Professional Documents

Culture Documents

Ey Aarsrapport 2021 22 17

Ey Aarsrapport 2021 22 17

Uploaded by

Ronald RunruilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ey Aarsrapport 2021 22 17

Ey Aarsrapport 2021 22 17

Uploaded by

Ronald RunruilCopyright:

Available Formats

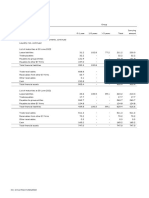

Note 1

Accounting policies

Group The Group has assessed that the lease term of the sub-

EY Godkendt Revisionspartnerselskab is a limited partnership lease agreements entered into with EY Partnership P/S as

company with its registered office in Denmark. The annual the lessor corresponds to the lease term of the head lease

report for the period 1 July 2021–30 June 2022 comprises agreements entered into between EY Partnership P/S and

the consolidated financial statements of EY Godkendt third party lessors as it is assessed that it is reasonable

Revisionspartnerselskab and its subsidiaries, Datoselskabet certain that the implicit renewal options of the assets in

as 18/10 2022 A/S and EY Grønland Statsautoriseret question in the lease and licence agreement between the

Revisionsanpartsselskab and the parent company financial group and EY Partnership P/S will be exercised.

statements.

Basis for preparation

The consolidated financial statements and parent company The annual report is presented in Danish kroner (DKK), which

financial statements have been prepared in accordance is the functional currency of the Parent Company, rounded to

with International Financial Reporting Standards as adopted million DKK presented to one decimal place.

by the EU and Danish disclosure requirements for large

reporting class C companies. The accounting policies described below have been applied

consistently to the financial year and the comparative figures.

On 16 December 2022, the Supervisory Board and the

Executive Board discussed and approved the annual report A few restatements of comparative figures have been

for 2021/22. The annual report will be presented to the incorporated.

shareholders of EY Godkendt Revisionspartnerselskab for

approval at the annual general meeting on 16 December Changes in accounting policies

2022. The Group has implemented the standards and

interpretations effective from 2021/22. None of these

Lease and licence agreement of the audit and standards and interpretations have had a material effect

advisory business on recognition and measurement in 2021/22 and are not

The Group pays consideration for the lease and licence expected to affect the Group going forward.

agreement entered into between EY Partnership P/S and the

Group. The consideration comprises a revenue-based lease Description of accounting policies

and license fee and a fixed fee related to the right of use to Consolidated financial statements

EY Partnership P/S’ fixed assets and the right of use to the The consolidated financial statements comprise the Parent

rental agreements, licence agreements and leases entered Company, EY Godkendt Revisionspartnerselskab, and its

into by EY Partnership P/S. The right of use to non-current wholly-owned subsidiaries Datoselskabet af 18/10 2022 A/S

assets, including assets held under rental agreements, and EY Grønland Statsautoriseret Revisionsanpartsselskab.

licence agreements and leases, is solely subject to minimum

payments. The consolidated financial statements are prepared as a

consolidation of the Parent Company’s and the subsidiaries’

The lease and licence agreement is terminable at one financial statements, which are prepared in accordance with

year’s notice and will then terminate on 31 December. The the Group’s accounting policies. On consolidation, intra-group

notice of termination comprises all components of the lease income and expenses, shareholdings, intra-group balances

and licence agreement, including the rights of use to EY and dividends as well as realised and unrealised gains on

Partnership P/S’ fixed assets and the right of use to the rental intra-group transactions are eliminated. Unrealised losses are

agreements, licence agreements and leases entered into by eliminated in the same way as unrealised gains to the extent

EY Partnership P/S. The agreement is subject to standard they do not reflect impairment.

termination clauses on non-performance in accordance with

the lease and license agreement.

Annual Report 2021/2022 | 17

You might also like

- Slideworks - Consulting Toolkit - OVERVIEW-8Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-8Ronald RunruilNo ratings yet

- Brainy kl7 Unit Tests Answer KeyDocument10 pagesBrainy kl7 Unit Tests Answer KeyNatalia Boettcher100% (1)

- Question ADocument2 pagesQuestion Asamuel ngNo ratings yet

- Albion II v3 User Manual v1.0Document34 pagesAlbion II v3 User Manual v1.0AlfricSmithNo ratings yet

- Ey Aarsrapport 2021 22 33Document1 pageEy Aarsrapport 2021 22 33Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 6Document1 pageEy Aarsrapport 2021 22 6Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 39Document1 pageEy Aarsrapport 2021 22 39Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 8Document1 pageEy Aarsrapport 2021 22 8Ronald RunruilNo ratings yet

