Professional Documents

Culture Documents

Problem 9

Uploaded by

Satyam Tripathi0 ratings0% found this document useful (0 votes)

1 views2 pagesThe document provides financial information for a company including sales, costs, margins, and budgets at different production levels. It includes an income statement using the gross margin and contribution margin methods. The company's break-even point is 35,385 units, with a margin of safety of 82.3% at its installed capacity of 200,000 units.

Original Description:

Original Title

06112023

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information for a company including sales, costs, margins, and budgets at different production levels. It includes an income statement using the gross margin and contribution margin methods. The company's break-even point is 35,385 units, with a margin of safety of 82.3% at its installed capacity of 200,000 units.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesProblem 9

Uploaded by

Satyam TripathiThe document provides financial information for a company including sales, costs, margins, and budgets at different production levels. It includes an income statement using the gross margin and contribution margin methods. The company's break-even point is 35,385 units, with a margin of safety of 82.3% at its installed capacity of 200,000 units.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

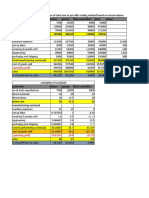

Problem 9

selling price per unit 12.5

direct material per unit 5

direct labour per unit 3

mfg overhead per unit 1

selling and admin per unit 0.25

admin and other overhead value 80000

selling and administrative value 35000

installed capacity units 200000

budgeted productions and sales units 100000

income statement- gross margin method

sales 1250000

less:

cost of good sold

direct material 500000

direct labour 300000

mfg overhead 100000

cogs 900000

gross margin 350000

gross margin % 28

selling and admin 60000

admin and other overhead 80000

net margin 210000

net margin% 16.8

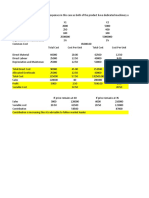

new budgeted production and sales 100000 150000 200000

income statement- contribution method

per unit value

sales 12.5 1250000 12.5 1875000 12.5 2500000

less:

Varibale expenses

direct material 5.00 500000 5.00 750000 5.00 1000000

direct labour 3.00 300000 3.00 450000 3.00 600000

mfg overhead 1.00 100000 1.00 150000 1.00 200000

selling and admin 0.25 25000 0.25 37500 0.25 50000

total varibale cost 9.25 925000 9.25 1387500 9.25 1850000

contribution 3.25 325000 3.25 487500 3.25 650000

contribuiton % 26 26 26

fixed cost

admin and other overhead 0.80 80000 0.53 80000 0.40 80000

selling and administrative 0.35 35000 0.23 35000 0.18 35000

total fixed cost 1.15 115000 0.77 115000 0.58 115000

net margin 2.10 210000 2.48 372500 2.68 535000

net margin % 16.8 19.86667 21.4

Break even Level ( no of units) 35385 35385 35385

Break even Level (Value) 442308 442308 442308

Break even as % of capacity ( Units) 17.7 17.7 17.7

Break even % in value terms 17.7 17.7 17.7

Margin of safety (Volumes) 164615 164615

Margin of safety (%) 82.30% 82.30% 82.30%

You might also like

- Templates To UseDocument22 pagesTemplates To UseGustavo FernandezNo ratings yet

- 05 Wilkerson Company Solution - StudentsDocument9 pages05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Babok Business Analysis Planning Monitoring PDFDocument1 pageBabok Business Analysis Planning Monitoring PDFShruti GuptaNo ratings yet

- Q&A Technical SuperintendentDocument10 pagesQ&A Technical SuperintendentRares Ang0% (1)

- Model Chapter 12 - ThipDocument14 pagesModel Chapter 12 - ThipThipparatM60% (5)

- Wilkerson Company ABCDocument4 pagesWilkerson Company ABCrajyalakshmiNo ratings yet

- Chapter 13Document11 pagesChapter 13MekeniMekeniNo ratings yet

- Module 8 Project ManagementDocument30 pagesModule 8 Project ManagementJohn Mark AdonaNo ratings yet

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocument4 pagesIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteNo ratings yet

- 11 Risks and Rates of Return KEYDocument12 pages11 Risks and Rates of Return KEYkNo ratings yet

- Classic Pen CompanyDocument6 pagesClassic Pen CompanySangtani PareshNo ratings yet

- Dokumen - Tips Sap Co PC Product Costing WorkshopDocument150 pagesDokumen - Tips Sap Co PC Product Costing WorkshopBalanathan VirupasanNo ratings yet

- Business Enhancement 2nd Summative TextDocument16 pagesBusiness Enhancement 2nd Summative TextCams DlunaNo ratings yet

- Bill French Accountant - Case AnalysisDocument8 pagesBill French Accountant - Case Analysischirag0% (2)

- Pittman Company Case.Document10 pagesPittman Company Case.Ankit VisputeNo ratings yet

- Management Accounting NotesDocument212 pagesManagement Accounting NotesFrank Chinguwo100% (1)

- Knowledge Musendekwa ACCA (Chartered Certified Accountant) : Seventh-Day Adventist Christian Personal StatementDocument3 pagesKnowledge Musendekwa ACCA (Chartered Certified Accountant) : Seventh-Day Adventist Christian Personal StatementAshley Knowledge100% (1)

