Professional Documents

Culture Documents

Group Reporting (FIN-CS) : Public Document Version: SAP S/4HANA 2022 (October 2022) - 2022-10-03

Uploaded by

Aymen AddouiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group Reporting (FIN-CS) : Public Document Version: SAP S/4HANA 2022 (October 2022) - 2022-10-03

Uploaded by

Aymen AddouiCopyright:

Available Formats

PUBLIC

Document Version: SAP S/4HANA 2022 (October 2022) – 2022-10-03

Group Reporting (FIN-CS)

© 2022 SAP SE or an SAP affiliate company. All rights reserved.

THE BEST RUN

Content

1 Group Reporting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4

1.1 Consolidation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

Authorization Objects in Group Reporting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

1.2 Getting Started. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Set Global Parameters. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Master Data. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13

Consolidation Settings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

Currencies in Group Reporting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .134

1.3 Period Preparation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140

Maintain Exchange Rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 141

Consistency Check of Accounting Integration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 141

1.4 Data Preparation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 142

Data Monitor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 142

Copy Transaction Data. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 182

Flexible Upload of Reported Financial Data. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 183

Group Journal Entries. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 193

Data Validation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 207

Interunit Reconciliation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 217

Task Logs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 218

1.5 Intercompany Matching and Reconciliation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 221

Features. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 221

Architecture. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 222

Quick Start. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 223

Intercompany Document Matching. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 230

Intercompany Reconciliation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 273

Intelligent Intercompany Reconciliation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 295

Advanced Settings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 313

Data Management in Intercompany Matching and Reconciliation. . . . . . . . . . . . . . . . . . . . . . . 376

1.6 Consolidation Process. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 381

Consolidation Monitor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 381

Group Journal Entries. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 404

Data Validation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .413

Consolidation of Investments (Activity-Based). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 414

Task Logs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 504

1.7 Analytics for Group Reporting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 507

"Manage Global Hierarchies" in Group Reporting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 508

Group Reporting (FIN-CS)

2 PUBLIC Content

Reporting Logic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 513

Group Data Analysis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .522

Group Data Analysis - With Reporting Rules. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 531

Validation Result Analysis - Unit View. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 533

Validation Result Analysis - Group View. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 536

Rule-Based Reports. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 538

Reports Using Outdated Reporting Logic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 540

1.8 Plan Consolidation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 543

1.9 Restatement and Simulation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 545

1.10 Customizing and Integration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 552

Customizing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 552

ICMR Elimination Method. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 553

Custom Field Extensibility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 559

Rules for Substitution/Validation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .562

Integration with SAP Analysis for Microsoft Office. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 578

Data Management in Group Reporting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 578

1.11 Focus Topics. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 581

Equity Pickup. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 582

Flexible Derivation of Consolidation Units. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 597

Integration with Group Reporting Preparation Ledger. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .613

Group Reporting (FIN-CS)

Content PUBLIC 3

1 Group Reporting

Group reporting consists of topics such as consolidation process and analytical reports and supports the

computation, creation, and disclosure of consolidated reports that provide information on the performance of

a corporate group.

Integration

The figure below depicts how group reporting as part of SAP S/4HANA is integrated with SAP Group Reporting

Data Collection and SAP Analytics Cloud and is followed by an explanation:

SAP Group Reporting Data Collection

SAP Group Reporting Data Collection helps you gather financial data for your business units. The app is hosted

on the SAP Business Technology Platform and relies on data such as master data and allowed breakdowns

from group reporting within SAP S/4HANA.

With SAP Group Reporting Data Collection, you can map data, create forms, design your own reports, and use

these or the predefined reports to collect data as part of your data preparation for consolidation.

For more information, see https://help.sap.com/viewer/p/SAP_Group_Reporting_Data_Collection.

SAP Analytics Cloud

(SAC) provides deep insights into your business using reporting and data visualization, which will help you

make better decisions.

With live data connections, the integration between SAP S/4HANA Finance for group reporting and SAC

enables business analysis at group or corporate level without data replication.

In this release, the following detail and overview reports are available out of the box:

• Consolidated report book for actual data

• Periodic overview report book

• Actual and budget comparison report book

Group Reporting (FIN-CS)

4 PUBLIC Group Reporting

• Actual, budget, and forecast comparison report book

• Predictive consolidated P&L analysis

• Group financial KPIs overview

Note

For more information about the integration between SAP S/4HANA and SAP Analytics Cloud, see SAP

Analytics Cloud product help page.

For troubleshooting information, the configuration content predelivered by SAP, and the frequently asked

questions about Group Reporting, see SAP Note 2659672 .

For the configuration settings and test steps required after installation or upgrade, see the “Test Script”

available at SAP Best Practices Explorer (https://rapid.sap.com/bp/#/browse/scopeitems/1SG ).

1.1 Consolidation

A complete consolidation process typically starts with preparatory steps, such as setting global parameters,

checking the master data of your organizational units and financial statement (FS) items, and specifying

effective exchange rates.

After that, you can proceed with collecting data reported by consolidation units, and standardizing the data

with features available in the Data Monitor. When the data is ready for consolidation, go to the Consolidation

Monitor to perform the consolidation tasks, such as various interunit eliminations and data validation. For a list

of the tasks and their descriptions, see Data Monitor [page 142] and Consolidation Monitor [page 381].

Throughout the process, you can cross check your processed data using reconciliation reports and currency

translation analysis reports, or generate various group reports in real time.

Group Reporting (FIN-CS)

Group Reporting PUBLIC 5

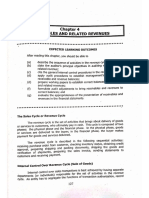

The process described above is shown in detail in the following diagram:

Prerequisites

• You have set up the proper authorizations for your users according to their job responsibilities. SAP

delivers the following roles for your reference:

• SAP_BR_GL_ACCOUNTANT_GRP: General Ledger Accountant - Group Reporting

• SAP_BR_GRP_ACCOUNTANT: Group Accountant

• SAP_BR_ADMINISTRATOR_GRP: Administrator - Group Reporting

• SAP_BR_EXTERNAL_AUDITOR_GRP: External Auditor - Group Reporting

• SAP_BR_BUSINESS_ANALYST_GRP: Business Analyst - Group Reporting

In your SAP Fiori front-end server, you can copy a delivered business role to create your own role, adapt its

contained business catalogs, and assign the created role to relevant users.

In addition, you need to set the necessary permissions by authorization object in the back-end systems, for

example, restrict the filed values a role can access by using the transaction code PFCG. After that, you can

assign the adapted roles to your business users using user administrator tool, such as transaction SU01.

For more information, see User and Role Administration of ABAP Platform.

Group Reporting (FIN-CS)

6 PUBLIC Group Reporting

• You have created consolidation units and set the Data Transfer Method to Read from Universal Journal or

Flexible Upload, depending on whether they are integrated with company codes in financial accounting

(FI). This can be done in the Consolidation Units - Create and Change [page 22] app.

• You have maintained the FS items for your consolidation charts of accounts and map them to the relevant

general ledger accounts. For more information, see Financial Statement Items [page 41].

