Professional Documents

Culture Documents

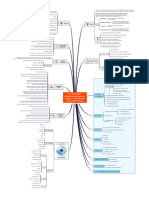

Mindmap Ethics - m4 (Gips)

Uploaded by

kimhoang8899Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mindmap Ethics - m4 (Gips)

Uploaded by

kimhoang8899Copyright:

Available Formats

must be the corporation, subsidiary, or division that is held out to clients as a business

Definition of the firm entity

If a firm has different geographic locations, the definition of the firm should include all the

various geographic locations and their clients

refers to how a firm determines which of the portfolios it manages should be included in a

Definition of discretion composite

A firm may determine that a portfolio is nondiscretionary—and therefore not include it in a

composite—if the client places restrictions on it that prevent the manager from carrying out

the intended strategy

Firms must comply with all the requirements of the GIPS standards, including any updates,

Guidance Statements, interpretations, Questions & Answers, and clarifications published by

CFA Institute and the GIPS Executive Committee, which are available on the GIPS website as

Representative accounts well as in the GIPS Handbook

Survivorship Bias Misleading practices in the past Firms must comply with all applicable laws and regulations regarding the calculation and

presentation of performance

Varying time periods

Firms must not present performance or performance-related information that is false or

misleading

Best practices for calculating and presenting

The GIPS standards must be applied on a firm-wide basis

Worldwide acceptance

Fundamentals of compliance

Firms must document their policies and procedures used in establishing and maintaining

Accurate and consistent data GIPS Objectives

compliance with the GIPS standards, including ensuring the existence and ownership of

client assets, and must apply them consistently

Why created?

Fair, global competition

Requirements

If the firm does not meet all the requirements of the GIPS standards, it must not represent

Self-regulation or state that it is “in compliance with the Global Investment Performance Standards except

for ...” or make any other statements that may indicate partial compliance with the GIPS

standards

Investment management firms

Who benefits from compliance?

Statements referring to the calculation methodology as being “in accordance,” “in

Prospective clients compliance,” or “consistent with” the GIPS standards, or similar statements, are prohibited

investment management firms that actually manage assets Statements referring to the performance of a single, existing client portfolio as being

“calculated in accordance with the GIPS standards” are prohibited, except when a GIPS-

voluntary Who can claim compliance? compliant firm reports the performance of an individual client’s portfolio to that particular

client

fully comply with all requirements of GIPS or not comply all

Firms must make every reasonable effort to provide a compliant presentation to all

prospective clients. Firms must not choose whom they present a compliant presentation to.

As long as a prospective client has received a compliant presentation within the previous 12

months, the firm has met this requirement

Global Investment

Performance

Fundamentals of Compliance Firms must provide a complete list of composite descriptions to any prospective client that

Standards (GIPS)

makes such a request. They must include terminated composites on their list of composite

descriptions for at least five years after the composite termination date

Input Data and Calculation Methodology

Firms must provide a compliant presentation for any composite listed on their list of

Composite and Pooled Fund Maintenaince

composite descriptions to any prospective client that makes such a request

Composite Time-weighted return report

Firms must be defined as an investment firm, subsidiary, or division held out to clients or

prospective clients as a distinct business entity

Composite Money-weighted return report Key concepts of GIPS standards for firms

For periods beginning on or after January 1, 2011, total firm assets must be aggregate fair

Pooled Fund Time-weighted return report value of all discretionary and non-discretionary assets managed by the firm. This includes

both fee-paying and non-fee-paying portfolios

Pooled Fund Money-weighted return report'

Total firm assets must include assets assigned to a sub-advisor, provided that the firm has

discretion over the selection of the sub-advisor

GIPS Advertising guidelines

Changes in a firm’s organization must not lead to alteration of historical composite

performance

When the firm jointly markets with other firms, the firm claiming compliance with the GIPS

standards must ensure that it is clearly defined and separate from the other firms being

marketed, and that it is clear which firm is claiming compliance

A grouping of individual actual discretionary portfolios representing a similar investment Firms should comply with the recommendations of the GIPS standards, including

strategy, objective, or mandate recommendations in any updates, Guidance Statements, interpretations, Questions&

Answers, and clarifications published by CFA Institute and the GIPS Executive Committee,

which will be made available on the GIPS website as well as in the GIPS Handbook

A composite must include all fee-paying, discretionary portfolios (current and past) that the

Recommendations

firm has managed in accordance with a particular strategy

Composite

Firms should be verified

The firm should identify which composite each managed portfolio is to be included in

before the portfolio’s performance is known in order to prevent composites with superior Firms should adopt the broadest, most meaningful definition of the firm, encompassing all

returns geographical offices operating under the same brand name regardless of the actual name

of the individual investment management company

Reporting on the performance of composites gives clients and prospects information about

the firm’s success in managing various types of securities and results for various investment Firms should provide to each existing client, on an annual basis, a compliant presentation

styles of the composite in which the client’s portfolio is included

All discretionary portfolios must be included in one, and only one, composite Who can claim verification Firms are encouraged to pursue independent verification of their compliance with GIPS

