Professional Documents

Culture Documents

CH 2 in Class

Uploaded by

MAINY RYANOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 2 in Class

Uploaded by

MAINY RYANCopyright:

Available Formats

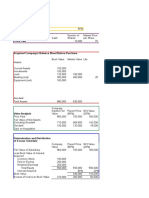

Chapter 2 Four Methods of recording an Equity Investment

On January 1, Year 5, Jenstar Corp. purchased 10% of the outstanding common shares of Safebuy Company at a cost of $95,000. Safebuy reported net income of assume this is a

$100,000 and paid dividends of $80,000 for the year ended December 31, Year 5. The fair value of Jenstar’s 10% interest in Safebuy was $98,000 at December 31, Year significant-

5. On January 10, Year 6, Jenstar sold its investment in Safebuy for $99,000. Ignore income tax and assumes that accumulated OCI for the FVTOCI investment is influence

transferred to retained earnings when the investment is sold. investment

FVTPL FVTOCI Cost Method Equity Method

Jan. 1, Year 5

Investment in Safebuy 95000 95000 95000 95000

Cash 95000 95000 95000 95000

To record the acquisition of 10% of Safebuy's shares

Dec. 31, Year 5

Cash (10% × 80,000) 8000 8000 8000 8000

Investment in safebuy 8000

Dividend income 8000 8000 8000

Investment in safebuy 10000

Equity Method Income 10000

Receipt of dividend from Safebuy

Dec. 31, Year 5

Investment in Safebuy (98,000–95,000) 3000 3000

Unrealized gains (reported in net income)

3000

OCI—unrealized gains 3000

To record investment at fair value

Jan. 10, Year 6 99000 99000 99000

Cash 98000 98000 95000

Investment in Safebuy 1000 4000

Gain on sale (reported in net income)

OCI—gain on sale 1000

Record sale of investment

Jan. 10, Year 6

Accumulated OCI—reclassification to retained earnings

4000

Retained earnings—gain on sale of FVTOCI investments

4000

Clear accumulated OCI to retained earnings

Self-Study 1

On January 1, Year 5, High Inc. purchased 10% of the outstanding common shares of Lowe Corp. for $192,000. From High’s perspective, Lowe was a FVTPL investment.

The fair value of High’s investment was $200,000 at December 31, Year 5. On January 1, Year 6, High purchased an additional 25% of Lowe’s shares for $500,000. This

second purchase allowed High to exert significant influence over Lowe. There was no acquisition differential on the date of the 25% acquisition. During the two years,

Lowe reported the following:

Profit Dividends

Year 5 $200,000 $120,000

Year 6 270,000 130,000

Required: Part A Prepare High’s journal entries with respect to this investment for both Year 5 and Year 6

Year 5 FVTPL

Dr Investment in 192K Cash 20k

Cr Cash 192k Cash 12k

Investment Rev 20k

Dr Investment Lo 8K Divend Rev 12k

Cr unrealized Gai 8k

Dr Investmnet FV 500k

Cr Cash 500k

Year 6 Equity Method

cash 45500

Investmnet in lowe 45500

Investment in low 94500

Equity methid reve 94500

You might also like

- Week 1 Notes From Chapter 2 - Investment in Equity SecuritiesDocument14 pagesWeek 1 Notes From Chapter 2 - Investment in Equity SecuritiesgloriyaNo ratings yet

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzNo ratings yet

- Review ComputationsDocument7 pagesReview ComputationsMae MaupoNo ratings yet

- Investment in Equity Securities (Prob 28-31)Document4 pagesInvestment in Equity Securities (Prob 28-31)Lorence Patrick LapidezNo ratings yet

- Co Operative HSG Soc. 2Document48 pagesCo Operative HSG Soc. 2ishan.patel.310No ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- Ifrs 9 Equity Investments IllustrationDocument7 pagesIfrs 9 Equity Investments IllustrationVatchdemonNo ratings yet

- Exercise 4Document7 pagesExercise 4Tania MaharaniNo ratings yet

- Chapter 4 - RoblesDocument18 pagesChapter 4 - RoblesYesha SibayanNo ratings yet

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- Financial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesDocument5 pagesFinancial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesShilla Mae BalanceNo ratings yet

- Consolidation - Cost vs. Equity MethodDocument8 pagesConsolidation - Cost vs. Equity MethodzaounxosakubNo ratings yet

- Tania Maharani - C1C019071 - Tugas AKL 4Document8 pagesTania Maharani - C1C019071 - Tugas AKL 4Tania MaharaniNo ratings yet

- Solution - Audit of InvestmentDocument4 pagesSolution - Audit of InvestmentMJ YaconNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Amounting 5,00,000.: Exelusively Ordinary Company Equity Capital. Debentures. Can Raise Capital FinancingDocument10 pagesAmounting 5,00,000.: Exelusively Ordinary Company Equity Capital. Debentures. Can Raise Capital FinancingMohit RanaNo ratings yet

