Professional Documents

Culture Documents

ECON310 Q1 - Key

Uploaded by

Refiye ÇakmakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ECON310 Q1 - Key

Uploaded by

Refiye ÇakmakCopyright:

Available Formats

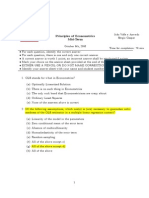

ECON310 QUIZ 1

2020-2021 Spring Semester

1. Which of the following is NOT an assumption of the Simple Linear Regression Model?

a.) The value of y, for each value of x, is

y = 1 + 2x + e

b.)The variance of the random error e is

var(e)= 2

c.) The covariance between any pair of random errors ei and ej is zero

d.) The parameter estimate of 1 is unbiased.

Ans: d (Ch2 Q3)

2. In an econometric model that aims to analyze the relationship between income and monthly

expenditures on entertainment, which variable is the dependent variable based on economic

knowledge?

a.) income

b.) monthly expenditures on entertainment

c.) income elasticity

d.) demand for entertainment

Ans: b (Ch2 tb Q1)

3. The OLS estimators for 1 and 2 are formulas derived by minimizing _____________.

a.) the sum of the error terms or residuals

b.) the sum of the squared residuals

c.) the slope of the regression line

d.) the fit of the regression line to the observed data.

Ans: b (Ch2 tb Q4)

4. If b1 is an estimator for 1 such that E(b1) = 1 , then it must be the case that

a.) b1 is an efficient estimator

b.) b1 is an unbiased estimator

c.) b1 is a linear estimator

d.) b1 is a preferred estimator

Ans: b (Ch2 tb Q7)

5. Under the Gauss-Markov Theorem when assumptions of the Classical Linear Regression Model

(CLRM) are met, what estimators of 1 and 2 may have smaller variances than b1 and b2?

a.) none

b.) a non-linear estimator

c.) a normally distributed estimator

d.) an estimator derived from economic theory

Ans: b (Ch2 tb Q8)

6. You have estimated the following equation using OLS:

Y^ = - 33.75 + 0.45 X

where Y is annual saving in and X is annual income both measured in thousands of dollars for a

sample of households. According to this estimated model, slope coefficient shows that

a.) average increase in saving is 0.45 dollars when income increases by one dollar

b.) marginal propensity to save is 0.45

c.) when income is zero, saving is negative

d.) both A and B are correct

Ans: d

7. You have the results of a simple linear regression model specified as y = 1 + 2x + u based on

cross-sectional data with N = 51 observations. For this regression equation the estimated error

variance is calculated as 2.04672. Given this information, the residual sum of squares equals

a.) 104.38

b.) 100.29

c.) 106.43

d.) cannot be determined from above information

Ans: b (Ch2 Q2.7-a book Hill)

8. You have the results of a simple linear regression model specified as y = 1 + 2x + u based on

cross-sectional data with N = 51 observations. If he estimated var( b 2 ¿= 0.00098, then the standard

error of b 2 is

a.) 0.03541

b.) 0.04330

c.) 0.03130

d.) 0.02342

Ans: c (Ch2 Q2.7-b book Hill)

9. You have the results of a simple linear regression model specified as y = 1 + 2x + u based on

cross-sectional data with N = 51 observations. If b 2= 0.18, X = 69.139 and Y = 15.187, what is the

estimate of the intercept parameter?

a.) 2.7420

b.) 1.8043

c.) 3.4342

d.) 1.3325

Ans: a (Ch2 Q2.7-d book Hill)

10. Which of the following is not a component of a hypothesis test?

a.) null hypothesis

b.) goodness-of-fit

c.) test statistic

d.) rejection region

Ans: b (Ch3 tb Q6)

11. You estimate a simple linear regression model using a sample of 25 observations and

obtain the following results (estimated standard errors in parentheses below coefficient

estimates):

Y = 97.25 + 33.74 X

(3.86) (9.42)

You want to test whether the slope parameter is statistically significantly different from

zero or not. The null and alternative hypothesis are

a.) null hypothesis: slope parameter equals zero, alternative hypothesis: slope parameter

is greater than zero

b.) null hypothesis: slope parameter equals zero, alternative hypothesis: slope parameter

is less than zero

c.) null hypothesis: slope parameter equals zero, alternative hypothesis: slope parameter

is not equal to zero

d.) null hypothesis: slope parameter greater than zero, alternative hypothesis: slope

parameter is equal to zero

Ans: c (Ch3 tb Q3)

12. You estimate a simple linear regression model using a sample of 25 observations and

obtain the following results (estimated standard errors in parentheses below coefficient

estimates):

