Professional Documents

Culture Documents

OBE Syllabus FAR

Uploaded by

Pearl Richmond LayugCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OBE Syllabus FAR

Uploaded by

Pearl Richmond LayugCopyright:

Available Formats

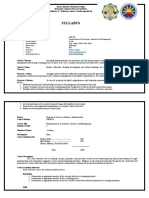

PAMANTASAN NG LUNGSOD NG MAYNILA

(University of the City of Manila)

PLM BUSINESS SCHOOL

Accountancy Department

DEGREE PROGRAM BACHELOR OF SCIENCE IN ACCOUNTANCY

PRE-REQUISITE/ CO-

COURSE CODE COURSE TITLE UNITS COURSE TYPE PRE-REQUISITE TO

REQUISITE

ACN1101 FINANCIAL ACCOUNTING AND REPORTING 3 Lecture --

This course provides a reinforcement of basic accounting, within the context of business and business decisions. Students obtain additional knowledge of

the principles and concepts of accounting as well as their application that will enable them to appreciate the production of accounting data. Emphasis is

placed on understanding the reasons underlying basic accounting concepts and providing students with an adequate background on the recording of

COURSE DESCRIPTION

transactions, their classifications and reporting function of accounting in a service and trading concern through the preparation of Statement of Financial

Position, Income Statement, Statement of Changes in Equity, and Cash Flow Statement. Exposure through the use of practice set, either manual or

computerized system in recording and reporting transactions for service or trading firms a requirement in this course.

UNIVERSITY VISION

The Pamantasan ng Lungsod ng Maynila shall be the premier people’s university pursuing public interest and national development.

UNIVERSITY MISSION

The Pamantasan ng Lungsod ng Maynila shall form critical-minded and service-oriented leaders and innovators in various disciplines through accessible and relevant quality

education, transformative institutional research and extension services, and key linkages.

CORE VALUES

The Pamantasan ng Lungsod ng Maynila shall be guided by the values of academic excellence, integrity and social responsibility, and by the principles of Karunungan, Kaunalaran and Kadakilaan.

GOALS AND KEY RESULT AREAS

“RAISE PLM”

Provide Relevant Quality Tertiary Education

Generate Augmented Resources

Sustain Institutionalized Research and Extension

Deliver Service to the Public

Advance Employee, Faculty and Student Welfare

Promote Public Interest

Establish Linkages and Partnerships

Optimize Management of Resources

PROGRAM EDUCATIONAL OBJECTIVES

Graduates of BS Accountancy Program are expected to:

1. Be highly competent in financial accounting, cost accounting, management accounting, government and non-profit accounting, auditing theories and applications,

management advisory services, tax accounting and forensic accounting as manifested in their involvement in their professional knowledge, skills, values, ethics and

attitudes that enable them to continue to learn and adapt to change throughout their professional lives.

2. Demonstrate analytical thinking and problem solving skills

3. Be successful in pursuing employment in commerce and industry; pubic practice; government and education sectors.

PROGRAM OUTCOMES

A graduate of the Bachelor of Science in Accountancy (BSA) program must attain:

a. Demonstrate working knowledge in the areas of financial accounting and reporting, cost accounting and management, management accounting, auditing, accounting

information systems and accounting research.

b. Demonstrate self-confidence in performing functions as a professional accountant.

c. Employ technology as a business tool in capturing financial and non-financial information, preparing reports and making decisions.

d. Apply acquired knowledge and skills to pass professional licensure/certification examinations.

e. Appraise ethical problems/issues in practical business and accounting situations and recommend appropriate course of action that adheres to the professional code of ethics.

f. Competent to support national, regional and local development plans.

2 | PLM BS / Accountancy/ FAR

General Topics No. Of Learning Objectives Topics for Discussion Methodology Assessment/ Supplementary

Hours Evaluation Resources

The learners shall be able to:

Week 1 Power point

a. Express ones thought about the Course Orientation

3 hours presentation

course Assignment: Microsoft Teams

1. Syllabus

b. Know the structure and MS Form Class List

requirement of the course. 2. Class Policy Interactive Zoom

c. Be familiar on the roundabout Discussion

3. LMS ( Microsoft teams

of the learning management

and Zoom)

systems (LMS) of PLM.

a. Describe the nature and

purpose of accounting.

b. Give examples of branches of Enabling Activities:

accounting. Power point

Poll/Self-

c. State the function of accounting presentation

Assessment

in a business.

