Professional Documents

Culture Documents

213

Uploaded by

yoeliyyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

213

Uploaded by

yoeliyyCopyright:

Available Formats

At the start of 20x1, Aglolos Co.

’s held for trading securities consist of 10,000 shares of

Trucking Co. with fair value per share of P 80. Aglolo’s trading activities relating to Trucking

Co.’s shares during the year are summarized below:

Acquired 5,000 shares at P 78 per share. Total transaction cost (tax) was P 18,500.

Sold 3,000 shares (from those held at the start of the year) at P 82 per share. Total

transaction cost was P 12,300.

Trucking Co.’s shares have a fair value of P 81 per share on December 31, 20x1.

Requirements: Provide the journal entries. Determine the total net gail (loss) from the sale

and fair value change during the period.

Solution:

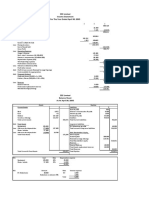

Acquisitio Held for trading securities 390,000

n Taxes and licenses 18,500

Cash 408,50

0

Sale Cash [(3,000 x 82) – 12,300] 233,700

Loss 6,300

Held for trading sec. (3,000 x 80) 240,000

Dec. 31, Held for trading securities 22,000

20x1 Gain (a) 22,000

(a) Fair value on 12/31/x1 (10,000 sh. + 5,000 sh. – 3,000 sh.) x ₱81 972,000

Carrying amount (10,000 sh. x ₱80) beg. + 390,000 Dr. – 240,000 Cr. 950,000

Gain 22,000

Realized loss on sale (6,300)

Unrealized gain on fair value change Net gain 22,000

15,700

❖ Reconciliation:

Held for trading - beg. 800,00

0

Acquisitions during the year 390,00

0

Total 1,190,000

Held for trading - end. 972,00

0

Net proceeds from sale 233,70

0

Total 1,205,700

Total net gain from fair value change and sale 15,70

0

This study source was downloaded by 100000855042860 from CourseHero.com on 10-18-2022 22:35:49 GMT -05:00

https://www.coursehero.com/file/81885974/213docx/

Powered by TCPDF (www.tcpdf.org)

You might also like

- Requirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) FromDocument1 pageRequirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) FromJaneNo ratings yet

- Vertical Income Statement and Balance Sheet for Jyoti LtdDocument6 pagesVertical Income Statement and Balance Sheet for Jyoti LtdAravind ShekharNo ratings yet

- Exercise No.4 Bus. Co.Document56 pagesExercise No.4 Bus. Co.Jeane Mae BooNo ratings yet

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaNo ratings yet

- Multiple-step income statement for Muffin LimitedDocument4 pagesMultiple-step income statement for Muffin LimitedPrerna AroraNo ratings yet

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- Final Accounts (2)Document39 pagesFinal Accounts (2)aayushsurana1204No ratings yet

- Edrich Company gross sales computationDocument2 pagesEdrich Company gross sales computationYukiNo ratings yet

- Konsolidasi Laporan Keuangan dan Pajak PerusahaanDocument7 pagesKonsolidasi Laporan Keuangan dan Pajak PerusahaanMuhammad FadhilNo ratings yet

- Class Work NAME: - SECTIONDocument1 pageClass Work NAME: - SECTIONpalashndcNo ratings yet

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- Whiteboard Feb 01, 2021Document11 pagesWhiteboard Feb 01, 2021arun maheshwariNo ratings yet

- Income StatementDocument1 pageIncome StatementNIAZ HUSSAINNo ratings yet

- 4 1 Question - 1Document7 pages4 1 Question - 1McAndah JoeNo ratings yet

- Financial Statements of Limited CompaniesDocument6 pagesFinancial Statements of Limited CompaniesFazal Rehman Mandokhail50% (2)

- Chapter 8 Problems Financial StatementsDocument12 pagesChapter 8 Problems Financial StatementsSarah May Tigue TalagtagNo ratings yet

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- Inventory Estimation and LCNRV Sample ProblemsDocument3 pagesInventory Estimation and LCNRV Sample Problemsaldric taclanNo ratings yet

