Professional Documents

Culture Documents

Risk Analysis Tool

Risk Analysis Tool

Uploaded by

veerannjaneyuluOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Analysis Tool

Risk Analysis Tool

Uploaded by

veerannjaneyuluCopyright:

Available Formats

www.opengroup.

org/library/i181

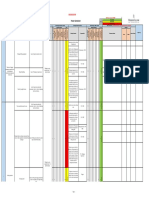

OPEN FAIR™

RISK ANALYSIS TOOL

The Open Group Security Forum has developed a Risk

Analysis Tool compliant with The Open Group Open

FAIR™ standards – Risk Taxonomy (O-RT) and Risk

Analysis (O-RA).

Using the Open FAIR standards to guide critical thinking and decomposition of risk questions, the Tool has been

designed to allow its user to compare “before and after risk states” of a proposed risk mitigation project.

The Tool is designed for international use, with the user able to select local currency units and the order of magnitude

(thousands, millions, billions, etc.) relevant to the analysis. Embedded graphs are controlled through intuitive settings,

letting analysts and management “zoom in” on relevant areas of the results. The Tool further informs management by

comparing and presenting statistical results such as the average annual loss exposure and user-defined percentile

thresholds of loss and chance of exceedance of annual loss.

The target audience is both students in university who are learning quantitative risk analysis, as well as risk practitioners

in a corporate environment who need a simple yet accurate risk evaluator for single risk questions. The Tool is genuinely

versatile, making it equally suitable for the university professor or corporate trainer, as well as an experienced corporate

risk analyst, who requires an easy-to-use analytic tool to analyze individual risk questions.

Risk Scroll through

individual

Risk

100%

Loss Magnitude/yr. $000s

Total Risk Simulated Loss

Trial 3/100

simulation Loss Magnitude

Loss

Magnitude 80%

Proposed Cur. Prop. trials

60%

Current 141.9

Diff.

110.8

31.1

Specify triangular

About

Open FAIR™ distributions for Risk

Loss Magnitude

Specify Secondary

Risk Analysis Tool 40% Calculated Below

Loss Event Loss Average Loss

Cur. Prop. Current and Current 1 20 50 Loss

← Frequency

Magnitud 20%

Frequency

127.7 97.7 Statistics based Proposed Primary Loss Event

Frequency

Loss

Magnitude

Proposed 40

0%

0 50 100 150 200 250 300 350 400 450

Diff. 30.0

on all trials Loss Magnitude

Drill Down

100%

Chance of Exceeding Percentile Loss 95% appear here Primary Loss Magnitude Secondary Loss Magnitude

Cur. Prop.

Proposed Current Min ML Max Min ML Max

80% 267.5 215.0

Diff. 52.6 Productivity 5 18 20 ← SLEF Current 0% 30% 60% ←

Current

60% Replacement 6 8 10 ← Proposed 10% 15% 20% ←

Chance Loss Response ←

40%

Exceeds 5 Reputation ← Current Min ML Max

Cur. Prop.

20%

95% 95% Adjust graph Competitive Adv.

Judgments

←

←

Productivity

Replacement

←

←

0%

0 100 200 300 400 500

Diff. 0%

settings here Response 3 9 15 ←

Loss Units Loss Measure Bins Width Magnitude Display Mode Proposed Min ML Max Reputation 4 10 16 ←

$ 000s 10 50 Productivity ← Competitive Adv. 5 11 17 ←

Replacement ← Judgments ←

Grey loss form boxes

Response ←

Set Units and Magnitudes can be input,Reputation

but are ← Proposed Min ML Max

Loss Event Frequency for all screens Competitive Adv.

not usually Judgments

←

←

Productivity

Replacement

←

←

associated with the Response 4 10 12 ←

Reputation 2 5 7 ←

About given primary or Specify Current and

Competitive Adv. 3 7 8 ←

Risk

Loss Event Frequency/yr. 100%

Loss Events/yr.

secondary loss Proposed Secondary

Judgments ←

Calculated Below

Drill up or down

Current 1 2 5 ← Loss Magnitude

Loss Event

Frequency

Loss

Magnitude

Proposed 1 2 3 ← with

0% Check Boxes

Drill Down 0 1 2 3 4

Threat Event Frequency/yr. Vulnerability

Calculated Below Min ML Max Specify Magnitude

Cur. 20 28 35 ← Cur. 5% 30% 70% ← Display Mode

Prop. ← Prop. ←

Drill Down Drill Down

Contact Probability Threat Enter assumptions

Resistance

Frequency/yr.