• To use SAP S/4HANA Finance for group reporting, SAP recommends that you install the SAP Best

Practices configuration content for the solution. You will gain a configuration starting point, which you can

adapt to your needs in Customizing. Examples in this documentation are based on the SAP Best Practices

content. For more information, see https://rapid.sap.com/bp/#/browse/scopeitems/1SG and

Administration Guide.

Integration

Consolidation is integrated with different modules within SAP S/4HANA. Integration enables the following:

• Generation of the organizational units for consolidation, based on the units in the transaction system

• Collection of the reported financial data. There are two methods of collecting transaction data:

• Data can be read directly from the universal journal.

• Data that is not stored in the universal journal, for example, the transaction data of companies that use

non-SAP systems, can be uploaded flexibly.

• Drill-through to the accounting app Manage Journal Entries for the source accounting documents

• Hierarchy definition for the consolidation-specific master data by using the framework app Manage Global

Hierarchies

Features

• You can use different methods for transferring transaction data to the consolidation system. Which

methods you use depends on your consolidation scenario.

• You can post manual journal entries (documents), for example, to standardize the reported data to the

group's methods of balance sheet valuations.

• You can use validations to check the consistency of the reported, standardized, or consolidated financial

data.

• You can translate the reported financial data into the currency of the consolidation group.

• You can automatically execute the following elimination tasks:

• Interunit eliminations (elimination of payables and receivables, elimination of revenue and expense,

elimination of investment income)

• Consolidation of investments

Group Reporting (FIN-CS)

Group Reporting PUBLIC 7

1.1.1 Authorization Objects in Group Reporting

Group Reporting offers the following authorization objects:

Authorization Object Description Where it is Used

E_CS_BUNIT Consolidation unit Processing of master data consolida

tion unit.

E_CS_CACTT Consolidation tasks Running a consolidation task; When a

user starts the task for a consolidation

group/s for which he has the authoriza

tion, all subassigned consolidation units

are included automatically; no exclu

sion is possible.

The authorization for subassigned con

solidation units is not checked, when

the user starts the task with the non-ini

tial consolidation group parameter and

authorization for this consolidation

group is granted. It is not possible to ex

ecute the task for the consolidation unit

and exclude any of subassigned consol

idation units.

The authorization for consolidation

units is only checked, when the consoli

dation group parameter is initial.

E_CS_CONGR Consolidation group Processing of master data consolida

tion group.

E_CS_DIMEN Dimension Full authorization for dimension Y1 nec

essary.

E_CS_ITCLG Consolidated chart of accounts Processing of master data consolida

tion chart of accounts. Read access is

required to reading transactional data.

E_CS_PERMO Monitor, opening/closing of periods When opening/closing a period, author

ization for both, the consolidation unit

and the consolidation group is checked.

If an authorization for a consolidation

unit is missing, the period is not opened

for this consolidation unit.

E_CS_RPT Group reporting organizational units Used for analytics in group reporting.

Group Reporting (FIN-CS)

8 PUBLIC Group Reporting

Authorization Object Description Where it is Used

E_CS_RPTNG Data reporting Reporting of consolidation data; The

rules for CG/CU are the same as for

E_CS_CACTT.

E_CS_RVERS Version Processing of master data consolida

tion version.

G_881_GRLD Financial Accounting Processing of master data ledger.

FIN_CS_EPU Equity Pickup Authorization to run Equity Pickup.

FI_CS_MD Group Reporting master data Used in the Define Master Data for

Consolidation Fields app.

FI_CS_RULE Reporting rule assignment Used in the apps Define Reporting Rules

and Assign Reporting Rules to Versions.

FI_CS_FSM Financial statement item mapping Used in the Map FS Items with G/L

Accounts app.

FI_CS_FSMA Financial statement item mapping as Used in the Assign FS Item Mappings

signment app.

FI_CS_ADH Define Adhoc Items and Adhoc Sets Note that adhoc items can only be de

fined by using an OData Service which

is not published on the API Hub. It is in

cluded in the communication scenario

of GRDC (0241).

FI_CS_SEL Selections in Group Reporting Used in the Define Selections app.

FI_CS_RPT Reporting regarding organizational Used in analytical reports.

units

FI_CS_PLV

Posting Level Processing of posting level when using

the authorization object FI_CS_RPT in

analytics for group reporting.

FI_CS_LOG Group Reporting logs Obsolete; see SAP note 3028675 .

FI_CS_XPRA Group Reporting XPRA Used for X persistent remote applica

tion (XPRA) in group reporting.

For more information about the authorization checks, see the system documentation for the authorization

objects. To display this documentation, run transaction PFCG, and choose More Environment

Authorization Objects Display . Expand the corresponding node and choose Information (I) for the relevant

authorization object.

Group Reporting (FIN-CS)

Group Reporting PUBLIC 9

Related Information

User and Role Administration of ABAP Platform

1.1.1.1 Authorization Object E_CS_RPT

The authorization object E_CS_RPT (Group Reporting: Organizational Units) is used to maintain user

authorizations for analytics in group reporting.

Fields

The authorization object E_CS_RPT has the following fields:

• RVERS: Consolidation Version

• CONGR ($CONGR): Consolidation Group

• BUNIT ($BUNIT): Consolidation Unit

• PRCTR ($PRCTER): Profit Center

• KOKRS ($KOKRS): Controlling Area

• SEGMENT: Segment for Segmental Reporting

• FICSDOCTY: Document Type

• RITEM: Financial Statement Item

• FICSPSTLV: Posting Level

• ACTVT: Activity

Dependencies Between Fields

This authorization object considers dependencies between fields. For example, a certain consolidation unit

may be assigned to more than one consolidation group, or a consolidation group may be relevant in more than

one consolidation version. You can maintain authorizations that give access to specific data based on these

dependencies. It’s possible to maintain multiple authorizations to leverage these dependencies in different

ways for different fields.

For example, you can create an authorization where one consolidation unit is dependent on multiple groups to

which it belongs. At the same time, you can also create another authorization for a different consolidation unit

where it is dependent on only one group to which it belongs. This is illustrated in the following example.

Example

Group Reporting (FIN-CS)

10 PUBLIC Group Reporting

You want a user to have access to all the data of consolidation unit Cons Unit 1. So, you maintain Cons Unit

1 for the field BUNIT ($BUNIT). However, Cons Unit 1 is assigned to the consolidation groups Cons Group

A and Cons Group B. So, you need to make sure that you maintain Cons Group A and Cons Group B for

the field CONGR ($CONGR). Alternatively, you can simply maintain * so that a user has access to all

consolidation groups, including Cons Group A and Cons Group B.

You also want this user to have access to the data of Cons Unit 2, but only as it relates to Cons Group A. In

other words, you don’t want the user to access the data of Cons Unit 2 in Cons Group B. In this case, you

create a new authorization and maintain Cons Unit 2 for the field BUNIT ($BUNIT) and specify Cons Group

A only for the field CONGR ($CONGR). This way, the user can only see the data for Cons Unit 2 that's part

of Cons Group B.

