Professional Documents

Culture Documents

2021 Quiz 4

2021 Quiz 4

Uploaded by

j8noel0 ratings0% found this document useful (0 votes)

8 views1 pageFabian Woodworks purchased a truck for $12,000 on January 1, 2017 that has an estimated residual value of $1,000 and useful life of 5 years. Using the straight-line and double-declining methods, the document calculates the depreciation expense and book value for each year of the truck's useful life under both methods.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFabian Woodworks purchased a truck for $12,000 on January 1, 2017 that has an estimated residual value of $1,000 and useful life of 5 years. Using the straight-line and double-declining methods, the document calculates the depreciation expense and book value for each year of the truck's useful life under both methods.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 page2021 Quiz 4

2021 Quiz 4

Uploaded by

j8noelFabian Woodworks purchased a truck for $12,000 on January 1, 2017 that has an estimated residual value of $1,000 and useful life of 5 years. Using the straight-line and double-declining methods, the document calculates the depreciation expense and book value for each year of the truck's useful life under both methods.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

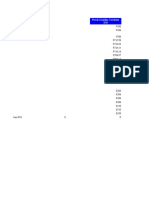

Quiz 4 Name___Jocelyn Noel_______ Student No.

___110036046_______

Fabian Woodworks purchased a truck on Jan. 1, 2017 at a cost of $12,000. The truck has an

estimated residual value of $1,000 and an estimated useful life of 5 years.

(1) Use the straight-line method to calculate depreciation expense for the truck and the book value of

the truck for each year of the useful life.

Year Depreciation Accumulated Book Value

Expense Depreciation

2200 2200 12000

2017 2200 2200 9800

2018 1960 4160 7840

2019 1176 5336 5880

2020 940.8 6276.8 4939.2

2021 799.68 7076.48 4139.52

(1) Use the double-declining method to calculate depreciation expense for the truck and the book

value of the truck for each year of the useful life.

Year Depreciation Accumulated Book Value

Expense Depreciation

2880 2880 12000

2017 2880 2880 9120

2018 2188.8 5068.8 6931.2

2019 1663.49 6732.29 5267.71

2020 1264.25 7996.54 4003.46

2021 960.83 8957.37 3042.63

You might also like

- Ocean Carrier Case Study CalculationDocument11 pagesOcean Carrier Case Study CalculationSatyajit BaruahNo ratings yet

- Teuer Furniture Case AnalysisDocument3 pagesTeuer Furniture Case AnalysisPankaj KumarNo ratings yet

- Automotive Industry in VietnamDocument45 pagesAutomotive Industry in VietnamNguyên Phạm ThanhNo ratings yet

- Advanced Clean Transit - Cost Assumptions and Data Sources - Update On 10/3/2016Document4 pagesAdvanced Clean Transit - Cost Assumptions and Data Sources - Update On 10/3/2016Erick Jesus BallenaNo ratings yet

- MSC301 MidDocument1 pageMSC301 MidAsif MahmoodNo ratings yet

- Data Harga Saham Sub Sektor Farmasi 2017-2021Document2 pagesData Harga Saham Sub Sektor Farmasi 2017-2021yesyarafah88No ratings yet

- Dólares Precio Promedio (Dolares) /KG Consumo (Toneladas)Document3 pagesDólares Precio Promedio (Dolares) /KG Consumo (Toneladas)Owen ArteagaNo ratings yet

- Dólares Precio Promedio (Dolares) /KG Consumo (Toneladas)Document3 pagesDólares Precio Promedio (Dolares) /KG Consumo (Toneladas)Owen ArteagaNo ratings yet

- Tabchart 7Document19 pagesTabchart 7Sahana SNo ratings yet

- EIU AllDataBySeriesDocument64 pagesEIU AllDataBySeriesMartín GuerreroNo ratings yet

- Demand and Supply ChickenDocument3 pagesDemand and Supply ChickenVea Abegail GarciaNo ratings yet

- Group Activities g5 1Document281 pagesGroup Activities g5 12021-108960No ratings yet

