Professional Documents

Culture Documents

Payment Agreement Template 03

Uploaded by

Dawn ManOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payment Agreement Template 03

Uploaded by

Dawn ManCopyright:

Available Formats

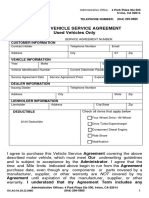

OREGON DEPARTMENT OF TRANSPORTATION

MOTOR CARRIER TRANSPORTATION DIVISION

3930 FAIRVIEW INDUSTRIAL DRIVE SE

SALEM OR 97302-1166 Reset Print

PH (503) 378-6658

FEE PAYMENT AGREEMENT

INSTRUCTIONS: COMPLETE AND RETURN THIS FORM TO THE OREGON DEPARTMENT OF TRANSPORTATION AT THE ADDRESS ABOVE. A COPY WILL BE

RETURNED TO YOU AFTER APPROVAL OR DISAPPROVAL.

NOTICE: THE FEE PAYMENT AGREEMENT FORM IS INTENDED FOR REGULAR OR FREQUENT LEASE OPERATIONS. THE LESSOR AND LESSEE MUST HAVE

OREGON OPERATING AUTHORITY IN GOOD STANDING. THE LESSEE IS REQUIRED TO HAVE LEASE RECORDS AVAILABLE AT THE TIME OF AUDIT TO

DETERMINE IF PROPER REPORTING HAS BEEN MADE. FEE PAYMENT AGREEMENT RECORD INFORMATION RECEIVED DURING THE LESSEE'S AUDIT WILL

BE USED AT THE TIME OF THE LESSOR'S AUDIT. AGREEMENTS WILL NOT BE APPROVED WITHOUT A SIGNATURE OF OWNER, PARTNER, OR CORPORATE

OFFICER.

BY THIS AGREEMENT

LESSEE, ENTERS INTO FEE PAYMENT AGREEMENT FOR HIGHWAY USE TAX

(MCTD ACCOUNT NUMBER)

PAYMENT WITH

LESSOR, .

(MCTD ACCOUNT NUMBER)

THE PARTIES MUTUALLY UNDERSTAND AND AGREE:

1. THIS AGREEMENT MUST BE APPROVED BY THE OREGON DEPARTMENT OF TRANSPORTATION, MOTOR CARRIER

AUDIT SECTION PRIOR TO THE LESSOR REPORTING TAX RESULTING FROM OPERATIONS WITH THIS LESSEE.

2. COPIES OF VALID LEASE AND APPROVED FEE PAYMENT AGREEMENT FORMS MUST BE IN THE VEHICLES AT ALL

TIMES AND AVAILABLE FOR INSPECTION BY LAW ENFORCEMENT OFFICIALS UPON REQUEST.

3. THIS AGREEMENT MAY BE REVOKED FOR NON-COMPLIANCE WITH ANY STATUTE, RULE, OR ORDER OF THE

OREGON DEPARTMENT OF TRANSPORTATION.

4. LESSOR WILL REPORT AND PAY ALL HIGHWAY USE TAXES ON VEHICLES WITH OREGON WEIGHT RECEIPTS AND

TAX IDENTIFIERS (RECEIPTS) IN THE LESSOR'S NAME AND PLACARDED IN THE LESSEE'S NAME, IN ACCORDANCE

WITH OAR 740-045-0120.

5. IN THE EVENT THE LESSOR DEFAULTS OR REFUSES TO BE HELD LIABLE, THE FINAL RESPONSIBILITY FOR THE

MILEAGE FEES RESTS WITH THE LESSEE.

