Professional Documents

Culture Documents

BIR Ruling OT-212-2022 - Transfer of Manila Polo Club Shares To Another Trustee Not Subject To CGT and DST

Uploaded by

Mark Domingo0 ratings0% found this document useful (0 votes)

383 views6 pagesOriginal Title

BIR Ruling OT-212-2022 - Transfer of Manila Polo Club Shares to another trustee not subject to CGT and DST

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

383 views6 pagesBIR Ruling OT-212-2022 - Transfer of Manila Polo Club Shares To Another Trustee Not Subject To CGT and DST

Uploaded by

Mark DomingoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

May 5, 2022

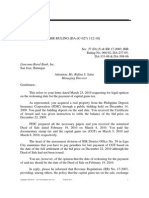

BIR RULING NO. OT-212-2022

Secs. 24 (C); 98; 175; RR 13-2004; BIR Ruling No. OT-0653-2020

Salvador Llanillo Bernardo

Attorneys-at-Law

815-816 Tower One and Exchange Plaza

Ayala Triangle, Ayala Avenue, Makati City

Attention: Attys. Maria Rosario L. Bernardo

and

Rachelle Anne D. Gutierrez

Gentlemen :

This refers to your letter dated January 10, 2020 requesting for

confirmation that the transfer of a Membership Share in Manila Polo Club

from its old trustee to its new trustee is exempt from capital gains tax (CGT)

and documentary stamp tax (DST).

Background:

Nestlé Philippines, Inc. (the "Company") is a domestic corporation

registered with the Securities and Exchange Commission and engaged in

business in the Philippines. The Company is the beneficial owner of a

Membership Share with Manila Polo Club (MPC) evidenced by Proprietary

Membership Certificates No. 7065 and 7075 (the "Membership Shares"), and

which are registered in the name of whoever is serving as the Company's

officers.

At present, the Membership Shares of the Company in MPC are placed

under the name of the following persons:

Membership Old

Position

Certificate No. Trustee/Transferor

7065 Luca Fichera SCM Director

7075 Paul Rodriguez Sales Director

Subsequently, the Company appointed Mr. Anderson Martins as its new

SCM Director and Mr. Arsalan Khan as its new Sales Director. In view thereof,

the Company seeks to appoint Mr. Martins and Mr. Khan as the new trustees

of its Membership Shares in MPC and to place the respective Membership

Shares, of Mr. Fichera and Mr. Rodriguez, in the name of the new trustees.

We reply, as follows:

The transfer of MPC Shares from Luca Fichera and Paul Rodriguez to

Mr. Anderson Martins and Mr. Arsalan Khan is not subject to CGT

and DST.

Upon execution of unilateral Declarations of Trust by Mr. Anderson

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

Martins and Mr. Arsalan Khan, a trust relationship was created between the

Company, Luca Fichera and Paul Rodriguez, and Mr. Anderson Martins and

Mr. Arsalan Khan.

A trust is a legal relationship between one person having an equitable

ownership of property and another person owning the legal title to such

property, the equitable ownership of the former entitling him to the

performance of certain duties and the exercise of certain powers by the latter.

What distinguishes a trust from other relations is the separation of the legal

title and equitable ownership of the property. In a trust relation, legal title is

vested in the fiduciary while equitable ownership is vested in a cestui que trust.

1

In relation thereto, a declaration of trust has been defined as an act by which a

person acknowledges that the property, title to which he holds, is held by him

for the use of another. 2

In the unilateral Declarations of Trust which Mr. Anderson Martins and

Mr. Arsalan Khan executed, they acknowledged that they are merely

appointed to represent the Membership Share actually owned by the

Company; that the registration of the Membership Shares in their names was

necessary to comply with the rules of the MPC that only natural persons shall

be admitted as a proprietary member; that they have no title, right, claim or

interest whatsoever over the said Membership Shares; that the certificates to

be issued in replacement of Certificates No. 7065 and 7075 still belong to

the Company; and that in the event that they will cease from being the

Company officers, the management of the Company may designate any

other Company officers it seems qualified to be the new holder of the

Membership Share. Hence, the transfers do not give Luca Fichera and Paul

Rodriguez nor Mr. Anderson Martins and Mr. Arsalan Khan any kind of right,

claim or interest whatsoever in the Membership Shares and that trustees of

the Company are merely holding the legal ownership of the same with the

beneficial ownership pertaining to the Company. Here, the trustor and the

cestui que trust is the Company while the fiduciary, also known as the

trustees, are the declarants/appointees, Mr. Anderson Martins and Mr.

