Professional Documents

Culture Documents

XS2396246931 - Report - 31.15% P.A. Phoenix Autocall On Carnival, Norwegian Cruise, Royal Caribbean

Uploaded by

vmakeienkoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

XS2396246931 - Report - 31.15% P.A. Phoenix Autocall On Carnival, Norwegian Cruise, Royal Caribbean

Uploaded by

vmakeienkoCopyright:

Available Formats

31.15% p.a.

Phoenix Autocall

Carnival, Norwegian Cruise, Royal Caribbean

Memory Stepdown Low Strike USD

Product Reporting as of 21 June 2023

50% REDEEMED 31.15% p.a.

Low Strike Level Memory Coupon

ISIN: XS2396246931 Product Valuation: -

Currency: USD Total Coupon Paid: 7.7875%

REDEEMED IN CASH

Issuer: BNP Paribas Product Perf: +7.7875%

100% + 7.7875%

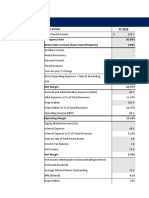

Underlying Price Initial Current Low Strike Distance Coupon Distance Autocall Distance

Name Level Fixing Price Level (50%) Barrier (60%) Trigger (99%)

Carnival Corp

103.27% 8.87 9.16 4.44 51.53% 5.32 41.92% 8.78 4.15%

[ CCL ]

Norwegian Cruise Line

Holding L... 119.79% 11.57 13.86 5.79 58.23% 6.94 49.93% 11.45 17.39%

[ NCLH ]

Royal Caribbean Cruises

Ltd. 121.15% 36.02 43.64 18.01 58.73% 21.61 50.48% 35.66 18.29%

[ RCL ]

Historical Graph

280%

Carnival

260% Norwegian Cruise

Royal Caribbean

240%

Autocall Trigger

(99%)

220%

Coupon Barrier

200% (60%)

180% Low Strike Level

(50%)

160% Product Bid Price

140%

120%

100%

80%

60%

40%

11. Jul 25. Jul 8. Aug 22. Aug 5. Sep 19. Sep

Jar Capital Page 1/3

Product reporting. Indicative data provided for maketing purposes. Please refer to the final termsheet.

Snapshot Features Prices

Asset Class Equity Low Strike Level 50% Price (Bid/Ask) -/-

ISIN Code XS2396246931 Coupon Barrier 60% Updated on 29.09.2022

Swiss Security Number 119867653 Autocall Trigger 99% Quotation Notional (%)

Currency USD Stepdown See events Price contributed by BNP Paribas

Denomination USD 1,000 Memory Coupon 7.7875% per Quarter Initial Fixing Date 29 June 2022

(31.15% p.a.)

Issue Price 100% Issue Date 06 July 2022

Memory Effect Yes

Minimum Trading Size USD 1,000 Final Fixing Date 30 June 2025

Observations Quarterly

Guarantor BNP Paribas (A+ | Aa3 | Maturity Date 07 July 2025

AA-) Redemption Type Physical

Past Events Next Events Next observation

Events Description Observation Payment Date

Memory Coupon & Autocall The product has been early redeemed at 100% + 7.7875% Coupon 29 Sep 2022 06 Oct 2022

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 29 Dec 2022 05 Jan 2023

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (99%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 29 Mar 2023 05 Apr 2023

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (98%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 29 Jun 2023 06 Jul 2023

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (97%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 29 Sep 2023 06 Oct 2023

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (96%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 29 Dec 2023 05 Jan 2024

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (95%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 01 Apr 2024 08 Apr 2024

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (94%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 01 Jul 2024 08 Jul 2024

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (93%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 30 Sep 2024 07 Oct 2024

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (92%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 30 Dec 2024 06 Jan 2025

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (91%)

Memory Coupon & Autocall A Coupon of 7.7875% (including Memory Effect) will be paid if the Worst closes at or 31 Mar 2025 07 Apr 2025

above the Coupon Barrier (60%)

On top of the Coupon, the product will be early redeemed at 100% if the Worst closes

at or above the Autocall Trigger (90%)

Jar Capital Page 2/3

Product reporting. Indicative data provided for maketing purposes. Please refer to the final termsheet.

