Professional Documents

Culture Documents

T9 - ABFA1153 (Extra)

Uploaded by

LOO YU HUANG0 ratings0% found this document useful (0 votes)

29 views2 pagesThis document discusses accounting for non-current assets such as land, motor vehicles, and furniture and fittings. It provides examples of recording transactions in the general ledger accounts for these non-current assets. It also shows extracts from the statement of financial position for the years 2008 and 2009, including the non-current asset balances and accumulated depreciation. Workings are provided for calculating depreciation amounts using the straight-line and reducing balance methods.

Original Description:

Financial Accounting Tutorial

Original Title

T9_ABFA1153 (extra)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses accounting for non-current assets such as land, motor vehicles, and furniture and fittings. It provides examples of recording transactions in the general ledger accounts for these non-current assets. It also shows extracts from the statement of financial position for the years 2008 and 2009, including the non-current asset balances and accumulated depreciation. Workings are provided for calculating depreciation amounts using the straight-line and reducing balance methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views2 pagesT9 - ABFA1153 (Extra)

Uploaded by

LOO YU HUANGThis document discusses accounting for non-current assets such as land, motor vehicles, and furniture and fittings. It provides examples of recording transactions in the general ledger accounts for these non-current assets. It also shows extracts from the statement of financial position for the years 2008 and 2009, including the non-current asset balances and accumulated depreciation. Workings are provided for calculating depreciation amounts using the straight-line and reducing balance methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

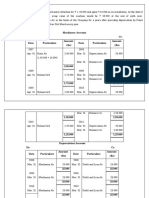

ABFA1153 FINANCIAL ACCOUNTING 1 1 May 2019

Tutorial 9 – Accounting for Non-current assets

Section 4: Acc. Dep.: Furniture & Fittings Account

Question 1: 2008 RM 2008 RM

Land Account Jan 1 Bal b/d 4,500

2008 RM 2008 RM Dec 31 Bal c/d 8,775 Dec 31 Depn 4,275

Jan 1 Bal b/d 80,000 Dec 31 Bal c/d 130,000 8,775 8,775

2010 Bank 50,000 2009 2009

130,000 130,000 Jan 1 Bal b/d 8,775

2009 2009 Dec 31 Bal c/d 13,236 Dec 31 Depn 4,461

Jan 1 Bal b/d 130,000 Dec31 Bal c/d 130,000 13,236 13,236

Motor Vehicles Account CUBE Trading

2008 RM 2008 RM Statement of Financial Position (extract) as at 31 December

Jan 1 Bal b/d 250,000 Dec31 Bal c/2 250,000

Non-current assets 2008 2009

Jan 1 Bal b/d 250,000 Dec 31 Bal c/d 295,000 RM RM RM RM

Bank 45,000 Land 850,000 850,000

295,000 295,000

Motor Vehicles 250,000 295,000

Furniture & Fittings Account Less : Accum Dep (50,000) 200,000 (79,500) 215,500

2008 RM 2008 RM

Jan 1 Bal b/d 90,000 Dec31 Bal c/2 90,000 Furniture & Fittings 90,000 98,000

Less : Accum Dep (8,775) 81,225 (13,236) 84,764

Jan 1 Bal b/d 90,000 Dec 31 Bal c/d 98,000 1,131,225 1,150,264

Bank 8,000

98,000 98,000

Acc. Dep.: Motor Vehicles Account

2008 RM 2008 RM Workings : Depreciation

Jan 1 Bal b/d 25,000 Motor vehicles : 2008 –> 250,000 x 10% = RM25,000

: 2009 –> 295,000 x 10% = RM29,000

Dec 31 Bal c/d 50,000 Dec 31 Depn 25,000

50,000 50,000

Furniture & Fittings:

2009 2009 1.1.08 NBV 85,00 (90,000-4,500)

Jan 1 Bal b/d 50,000 31.12.08 Depn (4,275) (85,500 x 5%)

Dec 31 Bal c/d 79,500 Dec 31 Depn 29,500

1.1.09 NBV 81,225

79,500 79,500 New 8,000

ABFA1153 FINANCIAL ACCOUNTING 1 2 May 2019

89,225

31.12.09 Depn (4,461) (89,225 5%)

NBV 84,764

Question 2:

(a) Depn. Each = (96,000-24,000)/3= 2,4000

(b) Reducing balance method:

RM

Cost 96,000

Yr1 (-) Dep. (96,000 x 37%) (35,520)

NBV 60,480

Yr2 (-) Dep. (60,480 x 37%) (22,378)

NBV 38,102

Yr3 (-) Dep. (38,102 x37%) (14,098)

NBV 24,004

You might also like

- Chapter 9 Special and Combination Journals, and Voucher SystemDocument3 pagesChapter 9 Special and Combination Journals, and Voucher SystemZyrene Kei Reyes100% (3)

- Social Construction of GenderDocument18 pagesSocial Construction of Genderyuuki_kiryuu23No ratings yet

- American Revolution Handout Cape History Unit 2Document6 pagesAmerican Revolution Handout Cape History Unit 2Janice Thomas100% (3)

- Piling Codes of Practice in Southern AfricaDocument7 pagesPiling Codes of Practice in Southern AfricaMfanelo MbanjwaNo ratings yet

- FAC1502 Tutorial Letter 102 UNISADocument45 pagesFAC1502 Tutorial Letter 102 UNISAdanNo ratings yet

- Book-Keeping and Accounts Level 2/series 2-2009Document13 pagesBook-Keeping and Accounts Level 2/series 2-2009Hein Linn Kyaw60% (10)

- Cost Operational AGMDocument1 pageCost Operational AGMAchmad DjunaidiNo ratings yet

- Installation and Setup Guide: Simulate ONTAP 9.7Document19 pagesInstallation and Setup Guide: Simulate ONTAP 9.7emcviltNo ratings yet

- BSP Accomplishment Report SampleDocument3 pagesBSP Accomplishment Report SampleMelbourneSinisin83% (6)

- Mckinsey - Transforming Advanced Manufacturing Through Industry 4 Point 0 - 2022Document7 pagesMckinsey - Transforming Advanced Manufacturing Through Industry 4 Point 0 - 2022Victor Cervantes ANo ratings yet

- 2008 LCCI Level1 Book-Keeping (1517-4)Document13 pages2008 LCCI Level1 Book-Keeping (1517-4)JessieChuk100% (2)

- Article On 1970s Angola Mercenaries, Colonel Mad Dog Callan Etc PDFDocument8 pagesArticle On 1970s Angola Mercenaries, Colonel Mad Dog Callan Etc PDFNick MustNo ratings yet

- Dark Days at Sunnyvale Can Teamwork Part The CloudsDocument3 pagesDark Days at Sunnyvale Can Teamwork Part The CloudsAssignmentLab.com100% (1)

- BK Chapter 12Document8 pagesBK Chapter 1232 Yeow Zi Xuan姚祉杏No ratings yet

- Answers AA015 - Chapter 8Document5 pagesAnswers AA015 - Chapter 8nur athirah100% (1)

- Faf Tutorial 3Document11 pagesFaf Tutorial 3ThomasNo ratings yet

- T10 - ABFA1153 (Extra)Document2 pagesT10 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- DepreciationDocument84 pagesDepreciationDubai SheikhNo ratings yet

- Practice Question DepreciationDocument100 pagesPractice Question DepreciationTinu Burmi AnandNo ratings yet

- 24.5 Gilbert CalDocument4 pages24.5 Gilbert CalINP PAINNo ratings yet

- CPA Paper 1 - Financial AccountingDocument13 pagesCPA Paper 1 - Financial Accountingahmad.khalif9999No ratings yet

- Worksheet Chapter 1 Accruals and prepayments (應計與預付項目)Document5 pagesWorksheet Chapter 1 Accruals and prepayments (應計與預付項目)Aejaz MohamedNo ratings yet

- SW3 PertubalDocument3 pagesSW3 PertubalNatividad, Kered ZilyoNo ratings yet

- SW3 Natividad BSA 2-13Document4 pagesSW3 Natividad BSA 2-13Natividad, Kered ZilyoNo ratings yet

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- AK Audit of Receivables ACP103Document2 pagesAK Audit of Receivables ACP103km dummieNo ratings yet

- Musendo Exams SolutionsDocument43 pagesMusendo Exams SolutionsTarmak Lyon100% (1)

- Depreciation AccountingDocument12 pagesDepreciation Accountingshreyu14796No ratings yet

