Professional Documents

Culture Documents

Eastman Kodak Company (KODK) - 5 Price Charts 201

Eastman Kodak Company (KODK) - 5 Price Charts 201

Uploaded by

Rabia FazalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eastman Kodak Company (KODK) - 5 Price Charts 201

Eastman Kodak Company (KODK) - 5 Price Charts 201

Uploaded by

Rabia FazalCopyright:

Available Formats

Menu

Search US Stock Reports

Search Symbol/Company:

Search

(eg: AAPL [or] Apple)

Eastman Kodak

Company (KODK) - 5

Stock Price Charts 2013-

2023 (History)

Netcials

!

Follow Page 659 followers

Netcials All KODK Reports ➤

More Stocks ➤

Want to observe and analyze Eastman Kodak

Company (KODK) stock price graphs for

various time ranges in history? This report will

help you.

ADVERTISEMENT

Looking for a freight rate?

With Quick Quotes, your inland

or ocean freight quote is ready

in an instant.

You will find 5 useful sections in this report.

Below is a table of contents to help you

navigate quickly.

1. Eastman Kodak Company (KODK) 10

Years Stock Chart History

2. KODK Stock Chart 5 Years (Recent

History)

3. Eastman Kodak Company (KODK) Stock

3-Year Chart

4. KODK Stock 1-Year Chart

5. KODK Stock 6 Months Chart

Note: Timeframe of analysis of this report is

between 2013-09-23 and 2023-04-18.

1 KODK 10 Years Stock

Chart History

Note: Long term investors give importance to

long term charts (typically covering decades).

The 10-year timeframe is a popular range of

analysis used by value investors.

Now let us see a 10-year stock chart of KODK.

The range of the graph is between 2013-04-20

and 2023-04-18.

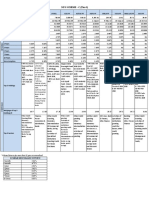

The above chart is plotted using avg. annual

prices of Eastman Kodak Company (KODK).

Below table contains annual avg. prices of

Eastman Kodak Company (KODK) used to plot

the above visual. First two columns contain the

years and the corresponding avg. stock prices.

The third and fourth columns will help you

grasp how the highest and lowest yearly prices

moved over time.

Year Price ($) Highest Lowest

(And Daily Price Daily Price

Change ($) ($)

From Past (And (And

Year %) Change Change

From Past From Past

Year %) Year %)

2013 26.60 34.71 19.4

2014 25.49 34.5 17.8

(-4.17%) (-0.61%) (-8.25%)

2015 16.64 22.07 10.85

(-34.72%) (-36.03%) (-39.04%)

2016 13.49 17.22 8.07

(-18.93%) (-21.98%) (-25.62%)

2017 9.13 16.3 3.1

(-32.32%) (-5.34%) (-61.59%)

2018 4.44 11.55 2.3

(-51.37%) (-29.14%) (-25.81%)

2019 2.69 4.65 2 (-13.04%)

(-39.41%) (-59.74%)

2020 5.40 33.2 1.55

(100.74%) (613.98%) (-22.5%)

2021 7.62 12.08 4.6

(41.11%) (-63.61%) (196.77%)

2022 4.96 7.01 2.87

(-34.91%) (-41.97%) (-37.61%)

2023 3.65 4.25 3.11

(-26.41%) (-39.37%) (8.36%)

ADVERTISEMENT

Looking for a freight rate?

With Quick Quotes, your inland or

ocean freight quote is ready in an

instant.

2 Eastman Kodak

Company (KODK) Stock

Chart 5 Years (Recent

History)

Note: Generally, an investing duration of

around 5 years can be considered medium-

term. Such investors would be naturally

interested in knowing the performance data of

a stock for the past 5 years. This data along

with many other metrics will help them

analyze the returns for the next 5 years.

Now let us check the historical 5-year price

chart of Eastman Kodak Company (KODK).

The below graph is plotted using avg. monthly

prices.

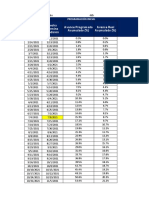

Below table contains 3rd, 6th, 9th and 12th-

month price data of KODK for every year within

5 years ending at 2023-04-18. The table data

will help you track price movements of Eastman

Kodak Company (KODK) for 5 years.