Past Events Next Events Last observation

Events Description Observation Payment Date

Coupon + Final Fixing A Coupon of 7.7875% will be paid if the Worst closes at or above the Coupon Barrier 30 Jun 2025 07 Jul 2025

(60%)

The closing price of the Worst will be used as reference for the calculation of the

Final Redemption

Stocks description and metrics on following page

Jar Capital Page 3/3

Carnival Corp

Carnival Corporation owns and operates cruise ships offering cruises to all major vacation destinations including North

America, United Kingdom, Germany, Southern Europe, South America, and Asia Pacific. The Company, through a

subsidiary also owns and operates hotels and lodges. Dually-listed company with CCL LN.

Top 5 Revenue Segmentation Top 5 Geographic Segmentation Valuation Metrics Buy / Hold / Sell

NAA 8 Bn North America 8 Bn P/E Ratio 9.91 9/7/5

EA 4 Bn Europe 4 Bn Dividend Yield 8.53%

Tour & Other 185 Mn Australia & Asia 312 Mn Market Cap (USD) 11 Bn

Consensus Target

Cruise Support 171 Mn Others 72 Mn ROE + 25.33%

Beta vs. SPX 1.68

Norwegian Cruise Line Holding Ltd.

Norwegian Cruise Line Holdings Ltd. operates a fleet of passenger cruise ships. The Company offers an array of cruise

itineraries and theme cruises, as well as markets its services through various distribution channels including retail and

travel agents, international and incentive sales, and consumer direct. Norwegian Cruise Line Holdings serves customers

worldwide.

Top 5 Revenue Segmentation Top 5 Geographic Segmentation Valuation Metrics Buy / Hold / Sell

Cruise Lines 5 Bn Worldwide 5 Bn P/E Ratio 7.69 9/6/2

Dividend Yield

Market Cap (USD) 5 Bn

Consensus Target

ROE + 34.40%

Beta vs. SPX 1.59

Royal Caribbean Cruises Ltd.

Royal Caribbean Cruises Ltd. operates as a global cruise company operating a fleet of vessels in the cruise vacation

industries. The Company operates through brands which primarily serve the contemporary, premium, and deluxe

segments of the cruise vacation industry which also includes the budget and luxury segments.

Top 5 Revenue Segmentation Top 5 Geographic Segmentation Valuation Metrics Buy / Hold / Sell

Cruise Lines 9 Bn North America 6 Bn P/E Ratio 10.41 11 / 7 / 0

Europe 2 Bn Dividend Yield

Other Regions 540 Mn Market Cap (USD) 16 Bn

Consensus Target

Reconciliation 458 Mn ROE + 29.63%

Asia/Pacific 372 Mn Beta vs. SPX 1.52

Disclaimers

All information contained in this promotional marketing document is indicative and non-binding. Jar Capital is not the issuer of the product and accepts no liability should any data contained in this document be

inaccurate. All the legally-binding documents containing all further relevant terms and conditions of this product, including but not limited to the final termsheet and relevant derivative program of the issuer valid as per

the initial fixing date, can be obtained upon request. Investors shall carefully read all the legal documentation of the product, this marketing document being not part of it.

This document is not for distribution outside of Switzerland unless otherwise stated in the final termsheet of the product. This document is for the exclusive use of investors categorized either as “eligible counterparties”

or “professional clients” within the meaning of the Markets in Financial Instruments Directive 2014/65/EU (“MiFID II”) and the Swiss Federal Act on Financial Services (“FinSA”). It is strictly forbidden to distribute this

document to the public in any way.

Neither Jar Capital nor any of its directors, officers or employees accept any responsibility or liability whatsoever for any expense, loss or damages arising out of or in any way connected with the use of all or any part of

this document. No opinions are expressed as to the merits or suitability of the products.

The past performance of any underlying mentioned in this document is not indicative of its future performance.

A structured product is not a collective investment scheme as per the Swiss Federal Act on Collective Investment Schemes (CISA) and is not subject to the authorization or supervision by the Swiss Financial Market

Supervisory Authority (FINMA). Therefore, investors in this product are not eligible for the specific investor protection under the Swiss Collective Investment Schemes Act. Investors are exposed to the credit risk of the

issuer.