- AC 100 Aug2006 MSDocument6 pagesAC 100 Aug2006 MSERICK MLINGWANo ratings yet

- Investment Accounts-Master Mind Answers PDFDocument7 pagesInvestment Accounts-Master Mind Answers PDFRam IyerNo ratings yet

- Intermediate Accounting 2008 PDFDocument7 pagesIntermediate Accounting 2008 PDFchin leaNo ratings yet

- FinancialsDocument10 pagesFinancialskamlesh_kumarNo ratings yet

- Chapter 22 Partnership Changes Q1 Wilson, Keppel and BettyDocument2 pagesChapter 22 Partnership Changes Q1 Wilson, Keppel and Bettymelody shayanwakoNo ratings yet

- Chapter 9 Special and Combination Journals and Voucher System Compress Chapter 9 Basic Financial Accounting and Reporting - CompressDocument3 pagesChapter 9 Special and Combination Journals and Voucher System Compress Chapter 9 Basic Financial Accounting and Reporting - Compresscorpuz.earlarchibal02No ratings yet

- AccountingDocument4 pagesAccountingclementhii264No ratings yet

- Exercise 11-7Document2 pagesExercise 11-7Kysa SmithNo ratings yet

- BQ Domestic Ipal 80 KK 6KKDocument3 pagesBQ Domestic Ipal 80 KK 6KKEdoElnatanNapitupuluNo ratings yet

- Ngongo Lundikazi 201813006 Tut3Document6 pagesNgongo Lundikazi 201813006 Tut3lundingongoNo ratings yet

- Partnership Accounts QuestionsDocument4 pagesPartnership Accounts QuestionsKaleli RockyNo ratings yet

- Master of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Document6 pagesMaster of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Namrata RamgadeNo ratings yet

- C2Document8 pagesC2Afzal AhmedNo ratings yet

- Data Rekap Imb Sampai 2022 r1Document1 pageData Rekap Imb Sampai 2022 r1teddyNo ratings yet

- ASE2007 Revised Syllabus - Specimen Paper Answers 2008Document7 pagesASE2007 Revised Syllabus - Specimen Paper Answers 2008WinnieOngNo ratings yet

- December 10th 2009 (KB)Document4 pagesDecember 10th 2009 (KB)nic tNo ratings yet

- 01.00 - CE - Slide Gate 2.0 X 2.0m - MotorizeDocument8 pages01.00 - CE - Slide Gate 2.0 X 2.0m - MotorizeJonesNo ratings yet

- AP PPE QuizDocument3 pagesAP PPE QuizjomsNo ratings yet

- Latihan Soal HageDocument4 pagesLatihan Soal HageLinda HaryantiNo ratings yet

- TM 6Document29 pagesTM 6hasnaNo ratings yet

- Wahab Limited SolutionDocument15 pagesWahab Limited SolutionPervaiz AkhterNo ratings yet

- ProbssDocument10 pagesProbssKlysh SalvezNo ratings yet

- Rek Mandiri Sep New PDFDocument2 pagesRek Mandiri Sep New PDFFarid RuskandaNo ratings yet

- BQ - Pulau Type 'E' (K.namu & Kemiri)Document1 pageBQ - Pulau Type 'E' (K.namu & Kemiri)dwi heru kusnadiNo ratings yet

- Car ShowroomDocument20 pagesCar ShowroomDanish ShakeelNo ratings yet

- Monthly BudgetDocument12 pagesMonthly Budgetwilfred panganibanNo ratings yet

- Chapter 8 - Notes Payable and Debt Restructuring: Problem 8-7Document3 pagesChapter 8 - Notes Payable and Debt Restructuring: Problem 8-7Pau LaguertaNo ratings yet

- Detailed Price ComparisonDocument1 pageDetailed Price ComparisonTariqMahmoodNo ratings yet

- 01.00 - CE - Operating Gear 2.0 X 0.8m - ManualDocument5 pages01.00 - CE - Operating Gear 2.0 X 0.8m - ManualJonesNo ratings yet

- 0452 Accounting: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersDocument10 pages0452 Accounting: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersItai Nigel ZembeNo ratings yet

- 01.00 - CE - Slide Gate 0.8 X 0.8mDocument7 pages01.00 - CE - Slide Gate 0.8 X 0.8mJonesNo ratings yet