- Financial AnalysisDocument2 pagesFinancial Analysismarinel ramirezNo ratings yet

- Ey Aarsrapport 2021 22 9Document1 pageEy Aarsrapport 2021 22 9Ronald RunruilNo ratings yet

- Acre Friendly Society - 205411 - Statements and Accounts - Dec 2012Document11 pagesAcre Friendly Society - 205411 - Statements and Accounts - Dec 2012sharma.geet9876No ratings yet

- 9023 - Joint ArrangementDocument4 pages9023 - Joint ArrangementAljur SalamedaNo ratings yet

- DCP FY 2022 AccountsDocument91 pagesDCP FY 2022 Accountsakintolarichard07No ratings yet

- Dangote Cement FY 2021 AccountsDocument88 pagesDangote Cement FY 2021 AccountsMulten PlanNo ratings yet

- BP Exploration (Azerbaijan) LimitedDocument49 pagesBP Exploration (Azerbaijan) LimitedRaul BabayevNo ratings yet

- Miscellaneous: The Company Shares and BondsDocument1 pageMiscellaneous: The Company Shares and BondsCatrinoiu PetreNo ratings yet

- Copy of Copy of Copy of Karnataka Kaleidoscope FNKDocument5 pagesCopy of Copy of Copy of Karnataka Kaleidoscope FNKgraciaseric14No ratings yet

- Contract ReviewDocument1 pageContract ReviewAdrian CNo ratings yet

- SECL - Audit Report - FY22 - Sign - ENGDocument101 pagesSECL - Audit Report - FY22 - Sign - ENGJAMES ANDROE TANNo ratings yet

- Grundfos Annual Report 2021Document59 pagesGrundfos Annual Report 2021bg2gbNo ratings yet

- 주식회사두산 2022 영문 연결 감사보고서 - ConDocument146 pages주식회사두산 2022 영문 연결 감사보고서 - Connhungoc3028No ratings yet

- Audit Strategies Memorandum: Orion Hanel Picture Tube Co LTDDocument8 pagesAudit Strategies Memorandum: Orion Hanel Picture Tube Co LTDTran AnhNo ratings yet

- 2943 0 2023-03-26 00-50-17 enDocument61 pages2943 0 2023-03-26 00-50-17 enabdullah.h.aloibiNo ratings yet

- Wuling Motors - Announcement of Final Results For The Year Ended 31 December 2012 PDFDocument32 pagesWuling Motors - Announcement of Final Results For The Year Ended 31 December 2012 PDFalan888No ratings yet

- Partnership Agreement Group 102 5Document4 pagesPartnership Agreement Group 102 5Elmira Joyce PaugNo ratings yet

- Q4 2022 Earnings PresentationDocument21 pagesQ4 2022 Earnings PresentationCesar AugustoNo ratings yet

- RA-02 SubDocument1 pageRA-02 SubFaizan SajjadNo ratings yet

- Abi Far AssignmentDocument11 pagesAbi Far AssignmentAbinayaNo ratings yet

- Disclosure No. 1232 2020 2019 Audited Financial StatementsDocument178 pagesDisclosure No. 1232 2020 2019 Audited Financial StatementsRaine PiliinNo ratings yet

- Generali 2021 Results Slide CommentaryDocument18 pagesGenerali 2021 Results Slide CommentaryAmal SebastianNo ratings yet

- Eni in 2021Document36 pagesEni in 2021BradNo ratings yet

- 2021 LG Chem Consolidated Financial Statements enDocument113 pages2021 LG Chem Consolidated Financial Statements enAyushika SinghNo ratings yet

- PSE2022 Annual Report enDocument276 pagesPSE2022 Annual Report enRICARDO LEONEL SALAS VARGASNo ratings yet

- B2Holding ReportDocument155 pagesB2Holding ReportRoshan RahejaNo ratings yet

- 2019 SBC Audited Financial Statements PDFDocument162 pages2019 SBC Audited Financial Statements PDFElsa MendozaNo ratings yet

- HDEC 2021 Annual ReportDocument174 pagesHDEC 2021 Annual Reportagust.abcNo ratings yet

- Chapter 1Document10 pagesChapter 1Girma NegashNo ratings yet

- BP Fourth Quarter 2023 Results Group DatabookDocument70 pagesBP Fourth Quarter 2023 Results Group DatabookjuanNo ratings yet

