Professional Documents

Culture Documents

Business Taxation - Syllabus - BS Commerce - IUB

Uploaded by

Labib ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Taxation - Syllabus - BS Commerce - IUB

Uploaded by

Labib ShahCopyright:

Available Formats

COM-01304 BUSINESS TAXATION

1. INTRODUCTION AND SCOPE OF INCOME TAX LAW IN PAKISTAN. Definitions and

Terminologies; Exclusions from total income; Reduction in tax liability; Exemption from specific

provisions of income tax ordinance 2001. Distinction between capital and revenue items of expenditures;

Tests for differentiating between capital and revenue receipts and expenditures; Capital loss.

2. INCOME FROM SALARY, SCOPE OF SALARY INCOME. Allowances and relieves under the

Ordinance; Types of provident fund, treatment of provident fund, the sixth schedule, employer’s

contribution of approved gratuity fund deduction from income, gratuity fund deduction from income,

gratuity fund and schemes; Computation of income tax payable from salaried persons.

3. INCOME FROM BUSINESS AND PROFESSION Terms used; Considerations governing taxation

of business profits; Maintenance of accounts on mercantile or cash basis; Income chargeability under

income tax law on income from business; Principles of computation of taxable profits, allowable

deductions; Deduction for computing business income, significant changes introduced by the ordinance;

Non-admissible expense; Bad-debts etc.

4. INCOME FROM PROPERTY TAX ON AGRICULTURE INCOME. Income from property tax

on agriculture income; Calculation of ALV; Allowable deduction from income from property; Set-off and

carry forward of losses; Types of Losses; Rules for set-off and carry forward; Penalties, offenses, appeals

and prosecutions; Income tax authorities their appointments, adducties and the limitation and powers.

5. INCOME FROM OTHER SOURCES: Deduction for computing income from other sources; Capital

gains; Exchange gain/losses, income deemed to accrue or arise

6. OTHER ANCILLARY PROVISIONS Tax accountings and assessment cycle, procedure filling of

return; Power to grant extension of time for filling the return, assessment procedure, provisional

assessment, notes for production of books of accounts, evidence, etc.; Assessment on the basis of return,

wealth statement, simplification of assessment of procedure, payment of tax before assessment, changes

in tax withholding and collection of tax; Withholding tax rates under section 50(6) collection of tax on

demand, recovery of tax; Recovery of arrears/ refunds demand, refund and tax credit, persons entitled to

claim refund in certain case, income tax refunds, penalties, enhanced tax rates for higher slabs of income,

first schedule rates of income tax for individuals, unregistered firms, association of persons and Hindu

individuals. Assessment of individual salaried and non-salaried person; Self-assessment scheme; Appeals;

Practical Problem

7. Income Tax Rules, 2002: Definitions related to the rules; Heads of income; Income of residents; Tax

of non-residents; Transfer pricing; Records and books of accounts; Certificates; Advance tax collection or

deduction, Payment, Statements of tax collected or deducted. Income tax recovery rules, Registration of

income tax practitioners, Recognized terminal benefits funds.

Recommended Books / Texts:

1. Income Tax Ordinance, 2001 issued by FBR

2. Income Tax Ordinance, 2001 published by Mehboob, A. Sheikh, Taxation, latest edition – current year.

3. Synopsis of Taxes by Mirza Munawwar Hussain, Latest Edition – current year

Reference Books:

1. Synopsis of Taxes in Pakistan by Mirza Munawar Husain (FCMA), Waheed Book House,

Lahore.

2. Business Taxation, Ijaz Ali Waince (Latest Edition covering latest finance bill), Waince

Academy, Lahore.

3. Mughal, Muhammad Muazzam, Income Tax-Principles and Practice, Syed Mobin & Co., Lahore.

You might also like

- SPDF May 2007Document8 pagesSPDF May 2007BfpCamarinesNorteNo ratings yet

- Income Taxation EssentialsDocument19 pagesIncome Taxation EssentialsMark IlanoNo ratings yet

- SYLLABUSDocument2 pagesSYLLABUSPawan BansalNo ratings yet

- Implications of The Small Business Tax Amnesty On Accounting, Auditing, Legislation and EthicsDocument23 pagesImplications of The Small Business Tax Amnesty On Accounting, Auditing, Legislation and EthicsGavin HenningNo ratings yet

- Company Law and Allied RulesDocument11 pagesCompany Law and Allied RulesFaisalNo ratings yet

- Business TaxationDocument3 pagesBusiness TaxationRaJa50% (2)

- The Cpa Licensure Examination Syllabus Taxation Effective October 2022 ExaminationDocument4 pagesThe Cpa Licensure Examination Syllabus Taxation Effective October 2022 ExaminationMarc Anthony Max MagbalonNo ratings yet

- Advance Taxation Fy 2076Document340 pagesAdvance Taxation Fy 2076Anil ShahNo ratings yet

