Professional Documents

Culture Documents

Key Formulas

Uploaded by

michel.r.skaff0 ratings0% found this document useful (0 votes)

2 views2 pagesThis document provides key formulas for:

1) Present and future value of cash flows, including perpetuities and annuities.

2) Measures of risk for individual assets such as variance, standard deviation, covariance, and correlation.

3) Portfolio analysis including expected return, variance, and weights of assets in a portfolio.

4) The Capital Asset Pricing Model relating asset return to market return.

5) Calculation of the weighted average cost of capital.

Original Description:

Original Title

20199325 - Key formulas

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides key formulas for:

1) Present and future value of cash flows, including perpetuities and annuities.

2) Measures of risk for individual assets such as variance, standard deviation, covariance, and correlation.

3) Portfolio analysis including expected return, variance, and weights of assets in a portfolio.

4) The Capital Asset Pricing Model relating asset return to market return.

5) Calculation of the weighted average cost of capital.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesKey Formulas

Uploaded by

michel.r.skaffThis document provides key formulas for:

1) Present and future value of cash flows, including perpetuities and annuities.

2) Measures of risk for individual assets such as variance, standard deviation, covariance, and correlation.

3) Portfolio analysis including expected return, variance, and weights of assets in a portfolio.

4) The Capital Asset Pricing Model relating asset return to market return.

5) Calculation of the weighted average cost of capital.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

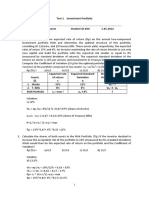

Key Formulas

Present value of a cash flow stream

-

𝐶'

𝑃𝑉# = %

(1 + 𝑟 )'

'./

Future value of a cash flow P0 at date t

𝐹𝑉 = 𝑃𝑉# × (1 + 𝑟)'

Present value of a perpetuity starting in date 1

𝐶/

𝑃𝑉# =

𝑟

Present value of an annuity starting in date 1

𝐶/ 1

𝑃𝑉# = × 21 − 4

𝑟 (1 + 𝑟 )-

Present value of a constantly growing perpetuity starting in date 1

𝐶/

𝑃𝑉# =

𝑟−𝑔

Present value of a growing annuity starting in date 1

𝐶/ 1+𝑔 -

𝑃𝑉# = × 61 − 7 8 9

𝑟−𝑔 1+𝑟

9 Always check the next page!

Measures of risk for individual assets

Variance:

C

𝑉𝑎𝑟 (𝑅< ) = 𝜎<? = 𝐸 (𝑅< − 𝑅A)? = % 𝑝< × (𝑅< − 𝑅A )?

<./

Standard deviation (volatility):

𝑆𝐷 (𝑅< ) = 𝜎< = F𝜎<?

Covariance:

𝐶𝑜𝑣I𝑅< , 𝑅K L = 𝜎<K = 𝐸[(𝑅< − 𝑅A< ) × I𝑅K − 𝑅AK L]

Correlation:

𝜎<K

𝐶𝑜𝑟𝑟I𝑅< , 𝑅K L = 𝜌<K =

𝜎< × 𝜎K

Portfolio analysis

Expected return of a portfolio p consisting of N assets where wi is the weight of i-th

asset in the portfolio:

C

𝐸I𝑅P L = % 𝑤< × 𝐸(𝑅< )

<./

Variance of the portfolio p:

C C C C

𝜎P? = % % 𝑤< 𝑤K 𝜎<K = % 𝑤<? 𝜎<? + % 𝑤< 𝑤K 𝜎<K

<./ K./ <./ <./

K./

<RK

𝐶𝑜𝑣(𝑅< , 𝑅T )

𝛽< =

𝑉𝑎𝑟(𝑅T )

Capital Asset Pricing Model

𝐸 (𝑅< ) = 𝑟U + 𝛽< × (𝐸 (𝑅T ) − 𝑟U )

Weighted average cost of capital

𝐸 𝐷

𝑅VWXX = × 𝑅Y + × 𝑅Z × (1 − 𝑇X )

𝐸+𝐷 𝐸+𝐷

10 Always check the next page!

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Pricing Approaches For Credit DerivativesDocument24 pagesPricing Approaches For Credit DerivativesTheodor MunteanuNo ratings yet

- Instructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYFrom EverandInstructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYNo ratings yet

- MOOC Econometrics3Document3 pagesMOOC Econometrics3edison medardoNo ratings yet

- RSM430 Final Cheat SheetDocument1 pageRSM430 Final Cheat SheethappyNo ratings yet

- Waterloo ACTSC372 Lec 7Document29 pagesWaterloo ACTSC372 Lec 7Claire ZhangNo ratings yet

- FINS5513 Lecture 2B: Forming Efficient PortfoliosDocument32 pagesFINS5513 Lecture 2B: Forming Efficient Portfolios萬之晨No ratings yet

- Accounting and Finance For Business Key Formulas: Statement of Financial PositionDocument3 pagesAccounting and Finance For Business Key Formulas: Statement of Financial PositionZOn YêuNo ratings yet

- Chapter 4Document12 pagesChapter 4mark sanadNo ratings yet

- Chapter Six Risk and ReturnDocument46 pagesChapter Six Risk and ReturnLetaNo ratings yet

- Financial Economics Formulas 2014-10-19 11-33-13Document4 pagesFinancial Economics Formulas 2014-10-19 11-33-13Romain FarsatNo ratings yet

- UNIT 3 Basic Economy Study MethodsDocument57 pagesUNIT 3 Basic Economy Study Methodscuajohnpaull.schoolbackup.002No ratings yet

- Chapter 5 Bài tậpDocument4 pagesChapter 5 Bài tậpVõ Hoàng Bảo TrânNo ratings yet