- Pat Miranda, The New Controller of Vault Hard DrivesDocument11 pagesPat Miranda, The New Controller of Vault Hard Driveslaale dijaanNo ratings yet

- PEM WorkingDocument33 pagesPEM Workingk60.2112153014No ratings yet

- SCM TableDocument5 pagesSCM TableRed VelvetNo ratings yet

- Particulars P1 P2Document4 pagesParticulars P1 P2sanket pareekNo ratings yet

- 8 Better and Better LTD SolutionDocument23 pages8 Better and Better LTD SolutionAbhijeet JatoliaNo ratings yet

- Financial Stuff (SME)Document14 pagesFinancial Stuff (SME)Sana KhanNo ratings yet

- CVP Analysis Q.1-10Document28 pagesCVP Analysis Q.1-10James WisleyNo ratings yet

- Acccob3 HW2Document3 pagesAcccob3 HW2neovaldezNo ratings yet

- Classic Pen Working HandoutsDocument1 pageClassic Pen Working HandoutsTushar DuaNo ratings yet

- Case 20 3Document3 pagesCase 20 3Елена КорховаNo ratings yet

- CVP Sample Problems With AnswersDocument21 pagesCVP Sample Problems With AnswersJonalyn TaboNo ratings yet

- Acccob3 k48 Hw4 Valdez NeoDocument6 pagesAcccob3 k48 Hw4 Valdez NeoneovaldezNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- Assignment Capital BudgetingDocument7 pagesAssignment Capital BudgetingSufyan AshrafNo ratings yet

- Corporate FinanceDocument3 pagesCorporate FinanceAdrien PortemontNo ratings yet

- E5.18 Contribution Margin Per Unit Fixed ExpensesDocument5 pagesE5.18 Contribution Margin Per Unit Fixed ExpensesK59 Lai Hoang SonNo ratings yet

- Classic Pen HandoutsDocument1 pageClassic Pen HandoutsSuraj KumarNo ratings yet

- s15 16 (AutoRecovered)Document14 pagess15 16 (AutoRecovered)R GNo ratings yet

- Lec 05Document6 pagesLec 05Muhammad HusnainNo ratings yet

- II Mor Chap 9 12.11.2020Document5 pagesII Mor Chap 9 12.11.2020Al BastiNo ratings yet

- UntitledDocument10 pagesUntitledSIMRAN BURMANNo ratings yet

- Madrigal Company Case StudyDocument4 pagesMadrigal Company Case StudyChleo EsperaNo ratings yet

- Yr1 Yr2 Yr3 Sales/year: (Expected To Continue)Document7 pagesYr1 Yr2 Yr3 Sales/year: (Expected To Continue)Samiksha MittalNo ratings yet

- Group 2: Dakshayani Biscuits (: Cost Sheet)Document6 pagesGroup 2: Dakshayani Biscuits (: Cost Sheet)Vinu DNo ratings yet

- B2B AnswerDocument4 pagesB2B AnswerRakesh KukatlaNo ratings yet

- Quiz 7 - Transfer PricingDocument2 pagesQuiz 7 - Transfer PricingAlbert XuNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- Võ Thành Thắng - 31211024016 - NFGDocument28 pagesVõ Thành Thắng - 31211024016 - NFGtungphan.31211023431No ratings yet

- MA hw6Document5 pagesMA hw6Caleb BuddNo ratings yet

- Management Accounting 1Document4 pagesManagement Accounting 1Tax TrainingNo ratings yet

- Learning Activity 3 Sensitivity AnalysisDocument3 pagesLearning Activity 3 Sensitivity AnalysisjessNo ratings yet

- Phuket Beach Hotel - 2022Document10 pagesPhuket Beach Hotel - 2022Gavani Durga SaiNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- Budgetary Control SolutionDocument9 pagesBudgetary Control SolutionAnkita VaswaniNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- Acccob3 HW5Document10 pagesAcccob3 HW5neovaldezNo ratings yet

- Decentralized Operations and Segment Reporting - Discussion Problems - SolutionsDocument16 pagesDecentralized Operations and Segment Reporting - Discussion Problems - SolutionsK IdolsNo ratings yet

- BudgetDocument12 pagesBudgetmaxev92106No ratings yet

- Management AccountingDocument7 pagesManagement AccountingTrang ĐàiNo ratings yet

- Unit 8 - BudgetingDocument8 pagesUnit 8 - Budgetingkevin75108No ratings yet

- Chapter 6-ExamplesDocument6 pagesChapter 6-ExamplesNguyen Tan AnhNo ratings yet

- Buget ExcelDocument9 pagesBuget ExcelKhushbu PandeyNo ratings yet

- PM PST QST SolvingDocument5 pagesPM PST QST Solvingoffong morningNo ratings yet

- FM Lab Week 8Document2 pagesFM Lab Week 8M shahjamal QureshiNo ratings yet

- Hello SirDocument8 pagesHello Sir2022-24 ANKIT KUMAR GUPTANo ratings yet

- Horizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BDocument10 pagesHorizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BKarysse Arielle Noel JalaoNo ratings yet

