Professional Documents

Culture Documents

CFAP1+ +Study+Manual+ 67

Uploaded by

.Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFAP1+ +Study+Manual+ 67

Uploaded by

.Copyright:

Available Formats

STUDY NOTES

CFAP 1: ADVANCED ACCOUNTING AND FINANCIAL REPORTING

CHAPTER 11: BASIC CONSOLIDATION AND CHANGES IN GROUP STRUCTURES

Group statement of financial position as at the reporting date

$000

Goodwill (W3) X

Assets (P + S) X

Total assets X

Equity capital (Parent's only) X

Retained earnings (W5) X

Other components of equity (W5) X

Non-controlling interest (W4) X

Total equity X

Liabilities (P + S) X

Liabilities (P + S) X

You will need to do the following:

• Eliminate the carrying amount of the parent's investments in its subsidiaries (these will be replaced by

goodwill)

• Add together the assets and liabilities of the parent and its subsidiaries in full

• Include only the parent's balances within share capital and share premium

• Set up and complete standard workings 2 – 5 to calculate goodwill, the non-controlling interest and group

reserves.

(W2) Net assets of each subsidiary

This working sets out the fair value of the subsidiary's identifiable net assets at acquisition date and at the

reporting date.

At acquisition At reporting

date

$000 $000

Equity capital X X

Share premium X X

Other components of equity X X

Retained earnings X X

Goodwill in the accounts of the sub. (X) (X)

Fair value adjustments (FVA) X X

Post acq'n dep'n/amort. on FVA (X)

PURP if the sub is the seller __________ (X)

X X

(to W3) __________

Remember to update the face of the statement of financial position for adjustments made to the net assets at

the reporting date (such as fair value uplifts and provisions for unrealized profits (PURPS)).

The fair value of the subsidiary's net assets at the acquisition date are used in the calculation of goodwill.

The movement in the subsidiary's net assets since acquisition is used to calculate the non-controlling interest

and group reserves.

From the desk of Hassnain R. Badami, ACA

TSB Education-Premium Accountancy Courses P a g e 66 of 445

You might also like

- Group Accounts - Subsidiaries (CSPLOCI) : Chapter Learning ObjectivesDocument28 pagesGroup Accounts - Subsidiaries (CSPLOCI) : Chapter Learning ObjectivesKeotshepile Esrom MputleNo ratings yet

- Ias 1Document7 pagesIas 1ADEYANJU AKEEMNo ratings yet

- Group Accounts - Subsidiaries (CSOFP) : Chapter Learning ObjectivesDocument58 pagesGroup Accounts - Subsidiaries (CSOFP) : Chapter Learning ObjectivesKeotshepile Esrom MputleNo ratings yet

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionRating: 4.5 out of 5 stars4.5/5 (15)

- Final Answers Chap 002Document174 pagesFinal Answers Chap 002valderramadavid67% (6)

- Leadership Style SurveyDocument3 pagesLeadership Style SurveyJanelle BergNo ratings yet

- Basic Consol Acc2 & 3Document17 pagesBasic Consol Acc2 & 3fortuinpdNo ratings yet

- Consolidated Statement of Financial PositionDocument6 pagesConsolidated Statement of Financial PositionRameen FatimaNo ratings yet

- Describe The Structure (Format) and Content of Financial Statements Under IFRS?Document5 pagesDescribe The Structure (Format) and Content of Financial Statements Under IFRS?Hashir AslamNo ratings yet

- FA - Preparing Basic Financial Statements: Producing Year-End AccountsDocument38 pagesFA - Preparing Basic Financial Statements: Producing Year-End AccountsBhupendra SinghNo ratings yet

- Financial Statements PDFDocument14 pagesFinancial Statements PDFArik HassanNo ratings yet

- Question 2 Single Company AccountsDocument10 pagesQuestion 2 Single Company AccountsjbmggknbrxNo ratings yet

- Lecture 7Document9 pagesLecture 7ngyx-ab22No ratings yet

- The Consolidated Statement of Financial Position (Formerly Known As Consolidated Balance Sheet-CBS)Document5 pagesThe Consolidated Statement of Financial Position (Formerly Known As Consolidated Balance Sheet-CBS)illyanaNo ratings yet

