Professional Documents

Culture Documents

36 Retained Earnings

Uploaded by

Shenna Mae LibradaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

36 Retained Earnings

Uploaded by

Shenna Mae LibradaCopyright:

Available Formats

CHAPTER

BLUE NOTES

36 S

L

Retained earnings represent the cumulative balance of periodic net income or loss, dividend distributions, prior period

errors, changes in accounting policy, and other capital adjustments.

Unappropriated retained earnings represent that portion Appropriated retained earnings represent that portion

which is free and can be declared as dividends to which has been restricted and therefore is not available

shareholders. for any dividend declaration.

Dividends are distributions of earnings or capital to the shareholder in proportion to their shareholdings.

DIVIDENDS OUT OF EARNINGS

Date of declaration is the date in which the directors authorize the payment of dividends to shareholders.

Date of record is the date on which the stock and transfer book of corporation will be closed for registration.

Only those shareholders registered as of such date are entitled to receive dividends.

Date of payment is the date on which the dividend liability is to be paid.

Note: The liability for dividend must be recognized on the date of declaration.

Types of dividends

Cash Dividends Property Dividends Liability Dividends Stock Dividends

Distribution of earnings of Distribution of earnings of These are actually deferred Distributions of earnings of

the entity to the the entity to the cash dividends. It may be in the entity in the form of the

shareholders in the form of shareholders in the form of the form of bond and scrip. entity’s own shares.

cash. cash.

Cash dividends

Date of Declaration: Date of Settlement:

Retained Earnings xx Dividends Payable xx

Dividends payable xx Cash xx

Property dividends

Measurement

At the fair value of the asset to be distributed.

At the end of each reporting period and at the date of settlement, the entity shall review and adjust the

carrying amount of the dividend payable with any change recognized in equity as adjustment to the amount of

distribution.

Settlement

The difference between the carrying amount of the dividend payable and the carrying amount of the asset

distributed shall be recognized in profit or loss.

If the fair value less cost to distribute is lower than the carrying amount of the asset at the end of the reporting period,

the difference is accounted for as impairment loss.

Liability dividends

In the form of bond or script dividends.

Theory of Accounts Practical Accounting 1

140 USL Blue Notes Chapter 36 – Retained Earnings

Bond Script

Long term Short Term

Normally, interest bearing May or may not be interest bearing

Stock dividends

Stock dividends or bonus issues are distributions of the earnings of the entity in the form of the

entity’s own shares.

When stocks dividends are declared, the retained earnings of the entity are in effect capitalized,

meaning transferred to share capital.

Rule

If the stock dividend is less than 20%, entities whose shares are registered with SEC and are listed in

stock exchange may account for stock dividend by transferring from retained earnings to share

capital and share premium the fair value on the date of declaration (or par or stated value, if higher

than fair value), of the additional shares issued.

If the stock dividend is 20% or more, the par or stated value is capitalized because this is conceived to

materially effect a reduction in the share market value.

Fractional stock dividends

The entity may issue warrants for the fractional shares and give the holders thereof enough time to

accumulate sufficient warrants for a full share.

The entity may pay cash in lieu of fractional share. This is possible only if the source of stock

dividends is retained earnings. If the source of stock dividends is share premium, the cash payment is

illegal.

DIVIDENDS OUT OF CAPITAL

These are also called liquidating dividends which are to be paid to the shareholders when the entity is

dissolved and liquidated. It is illegal to return capital to the shareholders during the lifetime of the

entity. This is in conformance with the trust fund doctrine.

However, wasting asset corporations may declare dividends which are in part distribution of earnings

and in part distribution of capital. This is in conformity with wasting asset doctrine which holds that a

wasting asset entity can declare dividends not only to the extent of the retained earnings balance but

also to the extent of the accumulated depletion.

EQUITY INSTRUMENT CLASSIFIED AS FINANCIAL LIABILITY

Examples:

a. A preference share that provides for mandatory redemption by the issuer for a fixed or determinable

amount at a future date.

b. A preference share that gives the holder the right to require the issuer to redeem the instrument at a

particular date for a fixed or determinable amount.