- 4 2-DepreciationDocument4 pages4 2-DepreciationzaugetsangryyNo ratings yet

- FORMULA SHEET For Final - FMDocument1 pageFORMULA SHEET For Final - FMNajia SiddiquiNo ratings yet

- Solution To Assignment-4 - (Revised)Document4 pagesSolution To Assignment-4 - (Revised)sgyn6cb4thNo ratings yet

- Energy AuditDocument91 pagesEnergy AuditKaliamoorthyNo ratings yet

- Opera FormulaDocument4 pagesOpera FormulaWasyif AlshammariNo ratings yet

- Equation Sheet For Midterm 1Document2 pagesEquation Sheet For Midterm 137. Nguyễn Lê Mỹ TiênNo ratings yet

- S5 Risk Return Online VersionDocument20 pagesS5 Risk Return Online Versionconstruction omanNo ratings yet

- Revision For Chap 7 Risk and ReturnDocument4 pagesRevision For Chap 7 Risk and ReturnQuý NguyễnNo ratings yet

- CH 13Document55 pagesCH 13Atif AslamNo ratings yet

- Gmb105 Business Statistics/Mathematics FormulaeDocument2 pagesGmb105 Business Statistics/Mathematics FormulaeLashierNo ratings yet

- Portfolio Theory and Security Analysis: Chapter 3, Unit 1Document11 pagesPortfolio Theory and Security Analysis: Chapter 3, Unit 1gsahneNo ratings yet

- CORPFIN1002 Formula Sheet - 2023Document1 pageCORPFIN1002 Formula Sheet - 2023jNo ratings yet

- Mind Map SampleDocument1 pageMind Map SampleRabi NarayanNo ratings yet

- Chapter 1 FormulasDocument1 pageChapter 1 FormulasSimphiweNo ratings yet

- "Formulas 2021Document1 page"Formulas 2021Jean DeslisNo ratings yet

- Stone-Geary Utility Function - выводDocument3 pagesStone-Geary Utility Function - выводМаксим НовакNo ratings yet

- DepreciationDocument3 pagesDepreciationEstera ShawnNo ratings yet

- FIN2704 NotesDocument4 pagesFIN2704 NotesYan KaiNo ratings yet

- Econ Formula From MagandaDocument4 pagesEcon Formula From MagandaLeslie Jean ObradorNo ratings yet

- 03 FM Main Book Solution File (Not To Print)Document152 pages03 FM Main Book Solution File (Not To Print)prince soniNo ratings yet

- 2.1 - Optimal Risk PortfoliosDocument25 pages2.1 - Optimal Risk PortfoliosMuhammad MuhaiminNo ratings yet

- DC and AC Power Fundamentals SAPDocument51 pagesDC and AC Power Fundamentals SAPPaul Danniel AquinoNo ratings yet

- FM1 - 15Document15 pagesFM1 - 15Namitha ShajanNo ratings yet

- Lecture 5Document34 pagesLecture 5ceyda.duztasNo ratings yet

- Engineering Economy FormulaDocument8 pagesEngineering Economy FormulaAllan Abobon Bulatao100% (1)

- Test 1 INV Portfolio - 5 - May - 2022Document2 pagesTest 1 INV Portfolio - 5 - May - 2022zakaria kerboubNo ratings yet

- 2 Power System Economics 1-58Document87 pages2 Power System Economics 1-58Rudraraju Chaitanya100% (1)

- Chapter 5Document50 pagesChapter 5ser hasbulaNo ratings yet

- Financial Ratio & Formulas: Activity RatiosDocument6 pagesFinancial Ratio & Formulas: Activity RatioswesamNo ratings yet

- DepreciationDocument10 pagesDepreciationAngelica May BangayanNo ratings yet

- FORMULA SHEET For Midterm ExamDocument4 pagesFORMULA SHEET For Midterm Examakshitak.2021No ratings yet

- Annuities: A Sequence of Payments Made Over A Period of TimeDocument3 pagesAnnuities: A Sequence of Payments Made Over A Period of TimeLdmNo ratings yet

- IE500/459: Engineering Methods in Supply Chain: Topic 1: Demand ForecastingDocument13 pagesIE500/459: Engineering Methods in Supply Chain: Topic 1: Demand ForecastingHrishikesh DeshmukhNo ratings yet

- Project Evaluation: Alternative MethodsDocument50 pagesProject Evaluation: Alternative MethodsMd SolaimanNo ratings yet

- Interest FormulaDocument1 pageInterest FormulaTimbas, Raizel DeeNo ratings yet

- Exercises 10 To 14 SolutionsDocument13 pagesExercises 10 To 14 SolutionsPanduh Shvely AmukamboNo ratings yet

- General Mathematics: 11 GradeDocument19 pagesGeneral Mathematics: 11 GradeRhea Rose AlmoguezNo ratings yet

- Calc 2.10 PacketDocument3 pagesCalc 2.10 Packetha haNo ratings yet

- DepreciationDocument11 pagesDepreciationEstera ShawnNo ratings yet

- Formula Sheet For Mid-Term ExamDocument4 pagesFormula Sheet For Mid-Term ExamPrashant Pratap SinghNo ratings yet

- Solow Model FinalDocument8 pagesSolow Model FinalgodussopnakamaNo ratings yet

- P14 Downloadable Slides 1Document74 pagesP14 Downloadable Slides 1Vi Nghiep LyNo ratings yet

- The Value ChainDocument6 pagesThe Value ChainFabio Hernan TorresNo ratings yet

- Hydrology 03 Probability and StatisticsDocument48 pagesHydrology 03 Probability and StatisticsMark anthony PalabayNo ratings yet

- Formule TestDocument2 pagesFormule TestPlushulik AninaNo ratings yet