- Formats For Consolidation Group StructureDocument4 pagesFormats For Consolidation Group StructureMuhammad3588No ratings yet

- Statement of Cash Flows (IAS 7)Document4 pagesStatement of Cash Flows (IAS 7)Rameen FatimaNo ratings yet

- Chapter 24 - The Consolidated Statement of BalanceDocument3 pagesChapter 24 - The Consolidated Statement of BalanceNazrin HasanzadehNo ratings yet

- FA - Preparing Simple Consolidated Financial StatementsDocument13 pagesFA - Preparing Simple Consolidated Financial StatementsKiri chrisNo ratings yet

- Lecture 8Document10 pagesLecture 8ngyx-ab22No ratings yet

- FA - Preparing Basic Financial Statements: ST STDocument53 pagesFA - Preparing Basic Financial Statements: ST STOwen GradyNo ratings yet

- Cash Flow - Format 2021Document3 pagesCash Flow - Format 2021Roy YadavNo ratings yet

- Chapter 22 - Statement of Cash FlowsDocument17 pagesChapter 22 - Statement of Cash Flowsprasad guthiNo ratings yet

- Name of Business Profit and Loss Appropriation Account For The Period Ended (Date)Document2 pagesName of Business Profit and Loss Appropriation Account For The Period Ended (Date)maxribeiro@yahoo.comNo ratings yet

- APII - Preparation of Final AccountsDocument8 pagesAPII - Preparation of Final AccountsMileticoNo ratings yet

- 8.1 Cash FlowsDocument1 page8.1 Cash FlowsHasif YusofNo ratings yet

- HWDocument3 pagesHWParas VohraNo ratings yet

- STUDYDocument10 pagesSTUDYkerniaserieuxxNo ratings yet

- Vertical Format: Name of Business Income Statement For The Year/month Ended - RevenueDocument7 pagesVertical Format: Name of Business Income Statement For The Year/month Ended - RevenueBashayirullah Noorul AMEENNo ratings yet

- ILLUSTRATION OF FINANCIAL STATEMENTS - Business SchoolDocument4 pagesILLUSTRATION OF FINANCIAL STATEMENTS - Business SchoolitsmekuskusumaNo ratings yet

- 8.1 Cash Flows - Format - Solution - Part 3Document51 pages8.1 Cash Flows - Format - Solution - Part 3Hasif YusofNo ratings yet

- Statement of Cash Flows (IAS 7) : Reconciliation of Operating Profit To Net Cash Flow From OperationsDocument2 pagesStatement of Cash Flows (IAS 7) : Reconciliation of Operating Profit To Net Cash Flow From OperationspriyaNo ratings yet

- Revision Notes Group Accounts PDFDocument11 pagesRevision Notes Group Accounts PDFEhsanulNo ratings yet

- Introduction To Single Entity AccountsDocument38 pagesIntroduction To Single Entity Accountsshrish gupta100% (1)

- FR Group Lesson 1Document16 pagesFR Group Lesson 1Adebola OguntayoNo ratings yet

- FAC1601 Partnership SummaryDocument7 pagesFAC1601 Partnership SummaryMary-Lou Anne MohrNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- Ias 28 AssociateDocument19 pagesIas 28 AssociateĐức DuyNo ratings yet

- Abc NotesDocument3 pagesAbc NotesAlyssa AnnNo ratings yet

- General Purpose Financial StatementDocument10 pagesGeneral Purpose Financial Statementfaith olaNo ratings yet

- PN F7i 001Document143 pagesPN F7i 001Iheanyi Achareke100% (1)

- Question 3 Cash Flow StatementDocument2 pagesQuestion 3 Cash Flow StatementjbmggknbrxNo ratings yet

- CA. Ranjay Mishra (FCA)Document14 pagesCA. Ranjay Mishra (FCA)ZamanNo ratings yet

- Cashflow StatementDocument1 pageCashflow StatementBarack MikeNo ratings yet

- Summary of Basic Conso TechniquesDocument5 pagesSummary of Basic Conso Techniquesutary4s3No ratings yet