You tube:

d. Differentiate between external 1. Nature of Accounting

Weeks and internal users of accounting 2. History of Accounting Accounting History

2-3 information. Main Task:

The Nature of 3. Business Environment

e. Trace the historical background Interactive

Accounting and 6 hours 4. Accounting Concept and Power Point

of accounting. Discussion Quiz

its Environment Principles Presentation:

f. State the forms of business

organization

g. State the types of business Reinforcement

according to their activities. Task:

h. Explain the varied accounting Group Work/

concepts and principles. Case study Practice set

i. Solve exercises on accounting

principles as applied in various

cases.

3 | PLM BS / Accountancy/ FAR

General Topics No. Of Learning Objectives Topics for Discussion Methodology Assessment/ Supplementary

Hours Evaluation Resources

The learners shall be able to:

a. Illustrate the accounting

equation.

b. Perform operations involving

simple cases with the use of

accounting equation.

c. Discuss the five major

accounts. Power point

d. Cite examples of each type of presentation Enabling Activities:

account. Poll/Self-

e. Prepare a Chart of Accounts. 1. Accounting Equation Assessment

f. Illustrate the format of general 2. Types of Major Accounts You tube:

Weeks and special journals. 3. Book of accounts and

Accounting g. Illustrate the format of general Interactive Main Task:

4-6 double entry system

Equation and and subsidiary ledgers. Discussion

9 hours 4. Business transaction and Quiz

double entry h. Describe the nature and give Power Point

their analysis

System examples of business Presentation:

5. Posting to the ledger

transactions.

i. Identify the different types of Reinforcement

business documents. Group Work/ Task:

j. Analyze common business Case study

transactions using the rules of Practice set

debit and credit.

k. Post transactions in the ledger

l. Prepare the unadjusted trial

balance.

Payroll and other a. Prepare payroll sheet and Enabling Activities: You tube:

1. Payroll/Payroll sheet

selected Weeks record salaries, wages and Power point

2. Acquisition cost of properties Poll/Self-

Business 7-8 payroll liabilities. presentation

3. Sale of Assets Assessment

b. Compute and record business

4. Owner’s Investment and

4 | PLM BS / Accountancy/ FAR

General Topics No. Of Learning Objectives Topics for Discussion Methodology Assessment/ Supplementary

Hours Evaluation Resources

The learners shall be able to:

taxes. Main Task:

c. Compute and record interest Interactive

/non-interest bearing notes. withdrawals Discussion Quiz

6 hours 5. Interest and non-interest Power Point

Transaction d. Record owner’s investment and

bearing notes. Presentation:

withdrawal of properties.

e. Record acquisition, use and 6. Taxes and registration fees

Reinforcement

disposal of properties. Task:

Group Work/

Case study Practice set

MIDTERM WEEK

Power point Enabling Activities:

presentation Poll/Self-

Assessment

a. Enumerate the common end-of- You tube:

Weeks period adjustments. 1. Adjusting Entries

Completing the 10-12 b. Prepare adjusting entries. 2. Financial statements Main Task:

Accounting Cycle Interactive

c. Prepare Worksheet 3. Closing entries Quiz

(Service Discussion Power Point

d. Prepare Financial Statements 4. Reversing entries

Provider) 12 hours e. Prepare closing entries Presentation:

f. Prepare Reversing entries

Reinforcement

Task:

Group Work/

Case study Practice set

Week a. Describe the nature of 1. Merchandising transactions Power point

Accounting Cycle

13-15 transactions in a merchandising 2. Journal, Cash book and presentation Enabling Activities: You tube:

of a

business. Special Journals

merchandising Poll/Self-

5 | PLM BS / Accountancy/ FAR

General Topics No. Of Learning Objectives Topics for Discussion Methodology Assessment/ Supplementary

Hours Evaluation Resources

The learners shall be able to:

Assessment

b. Record transactions of a

merchandising business in the

general and special journals. Interactive Main Task:

3. Adjusting and closing entries

c. Post transactions in the general Discussion

4. Post closing Trial balance, Quiz

and subsidiary ledgers. Power Point

business 9 hours Worksheet

d. Prepare adjusting entries. Presentation:

5. Financial Statements and

e. Prepare Worksheet

Financial Analysis

f. Prepare Financial Statements Reinforcement

g. Prepare closing entries Group Work/ Task:

h. Prepare Reversing entries Case study

Practice set

Power point

presentation Enabling Activities:

a. Explain why statement of cash Poll/Self-

flows is important. Assessment

b. Identify the cash activities as You tube:

operating, investing or financing.

1. Major business activities Interactive Main Task:

Reporting Cash c. Compute cash flows from

2. Direct and Indirect method Discussion

Flow operating activities using direct Quiz

3. Statement of cash flows Power Point

method and indirect method.

d. Compute cash flows from Presentation:

investing and finacing activities.

e. Prepare statement of cash flows. Reinforcement

Group Work/ Task:

Case study

Practice set

FINAL EXAMINATION WEEK

6 | PLM BS / Accountancy/ FAR

COURSE ASSESSMENT Quizzes 25%

Recitation/Poll/Self-Assessment 15

Assignment 5

Attendance/Behavior 5

Practice Set 10

Midterm Examination 20

Final Examination 20

100%

Transmutation:

98 - 100 1.00 83 – 85 2.25

95 – 97 1.25 80 – 82 2.50

92 – 94 1.50 77 – 79 2.75

89 – 91 1.75 75 – 76 3.00

86 – 88 2.00 Below 75 5.00

TEXTBOOK/ REFERENCES

1. The Accounting Process by Manuel, Zenaida

2. Financial Accounting and Reporting by Millan

3. Basic Accounting, by Valencia

4. Accounting by Warren and Reeve

5. Fundamentals of Accountancy, Business, and Management 1 by Flocer Lao Ong

6. Principles of accounting by Jerry Weygandt, Keryn Chalmers, Lorena Mitrione, Michelle Fyfe, Susana Yeun, Donald Kieso,

Paul Kimmel

Attested by: _______________________________

Librarian

CLASS POLICY 1. Don't share your password with anyone. Change your password if you think someone else might know it.

2. Always log out when you are finished using the system.

3. Students must contribute to the online discussions. ALL students should be logged in.

4. ALL assignments should be submitted by a specific due date. Late submission will not be accepted regardless of the reason.

5. Derogatory and sarcastic comments and jokes that marginalize anyone are fundamentally unacceptable.

6. Criticism must be constructive, well-meaning, and well-articulated.

7. All content and materials are copyrighted. Unauthorized use and sharing are strictly prohibited.

8. Always give proper credit when referencing or quoting another source. Avoid plagiarism.

7 | PLM BS / Accountancy/ FAR

9. Do not send confidential information via e-mail.

10. Sign your message with your name and return e-mail address

11. Make posts that are on topic and within the scope of the course material.

12. Avoid using the caps lock feature AS IT CAN BE INTERPRETTED AS YELLING.

COURSE CODE/ TITLE EFFECTIVITY DATE REVISION DATE PREPARED BY REVIEWED BY APPROVED BY NUMBER OF

(Faculty) (Dept Chair) (Acting Dean) PAGES

1st Semester

ACN1101 July 27 ,2020 Prof Jenely S. Almirol Prof. Josephine P. Yopo Dean Bernard Letrero 8

2023 – 2024

8 | PLM BS / Accountancy/ FAR

You might also like

- BUILDING THE SKILLS: LEARNING EXPERIENCE AT A CHARTERED ACCOUNTANT FIRMFrom EverandBUILDING THE SKILLS: LEARNING EXPERIENCE AT A CHARTERED ACCOUNTANT FIRMNo ratings yet

- OBE Syllabus Stategic Bus. Analysis Mgt. Acctg.Document10 pagesOBE Syllabus Stategic Bus. Analysis Mgt. Acctg.Rowena RogadoNo ratings yet

