Professional Documents

Culture Documents

Requirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) From

Uploaded by

JaneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Requirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) From

Uploaded by

JaneCopyright:

Available Formats

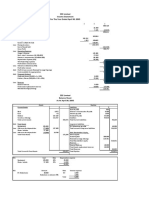

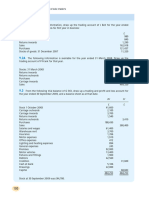

At the start of 20x1, MIRA Co.

’s held for trading securities consist of 10,000 shares of

Trucking Co. with fair value per share of P 80. Mira’s trading activities relating to

Trucking Co.’s shares during the year are summarized below:

• Acquired 5,000 shares at P 78 per share. Total transaction cost (tax) was P

18,500.

• Sold 3,000 shares (from those held at the start of the year) at P 82 per share.

Total transaction cost was P 12,300.

Trucking Co.’s shares have a fair value of P 81 per share on December 31, 20x1.

Requirements: Provide the journal entries. Determine the total net gail (loss) from

the sale and fair value change during the period.

Solution:

Acquisitio Held for trading securities 390,000

n

Taxes and licenses 18,500

Cash 408,500

Sale Cash [(3,000 x 82) – 12,300] 233,700

Loss 6,300

Held for trading sec. (3,000 x 80) 240,000

Dec. 31, Held for trading securities 22,000

20x1

Gain (a) 22,000

(a)

Fair value on 12/31/x1 (10,000 sh. + 5,000 sh. – 3,000 sh.) x ₱81 972,000

Carrying amount (10,000 sh. x ₱80) beg. + 390,000 Dr. – 240,000 Cr. 950,000

Gain 22,00

Realized loss on sale (6,30

Unrealized gain on fair value 22,00

change Net gain 15,70

❖ Reconciliation:

Held for trading - beg. 800,00

0

Acquisitions during the year 390,00

0

Total 1,190,00

0

Held for trading - end. 972,00

0

Net proceeds from sale 233,70

0

Total 1,205,70

0

Total net gain from fair value change and sale 15,7

00

This study source was downloaded by 100000875043479 from CourseHero.com on 11-01-2023 02:26:51 GMT -05:00

https://www.coursehero.com/file/105317837/1Edocx/

Powered by TCPDF (www.tcpdf.org)

You might also like

- Company Profit and LossDocument6 pagesCompany Profit and LossFazal Rehman Mandokhail50% (2)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Eyden - Air Transport Management PDFDocument526 pagesEyden - Air Transport Management PDFLê Đức Anh100% (1)

- Forex - DerivativesDocument5 pagesForex - DerivativesAllyse CarandangNo ratings yet

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- HR Operations SpecialistDocument2 pagesHR Operations SpecialistMuhammad FarhanNo ratings yet

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaNo ratings yet

- Chapter 15 From Textbook T.S. Grewal (2018) For Class 11 ACCOUNTANCYDocument59 pagesChapter 15 From Textbook T.S. Grewal (2018) For Class 11 ACCOUNTANCYvkbm42100% (2)

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADocument17 pagesOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarNo ratings yet

- Exercise No.4 Bus. Co.Document56 pagesExercise No.4 Bus. Co.Jeane Mae BooNo ratings yet

- T.S. Grewal (2018) For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial StatementsDocument97 pagesT.S. Grewal (2018) For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial Statementssumitha ganesan0% (1)

- Sec Opinion - Sept 3 1984 PDFDocument2 pagesSec Opinion - Sept 3 1984 PDFRobin ScherbatskyNo ratings yet

- 213Document1 page213yoeliyyNo ratings yet

- Final AccountsDocument39 pagesFinal Accountsaayushsurana1204No ratings yet

- P13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Document3 pagesP13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Friska AvriliaNo ratings yet

- Assign 4 Natividad BSA 2-13Document5 pagesAssign 4 Natividad BSA 2-13Natividad, Kered ZilyoNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- Double Entry Book Keeping Ts Grewal 2018 For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial StatementsDocument60 pagesDouble Entry Book Keeping Ts Grewal 2018 For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial Statementsrohit kumarNo ratings yet

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Income StatementDocument1 pageIncome Statementzin GuevarraNo ratings yet

