Professional Documents

Culture Documents

GSTNTF47

Uploaded by

JGVOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTNTF47

Uploaded by

JGVCopyright:

Available Formats

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section

(i)]

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise and Customs

Notification No. 47/2017 – Central Tax

New Delhi, the 18th October, 2017

G.S.R……(E):- In exercise of the powers conferred by section 164 of the Central Goods and

Services Tax Act, 2017 (12 of 2017), the Central Government hereby makes the following

rules further to amend the Central Goods and Services Tax Rules, 2017, namely:-

(1) These rules may be called the Central Goods and Services Tax (Tenth Amendment)

Rules, 2017.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Central Goods and Services Tax Rules, 2017, –

(i) in rule 89, insub-rule (1), for third proviso, the following proviso shall be substituted,

namely:-

“Provided also that in respect of supplies regarded as deemed exports, the application

may be filed by, -

(a) the recipient of deemed export supplies; or

(b) the supplier of deemed export supplies in cases where the recipient does not avail

of input tax credit on such supplies and furnishes an undertaking to the effect that the

supplier may claim the refund”;

(ii) in rule 96A, in sub-rule (1), in clause (a),after the words “after the expiry of three

months”, the words “, or such further period as may be allowed by the Commissioner,”

shall be inserted;

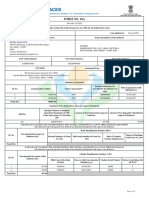

(iii) in FORM GST RFD-01,

(a) for “Statement-2”, the following Statement shall be substituted, namely:-

“Statement- 2 [rule 89(2)(c)]

Refund Type: Exports of services with payment of tax

(Amount in Rs.)

Sr. Invoice details Integrated tax Cess BRC/ FIRC Integrated Integrated Net

No. No. Date Value Taxable Amt. No. Date tax and tax and Integrated

value cess cess tax and

involved involved cess

in debit in credit (6+7+10 -

note, if note, if 11)

any any

1 2 3 4 5 6 7 8 9 10 11 12

”;

(b) for “Statement-4”, the following Statement shall be substituted, namely:-

“Statement-4 [rule 89(2)(d) and 89(2)(e)]

Refund Type: On account of supplies made to SEZ unit or SEZ Developer (on payment of

tax)

(Amount in Rs.)

GSTIN Invoice details Shipping Integrated Tax Cess Integrated Integrated Net

of bill/ Bill of tax and tax and Integrated

recipient export/ cess cess tax and

Endorsed involved involved cess

invoice by in debit in credit (8+9+10–

SEZ note, if note, if 11)

No. Date Value No. Date Taxable Amt. any any

Value

1 2 3 4 5 6 7 8 9 10 11 12

.”

[F. No. 349/58/2017-GST(Pt.)]

(Gunjan Kumar Verma)

Under Secretary to the Government of India

Note:- The principal rules were published in the Gazette of India, Extraordinary, Part II,

Section 3, sub-section (i) vide notification No. 3/2017-Central Tax, dated the 19thJune,2017,

published vide number G.S.R 610 (E), dated the 19thJune, 2017 and last amended vide

notification No. 45/2017-Central Tax, dated the 13th October, 2017, published vide number

G.S.R 1251 (E), dated the 13th October, 2017.

You might also like

- Explanation:-For The Purposes of This Sub-Rule, The ExpressionsDocument5 pagesExplanation:-For The Purposes of This Sub-Rule, The ExpressionsRakesh BenganiNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- Sample Format Form GSTR 2aDocument2 pagesSample Format Form GSTR 2aDeepanshu JaiswalNo ratings yet

- Form Gstr-2A (See Rule ..) : Details of Auto Drafted SuppliesDocument2 pagesForm Gstr-2A (See Rule ..) : Details of Auto Drafted SuppliesParameshwar RaoNo ratings yet

- Form GSTR 2aDocument2 pagesForm GSTR 2aparam.ginniNo ratings yet

- GSTR-5 FormDocument5 pagesGSTR-5 FormAnanya NairNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- GSTR 01Document9 pagesGSTR 01nisho tyagiNo ratings yet

- CA - Inter GST Important Questions Answers Part 2 May2023Document12 pagesCA - Inter GST Important Questions Answers Part 2 May2023Vishal AgrawalNo ratings yet

- 1w1212notification 54 2020Document4 pages1w1212notification 54 2020Adrian ŠainaNo ratings yet

- Form 16 Part A Name and Address of The Employer Name and Designation of The EmployeeDocument3 pagesForm 16 Part A Name and Address of The Employer Name and Designation of The EmployeeishaqmdNo ratings yet