In the below table, while the second column

contains monthly avg. prices, the last two

columns provide additional insights. The third

column contains the highest daily close for the

corresponding month, while the last column

displays the lowest daily close.

Month- Price Highest Daily Lowest Daily

Year ($) Price ($) Price ($)

4-2018 4.94 5.1 4.85

7-2018 3.68 4 3.15

10- 2.60 2.99 2.3

2018

1-2019 2.87 3.25 2.5

4-2019 2.65 3.12 2.35

7-2019 2.45 2.61 2.38

10- 2.56 2.7 2.4

2019

1-2020 3.61 4.03 3.21

4-2020 2.04 2.45 1.6

7-2020 6.00 33.2 2.02

10- 8.68 10.01 6.92

2020

1-2021 8.91 12.08 7.99

4-2021 7.63 8.34 7.11

7-2021 7.59 8.32 7.06

10- 6.89 7.41 6.5

2021

1-2022 4.28 4.89 3.64

4-2022 6.00 6.88 5.17

7-2022 5.11 5.74 4.64

10- 4.98 5.54 4.48

2022

1-2023 3.43 3.67 3.11

4-2023 3.86 4.25 3.62

An Observation:

The price change of $3.55 between Jun-2020

and Jul-2020 was the largest among the

analyzed monthly avg. values.

3 KODK Stock 3-Year

Chart

Now let us see the 3-year historical chart of

KODK. This chart will help both short and

medium-term investors in their analysis.

Note: Though there is no universal standard,

an investment duration of fewer than 3 years

can be considered short-term. And any

investment period over 3 years but within

around 10 years can be considered medium-

term. Hence, a 3-year chart should help both.

4 KODK Stock 1-Year

Chart

Most recent performances get captured in

short-term charts. Now let us see the 1-year

price chart of Eastman Kodak Company

(KODK). The duration of the plot is between

2022-04-18 and 2023-04-18.

Note: Unlike previous sections, in the below

graph we will be using weekly avg. prices

instead of the monthly or yearly averages.

The reason is simple. For a duration as short

as 1-year, weekly prices can give a balanced

view of the price movements. The prices will

neither look too volatile (lots of ups and

downs) nor too smooth.

The first two columns of the below table contain

data used to build the above visual. The last

couple of columns will help you track the trend

of highest and lowest weekly prices of Eastman

Kodak Company (KODK) in the 1-year time

frame.

Week- Price ($) Highest Lowest

Year (And Daily Price Daily Price

Change ($) ($)

From Past (And (And

Week %) Change Change

From Past From Past

Week %) Week %)

16- 5.87 6.18 5.52

2022

17- 5.31 5.56 5.17

2022 (-9.54%) (-10.03%) (-6.34%)

18- 5.55 5.81 (4.5%) 5.35

2022 (4.52%) (3.48%)

19- 4.36 4.93 3.86

2022 (-21.44%) (-15.15%) (-27.85%)

20- 4.46 4.62 4.34

2022 (2.29%) (-6.29%) (12.44%)

21- 4.33 4.6 4.15

2022 (-2.91%) (-0.43%) (-4.38%)

22- 4.64 4.75 4.47

2022 (7.16%) (3.26%) (7.71%)

23- 4.85 5 (5.26%) 4.7 (5.15%)

2022 (4.53%)

24- 5.07 5.36 (7.2%) 4.49

2022 (4.54%) (-4.47%)

25- 5.47 5.67 5.3

2022 (7.89%) (5.78%) (18.04%)

26- 4.88 5.32 4.64

2022 (-10.79%) (-6.17%) (-12.45%)

27- 4.84 4.96 4.72

2022 (-0.82%) (-6.77%) (1.72%)

28- 4.92 5.01 4.78

2022 (1.65%) (1.01%) (1.27%)

29- 5.39 5.74 4.99

2022 (9.55%) (14.57%) (4.39%)

30- 5.33 5.51 5.16

2022 (-1.11%) (-4.01%) (3.41%)

31- 5.87 6.12 5.56

2022 (10.13%) (11.07%) (7.75%)

32- 6.39 6.82 6 (7.91%)

2022 (8.86%) (11.44%)