Cur. Pro.

of Action

Cur. Pro.

Capacity

Cur. Pro.

at any level

Strength

Cur. Pro.

Min 1 Min 10% Min 10% Min 10%

ML 4 ML 50% 25% ML 50% ML 50%

Max 9 Max 75% 45% Max 60% Max 60%

↑ ↑ ↑ ↑ ↑ ↑

Enter ↑triangular

↑

distributions estimates at

any level. When lower levels are activated

upper-level estimates are bypassed.

© March 2018 - The Open Group. All rights reserved.

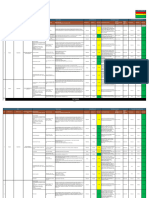

Feature Benefit

Able to perform, present, and visualize the Enables simple “before and after” comparisons.

risk of two states: current and proposed.

Interactive – change a risk parameter and Allows “what if” scenarios to be modeled quickly. A dashboard lets

instantly see the result. Supports intuitive the analyst or management stakeholder define key risk thresholds

A/B comparison. to enable informed management decision-making.

Built on the Open FAIR international Developed by an industry-based, vendor-neutral, and technology-

standards, using a proven statistical engine neutral voluntary standards consensus body: The Open Group.

from Probability Management. Uses SIPMath™ as the Monte Carlo simulator to ensure accuracy

of calculations and approach. Data and graphics are exportable to

other enterprise communication tools such as Microsoft® Word and

PowerPoint.

Extensible through using additional SIPMath The tool is built upon the industry standard and proven SIPMath

features. Modeler Tools from Probability Management

(www.probabilitymanagement.org), enabling experienced

analysts who are familiar with SIPMath to extend and improve the

spreadsheet using SIPMath directly if necessary. Advanced users

can develop and add features themselves.

Transparent and inspectable – all formulas, All of the spreadsheet’s calculations are overt and available for

calculations, and manipulations are visible inspection, making the tool open for evaluation, extension, and

to the user or other evaluator. critique.

No requirement to be online. Allows maximum flexibility and independent use for a Risk

Practitioner being offsite with clients and in areas where Internet

connectivity may be highly sensitive or impractical.

The tool is built on the Microsoft® Excel Can be used equally well in a Mac or PC environment. As

platform. Microsoft® Excel is the global market-leading spreadsheet product,

users are almost certain to have the required licensing in place to

allow them to easily deploy. This helps significantly reduce both the

cost of acquisition and of maintaining their Risk Analysis Tool suite.

Secure Analyses can be protected by securing the spreadsheet just as the

enterprise secures other sensitive financial information, making this

spreadsheet fit for limited but sensitive corporate purposes.

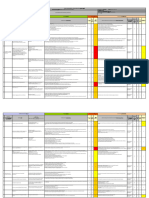

More information About The Open Group

The Open Group is a vendor-neutral and technology-neutral

For more information, please visit our website: consortium, whose vision of Boundaryless Information Flow™

www.opengroup.org/library/i181. will enable access to integrated information within and between

enterprises based on open standards and global interoperability.