Jar Capital Page 4/3

You might also like

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2deepika0% (1)

- Strategy Implementation, Evaluation and ControlDocument6 pagesStrategy Implementation, Evaluation and Controlbonny MishNo ratings yet

- MARY, Woman of Faith, Hope, Love (Lyrics & Chords)Document2 pagesMARY, Woman of Faith, Hope, Love (Lyrics & Chords)Jessa Marie Maquiling88% (8)

- CH1266854624 - Report - 17.01% P.A. Phoenix Autocall On Moderna, Microsoft, NVIDIADocument3 pagesCH1266854624 - Report - 17.01% P.A. Phoenix Autocall On Moderna, Microsoft, NVIDIAvmakeienkoNo ratings yet

- XS2599572224 - Report - 8.00% P.A. Phoenix Autocall On Euro Stoxx 50, Nikkei 225Document3 pagesXS2599572224 - Report - 8.00% P.A. Phoenix Autocall On Euro Stoxx 50, Nikkei 225vmakeienkoNo ratings yet

- Daily QuicK Count Peformance 21 Juli 2023Document33 pagesDaily QuicK Count Peformance 21 Juli 2023IrsyaddiraqNo ratings yet

- Discounted Cash Flow Someka Excel Template V2 Free VersionDocument4 pagesDiscounted Cash Flow Someka Excel Template V2 Free VersionnaveenkrealNo ratings yet

- Sariyadi Maret - 240301 - 083921Document1 pageSariyadi Maret - 240301 - 083921Novita DpsNo ratings yet

- Inventory and Recievables FormulasDocument7 pagesInventory and Recievables FormulasJoshua CabinasNo ratings yet

- Incentive SariyadiDocument1 pageIncentive SariyadiNovita DpsNo ratings yet

- Woodville General Trias, Cavite JANUARY 11, 2018Document2 pagesWoodville General Trias, Cavite JANUARY 11, 2018Mary FranceNo ratings yet

- FIN439 - CokeTemplate - TOWSON UNIVERSITYDocument35 pagesFIN439 - CokeTemplate - TOWSON UNIVERSITYJose RuizNo ratings yet

- Manaal - Commercial Banking W J.P MorganDocument9 pagesManaal - Commercial Banking W J.P Morganmanaal.murtaza1No ratings yet

- DCFTemplateDocument5 pagesDCFTemplateRob Keith100% (1)

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- Valuation - NVIDIADocument27 pagesValuation - NVIDIALegends MomentsNo ratings yet

- WOOD Pricelist 110917Document2 pagesWOOD Pricelist 110917Mary FranceNo ratings yet

- HAM 2015.11.24 Hybrid Annuity Model Bid Excel SheetDocument5 pagesHAM 2015.11.24 Hybrid Annuity Model Bid Excel Sheetanon_789699787No ratings yet

- SBG GLOBAL Reward 01 July v1Document23 pagesSBG GLOBAL Reward 01 July v1LalHmingmawiaNo ratings yet

- Gufron Maret - 240301 - 084019Document1 pageGufron Maret - 240301 - 084019Novita DpsNo ratings yet

- Gufron MaretDocument1 pageGufron MaretNovita DpsNo ratings yet

- Toha Adi Maret - 240301 - 084047Document1 pageToha Adi Maret - 240301 - 084047Novita DpsNo ratings yet

- Toha Adi MaretDocument1 pageToha Adi MaretNovita DpsNo ratings yet

- BLUE STAR LTD - Quantamental Equity Research Report-1Document1 pageBLUE STAR LTD - Quantamental Equity Research Report-1Vivek NambiarNo ratings yet

- Prataap Snacks Limited: DCF Analysis Valuation Date: 07 March, 2019Document41 pagesPrataap Snacks Limited: DCF Analysis Valuation Date: 07 March, 2019CharanjitNo ratings yet

- Car WashDocument1 pageCar WashEean KicapNo ratings yet

- Financial Model Example: Hotel Evaluation + M&A: Results Assumptions Loan BalanceDocument14 pagesFinancial Model Example: Hotel Evaluation + M&A: Results Assumptions Loan BalancemotebangNo ratings yet

- Maryam M. Al Ali - SolutionDocument2 pagesMaryam M. Al Ali - Solutionaminlaiba2000No ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- Underwriting Report-Week Ending 03 September 2020Document12 pagesUnderwriting Report-Week Ending 03 September 2020Emmanuel MonzeNo ratings yet