LESSEE BUSINESS NAME LESSOR BUSINESS NAME

SIGNATURE OF OWNER, PARTNER, OR CORPORATE OFFICER SIGNATURE OF OWNER, PARTNER, OR CORPORATE OFFICER

TITLE TITLE

DATE TELEPHONE DATE TELEPHONE

DO NOT WRITE BELOW THIS LINE

BY EFFECTIVE DATE

APPROVED DISAPPROVED

FORM 735-9485 (4-14)

FEE PAYMENT AGREEMENT INSTRUCTIONS

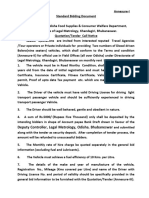

OREGON REVISED STATUTES CHAPTER 825 AND THE ADMINISTRATIVE RULES state that Motor Carriers leasing vehicles are

liable for all highway use tax while operating these vehicles on Oregon taxable roads. This applies to all vehicles whether on a

permanent or one-way trip lease. If certain criteria are met, tax reporting responsibility may be shifted from lessee to lessor.

PLEASE NOTE:

1. The carriers (Lessee and Lessor) must have Oregon operating authority in good standing. The lessor must have valid ODOT

vehicle credentials.

2. The form is to be completed and agreed to by both parties.

3. Signature authorization must be by - - owner, partner or an officer of the corporation (NOT AN EMPLOYEE).

Notarization not required.

4. The agreement will become effective after proper completion and final approval by ODOT. Parties will be notified in writing of

approval or disapproval.

TEMPORARY PASSES ARE NOT REQUIRED WHEN THE FOLLOWING CONDITIONS ARE MET:

1. A valid lease between the carriers has been effected and is in the possession of the driver.

2. A copy of an approved fee payment agreement must be in the possession of the vehicle driver.

3. The lessor has a valid ODOT plate or Oregon Weight Receipt and Tax Identifier for the leased vehicle.

AND

4. The lessor's vehicle is placarded in the name of the lessee.

Carriers who fail to meet the above conditions may be subject to lease violations and possible cancellation of their fee payment

agreements. Leasing of household goods and regular route passenger operations must be in conformance with OAR 740-045-0110.

The lessee is required to have lease records available at time of audit to determine if proper reporting has been made. Approved fee

payment agreements are valid until canceled by ODOT.

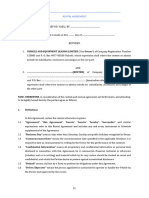

FEE PAY AGREEMENT RULE

Oregon Administrative Rule (OAR) 740-045-0150, Mileage Fees on Leased Equipment

(1) The lessee of vehicles being operated under OAR740-045-0110 to 740-045-0140 is responsible for mileage fees due for all

operations of those vehicles in Oregon during the term of the lease.

(2) The lessee may be relieved of responsibility for mileage fees on vehicles with valid identification devices being operated

under OAR 740-045-0110 only following written notification to the Department that the lease has been terminated.

(3) The lessee may enter into fee pay agreements authorizing the owner or lessor to report and pay mileage fees for vehicles

carrying the identification devices issued in the lessee's or lessor's name provided:

(a) The fee pay agreement is signed by both the lessee and the owner or lessor; and

(b) The agreement is filed with and approved by the Department. Such fee pay agreements shall not relieve the lessee of its

obligation for payment of mileage fees accruing during the term of the lease and prior to written notification of the

termination of the lease.

You might also like

- Lease Agreement TemplateDocument2 pagesLease Agreement TemplatenaranjobelennNo ratings yet

- Sample: Service AgreementDocument6 pagesSample: Service AgreementKumar ReddyNo ratings yet

- Agreement For Operation of Vehicle .: Mazhar Uddin AhmedDocument6 pagesAgreement For Operation of Vehicle .: Mazhar Uddin AhmedJubair NewazNo ratings yet

- North Pole Gen. Cont. LLC Agreement For Articulated Truck and Fork LiftDocument3 pagesNorth Pole Gen. Cont. LLC Agreement For Articulated Truck and Fork LiftJaveed TajiNo ratings yet

- The Lock Up Garage Specialists: ImportantDocument1 pageThe Lock Up Garage Specialists: Importantbeatriz vazNo ratings yet