Arsalan Khan.

A trust arises in favor of one who pays the purchase money of property

in the name of another, because of the presumption that he who pays for a

thing intends a beneficial interest therein for himself. 3 The principle of a

resulting trust is based on the equitable doctrine that valuable consideration,

and not legal title, determines the equitable title or interest and are

presumed always to have been contemplated by the parties. They arise from

the nature or circumstances of the consideration involved in a transaction

whereby one person thereby becomes invested with legal title but is

obligated in equity to hold his legal title for the benefit of another. 4

In the case of Sime Darby Pilipinas, Inc. v. Mendoza, 5 Sime Darby

acquired a Class "A" club share in Alabang Country Club ("ACC") in 1987, but

being a corporation which was expressly disallowed by ACC's By-Laws to

acquire and register the club share under its name, registered the share

under the name of respondent Mendoza, Sime Darby's sales manager at the

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

time. The Supreme Court held that a trust arrangement existed between

Sime Darby and Mendoza and while the share was bought by Sime Darby

and placed under the name of Mendoza, the latter's title was only limited to

the use and enjoyment of the club's facilities and privileges while employed

with the company.

In the instant case, the Company purchased the Membership Shares

and intends to give legal title thereto to its trustees-appointees, which title

entitles the trustees-appointees only to the use and enjoyment of the club's

facilities since, under the Articles of Incorporation and By-laws of MPC, only

natural persons may become registered members.

The transfer of the legal title of the Membership Shares from Luca

Fichera and Paul Rodriguez (old trustees-appointees) to its new trustees-

appointees, Mr. Anderson Martins and Mr. Arsalan Khan, is not subject to CGT

considering that the transfer involves neither monetary consideration nor

change in beneficial ownership.

Section 24 (C) of the National Internal Revenue Code (Tax Code) of

1997, as amended, provides that CGT is imposed upon the net capital gains

realized during the taxable year from the sale, barter, exchange or other

disposition of shares of stock in a domestic corporation, except shares sold,

or disposed of through the Stock Exchange. In other words, CGT is imposed

on the gain or profit from the sale of capital assets. 6

In this case, the Membership Shares will be transferred from Luca

Fichera's and Paul Rodriguez's names, as the former trustees, to Mr.

Anderson Martins and Mr. Arsalan Khan, who will be the Company's new

trustees-appointees. Since Luca Fichera and Paul Rodriguez only possessed

legal title over the Membership Shares, the transfer of the subject shares in

favor of Mr. Anderson Martins and Mr. Arsalan Khan will be limited only to the

transfer of the legal title.

The intention of the Company in giving legal title of the Membership

Shares to Mr. Anderson Martins and Mr. Arsalan Khan is to make them an

extension of the Company's ownership over the same. Practically speaking,

being a juridical entity, the Company cannot directly enjoy the privileges

that come with owning the Membership Share, hence, must assign someone

to use the club facilities on its behalf.

Since the beneficial ownership over the Membership Share remains

with the Company, there is no actual transfer of ownership of the said share

as between the Company and its trustees and/or from old trustees to the

new trustees, and therefore, no gain or profit shall be recognized.

Therefore, considering that there is no actual transfer of ownership and

no monetary consideration, and consequently no gain or profit involved in

the transfer which is merely by virtue of an assignment as evidenced by the

Declarations of Trust, this Office confirms that the transfer is not subject to

CGT.

The Transfer is not subject to DST

Likewise, the transfer is not subject to DST under Section 175 of the

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

Tax Code of 1997, as amended. The rule is that the assignment of shares of

stock of a domestic corporation is subject to DST upon execution of the deed

transferring ownership or rights thereto, or upon delivery, assignment or

indorsement of such shares in favor of another.

Revenue Regulations (RR) No. 13-2004 dated December 23, 2004,

implementing the provisions of Republic Act (RA) No. 9243, otherwise known

a s An Act Rationalizing Further the Structure and Administration of the

Documentary Stamp Tax 7 qualified this rule by stating that for a sale or

exchange to be taxable, there must be an actual or constructive transfer of

beneficial ownership of the shares of stock from one person to another.