Note:

This is a financial liability of the issuer because the issuer has a contractual obligation to pay cash at some future time.

Dividends paid to shareholders of “mandatorily redeemable preference shares” shall be accounted for as interest expense a

component of finance cost in the income statement. The mandatorily redeemable preference share shall be presented as current or

noncurrent liability depending on the redemption date.

Practical Accounting 1 Theory of Accounts

Chapter 36 – Retained Earnings USL Blue Notes 141

APPROPRIATION OF RETAINED EARNINGS

Legal appropriation

This arises from the fact that the legal capital cannot be returned to the shareholders until the entity is

dissolved and liquidated.

Contractual appropriation

This arises from the fact that the terms of the bond issue and preference share issue may impose restriction on

the payment of dividends. This is to ensure the eventual payment of the bonds and redemption of the preference

share.

Voluntary appropriation

This is a matter of discretion on the part of the management. It may arise from the fact that management

wishes to preserve the funds for expansion purposes or for covering possible losses or contingencies.

RESERVES

a. Share premium reserve is the excess over par or stated value.

b. Appropriation reserve is the earmarking of retained earnings for a certain purpose which may be legal, contractual

or voluntary. This is technically known as Retained earnings appropriated.

c. Asset revaluation reserve arises from the revaluation of PPE. It is the excess of fair value or depreciated

replacement cost of the revalued property over its book value. This is technically known as Revaluation surplus.

d. Other comprehensive income reserve

QUASI-REORGANIZATION

It is a permissive but not a mandatory proce3dure under which a financially troubled entity restates its

accounts and establishes a “fresh start” in accounting sense. It is also called “corporate readjustment”. It may be done

through:

Recapitalization

Revaluation of PPE

Circumstances that may justify quasi-reorganization:

When a large deficit exists

When approved by the shareholders and creditors

When the cost basis of accounting for PPE becomes unrealistic. An entity in financial difficulty

may be permitted by the SEC to undergo a quasi-reorganization and in the process may be

allowed to revalue its PPE if their current value is substantially more than their cost.

When s “fresh start” appears to be desirable or advantageous to all parties concerned.

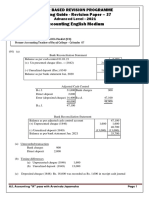

Illustration – thru recapitalization

Assume the following statement of financial position of Purdits Company on January 1, 2013 prior to

quasi-reorganization.

Current assets 1, 000, 000

PPE 7, 500, 000

Accumulated Depreciation 1, 000, 000 6, 500, 000

7, 500, 000

Liabilities 4, 500, 000

Theory of Accounts Practical Accounting 1

142 USL Blue Notes Chapter 36 – Retained Earnings

Share capital, 100 par, 50, 000 shares 5, 000, 000

Retained earnings (deficit) (2, 000, 000)

7, 500, 000

On January 1, 2013 the shareholders and creditors agreed to quasi-reorganization. Accordingly, the

following restatements should be made:

The PPE shall be recorded at the fair value of 6, 000, 000

The inventory is overvalued to the extent of 250, 000 and shall be revalued accordingly

The share capital is reduced to 2, 000, 000, 20, 000 shares, 100 par value

The resulting deficit is charged to the share premium arising from the reorganization.

Adjusting entries are:

Accumulated depreciation 1, 000, 000

Retained earnings 500, 000

PPE 1, 500, 000

Retained earnings 250, 000

Inventory 250, 000

Share capital 3, 000, 000

Share premium 3, 000, 000

Share premium 2, 750, 000

Retained earnings 2, 750, 000

(To eliminate the deficit in the retained earnings)

Illustration – thru revaluation

Ajitjit Company has sustained heavy losses over a period of time and conditions warrant that Ajitjit

Company undergoes quasi-reorganization on December 31, 2013.

The statement of financial position of Ajitjit Company prior to reorganization is:

Current assets 1, 000, 000

PPE 5, 000, 000

Accumulated depreciation 1, 500, 000 3, 500, 000

Goodwill 100, 000

Total Assets 4, 600, 000

Current liabilities 1, 100, 000

Share capital, 10 par 5, 000, 000

Share premium 500, 000

Retained earnings (deficit) (2, 000, 000)

Total Liabilities and SHE 4, 600, 000

The SEC approves the quasi-reorganization on the basis of the unrealistic valuation of the PPE.