- Due Diligence-Tax Due Dil - FinalDocument6 pagesDue Diligence-Tax Due Dil - FinalEljoe VinluanNo ratings yet

- AX Lanning: by Anup K SuchakDocument27 pagesAX Lanning: by Anup K SuchakanupsuchakNo ratings yet

- Resume 5Document5 pagesResume 5MariaNo ratings yet

- TaxationDocument11 pagesTaxationAlexis SosingNo ratings yet

- Syllabus - Modified Scheme of Study: Strategic Level-1Document3 pagesSyllabus - Modified Scheme of Study: Strategic Level-1Sadaqat AliNo ratings yet

- Tax Planning and ManagementDocument23 pagesTax Planning and Managementarchana_anuragi100% (1)

- Law of Taxation Law-I Course SyllabusDocument2 pagesLaw of Taxation Law-I Course SyllabusAmanNo ratings yet

- MPA605 Taxation Course Outline-1Document2 pagesMPA605 Taxation Course Outline-1Aminul Islam Rubel100% (1)

- CT Part 1-IntroductionDocument45 pagesCT Part 1-IntroductionSHAURYA VERMANo ratings yet

- Principles of Taxation and Financial AccountingDocument12 pagesPrinciples of Taxation and Financial Accountingnikol sanchezNo ratings yet

- Accounts, Taxation & Sap Fico SyllabusDocument4 pagesAccounts, Taxation & Sap Fico SyllabusAditi BansalNo ratings yet

- Employers' GuideDocument44 pagesEmployers' GuideMary Ann AdrianoNo ratings yet

- Corporate Tax Management EDU MBA Summer 2020Document100 pagesCorporate Tax Management EDU MBA Summer 2020Foyez HafizNo ratings yet

- Accounting 170Document14 pagesAccounting 170cynthia reyesNo ratings yet

- TAX 2 Group 1 Handout PDFDocument6 pagesTAX 2 Group 1 Handout PDFMi-young SunNo ratings yet

- REGULAR INCOME TAX: KEY ITEMS AND RULESDocument24 pagesREGULAR INCOME TAX: KEY ITEMS AND RULESAce ReytaNo ratings yet

- Income Tax Unit - 1Document13 pagesIncome Tax Unit - 1YuvrajNo ratings yet

- Due Diligence-Tax Due DilDocument4 pagesDue Diligence-Tax Due DilEljoe VinluanNo ratings yet

- Income Tax Appeals FormDocument17 pagesIncome Tax Appeals FormKim NisarNo ratings yet

- Employers' comprehensive guide to PAYE obligationsDocument42 pagesEmployers' comprehensive guide to PAYE obligationsGarth ChambersNo ratings yet

- The PAYE System: Employers’ Guide to Personal Income TaxDocument53 pagesThe PAYE System: Employers’ Guide to Personal Income TaxTrent DavisNo ratings yet

- How To Compute Income TaxDocument36 pagesHow To Compute Income TaxbrownboomerangNo ratings yet

- Basic Concepts of Income TaxationDocument250 pagesBasic Concepts of Income TaxationSpace ResearchNo ratings yet

- Stages of Tax Audit ProcessDocument2 pagesStages of Tax Audit ProcessMisshtaCNo ratings yet

- Self Assessments SchemeDocument10 pagesSelf Assessments SchemeRafae ShahidNo ratings yet

- (ACYFAR 5) ReflectionDocument28 pages(ACYFAR 5) ReflectionAl ChuaNo ratings yet

- Differences Between Taxable Income and Business IncomeDocument17 pagesDifferences Between Taxable Income and Business IncomeMegawati MediyaniNo ratings yet

- Advance Tax Explained: Key Concepts and Provisions for AssesseesDocument10 pagesAdvance Tax Explained: Key Concepts and Provisions for Assesseesnaman guptaNo ratings yet

- University of Lusaka: School of Economics, Business & ManagementDocument92 pagesUniversity of Lusaka: School of Economics, Business & ManagementDixie Cheelo100% (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Homework - Income TaxesDocument3 pagesHomework - Income TaxesPeachyNo ratings yet

- Final Tax and Creditable Withholding TaxesDocument3 pagesFinal Tax and Creditable Withholding Taxesarrianemartinez100% (4)

- PWC Client AdvisoryDocument8 pagesPWC Client AdvisoryFedsNo ratings yet

- Interplay of Accounting and Taxation PrinciplesDocument20 pagesInterplay of Accounting and Taxation PrinciplesChelsea BorbonNo ratings yet

- Tax Avoidance and Tax EvasionDocument6 pagesTax Avoidance and Tax EvasionBhavanaNo ratings yet