- Solution Chapter 6 Financial Statements Pre Adjustments 1Document8 pagesSolution Chapter 6 Financial Statements Pre Adjustments 1IsmahNo ratings yet

- 01 ELMS Activity 2Document2 pages01 ELMS Activity 2Gonzaga FamNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- Principles of Accounting ExerciseDocument4 pagesPrinciples of Accounting ExerciseAin FatihahNo ratings yet

- FM Company Statement of Comprehensive Income For The Year Ended December 31, 2017 Net SalesDocument2 pagesFM Company Statement of Comprehensive Income For The Year Ended December 31, 2017 Net SalesJelly Ann AndresNo ratings yet

- BSA 2-13 Assignment #4 Equity Method ProblemsDocument5 pagesBSA 2-13 Assignment #4 Equity Method ProblemsNatividad, Kered ZilyoNo ratings yet

- Double Entry Book Keeping Ts Grewal 2018 For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial StatementsDocument60 pagesDouble Entry Book Keeping Ts Grewal 2018 For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial Statementsrohit kumarNo ratings yet

- Statement of Comprehensive Income RM RMDocument11 pagesStatement of Comprehensive Income RM RMKashveena BathmanathanNo ratings yet

- Castillo - Income Statement and Cost ControlDocument2 pagesCastillo - Income Statement and Cost ControlAndriel JophineNo ratings yet

- Exchange of MachineDocument2 pagesExchange of MachineShoebNo ratings yet

- ROI BaripadaDocument1 pageROI BaripadaTanmay AgarwalaNo ratings yet

- Integrated Review 1 SubmissionsDocument17 pagesIntegrated Review 1 SubmissionsJohn Lexter Macalber100% (1)

- This Study Resource Was: Solutions To Assigned Problems & ExercisesDocument3 pagesThis Study Resource Was: Solutions To Assigned Problems & ExercisesMikaela Amigan EvangelistaNo ratings yet

- Vulcan Company's June income statements analyzedDocument1 pageVulcan Company's June income statements analyzedJalaj GuptaNo ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- 12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Document6 pages12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Tess CoaryNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- RadheDocument11 pagesRadheApoorv GUPTANo ratings yet

- Statement of Profit or Loss For The Year Ended 31 March 2009Document1 pageStatement of Profit or Loss For The Year Ended 31 March 2009Plawan GhimireNo ratings yet

- Calculating operating, financial and combined leverage ratios from income statementsDocument8 pagesCalculating operating, financial and combined leverage ratios from income statementsMidhun George VargheseNo ratings yet

- Mock Test PreparationDocument6 pagesMock Test PreparationHà Quảng TâyNo ratings yet

- Chapter 5 Tutorial ExerciseDocument5 pagesChapter 5 Tutorial ExerciseFarheen AkramNo ratings yet

- Income StatementDocument1 pageIncome Statementzin GuevarraNo ratings yet

- Accounts Homework SolutionsDocument67 pagesAccounts Homework SolutionsKunal BhansaliNo ratings yet

- Lecture Notes - Financial Statement AnalysisDocument56 pagesLecture Notes - Financial Statement AnalysisRajnishKumarRohatgiNo ratings yet

- Installment Sales NotesDocument19 pagesInstallment Sales NotesTrixie HicaldeNo ratings yet

- Close LTDDocument5 pagesClose LTDXianFa WongNo ratings yet

- IS - Notes (Part1)Document14 pagesIS - Notes (Part1)Andrea Marie CalmaNo ratings yet

- 12 - Incomplete Record - With - AnswerDocument13 pages12 - Incomplete Record - With - AnswerAbid faisal AhmedNo ratings yet

- Activity 2 - Assignment (Answer)Document1 pageActivity 2 - Assignment (Answer)karmaudeNo ratings yet

- Acinac Problem 5Document5 pagesAcinac Problem 5Angelo Gian CoNo ratings yet

- Bayer Lamp CompanyDocument5 pagesBayer Lamp CompanyTrisha Mae CorpuzNo ratings yet