- DOLPHIN OFFSHORE (Introduction)Document12 pagesDOLPHIN OFFSHORE (Introduction)Anjum SamiraNo ratings yet

- AFS HardwareDocument32 pagesAFS HardwareThabiso MojakisaneNo ratings yet

- Group Statements - Lecture 2 - 1-15Document15 pagesGroup Statements - Lecture 2 - 1-15TendaniNo ratings yet

- Asl Marine Holdings LTDDocument12 pagesAsl Marine Holdings LTDKevin ParkerNo ratings yet

- Booths 2023 Companies - House - DocumentDocument46 pagesBooths 2023 Companies - House - DocumenttuyreNo ratings yet

- Third Quarter 2019 Accounting & Assurance UpdateDocument58 pagesThird Quarter 2019 Accounting & Assurance Updategarrett cNo ratings yet

- Audit RequirementsDocument4 pagesAudit RequirementsSamson OlubodeNo ratings yet

- Norden Q3-2023 Uk FinalDocument21 pagesNorden Q3-2023 Uk FinalMo LaNo ratings yet

- Annual Report 2022 Financial Statements and NotesDocument148 pagesAnnual Report 2022 Financial Statements and Notesfaheem.ashrafNo ratings yet

- Annual Report ReleaseDocument2 pagesAnnual Report ReleaseZyyFakeeNo ratings yet

- Audited Financials 2022Document159 pagesAudited Financials 2022Anjelika ViescaNo ratings yet

- 7eleven 2021 AFSDocument99 pages7eleven 2021 AFSjessellejeanenot21No ratings yet

- 2021 Audit ReportDocument93 pages2021 Audit ReportManishNo ratings yet

- Building The Marketplace of The: Interim Report 2023Document76 pagesBuilding The Marketplace of The: Interim Report 2023Rhoda LawNo ratings yet

- Accounting ProjectDocument3 pagesAccounting ProjectAbeer PervaizNo ratings yet

- Mashreq Consolidated Financial Statements 2021 EnglishDocument179 pagesMashreq Consolidated Financial Statements 2021 EnglishHassan AliNo ratings yet

- FRS 102 FS ExamplesDocument134 pagesFRS 102 FS ExamplesIan ApindiNo ratings yet

- Cuentas Anuales Consolidadas - 2022Document238 pagesCuentas Anuales Consolidadas - 2022josecente123321No ratings yet

- Individual AssignmentDocument11 pagesIndividual AssignmentMohd Shahrul Naim ZulkifliNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Ey Aarsrapport 2021 22 36Document1 pageEy Aarsrapport 2021 22 36Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 39Document1 pageEy Aarsrapport 2021 22 39Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 40Document1 pageEy Aarsrapport 2021 22 40Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 38Document1 pageEy Aarsrapport 2021 22 38Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 11Document1 pageEy Aarsrapport 2021 22 11Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 14Document1 pageEy Aarsrapport 2021 22 14Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 15Document1 pageEy Aarsrapport 2021 22 15Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 35Document1 pageEy Aarsrapport 2021 22 35Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 37Document1 pageEy Aarsrapport 2021 22 37Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 6Document1 pageEy Aarsrapport 2021 22 6Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 13Document1 pageEy Aarsrapport 2021 22 13Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 9Document1 pageEy Aarsrapport 2021 22 9Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 10Document1 pageEy Aarsrapport 2021 22 10Ronald RunruilNo ratings yet

- Brand Plan Workshop 2Document1 pageBrand Plan Workshop 2Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 7Document1 pageEy Aarsrapport 2021 22 7Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 8Document1 pageEy Aarsrapport 2021 22 8Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 4Document1 pageEy Aarsrapport 2021 22 4Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- Brand Plan Workshop 8Document1 pageBrand Plan Workshop 8Ronald RunruilNo ratings yet

- Brand Plan Workshop 4Document1 pageBrand Plan Workshop 4Ronald RunruilNo ratings yet

- (ES) +Mr+Jeff +Business+in+a+Box-45Document1 page(ES) +Mr+Jeff +Business+in+a+Box-45Ronald RunruilNo ratings yet

- Slideworks - Consulting Toolkit - OVERVIEW-5Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-5Ronald RunruilNo ratings yet

- BrandVal JBM10Document38 pagesBrandVal JBM10Ronald RunruilNo ratings yet

- Slideworks - Consulting Toolkit - OVERVIEW-4Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-4Ronald RunruilNo ratings yet

- Academic Workbook Meddent v1.3 1Document52 pagesAcademic Workbook Meddent v1.3 1Ronald RunruilNo ratings yet