- Tax SyllabusDocument22 pagesTax SyllabusJulius AlcantaraNo ratings yet

- Different Ways of Tax Avoidance and EvasionDocument4 pagesDifferent Ways of Tax Avoidance and EvasionPriyankaNo ratings yet

- Tax Laws and Practice (Module I Paper 4)Document778 pagesTax Laws and Practice (Module I Paper 4)sonamkhanchandaniNo ratings yet

- National TaxationDocument18 pagesNational TaxationShiela Joy CorpuzNo ratings yet

- IrsDocument64 pagesIrsYogesh KumarNo ratings yet

- Principles of AccountingDocument5 pagesPrinciples of AccountingAminul Haque RusselNo ratings yet

- CHAPTER 13 - SummarizeDocument13 pagesCHAPTER 13 - SummarizejsgiganteNo ratings yet

- Tax Planning, Avoidance, Tax EvasionDocument40 pagesTax Planning, Avoidance, Tax Evasionsimm170226No ratings yet

- Untitled DocumentDocument3 pagesUntitled DocumentbshivamofficialNo ratings yet

- Tax Planning DefinitionDocument7 pagesTax Planning DefinitionAlex MasonNo ratings yet

- FREE Online Tax Return Audit Before FilingDocument49 pagesFREE Online Tax Return Audit Before FilingIamangel10100% (17)

- HK Inland Revenue Department Interpretation and Practice Notes on Commissions, Rebates and DiscountsDocument6 pagesHK Inland Revenue Department Interpretation and Practice Notes on Commissions, Rebates and DiscountsDifanny KooNo ratings yet

- Chap 13 ReportDocument11 pagesChap 13 Report2vpsrsmg7jNo ratings yet

- 8 Pointers For Expanded Withholding Taxes in The PhilippinesDocument3 pages8 Pointers For Expanded Withholding Taxes in The Philippinesjan daveNo ratings yet

- Tax PlanningDocument66 pagesTax PlanningshailendraNo ratings yet

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthFrom EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNo ratings yet

- Sales Tax, Excise Duty and Customs - Syllabus - BS Commerce - IUBDocument2 pagesSales Tax, Excise Duty and Customs - Syllabus - BS Commerce - IUBLabib ShahNo ratings yet

- Donald Chapter 1Document53 pagesDonald Chapter 1Labib ShahNo ratings yet

- Lecture 08Document12 pagesLecture 08Riaz Baloch NotezaiNo ratings yet

- Balance SheetDocument2 pagesBalance SheetLabib ShahNo ratings yet

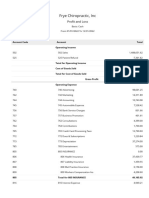

- Profit and LossDocument3 pagesProfit and LossLabib ShahNo ratings yet

- Examples of Absorption and Variable CostingDocument26 pagesExamples of Absorption and Variable CostingLabib ShahNo ratings yet

- Lecture 04Document36 pagesLecture 04Labib ShahNo ratings yet

- Lecture 04Document36 pagesLecture 04Labib ShahNo ratings yet

- Lecture 07Document17 pagesLecture 07Riaz Baloch NotezaiNo ratings yet

- Spring 2013 - FIN730 - 1 PDFDocument3 pagesSpring 2013 - FIN730 - 1 PDFLabib ShahNo ratings yet

- Lecture 04Document36 pagesLecture 04Labib ShahNo ratings yet

- Lecture 05Document32 pagesLecture 05Riaz Baloch NotezaiNo ratings yet

- Spring 2013 - FIN730 - 1 - SOL PDFDocument3 pagesSpring 2013 - FIN730 - 1 - SOL PDFLabib ShahNo ratings yet

- Lecture 03Document30 pagesLecture 03Labib ShahNo ratings yet

- 7 E's Management AccountingDocument18 pages7 E's Management AccountingLabib Shah100% (2)

- Semester Spring 2013 Investment Analysis & Portfolio Management-FIN730Document2 pagesSemester Spring 2013 Investment Analysis & Portfolio Management-FIN730Labib ShahNo ratings yet

- Behavioral Classification of CostDocument22 pagesBehavioral Classification of CostLabib ShahNo ratings yet

- Semester Spring 2013 Investment Analysis & Portfolio Management-FIN730Document3 pagesSemester Spring 2013 Investment Analysis & Portfolio Management-FIN730Labib ShahNo ratings yet

- Investment Analysis GDBs of MR ButtDocument8 pagesInvestment Analysis GDBs of MR ButtLabib ShahNo ratings yet

- Spring 2013 - FIN730 - 1 PDFDocument3 pagesSpring 2013 - FIN730 - 1 PDFLabib ShahNo ratings yet

- Semester Spring 2013 Investment Analysis & Portfolio Management-FIN730Document3 pagesSemester Spring 2013 Investment Analysis & Portfolio Management-FIN730Labib ShahNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)Labib ShahNo ratings yet