Y = 97.25 + 33.74 X

(3.86) (9.42)

You want to test whether the slope parameter is statistically significantly different from

zero or not. For the estimated slope coefficient, the calculated t-statistics is

a.) 25.1943

b.) 13.5817

c.) 3.5817

d.) 15.1943

Ans: c (Ch3 tb created from Q3)

13. You estimate a simple linear regression model using a sample of 25 observations and

obtain the following results (estimated standard errors in parentheses below coefficient

estimates):

Y = 97.25 + 33.74 X

(3.86) (9.42)

You want to test whether the slope parameter is statistically significantly different from

zero or not. If you choose 5% significance level, what is the critical t- value?

a.) 2.069

b.) 1.714

c.) 2.060

d.) 1.708

Ans: a (Ch3 tb)

14. You estimate a simple linear regression model using a sample of 25 observations and

obtain the following results (estimated standard errors in parentheses below coefficient

estimates):

Y = 97.25 + 33.74 X

(3.86) (9.42)

You want to test the following hypothesis: H0: beta2 = 12, H1: beta2 ≠12. If you choose to

reject the null hypothesis based on these results, what is the probability you have

committed a Type I error?

a.) between .05 and .10

b.) between .01 and .025

c.) between .02 and .05

d.) It is impossible to determine without knowing the true value of beta 2

Ans: c

15.) In testing H0: beta2 = 2 using a .05 probability of a Type I error, you find a p-value of

0.38. What should you conclude?

a.) H0 is true, beta2 = 2.

b.) H0 should be rejected and is unlikely to be true since the p-value < .50.

c.) It is impossible to know for sure, but there is a 0.38 probability that beta 2 = c.

d.) There is not sufficient evidence to reject H0, so we accept the hypothesis by default.

Ans: d

16. When should a left-tailed significance test be used?

a.) When economic theory suggests the coefficient should be positive

b.) When it allows you to reject the null hypothesis at a lower p-value

c.) When economic theory suggests the coefficient should be negative

d.) When you know the true value of beta2 is positive.

Ans: c (CH3 tb Q.19)

17. You estimate a simple linear regression model using a sample of 25 observations and

obtain the following results (estimated standard errors in parentheses below coefficient

estimates):

Y = 97.25 + 19.74X R2 = 0.74

(3.86) (3.42)

The coefficient of determination shows

a) There is 74% variation in the explanatory variable.

b) Correlation coefficient between X and Y variables is 74%

c) About 74% of variation in Y variable can be explained by variations in X variable

d) The model has low predictive power.

Ans: d

You might also like

- Introduction To Probability and Statistics (IPS) : EndtermDocument16 pagesIntroduction To Probability and Statistics (IPS) : Endterm208vaibhav bajajNo ratings yet

- BMSIDocument24 pagesBMSIadil jahangirNo ratings yet

- Aff700 1000 221209Document11 pagesAff700 1000 221209nnajichinedu20No ratings yet

- Group 5:: Statistical Analysis With Software ApplicationDocument8 pagesGroup 5:: Statistical Analysis With Software ApplicationMitch Tokong MinglanaNo ratings yet

- Measures of Central Tendency and Dispersion MCQsDocument13 pagesMeasures of Central Tendency and Dispersion MCQsCHARAN GOPI KRISHNA Kondapalli100% (1)

- Simple Linear Regression and Correlation ExplainedDocument76 pagesSimple Linear Regression and Correlation Explainedcookiehacker100% (1)

- Chapter 5 Econometrics Practice MCDocument36 pagesChapter 5 Econometrics Practice MCYiğit KocamanNo ratings yet

- 1 1Document6 pages1 1Goher AyubNo ratings yet

- Quiz Questions on Regression Analysis and CorrelationDocument10 pagesQuiz Questions on Regression Analysis and CorrelationHarsh ShrinetNo ratings yet

- Econometrics Assignment 2Document3 pagesEconometrics Assignment 2Peter ChenzaNo ratings yet

- All the Previous QuestionsDocument37 pagesAll the Previous Questionsermiasbiru62No ratings yet

- Chapter 3 Econometrics Practice MCDocument35 pagesChapter 3 Econometrics Practice MCYiğit KocamanNo ratings yet

- Chapter 5 Regression With A Single Regressor: Hypothesis Tests and Confidence IntervalsDocument32 pagesChapter 5 Regression With A Single Regressor: Hypothesis Tests and Confidence Intervalsdaddy's cockNo ratings yet

- Midterm Review - Answer KeyDocument24 pagesMidterm Review - Answer KeyUmar KhanNo ratings yet