- GSTR - 1 Format 3 Jun 2017Document8 pagesGSTR - 1 Format 3 Jun 2017lokwaderNo ratings yet

- GSTR 9C Audit ProformaDocument14 pagesGSTR 9C Audit ProformaChaitanya krishna reddy DontireddyNo ratings yet

- Service Tax - Form A1Document5 pagesService Tax - Form A1kuriakose_mv3653No ratings yet

- GST Mcq'sDocument43 pagesGST Mcq'sSuraj PawarNo ratings yet

- GSTR Form-9cDocument13 pagesGSTR Form-9cAditya VishwakarmaNo ratings yet

- GSTR 9cDocument1 pageGSTR 9cfintech ConsultancyNo ratings yet

- Imports Under GSTDocument12 pagesImports Under GSThumanNo ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Shree Suleshvari EnterpriseDocument4 pagesShree Suleshvari EnterpriseDIVISION4 MAHESANANo ratings yet

- Priyanka Tungidwar - 21036Document1 pagePriyanka Tungidwar - 21036Anonymous 5l219Y7Iu1No ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToHotel Elegance DelhiNo ratings yet

- GSTR 9Document24 pagesGSTR 9Pushpraj SinghNo ratings yet

- GST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormDocument3 pagesGST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormSANDEEP SINGHNo ratings yet

- Answer Sheet of Mock Test Paper 31.3.2020Document19 pagesAnswer Sheet of Mock Test Paper 31.3.2020Babu GupthaNo ratings yet

- GST Act, 2017-SorDocument6 pagesGST Act, 2017-SorMohit NagarNo ratings yet

- GST Pass Order PDFDocument4 pagesGST Pass Order PDFvenkat dNo ratings yet

- Notificaiton 5Document3 pagesNotificaiton 5Parmeet NainNo ratings yet

- Go 67 - GSTDocument4 pagesGo 67 - GSTPrabhakar PothunuriNo ratings yet

- Calculation of Tax Liability Assignment: Rishabh KaushikDocument22 pagesCalculation of Tax Liability Assignment: Rishabh KaushikLkNo ratings yet

- IT FormDocument8 pagesIT Formapi-3829020No ratings yet

- Return GST IndiaDocument56 pagesReturn GST IndiathecoltNo ratings yet

- Form16Rpt 169567-1Document3 pagesForm16Rpt 169567-1ishalshamnasNo ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- Interim Payment Certificate (Ipc) No. 03: (Contract No. DJT/RJP-01)Document35 pagesInterim Payment Certificate (Ipc) No. 03: (Contract No. DJT/RJP-01)muhammad iqbalNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- GSTDocument6 pagesGSTPWD r&b nagalandNo ratings yet

- 2018fin MS58Document3 pages2018fin MS58Rajesh KarriNo ratings yet

- TDS in GSTDocument3 pagesTDS in GSTacm001No ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Notification No. 16/2021 - Central Tax (Rate)Document2 pagesNotification No. 16/2021 - Central Tax (Rate)santanu sanyalNo ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- Form 27 Dec 2022Document3 pagesForm 27 Dec 2022srinivasgateNo ratings yet

- 01 2023 CT EngDocument1 page01 2023 CT Engcadeepaksingh4No ratings yet

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaNo ratings yet

- Inu 2216 Idt - Suggested AnswersDocument5 pagesInu 2216 Idt - Suggested AnswersVinil JainNo ratings yet

- Form GST PMT 01Document4 pagesForm GST PMT 01Akash KamathNo ratings yet

- GSTR 3B NewDocument2 pagesGSTR 3B Newarpit85No ratings yet

- Return FormatsDocument56 pagesReturn Formatspuran1234567890No ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- Form GSTR-1: Government of India/State Department ofDocument11 pagesForm GSTR-1: Government of India/State Department ofManish PandeyNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- GSTNTF64Document1 pageGSTNTF64JGVNo ratings yet

- GSTNTF65Document1 pageGSTNTF65JGVNo ratings yet

- GSTNTF66Document1 pageGSTNTF66JGVNo ratings yet

- GSTNTF55Document7 pagesGSTNTF55JGVNo ratings yet

- Circularno 21 CGSTDocument2 pagesCircularno 21 CGSTJGVNo ratings yet

- Circularno 20 CGSTDocument1 pageCircularno 20 CGSTJGVNo ratings yet

- 06 - 2022 CTR EngDocument7 pages06 - 2022 CTR EngJGVNo ratings yet

- "Doing" StrategyDocument10 pages"Doing" StrategyHendra PoltakNo ratings yet

- Financial Derivatives: Reference: Chapter 10, FFOM BookDocument24 pagesFinancial Derivatives: Reference: Chapter 10, FFOM BookAnonymous tgYyno0w6No ratings yet