- CMA Individual Assignment Manu M EPGPKC06054Document6 pagesCMA Individual Assignment Manu M EPGPKC06054CH NAIRNo ratings yet

- CVP AnalysisDocument2 pagesCVP AnalysisAhmed AtifNo ratings yet

- Process CostingDocument4 pagesProcess Costingsus meetaNo ratings yet

- Finanance Project.Document54 pagesFinanance Project.Satyam TripathiNo ratings yet

- Cost Assignment and Cost Allocation - Costs - Case StudiesDocument5 pagesCost Assignment and Cost Allocation - Costs - Case StudiesSatyam TripathiNo ratings yet

- Dairy and Eggs___Milk_Cheese_Yogurt_Eggs_Butter_Bakery Products___Bread_Pastries_Cakes_Bagels_Meat and Seafood___Beef, pork, lamb, etc._Poultry (e.g., chicken, turkey)_Fish (e.g., salmon, cod)_Shellfish (e.g., shrimp, mussels)_Canned and PaDocument1 pageDairy and Eggs___Milk_Cheese_Yogurt_Eggs_Butter_Bakery Products___Bread_Pastries_Cakes_Bagels_Meat and Seafood___Beef, pork, lamb, etc._Poultry (e.g., chicken, turkey)_Fish (e.g., salmon, cod)_Shellfish (e.g., shrimp, mussels)_Canned and PaSatyam TripathiNo ratings yet

- Project Scom Report RequestDocument10 pagesProject Scom Report RequestSatyam TripathiNo ratings yet

- Ratio AnalysisDocument54 pagesRatio AnalysisSatyam TripathiNo ratings yet

- Swot Analysis Edited2Document8 pagesSwot Analysis Edited2Ronnel CompayanNo ratings yet

- Test Bank For Financial Accounting 4th Edition Paul D KimmelDocument46 pagesTest Bank For Financial Accounting 4th Edition Paul D KimmelMai SươngNo ratings yet

- Assignment (2) - 1Document3 pagesAssignment (2) - 1Aleia Coleen ORENSENo ratings yet

- Chap 003Document31 pagesChap 003NazifahNo ratings yet

- Lecture 6 (Part A) : Supply Chain Management ModelsDocument13 pagesLecture 6 (Part A) : Supply Chain Management ModelsAbelaNo ratings yet

- Test Bank For Marketing Real People Real Choices 10th Edition Michael R Solomon Greg W Marshall Elnora W Stuart 13 978Document36 pagesTest Bank For Marketing Real People Real Choices 10th Edition Michael R Solomon Greg W Marshall Elnora W Stuart 13 978statablepostboy.asr67100% (45)

- Index of Activities: Chartered Accountants Program Financial Accounting & ReportingDocument150 pagesIndex of Activities: Chartered Accountants Program Financial Accounting & ReportingJAGRUITI JAGRITINo ratings yet

- B03013 Class3 TimeValueofMoneyDocument20 pagesB03013 Class3 TimeValueofMoneyLâm Thị Như ÝNo ratings yet

- ERP Next BrochureDocument2 pagesERP Next BrochureYusuf MulinyaNo ratings yet

- Chap004, Process CostingDocument17 pagesChap004, Process Costingrief1010No ratings yet

- Summer Internship Project Report On WorkDocument43 pagesSummer Internship Project Report On WorkDivya Kapadne BorseNo ratings yet

- Grievance ProcedureDocument2 pagesGrievance ProcedureAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Luis Eduardo Rabell PulidoDocument1 pageLuis Eduardo Rabell PulidoLuis Eduardo Rabell PulidoNo ratings yet

- Internal Verification of Assessment Decisions - BTEC (RQF) : Higher NationalsDocument44 pagesInternal Verification of Assessment Decisions - BTEC (RQF) : Higher NationalsJASRA FAZEERNo ratings yet

- Sample Report-BBADocument24 pagesSample Report-BBASabbir Hossan ChowdhuryNo ratings yet

- Chai Qawali AssignmentDocument15 pagesChai Qawali AssignmentCadet SaqlainNo ratings yet

- Success Joint Ventures.Document12 pagesSuccess Joint Ventures.yuszriNo ratings yet

- L CattertonDocument15 pagesL CattertonNgo Tung100% (1)

- Top 5 Problems On Overhead With Solutions - Cost AccountingDocument1 pageTop 5 Problems On Overhead With Solutions - Cost AccountingAMRITHANo ratings yet

- Annex H - Individual Employee Dev't. Plan Form-JNS 2021 1st SemDocument12 pagesAnnex H - Individual Employee Dev't. Plan Form-JNS 2021 1st SemJocelyn NapiereNo ratings yet

- Chapter 12 PresentationDocument31 pagesChapter 12 PresentationWa Qās RajpoøtNo ratings yet

- Soumojeet Biswas (GE5B-01)Document9 pagesSoumojeet Biswas (GE5B-01)Debajyoti SahooNo ratings yet