- Econometrics Sample PaperDocument5 pagesEconometrics Sample PaperGiri PrasadNo ratings yet

- GOVT. MODEL QUESTION PAPER STATISTICSDocument11 pagesGOVT. MODEL QUESTION PAPER STATISTICSbindum_9No ratings yet

- UPDATED Practice Final Exams SolutionsDocument39 pagesUPDATED Practice Final Exams SolutionsReza MohagiNo ratings yet

- CH 10 TestDocument23 pagesCH 10 TestDaniel Hunks100% (1)

- Question Paper FinalDocument10 pagesQuestion Paper FinalasdNo ratings yet

- R04 Introduction To Linear RegressionDocument12 pagesR04 Introduction To Linear RegressionIndonesian ProNo ratings yet

- MGMT 2012 Practice Coursework 2023Document5 pagesMGMT 2012 Practice Coursework 2023Priya Rani100% (1)

- Hypothesis Testing SeminarDocument10 pagesHypothesis Testing SeminarJacky C.Y. HoNo ratings yet

- Final Assignment Probability and Statistics: Due Date: Final Exam DayDocument9 pagesFinal Assignment Probability and Statistics: Due Date: Final Exam DayHamza QureshiNo ratings yet

- Chapter 4 Econometrics Practice MCDocument38 pagesChapter 4 Econometrics Practice MCYiğit KocamanNo ratings yet

- 2018-IPS Endterm SolsDocument14 pages2018-IPS Endterm SolsAnurag BhartiNo ratings yet

- SSC CGL Tier-2 10th August 2022 Statistics by CrackuDocument27 pagesSSC CGL Tier-2 10th August 2022 Statistics by CrackuManan AnandNo ratings yet

- Stats Final ADocument10 pagesStats Final Asagaoclearance16No ratings yet

- STA301Document64 pagesSTA301Younas MujahidNo ratings yet

- ABACUS-Business StatisticsDocument3 pagesABACUS-Business StatisticsaamirNo ratings yet

- Homework Assignment Meeting 5Document10 pagesHomework Assignment Meeting 5Marwah FazliNo ratings yet

- MCQs_FTUKey_EngDocument7 pagesMCQs_FTUKey_EngNguyn Lại QuengNo ratings yet

- PSQ Reviewer 1Document6 pagesPSQ Reviewer 1Jan Michael AbarquezNo ratings yet

- Name: . ID No: .. BITS-Pilani Dubai Campus Econ F241 Econometric Methods Semester I, 2018test-1 (Closed Book)Document6 pagesName: . ID No: .. BITS-Pilani Dubai Campus Econ F241 Econometric Methods Semester I, 2018test-1 (Closed Book)Giri PrasadNo ratings yet

- BCOM 209 Business StatisticsDocument12 pagesBCOM 209 Business StatisticsRajshree SinghNo ratings yet

- 2005 Exam CDocument36 pages2005 Exam CdiordesasNo ratings yet

- Simple RegressionDocument35 pagesSimple RegressionHimanshu JainNo ratings yet

- Maths PDFDocument4 pagesMaths PDFSanket PatilNo ratings yet

- MCQs Simple Linear RegressionDocument3 pagesMCQs Simple Linear RegressionEngr Mujahid Iqbal100% (6)

- JNU-2008 PaperDocument9 pagesJNU-2008 PaperVivek SharmaNo ratings yet

- Final Exam in StatisticsDocument7 pagesFinal Exam in StatisticsMitch Tokong MinglanaNo ratings yet

- BMSI ET 6 Stat-1Document3 pagesBMSI ET 6 Stat-1adil jahangirNo ratings yet

- Statistics 17 by KellerDocument76 pagesStatistics 17 by KellerMahmoudElbehairyNo ratings yet

- Kerala Set Exam Previous Year Question PaperDocument12 pagesKerala Set Exam Previous Year Question Papertinkbright10No ratings yet

- MCQs Unit 2 Measures of Central TendencyDocument16 pagesMCQs Unit 2 Measures of Central TendencyGamer Bhagvan100% (1)

- TrachnhiemDocument4 pagesTrachnhiemQuyên ThanhNo ratings yet

- Statistical Theory MCQsDocument19 pagesStatistical Theory MCQsPhoton Online Science AcademyNo ratings yet

- STA 3024 Practice Problems Exam 2 Multiple RegressionDocument13 pagesSTA 3024 Practice Problems Exam 2 Multiple Regressiondungnt0406100% (2)