- Bank of Ireland - Financial Ratio Analysis: Hyperlink Tab 1 Tab 2 Tab 3 Tab 4 Tab 5 Tab 6 Tab 7 Tab 8Document25 pagesBank of Ireland - Financial Ratio Analysis: Hyperlink Tab 1 Tab 2 Tab 3 Tab 4 Tab 5 Tab 6 Tab 7 Tab 8Kiran NaiduNo ratings yet

- Amena Akter Mim 1620741630 - SCM 320 Individual Assignment 1Document10 pagesAmena Akter Mim 1620741630 - SCM 320 Individual Assignment 1amena aktar MimNo ratings yet

- Sector en Cifras Ingles Resumen JulioDocument19 pagesSector en Cifras Ingles Resumen JulioRomel Angel Erazo BoneNo ratings yet

- Year Historical Demand Increase Percent of IncreaseDocument3 pagesYear Historical Demand Increase Percent of Increasemelissa melancolicoNo ratings yet

- HW2 Worksheet Ch09-2Document6 pagesHW2 Worksheet Ch09-2cyc135790cycNo ratings yet

- Least Square Methyl ChlorideDocument11 pagesLeast Square Methyl ChlorideIqbal Muhamad IrfanNo ratings yet

- Cost Accounting Questions Chapter 5Document7 pagesCost Accounting Questions Chapter 5Owais Khan KhattakNo ratings yet

- Renewable Energy ResearchDocument17 pagesRenewable Energy ResearchEugeneNo ratings yet

- Trimestral 20220818 203612Document20 pagesTrimestral 20220818 203612WENDY CAROL NINA VALENCIANo ratings yet

- Cash Cost - Empresa Minera Milpo - Unidad Minera "Atacocha"Document27 pagesCash Cost - Empresa Minera Milpo - Unidad Minera "Atacocha"Carlos SaavedraNo ratings yet

- Cash Cost - Empresa Minera Milpo - Unidad Minera "Atacocha"Document22 pagesCash Cost - Empresa Minera Milpo - Unidad Minera "Atacocha"Victor Miguel peña huamanNo ratings yet

- Ekonomi Teknik: Prarancangan Pabrik Sirop Glukosa Dari Pati Jagung Secara Enzimatis Dengan Kapasitas 96.000 Ton/TahunDocument6 pagesEkonomi Teknik: Prarancangan Pabrik Sirop Glukosa Dari Pati Jagung Secara Enzimatis Dengan Kapasitas 96.000 Ton/TahunamaliaNo ratings yet

- Content Handbook of Energy and Economic Statistics of Indonesia 2018 Final Edition PDFDocument107 pagesContent Handbook of Energy and Economic Statistics of Indonesia 2018 Final Edition PDFIreg TraxNo ratings yet

- Content Handbook of Energy and Economic Statistics of Indonesia 2018 Final Edition PDFDocument107 pagesContent Handbook of Energy and Economic Statistics of Indonesia 2018 Final Edition PDFAnwaruddin SalehNo ratings yet

- Samsung ReportDocument12 pagesSamsung ReportARNIM TULSYANNo ratings yet

- TexRanchDocument3 pagesTexRanchMyron BrandwineNo ratings yet

- Corp Finance Ocean CarriersDocument146 pagesCorp Finance Ocean CarriersJingwen YangNo ratings yet

- Details of Mobile Health Unit at S&P Complex CSR (MHU-1) Utkal E CoalDocument3 pagesDetails of Mobile Health Unit at S&P Complex CSR (MHU-1) Utkal E CoalPrasant DasNo ratings yet

- 11-E - Group 3 - Data Set (Info Dashboard)Document5 pages11-E - Group 3 - Data Set (Info Dashboard)Mikai DelloroNo ratings yet

- Handy Whitman IndexDocument2 pagesHandy Whitman IndexJuan Dela Cruz0% (1)

- ITC Key RatiosDocument1 pageITC Key RatiosHetNo ratings yet

- Cash - Cost - EBITDA 2017-2022 FVDocument7 pagesCash - Cost - EBITDA 2017-2022 FVJulian Brescia2No ratings yet

- Nguyễn Thị Kim ChiDocument8 pagesNguyễn Thị Kim Chitsunami133100100020No ratings yet