Accordingly, the SEC recommended that the PPE be revalued by an independent expert.

The PPE are determined to have replacement cost of 9, 000, 000

Practical Accounting 1 Theory of Accounts

Chapter 36 – Retained Earnings USL Blue Notes 143

The inventory be written down by 400, 000

The goodwill is to be written off

Unrecorded accounts payable amounted to 200, 000

Any resulting deficit is charged against revaluation surplus.

Adjusting entries are as follows:

PPE 4, 000, 000

Accumulated depreciation 1, 200, 000

Revaluation surplus 2, 800, 000

Cost Replacement cost Appreciation

PPE 5, 000, 000 9, 000, 000 4, 000, 000

Accum. Depreciation (30%) 1, 500, 000 2, 700, 000 1, 200, 000

3, 500, 000 6, 300, 000 2, 800, 000

Retained earnings 400, 000

Inventory 400, 000

Retained earnings 100, 000

Goodwill 100, 000

Retained earnings 200, 000

Accounts payable 200, 000

Revaluation surplus 2, 700, 000

Retained earnings 2, 700, 000

(To eliminated the deficit)

Other illustrations:

Case 1

Mamabear Company had the following shareholder’s equity account balances on January 1, 2010:

Preference share capital, 100 par, 10% cumulative 2, 000, 000

Ordinary share capital, no par, 5 stated value 5, 150, 000

Share premium 3, 500, 000

Retained earnings 4, 000, 000

Treasury share ordinary 400, 000

Transactions during 2010 and other information were:

On January 15, 2010, Mamabear Company formally retired all the 30, 000 treasury shares. The treasury

shares were acquired in January 2009. The shares were originally issued at 10 per share.

Mamabear owned 10, 000 shares of Papabear Company purchased in 2009 for 800, 000. The Papabear

shares were included in Mamabear’s noncurrent securites. On December 31, 2010, Mamabear declared a

dividend in king of one share of Papabear for every hundred ordinary shares of Mamabear held by

shareholders. The fair value of the Papabear shares is 90 on December 31, 2010. The dividend in king was

distributed on March 15, 2011 when then fair value of Papabear’s share is 100.

Theory of Accounts Practical Accounting 1

144 USL Blue Notes Chapter 36 – Retained Earnings

On December 31, 2010, Mamabear declared yearly cash dividend on preference share, payable on January

15, 2011.

On January 15, 2011, before the accounting records were closed for 2010, Mamabear became aware that

rent income for the year ended December 31, 2009 was overstated by 1, 000, 000. The after-tax effect on

2009 net income was 700, 000. After correcting the rent income, the net income for 2010 was 3, 000, 000.

What is the adjusted balance of retained earnings on December 31, 2010?

Retained earnings – January 1, 2010 4, 000, 000

Excess of cost of treasury over issue price

(400, 00- 300, 000) (100, 000)

Property dividend of Papabear’s share (10, 000x 90) (900, 000)

Preference dividend (10% x 2, 000, 000) (200, 000)

Overstatement of 2009 rent income – net of tax (700, 000)

Net income for 2010 3, 000, 000

Retained earnings – December 31, 2010 5, 100, 000

Case 2

Bergite Company was organized on January 1, 2008. After 2 years of profitable operations, the equity section

of the statement of financial position was as follows:

Contributed capital:

Share capital, 5 par, 600, 000 share authorized,

200, 000 shares issued and outstanding 1, 000, 000

Share premium 6, 000, 000

Retained earnings 2, 800, 000

Total SHE 9, 800, 000

During 2010, the following chronological transactions affected shareholders’ equity:

Reacquired 10, 000 shares at 30 per share to be help as treasury

Declared and issued a 30% stock dividend

Declared and paid cash dividend of 10 per share

Net income for 2010 amounted to 3, 000, 000

What is unappropriated balance of retained earnings on December 31, 2010?