- Pamantasan NG Lungsod NG Maynila (University of The City of Manila) PLM Business School Accounting DepartmentDocument10 pagesPamantasan NG Lungsod NG Maynila (University of The City of Manila) PLM Business School Accounting DepartmentAndrea BaldonadoNo ratings yet

- PDF Conceptual Framework and Accounting Standard Syllabus DDDocument11 pagesPDF Conceptual Framework and Accounting Standard Syllabus DDMariya BhavesNo ratings yet

- Course Outline: Accounting Department Faculty of Economics and Business, Universitas BrawijayaDocument11 pagesCourse Outline: Accounting Department Faculty of Economics and Business, Universitas BrawijayaEddi SoegiartoNo ratings yet

- Ok - Elect 304 Services MarketingDocument20 pagesOk - Elect 304 Services Marketingchristian duranNo ratings yet

- College of Business and Entrepreneurial Technology: Rizal Technological UniversityDocument8 pagesCollege of Business and Entrepreneurial Technology: Rizal Technological Universitypraise ferrerNo ratings yet

- Syllabus: I. Course InformationDocument5 pagesSyllabus: I. Course InformationLorisa CenizaNo ratings yet

- BSA 3101 - Accounting For Special TransactionsDocument12 pagesBSA 3101 - Accounting For Special TransactionsMariel TagubaNo ratings yet

- OBE Syllabus Operations Management With TQM San Francisco CollegeDocument4 pagesOBE Syllabus Operations Management With TQM San Francisco CollegeJerome SaavedraNo ratings yet

- Syllabus - Bsa 3101-Accounting For Special TransactionsDocument10 pagesSyllabus - Bsa 3101-Accounting For Special TransactionsMaviel SuaverdezNo ratings yet

- Stratbusnanal Syll Sem2 2023 2024Document8 pagesStratbusnanal Syll Sem2 2023 2024Mary Jane MaralitNo ratings yet

- ACC 12 - Entrepreneurial Accounting Course Study GuideDocument66 pagesACC 12 - Entrepreneurial Accounting Course Study GuideHannah Jean MabunayNo ratings yet

- Conceptual Framework and Accounting Standard SyllabusDocument12 pagesConceptual Framework and Accounting Standard Syllabusrenzelmagbitang222No ratings yet

- RPS Sem Akt Manajemen - January - 2019 - EnglishDocument17 pagesRPS Sem Akt Manajemen - January - 2019 - EnglishMuhammad Dio ViandraNo ratings yet

- BBA Semester 3Document8 pagesBBA Semester 3Navya ShahiNo ratings yet

- Strategic Cost Management Course OutlineDocument11 pagesStrategic Cost Management Course OutlineTrine De LeonNo ratings yet

- AE 1 Managerial Econ Syllabus New v1Document8 pagesAE 1 Managerial Econ Syllabus New v1Jazz TinNo ratings yet

- MM-New-CBA-Syllabus-Format - Man eCODocument6 pagesMM-New-CBA-Syllabus-Format - Man eCOGayl Ignacio TolentinoNo ratings yet

- Syllabus For Recruitment and SelectionDocument8 pagesSyllabus For Recruitment and SelectionRonnel MadrasoNo ratings yet

- Xmanac1 Syl IbmDocument12 pagesXmanac1 Syl IbmMark Anthony ManarangNo ratings yet

- BBA CurriculamDocument17 pagesBBA CurriculamAmit sahuNo ratings yet

- Managerial Accounting Module DescriptorDocument4 pagesManagerial Accounting Module Descriptorవెంకటరమణయ్య మాలెపాటిNo ratings yet

- Aec-44 - Course Outline (Strategic-Cost-Management)Document6 pagesAec-44 - Course Outline (Strategic-Cost-Management)Hyacinth FNo ratings yet

- Accounting 11 - Standardized OBE Syllabus - 6 UnitsDocument11 pagesAccounting 11 - Standardized OBE Syllabus - 6 UnitsTess GalangNo ratings yet

- Syllabus - ACCBP 100 CompleteDocument10 pagesSyllabus - ACCBP 100 CompleteCleah WaskinNo ratings yet