- PWVdryhrvrcpebT77XqbNFr85pLwmWvX6Y1rqZIHGO8Kyn62 Gnbe hmrzT2l-PkPen1VV-OZa7Document6 pagesPWVdryhrvrcpebT77XqbNFr85pLwmWvX6Y1rqZIHGO8Kyn62 Gnbe hmrzT2l-PkPen1VV-OZa7mavinochiNo ratings yet

- Hertz VIR20150630Document2 pagesHertz VIR20150630Sal SNo ratings yet

- Ox DiamondDocument30 pagesOx DiamondabhiNo ratings yet

- Equipment Lease Agreement 26Document3 pagesEquipment Lease Agreement 26Alicia CheahNo ratings yet

- White Pearl Tours Lease Agreement PDFDocument13 pagesWhite Pearl Tours Lease Agreement PDFOscar MasindeNo ratings yet

- Form 30Document1 pageForm 30panangul1992No ratings yet

- Terms and Conditions 2019Document7 pagesTerms and Conditions 2019Raquel Ojeda SaldiviaNo ratings yet

- Full Package - New Driver Aplication PDFDocument11 pagesFull Package - New Driver Aplication PDFdina junu100% (1)

- NP Auto Group Inc.: Nextcar - Reservation Services Agreement March 2019Document21 pagesNP Auto Group Inc.: Nextcar - Reservation Services Agreement March 2019Josué LópezNo ratings yet

- DQR TenderDocument13 pagesDQR Tenderkiranraj p sagabalaNo ratings yet

- Autopass Agreement.: General Terms and ConditionsDocument4 pagesAutopass Agreement.: General Terms and ConditionsRodas 108No ratings yet

- Lease Agreement 1Document5 pagesLease Agreement 1Sukhdeb BiswakarmaNo ratings yet

- Deputy Controller, Legal Metrology, Odisha BhubaneswarDocument6 pagesDeputy Controller, Legal Metrology, Odisha Bhubaneswarthe creationNo ratings yet

- Car Rental Agreement ViosDocument6 pagesCar Rental Agreement ViosKathyrn Ang-ZarateNo ratings yet

- Agreement For The Sale of A Used Vehicle - KICKSDocument5 pagesAgreement For The Sale of A Used Vehicle - KICKSbw25rndn5kNo ratings yet

- Terms of AgreementDocument7 pagesTerms of AgreementOstynNo ratings yet

- Broker Carrier AgreementDocument1 pageBroker Carrier AgreementJessica MartinezNo ratings yet

- Vehicle Rental Agreement: Shree Kamal Enterprises. As Agent ForDocument4 pagesVehicle Rental Agreement: Shree Kamal Enterprises. As Agent Forhitesh tokeNo ratings yet

- Rider Freelance Agreement AGR V5 20.12.2021Document4 pagesRider Freelance Agreement AGR V5 20.12.2021Muhammadullah MAniNo ratings yet

- GT Driver (Ind) TC V 2Document5 pagesGT Driver (Ind) TC V 2Alva KlinNo ratings yet

- AGREEMENT CorporateDocument7 pagesAGREEMENT Corporateverifinance solutionsNo ratings yet

- NEW AVP List of RequirementsDocument1 pageNEW AVP List of RequirementsJaime MutiaNo ratings yet

- Annex Ure IDocument4 pagesAnnex Ure IAmalendu NathNo ratings yet

- FL DMV ManualDocument21 pagesFL DMV Manualgodesi11100% (1)

- HCV Application Form v04Document4 pagesHCV Application Form v04unixninetyeightNo ratings yet

- Vehicle Hire AgreementDocument5 pagesVehicle Hire AgreementRaghavendra Sudhir RaghavendraNo ratings yet

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransfershiviariNo ratings yet