- Semester Spring 2013 Investment Analysis & Portfolio Management-FIN730Document2 pagesSemester Spring 2013 Investment Analysis & Portfolio Management-FIN730Labib ShahNo ratings yet

- Investment Analysis GDBs of MR ButtDocument8 pagesInvestment Analysis GDBs of MR ButtLabib ShahNo ratings yet

- WR CSM 20 NameList 24032021 EngliDocument68 pagesWR CSM 20 NameList 24032021 EnglivijaygnluNo ratings yet

- Moving Up Ceremony SpeechDocument3 pagesMoving Up Ceremony SpeechJhei AfableNo ratings yet

- WHD20162022a Pérez Vs Puerto Rico Police Department DemandaDocument8 pagesWHD20162022a Pérez Vs Puerto Rico Police Department DemandaEmily RamosNo ratings yet

- Eligibility Criteria For Fullerton India Personal LoanDocument7 pagesEligibility Criteria For Fullerton India Personal LoanSaikat MridhaNo ratings yet

- Segment Ix: Katarungang Pambarangay LAWDocument56 pagesSegment Ix: Katarungang Pambarangay LAWYandi BellsNo ratings yet

- EXAM HALL INSTRUCTIONS EditedDocument1 pageEXAM HALL INSTRUCTIONS EditedObaid RahmanNo ratings yet

- Issues and DefensesDocument34 pagesIssues and DefensesGrasya AlbanoNo ratings yet

- Edillon v. Manila Bankers Life, 1982Document1 pageEdillon v. Manila Bankers Life, 1982Randy SiosonNo ratings yet

- Study Guide For Module No.10: X Protecting InventoryDocument4 pagesStudy Guide For Module No.10: X Protecting InventoryTherese Anne SalvalozaNo ratings yet

- The Fetid Revel v2Document6 pagesThe Fetid Revel v2Alexandre CrowNo ratings yet

- Customer No.: 22536396 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument6 pagesCustomer No.: 22536396 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressjunedrkaziNo ratings yet

- Dl-54b Photo ID Card ChangeDocument2 pagesDl-54b Photo ID Card ChangePA Work LicenseNo ratings yet

- HPE 3PAR StoreServ 7000 Storage Drive Support ReferenceDocument17 pagesHPE 3PAR StoreServ 7000 Storage Drive Support Referenceben boltNo ratings yet

- Arthur and Leonora Stilgrove (Sec. 3 (E) of R.A. 3019Document13 pagesArthur and Leonora Stilgrove (Sec. 3 (E) of R.A. 3019Shan KhingNo ratings yet

- MR Michael Ogbu - Deed of AssignmentDocument6 pagesMR Michael Ogbu - Deed of AssignmentEmmanuel Emeka EkemedoNo ratings yet

- Promo: Choose ProducerDocument1 pagePromo: Choose ProducerJakub OpalkaNo ratings yet

- Syntizen Business ProfileDocument9 pagesSyntizen Business Profiledinesh1625No ratings yet

- FWD 2Document21 pagesFWD 2Maria Ghingerlee SalvadorNo ratings yet

- Ligot Vs RepublicDocument5 pagesLigot Vs RepublicPaolo MendioroNo ratings yet

- Law and Rural Development SynopsisDocument5 pagesLaw and Rural Development SynopsisShaswat JoshiNo ratings yet

- FTTH Purchase Order TitleDocument3 pagesFTTH Purchase Order TitleRicardo Viriato Barrocas Van Der MerweNo ratings yet

- Sanjay Industries - Vertical Format - For StudentsDocument19 pagesSanjay Industries - Vertical Format - For StudentsGarimaBhandariNo ratings yet

- 06-Projected Financial StatementsDocument7 pages06-Projected Financial StatementsMaria NisarNo ratings yet

- Drehkreuz Installation Manual 1 3 en ManDocument58 pagesDrehkreuz Installation Manual 1 3 en ManDouglas Cabral100% (1)

- BAC Resolution NoDocument3 pagesBAC Resolution NoAnnie Gracia G Estrella100% (1)

- Tertullians Disciplinary, Moral and Ascetical Writings, New York 1959Document328 pagesTertullians Disciplinary, Moral and Ascetical Writings, New York 1959diadass100% (2)

- Maurices Code of Conduct - PT. Pan Pacific Jakarta - EncryptedDocument4 pagesMaurices Code of Conduct - PT. Pan Pacific Jakarta - EncryptedAchmad Diky IrawanNo ratings yet

- F7 Sir Zubair NotesDocument119 pagesF7 Sir Zubair NotesAli OpNo ratings yet

- Chapter 2 Basic LawsDocument15 pagesChapter 2 Basic LawsChristian Muli0% (1)

- Dr. Shahnawaz Letter of IntentDocument2 pagesDr. Shahnawaz Letter of Intentamukherjee84No ratings yet