Retained earnings – January 1, 2010 2, 800, 000

Stock dividend (57, 000 x 5) (285, 000)

*Cash dividend (247, 000 x 10) (2, 470, 000)

Net income 3, 000, 000

Appropriated for treasury shares (10, 000 x 30) (300, 000)

Unappropriated balance – December 31, 2010 2, 745, 000

*Shares issued – January 1, 2010 200, 000

Treasury shares (10, 000)

Outstanding shares 190, 000

Practical Accounting 1 Theory of Accounts

Chapter 36 – Retained Earnings USL Blue Notes 145

Stock dividend (30% x 190, 000) 57, 000

Total outstanding shares 247, 000

Case 3

On November 1, 2010, Yourface Company declared a property dividend of equipment payable on

March 1, 2011. The carrying amount of the equipment 3, 000, 000 and the fair value is 2, 500, 000 on

November 1, 2010.

However, the fair value less cost to distribute the equipment is 2, 200, 000 on December 31, 2010 and

2, 000, 000 on March 1, 2011.

What is the dividend payable on December 31, 2010?2, 200, 000

To recognize the dividend payable on November 1, 2010

Retained earnings 2, 500, 000

Dividends payable 2, 500, 000

To recognize the decrease in dividend payable on December 31, 2010

Dividends payable 300, 000

Retained earnings 300, 000

What is the measurement of the equipment on December 31, 2010? 2, 200, 000

Carrying amount 3, 000, 000

Fair value less cost to distribute 2, 000, 000

Impairment loss 800, 000

Impairment loss 800, 000

Equipment 800, 000

What amount of loss is recognized in profit or loss on March 1, 2011? 200, 000

Fair value – March 1, 2011 2, 000, 000

Fair value – December 31, 2011 (2, 200, 000)

Decrease in dividend payable (200, 000)

Dividend payable 200, 000

Retained earnings 200, 000

Dividends parable – March 1, 2011 2, 000, 000

Carrying amount of equipment – December 31, 2010 (2, 200, 000)

Loss on distribution of property dividend (200, 000)

Dividend payable 2, 000, 000

Loss on distribution of property dividend 200, 000

Equipment 2, 200, 000

Theory of Accounts Practical Accounting 1

You might also like

- Dividend Policy of Reliance Industries SwatiDocument24 pagesDividend Policy of Reliance Industries SwatiYashasvi KothariNo ratings yet

- Dividend Policy of Reliance Industries Itd.Document24 pagesDividend Policy of Reliance Industries Itd.rohit280273% (11)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Dak WsaDocument47 pagesDak WsasugamsehgalNo ratings yet

- ACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredDocument26 pagesACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredJoseph W. RodgersNo ratings yet

- OncaDocument6 pagesOncaVinylcoated ClipsNo ratings yet

- Understanding Retained EarningsDocument72 pagesUnderstanding Retained EarningsItronix MohaliNo ratings yet

- Retained EarningsDocument28 pagesRetained EarningsKen MaulionNo ratings yet

- Lesson 6 - Statement of Financial Position (Part 2)Document9 pagesLesson 6 - Statement of Financial Position (Part 2)yana jungNo ratings yet

- Block 5 ECO 02 Unit 2Document9 pagesBlock 5 ECO 02 Unit 2HozefadahodNo ratings yet

- Chapter 8 - CorporationDocument7 pagesChapter 8 - CorporationNyah MallariNo ratings yet

- 7 - Consolidated Financial Statements P3 PDFDocument7 pages7 - Consolidated Financial Statements P3 PDFDarlene Faye Cabral RosalesNo ratings yet

- BEACTG 03 REVISED MODULE 8 Components of Stockholder's Equity of Different Forms of Business OwnershipDocument7 pagesBEACTG 03 REVISED MODULE 8 Components of Stockholder's Equity of Different Forms of Business OwnershipJessica PangilinanNo ratings yet

- Piecemeal Distribution of Cash ExplainedDocument7 pagesPiecemeal Distribution of Cash ExplainedNikita SonawaneNo ratings yet

