Professional Documents

Culture Documents

Sec Code of Corporate Governance Principle

Uploaded by

reigne carlit0 ratings0% found this document useful (0 votes)

8 views2 pagesThe SEC Code of Corporate Governance outlines principles and policies to foster ethical behavior, effective risk management, prudent leadership and transparency in Philippine corporations. It aims to raise governance standards to regional and global levels. Key provisions include establishing a code of business conduct, strengthening board independence and performance, enhancing disclosure, respecting stakeholder rights, and encouraging sustainability and social responsibility. The Board is responsible for implementing the code to ensure management and employees comply with internal policies.

Original Description:

sUMMARY ABOUT SEC CODE OF CORPORATE GOVERNANCE PRINCIPLE

Original Title

SEC CODE OF CORPORATE GOVERNANCE PRINCIPLE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe SEC Code of Corporate Governance outlines principles and policies to foster ethical behavior, effective risk management, prudent leadership and transparency in Philippine corporations. It aims to raise governance standards to regional and global levels. Key provisions include establishing a code of business conduct, strengthening board independence and performance, enhancing disclosure, respecting stakeholder rights, and encouraging sustainability and social responsibility. The Board is responsible for implementing the code to ensure management and employees comply with internal policies.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesSec Code of Corporate Governance Principle

Uploaded by

reigne carlitThe SEC Code of Corporate Governance outlines principles and policies to foster ethical behavior, effective risk management, prudent leadership and transparency in Philippine corporations. It aims to raise governance standards to regional and global levels. Key provisions include establishing a code of business conduct, strengthening board independence and performance, enhancing disclosure, respecting stakeholder rights, and encouraging sustainability and social responsibility. The Board is responsible for implementing the code to ensure management and employees comply with internal policies.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

SEC CODE OF CORPORATE GOVERNANCE P4 – FOSTERING COMMITMENT P8 – ENHANCING COMPANY DISCLOSURE

PRINCIPLE POLICIES AND PROCEDURES

R1 – Attend meetings (50% Absence- ground for disq)

THE BOARD’S GOVERNANCE RESPONSIBILITIES R2 – Multiple board seats (5 publicly listed companies) R1 –have Corporate disclosure policies & procedures

R3 – Incumbent director R2 – Internal disclosure to company any dealings by l l l l

P1 – COMPETENT BOARD director in company shares

P5 – REINFORCING BOARD INDEPENDENCE R3 – Disclosure of board members and key executives’ l

R1 -Competence material information

R2 – Majority of non executive directors R1 - Composition (higher between, at least 3 IDs/ 1/3 l l R4 – Disclosure on policies/procedure for Board and l l l

R3 – Training of directors (orientation) of the members of the board) executing remuneration

R4 – Board Diversity R2 – Possess qualifications & none of disqualification R5 – Disclosure on policies governing RPTs

R6 – Compliance Officer R3 – IDs serve max cumulative term of 9 years R6 – Disclosure on the acquisition/disposal of l l l l l l l ll l l

R4 – 2 tier board (separate positions for CH and CEO) significant assets

P2 – ROLES & RESPONSIBILITIES OF BOARD R5 – Lead director (if chairman- not indp or 1-tier board R7 – Manual on Corporate Governance contains PPP

R6 - Self-dealing directors (no participation in in RPT, l l

R1 – Fiduciary Duty (duty of care & loyalty) self-dealing or any transaction with material interest) P9 – STRENGTHENING THE EXTERNAL AUDITOR’S

R2 – Strategic Direction and Corporate Performance R7 – Non-executive director INDEPENDENCE AND IMPROVING AUDIT QUALITY

R3 - Chairperson

R4 – Succession Planning (retirement policy) R1 – Process for Appointment, Reappointment, L L LL L

R5 – Remuneration and other performance P6 – ASSESSING BOARD PERFORMANCE LLLL Removal and Fees of the external director