- Terms ES enDocument1 pageTerms ES enSasho NedeljkovskiNo ratings yet

- Form 30Document2 pagesForm 30SAROJ KUMAR PAIKARAYNo ratings yet

- Application FormDocument6 pagesApplication FormhayowayanNo ratings yet

- Party Details: Not eDocument25 pagesParty Details: Not eShashi ShekharNo ratings yet

- Cab Service AgreementDocument6 pagesCab Service AgreementDeepti sharma0% (1)

- Vehicle Rental AgreementDocument2 pagesVehicle Rental AgreementUdai Shekawat100% (1)

- Company Leased Vehicle PolicyDocument5 pagesCompany Leased Vehicle PolicyGunjan Sharma100% (2)

- Broker Carrier Agreement L1Document6 pagesBroker Carrier Agreement L1Diego Alfaro100% (1)

- 10 D Truck RentalDocument8 pages10 D Truck RentalSophia YangNo ratings yet

- Freight Rate Central Carrier Packet 2023Document12 pagesFreight Rate Central Carrier Packet 2023violetta0423No ratings yet

- AgreementDocument10 pagesAgreementraja2gummadiNo ratings yet

- Vehicle Registration Transfer Application: Information SheetDocument5 pagesVehicle Registration Transfer Application: Information SheetMatt CarltonNo ratings yet

- NEW AVP List of Requirements Rev2-10-Jul-23Document1 pageNEW AVP List of Requirements Rev2-10-Jul-23cholo salcedoNo ratings yet

- Budget FastbreaktncDocument26 pagesBudget FastbreaktncJuan Pablo Perez FrancoNo ratings yet

- Vsa17a PDFDocument2 pagesVsa17a PDFxerxeschuaNo ratings yet

- 0000Document19 pages0000ShubhLabh ShrivastavaNo ratings yet

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransferYhr YhNo ratings yet

- Mcrent GTC Germany enDocument2 pagesMcrent GTC Germany enstandevenshxnrhgNo ratings yet

- PDF Rental AgreementDocument10 pagesPDF Rental Agreementpeterkemboi998No ratings yet

- Mortgage Bond For VehicleDocument4 pagesMortgage Bond For Vehicleapi-19745405No ratings yet

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransferChristopher RusliNo ratings yet

- GEORGIA MV Vehicles Titles ManualDocument144 pagesGEORGIA MV Vehicles Titles ManualDavid CarusoNo ratings yet

- Policy: 156954673.doc Section: Manual: Human Resources Policies and Procedures ManualDocument25 pagesPolicy: 156954673.doc Section: Manual: Human Resources Policies and Procedures ManualahmedtaniNo ratings yet

- Terms and ConditionDocument15 pagesTerms and ConditionDr-RohitAash Malik Tara ChandNo ratings yet

- Terms and Conditions For Car Rental: BKW Rent A Car Pte LTDDocument1 pageTerms and Conditions For Car Rental: BKW Rent A Car Pte LTDalfredNo ratings yet

- Audit ProgDocument7 pagesAudit ProgSara BautistaNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Proof of Funds Letter Template 09Document1 pageProof of Funds Letter Template 09Dawn ManNo ratings yet

- Legal Services AgreementDocument2 pagesLegal Services AgreementDawn ManNo ratings yet

- Interior Designer Contract TemplateDocument7 pagesInterior Designer Contract TemplateDawn ManNo ratings yet

- Talent Show Award Certificate TemplateDocument1 pageTalent Show Award Certificate TemplateDawn ManNo ratings yet

- Authorizing Resolution of IDA September 11, 2019 (PILOT Amendment) (Nut Brown Realty, LLC) (4841-0629-3667 3)Document5 pagesAuthorizing Resolution of IDA September 11, 2019 (PILOT Amendment) (Nut Brown Realty, LLC) (4841-0629-3667 3)Kelsey O'ConnorNo ratings yet

- IM Angul Railways PIF IIDocument52 pagesIM Angul Railways PIF IIarmaanNo ratings yet