- CBM 0004 Good Governance and Social ResponsibilityDocument10 pagesCBM 0004 Good Governance and Social ResponsibilityTahinay KarlNo ratings yet

- 1.1 Syllabus - ACC C203 BSA-1Document7 pages1.1 Syllabus - ACC C203 BSA-1Jessica TalionNo ratings yet

- BSMA STRAT AUD SyllabusDocument7 pagesBSMA STRAT AUD SyllabusDSAW VALERIO100% (3)

- BME 2 Operations ManagementDocument10 pagesBME 2 Operations ManagementArgie LunaNo ratings yet

- Syllabus in Accounting Information SystemDocument10 pagesSyllabus in Accounting Information SystemChristine LealNo ratings yet

- Accounting Cycle: Corporation: Horizontal AlignmentDocument4 pagesAccounting Cycle: Corporation: Horizontal AlignmentAngelica BarcenaNo ratings yet

- MS 1Document8 pagesMS 1Pappy TresNo ratings yet

- Management AccountingDocument5 pagesManagement AccountingCarrots TopNo ratings yet

- Acco 30013 Accounting For Special Transactions 2019Document8 pagesAcco 30013 Accounting For Special Transactions 2019Azel Ann AlibinNo ratings yet

- ACCTG11 FINANCIAL ACCTG AND REPORTING BSA Coursse OutlineDocument9 pagesACCTG11 FINANCIAL ACCTG AND REPORTING BSA Coursse OutlineJaya RamirezNo ratings yet

- AE13 - Financial Reporting and AnalysisDocument5 pagesAE13 - Financial Reporting and AnalysisMa. Liza MagatNo ratings yet

- COA Course OutlineDocument4 pagesCOA Course OutlineSanjana WadhankarNo ratings yet

- MBA501A ABM v2.1Document5 pagesMBA501A ABM v2.1Ayush SatyamNo ratings yet

- A Core Competency in Managerial Accounting Education: Project ManagementDocument9 pagesA Core Competency in Managerial Accounting Education: Project Managementpiyush kumarNo ratings yet

- Tanauan City College Bachelor of Science in Management Accounting ProgramDocument6 pagesTanauan City College Bachelor of Science in Management Accounting Programtcc 0029No ratings yet

- ACC3006 - Trimester 1, AY 2022 - 23 Student GuideDocument8 pagesACC3006 - Trimester 1, AY 2022 - 23 Student GuideCeline LowNo ratings yet

- Bda 604 Business Management SyllabusDocument7 pagesBda 604 Business Management SyllabusDaisy ObisoNo ratings yet

- Syllabus - Operations Management - (12.16.2019)Document11 pagesSyllabus - Operations Management - (12.16.2019)Ezekiel Magalladora75% (4)

- New Course Specs-Business Ethics 2018-19Document10 pagesNew Course Specs-Business Ethics 2018-19Ana BereNo ratings yet

- CLP - Operations Management and TQMDocument10 pagesCLP - Operations Management and TQMALMIRA LOUISE PALOMARIANo ratings yet

- Services Marketing (Course Handout) - Nov2022Document5 pagesServices Marketing (Course Handout) - Nov2022DiptNo ratings yet

- Intermediate Financial Accounting Hand Book (Bloomberg)Document11 pagesIntermediate Financial Accounting Hand Book (Bloomberg)KhAn Abbas100% (1)

- Iba Syllabus AamdDocument6 pagesIba Syllabus AamdAshar ZiaNo ratings yet

- Tomas Del Rosario College: City of BalangaDocument5 pagesTomas Del Rosario College: City of BalangaVanessa L. VinluanNo ratings yet

- Course OutlineDocument4 pagesCourse OutlineREV DELA DONKORNo ratings yet

- Approved CAE BSA ACP 311 PetalcorinDocument132 pagesApproved CAE BSA ACP 311 PetalcorinFRAULIEN GLINKA FANUGAONo ratings yet

- Improving Operations at XYZDocument13 pagesImproving Operations at XYZMohamed El-shaarawi0% (1)