Maintaining Fields

You can maintain specific values for each field in the authorization object. This gives a user the authorization to

access specific data for a field. For more information, see ABAP Authorization Concept.

Note

It’s recommended to maintain values for all fields. If you leave a field blank, it receives the status

Unmaintained Organization Level.

Maintaining Fields with *

You can maintain a field with the value * to give full authorization for that field. This means that a user has

access to all data of that particular field. For example, if you set * for the field CONGR ($CONGR), then a user

with that authorization can access the data for all consolidation groups, including cases where the

consolidation group is maintained as blank.

Maintaining Fields with ‘’

You can maintain a field with the value ‘’ (two apostrophes with no space in between) to indicate a field with an

empty field value. This refers to fields that are maintained as blank in the Consolidation Journal Entries (table

ACDOCU). When you maintain ‘’, the system treats these empty fields in the same way as fields that are

assigned with actual values.

Note

For the field CONGR ($CONGR), it’s important to maintain the value ‘’ if you want to give the user access to

data which is stored without group dependency and without consolidation group derivation by the

reporting logic, such as data on posting levels Blank, 00, 10, and 20. This can be necessary even if you

additionally give the user access to specific consolidation groups.

The one exception where this isn’t necessary is if you maintain the value * for CONGR ($CONGR). This

indicates full authorization for all consolidation groups and inherently includes cases where the

consolidation group is not assigned, such as data on the posting levels Blank, 00, 10, and 20 without

consolidation group derivation by the reporting logic.

Field BUNIT ($BUNIT) and Posting Level 20

The maintenance of the field BUNIT ($BUNIT) impacts the posting level 20 (two-sided elimination entries for

consolidation unit pairs – reporting unit and partner unit). When you maintain a consolidation unit for BUNIT

Group Reporting (FIN-CS)

Group Reporting PUBLIC 11

($BUNIT), the consolidation unit is only considered as the reporting unit in posting level 20, not as the partner

unit.

Example

For Cons Group A, there are two elimination lines on the posting level 20:

Reporting Unit Partner Unit FS Item Amount in Group Currency

Cons Unit 1 Cons Unit 2 FSI001 100

Cons Unit 2 Cons Unit 1 FSI002 -100

You create the following authorizations and assign them to a user:

CONGR ($CONGR) Cons Group A

BUNIT ($BUNIT) Cons Unit 1

In this case, the user is authorized to view data for Cons Unit 1 only, not for Cons Unit 2. Also, since the

posting level is 20, the only accessible data for Cons Unit 1 is the data where Cons Unit 1 is the reporting

unit. As a result, the user can only view the first line of the elimination entry because here Cons Unit 1 is the

reporting unit.

Reporting Unit Partner Unit FS Item Amount in Group Currency

Cons Unit 1 Cons Unit 2 FSI001 100

The second line is not visible. This is because the user is not authorized to view data of Cons Unit 2. And

even though the user is authorized to view data for Cons Unit 1, Cons Unit 1 is the partner unit in this

second line, not the reporting unit. As a result, the authorization doesn’t allow access to this data.

Activating E_CS_RPT with the Switchable Authorization Check Framework

(SACF)

To start using the authorization object E_CS_RPT, you must activate it with the Switchable Authorization Check

Framework (SACF). For a complete guide on how to do this, see SAP Note 3120976 .

Related Information

ABAP Authorization Concept

Authorization Objects in Group Reporting [page 8]

Group Reporting (FIN-CS)

12 PUBLIC Group Reporting

1.2 Getting Started

The following sections describe how you set up the system.

1.2.1 Set Global Parameters

With this app, you can specify the global parameters that will apply to all further steps of the consolidation

process.

Inputs to the following global parameter fields are required:

• Version: Versions make it possible to consolidate different sets of financial data or consolidate in different

group currencies. You can only select standard versions. Therefore, if you select a version which is a group

currency extension version or an extension version, your selection is adjusted to the corresponding

standard version. For more information, see Consolidation Versions [page 68].

• Fiscal Year/Period

• Consolidation Chart of Accounts: A systematic grouping of financial statement (FS) items that belong

together and are used on the group reporting or consolidation level.

Note

If the old reporting logic is active, you also need to select the Consolidation Ledger. For more information,

see Consolidation Ledger [page 74].

Note

Preset versions, consolidation chart of accounts, and consolidation ledgers exist in the system. You can

also make your own configuration settings via Customizing activities under SAP S/4HANA for Group

Reporting.

You can also enter a consolidation group or unit to perform consolidation tasks only on that group or unit.

1.2.2 Master Data

This section describes how to display and define consolidation-specific master data, such as organizational

units and financial statement (FS) items.

In group reporting, master data includes the following:

• Configuration objects, such as version, subitem, and document type

• Consolidation-specific master data objects, such as consolidation units, consolidation groups, and FS

items

• Additional consolidation master data values

Group Reporting (FIN-CS)

Group Reporting PUBLIC 13

Each object is treated differently when defining master data. This section describes how to display and define

consolidation-specific master data.

1.2.2.1 Organizational Units Master Data

The organizational units of Group Reporting include consolidation groups and consolidation units.

In the consolidation group structure, consolidation units are assigned to consolidation groups. Also,

consolidation group-specific settings for the consolidation units are maintained, such as the fiscal year and

period of first consolidation as well as consolidation method.

1.2.2.1.1 Consolidation Units

A consolidation unit is the smallest element in a consolidation group structure.

1.2.2.1.1.1 Consolidation Unit Maintenance

Learn how to maintain consolidation units using the different consolidation unit master data apps.

Depending on your system settings, you can use one or more of the following apps to enter and display master

data of consolidation units:

• Define Consolidation Units

• Consolidation Units - Create and Change

• Consolidation Units - Display

The following table gives an overview of which consolidation unit master data app must be used, can't be used,

or is recommended to be used in which situation:

Consolidation Units - Create and

Change

SAP S/4HANA system using... Define Consolidation Units Consolidation Units - Display

…the new reporting logic exclusively. The app must be used in any fiscal year. The app can't be used.

The system was set up as of the release

2020 or higher, or a migration from EC-

CS to Group Reporting took place.

...the old reporting logic exclusively. The app can't be used. The app must be used in any fiscal year.

The system that was set up before the

release 2020 and not yet migrated to

the new reporting logic.

Group Reporting (FIN-CS)

14 PUBLIC Group Reporting

Consolidation Units - Create and

Change

SAP S/4HANA system using... Define Consolidation Units Consolidation Units - Display

...the old and new reporting logic. The app must be used for master data The app must be used for consolidation

maintenance as of the from year of the unit master data maintenance before

The system was set up before the re new reporting logic. the from year of new reporting logic

lease 2020 and migrated to the new re

SAP recommends to use this app for The app can't be used for consolidation

porting logic later.

parallel maintenance of consolidation unit master data changes as of the from

unit master data changes applied by year of the new reporting logic.

the Consolidation Units - Create and

Change app before the from year of the

new reporting logic.

