Professional Documents

Culture Documents

Govacc

Uploaded by

Anne Desal0 ratings0% found this document useful (0 votes)

4 views1 pageGovacc

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGovacc

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageGovacc

Uploaded by

Anne DesalGovacc

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

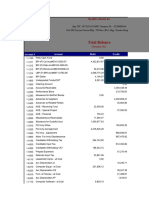

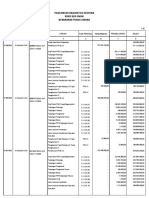

ACCO 30033 Accounting for National Government Agencies (NGAs)

Exercise 1. Required: Journalize the transactions with codes.

1. Received the NCA from DBM for P1,800,000.

Regular-P1,500,000 TRA-P300,000

Cash-MDS, Regular 1-01-04-040 1,500,000.00

Cash-Tax Remittance Advice 1-01-04-070 300,000.00

Subsidy from National Government 4-03-01-010 1,800,000.00

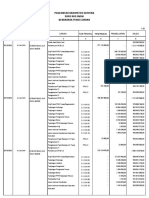

2. Recorded the obligation and liability for Payroll.

Salaries 400,000

PERA 50,000 P450,000

Less: Withholding tax 60,000

Ret. & Life Ins. Prems. 45,000

Pag-IBIG premiums 6,000

PhilHealth premiums 4,000 115,000

Net amount 335,000

Salaries and Wages, Regular 5-01-01-010 400,000.00

Personal Economic Relief Allowance(PERA) 5-01-02-010 50,000.00

Due to BIR 2-02-01-010 60,000.00

Due to GSIS 2-02-01-020 45,000.00

Due to Pag-IBIG 2-02-01-030 6,000.00

Due to Philhealth 2-02-01-040 4,000.00

Due to Officers and Employees 2-01-01-020 335,000.00

3. Granted cash advance for payroll-P335,000.

Advances for Payroll 1-99-01-020 335,000.00

Cash-MDS, Regular 1-01-04-040 335,000.00

4. Liquidated the cash advance for payroll.

Due to Officers and Employees 2-01-01-020 335,000.00

Advances for Payroll 1-99-01-020 335,000.00

5. Remitted the salary deductions, excluding withholding tax.

Due to GSIS 2-02-01-020 45,000.00

Due to Pag-IBIG 2-02-01-030 6,000.00

Due to PHILHEALTH 2-02-01-040 4,000.00

Cash-MDS, Regular 1-01-04-040 55,000.00

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- ACCO 30033 ExercisesDocument16 pagesACCO 30033 ExercisesGenevieve Arpon100% (1)

- ACCO 30033 ExercisesDocument8 pagesACCO 30033 ExercisesGenevieve ArponNo ratings yet

- Provincial Veterinary Office - Statement of Appropriations - June 30, 2023Document2 pagesProvincial Veterinary Office - Statement of Appropriations - June 30, 2023kessejunsan16No ratings yet

- LBP Form 2 BudgetDocument1 pageLBP Form 2 BudgetJessa Jane NaboNo ratings yet

- Dep EDDocument74 pagesDep EDRenante SorianoNo ratings yet

- Provincial Veterinary Office - January 2023Document3 pagesProvincial Veterinary Office - January 2023kessejunsan16No ratings yet

- Saaob DetailedDocument3 pagesSaaob DetailedzcacctgauditNo ratings yet

- Dawood KhanDocument2 pagesDawood KhanRana Sunny KhokharNo ratings yet

- 2020 Annual Budget ReportDocument3 pages2020 Annual Budget ReportEllmaaanNo ratings yet

- Programmed Appropriation and Obligation by Object of Expenditure Local Government Unit-Santiago CityDocument2 pagesProgrammed Appropriation and Obligation by Object of Expenditure Local Government Unit-Santiago CityShie La Ma RieNo ratings yet

- Programmed Appropriation and Obligation by Object of ExpenditureDocument7 pagesProgrammed Appropriation and Obligation by Object of ExpenditureKristin Villaseñor-MercadoNo ratings yet

- 2018 - Budget FormsDocument49 pages2018 - Budget FormsFreda Lyn Benito Namuro100% (1)

- Budget 2022Document14 pagesBudget 2022Krisna Criselda Simbre100% (1)

- Rka 2018Document181 pagesRka 2018Agus Fauron SafiiNo ratings yet

- LBP Form No. 2 RevisedDocument80 pagesLBP Form No. 2 RevisedJhumar YuNo ratings yet