Section 4 of RR No. 13-2004 provides, to wit:

"For a sale or exchange to be taxable, there must be an actual or

constructive transfer of beneficial ownership of the shares of stock

from one person to another. Such transfer may be manifested by the

clear exercise of attributes of ownership over such stocks by the

transferee, or by an actual entry of a change in the name appearing in

the certificate of stock or in the Stock and Transfer Book of the issuing

corporation or by any entry indicating transfer of beneficial ownership

in any form of registry including those of a duly authorized scripless

registry, such as those maintained for or by the Philippine Stock

Exchange. However, if by the transfer of certificates of stock from a

resigned trustee to a newly appointed trustee such certificate of stock

remains in the name of the cestui que trust or the resigned trustee so

that the new trustee is constituted as mere depository of the stock,

such transfer is not taxable . Provided, however, that transfer of

shares to "nominees" to qualify them to sit in the board or to qualify

them to perform any act in relation to the corporation shall not be

subject to the DST provided herein only upon proof of a duly executed

Nominee Agreement showing the purpose of the transfer; that the

transfer is without consideration other than the undertaking of the

nominee to only represent the beneficial owner of the stock; and the

transfer is in trust." (Emphasis and underscoring supplied)

The herein transfer comply with the afore-cited rules. First, there is no

actual or constructive transfer of the beneficial ownership of the shares. Only

the legal title was transferred when the Company changed its appointees

from Luca Fichera and Paul Rodriguez to Mr. Anderson Martins and Mr.

Arsalan Khan. Second, the execution of and by the express provisions of the

Declarations of Trust, the intention of the parties was clearly for Luca Fichera

and Paul Rodriguez and now Mr. Anderson Martins and Mr. Arsalan Khan to

hold the shares in trust for the Company.

Furthermore, in the case of Commissioner of Internal Revenue v. First

Express Pawnshop, Inc. , 8 the Supreme Court explained that Sections 175

and 176 of the Tax Code of 1997, as amended, on DST contemplates the

execution of a subscription agreement in order for a taxpayer to be liable to

pay the DST. The Supreme Court ruled, thus:

"As pointed out by the CTA, Sections 175 and 176 of the Tax Code

contemplate a subscription agreement in order for a taxpayer to be

liable to pay the DST. A subscription contract is defined as any contract

for the acquisition of unissued stocks in an existing corporation or a

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

corporation still to be formed. A stock subscription is a contract by

which the subscriber agrees to take a certain number of shares of the

capital stock of a corporation, paying for the same or expressly or

impliedly promising to pay for the same."

A mere transfer of a share from one trustee to another, without change

in the beneficial ownership of the share is, therefore, not the taxable

transaction being contemplated under the Tax Code provisions on DST. That

the transfer from Luca Fichera and Paul Rodriguez to Mr. Anderson Martins

and Mr. Arsalan Khan is without a subscription agreement or any kind of

consideration is indicative of the real intention of the parties that there

would be no transfer of beneficial ownership of the Membership Share. The

same remains with the Company.

In view thereof, the herein transfer cannot be subject to DST as there

are no transfer or conveyance from Luca Fichera and Paul Rodriguez to Mr.

Anderson Martins and Mr. Arsalan Khan of the beneficial ownership of or any

right, claim or interest over the Membership Shares or over the assets of

MPC. There being no new conveyance to speak of in this case, there is no

new exercise of a privilege upon which DST may be imposed. Consequently,

since there will be no transfer or conveyance of the Membership Shares from

Luca Fichera and Paul Rodriguez to Mr. Anderson Martins and Mr. Arsalan

Khan, the same shall not be subject to donor's tax under Section 98 of the

Tax Code of 1997, as amended.

This ruling is being issued on the basis of the foregoing facts as

represented. However, if upon investigation, it will be disclosed that the

facts are different, then this ruling shall be considered null and void.

Very truly yours,

CAESAR R. DULAY

Commissioner of Internal Revenue

By:

(SGD.) MARISSA O. CABREROS

Deputy Commissioner

Legal Group

Officer-in-Charge

Footnotes

1. Soledad Cañezo substituted by William Cañezo and Victoriano Cañezo v.

Concepcion Rojas, G.R. No. 148788, 23 November 2007.

