Professional Documents

Culture Documents

MAS Prob

Uploaded by

RACHEL DAMALERIO0 ratings0% found this document useful (0 votes)

7 views1 pageThe document compares the financial impact of retaining current equipment versus renting new equipment. Retaining the current equipment results in an operating profit of $1,125,000 but recognizing a $2,550,000 loss from writing off the equipment. Renting new equipment increases operating profit to $1,356,000, a $231,000 increase, and avoids costs associated with owning the equipment. Therefore, renting the new equipment is more profitable for the company.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares the financial impact of retaining current equipment versus renting new equipment. Retaining the current equipment results in an operating profit of $1,125,000 but recognizing a $2,550,000 loss from writing off the equipment. Renting new equipment increases operating profit to $1,356,000, a $231,000 increase, and avoids costs associated with owning the equipment. Therefore, renting the new equipment is more profitable for the company.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageMAS Prob

Uploaded by

RACHEL DAMALERIOThe document compares the financial impact of retaining current equipment versus renting new equipment. Retaining the current equipment results in an operating profit of $1,125,000 but recognizing a $2,550,000 loss from writing off the equipment. Renting new equipment increases operating profit to $1,356,000, a $231,000 increase, and avoids costs associated with owning the equipment. Therefore, renting the new equipment is more profitable for the company.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

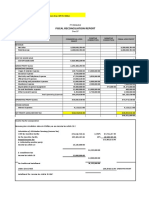

Retain the Equipment Renting the New Equipment Difference

1 Sales Revenue $ 4,800,000.00 $ 4,800,000.00 -

Less: Variable Operating Cost (600,000.00) (600,000.00) -

Contribution Margin 4,200,000.00 4,200,000.00 -

Less: Fixed Operating Costs (2,250,000.00) (2,250,000.00) -

Equipment Depreciation (450,000.00) (450,000.00) -

Other Depreciation (375,000.00) (375,000.00) -

1,125,000.00 1,125,000.00 -

Less: Loss from Written-Off Equipment (2,550,000.00) (2,550,000.00)

Operatig Profit $ 1,125,000.00 $ (1,425,000.00) $ 2,550,000.00 Decrease

There's a decrease of $ 2,550,000 in operating profit of the current year due to the derecognition of equipment by recognizing its loss from write-off.

Retain the Equipment Renting the New Equipment Difference

2 Sales Revenue $ 4,800,000.00 $ 5,136,000.00 $ 336,000.00

Less: Variable Operating Cost (600,000.00) (600,000.00) -

Contribution Margin 4,200,000.00 4,536,000.00 336,000.00

Less: Fixed Operating Costs (2,250,000.00) (2,115,000.00) 135,000.00

Equipment Depreciation (450,000.00) - 450,000.00

Other Depreciation (375,000.00) (375,000.00) -

Annual rental Charge on Equipment (690,000.00) (690,000.00)

Operatig Profit $ 1,125,000.00 $ 1,356,000.00 $ 231,000 Increase

There's an increase of $ 231,000 in operating profit in renting the equipment than retaining the current one.

3 Yes, I would rather rent the new equipment because it has a net effect of increasing the profitability of the company, as it increases $ 231,000 or 21% of profit compared on retaining the current equipment.

It also saves the company from other expenses and increases the cash flow of the company from its customers.

You might also like

- Babok Business Analysis Planning Monitoring PDFDocument1 pageBabok Business Analysis Planning Monitoring PDFShruti GuptaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Reto S.A.Document9 pagesReto S.A.Nishant Goyal0% (1)

- 2018 - Aal Chem Supplier Brochures PDFDocument366 pages2018 - Aal Chem Supplier Brochures PDFChris Smith50% (2)

- PMP Flash Cards: 244 Madison Ave, New YorkDocument19 pagesPMP Flash Cards: 244 Madison Ave, New YorkMMNo ratings yet

- JD Sdn. BHD Study CaseDocument5 pagesJD Sdn. BHD Study CaseSuperFlyFlyers100% (2)

- Income Taxation 2019 Chapter 13A 13C 14 BanggawanDocument8 pagesIncome Taxation 2019 Chapter 13A 13C 14 BanggawanEricka Einjhel Lachama100% (9)

- Acct2015 - 2021 Paper Final SolutionDocument128 pagesAcct2015 - 2021 Paper Final SolutionTan TaylorNo ratings yet

