Professional Documents

Culture Documents

Materi Lab 8 - IPT Bonds

Uploaded by

PUTRI YANIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Materi Lab 8 - IPT Bonds

Uploaded by

PUTRI YANICopyright:

Available Formats

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

MATERI LAB 8

INTERCOMPANY PROFIT TRANSACTIONS – BONDS

Constructive Retirement: Pembelian kembali bonds yang terjadi ketika afiliasi (parent

atau subsidiary) membeli outstanding bonds dari pihak yang menerbitkan (parent atau

subsidiary) di pasar terbuka.

Constructive Gain/Loss:

Gain = Price Paid < Book Value of Bonds

Loss = Price Paid > Book Value of Bonds

Piecemeal: Pengakuan bertahap karena adanya perbedaan pengakuan nilai bonds pada parent

dan subsidiary setiap tahunnya.

! Asumsi perhitungan amortisasi discount dan premium dari bonds menggunakan

straight-line method:

𝐶𝑜𝑛𝑠𝑡𝑟𝑢𝑐𝑡𝑖𝑣𝑒 𝐺𝑎𝑖𝑛 𝑜𝑟 𝐿𝑜𝑠𝑠

𝑃𝑖𝑒𝑐𝑒𝑚𝑒𝑎𝑙 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 =

𝑈𝑠𝑒𝑓𝑢𝑙 𝑙𝑖𝑓𝑒 𝑜𝑓 𝑏𝑜𝑛𝑑𝑠

! Asumsi perhitungan amortisasi discount dan premium dari bonds menggunakan

effective-interest method:

Penambahan atau pengurangan piecemeal sesuai dengan

hasil perhitungan effective-interest method.

• Downstream: subsidiary’s acquisition of parent’s bonds

• Upstream: parent’s acquisition of subsidiary’s bonds

Premium = Stated Rate > Market Rate

Discount = Stated Rate < Market Rate

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

Illustration:

On January 10, 2022, Bella Corp. acquired 80% interest in Andrew Corp. for $24,000,000.

Andrew’s equity consisted of $19,600,000 share capital ordinary and $10,400,000 retained

earnings on the date of acquisition. Bella issued $16,000,000 par, 4%, 5 years bonds with

$1,200,000 unamortized premium on January 12, 2022. Six days later, Andrew purchased

20% of these bonds for $2,900,000 from an investment broker. The interest is paid semi-

annually on January 1 and July 1. Straight-line method amortization is applicable.

Andrew’s net income for December 31, 2021 is $900,000.

Prepare the calculations and entries for the year ended December 31, 2022!

Solution:

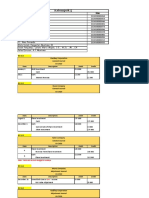

1. Preliminary Computation (in thousands)

Fair Value of 80% Interest acquired $ 24,000

Implied Fair Value of 100% interest ($24,000 ÷ 80%) $ 30,000

BV of Andrew ($19,600 + $10,400) $ 30,000

Total Excess 0

Bella Corp

Issuance of Bella’s bonds on January 12, 2022

Selling Price $ 17,200

Face Value of the Bonds $ 16,000

Premium $ 1,200

$1,200,000

𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑒𝑑 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 = = $240,000 𝑝𝑒𝑟 𝑦𝑒𝑎𝑟

5 𝑦𝑒𝑎𝑟𝑠

Andrew Corp

Purchasing 20% of Bella's bonds on January 18, 2022

Purchase Price $ 2,900

Face Value of the Bonds (20% × $16,000) $ 3,200

Discount $ 300

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

$300,000

𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑒𝑑 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 = = $60,000 𝑝𝑒𝑟 𝑦𝑒𝑎𝑟

5 𝑦𝑒𝑎𝑟𝑠

Consolidated

BV of 20% Bonds Payable purchased by Andrew Corp on January

$ 3,440

18, 2022 ($17,200 × 20%)

Purchase Price $ 2,900

Constructive Gain $ 540

$540,000

𝑃𝑖𝑒𝑐𝑒𝑚𝑒𝑎𝑙 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 = = $108,000 𝑝𝑒𝑟 𝑦𝑒𝑎𝑟