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- P13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Document3 pagesP13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Friska AvriliaNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- Final Account (Solution) RainbowDocument4 pagesFinal Account (Solution) RainbowIsteehad RobinNo ratings yet

- Accounting Exercise Chap 13Document10 pagesAccounting Exercise Chap 13Zi Yan HoonNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Practical Questions (Sandeep Garg 2018-19)Document10 pagesPractical Questions (Sandeep Garg 2018-19)Kanishk SinglaNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- ANT212 Demonstration 3413Document16 pagesANT212 Demonstration 3413yoeliyyNo ratings yet

- EE205 Study Guide 5014Document16 pagesEE205 Study Guide 5014yoeliyyNo ratings yet

- FIN2105 Questions 5060Document16 pagesFIN2105 Questions 5060yoeliyyNo ratings yet

- ENGL240 Handout 7356Document16 pagesENGL240 Handout 7356yoeliyyNo ratings yet

- BIOL8986 Practice Problems 9859Document16 pagesBIOL8986 Practice Problems 9859yoeliyyNo ratings yet

- ARCH2355 Exam 7873Document16 pagesARCH2355 Exam 7873yoeliyyNo ratings yet

- ARCH3315 Review 4Document4 pagesARCH3315 Review 4yoeliyyNo ratings yet

- Lecture on Professor Alan Brein McGuire at Hol Land Foundation UniversityDocument15 pagesLecture on Professor Alan Brein McGuire at Hol Land Foundation UniversityyoeliyyNo ratings yet

- FINA6212 Analysis 787Document16 pagesFINA6212 Analysis 787yoeliyyNo ratings yet

- ARCH3315 Practice Problems 6Document3 pagesARCH3315 Practice Problems 6yoeliyyNo ratings yet

- ENVI161 Information 4359Document16 pagesENVI161 Information 4359yoeliyyNo ratings yet

- Biol353b Report 7440Document16 pagesBiol353b Report 7440yoeliyyNo ratings yet

- 4th ActivityDocument3 pages4th ActivityyoeliyyNo ratings yet

- BIO170-Lecture Notes-5915Document15 pagesBIO170-Lecture Notes-5915yoeliyyNo ratings yet

- ARCH3315 Research 3Document4 pagesARCH3315 Research 3yoeliyyNo ratings yet

- ARCH3315 Lecture Notes 5Document5 pagesARCH3315 Lecture Notes 5yoeliyyNo ratings yet

- ARCH3315 Chapter 1Document5 pagesARCH3315 Chapter 1yoeliyyNo ratings yet

- 3 Ecraela Vs Pangalangan AC No. 10676Document1 page3 Ecraela Vs Pangalangan AC No. 10676yoeliyyNo ratings yet

- 07 Performance Task 1 ARGDocument1 page07 Performance Task 1 ARGyoeliyyNo ratings yet

- 212Document1 page212yoeliyyNo ratings yet

- ARCH3315 Answer Key 3Document4 pagesARCH3315 Answer Key 3yoeliyyNo ratings yet

- Simple Marketing Plan For Cebu CityDocument18 pagesSimple Marketing Plan For Cebu CityyoeliyyNo ratings yet

- ARCH3315 Study Guide 7Document4 pagesARCH3315 Study Guide 7yoeliyyNo ratings yet

- RLW 5th ActivityDocument2 pagesRLW 5th ActivityyoeliyyNo ratings yet

- The VI Editor System Ad Laboratory ExerciseDocument11 pagesThe VI Editor System Ad Laboratory ExerciseyoeliyyNo ratings yet

- Boracay Landowners vs DENRDocument3 pagesBoracay Landowners vs DENRyoeliyyNo ratings yet

- Research Capstone 1Document25 pagesResearch Capstone 1yoeliyyNo ratings yet

- Sexual Self PDFDocument50 pagesSexual Self PDFyoeliyyNo ratings yet

- SE Fitness Gym 2Document7 pagesSE Fitness Gym 2yoeliyyNo ratings yet

- 7 Final Accounts of CompaniesDocument15 pages7 Final Accounts of CompaniesAakshi SharmaNo ratings yet