- Analysis of Project Cash FlowsDocument16 pagesAnalysis of Project Cash FlowsTanmaye KapurNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- TECHNICAL PROPOSAL WITH TESTIMONIES Edt1Document35 pagesTECHNICAL PROPOSAL WITH TESTIMONIES Edt1ABELNo ratings yet

- Group 2 - Answers To QuestionsDocument2 pagesGroup 2 - Answers To QuestionsJr Roque100% (4)

- LLC Tatneft-Samara Sales and Purchase Agreement (Spa) Issued To Future Engineering & Gold Mining Co., LTD (En590-10ppm)Document16 pagesLLC Tatneft-Samara Sales and Purchase Agreement (Spa) Issued To Future Engineering & Gold Mining Co., LTD (En590-10ppm)TCL T100% (1)

- BPO Inida2Document60 pagesBPO Inida2Rasi chowNo ratings yet

- Maru BattingDocument28 pagesMaru BattingRealChiefNo ratings yet

- Fishbone Method: Arranged by Najmi Nasrudin Kiki Khairani Pikih Risma Uus RahmaDocument15 pagesFishbone Method: Arranged by Najmi Nasrudin Kiki Khairani Pikih Risma Uus Rahmaachit_abbastNo ratings yet

- FS 1 1Document4 pagesFS 1 1catzeyeNo ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- Principles of Taxation Suggested Solution # 12 - (Mock Solution)Document9 pagesPrinciples of Taxation Suggested Solution # 12 - (Mock Solution)Ali OptimisticNo ratings yet

- MGAC2 ForecastingDocument22 pagesMGAC2 ForecastingJoana TrinidadNo ratings yet

- Quicky Profit and LossDocument1 pageQuicky Profit and LossBea GarciaNo ratings yet

- 2022 12 01 Answer Key Additional M6 M7Document15 pages2022 12 01 Answer Key Additional M6 M7Niger RomeNo ratings yet

- Capital Budgeting Cash Flows ComputationDocument6 pagesCapital Budgeting Cash Flows Computationnelle de leonNo ratings yet

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- Pajak Rizki Rahmat Putra - 20AP2Document9 pagesPajak Rizki Rahmat Putra - 20AP2Alviana RenoNo ratings yet

- Assignment 2 Solution Fall 2023 MBA 5241EDocument11 pagesAssignment 2 Solution Fall 2023 MBA 5241EDhyan HariaNo ratings yet

- Chapter 5&6 Case 2Document3 pagesChapter 5&6 Case 2Erlangga DharmawangsaNo ratings yet

- Chapter12 AnalysisDocument25 pagesChapter12 AnalysisJan ryanNo ratings yet

- BA 118.3 Module 2 Post and Sage AnswersDocument18 pagesBA 118.3 Module 2 Post and Sage AnswersRed Ashley De LeonNo ratings yet

- 2015 Dec Ans-8Document1 page2015 Dec Ans-8何健珩No ratings yet

- ExpensesDocument3 pagesExpensesJezerie Kaye T. FerrerNo ratings yet

- Via BIR Form 1706Document1 pageVia BIR Form 1706YnnaNo ratings yet

- Weekly Asigment 1Document1 pageWeekly Asigment 1Inge setiawanNo ratings yet

- Excel Solution - Extruder Capital Budgeting Case StudyDocument15 pagesExcel Solution - Extruder Capital Budgeting Case Studyalka murarkaNo ratings yet

- Problem I - SolutionsDocument10 pagesProblem I - SolutionsDing CostaNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- M2 005. All Costing Statement IllustrationDocument36 pagesM2 005. All Costing Statement Illustrationhanis nabilaNo ratings yet

- Lap Laba RugiDocument1 pageLap Laba Rugisri riyantiNo ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- LC CaseDocument6 pagesLC Casesamurai_quackNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- 1capital and Revenue TransactionsDocument11 pages1capital and Revenue Transactionsdilhani sheharaNo ratings yet

- CA TM 2nd Edition Chapter 22 EngDocument38 pagesCA TM 2nd Edition Chapter 22 EngIp NicoleNo ratings yet

- Cash Flow Direct IndirectDocument18 pagesCash Flow Direct IndirectTalha HassanNo ratings yet

- Capital Budgeting Answer KeyDocument31 pagesCapital Budgeting Answer KeyEsel DimapilisNo ratings yet