- 9.IAS-21 Individual Entity LevelDocument12 pages9.IAS-21 Individual Entity LevelRana Ammar waheedNo ratings yet

- Alternative Treatment To SLPSAS 11 - Addendum To SLPSAS Volume IIIDocument4 pagesAlternative Treatment To SLPSAS 11 - Addendum To SLPSAS Volume IIIgeethNo ratings yet

- 1 IAS 1 - Presentation of Financial StatementsDocument27 pages1 IAS 1 - Presentation of Financial Statementsjaylord pidoNo ratings yet

- Fund Flow:: Working CapitalDocument19 pagesFund Flow:: Working CapitalAlex JayachandranNo ratings yet

- AP 03 - REO Shareholders - Equity2Document10 pagesAP 03 - REO Shareholders - Equity2jeshiela mae biloNo ratings yet

- Cash FlowDocument3 pagesCash FlowParimalaNo ratings yet

- Foundations in Accounting: Maintaining Financial RecordsDocument33 pagesFoundations in Accounting: Maintaining Financial RecordsKewish JhanjhanNo ratings yet

- Chap 02 - Introduction To Financial StatementsDocument43 pagesChap 02 - Introduction To Financial Statementshello100% (1)

- Financial Statements of Sole Trader (Unit-04) PDFDocument3 pagesFinancial Statements of Sole Trader (Unit-04) PDFImadNo ratings yet

- CF StatementDocument3 pagesCF StatementSukumarVenkataNo ratings yet

- The Consolidated Statement of Financial PositionDocument58 pagesThe Consolidated Statement of Financial PositionObeng CliffNo ratings yet

- All Formats To Be Used For Pearson Edexcel Igcse Accounting Year 10 Final Exams Aug 2022Document13 pagesAll Formats To Be Used For Pearson Edexcel Igcse Accounting Year 10 Final Exams Aug 2022Noor Waqas100% (1)

- Topic 7 OF ACCONTINGDocument11 pagesTopic 7 OF ACCONTINGCharlesNo ratings yet

- 04 Group Financial StatementsDocument56 pages04 Group Financial StatementsHaris IshaqNo ratings yet

- Published Accounts (Format) Sem Oct 2022 For Students PDFDocument8 pagesPublished Accounts (Format) Sem Oct 2022 For Students PDFNur SyafiqahNo ratings yet

- New FINANCIAL STATEMENTSDocument8 pagesNew FINANCIAL STATEMENTSCass EssentialsNo ratings yet

- Day 2 Dipifrs Weekend Batch 19022022Document21 pagesDay 2 Dipifrs Weekend Batch 19022022Kathleen De JesusNo ratings yet

- IAS 1 Pro Forma Layout of FSDocument3 pagesIAS 1 Pro Forma Layout of FSisrael adesanyaNo ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Dear Shareholders,: Future OutlookDocument1 pageDear Shareholders,: Future Outlook.No ratings yet

- Major Gen Naseer Ali Khan: ST SC HR EC SIC ACDocument1 pageMajor Gen Naseer Ali Khan: ST SC HR EC SIC AC.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Profile of The Board: Syed Bakhtiyar KazmiDocument1 pageProfile of The Board: Syed Bakhtiyar Kazmi.No ratings yet

- 2022 Performance Highlights: People Planet ProsperityDocument1 page2022 Performance Highlights: People Planet Prosperity.No ratings yet

- Financial CapitalDocument1 pageFinancial Capital.No ratings yet

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- The Grape Group (Acquisition) : Cfap 1: A A F RDocument1 pageThe Grape Group (Acquisition) : Cfap 1: A A F R.No ratings yet

- IMS DB Interview Questions: Beginner LevelDocument19 pagesIMS DB Interview Questions: Beginner LevelsudhakarcheedaraNo ratings yet

- General Mathematics 2nd Quarter ExamDocument3 pagesGeneral Mathematics 2nd Quarter ExamDeped TambayanNo ratings yet

- My New ResumeDocument1 pageMy New Resumeapi-412394530No ratings yet

- Case Title: G.R. No.: Date: Venue: Ponente: Subject: TopicDocument3 pagesCase Title: G.R. No.: Date: Venue: Ponente: Subject: TopicninaNo ratings yet