- Repair Maintenance FormDocument3 pagesRepair Maintenance FormDaus SallehNo ratings yet

- Thesis PaperDocument6 pagesThesis PaperMaryrose Laparan OliverosNo ratings yet

- Full Download At:: Operations Management Operations and Supply Chain Management 14th Edition JacobsDocument12 pagesFull Download At:: Operations Management Operations and Supply Chain Management 14th Edition JacobsHoàng Thiên LamNo ratings yet

- final report. (1)Document48 pagesfinal report. (1)Arjun Singh ANo ratings yet

- Hridoy CVDocument2 pagesHridoy CVridoy467No ratings yet

- TOPIC: Operative Function of HRM (Maintenance, Motivation & Integration)Document6 pagesTOPIC: Operative Function of HRM (Maintenance, Motivation & Integration)jayram FashionNo ratings yet

- Business Ethics AssignmentDocument17 pagesBusiness Ethics AssignmentsevinchNo ratings yet

- How Schindler Group Elevated Performance in Its Corporate CultureDocument4 pagesHow Schindler Group Elevated Performance in Its Corporate Cultureshivangi guptaNo ratings yet

- Intro Basic Network ConceptsDocument48 pagesIntro Basic Network ConceptsJay Carlo SalcedoNo ratings yet

- The Contemporary World Pointer AimeeDocument3 pagesThe Contemporary World Pointer Aimeebobadillamarie156No ratings yet

- Welcome SpeechDocument3 pagesWelcome Speechrcpasc100% (2)

- Dissertation Topics in EntrepreneurshipDocument4 pagesDissertation Topics in EntrepreneurshipWhitePaperWritingServicesSingapore100% (1)

- HR 2-Email DraftDocument4 pagesHR 2-Email DraftMallu SailajaNo ratings yet

- hsg177 - Managing Health and Safety in DockworkDocument29 pageshsg177 - Managing Health and Safety in Dockworkchelios2No ratings yet

- Exercise Case 6 7 AnswerDocument1 pageExercise Case 6 7 AnswerMinle HengNo ratings yet

- Local Self-Government Notes - 2Document3 pagesLocal Self-Government Notes - 2ashish7541No ratings yet

- 2019 Deloitte and MAPI Smart Factory Study3885Document36 pages2019 Deloitte and MAPI Smart Factory Study3885Rahul Sinha100% (1)

- Advanced Math For BeaDocument1 pageAdvanced Math For Beacathy santosNo ratings yet

- Discussion 02 - The Role of English in International Corporate CommunicationDocument18 pagesDiscussion 02 - The Role of English in International Corporate CommunicationmirandaNo ratings yet

- Leader 3Document65 pagesLeader 3Aklilu100% (1)

- Experience is a Hard TeacherDocument8 pagesExperience is a Hard Teacherxiu yingNo ratings yet

- Vendor Master Form - v2 (IDX)Document1 pageVendor Master Form - v2 (IDX)jaguar proNo ratings yet

- CSR Square PharmaDocument18 pagesCSR Square PharmaIfaz Mohammed Islam 1921237030No ratings yet

- MBA Orientation Manual March 2021Document9 pagesMBA Orientation Manual March 2021SaranyaNo ratings yet

- ACCY918 Case Study Information Trimester 3, 2023Document8 pagesACCY918 Case Study Information Trimester 3, 2023NIRAJ SharmaNo ratings yet

- Bregoli, Jesel B. - ResumeDocument3 pagesBregoli, Jesel B. - ResumeJesel BregoliNo ratings yet

- Ms-Excel Assignment: Slno Student Name Course Joined Semester Fees Paid Fees DueDocument5 pagesMs-Excel Assignment: Slno Student Name Course Joined Semester Fees Paid Fees Dueviveksbdesai99@yahoo.co.inNo ratings yet

- Online Trading ProposalDocument14 pagesOnline Trading ProposalAlex CurtoisNo ratings yet

- Managing Change and Innovation: Stephen P. Robbins Mary CoulterDocument31 pagesManaging Change and Innovation: Stephen P. Robbins Mary CoulterRatul HasanNo ratings yet