- Chapter 8Document12 pagesChapter 8Sarah May Tigue TalagtagNo ratings yet

- Exchange of MachineDocument2 pagesExchange of MachineShoebNo ratings yet

- By of 3,750: AccountDocument6 pagesBy of 3,750: AccountAravind ShekharNo ratings yet

- Income StatementDocument1 pageIncome StatementNIAZ HUSSAINNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- Whiteboard Feb 01, 2021Document11 pagesWhiteboard Feb 01, 2021arun maheshwariNo ratings yet

- Class Work NAME: - SECTIONDocument1 pageClass Work NAME: - SECTIONpalashndcNo ratings yet

- Mock Solution FAR 1-KnSDocument12 pagesMock Solution FAR 1-KnSMuhammad YahyaNo ratings yet

- Aud1 022424 LectureDocument1 pageAud1 022424 LectureJessie PaterezNo ratings yet

- Practice Sheet For ClassDocument4 pagesPractice Sheet For ClassPrerna AroraNo ratings yet

- 01 ELMS Activity 2Document2 pages01 ELMS Activity 2Gonzaga FamNo ratings yet

- MTP 12 25 Answers 1697029886Document13 pagesMTP 12 25 Answers 1697029886harshallahotNo ratings yet

- Solution:: Investments: Problem 6: For Classroom DiscussionDocument21 pagesSolution:: Investments: Problem 6: For Classroom DiscussionMarie Frances SaysonNo ratings yet

- IS & SFP PracticeDocument3 pagesIS & SFP PracticesubachaluNo ratings yet

- This Study Resource WasDocument1 pageThis Study Resource WasKimberly Claire AtienzaNo ratings yet

- Konsolidasi A. Alokasi Harga: Nama: Muhammad Fadhil NIM: 023152000055 Matkul: Pelaporan KorporatDocument7 pagesKonsolidasi A. Alokasi Harga: Nama: Muhammad Fadhil NIM: 023152000055 Matkul: Pelaporan KorporatMuhammad FadhilNo ratings yet

- This Study Resource Was: Solutions To Assigned Problems & ExercisesDocument3 pagesThis Study Resource Was: Solutions To Assigned Problems & ExercisesMikaela Amigan EvangelistaNo ratings yet

- This Study Resource Was Shared Via: RequiredDocument1 pageThis Study Resource Was Shared Via: RequiredJalaj GuptaNo ratings yet

- ORQUIA AssignmentDocument4 pagesORQUIA AssignmentClint RoblesNo ratings yet

- 4 1 Question - 1Document7 pages4 1 Question - 1McAndah JoeNo ratings yet

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- RadheDocument11 pagesRadheApoorv GUPTANo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceRos Shafiqah Husna RoslanNo ratings yet

- General Ledger Account Balance Account Name Debit (RM) Credit (RM)Document1 pageGeneral Ledger Account Balance Account Name Debit (RM) Credit (RM)Ros Shafiqah Husna RoslanNo ratings yet

- F7 (FR) Workbook (Mix)Document6 pagesF7 (FR) Workbook (Mix)Aye Myat ThawtarNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasYukiNo ratings yet

- LECTURE NOTES-Translation of Foreign FSDocument4 pagesLECTURE NOTES-Translation of Foreign FSGenesis CervantesNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- 6 AdvacDocument4 pages6 AdvacAlayka LorzanoNo ratings yet

- Solution Chapter 6 Financial Statements Pre Adjustments 1Document8 pagesSolution Chapter 6 Financial Statements Pre Adjustments 1IsmahNo ratings yet

- Solutions DepreciationDocument5 pagesSolutions DepreciationMaria Sarah RevecoyNo ratings yet

- Leverage QuestionsDocument8 pagesLeverage QuestionsMidhun George VargheseNo ratings yet

- 12 - Incomplete Record - With - AnswerDocument13 pages12 - Incomplete Record - With - AnswerAbid faisal AhmedNo ratings yet

- Activity 2 - Assignment (Answer)Document1 pageActivity 2 - Assignment (Answer)karmaudeNo ratings yet

- IT Assessment of Individuals IllustrationDocument5 pagesIT Assessment of Individuals Illustrationsyedfareed596No ratings yet

- Castillo - Income Statement and Cost ControlDocument2 pagesCastillo - Income Statement and Cost ControlAndriel JophineNo ratings yet