- AUD 323 Auditing & Assurance: Concepts & ApplicationsDocument33 pagesAUD 323 Auditing & Assurance: Concepts & ApplicationsYvone Claire Fernandez SalmorinNo ratings yet

- Treasury shares transactionsDocument9 pagesTreasury shares transactionsKathleenNo ratings yet

- Accounting 3 & 4 - Shareholders' Equity, Retained Earnings, and DividendsDocument10 pagesAccounting 3 & 4 - Shareholders' Equity, Retained Earnings, and DividendsLaurio, Genebabe TagubarasNo ratings yet

- Sweda Arifah (1862201120)Document7 pagesSweda Arifah (1862201120)Sweda ArifahNo ratings yet

- Rules of Debits and CreditsDocument6 pagesRules of Debits and CreditsJubelle Tacusalme Punzalan100% (1)

- Cash DividendsDocument19 pagesCash DividendsirishNo ratings yet

- FINANCIAL ACCOUNTING LLDocument197 pagesFINANCIAL ACCOUNTING LLArhin EmmanuelNo ratings yet

- Accounting For and Reporting of Preference SharesDocument19 pagesAccounting For and Reporting of Preference SharesAis Syang DyaNo ratings yet

- Dividends: 1.1 Definition of DividendDocument11 pagesDividends: 1.1 Definition of Dividendshiza sheikhNo ratings yet

- Dividends: 1.1 Definition of DividendDocument11 pagesDividends: 1.1 Definition of Dividendshiza sheikhNo ratings yet

- Partnership Liquidation and Incorporation Joint Ventures: ©the Mcgraw Hill Companies, Inc. 2006 Mcgraw Hill/IrwinDocument29 pagesPartnership Liquidation and Incorporation Joint Ventures: ©the Mcgraw Hill Companies, Inc. 2006 Mcgraw Hill/Irwinmahmoud ragabNo ratings yet

- Capital Maintenance and Dividend LAWDocument23 pagesCapital Maintenance and Dividend LAWHusnain SattiNo ratings yet

- Corporate Accounting TransactionsDocument7 pagesCorporate Accounting TransactionsJohncel Tawat100% (1)

- Equity, Income and Expenses Definition of Equity-Owner's Equity Is A Residual Interest in The Assets of An Entity After Deducting Its LiabilitiesDocument21 pagesEquity, Income and Expenses Definition of Equity-Owner's Equity Is A Residual Interest in The Assets of An Entity After Deducting Its LiabilitiesFarah PatelNo ratings yet

- Retained Earnings Appropriation and Quasi-Reorganization Retained Earnings Appropriation and Quasi-ReorganizationDocument10 pagesRetained Earnings Appropriation and Quasi-Reorganization Retained Earnings Appropriation and Quasi-ReorganizationJamie RamosNo ratings yet

- Reviewer - IntaccDocument36 pagesReviewer - IntaccPixie CanaveralNo ratings yet

- Dividends and equity investmentsDocument19 pagesDividends and equity investmentsBukhani MacabanganNo ratings yet

- Equity and LiabilitiesDocument11 pagesEquity and LiabilitiesLaston MilanziNo ratings yet

- Corporate Accounting Theory For First Unit-2Document9 pagesCorporate Accounting Theory For First Unit-2Rigved PrasadNo ratings yet

- Retained EarningsDocument3 pagesRetained EarningsKyla RequironNo ratings yet

- ACCOUNTING FOR CORPORATIONS-Retained EarningsDocument53 pagesACCOUNTING FOR CORPORATIONS-Retained EarningsMarriel Fate Cullano100% (3)

- Partnership Liquidation and Termination ProcessDocument34 pagesPartnership Liquidation and Termination ProcessclevereuphemismNo ratings yet

- Partnership Accounting Liquidation - InstallmentDocument4 pagesPartnership Accounting Liquidation - InstallmentMerielyn MetilloNo ratings yet

- Lesson 9.3_Retained Earnings (Part 3)Document7 pagesLesson 9.3_Retained Earnings (Part 3)tooru oikawaNo ratings yet

- AFAR-01D Partnership LiquidationDocument8 pagesAFAR-01D Partnership LiquidationLouie RobitshekNo ratings yet