- RPS - Akuntansi - Manajemen - Berbasis - OBE - DistanceLearning - Share Ke MHSDocument13 pagesRPS - Akuntansi - Manajemen - Berbasis - OBE - DistanceLearning - Share Ke MHSaulia endiniNo ratings yet

- 09 - MMS Complete Syllabus NewDocument130 pages09 - MMS Complete Syllabus NewhsonisubscriptionsNo ratings yet

- COMP106 Word APA Report S23Document11 pagesCOMP106 Word APA Report S23Japanpreet JapanpreetNo ratings yet

- ACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022Document14 pagesACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022NURHAM SUMLAYNo ratings yet

- Structured On-the-Job Training: Unleashing Employee Expertise in the WorkplaceFrom EverandStructured On-the-Job Training: Unleashing Employee Expertise in the WorkplaceRating: 5 out of 5 stars5/5 (3)

- Customer Service Understanding Gender DifferencesDocument9 pagesCustomer Service Understanding Gender DifferencesPearl Richmond LayugNo ratings yet

- CPARDocument9 pagesCPARPearl Richmond LayugNo ratings yet

- PerDev11 1SEM Mod3 Building-And-Maintaining-Relationships Version3Document25 pagesPerDev11 1SEM Mod3 Building-And-Maintaining-Relationships Version3Ann Marie Balatero Abadies75% (8)

- CPARDocument9 pagesCPARPearl Richmond LayugNo ratings yet

- National Artists of The Philippines MOD 4 PPT 2Document18 pagesNational Artists of The Philippines MOD 4 PPT 2Pearl Richmond LayugNo ratings yet

- Oral Communication Q1 M1 L1Document15 pagesOral Communication Q1 M1 L1Mickaela Rosales67% (3)

- Reading-Writing Q3 Mod1 Wks1-2 V5Document26 pagesReading-Writing Q3 Mod1 Wks1-2 V5Pearl Richmond LayugNo ratings yet

- English4 - q3 - Mod5 - Use Appropriate Graphic Organizers in The Text ReadDocument16 pagesEnglish4 - q3 - Mod5 - Use Appropriate Graphic Organizers in The Text ReadPearl Richmond Layug100% (1)

- UCSP11 - Q1 - Mod2 LESSON 2Document10 pagesUCSP11 - Q1 - Mod2 LESSON 2Pearl Richmond LayugNo ratings yet

- PERDEV Q1 Mod7 Emotional-Intelligence-1Document23 pagesPERDEV Q1 Mod7 Emotional-Intelligence-1Pearl Richmond LayugNo ratings yet

- Mod 2 Lesson 1 UCSPDocument5 pagesMod 2 Lesson 1 UCSPPearl Richmond LayugNo ratings yet

- Mental Health Stress Mod 4Document23 pagesMental Health Stress Mod 4Pearl Richmond LayugNo ratings yet

- Ucsp11 - Q1 - Mod 2 Lesson 1Document11 pagesUcsp11 - Q1 - Mod 2 Lesson 1Pearl Richmond LayugNo ratings yet

- Learning Modalities For 2020-2021Document20 pagesLearning Modalities For 2020-2021Cielo Tobias JacintoNo ratings yet

- CBC-Food and Beverage Services NCIIDocument35 pagesCBC-Food and Beverage Services NCIIAmy Amper Pelenio-Lofranco67% (3)

- International Relations Brief Edition 8Th Edition Full Chapter PDFDocument41 pagesInternational Relations Brief Edition 8Th Edition Full Chapter PDFsandra.watkins960100% (64)

- Peer Assessment FeedbackFruits PeergradeDocument27 pagesPeer Assessment FeedbackFruits PeergradeCole GroomNo ratings yet

- Peace Corps Learning Management System (LMS) Solicitation PC-17-Q-030Document81 pagesPeace Corps Learning Management System (LMS) Solicitation PC-17-Q-030Accessible Journal Media: Peace Corps DocumentsNo ratings yet

- Instructions For Conducting Online Examination System: TeachersDocument2 pagesInstructions For Conducting Online Examination System: TeachersShahzad AhmedNo ratings yet

- Epiplex500 Overview Features BenefitsDocument7 pagesEpiplex500 Overview Features BenefitsSeaboyWavesNo ratings yet