- Card Type Limit Balance Utilization Payments NEW Balance "New" UtilizationDocument2 pagesCard Type Limit Balance Utilization Payments NEW Balance "New" UtilizationLiezl MaigueNo ratings yet

- Data Grafik DiareDocument25 pagesData Grafik DiareDiahNo ratings yet

- Line 2 Wafello Italia Cokelat 135 GRDocument4,666 pagesLine 2 Wafello Italia Cokelat 135 GRokkynbxNo ratings yet

- Report 3Document29 pagesReport 3Riya ThakurNo ratings yet

- Improvement Achievement Dept 2020-FixDocument31 pagesImprovement Achievement Dept 2020-FixMuhammad Alvine AldioNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 December 10Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 December 10Australian Property ForumNo ratings yet

- Sensitivity AnalysisDocument27 pagesSensitivity AnalysisVipin UniyalNo ratings yet

- 5197 PDFDocument1 page5197 PDFarpannathNo ratings yet

- Model Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue CalculationDocument41 pagesModel Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue Calculationavinash singhNo ratings yet

- 27 November 2022Document1 page27 November 2022guntoro situmorangNo ratings yet

- Project Monitoring - ALL Rev 3Document91 pagesProject Monitoring - ALL Rev 3Moch FaridNo ratings yet

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterNo ratings yet

- Portfolio 1Document10 pagesPortfolio 1gurudev21No ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Lease Option: Planet Club Karaoke: Equity DebtDocument39 pagesLease Option: Planet Club Karaoke: Equity DebtebasyaNo ratings yet

- UAV Mar Y15Document2 pagesUAV Mar Y15Ngọc ÁnhNo ratings yet

- Nike Inc Basic Valuation TemplateDocument70 pagesNike Inc Basic Valuation Templatetranejones763No ratings yet

- Full Complete ModelDocument18 pagesFull Complete ModelSyed Mohammad Kishmal NNo ratings yet

- Project Monitoring - ALL Rev 3.1Document97 pagesProject Monitoring - ALL Rev 3.1Moch FaridNo ratings yet

- Unprotect - CRM KPI Dashboard Someka V1FDocument10 pagesUnprotect - CRM KPI Dashboard Someka V1Fseminuevos sapporoNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- Group08 FedEx SecADocument17 pagesGroup08 FedEx SecAMrudul Vasant NaikNo ratings yet

- HebDocument6 pagesHebYashasvi GuptaNo ratings yet

- Talwalkars Better Value Fitness Limited BSE 533200 FinancialsDocument36 pagesTalwalkars Better Value Fitness Limited BSE 533200 FinancialsraushanatscribdNo ratings yet

- Preço de VendaDocument49 pagesPreço de VendaCelso Dal Negro Dal NegroNo ratings yet

- Investment Plan Using Valuation Vs Trendline Log RegressionDocument12 pagesInvestment Plan Using Valuation Vs Trendline Log RegressionfoxNo ratings yet

- Alphabet - Informational Equity Report - August 2018Document20 pagesAlphabet - Informational Equity Report - August 2018B WNo ratings yet

- Blanket Insentif DB P11-2023 201615-CV. Jaya Abadi (Sumbawa) GTDocument1 pageBlanket Insentif DB P11-2023 201615-CV. Jaya Abadi (Sumbawa) GTDedi HendriadiNo ratings yet

- Specsem Erm 2001 Handouts Dickson1Document20 pagesSpecsem Erm 2001 Handouts Dickson1Ayid AlmgatiNo ratings yet

- DCF Template: Exit MultipleDocument11 pagesDCF Template: Exit MultipleShane BrooksNo ratings yet

- xs2396247079 Phoenix Autocall Stepdown Memory On Aal Dal UalDocument6 pagesxs2396247079 Phoenix Autocall Stepdown Memory On Aal Dal UalvmakeienkoNo ratings yet

- 3 Ts xs2443300962 24m Usd Autocall RacevolvblcidDocument9 pages3 Ts xs2443300962 24m Usd Autocall RacevolvblcidvmakeienkoNo ratings yet

- Performancereport XS1555940714Document3 pagesPerformancereport XS1555940714vmakeienkoNo ratings yet

- GLR190001 Dev en Brochure 1Document23 pagesGLR190001 Dev en Brochure 1vmakeienkoNo ratings yet