- Slides of Lecture#09 Corporate Finance (FIN-622)Document4 pagesSlides of Lecture#09 Corporate Finance (FIN-622)sukhiesNo ratings yet

- Film CompanyDocument1 pageFilm CompanyKathy PanilagNo ratings yet

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- CSEC Accounting Formats and TemplatesDocument15 pagesCSEC Accounting Formats and TemplatesRealGenius (Carl)No ratings yet

- FS - LandscapeDocument9 pagesFS - LandscapeMekay OcasionesNo ratings yet

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- JournalDocument8 pagesJournalAmelia AndrianiNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- Planed Cash Reciepts: Collection of Account RecievablesDocument11 pagesPlaned Cash Reciepts: Collection of Account RecievablesMani ManandharNo ratings yet

- Appendix 2 Problem 67 ADocument7 pagesAppendix 2 Problem 67 AzhakiraatiqaNo ratings yet

- CF Assignment 1 - Answers GMPe15-16 - GROUP4Document10 pagesCF Assignment 1 - Answers GMPe15-16 - GROUP4Swati MoolchandaniNo ratings yet

- Category Cost of Asset Accumulated DepreciationDocument10 pagesCategory Cost of Asset Accumulated DepreciationAaliyah ManuelNo ratings yet

- MGT AC - Prob-NewDocument276 pagesMGT AC - Prob-Newrandom122No ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 3)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 3)Renee WongNo ratings yet

- BA713 Financial Management Tutorial 2Document4 pagesBA713 Financial Management Tutorial 2Ten NineNo ratings yet

- OJT EVALUATION - Docx Rating 1 1 1Document2 pagesOJT EVALUATION - Docx Rating 1 1 1RACHEL DAMALERIONo ratings yet

- 2307 - CTT Synergy - CorporationDocument2 pages2307 - CTT Synergy - CorporationRACHEL DAMALERIONo ratings yet

- Milano One Inc. Unique FileDocument874 pagesMilano One Inc. Unique FileRACHEL DAMALERIONo ratings yet

- Epermit2024 0098 8306Document5 pagesEpermit2024 0098 8306RACHEL DAMALERIONo ratings yet

- REquest For Manual PaymentDocument1 pageREquest For Manual PaymentRACHEL DAMALERIONo ratings yet

- Adjusted Trial BalanceDocument1 pageAdjusted Trial BalanceRACHEL DAMALERIONo ratings yet

- Letter For Consultant MS. BELCHEZDocument1 pageLetter For Consultant MS. BELCHEZRACHEL DAMALERIONo ratings yet

- New HubDocument3 pagesNew HubRACHEL DAMALERIONo ratings yet

- 2307 Thedeleons Co LTDDocument2 pages2307 Thedeleons Co LTDRACHEL DAMALERIONo ratings yet

- Certificate of Validation GrammarianDocument1 pageCertificate of Validation GrammarianRACHEL DAMALERIONo ratings yet

- Table of ContentsDocument5 pagesTable of ContentsRACHEL DAMALERIONo ratings yet

- MFC Extra Payroll System 0513-192022Document166 pagesMFC Extra Payroll System 0513-192022RACHEL DAMALERIONo ratings yet

- Title Proposal Group7 A2 2023 2024Document7 pagesTitle Proposal Group7 A2 2023 2024RACHEL DAMALERIONo ratings yet

- Yema PlanDocument2 pagesYema PlanRACHEL DAMALERIONo ratings yet

- MicroplasticDocument2 pagesMicroplasticRACHEL DAMALERIONo ratings yet

- Long Quiz in Entrepreneur M1 To 4Document2 pagesLong Quiz in Entrepreneur M1 To 4RACHEL DAMALERIONo ratings yet

- Periodic Method-GG StoreDocument8 pagesPeriodic Method-GG StoreRACHEL DAMALERIONo ratings yet

- Lingg 1Document5 pagesLingg 1RACHEL DAMALERIONo ratings yet

- Periodic Method-Joseph MerchandiseDocument8 pagesPeriodic Method-Joseph MerchandiseRACHEL DAMALERIONo ratings yet

- Unleashing The Wonders of Science and TechnologyDocument1 pageUnleashing The Wonders of Science and TechnologyRACHEL DAMALERIONo ratings yet

- Application of Business Retirement CertificateDocument3 pagesApplication of Business Retirement CertificateRACHEL DAMALERIONo ratings yet