- Students Satisfaction Towards E-LearningDocument60 pagesStudents Satisfaction Towards E-LearningGeorge K SonyNo ratings yet

- Development of Online Learning System For Software PDFDocument12 pagesDevelopment of Online Learning System For Software PDFRafy AlahmadNo ratings yet

- Library Management System Research ProposalDocument12 pagesLibrary Management System Research ProposalZwandyNo ratings yet

- Capitol University Basic Education Department Capistrano Complex, Gusa, Cagayan de Oro CityDocument3 pagesCapitol University Basic Education Department Capistrano Complex, Gusa, Cagayan de Oro CityvonNo ratings yet

- SIMSCI Operator Training SimulatorsDocument31 pagesSIMSCI Operator Training SimulatorsurfiNo ratings yet

- DataAndDigitalCommunications SYLLABUS JURADODocument30 pagesDataAndDigitalCommunications SYLLABUS JURADOjames paul baltazarNo ratings yet

- Q1 An Innovative Strategy To Anticipate Students Cheating The Development of Automatic Essay Assessment On The MoLearn Learning Management SystemDocument10 pagesQ1 An Innovative Strategy To Anticipate Students Cheating The Development of Automatic Essay Assessment On The MoLearn Learning Management SystemHardman BudiharjoNo ratings yet

- Step-By-Step Essay Writing Scavenger Hunt-1Document3 pagesStep-By-Step Essay Writing Scavenger Hunt-1crist Ian IANo ratings yet

- Review of Related Literature and StudiesDocument3 pagesReview of Related Literature and StudiesQUINTOS, JOVINCE U. G-12 HUMSS A GROUP 8No ratings yet

- Oracle E-Business Suite R12.1 HCM Course Guided Path OverviewDocument42 pagesOracle E-Business Suite R12.1 HCM Course Guided Path Overviewemeka.mek50% (2)

- DVX Adaptive Learning White PaperDocument30 pagesDVX Adaptive Learning White PaperkiNo ratings yet

- Project STAR Training on Designing Assessment for Blended LearningDocument10 pagesProject STAR Training on Designing Assessment for Blended LearningAya SismondoNo ratings yet

- Career Development Work ValuesDocument11 pagesCareer Development Work ValuesZanne AlcasidNo ratings yet

- The TPACK Framework Explained (With Classroom Examples)Document8 pagesThe TPACK Framework Explained (With Classroom Examples)Fairoza Fidelyn VillaruzNo ratings yet

- Budget of Work Epp 6Document2 pagesBudget of Work Epp 6John Louise Templado Andrada100% (2)

- Flexible Instruction Delivery Plan (Fidp) Core Subject Title: EMPOWERMENT TECHNOLOGIES (Techno) GRADE: 11/12Document14 pagesFlexible Instruction Delivery Plan (Fidp) Core Subject Title: EMPOWERMENT TECHNOLOGIES (Techno) GRADE: 11/12Paul Jeremiah Ursos100% (1)

- English Work EuniceDocument14 pagesEnglish Work EuniceSilde tomasNo ratings yet

- An Assessment of The E-Learning Management Systems Used by Philippine Insurance Agents of An International Financial Organization Using HELAMDocument5 pagesAn Assessment of The E-Learning Management Systems Used by Philippine Insurance Agents of An International Financial Organization Using HELAMJeh UbaldoNo ratings yet

- WHLP - Oral-Communication - Weeks 1 and 2Document4 pagesWHLP - Oral-Communication - Weeks 1 and 2KYNAH AMOR DARVINNo ratings yet

- CHED Conducts Blended Learning WebinarDocument12 pagesCHED Conducts Blended Learning WebinarMark Anthony Nieva RafalloNo ratings yet

- Course Module Contemporary WorldDocument287 pagesCourse Module Contemporary WorldVea Bianca DavidNo ratings yet

- N.A.B.A. e-learning platform training documentDocument5 pagesN.A.B.A. e-learning platform training document于婧丹No ratings yet

- Learning Module 4Document6 pagesLearning Module 4Ernesto Thaddeus Mercado SolmeranoNo ratings yet