- NR StatsDocument29 pagesNR StatshumayriNo ratings yet

- Ocean CarriersDocument17 pagesOcean CarriersJuvairiaNo ratings yet

- 34 Mail-1Document8 pages34 Mail-1shifaanjum321No ratings yet

- Ass Intacc 3 - GonzagaDocument12 pagesAss Intacc 3 - GonzagaLalaine Keendra GonzagaNo ratings yet

- Diagram:calculations - OBUDocument6 pagesDiagram:calculations - OBUkiranNo ratings yet

- From Given Dataset We Have F' As A Data Set.: Experiential Learning AssignmentDocument4 pagesFrom Given Dataset We Have F' As A Data Set.: Experiential Learning AssignmentAditya ChaudharyNo ratings yet

- Putri Nur Fitriani - Tugas 5Document16 pagesPutri Nur Fitriani - Tugas 5Putri NurNo ratings yet

- Bangkok Expressway and Metro Public Company Limited (BEM) Opportunity Day Ye2022Document25 pagesBangkok Expressway and Metro Public Company Limited (BEM) Opportunity Day Ye2022sozodaaaNo ratings yet

- AXISDocument3 pagesAXISgauravNo ratings yet

- Upah Minimum Provinsi Dan Inflasi Di DKI Jakarta, 1999-2020 Provincial Minimum Wages and Inflation at DKI Jakarta, 1999-2020Document3 pagesUpah Minimum Provinsi Dan Inflasi Di DKI Jakarta, 1999-2020 Provincial Minimum Wages and Inflation at DKI Jakarta, 1999-2020nurul husnaNo ratings yet

- Global Textiles & Apparels - E-Paper (11 August 2021)Document7 pagesGlobal Textiles & Apparels - E-Paper (11 August 2021)Rahul SoodNo ratings yet

- Statistical Report Glass Alliance Europe 2019 2020Document15 pagesStatistical Report Glass Alliance Europe 2019 2020pepeNo ratings yet

- Power Sector WriteupDocument17 pagesPower Sector WriteupAgha Alamdar HussainNo ratings yet

- Demanda FuturaDocument13 pagesDemanda FuturaLorena SepúlvedaNo ratings yet

- Mindtree Company PROJECTDocument16 pagesMindtree Company PROJECTSanjay KuriyaNo ratings yet

- Teuer Furniture Case AnalysisDocument3 pagesTeuer Furniture Case AnalysisPankaj Kumar0% (1)

- Brazil Russia India China: Additional Information: SourceDocument1 pageBrazil Russia India China: Additional Information: SourceKuzman FilipNo ratings yet

- Table 6.0 Computation For Projected Annual Demand Using Statistical Straight LineDocument3 pagesTable 6.0 Computation For Projected Annual Demand Using Statistical Straight LineJustin Jay CruzNo ratings yet

- XX X/N YX Y/n: Yonxline XonylineDocument7 pagesXX X/N YX Y/n: Yonxline XonylineJigarNo ratings yet

- BAFL FinalDocument9 pagesBAFL Finaltalhazaman76No ratings yet

- Aaf020-1 Sem2 As02m Data SetDocument7 pagesAaf020-1 Sem2 As02m Data SetThảo NguyễnNo ratings yet

- BESS CalculationsDocument8 pagesBESS CalculationsPreetham BharadwajNo ratings yet

- Marketing Plan: Demand & Supply Analysis Projected Demand Year of Operation Total Projected DemandDocument5 pagesMarketing Plan: Demand & Supply Analysis Projected Demand Year of Operation Total Projected DemandMaritess MunozNo ratings yet

- HectorDocument42 pagesHectorJehPoyNo ratings yet

- Acct. Ch. 9 H.W.Document7 pagesAcct. Ch. 9 H.W.j8noelNo ratings yet

- ACCT CH.2 HomeworkDocument13 pagesACCT CH.2 Homeworkj8noelNo ratings yet

- Acct CH.7 H.W.Document8 pagesAcct CH.7 H.W.j8noelNo ratings yet

- Acct C.H.10Document6 pagesAcct C.H.10j8noelNo ratings yet