- Stat Paper For 2 YearDocument3 pagesStat Paper For 2 Yearfazalulbasit9796100% (1)

- Stat Final Exam '17-'18Document2 pagesStat Final Exam '17-'18Shiery Mae Falconitin100% (3)

- Final Examination in Statistics and ProbabilityDocument2 pagesFinal Examination in Statistics and ProbabilityMagz Magan100% (12)

- Assignment 1 Each One of You Are Assigned Roll No Wise 1 Question Individually That You Are SubmittingDocument10 pagesAssignment 1 Each One of You Are Assigned Roll No Wise 1 Question Individually That You Are SubmittingsiddheshNo ratings yet

- MCq mth302 without ans-1Document11 pagesMCq mth302 without ans-1IcedeckNo ratings yet

- QTM AssignmentDocument12 pagesQTM AssignmentShivenNo ratings yet

- Stat ExamDocument2 pagesStat ExamKelvin C. Grajo100% (1)

- Midterm PrinciplesDocument8 pagesMidterm Principlesarshad_pmadNo ratings yet

- Chapter 3 Exercise Solutions for Principles of EconometricsDocument29 pagesChapter 3 Exercise Solutions for Principles of EconometricsTimroo Hamro100% (3)

- 5 Regression 150330040604 Conversion Gate01Document5 pages5 Regression 150330040604 Conversion Gate01Venkat Macharla100% (1)

- Homework 8-Huilin ZhangDocument9 pagesHomework 8-Huilin ZhangMax RahmanNo ratings yet

- NSE BA Sample Paper With SolutionDocument18 pagesNSE BA Sample Paper With SolutionSanjay Singh100% (1)

- Guide Spec DX Air Outdoor Condensing Unit 2 2017Document5 pagesGuide Spec DX Air Outdoor Condensing Unit 2 2017JamesNo ratings yet

- Project Report ON: "Brand Preference of Onida Colour TV in Coastal OrissaDocument66 pagesProject Report ON: "Brand Preference of Onida Colour TV in Coastal OrissaApurba KhanduriNo ratings yet

- Bulk PricesDocument2 pagesBulk PricesMega Byte0% (1)

- RFPDocument88 pagesRFPJayaram Peggem P0% (1)

- C31 C31M 03aDocument5 pagesC31 C31M 03aJesus Luis Arce GuillermoNo ratings yet

- 11608-Driving Women Fiction and PDFDocument240 pages11608-Driving Women Fiction and PDFAleksi KnuutilaNo ratings yet

- A350 XWB Training Brochure PDFDocument8 pagesA350 XWB Training Brochure PDFBertrand100% (1)

- English For Academic and Professional Purposes: Quarter 1 - Module 3Document9 pagesEnglish For Academic and Professional Purposes: Quarter 1 - Module 3John Vincent Salmasan100% (5)

- Modern Control Systems Linear Approximation Laplace TransformDocument3 pagesModern Control Systems Linear Approximation Laplace TransformramNo ratings yet

- Ball ValveDocument12 pagesBall ValveIdabaNo ratings yet

- Chapter OneDocument14 pagesChapter Oneogunseyeopeyemi2023No ratings yet

- Viewing Partition of India as an Imperfect SolutionDocument36 pagesViewing Partition of India as an Imperfect Solutionsingh1910511753No ratings yet

- How To Combine Cells Into A Cell With Comma, Space and Vice VersaDocument8 pagesHow To Combine Cells Into A Cell With Comma, Space and Vice VersaClifford Marco ArimadoNo ratings yet

- Automatic Transmission System SeminarDocument14 pagesAutomatic Transmission System SeminarAnonymous 2YgIckU0No ratings yet

- Understanding Data GovernanceDocument28 pagesUnderstanding Data GovernanceJoe leninja100% (1)

- AICTE NoticeDocument1 pageAICTE NoticeThe WireNo ratings yet

- Guided Overview of Impression MaterialsDocument212 pagesGuided Overview of Impression MaterialsSai Kumar100% (1)

- University of The Cordilleras Process CostingDocument5 pagesUniversity of The Cordilleras Process CostingJane PadillaNo ratings yet

- Assignment 2 QP MPMC - ITDocument1 pageAssignment 2 QP MPMC - ITProjectsNo ratings yet

- UI UX Research DesignDocument7 pagesUI UX Research DesignSomya ShrivastavaNo ratings yet

- A Seminar Report On Floating Wind TurbineDocument26 pagesA Seminar Report On Floating Wind Turbinevaishakh123450% (6)

- Installation and User's Guide InformixDocument52 pagesInstallation and User's Guide Informixissa912721No ratings yet

