Professional Documents

Culture Documents

Form12 Sunpetro E87776 Desh Deepak 2023 2024

Uploaded by

Desh DeepakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form12 Sunpetro E87776 Desh Deepak 2023 2024

Uploaded by

Desh DeepakCopyright:

Available Formats

FORM NO.

12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1 Employee code/name: E87776-DESH DEEPAK

Address of the employee: H.No-129a, WARD N0-2, SHASTRI NAGAR, KAILY ROAD, NEAR NAGAR

2

PANCHAYAT OFFICE,

3 PAN of the employee: ERPPD5888B

4 Financial year: 2023-2024

Details of claims and evidence thereof

Evidence

Sl. No Nature of claim Amount(Rs.)

/particulars

(1) (2) (3) (4)

1 House Rent Receipt

Rent Receipts

Rent paid to the landlord 0 with signed by

landlord

Note: Permanent Account Number shall be furnished if the

aggregate rent paid during the Previous year exceeds one lakh

rupees and Benefit is available only for rent paid

2 Leave travel concessions or assistance 0

2 Income/loss from house property(Let out) 0

3 Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

(ii)Name of the lender

(iii) Address of the lender

(iv) Permanent Account Number of the lender

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

4 Income from other sources 0

5 Deduction under Chapter VI-A

80C-PF 25320.00

Verification

I,DESH DEEPAK son/daughter of RAM KESH SINGH hereby certify

that the information given above is complete and correct.

Place: CHANDAULI

Date: 24/07/2023 (Signature of the employee)

Designation: Sr. Officer Full Name: DESH DEEPAK

You might also like

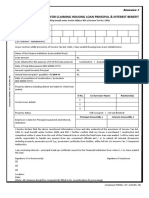

- Self-Declaration For Claiming Housing Loan Principal & Interest BenefitDocument1 pageSelf-Declaration For Claiming Housing Loan Principal & Interest Benefitinkedin linkedinNo ratings yet

- Caja Automatica Suzuki Sidekick 1995Document15 pagesCaja Automatica Suzuki Sidekick 1995Glenn50% (2)

- Mark Muscente ResumeDocument3 pagesMark Muscente Resumeapi-355428390No ratings yet

- Field Training Program On FTTH: Introduction To FTTH, PON Technologies FTTH Link Design Aspects FTTH Tariffs and PlansDocument60 pagesField Training Program On FTTH: Introduction To FTTH, PON Technologies FTTH Link Design Aspects FTTH Tariffs and Plansnetfrog100% (3)

- Deed of Road Right of WayDocument6 pagesDeed of Road Right of WayPlaridel Madrigal75% (4)

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- Form 12BB Qqa0345Document6 pagesForm 12BB Qqa0345Santosh UlpiNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Form 12BB Oz-2756Document4 pagesForm 12BB Oz-2756alankarmcNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument4 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAmitNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportKabir's World dinoloverNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- Form 12BBDocument2 pagesForm 12BBNithin B HNo ratings yet

- Img 0006Document3 pagesImg 0006Puneet GuptaNo ratings yet

- Form 12BB PW9560Document3 pagesForm 12BB PW9560hunterrems18No ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- Form-12BB Format - FY 2023-24Document2 pagesForm-12BB Format - FY 2023-24Sreedhar BodalapalleNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAnonymous Gg6z0u9IBzNo ratings yet

- Housing Loan Self DeclarationDocument1 pageHousing Loan Self DeclarationSreenivasa RaoNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- Neha Enterprise DRC-03 Dated 03-04-2023 (131000)Document2 pagesNeha Enterprise DRC-03 Dated 03-04-2023 (131000)vikenveerNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Agriculture Loan App - FCFLDocument6 pagesAgriculture Loan App - FCFLankitssinghgadhwalNo ratings yet

- Loan Application Format - (CROP LOAN/ KCC) : Crop Loans With Kisan Credit CardDocument6 pagesLoan Application Format - (CROP LOAN/ KCC) : Crop Loans With Kisan Credit CardSandipan DasNo ratings yet

- 2022 23 0251 - BLDocument2 pages2022 23 0251 - BLAccount Branch RewariNo ratings yet

- Rishabh 239Document1 pageRishabh 239Anikate SharmaNo ratings yet

- MOSL Pledge Request FormDocument2 pagesMOSL Pledge Request FormPushpa Devi100% (1)

- MandateFormDocument1 pageMandateFormuniquerealestate098No ratings yet

- Six Digit As Given On Pay SlipDocument4 pagesSix Digit As Given On Pay SlipShahzad DurraniNo ratings yet

- Hba Form11Document3 pagesHba Form11Kamaraj PandianNo ratings yet

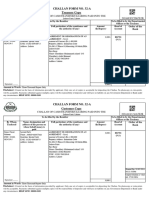

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheniazartgraphicsNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- Annex SPLDocument6 pagesAnnex SPLNaafsiif AddunyaaNo ratings yet

- Allegis - Investment Proof Submission Form - 2018-19Document6 pagesAllegis - Investment Proof Submission Form - 2018-19Sachin Kumar J KNo ratings yet

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheniazartgraphicsNo ratings yet