Note

The following section is only relevant for systems that were migrated from the old reporting logic to the new

reporting logic.

The new reporting logic uses the new consolidation unit master data, and the old reporting logic uses old

consolidation unit master data. The old and the new master data environments don't share the master data

and are completely separate from each other. This includes consolidation unit descriptions and master data

attributes. There is no synchronization of changes taking place between the old and new consolidation unit

master data environment.

This results in a special situation when you have to apply consolidation unit master data changes in a fiscal year

where the old reporting logic is still active. For these changes to have any effect, you have to maintain them

using the Consolidation Units - Create and Change app in the old consolidation unit master data environment.

To have consistent consolidation unit master data, SAP recommends that you make these changes in the

Define Consolidation Units app in the new consolidation unit master data environment as well

Related Information

Consolidation Units - Create and Change [page 22]

Define Consolidation Units [page 15]

Consolidation Units [page 14]

1.2.2.1.1.1.1 Define Consolidation Units

With this app, you can display, change, create, or delete consolidation unit (CU) master data individually.

Group Reporting (FIN-CS)

Group Reporting PUBLIC 15

Key Features

This app provides the following key features:

• Display consolidation units

• Change consolidation units

• Create consolidation units

• Delete consolidation units

Creating and Maintaining Consolidation Units

To create a consolidation unit, choose Create and enter the name of the consolidation unit. You can also copy

an existing consolidation unit to create a new one. To do so, you choose Copy, enter the name of the

consolidation unit and select if you want to copy the time- and version-dependent data as of the current fiscal

year and period and version or for all fiscal years and periods and versions.

Note

If you're working in a year before the From Year for Group Reporting Preparation Ledger or in a planning

version, universal journal integration for a consolidation unit with special characters in its name is not

possible. This is because the system requires a company with the same name as the consolidation unit in

this case, and special characters are not supported for the company name.

When displaying the details of a consolidation unit, you can change the settings of the selected consolidation

unit by choosing Edit. After making changes, choose Save to apply the changes.

Note

If you want to change the hierarchy of the consolidation units, use the Manage Global Hierarchies app.

The following settings can be made for each consolidation unit:

Basic Data (not time- and version-dependent)

• Consolidation Unit Description: Maintained in the log-on language, other languages need to be maintained

in the Language-Dependent Texts section.

• Country

Time-Dependent Attributes:

• Local Currency (mandatory)

Note

You can only change the local currency as of the first period of the year. When you change the local

currency of a consolidation unit, the system translates the old local currency values into the new local

currency during the balance carryforward. Because of this, you must assign a currency translation

method to the consolidation unit.

Group Reporting (FIN-CS)

16 PUBLIC Group Reporting

However, be aware that changing the local currency of a consolidation unit can lead to inconsistencies

in cases where data already exists for a consolidation unit that uses the local currency that’s to be

changed.

• Company: You can only assign companies to consolidation units if the following prerequisites are met:

• You’re working in fiscal year period as of the From Year for Group Reporting Preparation Ledger.

• You’re working in a version that is not a plan version.

Note

If you're working in a year before the From Year for Group Reporting Preparation Ledger, you can't assign the

company yourself. Instead, a company with the same ID as the corresponding consolidation unit is

assigned to the consolidation unit. If such a company doesn't exist, then no company is assigned to the

consolidation unit.

Time- and Version-Dependent Attributes:

Note

The following attributes are time- and version-dependent for a consolidation unit. If you create, display, or

change consolidation unit attributes, you make the changes to these attributes for the selected version

(and related versions) only and as of the selected fiscal year and period onwards. Time- and version-

dependency for consolidation units works in the same way as it does for financial statement items. For

more information, see Time- and Version-Dependency [page 45].

• Consolidation Unit is Partner Unit Only: Specifies if the new consolidation unit is to be used as a partner

unit only. If you select this checkbox, all other time- and version-dependent attributes are disabled. A

consolidation unit is specified as partner unit where it is not relevant for a consolidation process and

requires only a minimal set of master data to be used, for example, as where a consolidation unit is

specified as a partner unit in transferred data or in consolidation postings.

• Currency Translation Method: Required if the local currency is different from the group currency. The

translation method determines the exchange rate used for specific financial statement (FS) items, and

how translation and rounding differences are posted.

You can choose from the following predelivered currency translation (CT) methods:

• S0902 (Translation-FC@First Period - Periodic): You can assign this method to CUs that are newly

integrated into the group starting from the first period of the fiscal year. For the FS items in the P&L

statement and the movements-related FS items in the balance sheet, S0902 translates periodic values

at the exchange rates for their respective periods.

• S0903 (Standard Translation - Periodic): It translates values for all FS items at the monthly average

exchange rate for each period.

• S0904 (Translation-FC@Incoming Unit): It translates incoming units at a specific rate (exchange rate

indicator J) maintained for incoming unit. This offers more flexibility to incoming units.

• S0905 (Standard Translation Activity-Based C/I): You assign this method if you are using the task for

automatic consolidation of investments in the consolidation monitor. The translation method uses the

No Retranslation of Existing Group Currency Value translation key for investment and equity, to fix their

group currency values to the historical rate. This means that in data collection of reported financial

data for investment and equity, you must maintain the amounts in both local and group currency.

• Y0901 (Standard Translation - YTD): Same as S0903, except that for the FS items in the P&L

statement and the movements-related FS items in the balance sheet, S0903 translates periodic values

Group Reporting (FIN-CS)

Group Reporting PUBLIC 17

at the exchange rates for their respective periods while Y0901 translates cumulative values at the

monthly average exchange rate of the current period.

• Y0902 (S4 Accounting GC): It can be assigned to CUs that set Read from Universal Document as the

data transfer method and therefore read financial data from universal documents.

The main differences between these CT methods are the Exchange Rate Indicator (ERI) and the Translation

Key (CT Key) that are assigned to the FS item selections. ERI determines the exchange rate to be used in

the currency translation, either monthly average rate (AVG) or monthly closing rate (CLO). CT key controls

whether cumulative values are translated at the rate for current period (YTD) or periodic values are

translated at the rates for their respective periods (PER). The table below displays the detailed settings for

each method.

Descrip P&L, B/S Move Opening Balances in B/S FS Items - In Investments and

Method tion ments B/S* coming Units Equity in B/S*

ERI CT Key ERI CT Key ERI CT Key ERI CT Key

S0902 Transla AVG PER AVG PER CLO PER AVG PER

tion-

FC@First

Period -

Periodic

S0903 Standard AVG PER AVG PER AVG PER AVG PER

Transla

tion - Peri

odic

S0904 Transla AVG PER AVG PER INC2 PER AVG PER

tion-

FC@In

coming

Unit

S0905 Standard AVG PER AVG PER AVG PER Existing group cur

Transla rency values are not

tion Activ retranslated.

ity-Based

COI

Y0901 Standard AVG YTD AVG PER AVG PER AVG PER

Transla

tion - YTD

Y0902 S4 Ac Existing group currency values are not retranslated.

counting

GC

*Since the opening balance is stored on period 000, the amount in the group currency is kept at its original

value.

