ratings yet

- GemDocument135 pagesGemZelia GregoriouNo ratings yet

- MiscelaneDocument23 pagesMiscelaneMiscelane ArenajoNo ratings yet

- 1 Learning Activity ContempoDocument2 pages1 Learning Activity ContempoAira Gel Daroy CarinoNo ratings yet

- Let's Talk To The Media: Practical Guide For Refugee Community Organisations and Refugee Practitioners On Working With The MediaDocument40 pagesLet's Talk To The Media: Practical Guide For Refugee Community Organisations and Refugee Practitioners On Working With The MediaOxfamNo ratings yet

- Youth Marginalaisation PosterDocument2 pagesYouth Marginalaisation PosterblakskorpioNo ratings yet

- Joona Repo - Pabongkha and The YoginiDocument34 pagesJoona Repo - Pabongkha and The YoginiChoong L SeowNo ratings yet

- Equilon Enterprises LLC vs. California State Board of EquilizatoinDocument26 pagesEquilon Enterprises LLC vs. California State Board of EquilizatoinThinkProgressNo ratings yet

- Conflict of Laws Syllabus - Atty. QuibodDocument8 pagesConflict of Laws Syllabus - Atty. QuibodEzer Ivan Ria BacayoNo ratings yet

- Re Coventry Decd Coventry V Coventry Re Coventry Decd CoventDocument31 pagesRe Coventry Decd Coventry V Coventry Re Coventry Decd CoventTyler ReneeNo ratings yet