R6 – Board nomination & election R2 - Audit Com – assess the integrity and

R7 – Related party transactions R1 - Annual Self-Assessment (Board, CH), counter assess l l independence of external auditors

by external facilitator every 3 years

R8 – Executive Mngt Team & Annual Performance c R3 – Disclose nature of non-audit services by external

R2 - System (criteria and process of assessing performance)

Evaluation directors

R9 – Performance Management Framework

R10 – Internal Control System P10 – INCREASING ON FOCUS ON NON-FINANCIAL

P7 – STRENGTHENING BOARD ETHICS

R11 – Enterprise Risk Management AND SUSTAINABILITY REPORTING

R12 – Board Charter R1 – Adopt Code od Business Conduct and Ethic

R1 - Policy on disclosing Material and reportable non

R2 – Policies implementing the Code of Business ; l ; l

P3 – BOARD COMITTEES financial and sustainability issues (EESG issues)

Conduct and Ethics governing

R1 – Board Committee

R2 – Audit Committee

R3 – Corporate Governance Committee P11 – PROMOTING A COMPREHENSIVE AND COST-

DISCLOSURE AND TRANSPARENCY

R4 - Board Risk Oversight Committee EFFICIENT ACCESS TO RELEVANT INFORMATION

R5 – Related Party Transaction Committee

R6 – Committee Charters

R1 – Media and analyst’ briefing as channels of P14 – RESPECTING RIGHTS OF STAKEHOLDERS On November 10, 2016, the Securities and Exchange

communication to ensure timely and accurate AND EFFECTIVE REDRESS FOR VIOLATION OF Commission approved the Code of Corporate Governance

dissemination STAKEHOLDER’S RIGHT for publicly-listed companies.

INTERNAL CONTROL SYSTEM AND RISK R1 – Identification of Stakeholders

MANAGEMENT FRAMEWORK R2 – Fair Treatment and Protection of Stakeholders Its goal is to help companies develop and sustain an

(policies and programs) ethical corporate culture and keep abreast with recent

P12 – STRENGTHENING THE INTERNAL CONTROL R3 – Stakeholder Engagement and its touchpoints developments in corporate governance

SYSTEM AND ENTERPRISE RISK MANAGEMENT (allow SK communicate and redress the violation

FRAMEWORK of their rights through IRO,OSC,CRO,CCG)

to raise corporate governance standards of Philippine

R1 – have Internal Control System & Enterprise Risk

corporations to a level at par with its regional and global

Management Framework

counterparts.

R2 – Independent Internal Audit Function P15 – ENCOURAGE EMPLOYEES PARTICIPATION

R3 - Chief Audit Executive (CAE)

R4 - separate Risk Management Function R1 – Policies and Programs for the Benefit of the

Employees One of its salient provisions is for publicly-listed

R5 – Chief Risk Officer (CRO)

R2 – Anti-Corruption Policy and Programs companies is to establish a code of business conduct and

R3 – Whistleblowing Framework/Policy submit a new manual on Corporate Governance that would

“provide standards for professional and ethical behavior as

CULTIVATING A SYNERGIC RELATIONSHIP WITH P16 – ENCOURAGING SUSTAINABILITY AND well as articulate acceptable and unacceptable conduct and

SHAREHOLDERS SOCIAL RESPONSIBILITY practices”.

P13 – PROMOTING SHAREHOLDER RIGHTS R1 – Interdependence between business and society

and mutual beneficial relationships The Board of Directors is required to implement the code

R1 – Basic Shareholder’s right (disclosed-Manual&web) (Sustainable Development) ad make sure that management and employees comply

R2 – Notice of Annual and Special Shareholder’s with the internal policies set.