- Climate Change - : Mitigation and AdaptationDocument3 pagesClimate Change - : Mitigation and AdaptationIis SabahudinNo ratings yet

- 454235-2023-07 Fiche Sécurité KLIDocument84 pages454235-2023-07 Fiche Sécurité KLIamhaniteNo ratings yet

- Preservative Challenge TestDocument8 pagesPreservative Challenge TestBernardo100% (1)

- Fisher 3710 and 3720 Positioners and 3722 Electro Pneumatic ConverterDocument12 pagesFisher 3710 and 3720 Positioners and 3722 Electro Pneumatic ConverterGuillermo de la Fuente SantiagoNo ratings yet

- Company PipelineDocument12 pagesCompany PipelineAhamed kabeerNo ratings yet

- Risk Assessment For A Chemical Spill Into A RiverDocument11 pagesRisk Assessment For A Chemical Spill Into A RiverWayne GajadharNo ratings yet

- 3.teaching Methods Any 5Document18 pages3.teaching Methods Any 5Veena DalmeidaNo ratings yet

- Lucent 5ESS PDFDocument1 pageLucent 5ESS PDFJosue Calebe Rodrigues Machado100% (1)

- Conveyancing Assignment Set 1Document2 pagesConveyancing Assignment Set 1deepak singhal100% (1)

- Cleaning of Water BodiesDocument14 pagesCleaning of Water BodiesSaiTimmaraoNo ratings yet

- Ejectment JurisprudenceDocument17 pagesEjectment Jurisprudenceeds billNo ratings yet

- Autonomous Weapons PDFDocument10 pagesAutonomous Weapons PDFapi-510681335No ratings yet

- Es2 3-12vDocument1 pageEs2 3-12vapi-170472102No ratings yet

- 2013 GPI Report ES - 0 - GlobalPeaceIndexDocument106 pages2013 GPI Report ES - 0 - GlobalPeaceIndexchristian.lochmuellerNo ratings yet

- Al Bahar TowerDocument25 pagesAl Bahar TowerRajesh Singh100% (2)

- Cu Dan EcoparkDocument248 pagesCu Dan Ecoparktomtem50% (2)

- 6500CSQRQR Module Handbook 2021-22-1Document11 pages6500CSQRQR Module Handbook 2021-22-1Althaf MubinNo ratings yet

- Advanced Intelligent Systems For Sustain PDFDocument1,021 pagesAdvanced Intelligent Systems For Sustain PDFManal EzzahmoulyNo ratings yet

- Resume Prateek VyasDocument2 pagesResume Prateek VyasPrateek VyasNo ratings yet

- Ear 14Document59 pagesEar 14anon_179315406No ratings yet

- Paper 199-Morse Code Translator Using The Arduino PlatformDocument6 pagesPaper 199-Morse Code Translator Using The Arduino PlatformSérgio SilvaNo ratings yet

- Auction Policy MannapuramDocument7 pagesAuction Policy MannapuramRaju vadeNo ratings yet

- Note On Amendments of LARR Bill, 2015Document2 pagesNote On Amendments of LARR Bill, 2015Arvind BajpaiNo ratings yet

- Cherangany Dairy Group - Revised Strategic Plan - 2022-2027Document70 pagesCherangany Dairy Group - Revised Strategic Plan - 2022-2027mathews anthony see me youNo ratings yet

- Why Information Systems?: M7011 © Peter Lo 2005 1 M7011 © Peter Lo 2005 2Document14 pagesWhy Information Systems?: M7011 © Peter Lo 2005 1 M7011 © Peter Lo 2005 2cory kurdapyaNo ratings yet

- En Cosmos Instruction-Manual - 1.3Document60 pagesEn Cosmos Instruction-Manual - 1.3peteatkoNo ratings yet

- The Behavioral Ecology of The Komodo Monitor by Walter AuffenbergDocument10 pagesThe Behavioral Ecology of The Komodo Monitor by Walter Auffenbergqwertyuiop asdfghjklNo ratings yet

- Challenges of Transmission System Operation During The NATO Bombing of The Republic of SerbiaDocument62 pagesChallenges of Transmission System Operation During The NATO Bombing of The Republic of SerbiakeramicarNo ratings yet