- Language VariationDocument7 pagesLanguage VariationRACHEL DAMALERIONo ratings yet

- Cpar Q4Lesson10Document33 pagesCpar Q4Lesson10RACHEL DAMALERIONo ratings yet

- Triprism Vicinity MapDocument1 pageTriprism Vicinity MapRACHEL DAMALERIONo ratings yet

- Module 5 Lesson 3 - HandoutDocument1 pageModule 5 Lesson 3 - HandoutRACHEL DAMALERIONo ratings yet

- Q4Lesson10 HandoutDocument2 pagesQ4Lesson10 HandoutRACHEL DAMALERIONo ratings yet

- Contractor Work Preparation Process Improvement Using Lean Six SigmaDocument29 pagesContractor Work Preparation Process Improvement Using Lean Six SigmaJulia De Oliveira MoraisNo ratings yet

- Success Joint Ventures.Document12 pagesSuccess Joint Ventures.yuszriNo ratings yet

- E-Commerce Business in Nepal - Registration and MoreDocument5 pagesE-Commerce Business in Nepal - Registration and MoreManish Modi100% (1)

- Child Safeguarding Audit Report - TemplateDocument7 pagesChild Safeguarding Audit Report - TemplateLopes CassamáNo ratings yet

- 2017 Factors Affecting Strategy Implementation - A Case Study of Pharmaceutical Companies in The Middle EastDocument37 pages2017 Factors Affecting Strategy Implementation - A Case Study of Pharmaceutical Companies in The Middle EastYeimy Salvatierra GarciaNo ratings yet

- MAS - First Pre-Board 2014-15 With SolutionsDocument6 pagesMAS - First Pre-Board 2014-15 With SolutionsAj de CastroNo ratings yet

- Quality Management For The Medical Laboratory: Michael Noble MD FRCPCDocument26 pagesQuality Management For The Medical Laboratory: Michael Noble MD FRCPCRobinson KetarenNo ratings yet

- Chapter 3 - The Master ScheduleDocument31 pagesChapter 3 - The Master ScheduleAinatul Alia AlliasNo ratings yet

- Capt. Sandeep Goswami: Contact: 9836666066/9831147783 E-MailDocument3 pagesCapt. Sandeep Goswami: Contact: 9836666066/9831147783 E-MailHRD CORP CONSULTANCYNo ratings yet

- Case Study 8 FinalDocument3 pagesCase Study 8 FinalAMNANo ratings yet

- Organization Change Management To Build An Ai-Powered OrganizationDocument8 pagesOrganization Change Management To Build An Ai-Powered OrganizationSailendran MenattamaiNo ratings yet

- Safety Health Environment Security PolicyDocument2 pagesSafety Health Environment Security PolicyAlex BissetNo ratings yet

- Kdoe.1 - 2021 - 15.10 - Tran Thi Ha Vi - 1915530542Document19 pagesKdoe.1 - 2021 - 15.10 - Tran Thi Ha Vi - 1915530542Vi TrầnNo ratings yet

- Internal Verification of Assessment Decisions - BTEC (RQF) : Higher NationalsDocument44 pagesInternal Verification of Assessment Decisions - BTEC (RQF) : Higher NationalsJASRA FAZEERNo ratings yet

- The Stakeholders Group 3 SRGGDocument15 pagesThe Stakeholders Group 3 SRGGFuyumi HikotoNo ratings yet

- Documentos Do 2105442Document19 pagesDocumentos Do 2105442juanNo ratings yet

- Project Work Plan TemplateDocument27 pagesProject Work Plan TemplateLove AQ DearNo ratings yet

- Welcome To The Period End Closing TopicDocument25 pagesWelcome To The Period End Closing TopicFernandoNo ratings yet

- Soumojeet Biswas (GE5B-01)Document9 pagesSoumojeet Biswas (GE5B-01)Debajyoti SahooNo ratings yet

- How To Get and Write A Testimonial Letter That Will Increase Your Business!Document10 pagesHow To Get and Write A Testimonial Letter That Will Increase Your Business!Mobile MentorNo ratings yet

- Risk Assessment:: Risk Id Identified RiskDocument281 pagesRisk Assessment:: Risk Id Identified RiskLoi ThanhNo ratings yet

- 22 27351 002 Matter 1 1 Device Library SpecificationDocument95 pages22 27351 002 Matter 1 1 Device Library Specificationcagona5339No ratings yet