Meeting (at least 28 days before meeting)

R3 - Voting Results(next working day) and Minutes of

meeting (within 5 bus days from the meeting)

R4 - Alternative Dispute Resolution (ADR)

R5 – Investor Relations Office (IRO)

DUTIES TO STAKEHOLDERS Securities and Exchange Commission (SEC)

Memorandum Circular No. 19, Series of 2016

You might also like

- 2nd Director of Lockheed Skunkwork's Shocking Comments About UFO TechnologyDocument6 pages2nd Director of Lockheed Skunkwork's Shocking Comments About UFO Technologyloriann14No ratings yet

- Audit Committee Guide KPMGDocument61 pagesAudit Committee Guide KPMGSara SunceNo ratings yet

- FLVL-QHSE-SOP-F-006 Management Review MeetingDocument7 pagesFLVL-QHSE-SOP-F-006 Management Review MeetingmanjunathaNo ratings yet

- Personal JXN Flow ChartDocument1 pagePersonal JXN Flow Chartpmariano_5No ratings yet

- Reading List: Black Economists On Criminal Justice: Mstevenson@law - Virginia.eduDocument46 pagesReading List: Black Economists On Criminal Justice: Mstevenson@law - Virginia.eduMelissa BoughtonNo ratings yet

- Cpa Ethics and Governance Exam IndexDocument28 pagesCpa Ethics and Governance Exam IndexDamien Smith100% (1)

- Androa Asenua V UgandaDocument30 pagesAndroa Asenua V UgandaAloro Abdul Hakim BonaparteNo ratings yet

- Manual of Corporate Governance: Theory and Practice for Scholars, Executive and Non-Executive DirectorsFrom EverandManual of Corporate Governance: Theory and Practice for Scholars, Executive and Non-Executive DirectorsNo ratings yet

- Overview of PNP P.A.T.R.O.L. PLAN 2030: Philippine National Police Special Action ForceDocument90 pagesOverview of PNP P.A.T.R.O.L. PLAN 2030: Philippine National Police Special Action ForceLower Dean Araza HurbinaNo ratings yet

- Sample Succession Plan: Association of Baltimore Area Grantmakers Leadership Development and Emergency Succession PlanDocument6 pagesSample Succession Plan: Association of Baltimore Area Grantmakers Leadership Development and Emergency Succession PlanJoohee LeeNo ratings yet

- Capital, Liquidity, Recovery and Resolution Plans: Helping You Manage Your SREP FrameworkDocument8 pagesCapital, Liquidity, Recovery and Resolution Plans: Helping You Manage Your SREP FrameworkmohamedNo ratings yet

- What Is An HR Maturity Level?Document20 pagesWhat Is An HR Maturity Level?Cha Magaoay Tamani100% (1)

- Project AnalyticsDocument19 pagesProject AnalyticsalNo ratings yet

- G G C G: Uide To OOD Orporate OvernanceDocument14 pagesG G C G: Uide To OOD Orporate OvernanceE W100% (1)

- The Marketing Director's Role in Business Planning and Corporate GovernanceFrom EverandThe Marketing Director's Role in Business Planning and Corporate GovernanceNo ratings yet

- IT Governance Assessment MasterclassDocument102 pagesIT Governance Assessment MasterclassCarolynn ChalmersNo ratings yet

- Business Policy Chapter 1-3 SlidesDocument77 pagesBusiness Policy Chapter 1-3 SlidesAfaq Zaim0% (1)

- Botha Nepgen - Connecting The Dots PAS 55 ISO 55000 and GFMAMDocument133 pagesBotha Nepgen - Connecting The Dots PAS 55 ISO 55000 and GFMAMrevitaNo ratings yet

- Index CPA Ethics & Governance - Sem 2 2020Document51 pagesIndex CPA Ethics & Governance - Sem 2 2020NirmitNo ratings yet

- 2-Pengenalan Kluasul ISO55K - KeywordsDocument37 pages2-Pengenalan Kluasul ISO55K - KeywordsKhayrina TrimarentraNo ratings yet