2. Resurreccion de Leon, et al. v. Emiliano Molo-Peckson, et al., G.R. No. L-17809,

29 December 1962.

3. Marsh Thomson v. Court of Appeals and the American Chamber of Commerce of

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

the Philippines, Inc., G.R. No. 116631, 28 October 1998.

4. Spouses Trinidad v. Imson , G.R. No. 197728, 16 September 2015.

5. G.R. No. 202247, 19 June 2013.

6. Salud v. Commissioner of Internal Revenue, C.T.A. EB CASE NO. 412, 30 April

2009.

7. RR 13-2004.

8. G.R. Nos. 172045-46, 16 June 2009.

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

You might also like

- Legal Forms - Reply To Demand LetterDocument1 pageLegal Forms - Reply To Demand LetterMark DomingoNo ratings yet

- Lawyer Resume Sample 2019 OriginalDocument2 pagesLawyer Resume Sample 2019 OriginalJonRumania100% (1)

- NWRB opposition to CPC applicationDocument10 pagesNWRB opposition to CPC applicationShan KhingNo ratings yet

- Re: Registration of Second Amendment To The Real Estate Mortgage of Sps. Lilian B. and Filamer Amado P. BulaoDocument2 pagesRe: Registration of Second Amendment To The Real Estate Mortgage of Sps. Lilian B. and Filamer Amado P. BulaoAl MarvinNo ratings yet

- BIR Ruling DA-C-133 431-08Document5 pagesBIR Ruling DA-C-133 431-08Lee Anne YabutNo ratings yet

- ROHQ ClosureDocument1 pageROHQ ClosureVeron AGNo ratings yet

- Secs Cert ElviraDocument2 pagesSecs Cert ElviraAnn SCNo ratings yet

- Labor Law Review - Grievance Machinery To Strikes and LockoutsDocument7 pagesLabor Law Review - Grievance Machinery To Strikes and LockoutslchieSNo ratings yet

- BOI Citizen's CharterDocument32 pagesBOI Citizen's CharterPam MarceloNo ratings yet

- Stirling HomexDocument3 pagesStirling HomexAnne cutieNo ratings yet

- Executive Summary Enclosed for Investment Opportunity in Growing Industry CompanyDocument2 pagesExecutive Summary Enclosed for Investment Opportunity in Growing Industry CompanySunil Soni100% (1)

- War crimes and crimes against humanity in the Rome Statute of the International Criminal CourtFrom EverandWar crimes and crimes against humanity in the Rome Statute of the International Criminal CourtNo ratings yet

- The Greenbury Report (1995)Document8 pagesThe Greenbury Report (1995)dharmsonu100% (2)

- Ramchrisen H. Haveria, Petitioner, vs. Social Security System, Corazon de La Paz, and Leonora S. Nuque, RespondentsDocument2 pagesRamchrisen H. Haveria, Petitioner, vs. Social Security System, Corazon de La Paz, and Leonora S. Nuque, RespondentsViolet Blue100% (1)

- Section 2.57.4 of RR No. 2-98Document2 pagesSection 2.57.4 of RR No. 2-98fatmaaleahNo ratings yet

- Car Insurance Cancellation LetterDocument4 pagesCar Insurance Cancellation LetterAiza VillanuevaNo ratings yet

- FGEN: Declaration of Cash DividendsDocument2 pagesFGEN: Declaration of Cash DividendsBusinessWorldNo ratings yet

- RR 1-79Document2 pagesRR 1-79Edione CueNo ratings yet

- Course Syllabus: College of Business Management and AccountancyDocument4 pagesCourse Syllabus: College of Business Management and AccountancyThea FloresNo ratings yet

- Form Sec 10.1Document3 pagesForm Sec 10.1xtinemaniegoNo ratings yet

- BIR Ruling No. OT-026-20 (RMO 9-14)Document4 pagesBIR Ruling No. OT-026-20 (RMO 9-14)Hailin QuintosNo ratings yet

- Iso Dar Clearance TemplateDocument9 pagesIso Dar Clearance TemplateCarlo ColumnaNo ratings yet