- Far510 Solution July 2020Document7 pagesFar510 Solution July 2020clumsycaaaaaNo ratings yet

- 01 Quiz 1Document3 pages01 Quiz 1Emperor SavageNo ratings yet

- Solution Final Mock Paper (Sure Shot Questions) Class 12 - AccountancyDocument10 pagesSolution Final Mock Paper (Sure Shot Questions) Class 12 - AccountancyPratik PrakashNo ratings yet

- Date Account Title Debit Credit: Cost Method Equity MethodDocument4 pagesDate Account Title Debit Credit: Cost Method Equity MethodFriska AvriliaNo ratings yet

- LOGON AustriaDocument28 pagesLOGON AustriapapirihemijskaNo ratings yet

- Reply-Wesco - FICO AMDocument165 pagesReply-Wesco - FICO AMJit GhoshNo ratings yet

- Catholic Relief Services-USCCB Proposed Chart of Accounts For PartnersDocument59 pagesCatholic Relief Services-USCCB Proposed Chart of Accounts For PartnersRic VinceNo ratings yet

- Chapter 11-12 - Marketing StrategyDocument70 pagesChapter 11-12 - Marketing StrategyHaryadi WidodoNo ratings yet

- Peak - CurrentCPDactivitiesDocument64 pagesPeak - CurrentCPDactivitiesBen YungNo ratings yet

- Chapter 4Document6 pagesChapter 4Fatemah MohamedaliNo ratings yet

- Punjab National Bank Financial Inclusion: Experience SharingDocument18 pagesPunjab National Bank Financial Inclusion: Experience SharingShreya DubeyNo ratings yet

- C.A IPCC May 2008 Tax SolutionsDocument13 pagesC.A IPCC May 2008 Tax SolutionsAkash GuptaNo ratings yet

- Chapter 06 Test BankDocument61 pagesChapter 06 Test BankMariamNo ratings yet

- Chapter-1 Company Profile: A Study of Industrial Relations in Cadbury India LTDDocument51 pagesChapter-1 Company Profile: A Study of Industrial Relations in Cadbury India LTDAnkit SalujaNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingSirshajit SanfuiNo ratings yet

- PolvoronDocument25 pagesPolvoronChristine Margoux SiriosNo ratings yet

- Labour Law Notes - WIPDocument38 pagesLabour Law Notes - WIPSabarNo ratings yet

- 01 - Ishares 7-10 Year Treasury Bond FundDocument0 pages01 - Ishares 7-10 Year Treasury Bond FundRoberto PerezNo ratings yet

- MGT610 Business Ethics Mid Term Solved MCQs 1Document15 pagesMGT610 Business Ethics Mid Term Solved MCQs 1irtaza HashmiNo ratings yet

- 2 - Cost Concepts and BehaviorDocument3 pages2 - Cost Concepts and BehaviorPattraniteNo ratings yet

- Chapter 1 4Document58 pagesChapter 1 4Jessica CortesNo ratings yet

- Group Annual Report 2020Document260 pagesGroup Annual Report 2020Prysmian GroupNo ratings yet

- Sibilski OdpDocument35 pagesSibilski Odpkalineczka.rausNo ratings yet

- Supply Chain ManagementDocument71 pagesSupply Chain ManagementYopi TheaNo ratings yet

- Covid19 and The Power Sector ReportDocument7 pagesCovid19 and The Power Sector ReportSunny EnergyEfficiency EjimaNo ratings yet

- CorningGlass PDFDocument78 pagesCorningGlass PDFAlexandre Antonio MaitaNo ratings yet

- Learn Vibrant: Class 10th: CH 4 The Making of Global World History Social Studies Important Questions Answer IncludedDocument19 pagesLearn Vibrant: Class 10th: CH 4 The Making of Global World History Social Studies Important Questions Answer Includedᴊᴊ ᴇᴅɪᴛꜱNo ratings yet

- Itroduction: According To A Report by Confederation of IndianDocument2 pagesItroduction: According To A Report by Confederation of Indiansrishti bhatejaNo ratings yet

- Syed Zaveer Naqvi Internship Viva ReportDocument42 pagesSyed Zaveer Naqvi Internship Viva ReportMuhammad HasnatNo ratings yet

- New Rules of MoneyDocument2 pagesNew Rules of MoneyTKNo ratings yet