- GOVERCO-Notes (CH 3 & 4)Document2 pagesGOVERCO-Notes (CH 3 & 4)Dianne BallonNo ratings yet

- (Remuneration) : Overview of Corporate Governance Corporate Governance - Various PerspectivesDocument22 pages(Remuneration) : Overview of Corporate Governance Corporate Governance - Various PerspectivesValentina Tan DuNo ratings yet

- CH 02 Wheelen 10e SMDocument11 pagesCH 02 Wheelen 10e SMAbdul HannanNo ratings yet

- SLT Ar 2018 PDFDocument192 pagesSLT Ar 2018 PDFanushanNo ratings yet

- ACAUD-2348-N000-Auditing Theory 2Document20 pagesACAUD-2348-N000-Auditing Theory 2Royce DenolanNo ratings yet

- MG8591 Principals of Management - by WWW - Learnengineering.inDocument126 pagesMG8591 Principals of Management - by WWW - Learnengineering.inSimson SilvestarNo ratings yet

- Overview of The Professional Practices Framework: Presented To The Dallas Chapter IIA By: Lori Rainwater, CIA, CPA, CFEDocument35 pagesOverview of The Professional Practices Framework: Presented To The Dallas Chapter IIA By: Lori Rainwater, CIA, CPA, CFEAaronJosiahNo ratings yet

- Chap01 - Managerial AccountingDocument15 pagesChap01 - Managerial AccountingChi Nguyễn Thị KimNo ratings yet

- (Relations With Shareholders) : Overview of Corporate Governance Corporate Governance - Various PerspectivesDocument17 pages(Relations With Shareholders) : Overview of Corporate Governance Corporate Governance - Various PerspectiveschinchangeNo ratings yet

- GRC New 1Document18 pagesGRC New 1santhoshkapalavai2No ratings yet

- FGV Ar2016Document370 pagesFGV Ar2016Raymond LimNo ratings yet

- Junior Lawyer - Job Description PDFDocument4 pagesJunior Lawyer - Job Description PDFNicholas Dammen Jr.No ratings yet

- HF5 SKaizenDocument186 pagesHF5 SKaizenSyed AliNo ratings yet

- Chapter 6Document16 pagesChapter 6aa4e11No ratings yet

- STRATEGY Case Notes Case Study Tricon Re PDFDocument20 pagesSTRATEGY Case Notes Case Study Tricon Re PDFNoor FatimaNo ratings yet

- Outline - Corporate Governance PDFDocument5 pagesOutline - Corporate Governance PDFHamzaNo ratings yet

- New Cover.1ADocument19 pagesNew Cover.1Asomnath konarNo ratings yet

- GSK Annual Report 2020Document193 pagesGSK Annual Report 2020Mustafa Aziz SadiqNo ratings yet

- Risk Management Week 4 171019 StudentDocument21 pagesRisk Management Week 4 171019 StudentHristo DimitrovNo ratings yet

- Orgip Im Ge 08 2-Annex4Document40 pagesOrgip Im Ge 08 2-Annex4TadilakshmikiranNo ratings yet

- Worksheet in G bizSAFE RM Audit Template Rev 160401Document12 pagesWorksheet in G bizSAFE RM Audit Template Rev 160401HT MokNo ratings yet

- 419 Reviewer MIDTERMSDocument12 pages419 Reviewer MIDTERMSGatungay JanessaNo ratings yet

- Report On Corporate GovernanceDocument22 pagesReport On Corporate GovernanceMahek KhanNo ratings yet

- Corporate Governance Syllabus Aug 2012Document9 pagesCorporate Governance Syllabus Aug 2012Dushyant PatadiyaNo ratings yet

- Course Outline - Ethics, Risk and Corporate GovernanceDocument6 pagesCourse Outline - Ethics, Risk and Corporate GovernancemahrukhNo ratings yet

- Pertemuan 8 Laporan KeberlanjutanDocument14 pagesPertemuan 8 Laporan KeberlanjutanBryan PradindaNo ratings yet