- FormANNX 2022 1Document3 pagesFormANNX 2022 1spider14No ratings yet

- Form 16 - Fy 2019-20Document4 pagesForm 16 - Fy 2019-20CA SHOBHIT GoelNo ratings yet

- Form 12BB 270491Document2 pagesForm 12BB 270491ShreeKrishnaGuptaNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Instrument For Registration of Lease For Residential UnitsDocument2 pagesInstrument For Registration of Lease For Residential UnitsM. AdhityaNo ratings yet

- Form ISR-4: Request For Issue of Duplicate Certificate and Other Service RequestsDocument3 pagesForm ISR-4: Request For Issue of Duplicate Certificate and Other Service RequestsNidhi AggarwalNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Rent AgreementDocument7 pagesRent AgreementarpanghatakNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- Form Deposit RefundDocument2 pagesForm Deposit RefundMIKAIL FizaNo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- LTA Reimbursement Claim Form For 2020-2021: Company NameDocument3 pagesLTA Reimbursement Claim Form For 2020-2021: Company NameAnish JainNo ratings yet

- Mahesh Chand v. DSC Ltd. EXE - PET.no.128 of 2019 Affidavit of Assets JD-2 PDFDocument347 pagesMahesh Chand v. DSC Ltd. EXE - PET.no.128 of 2019 Affidavit of Assets JD-2 PDFvinay kumar100% (1)

- ConnectionPrintPDF AspxDocument1 pageConnectionPrintPDF AspxraghavcyberpointNo ratings yet

- MandateFormDocument2 pagesMandateFormNitin RautNo ratings yet

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- Abb Furse Earthing A4 8pp Brochure FinalDocument8 pagesAbb Furse Earthing A4 8pp Brochure FinalTony BombataNo ratings yet

- Application of TCSC To Enhance Power Transfer CapabilityDocument20 pagesApplication of TCSC To Enhance Power Transfer Capabilitykubera uNo ratings yet

- Brexit - Unravelling The Ties That Bind The Past, Present, and FutureDocument26 pagesBrexit - Unravelling The Ties That Bind The Past, Present, and FutureShoaib A. MalikNo ratings yet

- Mockingbird Corrective Action PlanDocument11 pagesMockingbird Corrective Action Planthe kingfishNo ratings yet

- FM PDFDocument1 pageFM PDFnes2130No ratings yet

- Barriers For Deconstruction and Reuse:Recycling of Construction Materials - CIB 2014 PDFDocument186 pagesBarriers For Deconstruction and Reuse:Recycling of Construction Materials - CIB 2014 PDFNadine MuffelsNo ratings yet

- Republic vs. Valencia CcvcccbjbtyrxcDocument2 pagesRepublic vs. Valencia CcvcccbjbtyrxcMonikka100% (1)

- Eng SS 114-151009 A3Document48 pagesEng SS 114-151009 A3Crespo JorgeNo ratings yet

- Oracle R12 Multi Period AccountingDocument37 pagesOracle R12 Multi Period AccountingSiva KumarNo ratings yet

- Encoder Incremental KoyoDocument3 pagesEncoder Incremental KoyovisypatyNo ratings yet

- Hm70 Mobile Chipset BriefDocument4 pagesHm70 Mobile Chipset BriefUmair Latif KhanNo ratings yet

- 2022-The General Court's Decisions On State Aid Law in Times of COVID-19 PandemicDocument24 pages2022-The General Court's Decisions On State Aid Law in Times of COVID-19 Pandemicllord.zhouNo ratings yet

- Module 1 & 2Document55 pagesModule 1 & 2Amit TiwaryNo ratings yet

- Level Switch Vibration Liquiphant S FTL 70 71 TIDocument20 pagesLevel Switch Vibration Liquiphant S FTL 70 71 TIHerman SandyNo ratings yet

- Design Impact: Darin Grice Creates New Protective HeadgearDocument2 pagesDesign Impact: Darin Grice Creates New Protective HeadgearspencergriceNo ratings yet

- HVAC Maintenance PDFDocument13 pagesHVAC Maintenance PDFКирилл СоколовNo ratings yet

- Bach, Well Tempered ClavierDocument3 pagesBach, Well Tempered ClavierLucas BauerNo ratings yet

- Transport Management SystemDocument12 pagesTransport Management Systemvinay748678No ratings yet

- Manual Secador CD 550+Document1 pageManual Secador CD 550+Paulo GarciaNo ratings yet

- Stacks HWDocument3 pagesStacks HWSarah PachapureNo ratings yet

- Biomechatronic HandDocument17 pagesBiomechatronic HandZubear Mustafa100% (1)

- Marketing 3rd Quarter ReviewerDocument10 pagesMarketing 3rd Quarter ReviewerJohn Cris BuanNo ratings yet

- 12 796 and 798 Update - Jeff - 20nov18Document17 pages12 796 and 798 Update - Jeff - 20nov18tatiana100% (1)

- SDDSDDocument2 pagesSDDSDKaushalya PereraNo ratings yet

- Modelling of Electrical Transformers in Dynamic RegimesDocument8 pagesModelling of Electrical Transformers in Dynamic RegimesFatmir JashariNo ratings yet

- KirbyDocument42 pagesKirbyandrogutlay55555No ratings yet