- Cancellation of Encumbrance Sec 7 Ra 26 - Google SearchDocument2 pagesCancellation of Encumbrance Sec 7 Ra 26 - Google Searchbatusay575No ratings yet

- Baneko Ne: Serurrel PilipinasDocument16 pagesBaneko Ne: Serurrel PilipinasEselito C. RuizNo ratings yet

- Rmo 15-03 - Car and OnettDocument81 pagesRmo 15-03 - Car and OnettHomerNo ratings yet

- Tax Alert BIR Ruling 142 2011 PDFDocument3 pagesTax Alert BIR Ruling 142 2011 PDFJm CruzNo ratings yet

- Application For Closure of BusinessDocument2 pagesApplication For Closure of BusinessallanNo ratings yet

- Makati City Hall Business Termination LetterDocument2 pagesMakati City Hall Business Termination LetterBella TanNo ratings yet

- Revised Withholding Tax TablesDocument1 pageRevised Withholding Tax TablesJonasAblangNo ratings yet

- Limcoma Rural Bank, Inc. June 25, 2010Document4 pagesLimcoma Rural Bank, Inc. June 25, 2010Ronnie RimandoNo ratings yet

- Affidavit of Adjoining OwnersDocument1 pageAffidavit of Adjoining OwnersRamil Carreon100% (1)

- LIST OF SUPREME COURT 3 DIVISION's AND EN BANC DECISIONS INVOLVING TALA ESTATE PARCEL OF LAND AS SUBJECT IN THE CASEDocument9 pagesLIST OF SUPREME COURT 3 DIVISION's AND EN BANC DECISIONS INVOLVING TALA ESTATE PARCEL OF LAND AS SUBJECT IN THE CASERonaldo Masbate MarbellaNo ratings yet

- Sample Contract To SellDocument2 pagesSample Contract To SellJM BermudoNo ratings yet

- 03-08-17 Accomplishment ReportDocument5 pages03-08-17 Accomplishment ReportAngelo MurilloNo ratings yet

- Sec Green Lane FormDocument8 pagesSec Green Lane FormZena E. SugatainNo ratings yet

- DOJ upholds DAR authority on land conversionsDocument2 pagesDOJ upholds DAR authority on land conversionsDred OpleNo ratings yet

- Secretary'S Certificate: Jerome CuiDocument1 pageSecretary'S Certificate: Jerome Cuiarchie l. alfonsoNo ratings yet

- Court Documents Reveal Land Ownership DisputeDocument2 pagesCourt Documents Reveal Land Ownership DisputeEmer MartinNo ratings yet

- Retirement Agreement 1Document6 pagesRetirement Agreement 1liza avilaNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Transfer Estate TIN Special Power of AttorneyDocument1 pageTransfer Estate TIN Special Power of AttorneyHanan KahalanNo ratings yet

- Regional Trial Court of Cebu Branch - : PlaintiffDocument2 pagesRegional Trial Court of Cebu Branch - : PlaintiffNika RojasNo ratings yet

- 2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFDocument191 pages2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFRamon PamosoNo ratings yet

- Resignation LetterDocument1 pageResignation LetterAndrewJosephBarciaCruzNo ratings yet

- Lawyers ID FormDocument1 pageLawyers ID Formnicakyut100% (1)

- RMO No. 17-2016Document7 pagesRMO No. 17-2016leeNo ratings yet

- SC Decision On Party-ListDocument7 pagesSC Decision On Party-ListSunStar Philippine NewsNo ratings yet

- SEC Opinion 4-28-1997Document2 pagesSEC Opinion 4-28-1997Nash Ortiz LuisNo ratings yet

- 2 Affidavit of Consent To TravelDocument2 pages2 Affidavit of Consent To TravelRaf RufNo ratings yet

- Resignation Letter For DMSI of RSDDocument1 pageResignation Letter For DMSI of RSDApril NNo ratings yet

- BIR Ruling Determines CEBU Air Inc Subject to IAETDocument4 pagesBIR Ruling Determines CEBU Air Inc Subject to IAETseraphinajewelineNo ratings yet

- Motion For Extension of Time To File Answer Orig vs. Municipality of Balilihan Et. Al. Civil Case No. 8782Document3 pagesMotion For Extension of Time To File Answer Orig vs. Municipality of Balilihan Et. Al. Civil Case No. 8782David Sibbaluca MaulasNo ratings yet