- IFRS 9 Non-Strategic Equity Investments ExampleDocument10 pagesIFRS 9 Non-Strategic Equity Investments Examplenicklewandowski87No ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Corporate ReportingDocument5 pagesCorporate ReportingZANGINA Nicholas NaaniNo ratings yet

- Chap 17 1 3 SolutionsDocument5 pagesChap 17 1 3 Solutionspdmallari12No ratings yet

- ConsolidationDocument25 pagesConsolidationAEDRIAN LEE DERECHONo ratings yet

- Liabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsDocument3 pagesLiabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsAmit GodaraNo ratings yet

- POF Class Activity - 1Document1 pagePOF Class Activity - 1Muhammad MansoorNo ratings yet

- Final Quiz 1 Set A With AnswerDocument9 pagesFinal Quiz 1 Set A With Answer11mahogany.hazelnicoletiticNo ratings yet

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- Chapter 9 ExercisesDocument14 pagesChapter 9 Exercisesshiroe raabuNo ratings yet

- To Give The Shareholders / Investors The Return of Their Investments DividendsDocument8 pagesTo Give The Shareholders / Investors The Return of Their Investments DividendsDeryl GalveNo ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- Far460 Group Project 1Document3 pagesFar460 Group Project 1NURAMIRA AQILANo ratings yet

- Activity I Problem 15-6: W/ ChangesDocument106 pagesActivity I Problem 15-6: W/ Changesmore100% (1)

- Financial Accounting 2B Tutorials - 013048Document19 pagesFinancial Accounting 2B Tutorials - 013048Pinias ShefikaNo ratings yet

- Problem 2: Income StatementDocument1 pageProblem 2: Income StatementazisridwansyahNo ratings yet

- Assignment in Buscom at Acquisition and SubsequentDocument15 pagesAssignment in Buscom at Acquisition and SubsequentToni MarquezNo ratings yet

- Financial Analysis May Be Used To Test TheDocument8 pagesFinancial Analysis May Be Used To Test TheJohnAllenMarilla100% (1)

- This Study Resource Was: Quiz 16Document7 pagesThis Study Resource Was: Quiz 16Jeff GonzalesNo ratings yet

- Cash and Receivable Management With SolutionsDocument3 pagesCash and Receivable Management With SolutionsRandy ManzanoNo ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument31 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementRonak ChhabriaNo ratings yet

- A3 Example NotesDocument8 pagesA3 Example NotesMuyano, Mira Joy M.No ratings yet

- Statement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Document13 pagesStatement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Fiza Xiena100% (1)

- Investments in Equity Securities Problems (Victoria Corporation) Year 1Document12 pagesInvestments in Equity Securities Problems (Victoria Corporation) Year 1Xyza Faye Regalado100% (2)

- 2 Finalnew Suggans Nov09Document16 pages2 Finalnew Suggans Nov09spchheda4996No ratings yet

- N. Title Location: List of Examples Consolidation + Group AccountsDocument34 pagesN. Title Location: List of Examples Consolidation + Group AccountsMuhammad Sarfraz AsmatNo ratings yet

- Intercorporate - Class Exercises - ANSWERSDocument5 pagesIntercorporate - Class Exercises - ANSWERSKhushbooNo ratings yet

- Consolidated Net Income P 370,000 P 460,000: Illustrative ProblemsDocument11 pagesConsolidated Net Income P 370,000 P 460,000: Illustrative ProblemsKeir GaspanNo ratings yet

- Konsolidasi A. Alokasi Harga: Nama: Muhammad Fadhil NIM: 023152000055 Matkul: Pelaporan KorporatDocument7 pagesKonsolidasi A. Alokasi Harga: Nama: Muhammad Fadhil NIM: 023152000055 Matkul: Pelaporan KorporatMuhammad FadhilNo ratings yet

- Quiz - Investment, Part 2 ANSWERDocument4 pagesQuiz - Investment, Part 2 ANSWERJaylord Reyes100% (1)

- Required: Prepare Entries For Year 1 and 2 in The Books of Victoria CorporationDocument9 pagesRequired: Prepare Entries For Year 1 and 2 in The Books of Victoria CorporationJennica CruzadoNo ratings yet

- Assignment 2Document43 pagesAssignment 2Judy ZhangNo ratings yet

- Consolidated Working PaperDocument6 pagesConsolidated Working PaperChaCha Delos Reyes AguinidNo ratings yet

- Advance Financial Accounting Solutions - Chapter 2Document6 pagesAdvance Financial Accounting Solutions - Chapter 2haidaNo ratings yet

- Lets Try This 4Document2 pagesLets Try This 4syramaebillones26No ratings yet

- E 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Document10 pagesE 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Lusiana Purnama SariNo ratings yet

- Hifa NurafwaDocument8 pagesHifa Nurafwa20197 Elisa Nurhayati AhmadNo ratings yet

- Intermediate Accounting Chapter 4 ProblemsDocument18 pagesIntermediate Accounting Chapter 4 ProblemsPattraniteNo ratings yet