- Solution For MFRS112 ExercisesDocument11 pagesSolution For MFRS112 Exercisesm-7039266No ratings yet

- Answers To PreboardDocument7 pagesAnswers To PreboardCodeSeekerNo ratings yet

- General Journal Date Account Title Debit CreditDocument3 pagesGeneral Journal Date Account Title Debit CreditAhwer KhanNo ratings yet

- General LedgerDocument6 pagesGeneral LedgerAqmarRahmatNo ratings yet

- Joural, T Account and TBDocument9 pagesJoural, T Account and TBPrafulla Man PradhanNo ratings yet

- Chapter 2 Residence StatusDocument9 pagesChapter 2 Residence StatusLOO YU HUANGNo ratings yet

- Chapter 4 Employment IncomeDocument29 pagesChapter 4 Employment IncomeLOO YU HUANGNo ratings yet

- Chapter 3 Ascertainment of Chargeable IncomeDocument9 pagesChapter 3 Ascertainment of Chargeable IncomeLOO YU HUANGNo ratings yet

- T3 - ABFA1153 (Extra)Document3 pagesT3 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- T2 - ABFA1153 (Extra)Document2 pagesT2 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- International Marketing Review: Article InformationDocument24 pagesInternational Marketing Review: Article InformationThuy Linh NguyenNo ratings yet

- Word OrderDocument6 pagesWord OrderEditura Sf MinaNo ratings yet

- Potsdam Police Blotter May 6Document3 pagesPotsdam Police Blotter May 6NewzjunkyNo ratings yet

- Case Information: Go Back NowDocument3 pagesCase Information: Go Back Nowghj6680No ratings yet

- Actgfr ch02Document21 pagesActgfr ch02chingNo ratings yet

- FamilyDocument19 pagesFamilySarvesh yadavNo ratings yet

- Keith Haring Foundation v. Colored Thumb - ComplaintDocument22 pagesKeith Haring Foundation v. Colored Thumb - ComplaintSarah BursteinNo ratings yet

- Appendix A: Base VariablesDocument9 pagesAppendix A: Base VariablesMarlhen EstradaNo ratings yet

- Environmental ClearanceDocument5 pagesEnvironmental ClearanceRadhakrishnaNo ratings yet

- 16º Interpretação TextualDocument59 pages16º Interpretação TextualAlessandro SantosNo ratings yet

- Sir M. Visvesvaraya Institution of Technology Bangalore: Name: Ranjitha O Usn: 1Mz19Mba17Document12 pagesSir M. Visvesvaraya Institution of Technology Bangalore: Name: Ranjitha O Usn: 1Mz19Mba17Nithya RajNo ratings yet

- World Bank SME FinanceDocument8 pagesWorld Bank SME Financepaynow580No ratings yet

- Ds Web Gateway Reverse ProxyDocument3 pagesDs Web Gateway Reverse ProxyKuncen Server (Yurielle's M-Chan)No ratings yet

- Strategy Evaluation and ChoiceDocument3 pagesStrategy Evaluation and ChoicePrabakaran PrabhaNo ratings yet

- The Origins of HumanismDocument2 pagesThe Origins of HumanismnadaatakallaNo ratings yet

- Downloads - Covid 19 SOP GuidelinesDocument10 pagesDownloads - Covid 19 SOP GuidelinesRashidi RahmanNo ratings yet

- Lesson 8 For May 25, 2019Document10 pagesLesson 8 For May 25, 2019Maj LualhatiNo ratings yet

- Indian Zinc Industry, Zinc Industry in India, Zinc Industry, Zinc IndustriesDocument7 pagesIndian Zinc Industry, Zinc Industry in India, Zinc Industry, Zinc IndustriesNitisha RathoreNo ratings yet

- Cherry HillDocument2 pagesCherry HillAbhinay_Kohli_4633No ratings yet

- 3 ExerciseDocument3 pages3 Exercisehhvuong5859No ratings yet

- Iim Bodh Gaya SynopsisDocument7 pagesIim Bodh Gaya SynopsiskhanNo ratings yet

- Jadwal Atls Online 12 Juni 21, JKTDocument3 pagesJadwal Atls Online 12 Juni 21, JKTTedja PrakosoNo ratings yet