Professional Documents

Culture Documents

Tugas AKD Week 9

Uploaded by

Muhammad zikri FajarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas AKD Week 9

Uploaded by

Muhammad zikri FajarCopyright:

Available Formats

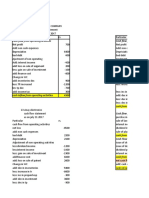

E23-11

Fairchild Company

Statement of Cash Flow

For The Year Ended December 31, 2015

Cash Flow from Operating Activities

Net Income 810

Adjustment to reconcile to net income

Increase in depreciation expense 30

Increase in account receivable -450

Gain on sale investment -80

Increase in account payable 400

Decrease in acrued liabilites -50

Decrease in inventory 300 150

Net Cash provided from operating activities 960

Cash Flow from Investing Activities

Increase in plant asset -130

Sale Investment 250

Net cash provided from Investing activies 120

Cash flow from Financing activities

Issuance Share Capital 130

Increase in bond payable -250

Payment Cash Devidend -260

Net cash provided from financing activities -380

Net increase 700

Cash, January 1, 2015 1100

Cash, December 31, 2015 1800

P23-1

SULLIVAN CORP.

Statement of Cash Flows

For The Year Ended December 31, 2015

Cash flows from operating activities

Net Income 370,000

Adjustments to reconcile net income

Depreciation 147,000

Gain on sale of equipment - 2,000

Equity in earnings of Myer's Co - 35,000

Decrease in accounts receivable 40,000

Increase in inventory - 135,000

Increase in accounts payable 60,000

Decrease in income taxes payable - 20,000 55,000

Net cash provided by operating activities 425,000

Cash flows from investing activities :

Proceeds from sale of equipment 40,000

Loan to TLC Co - 300,000

Principal payment of loan receivable 50,000

Net cash provided by investing activities - 210,000

Cash flows from financing activities

Dividends paid - 100,000

Net cash provided by financing activities - 100,000

Net increase in cash 115,000

Cash, January 1, 2015 700,000

Cash, December 31, 2015 815,000

You might also like

- Lesson 6 - Cash Flows PDFDocument40 pagesLesson 6 - Cash Flows PDFChy B80% (5)

- ASSESSMENTSDocument23 pagesASSESSMENTSJoana TrinidadNo ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRavina Singh100% (1)

- CH 21 TBDocument18 pagesCH 21 TBJessica Garcia100% (1)

- Cashflow ActivityDocument2 pagesCashflow ActivityHannie CaratNo ratings yet

- Annisa Nabila Kanti - Task 17Document4 pagesAnnisa Nabila Kanti - Task 17Annisa Nabila KantiNo ratings yet

- Tugas Cash Flow (Kel 4)Document22 pagesTugas Cash Flow (Kel 4)RamaNo ratings yet

- Cash FlowDocument12 pagesCash FlowalguienNo ratings yet

- Cash FlowsDocument12 pagesCash FlowsEjaz AhmadNo ratings yet

- 01 eLMS Activity 3 - ARGDocument2 pages01 eLMS Activity 3 - ARGJilliane MaineNo ratings yet

- Gould Corporation - Cash FlowDocument1 pageGould Corporation - Cash FlowYasir RahimNo ratings yet

- Carol Majestica-01012190047-PR Pertemuan 04Document7 pagesCarol Majestica-01012190047-PR Pertemuan 04nadila ika sefiraNo ratings yet

- Akmen MandiriDocument6 pagesAkmen Mandiricalsey aNo ratings yet

- Activity 1 Intact 3Document7 pagesActivity 1 Intact 3Kate NuevaNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Llagas 01 eLMS Activity 3Document3 pagesLlagas 01 eLMS Activity 3Angela Fye LlagasNo ratings yet

- Akm 2 Week 11Document3 pagesAkm 2 Week 11Ahsan FirdausNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Assignment: Financial Ratios: Submitted byDocument4 pagesAssignment: Financial Ratios: Submitted byHarshit DalmiaNo ratings yet

- Chapter 17 Cash FlowDocument13 pagesChapter 17 Cash FlowToni MarquezNo ratings yet

- ASS SoCFDocument2 pagesASS SoCFpau mejaresNo ratings yet

- Adhila Sandra Devy - LF53 - Cash in FlowsDocument4 pagesAdhila Sandra Devy - LF53 - Cash in FlowsLydia limNo ratings yet

- WEEK 9 Solution To Questions On Statement of Cash FlowsDocument3 pagesWEEK 9 Solution To Questions On Statement of Cash Flowsvictoriaahmad95No ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementSara KarenNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Ex 09 Electro ProductsDocument6 pagesEx 09 Electro ProductsRiznel Anthony CapaladNo ratings yet

- Cash Flows StatementDocument2 pagesCash Flows StatementWambo MonsterrNo ratings yet

- SAPL Exercise On Cash flows-IndASDocument1 pageSAPL Exercise On Cash flows-IndASSakshi SodhiNo ratings yet

- Cash Flow 2020 SpringDocument2 pagesCash Flow 2020 SpringPravin Sagar ThapaNo ratings yet

- M - 30 S 2020 o ($'000) ($'000) ADocument10 pagesM - 30 S 2020 o ($'000) ($'000) AAmmar TahirNo ratings yet

- Statement of Cash FlowsDocument42 pagesStatement of Cash FlowsCelina PamintuanNo ratings yet

- Cash Flow Prob 2 and 3Document7 pagesCash Flow Prob 2 and 3LOKI MATENo ratings yet