- Lwua Citizen's Charter 2020Document80 pagesLwua Citizen's Charter 2020Alfred YangaoNo ratings yet

- Affidavit of Undertaking For AEP Format 16dec2020 Rev.1Document2 pagesAffidavit of Undertaking For AEP Format 16dec2020 Rev.1Princess GarciaNo ratings yet

- Master DeedDocument264 pagesMaster DeedLyra NicoleNo ratings yet

- 17Document4 pages17Mariel Joyce PortilloNo ratings yet

- Attachments Amaia Land Corp.Document4 pagesAttachments Amaia Land Corp.AbbaNo ratings yet

- Affidavit of Release and Quitclaim With Indemnity Undertaking in Partible CaseDocument1 pageAffidavit of Release and Quitclaim With Indemnity Undertaking in Partible CaseJaime GonzalesNo ratings yet

- AFFIDAVIT OF Two Disinterested PersomnDocument2 pagesAFFIDAVIT OF Two Disinterested PersomnWillnard LaoNo ratings yet

- RDO No. 15 - Naguilian, IsabelaDocument982 pagesRDO No. 15 - Naguilian, IsabelaJames ReyesNo ratings yet

- SEC Opinion 11-44 PDFDocument11 pagesSEC Opinion 11-44 PDFJf ManejaNo ratings yet

- Affidavit of Consent To Adoption: SUBSCRIBED AND SWORN To Before Me This - TH Day ofDocument1 pageAffidavit of Consent To Adoption: SUBSCRIBED AND SWORN To Before Me This - TH Day ofCyril BermudoNo ratings yet

- Walking a Tightrope: Biography of Honorable Mayor Catalino Gabot Hermosilla Sr.From EverandWalking a Tightrope: Biography of Honorable Mayor Catalino Gabot Hermosilla Sr.No ratings yet

- BIR RULING NO. OT-421-2021: Sun Life of Canada (Philippines), IncDocument6 pagesBIR RULING NO. OT-421-2021: Sun Life of Canada (Philippines), IncCarlota VillaromanNo ratings yet

- Revenue Regulation No. 16-2005Document0 pagesRevenue Regulation No. 16-2005Kaye MendozaNo ratings yet

- JuratDocument1 pageJuratpaxdonNo ratings yet

- 12 en - Banc - Reso - 2 - 2022 - Ja of Icpa and Usb 500 Pages or MoreDocument3 pages12 en - Banc - Reso - 2 - 2022 - Ja of Icpa and Usb 500 Pages or MoreMark DomingoNo ratings yet

- 8 RR No. 16-2021 (Allowing Submission of Scanned Copies of 2307)Document3 pages8 RR No. 16-2021 (Allowing Submission of Scanned Copies of 2307)Mark DomingoNo ratings yet

- 9644 - No LOA After Issuance of FAN, FDDA Void Including FANDocument19 pages9644 - No LOA After Issuance of FAN, FDDA Void Including FANMark DomingoNo ratings yet

- Argument Retroactive Application of RR No. 6-2018Document5 pagesArgument Retroactive Application of RR No. 6-2018Mark DomingoNo ratings yet

- Philippine Legal Forms 2015bDocument394 pagesPhilippine Legal Forms 2015bJoseph Rinoza Plazo100% (14)

- Legal Forms Syllabus (2015-2016)Document9 pagesLegal Forms Syllabus (2015-2016)Mark DomingoNo ratings yet

- CTA Law - R.A. 1125Document4 pagesCTA Law - R.A. 1125Mark DomingoNo ratings yet

- Aces Philippines V CIR GR 226680 - Aug 30 2022Document36 pagesAces Philippines V CIR GR 226680 - Aug 30 2022Mark DomingoNo ratings yet

- Act 2103Document1 pageAct 2103Bea Charisse MaravillaNo ratings yet

- EO 292 As Amended by RA9406Document1 pageEO 292 As Amended by RA9406Mark DomingoNo ratings yet

- Telecon Minutes of Special Meeting of BOD (Sample)Document2 pagesTelecon Minutes of Special Meeting of BOD (Sample)Mark DomingoNo ratings yet