5 𝑦𝑒𝑎𝑟𝑠

2. Journal Entries (in thousands)

Bella Corp Andrew Corp

Date Account Amount Date Account Amount

Investment in Bella ’s

12-Jan Cash $ 17,200 18-Jan $ 2,900

Bonds

Bonds Payable $ 17,200 Cash $2,900

1-Jul Bonds Payable* $ 120 1-Jul Cash*** $ 64

Investment in Bella’s

Interest Expense $ 200 $ 30

Bonds

Cash** $ 320 Interest Revenue $ 94

31-Dec Bonds Payable $ 120 31-Dec Interest Receivable $ 64

Investment in Bella’s

Interest Expense $ 200 $ 30

Bonds ****

Interest Payable $ 320 Interest Revenue $ 94

Notes:

*) $120,000 = Bella’s bonds amortized premium × 6/12 ($240,000 × 6/12)

**) $320,000 = The amount of interest of Bella’s bonds payable ($16,000,000 × 4% × 6/12)

***) $64,000 = The amount of interest received from Andrew’s purchase of Bella’s bonds

($3,200,000 × 4% × 6/12)

****) $30,000 = Andrew ’s amortized discount × 6/12 ($60,000 × 6/12)

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

3. Balance at December 31, 2022 (in thousands)

Bonds Payable (Bella’s) Investment in Bella’s Bonds

On January 12, 2022 $ 17,200 On January 18, 2022 $ 2,900

Premium Amortization $ 240 Discount Amortization $ 60

On December 31, 2022 $ 16,960 On December 31, 2022 $ 2,960

Interest Expense $ 400 Interest Revenue $ 188

4. Income Calculation (in thousands)

CI Share NCI Share

(80%) (20%)

Andrew’s Net Income ($900) $ 720 $ 180

Add: Constructive Gain $ 540 -

Less: Piecemeal Recognition of Constructive

$ (108)

Gain

Income from Andrew $ 1,152 $ 180

5. Investment Calculation (in thousands)

CI Share NCI Share

(80%) (20%)

Andrew’s Underlying Equity ($19,600 +

$ 24,720 $ 6,180

$10,400 + $900)

Add: Constructive Gain ($540 - $108) $ 432 -

Ending Investment in Andrew $ 25,152 $ 6,180

OR

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

CI Share NCI Share

(80%) (20%)

Beginning Investment in Andrew ($30,000) $ 24,000 $ 6,000

Add: Income from Andrew $ 1,152 $ 180

Ending Investment in Andrew $ 25,152 $ 6,180

6. Workpaper Journal Entries

a. To eliminate reciprocal bonds investment and bonds liability and to enter gain

Bonds Payable ($16,960 × 20%) $ 3,392

Investment in Bella Bonds $ 2,960

Gain on Retirement of Bonds $ 432

b. To eliminate reciprocal interest revenue and interest expense

Interest Revenue $ 188

Interest Expense ($400 × 20%) $ 80

Gain on Retirement Bonds $ 108

c. To eliminate reciprocal interest payable and interest receivable

Interest Payable $ 64

Interest Receivable $ 64

d. To eliminate income and adjust investment to its beginning of the period balance

Income from Andrew $ 1,152

Investment in Andrew $ 1,152

e. To enter NCI Share and NCI

NCI Share $ 180

NCI $ 180

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

f. To eliminate reciprocal investment and equity balance and record beginning NCI

Capital Stock $ 19,600

Retained Earnings $ 10,400

Investment in Andrew $ 24,000

NCI $ 6,000

ADIVA – FARHAN – NADYA FATA 2019

You might also like

- Materi Lab 8 - Intercompany Profit Transactions - BondsDocument5 pagesMateri Lab 8 - Intercompany Profit Transactions - BondsAlvira FajriNo ratings yet

- Tgas 1 Kelompok 5 (PA 2)Document9 pagesTgas 1 Kelompok 5 (PA 2)Muhammad RiskiNo ratings yet

- Tugas 3 - 27190096 - Liussetiawan AndyDocument5 pagesTugas 3 - 27190096 - Liussetiawan AndyLiussetiawan AndyNo ratings yet

- Date Particulars Dr. CR.: Answer 01Document7 pagesDate Particulars Dr. CR.: Answer 01Mursalin RabbiNo ratings yet

- Tugas KB Aklan TM 13-Kelompok 1Document10 pagesTugas KB Aklan TM 13-Kelompok 1AdnanNo ratings yet