- By of 3,750: AccountDocument6 pagesBy of 3,750: AccountAravind ShekharNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- Financial Management For EntrepreneursDocument40 pagesFinancial Management For EntrepreneursHerald TheHorrorNo ratings yet

- Sixteenth Edition: Global E-Business and CollaborationDocument40 pagesSixteenth Edition: Global E-Business and CollaborationChong Wei Qian100% (1)

- Herauf10e SM Ch08 FINALDocument88 pagesHerauf10e SM Ch08 FINALMAINY RYAN0% (1)

- ?UTF 8?B?TGVjdHVyZTA1LnBkZg ? 2Document42 pages?UTF 8?B?TGVjdHVyZTA1LnBkZg ? 2MAINY RYANNo ratings yet

- ?UTF 8?B?TGVjdHVyZTA4LnBkZg ? 2Document66 pages?UTF 8?B?TGVjdHVyZTA4LnBkZg ? 2MAINY RYANNo ratings yet

- Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectDocument1 pageBranch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectNishchay Kumar RaiNo ratings yet

- Project Proposal For Real-Estate Development: Project To Be Implemented in Oromia Special Zone Sebeta TownDocument48 pagesProject Proposal For Real-Estate Development: Project To Be Implemented in Oromia Special Zone Sebeta TownTesfaye Degefa94% (17)

- Project On Max Life InsuranseDocument49 pagesProject On Max Life InsuranseViPul80% (15)

- Tax CalculationDocument4 pagesTax CalculationRajat SharmaNo ratings yet

- FATCA/CRS Declaration Form - (Individual)Document3 pagesFATCA/CRS Declaration Form - (Individual)ansfaridNo ratings yet

- Company ProfileDocument19 pagesCompany ProfileDiana CitraNo ratings yet

- Hotel Master Critical PathDocument14 pagesHotel Master Critical Pathtaola80% (25)

- The Maharashtra Stamp (Determination of True Market Value of Property) Rules, 1995 - Maharashtra Housing and Building LawsDocument20 pagesThe Maharashtra Stamp (Determination of True Market Value of Property) Rules, 1995 - Maharashtra Housing and Building LawsSudarshan GadalkarNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- 32585Document1 page32585anand suryaNo ratings yet

- IGCSE Economics RevisionDocument51 pagesIGCSE Economics RevisionZahra AliNo ratings yet

- Tax 1 - Ass No. 2Document6 pagesTax 1 - Ass No. 2De Guzman E AldrinNo ratings yet

- Market Failures and Government InterventionDocument20 pagesMarket Failures and Government InterventionGiorgi TediashviliNo ratings yet

- 200 SAP SD Interview Questions and AnswersDocument16 pages200 SAP SD Interview Questions and Answersestivali10No ratings yet

- TCF Annual Report 07 WebDocument74 pagesTCF Annual Report 07 WebcommunitymarketsNo ratings yet

- Reviewer On Taxation MamalateoDocument80 pagesReviewer On Taxation MamalateoKMBH100% (1)

- Concur Expense: Taxation: Setup Guide For Standard EditionDocument47 pagesConcur Expense: Taxation: Setup Guide For Standard Editionoverleap5208No ratings yet

- Me Important Question1,2,3,4,5Document58 pagesMe Important Question1,2,3,4,5Asis MahalikNo ratings yet

- Microeconomics Theory and Applications 12th Edition Browning Test Bank 1Document43 pagesMicroeconomics Theory and Applications 12th Edition Browning Test Bank 1michael100% (59)

- Deep Industries Limited: Pay Slip For The Month of SEPTEMBER - 2018Document2 pagesDeep Industries Limited: Pay Slip For The Month of SEPTEMBER - 2018Ankush SehgalNo ratings yet

- Release Notes Insurance 471 (FS-CM, FS-CD) EDocument133 pagesRelease Notes Insurance 471 (FS-CM, FS-CD) EViviana GuimarãesNo ratings yet

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFDocument2 pages2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoNo ratings yet

- Qatar PDFDocument26 pagesQatar PDFAbdullah SaleemNo ratings yet

- Request For Proposals: 2017 Lodging Tax FundDocument16 pagesRequest For Proposals: 2017 Lodging Tax FundPratitiNo ratings yet

- Example Problem Goal Programming PDFDocument21 pagesExample Problem Goal Programming PDFkash100% (1)

- Small Business Income and Expenses TemplateDocument3 pagesSmall Business Income and Expenses TemplateMETANOIANo ratings yet

- Business Tax AssignementDocument7 pagesBusiness Tax AssignementAleya MonteverdeNo ratings yet

- Test 1 Tax 667 - Mac 2019Document4 pagesTest 1 Tax 667 - Mac 2019Fakhrul Haziq Md FarisNo ratings yet

- 2005 BIR-RR ContentsDocument7 pages2005 BIR-RR ContentsMary Grace Caguioa AgasNo ratings yet

- Chapter VI Just CompensationDocument8 pagesChapter VI Just CompensationLawStudent101412No ratings yet