33- 6.73 6.98 6.21 (3.5%)

2022 (5.32%) (2.35%)

34- 5.77 5.92 5.59

2022 (-14.26%) (-15.19%) (-9.98%)

35- 5.44 5.7 5.27

2022 (-5.72%) (-3.72%) (-5.72%)

36- 5.26 5.43 5.09

2022 (-3.31%) (-4.74%) (-3.42%)

37- 5.34 5.57 5.22

2022 (1.52%) (2.58%) (2.55%)

38- 4.99 5.18 (-7%) 4.84

2022 (-6.55%) (-7.28%)

39- 4.71 4.87 4.59

2022 (-5.61%) (-5.98%) (-5.17%)

40- 4.87 (3.4%) 5.08 4.65

2022 (4.31%) (1.31%)

41- 4.55 4.71 4.48

2022 (-6.57%) (-7.28%) (-3.66%)

42- 5.02 5.29 4.68

2022 (10.33%) (12.31%) (4.46%)

43- 5.41 5.54 5.16

2022 (7.77%) (4.73%) (10.26%)

44- 5.49 5.71 5.35

2022 (1.48%) (3.07%) (3.68%)

45- 4.92 5.73 4.35

2022 (-10.38%) (0.35%) (-18.69%)

46- 4.61 4.78 4.51

2022 (-6.3%) (-16.58%) (3.68%)

47- 4.34 4.36 4.33

2022 (-5.86%) (-8.79%) (-3.99%)

48- 4.18 4.23 4.13

2022 (-3.69%) (-2.98%) (-4.62%)

49- 3.93 4.05 3.84

2022 (-5.98%) (-4.26%) (-7.02%)

50- 3.42 3.72 3.12

2022 (-12.98%) (-8.15%) (-18.75%)

51- 3.11 3.16 3.08

2022 (-9.06%) (-15.05%) (-1.28%)

52- 2.98 3.05 2.87

2022 (-4.18%) (-3.48%) (-6.82%)

1- 3.23 3.29 3.11

2023 (8.39%) (7.87%) (8.36%)

2- 3.49 3.62 3.35

2023 (8.05%) (10.03%) (7.72%)

3- 3.47 3.67 3.29

2023 (-0.57%) (1.38%) (-1.79%)

An Observation:

The biggest shift of weekly prices was $0.54

between Week 30-2022 and Week 31-2022.

5 Eastman Kodak

Company (KODK) Stock 6

Months Chart

Now we have entered the final section of this

report. We are going to see a 6-month historical

graph of KODK.

Generally investing for a duration as low as 6

months is not recommended for value

investors. However, a chart of 6 months can

help one keep track of price movements and

analyze the corresponding factors.

Conclusion:

Pictures speak better than words. Hopefully, the

bunch of Eastman Kodak Company (KODK)

historical charts you just witnessed will help you

analyze deep before and during investing.

Everyone would want the investments to grow

over time. Especially, long-term investors would

expect a multi-fold growth. If you are such an

investor, you have to have a look at historical

growth analysis of KODK.

Disclaimer:

We have validated the data to the best of our

knowledge. If you find data inaccuracies kindly

let us know using the contact form so that we

can act promptly.

Want to become a smart investor?

Are you planning to invest in stocks,

mutual funds, ETFs, index funds,

commodities, etc?

Netcials reports section helps you with deep

insights into the performance of various assets

over the years. We are constantly upgrading and

updating our reports section. Feel free to access

them. Do not forget to leave your feedback.

Visit Reports Section, Now

Stock | Financial

All Eastman Kodak Company (KODK)

Reports:

Stocks:

History: 10 Years, 5 Years, Charts

Recent: Month, 6 Months, Year,

Last Year

Peaks/Troughs: Highest, Lowest,

52 Weeks

Performance: Rise, Trend, Returns,

Growth, 1000$ in 10 Years

Others: Volatility, Volume

Financials:

Profits: Gross, Net, Operating

Profit Margin: Gross, Net

Ratios: Current, Debt-to-Equity

Value: Market Cap, Net Worth

Revenue: History, Recent Year, Growth

Cash Flow: History, Recent Year

Assets: Total & Current, Goodwill, PPE

Liabilities: Total & Current,

Long Term Debt

Others: Shares Outstanding

Chart History Reports of Similar Stocks:

Ticker Stock/Company Name

ETO Eaton Vance Tax Advantage Global

Dividend Opp

IBP Installed Building Products Inc

NJV Nuveen New Jersey Municipal Value

Fund

ZBH Zimmer Biomet Holdings Inc

MQT Blackrock MuniYield Quality Fund II

Inc

Find Other Stocks >>

About Us Privacy Policy Disclaimer

Terms and Conditions of Use Contact Us

Copyright © 2023 Netcials. All Rights Reserved.