- Accounts 2015 SamDocument24 pagesAccounts 2015 SamBIKASH166No ratings yet

- Financial Instruments FINALDocument40 pagesFinancial Instruments FINALShaina DwightNo ratings yet

- Financial InstrumentsDocument40 pagesFinancial InstrumentsArvind KumarNo ratings yet

- Handout 3 Audit IntegDocument8 pagesHandout 3 Audit IntegCeage SJNo ratings yet

- Accounting For Corporations REDocument15 pagesAccounting For Corporations RENichole Balao-asNo ratings yet

- Financial Management - ResumosDocument10 pagesFinancial Management - ResumosBeatriz BastosNo ratings yet

- Module 5 Part 4 The Corporation-Retained EarningsDocument27 pagesModule 5 Part 4 The Corporation-Retained EarningsKRISTINA CASSANDRA CUEVASNo ratings yet

- Accumulated Profits and TransactionsDocument22 pagesAccumulated Profits and Transactionsneza12No ratings yet

- Retained Earnings DividendsDocument3 pagesRetained Earnings DividendsLyka Faye AggabaoNo ratings yet

- RETAINED EARNINGS AND DIVIDENDSDocument3 pagesRETAINED EARNINGS AND DIVIDENDSSuper JhedNo ratings yet

- Chapter 6 Lumpsum LiquidationDocument24 pagesChapter 6 Lumpsum LiquidationJenny BernardinoNo ratings yet

- Dividend Assignment 1212Document3 pagesDividend Assignment 1212yatin rajputNo ratings yet

- Capital Maintenance and Dividend Law (ACCA, LW-F4)Document18 pagesCapital Maintenance and Dividend Law (ACCA, LW-F4)simranNo ratings yet

- Retained Earnings-Dividends-PPT - 0Document38 pagesRetained Earnings-Dividends-PPT - 0lilienesieraNo ratings yet

- Difference Between Provision and ReserveDocument5 pagesDifference Between Provision and ReserveŚáńtőśh MőkáśhíNo ratings yet

- Appropriated P & L DetailsDocument10 pagesAppropriated P & L DetailsM Usman AslamNo ratings yet

- Appropriation of Retained Earnings: Voluntary Appropriation Is A Matter of Discretion On The Part of Management. ThisDocument2 pagesAppropriation of Retained Earnings: Voluntary Appropriation Is A Matter of Discretion On The Part of Management. ThisJb De GuzmanNo ratings yet

- Week 05 - 02 - Module 11 - Investment in Equity InstrumentsDocument10 pagesWeek 05 - 02 - Module 11 - Investment in Equity Instruments지마리No ratings yet

- Module 009 Week003-Finacct3 Statement of Financial PositionDocument7 pagesModule 009 Week003-Finacct3 Statement of Financial Positionman ibeNo ratings yet

- Financial Reporting & Analysis in 40 CharactersDocument31 pagesFinancial Reporting & Analysis in 40 CharactersAbinash MishraNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- car shampoO PRINTDocument2 pagescar shampoO PRINTShenna Mae LibradaNo ratings yet

- After Defense Thesis 3Document93 pagesAfter Defense Thesis 3Shenna Mae LibradaNo ratings yet

- AFAR QuestionnaireDocument7 pagesAFAR QuestionnaireShenna Mae LibradaNo ratings yet

- AFAR QuestionnaireDocument7 pagesAFAR QuestionnaireShenna Mae LibradaNo ratings yet

- Answer SharingDocument1 pageAnswer SharingShenna Mae LibradaNo ratings yet

- Answer SharingDocument1 pageAnswer SharingShenna Mae LibradaNo ratings yet

- Political and Legal Systems in National EnvironmentsDocument4 pagesPolitical and Legal Systems in National EnvironmentsShenna Mae LibradaNo ratings yet

- According To Home EngineeringDocument24 pagesAccording To Home EngineeringShenna Mae LibradaNo ratings yet

- 35 Shareholders EquityDocument5 pages35 Shareholders EquityShenna Mae LibradaNo ratings yet