- Material - Gestión Financiera - Cash Flow Forecasting (Unsolved)Document6 pagesMaterial - Gestión Financiera - Cash Flow Forecasting (Unsolved)jessicaNo ratings yet

- A1C019118 Jurati Latihan7Document6 pagesA1C019118 Jurati Latihan7jurati100% (1)

- Transaction Debit Account Title Credit Account Title Amount ComputationDocument1 pageTransaction Debit Account Title Credit Account Title Amount ComputationShane dela CruzNo ratings yet

- Tugas AKM II Minggu 9Document2 pagesTugas AKM II Minggu 9Clarissa NastaniaNo ratings yet

- May'22 P2 SOLUTIONSDocument8 pagesMay'22 P2 SOLUTIONSStephano OlliviereNo ratings yet

- Cherryl Febryan Christyanto - 202030225Document6 pagesCherryl Febryan Christyanto - 202030225Cherryl Febryan ChristyantoNo ratings yet

- RtgsDocument3 pagesRtgsFungaiNo ratings yet

- 3.3.1 Notes and Loans Receivable Receivable FinancingDocument14 pages3.3.1 Notes and Loans Receivable Receivable FinancingJan Nelson BayanganNo ratings yet

- Prepare Financial Statements From Trial Balance in ExcelDocument5 pagesPrepare Financial Statements From Trial Balance in ExcelShania FordeNo ratings yet

- FA TableDocument8 pagesFA TableVy Duong TrieuNo ratings yet

- Acc 201 CH 10Document16 pagesAcc 201 CH 10Trickster TwelveNo ratings yet

- Neraca Penyesuaian - Timotius Siagian 1 C3Document38 pagesNeraca Penyesuaian - Timotius Siagian 1 C3Timotius SiagianNo ratings yet

- Assestment Test 2Document11 pagesAssestment Test 2Nicolas ErnestoNo ratings yet

- Read This First:: Loan & General InfoDocument14 pagesRead This First:: Loan & General InfoJoannaNo ratings yet

- 9926 Archdale - Performance ReportDocument1 page9926 Archdale - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Taxation - Assignment #1 Winter 2021: UestionsDocument8 pagesTaxation - Assignment #1 Winter 2021: UestionsAssignment &ExamsNo ratings yet

- AKM (Pert.10)Document6 pagesAKM (Pert.10)akunkampusdinaNo ratings yet

- ACC 200 Quiz #2Document4 pagesACC 200 Quiz #2Idrees ShinwaryNo ratings yet

- Bonds PayableDocument4 pagesBonds PayableyelzNo ratings yet

- Chapter 7 - Loans ReceivableDocument15 pagesChapter 7 - Loans ReceivableTurksNo ratings yet

- A. General Journal Date Account Title Ref DebitDocument4 pagesA. General Journal Date Account Title Ref DebitFriska AvriliaNo ratings yet

- Acca 101 QuestionsDocument6 pagesAcca 101 QuestionsElma Joyce BondocNo ratings yet

- 07 - Activity - 124 Ni MarDocument2 pages07 - Activity - 124 Ni Mar21-55654No ratings yet

- Fra 3Document7 pagesFra 3Subhajyoti MukhopadhyayNo ratings yet

- Intercompany Profit Transaction - Bonds (Revised) - Part 1Document27 pagesIntercompany Profit Transaction - Bonds (Revised) - Part 1Raihan YonaldiiNo ratings yet

- Pindi YulinarRosita - Chapter 15 IA 2Document10 pagesPindi YulinarRosita - Chapter 15 IA 2Pindi YulinarNo ratings yet

- Julia DumarsDocument2 pagesJulia DumarsSilvia NurNo ratings yet

- Sale of An Income Producing Asset To A Grantor Trust: Prepared For Mr. & Mrs. James SmithDocument15 pagesSale of An Income Producing Asset To A Grantor Trust: Prepared For Mr. & Mrs. James SmithBen SaltzmanNo ratings yet

- AkunDocument9 pagesAkunmorinNo ratings yet

- Latihan AJEDocument13 pagesLatihan AJEkhalzhrni17No ratings yet

- Accruals and Prepayments: AlreadyDocument4 pagesAccruals and Prepayments: AlreadyLOW YAN QINNo ratings yet

- 11a - 21feb2017 - Buying Your First HDB HomeDocument15 pages11a - 21feb2017 - Buying Your First HDB HomeHan Meng KohNo ratings yet