When an FS item is not included in any rule, the reference exchange rate defined in the methods applies.

When the translation results in rounding differences, these differences are posted in the group currency on

the following FS item:

• 900: B/S rounding difference is posted on FS item 314800

Group Reporting (FIN-CS)

18 PUBLIC Group Reporting

• 901: Annual net income - B/S, P&L rounding difference is posted on FS item 799000

• 902: P&L rounding difference is posted on FS item 604000

• Tax Rate: Used to automatically calculate the deferred tax in manual or automatic journal entries, if the

deferred tax calculation is enabled in the document type.

• Deviating Fiscal Year Variant: By maintaining a deviating fiscal year variant (FYV) on the consolidation unit

level, you're able use the numbers from a local close of a company code in the group close, which result

from a shifted fiscal year compared to the group close. This is allowed from a legal point of view under

certain circumstances so that an additional local close of such a company code isn’t necessary.

Note

This scenario is only supported if the number of "normal" fiscal year periods in the deviating FYV of the

consolidation unit is that same as the number of "normal" fiscal year periods in the FYV of the

consolidation version.

This field is disabled in all consolidation versions except planning versions unless you're working in a year

before the From Year for Group Reporting Preparation Ledger. In this case or in case you're working in a

planning version, you only need to enter a deviating FYV if the FYV for the selected consolidation unit is

different from the FYV assigned to the selected version.

Note

As the deviating FYV is time- and version-dependent, you can change the assignment of the FYV over

time. This can lead to double assignments or missing assignments when transferring transaction data

to consolidation. In this instance, you need to correct the transaction data in consolidation by using

manual posting or flexible file upload.

Example: If you have assigned an FYV value for period 001/2020, where the fiscal year periods start on

the 1st of the month, and change the FYV value in period 002/2020 to a variant, where the fiscal year

periods start on the 15th of the month, assignments between day one and 14 of period 002 are missing.

To avoid having to correct transaction data in consolidation, you can define an FYV that changes its

behavior over time and you assign only this FYV to the consolidation unit. The FYV definition

guarantees that every date is assigned to exactly one fiscal year period. Or you can assign a third FYV

for the transition period between the other two FYVs. This third FYV is defined in a way that this

transition happens without double assignments or missing assignments.

• Universal Journal Integration: Specifies how the local reported financial data is collected from CUs for

consolidation.

• The Transfer from Universal Journal method is first of all only applicable for CUs where their reported

financial data resides in the same SAP S/4HANA system as group reporting. If you're working in a year

as of the From Year for Group Reporting Preparation Ledger, then the following prerequisites must be

fulfilled before you can choose Transfer from Universal Journal:

• The selected consolidation version must have a group reporting preparation ledger assigned for

the source ledger.

• A company must be assigned to the CU.

• A company code must be assigned to this company.

• The company code assigned to this company must have the same fiscal year variant as the

selected consolidation version. Deviating fiscal year variants are not supported by the integration

with group reporting preparation ledgers. For more information, see the in-app help for Deviating

Fiscal Year Variant.

Group Reporting (FIN-CS)

Group Reporting PUBLIC 19

• The company code assigned to this company must have the same functional currency as the local

currency of the selected CU.

• If the optional attribute Group Currency Source has been maintained for the selected version, the

currency derived from this source field for the company code assigned to this company must be

the same as the group currency defined for the selected consolidation version. For example, if the

Group Currency of the version is set to EUR and the Group Currency Source of the version is set to

Freely Defined Currency 2, then the Freely Defined Currency 2 set for all company

codes assigned to the company, which is assigned to the consolidation unit, must be EUR.

If you're working in a year before the From Year for Group Reporting Preparation Ledger, then the

following prerequisites must be fulfilled before you can choose Transfer from Universal Journal:

• A company exists that has the same ID as the consolidation unit.

• At least one company code has to be assigned to this company.

• The selected consolidation version needs to have an accounting source ledger assigned.

• The Source for Local Currency Key Figure, if configured, provides the same currency for all relevant

company codes as the local currency of the consolidation unit.

• The Source for Group Currency Key Figure, if configured, provides the same currency for all

relevant company codes as the group currency of the consolidation version.

Note

If any of these prerequisites for the selected CU in the selected consolidation version and fiscal

year period are not met, the Transfer from Universal Journal option is disabled and can't be chosen.

You can check which prerequisites are not fulfilled by clicking the Information icon ( ).

Note

If you have selected Transfer from Universal Journal for a consolidation unit, you can still use

flexible file upload or data transfer from SAP Group Reporting Data Collection for this consolidation

unit.

• If you select No Integration for a certain CU, you have to use flexible file upload or data transfer from

SAP Group Reporting Data Collection. If you have specified an Upload Method, it is used during the

flexible file upload. If you haven't, you have to select an upload method when you run the flexible file

upload.

Note

You can choose from the predelivered upload methods.

• Group Currency is Leading Currency: You can specify if the group currency should be used as the leading

currency instead of the local currency in data collection. Selecting this option has the following

implications:

Note

The option Group Currency is Leading Currency is only available if you've selected Group Currency is

Leading in the Check Global System Settings configuration activity. Otherwise, this option is not visible.

• Flexible File Upload: When collecting data with flexible file upload, the flexible file upload always takes

the values explicitly provided by the upload file, regardless of whether those values are in local

currency or group currency. However, if there's no explicit value provided in the file, then the flexible file

Group Reporting (FIN-CS)

20 PUBLIC Group Reporting

upload copies values from the leading currency to the not leading currency, but only if the local

currency and group currency are the same. If the option Group Currency is Leading Currency is

selected, then the group currency is the leading currency. If not, then the local currency is the leading

currency.

• Document Posting: When posting a document, the document posting always posts exactly the values

provided in the posting, regardless of whether those values are in local currency or group currency.

However, if there's no amount provided for the not leading currency, then the amount from the leading

currency is copied over, but only if the local currency and the group currency are the same. If the

option Group Currency is Leading Currency is selected, then the group currency is the leading currency.

If not, then the local currency is the leading currency.

Note

If you're working in a year before the From Year for Group Reporting Preparation Ledger and you've

selected the Transfer from Universal Journal option for the consolidation unit, then the Source for Group

Currency Key Figure becomes mandatory when you select Group Currency is Leading Currency. If you

don’t select Group Currency is Leading Currency, the Source for Local Currency Key Figure becomes

mandatory, and data is collected in local currency.

Source for Group Currency Key Figure and Source for Local Currency Key Figure specify the key figure in

the universal journal that the system imports for the selected consolidation unit. The amounts taken

over from that key figure are then processed as group or local currency during consolidation. The

system checks if the respective source field for the consolidation unit provides the correct currency for

the local and group currency. You cannot save your selection if this is not the case. Setting the source

for group and local currency key figure for a consolidation unit is only relevant if you want to transfer

from the universal journal. For planning versions, the system always takes fields HSL (Amount in

Company Code Currency) or KSL (Amount in Global Currency) from the planning database table as

long as one of these fields has a currency that matches the local currency of the consolidation unit (for

field HSL). Therefore the two source fields are inactive where the selected consolidation version is a

plan version.