- 2018 Trial BalanceDocument35 pages2018 Trial BalanceJames Hydoe ElanNo ratings yet

- Tabulation Form CVMC Sportsfest 2018Document30 pagesTabulation Form CVMC Sportsfest 2018Reia RuecoNo ratings yet

- Adjusted Trial Balance 12.31.22Document6 pagesAdjusted Trial Balance 12.31.22qhi.cgmacatiagNo ratings yet

- Balance de Comprobación de Sumas y SaldosDocument1 pageBalance de Comprobación de Sumas y SaldosInfuleski RocioNo ratings yet

- LBPF No. 2 - Budget Estimate 2020Document2 pagesLBPF No. 2 - Budget Estimate 2020Bplo CaloocanNo ratings yet

- 5-1 and 5-4Document2 pages5-1 and 5-4Rundhille AndalloNo ratings yet

- Journal of Disbursement 2023 TakunganDocument52 pagesJournal of Disbursement 2023 TakunganNazzer Balmores NacuspagNo ratings yet

- Appropriation OrdinanceDocument3 pagesAppropriation OrdinanceeightythreebcogonsanjoseNo ratings yet

- 6.bku JuniDocument28 pages6.bku JuniAhmed MwdNo ratings yet

- Journal Entry Voucher: National Housing Authority AgencyDocument22 pagesJournal Entry Voucher: National Housing Authority AgencyJENNIFER SIALANANo ratings yet

- Muhammad Zidan Akbar - Morgan Company - 1EB09Document12 pagesMuhammad Zidan Akbar - Morgan Company - 1EB09rully.movizarNo ratings yet

- LBP Form No.Document119 pagesLBP Form No.Cecille JimenezNo ratings yet

- General FundDocument102 pagesGeneral Fundpalengke barangayNo ratings yet

- Tupol Este 1.docx Landscape - DoneDocument23 pagesTupol Este 1.docx Landscape - DoneJoshua AssinNo ratings yet

- Special Education Fund - February 2023Document4 pagesSpecial Education Fund - February 2023kessejunsan16No ratings yet

- Soal Siklus AkuntansiDocument6 pagesSoal Siklus Akuntansidery dulitaNo ratings yet

- LAC GovUnallot June09Document1 pageLAC GovUnallot June09thegracekelly100% (2)

- Particulars Current Year Appropriation Account Code Past Year 2020Document16 pagesParticulars Current Year Appropriation Account Code Past Year 2020ruelan carnajeNo ratings yet

- 2021 - Budget FormsDocument31 pages2021 - Budget FormsFreda Lyn Benito NamuroNo ratings yet

- Annual Budget 2021 Bacoor CaviteDocument54 pagesAnnual Budget 2021 Bacoor CaviteKakam PwetNo ratings yet

- Lembar Kerja Akuntansi (Tim B SMK Karya Bahana Mandiri 2)Document9 pagesLembar Kerja Akuntansi (Tim B SMK Karya Bahana Mandiri 2)Su MiniNo ratings yet

- MeoDocument4 pagesMeoSum WhosinNo ratings yet

- Show Cause Notice To Units1Document5 pagesShow Cause Notice To Units1Abu Bakar SiddiqueNo ratings yet

- Trial Balance General Fund Code No. 101: Republic of The Philippines City of Ilagan As of July 31, 2020Document80 pagesTrial Balance General Fund Code No. 101: Republic of The Philippines City of Ilagan As of July 31, 2020elisethmaddara1411No ratings yet

- Report e 20230412112240Document17 pagesReport e 20230412112240mikiNo ratings yet

- April - Kenneth de OcampoDocument1 pageApril - Kenneth de OcampoDennis Dela CruzNo ratings yet

- Quiz 6 Compensation Income PDFDocument2 pagesQuiz 6 Compensation Income PDFcalliemozartNo ratings yet

- MHODocument4 pagesMHOSum WhosinNo ratings yet

- Government AccountingDocument1 pageGovernment AccountingJanJan BoragayNo ratings yet

- CAT Exam 3 - 2018 Answer KeyDocument32 pagesCAT Exam 3 - 2018 Answer KeyCharity Lumactod AlangcasNo ratings yet

- MboDocument4 pagesMboSum WhosinNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- Formatted Brgy. Forms EditDocument21 pagesFormatted Brgy. Forms EditJoshua AssinNo ratings yet

- NS Klasik Sebelum End PeriodDocument3 pagesNS Klasik Sebelum End PeriodElis RosmanawatiNo ratings yet