- RCH012386151 en Floorplan 2Document1 pageRCH012386151 en Floorplan 2vmakeienkoNo ratings yet

- Accounting 2 - MCQs (Revison) - AnswerDocument8 pagesAccounting 2 - MCQs (Revison) - Answernemoyassin4No ratings yet

- BDU-BIT-Electromechanical Engineering Curriculum (Regular Program)Document187 pagesBDU-BIT-Electromechanical Engineering Curriculum (Regular Program)beselamu75% (4)

- Hostel Standard and Safety MeasuresDocument16 pagesHostel Standard and Safety MeasuresSadiya IqbalNo ratings yet

- Citing SourcesDocument37 pagesCiting Sourcesasquared29No ratings yet

- Pyneng Readthedocs Io en LatestDocument702 pagesPyneng Readthedocs Io en LatestNgọc Duy VõNo ratings yet

- Noli and El FiliDocument2 pagesNoli and El FiliGeramei Vallarta TejadaNo ratings yet

- RK20 Power Flow SparseDocument33 pagesRK20 Power Flow Sparsejohn smithNo ratings yet

- Structure Fires Caused by Hot Work: Marty AhrensDocument14 pagesStructure Fires Caused by Hot Work: Marty AhrensBurgosg ValeryNo ratings yet

- LymphomaDocument20 pagesLymphomaChairul Adilla Ardy100% (1)

- Management of Developing DentitionDocument51 pagesManagement of Developing Dentitionahmed alshaariNo ratings yet

- Cline y Angier (2010) - The Arvon Book of Life Writing. Writing Biography, Autobiography and MemoirDocument289 pagesCline y Angier (2010) - The Arvon Book of Life Writing. Writing Biography, Autobiography and MemoirConstanza Arraño100% (5)

- Grammar - File12 C ROMERO VIDALDocument3 pagesGrammar - File12 C ROMERO VIDALYuy Oré Pianto50% (2)

- Advanced Concepts of GD&TDocument3 pagesAdvanced Concepts of GD&TPalani Trainer33% (3)

- Pms 500 - International Mechanics KitDocument0 pagesPms 500 - International Mechanics KitArsul RNo ratings yet

- Conjunction and Exposition Text-2Document19 pagesConjunction and Exposition Text-2keyshalaokkiNo ratings yet

- Tpa6404 q1Document12 pagesTpa6404 q1siogNo ratings yet

- 1270A544-032 Console v3.1Document304 pages1270A544-032 Console v3.1badr eddine100% (1)

- SDS - Molykote 1000Document8 pagesSDS - Molykote 1000Zarni KyawNo ratings yet

- Agitated Thin Film Dryer ClaculationDocument12 pagesAgitated Thin Film Dryer ClaculationakaashNo ratings yet

- Inter-Bank Fund Transfer: Case Study 6Document5 pagesInter-Bank Fund Transfer: Case Study 6Ravi RanjanNo ratings yet

- Crocheted Fish PDFDocument10 pagesCrocheted Fish PDFAleyda Bonfil LeónNo ratings yet

- Cemont 2011 Chapter 3 Mig Mag Welding239619Document21 pagesCemont 2011 Chapter 3 Mig Mag Welding239619josechr6100% (1)

- SKV-FM-QA-12 Non Conformity and Corrective ActionDocument1 pageSKV-FM-QA-12 Non Conformity and Corrective ActionSaurabh BhadouriyaNo ratings yet

- Lesson: Identifying Author's Bias For or Against: Quarter 3 Wk-1Document4 pagesLesson: Identifying Author's Bias For or Against: Quarter 3 Wk-1Mary Cris Navarro LiboonNo ratings yet

- This Study Resource Was: Rizal Morga Lifestyle: LifestyleDocument2 pagesThis Study Resource Was: Rizal Morga Lifestyle: LifestyleMarjorie GawalaNo ratings yet

- Rod and Pump DataDocument11 pagesRod and Pump DataYoandri Stefania Guerrero CamargoNo ratings yet

- Timely Hints OctoberDocument5 pagesTimely Hints OctoberDane McDonaldNo ratings yet

- A Sensorless Direct Torque Control Scheme Suitable For Electric VehiclesDocument9 pagesA Sensorless Direct Torque Control Scheme Suitable For Electric VehiclesSidahmed LarbaouiNo ratings yet