- Opaud NotesDocument13 pagesOpaud NotesGOJO MOJOJOJONo ratings yet

- Calibrating Precision: Annual ReportDocument194 pagesCalibrating Precision: Annual ReportHu Ri AbbaxiNo ratings yet

- CSF-not UploadingDocument2,708 pagesCSF-not UploadingHAMMADHRNo ratings yet

- CA Final Paper 3 Auditing Vol 2 Ravi SirDocument266 pagesCA Final Paper 3 Auditing Vol 2 Ravi SirNaveen MudhireddyNo ratings yet

- CIMA Conference: Essential Management Accounting Tools: Saturday 4 October 2014Document62 pagesCIMA Conference: Essential Management Accounting Tools: Saturday 4 October 2014bdmoinNo ratings yet

- Jenifer Basalo, CpaDocument12 pagesJenifer Basalo, CpaJenifer BasaloNo ratings yet

- 5 Competency Dictionary-SignedDocument38 pages5 Competency Dictionary-SignedJoannalyn GarciaNo ratings yet

- Iso 45001:2018 Implementation: Ruth Wilkinson, BSC (Hons), MSC, Cmiosh Head of Health and SafetyDocument20 pagesIso 45001:2018 Implementation: Ruth Wilkinson, BSC (Hons), MSC, Cmiosh Head of Health and Safetyabdulrahman abduNo ratings yet

- Lucky Cement Limited Annual Report 2022corrected 1Document396 pagesLucky Cement Limited Annual Report 2022corrected 1Hamza AsifNo ratings yet

- Corporate Governance Country Assessment PakistanDocument88 pagesCorporate Governance Country Assessment PakistanHannah RoseNo ratings yet

- Lec 2Document35 pagesLec 2Ahmad FauzanNo ratings yet

- How Choices Shape Corporate Cultures and Drive Personal and Professional ResultsDocument18 pagesHow Choices Shape Corporate Cultures and Drive Personal and Professional ResultsJose Miguel González PeraltaNo ratings yet

- P Btec H N D B 04. M & O (4) : Ssignment RiefDocument3 pagesP Btec H N D B 04. M & O (4) : Ssignment RiefQueen RaniaNo ratings yet

- Ar SRTG 2020 EngDocument160 pagesAr SRTG 2020 Enghedrywan8No ratings yet

- 2022 Topic 1-4 OverviewDocument10 pages2022 Topic 1-4 OverviewIma AdakaNo ratings yet

- Quality Assurance Review For Internal Audit ExcellenceDocument5 pagesQuality Assurance Review For Internal Audit ExcellencerakhasuryaNo ratings yet

- Chapter 1 - BFMDocument60 pagesChapter 1 - BFMTricia Kate TungalaNo ratings yet

- SOX Matrixes in Tenaris: StartDocument388 pagesSOX Matrixes in Tenaris: StartDiego Martin MatillaNo ratings yet

- RiskproBrochure2021 210405 151013Document44 pagesRiskproBrochure2021 210405 151013Sir JohnNo ratings yet

- Republic Act No 10175 - Chap5-8Document3 pagesRepublic Act No 10175 - Chap5-8reigne carlitNo ratings yet

- Republic Act No 10175-Chap 1Document3 pagesRepublic Act No 10175-Chap 1reigne carlitNo ratings yet

- Republic Act No 10175 - Chap 3 - 4Document5 pagesRepublic Act No 10175 - Chap 3 - 4reigne carlitNo ratings yet

- Summary of IAS 17Document4 pagesSummary of IAS 17reigne carlitNo ratings yet

- Government Budget ProcessDocument3 pagesGovernment Budget Processreigne carlitNo ratings yet

- Accountancy (Far Eastern University) Accountancy (Far Eastern University)Document21 pagesAccountancy (Far Eastern University) Accountancy (Far Eastern University)Shiela DanoNo ratings yet