- Dividends and Other PayoutsDocument26 pagesDividends and Other Payoutsmger2000No ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- IAIIASI05&ACT05 - For StudentsDocument22 pagesIAIIASI05&ACT05 - For StudentsLovely Anne Dela CruzNo ratings yet

- Ac11 Bondoc - Elma Joyce: Easy QuestionsDocument13 pagesAc11 Bondoc - Elma Joyce: Easy QuestionsElma Joyce BondocNo ratings yet

- Grace Fidelia - Akuntansi Keuangan Dasar 1Document13 pagesGrace Fidelia - Akuntansi Keuangan Dasar 1Grace FideliaNo ratings yet

- ABC - Homework 02 - JaguinesDocument5 pagesABC - Homework 02 - JaguinesHannah Mae JaguinesNo ratings yet

- Tugas Ch.14Document6 pagesTugas Ch.14Chupa HesNo ratings yet

- Recording Adjustments For Revenues & Recording EquityDocument7 pagesRecording Adjustments For Revenues & Recording Equitypratibha jaggan martinNo ratings yet

- Lecture 19 - Dividends and Other PayoutsDocument12 pagesLecture 19 - Dividends and Other PayoutsMai HồNo ratings yet

- Financial Plan - Gavin WestDocument7 pagesFinancial Plan - Gavin Westapi-531246385No ratings yet

- ACCT102 - Principles of Accounting II Practice Exam IDocument6 pagesACCT102 - Principles of Accounting II Practice Exam IEleanor RoatNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Service Business Accounting CycleDocument6 pagesService Business Accounting CycleMarie Kairish Damag Vivar100% (1)

- ACT1106 - Midterm Quiz No. 2 With AnswerDocument8 pagesACT1106 - Midterm Quiz No. 2 With AnswerPj Dela VegaNo ratings yet

- ACC 402 - Problem 28Document2 pagesACC 402 - Problem 28Maria PiaNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderNo ratings yet

- CH 9 Exercises SolDocument2 pagesCH 9 Exercises SolAisha PatelNo ratings yet

- Soal Dan Jawaban Tugas Lab 3 - Stock Investment PDFDocument4 pagesSoal Dan Jawaban Tugas Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Jackson Kervin Rey G. Intacc 189 Activity 4 Unit 2 1Document4 pagesJackson Kervin Rey G. Intacc 189 Activity 4 Unit 2 1Kervin Rey JacksonNo ratings yet

- Gmernacej W5C5 AssigmentOLDDocument6 pagesGmernacej W5C5 AssigmentOLDalmaNo ratings yet

- Ayesha MidsDocument5 pagesAyesha MidsPrince HuzaifaNo ratings yet

- COSO ERM Framework Lessons Eligible 2april2018Document49 pagesCOSO ERM Framework Lessons Eligible 2april2018PUTRI YANINo ratings yet

- Soal Dan Jawaban Tugas Lab 1 - Accounting EquationDocument5 pagesSoal Dan Jawaban Tugas Lab 1 - Accounting EquationPUTRI YANINo ratings yet

- Putri Yani - UTS Oil Dan GasDocument4 pagesPutri Yani - UTS Oil Dan GasPUTRI YANINo ratings yet

- Soal Dan Jawaban Latihan Lab 2 - Business CombinationDocument10 pagesSoal Dan Jawaban Latihan Lab 2 - Business CombinationPUTRI YANINo ratings yet

- Soal Dan Jawaban Tugas Lab 2 - Business CombinationDocument4 pagesSoal Dan Jawaban Tugas Lab 2 - Business CombinationPUTRI YANINo ratings yet

- Materi Lab 3 - Stock Investment PDFDocument4 pagesMateri Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Materi Lab 1 - Home Office and Branch Office PDFDocument11 pagesMateri Lab 1 - Home Office and Branch Office PDFPUTRI YANINo ratings yet

- Soal Dan Jawaban Tugas Lab 3 - Stock Investment PDFDocument4 pagesSoal Dan Jawaban Tugas Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Soal Dan Jawaban Latihan Lab 3 - Stock InvestmentDocument8 pagesSoal Dan Jawaban Latihan Lab 3 - Stock InvestmentPUTRI YANINo ratings yet

- Company Profile PT Adhi Medika Indonesia PDFDocument9 pagesCompany Profile PT Adhi Medika Indonesia PDFPUTRI YANINo ratings yet