- Online Auction SystemDocument29 pagesOnline Auction SystemDharmendra83% (6)

- Integral Abutment Bridge Design (Modjeski and Masters) PDFDocument56 pagesIntegral Abutment Bridge Design (Modjeski and Masters) PDFAnderson UrreaNo ratings yet

- IELTS PART 1 (Autoguardado)Document8 pagesIELTS PART 1 (Autoguardado)CARLOS CAICEDONo ratings yet

- North American Free Trade Agreement: Prof. MakhmoorDocument15 pagesNorth American Free Trade Agreement: Prof. MakhmoorShikha ShuklaNo ratings yet

- Final Investigative Report - MaSUDocument4 pagesFinal Investigative Report - MaSUinforumdocsNo ratings yet

- Consumer Behaviour 1Document11 pagesConsumer Behaviour 1Rushika ShahNo ratings yet

- DSP Lect 11 Iir DesignDocument50 pagesDSP Lect 11 Iir DesignSayyeda UmbereenNo ratings yet

- Petron Corporate PresentationDocument46 pagesPetron Corporate Presentationsivuonline0% (1)

- A Mathematician's Lament: How School Cheats Us Out of Our Most Fascinating and Imaginative Art FormFrom EverandA Mathematician's Lament: How School Cheats Us Out of Our Most Fascinating and Imaginative Art FormRating: 5 out of 5 stars5/5 (5)

- Build a Mathematical Mind - Even If You Think You Can't Have One: Become a Pattern Detective. Boost Your Critical and Logical Thinking Skills.From EverandBuild a Mathematical Mind - Even If You Think You Can't Have One: Become a Pattern Detective. Boost Your Critical and Logical Thinking Skills.Rating: 5 out of 5 stars5/5 (1)

- Mathematical Mindsets: Unleashing Students' Potential through Creative Math, Inspiring Messages and Innovative TeachingFrom EverandMathematical Mindsets: Unleashing Students' Potential through Creative Math, Inspiring Messages and Innovative TeachingRating: 4.5 out of 5 stars4.5/5 (21)

- Quantum Physics: A Beginners Guide to How Quantum Physics Affects Everything around UsFrom EverandQuantum Physics: A Beginners Guide to How Quantum Physics Affects Everything around UsRating: 4.5 out of 5 stars4.5/5 (3)

- Mental Math Secrets - How To Be a Human CalculatorFrom EverandMental Math Secrets - How To Be a Human CalculatorRating: 5 out of 5 stars5/5 (3)

- A Mathematician's Lament: How School Cheats Us Out of Our Most Fascinating and Imaginative Art FormFrom EverandA Mathematician's Lament: How School Cheats Us Out of Our Most Fascinating and Imaginative Art FormRating: 4.5 out of 5 stars4.5/5 (20)

- Making and Tinkering With STEM: Solving Design Challenges With Young ChildrenFrom EverandMaking and Tinkering With STEM: Solving Design Challenges With Young ChildrenNo ratings yet

- Basic Math & Pre-Algebra Workbook For Dummies with Online PracticeFrom EverandBasic Math & Pre-Algebra Workbook For Dummies with Online PracticeRating: 4 out of 5 stars4/5 (2)

- Strategies for Problem Solving: Equip Kids to Solve Math Problems With ConfidenceFrom EverandStrategies for Problem Solving: Equip Kids to Solve Math Problems With ConfidenceNo ratings yet

- A-level Maths Revision: Cheeky Revision ShortcutsFrom EverandA-level Maths Revision: Cheeky Revision ShortcutsRating: 3.5 out of 5 stars3.5/5 (8)

- Fluent in 3 Months: How Anyone at Any Age Can Learn to Speak Any Language from Anywhere in the WorldFrom EverandFluent in 3 Months: How Anyone at Any Age Can Learn to Speak Any Language from Anywhere in the WorldRating: 3 out of 5 stars3/5 (79)

- Calculus Workbook For Dummies with Online PracticeFrom EverandCalculus Workbook For Dummies with Online PracticeRating: 3.5 out of 5 stars3.5/5 (8)

- Limitless Mind: Learn, Lead, and Live Without BarriersFrom EverandLimitless Mind: Learn, Lead, and Live Without BarriersRating: 4 out of 5 stars4/5 (6)

- How Math Explains the World: A Guide to the Power of Numbers, from Car Repair to Modern PhysicsFrom EverandHow Math Explains the World: A Guide to the Power of Numbers, from Car Repair to Modern PhysicsRating: 3.5 out of 5 stars3.5/5 (9)