- (ES) +Mr+Jeff +Business+in+a+Box-1Document1 page(ES) +Mr+Jeff +Business+in+a+Box-1Ronald RunruilNo ratings yet

- BPTECHENDocument2 pagesBPTECHENRonald RunruilNo ratings yet

- BrandVal JBM10Document37 pagesBrandVal JBM10Ronald RunruilNo ratings yet

- Workbook User Guide en 2023Document27 pagesWorkbook User Guide en 2023Ronald RunruilNo ratings yet

- Idse Unit 2Document207 pagesIdse Unit 2farhan AliNo ratings yet

- Science Assessment TaskDocument4 pagesScience Assessment TaskNabiha SyedaNo ratings yet

- WHFRP Shadows Over BogenhafenDocument6 pagesWHFRP Shadows Over BogenhafenAdam Ogelsby100% (1)

- In The Lap of The Master.Document31 pagesIn The Lap of The Master.prashantkhatana50% (2)

- Be Aware of Fear in Your LifeDocument18 pagesBe Aware of Fear in Your LifeK ROKITHNo ratings yet

- Nus Career Fest 2020 PDFDocument8 pagesNus Career Fest 2020 PDFweiweiahNo ratings yet

- Canticum Canticorum Salomonis: AlestrinaDocument17 pagesCanticum Canticorum Salomonis: AlestrinaPaul DeleuzeNo ratings yet

- My PPT AbsDocument27 pagesMy PPT AbsTigerSrinivasanNo ratings yet

- Dipiro 2017Document2 pagesDipiro 2017LollypollybaekbyNo ratings yet

- Marketing Management Lecture 5Document24 pagesMarketing Management Lecture 5Mandeep Kumar HassaniNo ratings yet

- 7 Albano VS CaDocument4 pages7 Albano VS CaJasper LimNo ratings yet

- Socrative AssessmentDocument7 pagesSocrative Assessmentapi-301971007No ratings yet

- Open Mind Beginner Unit 2 Grammar and Vocabulary Test A - EditableDocument3 pagesOpen Mind Beginner Unit 2 Grammar and Vocabulary Test A - Editableandresalvarez.moriNo ratings yet

- "Cyber-Plus Evolution": Instruction ManualDocument110 pages"Cyber-Plus Evolution": Instruction ManualVasaNo ratings yet

- How To Segment Industrial MarketsDocument11 pagesHow To Segment Industrial MarketsPriyabrata Sahoo100% (1)

- BQ Bungalow 5Document3 pagesBQ Bungalow 5remi RahimNo ratings yet

- First Floor PlanDocument1 pageFirst Floor PlanHEET MEWADANo ratings yet

- English 10: Quarter 2 - Week 8Document86 pagesEnglish 10: Quarter 2 - Week 8Shania Erica GabuyaNo ratings yet

- Acuity Users ManualDocument41 pagesAcuity Users ManualJeff HowardNo ratings yet

- WTR 400Document11 pagesWTR 400Anil FauzdarNo ratings yet

- Bruce Lawrence On Marshall HodgsonDocument6 pagesBruce Lawrence On Marshall HodgsonAbu TalibNo ratings yet

- Markedness - Chapter 4 - Book - The Blackwell Companion To PhonologyDocument28 pagesMarkedness - Chapter 4 - Book - The Blackwell Companion To PhonologySamah HassanNo ratings yet

- BIOC15 Class 20 NotesDocument9 pagesBIOC15 Class 20 NotesCindy HouNo ratings yet

- Personal PronounsDocument6 pagesPersonal PronounsIma MariyamaNo ratings yet

- Karnataka Value Added Tax Rules, 2005 Government of Karnataka (Department of Commercial Taxes)Document3 pagesKarnataka Value Added Tax Rules, 2005 Government of Karnataka (Department of Commercial Taxes)narayanNo ratings yet

- Exam Ms 201 Implementing A Hybrid and Secure Messaging Platform Skills Measured PDFDocument5 pagesExam Ms 201 Implementing A Hybrid and Secure Messaging Platform Skills Measured PDFakdreamscapeNo ratings yet

- Degradasi Tanah Dan LahanDocument40 pagesDegradasi Tanah Dan LahannaufalshineNo ratings yet

- Pemanfaatan Minyak Atsiri Sebagai Rumen Modifier Pada Sapi PerahDocument12 pagesPemanfaatan Minyak Atsiri Sebagai Rumen Modifier Pada Sapi Perah20-074 Gita YudistiraNo ratings yet