- Index (2014)Document3,905 pagesIndex (2014)NocoJoeNo ratings yet

- Shop Rental AgreementDocument4 pagesShop Rental Agreementarjun_1985No ratings yet

- List of Mandatory Requirements - Consulta PDFDocument49 pagesList of Mandatory Requirements - Consulta PDFvjgumbanNo ratings yet

- Fund Based Financial ServicesDocument45 pagesFund Based Financial Servicesamitsingla19No ratings yet

- Display PDFDocument13 pagesDisplay PDFAlagammai SridharNo ratings yet

- Rewiew ALODocument3 pagesRewiew ALORaj SNo ratings yet

- Lease Agreement-Uzima Chicken LTDDocument7 pagesLease Agreement-Uzima Chicken LTDthesecretisaliveNo ratings yet

- Guide WholesalersDocument58 pagesGuide WholesalersulstergroupNo ratings yet

- The Central Goods and Services Tax Bill, 2017Document14 pagesThe Central Goods and Services Tax Bill, 2017SAURABH SUNNYNo ratings yet

- Land Law TermsDocument26 pagesLand Law TermsGURMUKH SINGHNo ratings yet

- K.L. Jute Products Private Limited v. Tirupti Jute Industries LTD., 2020 SCC OnLine NCLAT 426Document16 pagesK.L. Jute Products Private Limited v. Tirupti Jute Industries LTD., 2020 SCC OnLine NCLAT 426DevanshuNo ratings yet

- 76 de Guzman V CADocument2 pages76 de Guzman V CANina AndresNo ratings yet

- Sales Cases RevalidaDocument71 pagesSales Cases RevalidaPaulo HernandezNo ratings yet

- Cupino V. Pacific RehouseDocument4 pagesCupino V. Pacific RehouseJuris SyebNo ratings yet

- Mid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesDocument7 pagesMid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesAbby Hacther0% (2)

- Specific Deduction On Australian Tax SlidesDocument15 pagesSpecific Deduction On Australian Tax SlidesPhua Kien HanNo ratings yet

- SBLC Lease Agreement Deed of Agreement TDocument23 pagesSBLC Lease Agreement Deed of Agreement TArmstrong Corp.No ratings yet

- FRIA DigestsDocument14 pagesFRIA DigestsTen LaplanaNo ratings yet

- Technogas Philippines vs. Ca G.R. No. 108894 February 10, 1997 Panganiban, J.: FactsDocument3 pagesTechnogas Philippines vs. Ca G.R. No. 108894 February 10, 1997 Panganiban, J.: FactsZyreen Kate BCNo ratings yet

- Comprehensive Agrarian Reform Program CasesDocument257 pagesComprehensive Agrarian Reform Program CasesMa Tiffany CabigonNo ratings yet

- Case No. 2 NatresDocument3 pagesCase No. 2 NatresMilay IntongNo ratings yet

- Essential Elements: The Essential Elements of A Lease Are As FollowsDocument8 pagesEssential Elements: The Essential Elements of A Lease Are As FollowssssNo ratings yet

- PNCC Vs CA DigestDocument2 pagesPNCC Vs CA DigestChristin Jireh Nabata100% (2)

- 81 Elm Appt. 19 - DVDocument8 pages81 Elm Appt. 19 - DVGiovanni FioreNo ratings yet

- Rental Application Form - New LeaseDocument2 pagesRental Application Form - New LeaseLeah RamsunderNo ratings yet

- Recording and Accounting For Leases Through Oracle EBS R12Document13 pagesRecording and Accounting For Leases Through Oracle EBS R12porusNo ratings yet

- VAT (Chapter 8 Compilation of Summary)Document36 pagesVAT (Chapter 8 Compilation of Summary)Dianne LontacNo ratings yet

- Dissolution of A Partnership FirmDocument11 pagesDissolution of A Partnership FirmRajeev Tekwani100% (1)