Verification must be performed by a third party in order to increase confidence in the firm’s

How to perform verification claim of compliance

Independent verification Verification applies to the entire firm’s performance measurement practices and methods,

not a selected composite

Verification increase the knowledge of the firm’s performance and improve the consistency

and quality of the firm’s compliant presentations

Advantages of performing verification

Verification provides assurance on whether the firm’s policies and procedures related to

composite and pooled fund maintenance, as well as the calculation, presentation, and

distribution of performance

Verification improves internal processes and procedures as well as marketing advantages to

the firm

You might also like

- CSHP Form 1A-2023 Application-FormDocument4 pagesCSHP Form 1A-2023 Application-Formdepusoyjazzy021733% (3)

- CFPB Consumer Reporting Companies ListDocument35 pagesCFPB Consumer Reporting Companies Listgabby maca100% (2)

- Aluka Report - Nama HereroDocument293 pagesAluka Report - Nama HereroVaidah Veesimz SimentiNo ratings yet

- Chap 9Document21 pagesChap 9RafiaNo ratings yet

- M3.1 - PFRS For Small and Medium Sized Entities (SME) - Business Combination and GoodwillDocument7 pagesM3.1 - PFRS For Small and Medium Sized Entities (SME) - Business Combination and GoodwillJohn Michael A. PaclibareNo ratings yet

- Renault Vs Ford QuestionDocument3 pagesRenault Vs Ford QuestiontigerNo ratings yet

- Gamuda Annual Report 2020 (Page 132 To Back Page) 22222Document244 pagesGamuda Annual Report 2020 (Page 132 To Back Page) 22222U2104004 STUDENTNo ratings yet

- Chapter 2: Charting A Company S DirectionDocument1 pageChapter 2: Charting A Company S DirectionAlma CoronadoNo ratings yet

- Chapter 2: Charting A Company S DirectionDocument1 pageChapter 2: Charting A Company S DirectionAlma CoronadoNo ratings yet

- Untitled Notebook 10 2Document84 pagesUntitled Notebook 10 2Hassaan Ulhaq HaqqiNo ratings yet

- Chapter 2: Charting A Company S DirectionDocument2 pagesChapter 2: Charting A Company S DirectionAlma CoronadoNo ratings yet

- Teorias ContemporaneasDocument3 pagesTeorias ContemporaneasCamila QuirogaNo ratings yet

- Strategic Management 1&2Document16 pagesStrategic Management 1&2JulNo ratings yet

- Lesson Four - Corporate GovenaceDocument16 pagesLesson Four - Corporate GovenacemaheeanuNo ratings yet

- SAV ASSOCIATES - Approaches For Optimizing Your ICFR in The Context of The New COSODocument56 pagesSAV ASSOCIATES - Approaches For Optimizing Your ICFR in The Context of The New COSOSanjay ChadhaNo ratings yet

- Business FinanceDocument4 pagesBusiness FinanceSammie CaneteNo ratings yet

- Ifrs 15 For Investment Management Companies: Are You Good To Go?Document45 pagesIfrs 15 For Investment Management Companies: Are You Good To Go?hamadeenooNo ratings yet

- Commercial ManagerDocument1 pageCommercial Managerms2321838No ratings yet

- The Levels and Formulation of StrategyDocument12 pagesThe Levels and Formulation of StrategyPatricia RodriguesNo ratings yet

- COBIT 5 Poster 2 - What Drives IT Governance PDFDocument1 pageCOBIT 5 Poster 2 - What Drives IT Governance PDFLuis MessiasNo ratings yet

- CG Guidelines For Listed Companies Nov2010Document13 pagesCG Guidelines For Listed Companies Nov2010Raymond ChengNo ratings yet

- Annually - Certificate of Compliance With Stewardship Principles - PFRDA - 2022-23Document3 pagesAnnually - Certificate of Compliance With Stewardship Principles - PFRDA - 2022-23PrakNo ratings yet

- Unit 1Document2 pagesUnit 1J. KNo ratings yet

- PWC Tiag Perspectives On Ifrs 15Document4 pagesPWC Tiag Perspectives On Ifrs 15Firas AbsaNo ratings yet

- Concept Map - Abril PachecoDocument2 pagesConcept Map - Abril PachecoMar y másNo ratings yet

- Beneish - 1999 - The Detection of Earnings Manipulation PDFDocument14 pagesBeneish - 1999 - The Detection of Earnings Manipulation PDFM Abdul GaniNo ratings yet

- 2007 Corporate Governance Annual Report enDocument4 pages2007 Corporate Governance Annual Report ensukhrabNo ratings yet