Source fields that are already defined and that are relevant for other consolidation versions that are not

plan versions but share the same consolidation unit attribute version with the plan version are not

affected.

Displaying Consolidation Units

Using the filter criteria, you can display consolidation units and their settings, such as local currency, upload

method, or currency translation method.

Note

You have to select exactly one consolidation version and fiscal year and period. This is required to display

the time- and version-dependent consolidation unit attribute values in the table below the filter bar. Filter

values for consolidation version and fiscal year and period are taken from your global parameter settings

but can be changed at any time.

In the list, you can sort or filter the consolidation units using any of the available criteria. You can also drill down

to the details of each consolidation unit to display more information. Here you can also change the context for

the time and version and display attribute value assignments over time or across versions.

Group Reporting (FIN-CS)

Group Reporting PUBLIC 21

Deleting Consolidation Units

You can delete one or more consolidation units. You must select at least one consolidation unit to activate the

Delete button. If you delete a consolidation unit, it is deleted across all versions, not only in the selected

version.

A where-used check is run when you delete a consolidation unit. A consolidation unit can only be deleted if it is

not used. If you have selected more than one consolidation unit, the consolidation units that are not used

anywhere are deleted. If some of the selected consolidation units are still used, these consolidation units are

not deleted. If a consolidation unit is not deleted, because it is still used, you can use the where-used feature to

get information on the usage. Some usages, such as the assignment of a consolidation unit to a consolidation

group can be deleted, other usages, such as existing transaction data, can't be deleted. If you have deleted all

usages, you can delete the consolidation unit.

To check if a consolidation unit is used, select one consolidation unit and choose Check Where Used.

Information for Key Users

The SAP Fiori apps reference library has details about the content necessary for giving users access to an app

on the SAP Fiori launchpad. To see this app’s Fiori content, go to the SAP Fiori apps reference library and

search for the app. Then select the product. On the Implementation Information tab, select the correct release.

The details are in the Configuration section.

Supported Device Types

• Desktop

• Tablet

• Smartphone

1.2.2.1.1.1.2 Consolidation Units - Create and Change

You can maintain or create consolidation unit (CU) master data individually. If you want to change the hierarchy

of the consolidation units, use the Manage Global Hierarchies app.

To create a consolidation unit, choose More Consolidation Unit Create . Enter the name of the

consolidation unit and confirm.

The following settings should be made for each consolidation unit:

• Tax Rate

• Local Currency

• Translation Method: You can maintain or create consolidation unit (CU) master data individually. If you:

Required if the local currency is different from the group currency. The translation method determines the

Group Reporting (FIN-CS)

22 PUBLIC Group Reporting

exchange rate used for specific financial statement (FS) items, and how translation and rounding

differences are posted.

You can choose from the following SAP Best Practices predelivered currency translation (CT) methods:

• S0902 (Translation-FC@First Period - Periodic): You can assign this method to CUs that are newly

integrated into the group starting from the first period of the fiscal year. For the FS items in the P&L

statement and the movements-related FS items in the balance sheet, S0902 translates periodic values

at the exchange rates for their respective periods.

• S0903 (Standard Translation - Periodic): It translates values for all FS items at the monthly average

exchange rate for each period.

• S0904 (Translation-FC@Incoming Unit): It translates incoming units at a specific rate (exchange rate

indicator J) maintained for incoming unit. This offers more flexibility to incoming units.

• S0905 (Standard Translation Activity-Based C/I): You assign this method if you are using the task for

automatic consolidation of investments in the consolidation monitor. The translation method uses the

No Retranslation of Existing Group Currency Value translation key for investment and equity, to fix their

group currency values to the historical rate. This means that in data collection of reported financial

data for investment and equity, you must maintain the amounts in both local and group currency.

• Y0901 (Standard Translation - YTD): Same as S0903, except that for the FS items in the P&L

statement and the movements-related FS items in the balance sheet, S0903 translates periodic values

at the exchange rates for their respective periods while Y0901 translates cumulative values at the

monthly average exchange rate of the current period.

• Y0902 (S4 Accounting GC): It can be assigned to CUs that set Read from Universal Document as the

data transfer method and therefore read financial data from universal documents.

The main differences between these CT methods are the Exchange Rate Indicator (ERI) and the Translation

Key (CT Key) that are assigned to the FS item selections. ERI determines the exchange rate to be used in

the currency translation, either monthly average rate (AVG) or monthly closing rate (CLO). CT key controls

whether cumulative values are translated at the rate for current period (YTD) or periodic values are

translated at the rates for their respective periods (PER). The table below displays the detailed settings for

each method.

Descrip P&L, B/S Move Opening Balances in B/S FS Items - In Investments and

Method tion ments B/S* coming Units Equity in B/S*

ERI CT Key ERI CT Key ERI CT Key ERI CT Key

S0902 Transla AVG PER AVG PER CLO PER AVG PER

tion-

FC@First

Period -

Periodic

S0903 Standard AVG PER AVG PER AVG PER AVG PER

Transla

tion - Peri

odic

Group Reporting (FIN-CS)

Group Reporting PUBLIC 23

Descrip P&L, B/S Move Opening Balances in B/S FS Items - In Investments and

Method tion ments B/S* coming Units Equity in B/S*

S0904 Transla AVG PER AVG PER INC2 PER AVG PER

tion-

FC@In

coming

Unit

S0905 Standard AVG PER AVG PER AVG PER Existing group cur

Transla rency values are not

tion Activ retranslated.

ity-Based

COI

Y0901 Standard AVG YTD AVG PER AVG PER AVG PER

Transla

tion - YTD

Y0902 S4 Ac Existing group currency values are not retranslated.

counting

GC

*Since the opening balance is stored on period 000, the amount in the group currency is kept at its original

value.

When an FS item is not included in any rule, the reference exchange rate defined in the methods will apply.

When the translation results in rounding differences, these differences are posted in the group currency on

the following FS item:

• 900: B/S rounding difference is posted on FS item 314800

• 901: Annual net income - B/S, P&L rounding difference is posted on FS item 799000

• 902: P&L rounding difference is posted on FS item 604000

• Data Transfer Method: Specifies how the local reported financial data is collected from CUs for

consolidation.

• Method Read from Universal Document is only applicable for CUs whose reported financial data resides

in the S/4HANA system. If you select this method, and if the consolidation version is not linked to a

source category and source ledger in the version settings, the effective year should also be specified

(this setting is not required if data is sourced from ACDOCP).

• If you select the Flexible Upload method for a certain CU, you can also specify the Upload Method.

Note

You can choose from the 2 pre-delivered upload methods SRD1 and SRD2.

• In the Methods tab, you can view what validation methods have been assigned to your consolidation units.

If no validation method has been assigned for reported or standardized data yet, choose the Assign

Validation Methods button to go to the respective app.