- Statement of Fund Allocation-SPDocument6 pagesStatement of Fund Allocation-SPCharles D. FloresNo ratings yet

- 3 Budget Authorization FormDocument10 pages3 Budget Authorization FormGem BesandeNo ratings yet

- Barangay BudgetDocument6 pagesBarangay Budgetbarangay artacho1964 bautista100% (1)

- Penjelasan Arus KasDocument6 pagesPenjelasan Arus KasREKA CHANNELNo ratings yet

- Payslip 0213Document1 pagePayslip 0213sathiya moorthyNo ratings yet

- Special Education Fund - January 2023Document4 pagesSpecial Education Fund - January 2023kessejunsan16No ratings yet

- 11.nopember 2020Document42 pages11.nopember 2020Ahmed MwdNo ratings yet

- Programmed Appropriation by Ppa, Expense Class, Object of Expenditure and Expected Result, Fy 2021Document3 pagesProgrammed Appropriation by Ppa, Expense Class, Object of Expenditure and Expected Result, Fy 2021Barangay SamputNo ratings yet

- Neraca Saldo AwalDocument5 pagesNeraca Saldo AwalSilvia WulandariNo ratings yet

- p2 - Guerrero Ch13Document40 pagesp2 - Guerrero Ch13JerichoPedragosa88% (17)

- LGUsDocument1 pageLGUsAnne DesalNo ratings yet

- LGUsDocument1 pageLGUsAnne DesalNo ratings yet

- Scholarly Critique Latik PaperDocument5 pagesScholarly Critique Latik PaperAnne DesalNo ratings yet

- PHL 1105: Introduction To Logic Assignment 5.1: Conversion, Obversion, and Contraposition NameDocument3 pagesPHL 1105: Introduction To Logic Assignment 5.1: Conversion, Obversion, and Contraposition NameAnne DesalNo ratings yet

- DocsssDocument4 pagesDocsssAnne DesalNo ratings yet

- Combinepdf PDFDocument252 pagesCombinepdf PDFNah HamzaNo ratings yet

- Brief History of The Philippine ConstitutionDocument1 pageBrief History of The Philippine ConstitutionAnne DesalNo ratings yet

- Employment StrategyDocument1 pageEmployment StrategyAnne DesalNo ratings yet

- PHL 1105: Introduction To Logic Assignment 5.1: Conversion, Obversion, and Contraposition NameDocument3 pagesPHL 1105: Introduction To Logic Assignment 5.1: Conversion, Obversion, and Contraposition NameAnne DesalNo ratings yet

- Property PLant and EquipmentDocument1 pageProperty PLant and EquipmentAnne DesalNo ratings yet

- 361 Chapter 4 MC SolutionsDocument23 pages361 Chapter 4 MC SolutionsAnnaNo ratings yet

- DocsDocument3 pagesDocsAnne DesalNo ratings yet

- Steps in The Amendatory Process IncludeDocument1 pageSteps in The Amendatory Process IncludeAnne DesalNo ratings yet

- Essential Parts of A Good Written ConstitutionDocument1 pageEssential Parts of A Good Written ConstitutionAnne DesalNo ratings yet

- UntitledDocument1 pageUntitledAnne DesalNo ratings yet

- PolgovDocument1 pagePolgovAnne DesalNo ratings yet

- Urban Informal SectorDocument1 pageUrban Informal SectorAnne DesalNo ratings yet

- Lsiting ProcessDocument1 pageLsiting ProcessAnne DesalNo ratings yet

- SyllogismDocument1 pageSyllogismAnne DesalNo ratings yet

- Harris Todaro ModelDocument1 pageHarris Todaro ModelAnne DesalNo ratings yet

- Woman in SectorDocument1 pageWoman in SectorAnne DesalNo ratings yet

- ShareDocument1 pageShareAnne DesalNo ratings yet

- PSEDocument1 pagePSEAnne DesalNo ratings yet

- Capital ExercisesDocument2 pagesCapital ExercisesAnne DesalNo ratings yet

- Foreign NewsDocument1 pageForeign NewsAnne DesalNo ratings yet

- BondsDocument1 pageBondsAnne DesalNo ratings yet

- Fake NewsDocument1 pageFake NewsAnne DesalNo ratings yet

- Dividend ValutaionDocument1 pageDividend ValutaionAnne DesalNo ratings yet

- Andres BonifacioDocument1 pageAndres BonifacioAnne DesalNo ratings yet

- Product Market StakeholdersDocument3 pagesProduct Market Stakeholdersqaqapataqa100% (1)