All the information on this website is published in good faith

and for general information purpose only. www.netcials.com

does not make any warranties about the completeness,

reliability and accuracy of this information.

You might also like

- Micro Economy Today 14th Edition Schiller Solutions ManualDocument14 pagesMicro Economy Today 14th Edition Schiller Solutions Manualdrusillalionelmzqw9100% (31)

- Following the Trend: Diversified Managed Futures TradingFrom EverandFollowing the Trend: Diversified Managed Futures TradingRating: 3.5 out of 5 stars3.5/5 (2)

- Problems Sub-IfDocument11 pagesProblems Sub-IfChintakunta PreethiNo ratings yet

- Msci World Index Usd PriceDocument3 pagesMsci World Index Usd PriceMario FighetosteNo ratings yet

- Ek VLDocument1 pageEk VLJohn Aldridge ChewNo ratings yet

- Coca ColaDocument13 pagesCoca Colaramonese100% (2)

- UPS Vs FedEx - FinalDocument15 pagesUPS Vs FedEx - Finaltharrah1100% (1)

- Chapter 5Document14 pagesChapter 5RB100% (3)

- Cla 2Document22 pagesCla 2Ranjan KoiralaNo ratings yet

- Take-Home Assignment - MBA 1133 Statistics For BusinessDocument4 pagesTake-Home Assignment - MBA 1133 Statistics For BusinessIsuru KasthurirathneNo ratings yet

- Scheme G 1 September 2019Document1 pageScheme G 1 September 2019deesingNo ratings yet

- Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedsatishNo ratings yet

- Assignment 3 Corporate FinanceDocument32 pagesAssignment 3 Corporate Financebao.pham04No ratings yet

- Motaal Analysis TheoryDocument5 pagesMotaal Analysis TheoryKrishnamohan VaddadiNo ratings yet

- Real Sector 242Document61 pagesReal Sector 242Mai SharafNo ratings yet

- Chapter Three: Capital Marker Analysis of BangladeshDocument31 pagesChapter Three: Capital Marker Analysis of BangladeshGolam Samdanee TaneemNo ratings yet

- Demand ForecastingDocument18 pagesDemand ForecastingAtul GuptaNo ratings yet

- Extraordinary When One Looks at The Performance of The Broader Universe" As Well As WhenDocument9 pagesExtraordinary When One Looks at The Performance of The Broader Universe" As Well As Whenravi_405No ratings yet

- WACC TemplateDocument13 pagesWACC TemplateAsad AminNo ratings yet

- SCHEME - G (Tier-I) - 0Document1 pageSCHEME - G (Tier-I) - 0krishnaNo ratings yet

- PA2 - Wk6Document13 pagesPA2 - Wk6Ranjan KoiralaNo ratings yet

- Data Col PDFDocument2 pagesData Col PDFNelson ArturoNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- Group 13 - ME Group Assignment 2Document8 pagesGroup 13 - ME Group Assignment 2deepak krishnanNo ratings yet

- Indicator Unit: Dataset: Trade in Value Added (Tiva) 2021 Ed: Principal IndicatorsDocument4 pagesIndicator Unit: Dataset: Trade in Value Added (Tiva) 2021 Ed: Principal IndicatorsThảo NguyệtNo ratings yet

- GlaxoSmithKline FinancialsDocument28 pagesGlaxoSmithKline FinancialsChayanNo ratings yet

- 10 Q 2 LetterDocument3 pages10 Q 2 LetterfstreetNo ratings yet

- CPG Financial Model and Valuation v2Document10 pagesCPG Financial Model and Valuation v2Mohammed YASEENNo ratings yet