- Vivado Power Analysis OptimizationDocument120 pagesVivado Power Analysis OptimizationBad BoyNo ratings yet

- 3.2.3 Practice - Taking The PSAT (Practice)Document5 pages3.2.3 Practice - Taking The PSAT (Practice)wrighemm200No ratings yet

- Management and Entrepreneurship Important QuestionsDocument1 pageManagement and Entrepreneurship Important QuestionslambazNo ratings yet

- Evaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewDocument14 pagesEvaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewJaber AbdullahNo ratings yet

- WS-250 4BB 60 Cells 40mm DatasheetDocument2 pagesWS-250 4BB 60 Cells 40mm DatasheetTejash NaikNo ratings yet

- CIVREV!!!!Document5 pagesCIVREV!!!!aypod100% (1)

- Innova M3 New: 3. InstallationDocument8 pagesInnova M3 New: 3. InstallationAndreea DanielaNo ratings yet

- BP Azspu Driver Fatigue & Tiredness Management ProcedureDocument11 pagesBP Azspu Driver Fatigue & Tiredness Management ProcedureEl Khan100% (1)

- Stress and Strain - Axial LoadingDocument18 pagesStress and Strain - Axial LoadingClackfuik12No ratings yet

- Mercantile Law Zaragoza Vs Tan GR. No. 225544Document3 pagesMercantile Law Zaragoza Vs Tan GR. No. 225544Ceasar Antonio100% (1)

- Legal Environment of Business 7th Edition Kubasek Solutions Manual Full Chapter PDFDocument34 pagesLegal Environment of Business 7th Edition Kubasek Solutions Manual Full Chapter PDFlongchadudz100% (12)

- Joseph J. Fiumara v. Fireman's Fund Insurance Companies, 746 F.2d 87, 1st Cir. (1984)Document7 pagesJoseph J. Fiumara v. Fireman's Fund Insurance Companies, 746 F.2d 87, 1st Cir. (1984)Scribd Government DocsNo ratings yet

- Descriptive Na Ly TicsDocument112 pagesDescriptive Na Ly TicsJay Mart AvanceñaNo ratings yet

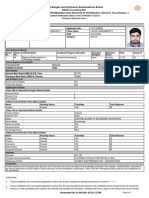

- West Bengal Joint Entrance Examinations Board: Provisional Admission LetterDocument2 pagesWest Bengal Joint Entrance Examinations Board: Provisional Admission Lettertapas chakrabortyNo ratings yet

- On The Backward Problem For Parabolic Equations With MemoryDocument19 pagesOn The Backward Problem For Parabolic Equations With MemorykamranNo ratings yet

- Unit 1: Exercise 1: Match The Words With The Pictures. Use The Words in The BoxDocument9 pagesUnit 1: Exercise 1: Match The Words With The Pictures. Use The Words in The BoxĐoàn Văn TiếnNo ratings yet

- The Financing Cycle Summary, Case Study, AssignmentsDocument18 pagesThe Financing Cycle Summary, Case Study, AssignmentsbernadetteNo ratings yet

- Eudemon8000E XDocument2 pagesEudemon8000E XGladys Medina100% (1)

- Sop Urilyzer 100Document4 pagesSop Urilyzer 100misriyantiNo ratings yet

- AMCHAM Press ReleaseDocument1 pageAMCHAM Press ReleaseAnonymous FnM14a0No ratings yet

- Chapter 10 Outline PDFDocument2 pagesChapter 10 Outline PDFjanellennuiNo ratings yet

- 04.CNOOC Engages With Canadian Stakeholders PDFDocument14 pages04.CNOOC Engages With Canadian Stakeholders PDFAdilNo ratings yet

- Ibt - Module 2 International Trade - Theories Are: Classical and Are From The PerspectiveDocument9 pagesIbt - Module 2 International Trade - Theories Are: Classical and Are From The PerspectiveLyca NegrosNo ratings yet

- A Study On Impact of Smartphone AddictioDocument4 pagesA Study On Impact of Smartphone AddictiotansuoragotNo ratings yet