- Character List of Hidden FiguresDocument5 pagesCharacter List of Hidden Figuresuzma latifNo ratings yet

- 2017-1, 28 November 2017 Proseding Unri ISBNDocument43 pages2017-1, 28 November 2017 Proseding Unri ISBNrositaNo ratings yet

- 2022 Icas TC Ar V ImpDocument534 pages2022 Icas TC Ar V ImphayatmyNo ratings yet

- ART Ganani Thesis v2 GRODocument248 pagesART Ganani Thesis v2 GROcregalbasuNo ratings yet

- Constitution. Project PDFDocument16 pagesConstitution. Project PDFPrince RajNo ratings yet

- DI Afghanistan 2010 EOM Final Report - WebDocument72 pagesDI Afghanistan 2010 EOM Final Report - WebDixon Sanjaya10No ratings yet

- SampleDocument12 pagesSampleRefilwe MakololoNo ratings yet

- Cambridge IGCSE: 0450/22 Business StudiesDocument12 pagesCambridge IGCSE: 0450/22 Business StudiesAurpa RahmanNo ratings yet

- Lembar Penilaian Pidato Bahasa InggrisDocument10 pagesLembar Penilaian Pidato Bahasa InggrisShabila LintangNo ratings yet

- National Service Training Program 1 - CWTS 3 Units Prerequisite: NoneDocument3 pagesNational Service Training Program 1 - CWTS 3 Units Prerequisite: NoneJamesluis PartosaNo ratings yet

- Panel of Auditors IBTS AuditDocument1 pagePanel of Auditors IBTS AuditPriska MalvinNo ratings yet

- Region Ix Zamboanga PeninsulaDocument6 pagesRegion Ix Zamboanga PeninsulaFroscheNo ratings yet

- Hmo Enrollment - Premium Deduction Schedule: Pay-Out Date Premium Payment CoverageDocument1 pageHmo Enrollment - Premium Deduction Schedule: Pay-Out Date Premium Payment CoveragePatrisha Mari KerrNo ratings yet

- AP - 12-20-2018 - APV#110652 - Aldrew & Gray Transport, Inc (ID 32399) PDFDocument42 pagesAP - 12-20-2018 - APV#110652 - Aldrew & Gray Transport, Inc (ID 32399) PDFLeah MoscareNo ratings yet

- Introduction: Jamiatur Raza Centre For Islamic Studies Bareilly Sharif IndiaDocument28 pagesIntroduction: Jamiatur Raza Centre For Islamic Studies Bareilly Sharif IndiaTariq100% (2)

- ToR Kickoff PMO-3Document3 pagesToR Kickoff PMO-3Almo PradanaNo ratings yet

- SectionA Group8 Manzana InsuranceDocument19 pagesSectionA Group8 Manzana Insurancekarthikmaddula007_66No ratings yet

- H4 EAD Complaint - Redacted (Nebraska)Document14 pagesH4 EAD Complaint - Redacted (Nebraska)sjsjNo ratings yet

- Decision Tree Exercise 2 SolDocument5 pagesDecision Tree Exercise 2 SoljitenNo ratings yet

- Seyon c1Document13 pagesSeyon c1Seyon HunpeganNo ratings yet

- How Washington Is Internationalising Conflict in The Red SeaDocument2 pagesHow Washington Is Internationalising Conflict in The Red Sealr473709No ratings yet

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping AgencyAnuj SoniNo ratings yet

- 2018-11-26 Endorsement of Partial List of Milf CommunitiesDocument34 pages2018-11-26 Endorsement of Partial List of Milf CommunitiesMohamedin SalilaguiaNo ratings yet

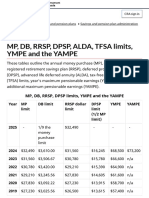

- MP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - CaDocument4 pagesMP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - Caag9004282No ratings yet