- EIA - Price of Liquefied U.S. Natural Gas Exports (Dollars Per Thousand Cubic Feet)Document2 pagesEIA - Price of Liquefied U.S. Natural Gas Exports (Dollars Per Thousand Cubic Feet)RaulNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Seven Months Data of 2022.23 3Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Seven Months Data of 2022.23 3shyam karkiNo ratings yet

- Motaal's Comprehensive Test of LiquidityDocument3 pagesMotaal's Comprehensive Test of LiquiditySarvanRajNo ratings yet

- Comparación de ProgramacionesDocument159 pagesComparación de ProgramacionesDario Cerda ArNo ratings yet

- United Engineers - CIMBDocument7 pagesUnited Engineers - CIMBTheng RogerNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Simple and Compound InterestDocument4 pagesSimple and Compound InterestJosé Pedro MesquitaNo ratings yet

- MonmouthDocument16 pagesMonmouthjamn1979100% (1)

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4shyam karkiNo ratings yet

- Tarea 4 - Riesgo y Rendimiento Parte 1Document30 pagesTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriarteNo ratings yet

- October 2022 Monthly Gold CompassDocument84 pagesOctober 2022 Monthly Gold CompassburritolnxNo ratings yet

- Unit+3+Changing+Populations+Assignment+ +2c+Cgc1d1+ +Canada+Population+PyramidDocument4 pagesUnit+3+Changing+Populations+Assignment+ +2c+Cgc1d1+ +Canada+Population+PyramidAfnansstuffNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eight Months Data of 2022.23Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eight Months Data of 2022.23acharya.arpan08No ratings yet

- Investment Performance Nov 30 2022 On 01062023Document3 pagesInvestment Performance Nov 30 2022 On 01062023Jaya GunehaNo ratings yet

- Chapter Three: Capital Marker Analysis of BangladeshDocument29 pagesChapter Three: Capital Marker Analysis of BangladeshGolam Samdanee TaneemNo ratings yet

- Industry - Report On Big CompanyDocument75 pagesIndustry - Report On Big CompanySk HindochaNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- 2021 Q3 Consumer Pulse Results - COVID TravelDocument10 pages2021 Q3 Consumer Pulse Results - COVID TravelAnonymous GF8PPILW5No ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Six Months Data of 2022.23 1Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Six Months Data of 2022.23 1shyam karkiNo ratings yet

- Key Tenets To Reduce Risks While Investing in EquitDocument8 pagesKey Tenets To Reduce Risks While Investing in EquitdigthreeNo ratings yet

- South Indian Bank Result UpdatedDocument13 pagesSouth Indian Bank Result UpdatedAngel BrokingNo ratings yet

- WACC (1) Group9 Section BDocument16 pagesWACC (1) Group9 Section BSarvesh KashyapNo ratings yet

- Database: Month Year District Revenue Cogs Advertising Spend Staff CostsDocument10 pagesDatabase: Month Year District Revenue Cogs Advertising Spend Staff CostsZandra AndraNo ratings yet

- UtkarshVikramSinghChauhan TATASTEELDocument12 pagesUtkarshVikramSinghChauhan TATASTEELUtkarsh VikramNo ratings yet

- Financial Performance HDFC 2023Document8 pagesFinancial Performance HDFC 2023udaya kumarNo ratings yet

- SageOne Investor Memo Mar 2024Document9 pagesSageOne Investor Memo Mar 2024bhavan123No ratings yet

- IGWT Report 23 - Nuggets 16 - Silvers Time To ShineDocument35 pagesIGWT Report 23 - Nuggets 16 - Silvers Time To ShineSerigne Modou NDIAYENo ratings yet

- Macroeconomía País Hungría Practica 4Document33 pagesMacroeconomía País Hungría Practica 4magdalenoNo ratings yet

- U.S. Economic Statistics - Monthly DataDocument2 pagesU.S. Economic Statistics - Monthly Dataapi-25887578No ratings yet

- HDFC Life InsuranceDocument83 pagesHDFC Life InsuranceSanket AndhareNo ratings yet

- Pakistan Key Economic IndicatorsDocument2 pagesPakistan Key Economic IndicatorsMohammad RazaNo ratings yet

- Bank of India Result UpdatedDocument12 pagesBank of India Result UpdatedAngel BrokingNo ratings yet