- Soal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficeDocument6 pagesSoal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficePUTRI YANINo ratings yet

- Soal Dan Jawaban Latihan Lab 1 - Home Office and Branch Office PDFDocument7 pagesSoal Dan Jawaban Latihan Lab 1 - Home Office and Branch Office PDFPUTRI YANINo ratings yet

- PPT1 - Introduction To Managerial FinanceDocument32 pagesPPT1 - Introduction To Managerial Financeiklan terusNo ratings yet

- Working Capital ManagmentDocument4 pagesWorking Capital ManagmentKundan kumarNo ratings yet

- CAPM in Capital BudgetingDocument2 pagesCAPM in Capital BudgetingNaga PraveenNo ratings yet

- Financial Accounting 2 Solved MCQs (Set-8)Document6 pagesFinancial Accounting 2 Solved MCQs (Set-8)Aarish AnsariNo ratings yet

- PAS 7 Statement of Cash FlowsDocument7 pagesPAS 7 Statement of Cash Flowspanda 1100% (6)

- Note 3Document37 pagesNote 3Anurag JainNo ratings yet

- مانيول شابتر 3Document38 pagesمانيول شابتر 3Abood AlissaNo ratings yet

- IFRS 16 Leases and Its Impact On Company'sDocument19 pagesIFRS 16 Leases and Its Impact On Company'sCamila Gonçalves WernerNo ratings yet

- Company Law ct1Document7 pagesCompany Law ct1TANISHA ISLAM SHENIZNo ratings yet

- What Are Assurance ServicesDocument2 pagesWhat Are Assurance ServicesMariella CatacutanNo ratings yet

- Topic 1 - Accounting EnvironmentDocument33 pagesTopic 1 - Accounting EnvironmentdenixngNo ratings yet

- CLS-Corporate Finance HonsDocument7 pagesCLS-Corporate Finance HonsMuskan KhatriNo ratings yet

- Economics Sanjeev VermaDocument12 pagesEconomics Sanjeev VermaPrakash Meena43% (7)

- Wema-Bank-Financial Statement-2019Document33 pagesWema-Bank-Financial Statement-2019john stonesNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- M & M APPLIANCE CENTER (PARTNERSHIP) Solved INCOME STATEMENTDocument1 pageM & M APPLIANCE CENTER (PARTNERSHIP) Solved INCOME STATEMENTsppNo ratings yet

- Transaction Analysis: Transaction 1. Investment by Owner Ray Neal Decides ToDocument31 pagesTransaction Analysis: Transaction 1. Investment by Owner Ray Neal Decides ToSophia LocreNo ratings yet

- Chapter 6 - Job Order CostingDocument52 pagesChapter 6 - Job Order CostingRicardo Nacor Jr.No ratings yet

- Accounting For Derivatives and Hedging ActivitiesDocument34 pagesAccounting For Derivatives and Hedging ActivitiesElle PaizNo ratings yet

- Tanco - Annual Report 2020 (Part 2)Document130 pagesTanco - Annual Report 2020 (Part 2)Yu Wen LaiNo ratings yet

- United MetalDocument2 pagesUnited MetalshakilnaimaNo ratings yet

- 04 - Audit of Payables and AccrualsDocument8 pages04 - Audit of Payables and AccrualsPhoebe WalastikNo ratings yet

- Jio Limited: Financial StatementsDocument27 pagesJio Limited: Financial StatementsAbhishek BajoriaNo ratings yet

- BIF Capital StructureDocument13 pagesBIF Capital Structuresagar_funkNo ratings yet

- Chapter 1-The Accounting ProcessDocument15 pagesChapter 1-The Accounting ProcessStarilazation KDNo ratings yet

- July 2021Document14 pagesJuly 2021RkkvanjNo ratings yet

- Amfi Exam NotesDocument2 pagesAmfi Exam NotesjaydipNo ratings yet

- Efficient Capital Market Powerpoint 1Document50 pagesEfficient Capital Market Powerpoint 1Janine Marquez100% (1)

- Section 272 of Companies Act 2013 Petition For Winding UpDocument3 pagesSection 272 of Companies Act 2013 Petition For Winding UpBazim sayd usmanNo ratings yet

- Business Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017Document6 pagesBusiness Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017NomaSonto NaMakoNo ratings yet