- 39 Earnings Per ShareDocument2 pages39 Earnings Per ShareShenna Mae LibradaNo ratings yet

- Research Report For Praedico GlobalDocument3 pagesResearch Report For Praedico GlobalAbhishek PatilNo ratings yet

- NCERT Class XI Accountancy Part IIDocument333 pagesNCERT Class XI Accountancy Part IInikhilam.com67% (3)

- MANAGEMENT SERVICES – VARIABLE & ABSORPTION COSTINGDocument11 pagesMANAGEMENT SERVICES – VARIABLE & ABSORPTION COSTINGKristine MagsayoNo ratings yet

- Financial Reporting: Ca P. C. SainiDocument103 pagesFinancial Reporting: Ca P. C. SainiFaraz AliNo ratings yet

- Schaeffler Vietnam Internship ReportDocument20 pagesSchaeffler Vietnam Internship ReportNghi TrầnNo ratings yet

- Sales Management NewDocument2 pagesSales Management NewMirza Naveed BaigNo ratings yet

- End of Term 1 Higher TestDocument3 pagesEnd of Term 1 Higher TestbussybeeNo ratings yet

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Malar SrirengarajahNo ratings yet

- Unit 2 - Developing and Applying Retail StrategyDocument6 pagesUnit 2 - Developing and Applying Retail StrategyPoorna VenkatNo ratings yet

- "A Study On Fundamental Analysis of Indian Infrastructure IndustryDocument18 pages"A Study On Fundamental Analysis of Indian Infrastructure IndustrySaadgi AgarwalNo ratings yet

- Essential Guide to Marketing StrategyDocument10 pagesEssential Guide to Marketing StrategyMayank BishtNo ratings yet

- TOApr May 23Document24 pagesTOApr May 23buzbonNo ratings yet

- Unit 3-Statement of Changes in Equity (2023)Document13 pagesUnit 3-Statement of Changes in Equity (2023)Chalé DarwinNo ratings yet

- Project Proposal On The Production of Industrial Adhesive Feasibility Study - Business Plan in Ethiopia PDFDocument1 pageProject Proposal On The Production of Industrial Adhesive Feasibility Study - Business Plan in Ethiopia PDFSulemanNo ratings yet

- FACILITY PLANNING BCT&CA NotesDocument128 pagesFACILITY PLANNING BCT&CA Notesgowthamkaringi0% (1)

- RFP For Airoli-Katai Highway ProjectDocument126 pagesRFP For Airoli-Katai Highway ProjectEkta Agrawal100% (1)

- PitchBook For Venture Capital Firms - Ebook - GlobalDocument20 pagesPitchBook For Venture Capital Firms - Ebook - GlobalHun Yao ChongNo ratings yet

- Breakfasting Mr. Ifan 31 Maret 2023Document2 pagesBreakfasting Mr. Ifan 31 Maret 2023Ifan FadilahNo ratings yet

- حق الاضراب لموظفي الدولةDocument67 pagesحق الاضراب لموظفي الدولةelmansoury hichamNo ratings yet

- Cold Email TemplateDocument15 pagesCold Email TemplateJordyNo ratings yet

- CH 3 PDFDocument29 pagesCH 3 PDFRefisa JiruNo ratings yet

- Module 1 PDFDocument9 pagesModule 1 PDFUday GowdaNo ratings yet

- Stanadyne Packaging and Shipping GuidelinesDocument39 pagesStanadyne Packaging and Shipping GuidelinesABDELOUAHEB HAMIDINo ratings yet

- Value Analysis / Value EngineeringDocument19 pagesValue Analysis / Value EngineeringthatchinamurthiNo ratings yet

- SSRN Id4045914Document51 pagesSSRN Id4045914Jack CrossNo ratings yet

- White Blue Modern Company ProfileDocument24 pagesWhite Blue Modern Company ProfileHadi SubariNo ratings yet

- Financial Performance Analysis of SIFCODocument8 pagesFinancial Performance Analysis of SIFCONamuna JoshiNo ratings yet

- SB1Document26 pagesSB1Suraj PantNo ratings yet