- Current Macroeconomic Situation Tables Based On Six Months Data of 2080.81 1Document85 pagesCurrent Macroeconomic Situation Tables Based On Six Months Data of 2080.81 1gharmabasNo ratings yet

- PM GROUPS BPA 8th E 11Document1 pagePM GROUPS BPA 8th E 11Rabia FazalNo ratings yet

- HRM10 e CH05Document26 pagesHRM10 e CH05Rabia FazalNo ratings yet

- ManHA Girls HostelDocument1 pageManHA Girls HostelRabia FazalNo ratings yet

- Internship ReportDocument10 pagesInternship ReportRabia Fazal0% (1)

- Enron Company Case StudyDocument6 pagesEnron Company Case StudyRabia FazalNo ratings yet

- Budget CutDocument8 pagesBudget CutAugustine AmutaNo ratings yet

- Auditor General Report-Level-CrossingsDocument101 pagesAuditor General Report-Level-CrossingsAlexNo ratings yet

- PDFDocument121 pagesPDFkrishnamoorthy TNo ratings yet

- Budgeting Exercises Answer Key PDFDocument2 pagesBudgeting Exercises Answer Key PDFCristine Jane Moreno CambaNo ratings yet

- Wipro Quantitative Aptitude Memory Based Paper 2021Document5 pagesWipro Quantitative Aptitude Memory Based Paper 2021piyushNo ratings yet

- Jason FielderDocument16 pagesJason FielderVijay KadamNo ratings yet

- Kota Fibres, Ltd. (FIX)Document10 pagesKota Fibres, Ltd. (FIX)Aldo MadonaNo ratings yet

- Boeing Current Market Outlook 2014Document43 pagesBoeing Current Market Outlook 2014VaibhavNo ratings yet

- A Project Report On BingoDocument24 pagesA Project Report On BingoNeeru BatraNo ratings yet

- Inflation ConvexityDocument6 pagesInflation ConvexitysmichelisaliceadslNo ratings yet

- American AirlinesDocument4 pagesAmerican AirlinesAbhik PaulNo ratings yet

- Accounting For Merchandising Operations: Learning ObjectivesDocument55 pagesAccounting For Merchandising Operations: Learning ObjectivesMasum HossainNo ratings yet

- Allied Bank (Final)Document21 pagesAllied Bank (Final)affanahmed11167% (3)

- Depriciation AccountingDocument42 pagesDepriciation Accountingezek1elNo ratings yet

- Chapter-I: 1.1. Indian Two-Wheeler SectorDocument32 pagesChapter-I: 1.1. Indian Two-Wheeler SectorPrithvi BarodiaNo ratings yet

- Money: Theory and Practice: Jin Cao Gerhard IllingDocument412 pagesMoney: Theory and Practice: Jin Cao Gerhard IllingBálint Gr100% (1)

- Demand Side ManagementDocument22 pagesDemand Side ManagementAbhishek SoodNo ratings yet

- InvestingDocument62 pagesInvestingAlexander HertzbergNo ratings yet

- Hull: Options, Futures, and Other Derivatives, Ninth Edition Chapter 2: Mechanics of Futures Markets Multiple Choice Test Bank: Question With AnswersDocument2 pagesHull: Options, Futures, and Other Derivatives, Ninth Edition Chapter 2: Mechanics of Futures Markets Multiple Choice Test Bank: Question With Answersnew england brickNo ratings yet

- Chapter 11 AnswerDocument16 pagesChapter 11 AnswerKathy WongNo ratings yet

- Energy Market Course OutlineDocument3 pagesEnergy Market Course OutlineRoger ChuaNo ratings yet

- Economic Issues and ConceptsDocument153 pagesEconomic Issues and Conceptshera joesandyNo ratings yet

- Marketing Notes For Competitive Exams PDFDocument15 pagesMarketing Notes For Competitive Exams PDFArjunGupta100% (3)

- Natural Gas 360 Oil & Gas PropagandaDocument38 pagesNatural Gas 360 Oil & Gas PropagandaCrystal RobertsonNo ratings yet

- John D. Rockefeller: Standard OilDocument2 pagesJohn D. Rockefeller: Standard Oilari wiliamNo ratings yet