• Source for Group Currency Key Figure : You can specify the source for group currency key figure by

choosing Goto Fiscal Year Variant Source for Group Currency Key Figure . Note that setting the

source for group currency key figure for a consolidation unit is only relevant if you want to use the data

transfer method Read from Universal Document, and you want to integrate one of the accounting key

figures into the group currency of group reporting. SAP recommends that you use the global currency key

Group Reporting (FIN-CS)

24 PUBLIC Group Reporting

figure in accounting for all company codes to carry the group currency value that you want to integrate into

group reporting. Also note that the source for local currency key figure and source for group currency key

figure settings are only applicable to regular versions that are not marked as Version for Plan Data. For

planning versions, the system always takes fields HSL (Amount in Company Code Currency) or KSL

(Amount in Global Currency) from the planning database table as long as one of these fields has a currency

that matches the local currency of the consolidation unit (for field HSL) or the ledger group currency (for

field KSL). This means, the ledger currency setting in the Define Consolidation Ledgers configuration step

is considered.

To display a list of the consolidation units, go to More Consolidation unit Print .

More Information

• The SAP Fiori apps reference library has details about the content necessary for giving users access to an

app on the SAP Fiori launchpad. The SAP Fiori apps reference library is available here: https://

fioriappslibrary.hana.ondemand.com

To see this app’s Fiori content, search for the app. Then select SAP S/4HANA as the product. On the

Implementation Information tab, select the correct release. The details are in the Configuration section.

1.2.2.1.1.2 Consolidation Unit Selection Attributes

Consolidation unit selection attributes classify consolidation units so that they can be selected and processed

together for various activities in group reporting. Learn more about how consolidation unit selection attributes

work, how to assign them to consolidation units, and how to use them.

Overview

A consolidation unit selection attribute is a classification you use to classify consolidation units. You do this by

assigning values for the selection attribute to individual consolidation units. After assigning attribute values to

consolidation units, all consolidation units that share the same attribute value can be selected together so that

they can be treated in the same way for certain activities, such as consolidation tasks.

SAP delivers the following consolidation unit selection attributes:

• Data Collection Selection

• Partner Selection

• Posting Rule Selection

• Validation Selection

For example, you can use the Posting Rule Selection attribute to select consolidation units for use as a trigger in

reclassifications. Or you can use the Data Collection Selection attribute to select consolidation units for

package definitions in SAP Group Reporting Data Collection.

Group Reporting (FIN-CS)

Group Reporting PUBLIC 25

Creating Attribute Values

To add attribute values for the predelivered consolidation unit selection attributes, use the Define Consolidation

Unit Attribute Values configuration activity. For more information, see the help documentation for the

configuration activity.

Assigning Attributes to Consolidation Units

You can assign values for consolidation unit attributes to consolidation units by using the Define Consolidation

Units [page 15] app or alternatively by using the Import Consolidation Master Data [page 90] app. When

you’re defining a consolidation unit, you assign attribute values to the consolidation unit in the Time- and

Version-Dependent Attributes section.

Using Consolidation Unit Attributes in Selections

When defining a selection using the Define Selections [page 84] app, you can choose Consolidation Unit for

the Field. Then, under Time- and Version-Dependent Attribute, you can select the available consolidation unit

selection attributes. The value helps provide you with the relevant selection attributes to define your selection

expressions.

You can then select a selection attribute to restrict your selection to a group of consolidation units that share

the same attribute value.

After you’ve defined selections using the consolidation unit selection attributes, you can use the selections in

the settings of various activities, such as in reclassifications. The selections then identify which consolidation

units to use in these actions. For more information, see Selections [page 83].

Related Information

Import Consolidation Master Data [page 90]

Define Consolidation Units [page 15]

Define Selections [page 84]

Selections [page 83]

Group Reporting (FIN-CS)

26 PUBLIC Group Reporting

1.2.2.1.1.3 Consolidation Unit Extensibility

You can create your own consolidation unit attributes for the new reporting logic. They can then be used in

selections, totals validation rules, and analytics.

Prerequisites

You need authorizations for extensibility to create your own consolidation unit attributes.

Creating Custom Fields

To create your own consolidation unit attributes, you must first define new custom fields for consolidation unit

master data in the Custom Fields app.

There are two types of consolidation unit attributes that you can define: attributes that are time- and version-

independent and attributes that are time- and version-dependent. Depending on which of these two types you

want, you select a specific Business Context from the following options:

• For time- and version-independent attributes, select Consolidation Unit for the business context.

• For time- and version-dependent attributes, select Consolidation Unit by Time and Version for the business

context.

Enable Usage for the Import Consolidation Master Data App

To be able to display and filter your custom consolidation unit attributes on the Import Consolidation Units

screen of the Import Consolidation Master Data [page 90] app, you must first enable this usage in the UIs and

Reports tab. To do so, navigate to the UIs and Reports tab and select Enable Usage for Consolidation Master

Data.

Publish

Be sure to Publish your custom fields once you finish defining them. If you don't publish the fields, they won't

be visible anywhere for users.

Using Consolidation Unit as the Business Object

You can select Consolidation Unit as the Business Object for a custom field of type Association to Business

Object. If you do this, then the existing consolidation units in your system appear as values that can be selected

for the field.

In this way, you can use the custom field to refer to a consolidation unit in the master data of another

consolidation unit. There's also no need to update the custom field with more values as you create more

consolidation units because your new consolidation units will appear automatically in the value help once you

create them.

Example

For example, a custom field with Consolidation Unit

Group Reporting (FIN-CS)

Group Reporting PUBLIC 27

In this case, there may be a "root" consolidation unit that the other "associated" consolidation units refer

to. To model this relationship between a "root" consolidation unit and "associated" consolidation units, you

can create a custom field with the business object as the business object is useful when the data of a

company is divided into several consolidation units. Consolidation Unit. Then, in the master data of the

"associated" consolidation units, you can use the custom field to select the "root" consolidation unit.

The "associated" consolidation units are then all grouped together because of their reference to the "root"

consolidation unit.

Maintenance

After you’ve defined custom fields, you can maintain consolidation unit attribute value assignments for your

custom attributes with the Define Consolidation Units [page 15] app and the Import Consolidation Master Data

[page 90] app.

Define Consolidation Units

In the Define Consolidation Units [page 15] as app, you can add your custom fields to the UI on the

Consolidation Unit Details screen, which you can access by selecting an entry in the table. With these fields on

the UI, you can then assign your attribute values to consolidation units. You can add these fields with the Adapt

UI option in the user actions menu.

Note

You must have extensibility authorizations to adapt the UI and add custom fields. All UI adjustments made

with the Adapt UI option are visible to every user of the app.

On the main screen of the Define Consolidation Units [page 15] app, you can add filters for your custom

consolidation unit attributes with Adapt Filters. Also, you can add columns to the table of consolidation units in

the table’s Settings. By doing so, you can filter for consolidation units that have certain attribute values

assigned for your custom consolidation attributes and see these attribute value assignments in the table.

Anyone can adjust the filters and columns on the main screen of the Define Consolidation Units [page 15] app

for their individual use. However, only a user with special authorizations can adjust the filters and columns and

then save the result centrally as a public view. The adjustments then appear for all users who select such a

public view.