- Profit Centers vs. Business AreasDocument4 pagesProfit Centers vs. Business Areassneel.bw3636No ratings yet

- Company'S Self-Assessment Checklist On Bcm-ReadinessDocument7 pagesCompany'S Self-Assessment Checklist On Bcm-ReadinessEncuestas CociberNo ratings yet

- Cost Chapter 2Document16 pagesCost Chapter 2Hazel Nicole TiticNo ratings yet

- Magic Quadrant For Enterprise Governance, Risk and Compliance PlatformsDocument10 pagesMagic Quadrant For Enterprise Governance, Risk and Compliance PlatformsjosecuervoNo ratings yet

- Composite Def Gs 2011Document9 pagesComposite Def Gs 2011cryellow8No ratings yet

- Financial Policy & Corporate Strategy: CA Mayank KothariDocument1 pageFinancial Policy & Corporate Strategy: CA Mayank KothariKomal BhattadNo ratings yet

- CRG741-CP3 Group3 Corporate GovernanceDocument61 pagesCRG741-CP3 Group3 Corporate GovernanceFauzuan FauziNo ratings yet

- Pai-Brochure 170521Document2 pagesPai-Brochure 170521yassineNo ratings yet

- Afar 2 Module CH 2Document22 pagesAfar 2 Module CH 2Ella Mae TuratoNo ratings yet

- Mae M. Maluping BSA 2 (Strategic Management)Document1 pageMae M. Maluping BSA 2 (Strategic Management)Gaelle CBNo ratings yet

- Oracle Workforce Compensation-Datasheet-Updated-FvDocument3 pagesOracle Workforce Compensation-Datasheet-Updated-FvPreeti SachanNo ratings yet

- Recasting FSDocument1 pageRecasting FSCapung SolehNo ratings yet

- Corporate Social Responsibility (CSR) Context ReportDocument5 pagesCorporate Social Responsibility (CSR) Context ReportCool TechieNo ratings yet

- Defining Issues 16 41 Revenue Technical CorrectionsDocument5 pagesDefining Issues 16 41 Revenue Technical CorrectionsChessking Siew HeeNo ratings yet

- Hotels & Resorts: Analytics at TheDocument2 pagesHotels & Resorts: Analytics at TheridwanhakimNo ratings yet

- Business Combinations & Consolidated Financial StatementsDocument16 pagesBusiness Combinations & Consolidated Financial Statementsisaac2008100% (1)

- Logbook For Kudakwashe Muzambi v2Document6 pagesLogbook For Kudakwashe Muzambi v2Tatenda Takie TakaidzaNo ratings yet

- Remote Governance and Controls: The New Reality Publication SeriesDocument20 pagesRemote Governance and Controls: The New Reality Publication Serieskovi mNo ratings yet

- ISO 37301 - 2021 Compliance Management SystemsDocument1 pageISO 37301 - 2021 Compliance Management Systemskhalilguesmi50No ratings yet

- Business Policy and Strategic Management PDFDocument51 pagesBusiness Policy and Strategic Management PDFAvinash KaurNo ratings yet

- NZ Employee Share Schemes Brochure Feb 2016Document12 pagesNZ Employee Share Schemes Brochure Feb 2016Ellamie EclipseNo ratings yet

- DIFFERENCES Between FASB and The Indonesian Conceptual FrameworkDocument17 pagesDIFFERENCES Between FASB and The Indonesian Conceptual FrameworkBella TjendriawanNo ratings yet

- Corporate Governance Public Companies and Registered IssuersDocument20 pagesCorporate Governance Public Companies and Registered IssuersCzarina JaneNo ratings yet

- Overview of IFRS For Micro Finance Reporting Discussion July 2009Document14 pagesOverview of IFRS For Micro Finance Reporting Discussion July 2009FinancialServices100% (2)

- Hill IB13e Ch13 PPT AccessibleDocument6 pagesHill IB13e Ch13 PPT AccessibleverashaNo ratings yet

- Complexity ReductionDocument1 pageComplexity ReductionRASHMI RASHMINo ratings yet

- Printable File - AcounBM2 - Knowledge Explorations - Learning Matrix TableDocument4 pagesPrintable File - AcounBM2 - Knowledge Explorations - Learning Matrix TableMa. Beatriz PatronNo ratings yet

- Ethics FinalDocument13 pagesEthics Finalm2myppdmrxNo ratings yet

- Accounting PrinciplesDocument3 pagesAccounting PrinciplesFranze Beatriz FLORESNo ratings yet

- Reshaping InsuranceDocument12 pagesReshaping InsuranceAyodeji OwadaraNo ratings yet

- 2750 New COSO 2013 Framework WHITEPAPER V4Document8 pages2750 New COSO 2013 Framework WHITEPAPER V4omarNo ratings yet