- Act No 2711Document7 pagesAct No 2711Mark DomingoNo ratings yet

- List of Mandatory Requirements - Consulta PDFDocument49 pagesList of Mandatory Requirements - Consulta PDFvjgumbanNo ratings yet

- Legal FormsDocument54 pagesLegal FormsSuiNo ratings yet

- PETITION FOR BAILDocument6 pagesPETITION FOR BAILMark DomingoNo ratings yet

- Project Proposal: School: Sta. Justina National High School Municipality: Buhi Congressional District: 5thDocument3 pagesProject Proposal: School: Sta. Justina National High School Municipality: Buhi Congressional District: 5thMary Jean C. BorjaNo ratings yet

- Identification EvidenceDocument4 pagesIdentification EvidencekahmingpohNo ratings yet

- Conrad James As Republican Party OperativeDocument1 pageConrad James As Republican Party OperativeMichael CorwinNo ratings yet

- Assignment On Labour Law PDFDocument11 pagesAssignment On Labour Law PDFTwokir A. Tomal100% (1)

- FIR and Its Evidentiary ValueDocument15 pagesFIR and Its Evidentiary ValueRemiza KhatunNo ratings yet

- Selected Jurisprudential Doctrines in Criminal LawDocument30 pagesSelected Jurisprudential Doctrines in Criminal LawAlexandraSoledadNo ratings yet

- Questions For CrimPro Mock BarDocument7 pagesQuestions For CrimPro Mock BarNeil AntipalaNo ratings yet

- G.R. No. 254282 (Case Digest)Document7 pagesG.R. No. 254282 (Case Digest)Nathalie Gyle GalvezNo ratings yet

- Joseph Burstyn, Inc. v. Wilson (1951)Document6 pagesJoseph Burstyn, Inc. v. Wilson (1951)mpopescuNo ratings yet

- Municipal LiabilityDocument4 pagesMunicipal LiabilityKira Jorgio100% (1)

- NOTES ON ARBITRATION AND CONTRACTSDocument19 pagesNOTES ON ARBITRATION AND CONTRACTSanjsur28No ratings yet

- Political Ideology and Comparative LawDocument22 pagesPolitical Ideology and Comparative LawhenfaNo ratings yet

- POMOY vs. PEOPLEDocument1 pagePOMOY vs. PEOPLEPrincessClarize100% (1)

- Supreme Court Decision Nullifies Mass Naturalization, Rebukes Judge's ActionsDocument57 pagesSupreme Court Decision Nullifies Mass Naturalization, Rebukes Judge's ActionsBeethovenMarkNo ratings yet

- Undergraduatebulletin 20072008Document261 pagesUndergraduatebulletin 20072008jtaveras100% (1)

- Fetterolf Sewickley Complaint UncertifiedDocument23 pagesFetterolf Sewickley Complaint UncertifiedThePoliticalHatNo ratings yet

- People Vs QuijadaDocument18 pagesPeople Vs QuijadaJojo LaroaNo ratings yet

- Battery as a Tort: Remedies and DefensesDocument11 pagesBattery as a Tort: Remedies and DefensesfatinNo ratings yet

- Court Acts Without Hearing Prosecution on Murder BailDocument5 pagesCourt Acts Without Hearing Prosecution on Murder BailRonald Alasa-as AtigNo ratings yet

- Credit Transactions (Escano and Silos v. Ortigas)Document3 pagesCredit Transactions (Escano and Silos v. Ortigas)Maestro LazaroNo ratings yet

- Doh v. CamposanoDocument9 pagesDoh v. CamposanoHaniyyah FtmNo ratings yet

- Law of EvidenceDocument10 pagesLaw of EvidenceHarpreet ChawlaNo ratings yet

- Moral Principles ExerciseDocument1 pageMoral Principles ExerciseGerome Isaiah RabangNo ratings yet

- Lecture Notes 01Document3 pagesLecture Notes 01KentNo ratings yet

- Landbank Online Account OpeningDocument2 pagesLandbank Online Account OpeningLORD IVAN BERNABENo ratings yet

- Minimum Wage BillDocument15 pagesMinimum Wage BillBernewsAdminNo ratings yet

- Motion for JudgmentDocument3 pagesMotion for JudgmentMary Joy Rosales DelanNo ratings yet