- Assignment 17Document8 pagesAssignment 17Nicolas ErnestoNo ratings yet

- Assignment 6Document8 pagesAssignment 6Lara Lewis AchillesNo ratings yet

- Cash FlowDocument3 pagesCash FlowErica BrionesNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- 01 ELMS Activity 3Document1 page01 ELMS Activity 3alexandra CarataoNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- HI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsDocument24 pagesHI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsFeku RamNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Cash Flow Statement-ShortDocument27 pagesCash Flow Statement-ShortLaurene Delos ReyesNo ratings yet

- Topic 5 Workshop SolutionsDocument7 pagesTopic 5 Workshop SolutionsCậuBéQuàngKhănĐỏNo ratings yet

- SAPL Cash FlowDocument11 pagesSAPL Cash FlowDibyendu Dey ChakrabortyNo ratings yet

- Bookkeeping Practice SetDocument31 pagesBookkeeping Practice SetSittie NorhanizahNo ratings yet

- Traditional HW 10, 11Document1 pageTraditional HW 10, 11gShOnEy8No ratings yet

- The Statement of Cash Flows Problems 5-1. (Currency Company)Document7 pagesThe Statement of Cash Flows Problems 5-1. (Currency Company)Marcos DmitriNo ratings yet

- BSB110 Solutions To RevisionDocument20 pagesBSB110 Solutions To RevisionSiyuan JiNo ratings yet

- Today'S Lesson: Preparing Cash Flow StatementDocument3 pagesToday'S Lesson: Preparing Cash Flow StatementTAFARA MUKARAKATENo ratings yet

- DauderisAnnand-IntroFinAcct-Chapter11 AmendedDocument15 pagesDauderisAnnand-IntroFinAcct-Chapter11 AmendedHome Made Cookin'No ratings yet

- Economatica Actividad 6Document17 pagesEconomatica Actividad 6Jenny Zulay SUAREZ SOLANONo ratings yet

- Net Cash Flow From Operating ActivitiesDocument3 pagesNet Cash Flow From Operating ActivitiesRydel CuachonNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Kelompok: Achmad Bahari Ilmi (041711333127) Yohanes Bosko Arya Bima (041711333195)Document3 pagesKelompok: Achmad Bahari Ilmi (041711333127) Yohanes Bosko Arya Bima (041711333195)ulil alfarisyNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- Performance Evaluation of Mutual Funds in India: Literature ReviewDocument12 pagesPerformance Evaluation of Mutual Funds in India: Literature Reviewritik bumbakNo ratings yet

- ADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsDocument6 pagesADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsFahad33% (3)

- CH 3 Open Economy Macroeconomics (Chap 3-2017) NewDocument63 pagesCH 3 Open Economy Macroeconomics (Chap 3-2017) NewLemma MuletaNo ratings yet

- Accounts PracticleDocument75 pagesAccounts PracticleMITESHKADAKIA60% (5)

- Asset Declaration RahimaDocument3 pagesAsset Declaration RahimaMukhlesur RahmanNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Financial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesDocument2 pagesFinancial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesMay Grethel Joy PeranteNo ratings yet

- M & A Regulations Takeover Code: Amity Global Business SchoolDocument56 pagesM & A Regulations Takeover Code: Amity Global Business SchoolAnkita DhimanNo ratings yet

- Banking Theory, Law and PracticeDocument51 pagesBanking Theory, Law and PracticePrem Kumar.DNo ratings yet

- Final Exam Abm 1Document2 pagesFinal Exam Abm 1Jucel Marco100% (1)

- Indian Banking Sector & Nabard, Sidbi, Exim & NHBDocument32 pagesIndian Banking Sector & Nabard, Sidbi, Exim & NHBramixudinNo ratings yet

- The Philip Fisher Screen That Fishes Quality StocksDocument3 pagesThe Philip Fisher Screen That Fishes Quality StocksMartinNo ratings yet

- Ecs Mandate Idbi1Document4 pagesEcs Mandate Idbi1lotusnotesjct9497No ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- FIN2004 - 2704 Week 2 SlidesDocument60 pagesFIN2004 - 2704 Week 2 SlidesJalen GohNo ratings yet

- Pakistan Water and Power Development Authority: (In Quadruplicate)Document2 pagesPakistan Water and Power Development Authority: (In Quadruplicate)AsadAli100% (1)

- Hyperin Ation in Venezuela: Research Question, Aim and GoalDocument2 pagesHyperin Ation in Venezuela: Research Question, Aim and GoalMilica NikolicNo ratings yet

- Assignment On MoneybhaiDocument7 pagesAssignment On MoneybhaiKritibandhu SwainNo ratings yet

- Recently Asked KYC Interview Questions and AnswersDocument21 pagesRecently Asked KYC Interview Questions and AnswersChika Novita PutriNo ratings yet

- Igcse Accounting Multiple Choice FDocument43 pagesIgcse Accounting Multiple Choice FAung Zaw HtweNo ratings yet

- Property Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693Document8 pagesProperty Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693fido1983No ratings yet

- How To Start A Picture Framing BusinessDocument3 pagesHow To Start A Picture Framing BusinessNi NeNo ratings yet

- Currency FuturesDocument14 pagesCurrency Futurestelesor13No ratings yet

- ECO-2-D11 - Compressed PDFDocument6 pagesECO-2-D11 - Compressed PDFAkshay kumarNo ratings yet

- PRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012Document4 pagesPRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012tilshilohNo ratings yet

- 06 MaterialityDocument2 pages06 MaterialityMan Cheng100% (1)

- AdmissionDocument23 pagesAdmissionPawan TalrejaNo ratings yet

- Compare Voltas With Blue Star - EquitymasterDocument12 pagesCompare Voltas With Blue Star - Equitymasteratul.jha2545No ratings yet

- Lira District Report of The Auditor General 2015 PDFDocument59 pagesLira District Report of The Auditor General 2015 PDFlutos2No ratings yet