- Offer Letter Sasken PankajDocument12 pagesOffer Letter Sasken PankajLingaiah Chowdary Abburi67% (3)

- ADP 401K Enrollment KitDocument20 pagesADP 401K Enrollment KitjcilvikNo ratings yet

- Module 1 - Think Like The RichDocument11 pagesModule 1 - Think Like The RichSampathNo ratings yet

- Logics of Action, Globalization, and Employment Relations Change in China, India, Malaysia, and The PhilippinesDocument57 pagesLogics of Action, Globalization, and Employment Relations Change in China, India, Malaysia, and The PhilippinesAyisha PatnaikNo ratings yet

- Resilience and Turnover Intention: The Role of Mindful Leadership, Empathetic Leadership, and Self-RegulationDocument17 pagesResilience and Turnover Intention: The Role of Mindful Leadership, Empathetic Leadership, and Self-Regulationsaggy13No ratings yet

- Challenges Faced by Management at Ufone PakistanDocument23 pagesChallenges Faced by Management at Ufone PakistanHareem Sattar0% (2)

- History Essay - Labour ReformsDocument3 pagesHistory Essay - Labour Reformsjhalvorson07No ratings yet

- Applicant Information Sheet: Tanauan City, Batangas 4232 Philippines 043-4301030 Local 2125/2126Document2 pagesApplicant Information Sheet: Tanauan City, Batangas 4232 Philippines 043-4301030 Local 2125/2126Renz Ryan DolorNo ratings yet

- Employment ContractDocument7 pagesEmployment ContractAini SjahabNo ratings yet

- Basic Problems in Micro Economics - Advanced EconomicsDocument3 pagesBasic Problems in Micro Economics - Advanced Economicsaravind_91No ratings yet

- Job Club BookDocument62 pagesJob Club Bookpatrick_coleman2100% (1)

- Leonardo Da Vinci As Compared To Vincent Van Gogh.20120927.140734Document2 pagesLeonardo Da Vinci As Compared To Vincent Van Gogh.20120927.140734anon_975486762No ratings yet

- Hospitality SecurityDocument315 pagesHospitality SecuritySummer Calf100% (3)

- (This Paper Consists of 6 Pages) Time Allowed: 60 Minutes: A. Watched B. Stopped C. PushedDocument5 pages(This Paper Consists of 6 Pages) Time Allowed: 60 Minutes: A. Watched B. Stopped C. PushedNguyễn Việt QuânNo ratings yet

- Hiring Family Members in A Family Business PDFDocument3 pagesHiring Family Members in A Family Business PDFjassNo ratings yet

- Strategic Human Resource Management in China: East Meets WestDocument18 pagesStrategic Human Resource Management in China: East Meets WestJelena MarinkovićNo ratings yet

- Position Description Form PDFDocument2 pagesPosition Description Form PDFJaynarose Castillo Rivera100% (3)

- Nebosh IGC Course BrochureDocument1 pageNebosh IGC Course BrochureSajid MahmoodNo ratings yet

- Dietz v. Finlay Fine JewelryDocument3 pagesDietz v. Finlay Fine JewelryLaura Elena LoganNo ratings yet

- Outsoucing Assignment Group 1Document36 pagesOutsoucing Assignment Group 1ASHISH RASALNo ratings yet

- Thailand Education Policy For Migrant Children From Burma: Nongyao NawaratDocument6 pagesThailand Education Policy For Migrant Children From Burma: Nongyao NawaratFatkhurRohmanNo ratings yet

- Accounting Policies and Procedures GuideDocument374 pagesAccounting Policies and Procedures GuideJohnPaul100% (1)

- Tcs Employment Application FormDocument6 pagesTcs Employment Application FormHemapiriya MNo ratings yet

- LDocument34 pagesLharisankar sureshNo ratings yet

- Compliance ChecklistDocument66 pagesCompliance ChecklistHemant AmbekarNo ratings yet

- LaderEditor XRCDocument94 pagesLaderEditor XRCrguzmanabundisNo ratings yet

- Business Ethics of NovartisDocument20 pagesBusiness Ethics of NovartisSujata KumarNo ratings yet

- Night Shift Nursing: Savvy Solutions For A Healthy LifestyleDocument26 pagesNight Shift Nursing: Savvy Solutions For A Healthy LifestyleBrent PatrickNo ratings yet

- Debra Sykes Resignation LetterDocument2 pagesDebra Sykes Resignation LetterSandra TanNo ratings yet