- 2018 Nigerian Code of Corporate GovernanceDocument21 pages2018 Nigerian Code of Corporate GovernanceReuben GrahamNo ratings yet

- The Nigerian Code of Corporate Governance 2018: Highlights and ImplicationsDocument21 pagesThe Nigerian Code of Corporate Governance 2018: Highlights and ImplicationsrkolarskyNo ratings yet

- IFRS 3 Business Combinations - IFRS 10 Consolidated Financial Statements - UrFU - 2019Document36 pagesIFRS 3 Business Combinations - IFRS 10 Consolidated Financial Statements - UrFU - 2019Дарья ГоршковаNo ratings yet

- Company Director Duties Appointment and RemovalDocument6 pagesCompany Director Duties Appointment and Removallindamirembe07No ratings yet

- What Is Financial ManagementDocument2 pagesWhat Is Financial ManagementRizza Manabat PacheoNo ratings yet

- Outagamie County Board ResolutionDocument3 pagesOutagamie County Board ResolutionFOX 11 NewsNo ratings yet

- Affidavit - Absolute Truth Declaration Esteban Corregido y Firmado 1 2 1Document6 pagesAffidavit - Absolute Truth Declaration Esteban Corregido y Firmado 1 2 1api-680293595No ratings yet

- Taxation Review LectureDocument600 pagesTaxation Review LectureJhazzie DolorNo ratings yet

- Analysis of Land and Building Tax (PBB) Performance As Source of Pad in PekanbaruDocument11 pagesAnalysis of Land and Building Tax (PBB) Performance As Source of Pad in PekanbarutaryonoNo ratings yet

- ConclusionDocument2 pagesConclusionKd CruzNo ratings yet

- Lenin On The Revolutionary NewspaperDocument13 pagesLenin On The Revolutionary NewspaperNagesh RaoNo ratings yet

- Flute Fingering Chart - Jane CavanaghDocument10 pagesFlute Fingering Chart - Jane CavanaghSelim TezcanNo ratings yet

- BDC Resolution No. 01, 2024 Endorsing BDP BdipDocument2 pagesBDC Resolution No. 01, 2024 Endorsing BDP BdipjomarNo ratings yet

- 9-Insular Savings Bank v. Far East Bank and Trust CompanyDocument2 pages9-Insular Savings Bank v. Far East Bank and Trust CompanyOscar Laborem GarciaNo ratings yet

- Legal Technique and LogicDocument16 pagesLegal Technique and LogicrealestateparanaqueNo ratings yet

- BENLAC - Financial LiteracyDocument6 pagesBENLAC - Financial LiteracyCecille Cabrera CariagaNo ratings yet

- DOMINGO V ATTY. SACDALANDocument3 pagesDOMINGO V ATTY. SACDALANLloyd David P. VicedoNo ratings yet

- International Council For Homeopathy - National Health Portal of IndiaDocument9 pagesInternational Council For Homeopathy - National Health Portal of IndiaDr. Kazy Habibur RahmanNo ratings yet

- Mhelsan Part 2Document8 pagesMhelsan Part 2michelle s. bautistaNo ratings yet

- I Am Vanessa Guillen Act of 2020Document29 pagesI Am Vanessa Guillen Act of 2020Texas Public RadioNo ratings yet

- Spectrum Academy Reform AgreementDocument10 pagesSpectrum Academy Reform AgreementThe Salt Lake TribuneNo ratings yet

- Unit 5 Democratic InterventionsDocument24 pagesUnit 5 Democratic InterventionsCristina Marie ManceraNo ratings yet

- Legal Research Stage3Document13 pagesLegal Research Stage3Divytwa UmareNo ratings yet

- 6 Marital Discrimination Full CaseDocument21 pages6 Marital Discrimination Full CasedaryllNo ratings yet

- RizalDocument1 pageRizalEngte RoNo ratings yet

- CH 12 Critical Perspectives of AccountingDocument38 pagesCH 12 Critical Perspectives of AccountingTawsiq Asef MahiNo ratings yet

- Reading 11 GARP Code of Conduct - AnswersDocument4 pagesReading 11 GARP Code of Conduct - AnswersPriyadarshini SealNo ratings yet

- STAT147 Cheat Sheet 2Document3 pagesSTAT147 Cheat Sheet 2gusbaszNo ratings yet

- Case 8 - MasseyDocument3 pagesCase 8 - MasseyImandaMuliaNo ratings yet

- Management of Human Resources The Essentials Canadian 4th Edition Dessler Solutions ManualDocument13 pagesManagement of Human Resources The Essentials Canadian 4th Edition Dessler Solutions Manualbonifycrusadebt1gq7100% (21)

- 2020-05-03 Sunday Herald PDFDocument74 pages2020-05-03 Sunday Herald PDFpeternewhousesNo ratings yet