Import Consolidation Master Data

In the Import Consolidation Master Data [page 90] app, you can maintain the assignments of your custom

consolidation unit attribute values in spreadsheets. When you download a template for consolidation units with

or without existing master data, your custom fields for the custom consolidation unit attributes appear as

columns. You can then maintain the value assignments for the custom consolidation unit attributes in these

columns for each consolidation unit.

Note

For custom defined consolidation unit attributes, the field types Code List and Checkbox automatically have

a value help in the spreadsheet. You can pick values from the value help or directly enter them into cells.

However, if you enter values that aren’t included in the value help, you'll receive check errors later, and the

respective data records can't be imported.

Group Reporting (FIN-CS)

28 PUBLIC Group Reporting

You can add filters for your custom consolidation unit attributes on the Import Consolidation Units screen with

Adapt Filters. Also, you can add columns to the table of consolidation units in the table’s Settings. By doing this,

you can filter uploaded master data for consolidation units that have certain attribute values assigned for your

custom consolidation attributes and see these attribute value assignments in the table.

Note

To display and filter your custom consolidation unit attributes, make sure you've already enabled the usage

of Consolidation Master Data in the UIs and Reports tab when you defined the custom field.

Anyone can adjust the filters and columns on the Import Consolidation Units screen of the Import

Consolidation Master Data [page 90] app for their individual use. However, only a user with special

authorizations can adjust the filters and columns and then save the result centrally as a public view. The

adjustments then appear for all users who select such a public view.

Use

After assigning the attribute values to consolidation units, you can use your custom consolidation unit

attributes in the following ways:

• In selections with the Define Selections [page 84] app

• In totals validation rules with the Define Validation Rules [page 99] app

• In Analytics for Group Reporting [page 507], such as in the Group Data Analysis [page 522] app

Note

Only custom consolidation unit attributes that are time- and version-independent can be used in

analytics.

Related Information

Custom Field Extensibility [page 559]

1.2.2.1.2 Consolidation Groups

A consolidation group is a user-defined group of consolidation units created for consolidation.

In the consolidation group maintenance apps, you can do the following:

• Create a new group.

• Specify master records for a group, such as name, country/region, and validation method assignment.

• Assign consolidation units to a group and specify a consolidation unit as the parent unit for this group.

Note that a given consolidation unit can belong to different consolidation groups.

Group Reporting (FIN-CS)

Group Reporting PUBLIC 29

• For the unit/group assignment, define group-dependent attributes, such as consolidation method,

acquisition date, and divestiture date.

Note

With the introduction of a new architecture/reporting logic, if you are working with the SAP S/4HANA 1909

release or a later release, consolidation groups should be maintained as flat lists of consolidation units by

using the Manage Group Structure - Group View [page 32] or Manage Group Structure - Unit View [page

35] app.

If working with a release earlier than 1909, you should continue using the Consolidation Group Hierarchy -

Display and Change [page 38] and Accounting Method Assignment - Display and Change [page 40] for

consolidation group maintenance, where consolidation groups can still be arranged in multiple hierarchies.

You can create an incident with the FIN-CS-COR component to activate the new reporting logic when

working with a release earlier than 1909.

1.2.2.1.2.1 Consolidation Groups - Create and Change

With this app, you can maintain or create consolidation group (CG) master data individually.

When you open the app, you can create a new consolidation group. To change a CG, choose More

Consolidation Group Change . Enter the name of the consolidation group and confirm.

Enter the name for the consolidation group you want to create and confirm.

The following settings should be made for each consolidation group:

• Description: Enter a short and medium text to describe the consolidation group.

• Consolidation Frequency

• Validation Methods: When you assign validation methods, you are redirected to the Assign Validation

Methods [page 109] app.

• If the new reporting logic is active, the fiscal year variant (FYV) is assigned in the Define Versions

transaction.

If the old reporting logic is active, you can access the menu by selecting More Go to Fiscal Year

Variant (FYV) to assign the consolidation group's fiscal year variant, which determines the fiscal year and

period based on the posting date.

Note

You can only assign a FYV to the consolidation group in a fiscal year prior to the from year of the new

reporting logic. In fiscal years where the new reporting logic is active, the FYV is assigned to the

consolidation version and not to the consolidation group. Therefore, the navigation to the assignment

of FYV to the consolidation group is not active as of the from year of the new reporting logic.

Note

When transferring accounting financial data, on group reporting side, the system derives the posting

period based on the accounting posting date and the period definition of the assigned FYV. Note that

Group Reporting (FIN-CS)

30 PUBLIC Group Reporting

the special periods defined for FYVs are not considered in group reporting, that is, only the posting date

is used to derive the posting period.

• If the old reporting logic is active, you should also select a Ledger: The group currency is determined by the

currency of the ledger assigned to the group. To define a ledger, see Define Consolidation Ledgers in the

Customizing for SAP S/4HANA for Group Reporting under Master Data. When multiple group currencies

are required for consolidation groups, the corresponding ledgers must be assigned to the consolidation

groups in different versions.

To display a list of the consolidation groups, go to More Consolidation group Print .

Supported Device Types

• Desktop

• Tablet

• Smartphone

1.2.2.1.3 Consolidation Group Structure

In the consolidation group structure, consolidation units are assigned to consolidation groups. Also,

consolidation group-specific settings for the consolidation units are maintained, such as the fiscal year and

period of first consolidation as well as consolidation method.

Depending on your system settings, there’s a slightly different concept behind the consolidation group

structure. Because of this, different apps are used to maintain the consolidation group structure.

As of the From Year for New Group Reporting Logic, the group structure manager is used to maintain the

consolidation group structure as a flat list of consolidation units assigned to a consolidation group.

If you’re working in a system where the old reporting logic is active (either exclusively or before the From Year

for New Group Reporting Logic), the consolidation group structure is maintained as hierarchies of consolidation

units and consolidation groups. These may be multi-level hierarchies. They are maintained using the

Consolidation Group Hierarchy - Display and Change [page 38] app and the Accounting Method Assignment -

Display and Change [page 40] app.

1.2.2.1.3.1 Group Structure Manager

With the group structure manager, you create and maintain consolidation group structures as of the From Year

for New Group Reporting Logic.

With the group structure manager, the consolidation group structure is maintained as a flat list of consolidation

units assigned to a consolidation group. Also, consolidation group-specific settings are maintained for the

assigned consolidation units. You can define such a consolidation group structure for any consolidation group.

The group structure manager consists of two apps:

Group Reporting (FIN-CS)

Group Reporting PUBLIC 31

• Manage Group Structure - Group View [page 32]

• Manage Group Structure - Unit View [page 35]

The same actions can be done in both apps, but they have a different point of view on the consolidation group

structures. In the Manage Group Structure - Group View [page 32] app, the focus is on the consolidation

group, the list of assigned consolidation units, and the maintenance of consolidation group-specific settings of

the consolidation units. The focus of the Manage Group Structure - Unit View [page 35] app is rather on the

consolidation unit and the assignment of the consolidation unit to different consolidation groups. However, the