The Open Group works with customers, suppliers, consortia,

and other standards bodies. Its role is to capture, understand,

ArchiMate®, DirecNet®, Making Standards Work®, OpenPegasus®, Platform 3.0®, The Open

and address current and emerging requirements, establish

Group®, TOGAF®, UNIX®, UNIXWARE®, X/Open®, and the Open Brand X® logo are registered policies, and share best practices; to facilitate interoperability,

trademarks and Boundaryless Information FlowTM, Build with Integrity Buy with ConfidenceTM,

Dependability Through AssurednessTM, EMMMTM, FACETM, the FACETM logo, IT4ITTM,

develop consensus, and evolve and integrate specifications and

the IT4ITTM logo, O-DEFTM, O-PASTM, Open FAIRTM, Open Platform 3.0TM, Open Process open source technologies; and to operate the industry's premier

AutomationTM, Open Trusted Technology ProviderTM, SOSATM, the Open OTM logo, and The

Open Group Certification logo (Open O and checkTM) are trademarks of The Open Group.

certification service.

SIPmath™ is a trademark of ProbabilityManagement.org.

Further information on The Open Group can be found at

www.opengroup.org.

© March 2018 - The Open Group. All rights reserved.

You might also like

- RA For Firefighting (CS Pipe Prefabrication-Sprinklers - Pressure Test and Flashing Painting-001)Document3 pagesRA For Firefighting (CS Pipe Prefabrication-Sprinklers - Pressure Test and Flashing Painting-001)RAMY ABOU AL DAHABNo ratings yet

- Blasting and Painting of Fire Fighting PipingDocument3 pagesBlasting and Painting of Fire Fighting PipingRAMY ABOU AL DAHABNo ratings yet

- RiskregisterDocument27 pagesRiskregisterSaravana kumar NagarajanNo ratings yet

- Step 1: Risk Identification Step 2: Risk Assessment Step 3: Risk Response Step 4: Monitor & ControlDocument27 pagesStep 1: Risk Identification Step 2: Risk Assessment Step 3: Risk Response Step 4: Monitor & ControlSead Zejnilovic100% (1)

- 4.1.2 Hira WFJDocument12 pages4.1.2 Hira WFJRizaNo ratings yet

- Risk - Register Template-2Document1 pageRisk - Register Template-2randulahathnagoda21No ratings yet

- Attachment 01 of SOP 05 - Hazard Identification Risk Assessment and ManagementDocument1 pageAttachment 01 of SOP 05 - Hazard Identification Risk Assessment and ManagementSarmad AbbasiNo ratings yet

- Risk Assessment Registry SAMPLEDocument2 pagesRisk Assessment Registry SAMPLERTL JRNo ratings yet

- Risk AssessmentDocument3 pagesRisk Assessmentsecretthing.6No ratings yet

- Hazrd Identification & Risk Assessment: Mmf100 Nov 2009 - Pm/105/01 © Mott Macdonald 2009Document2 pagesHazrd Identification & Risk Assessment: Mmf100 Nov 2009 - Pm/105/01 © Mott Macdonald 2009SuperuserAsadhussainNo ratings yet

- RA - EIA HousekeepingDocument1 pageRA - EIA HousekeepingعمروNo ratings yet

- RA - HDPE Fire FittingDocument2 pagesRA - HDPE Fire FittingRAMY ABOU AL DAHABNo ratings yet

- Riskdoc 23Document1 pageRiskdoc 23Rima KhanNo ratings yet

- RA - EIA Neon LampsDocument2 pagesRA - EIA Neon Lampsعمرو100% (1)

- Information Technology - Risk Register ASFANDocument1 pageInformation Technology - Risk Register ASFANYogender Singh RawatNo ratings yet

- RA - EIA GeneratorDocument4 pagesRA - EIA GeneratorعمروNo ratings yet

- HIRA - MS Staircase ErectionDocument7 pagesHIRA - MS Staircase ErectionRamNo ratings yet

- QHS - Risk AssessmentDocument66 pagesQHS - Risk AssessmentMinion Party0% (1)

- Hazard Analysis and Risk Control Record: Schlumberger-PrivateDocument2 pagesHazard Analysis and Risk Control Record: Schlumberger-Privatehans vatriolisNo ratings yet

- Hira - Risk Assessment - Merakes - Provision of Subsea Tructures FabricatioonDocument943 pagesHira - Risk Assessment - Merakes - Provision of Subsea Tructures FabricatioonFariz Fatahillah AlbugisiNo ratings yet

- Risk Assessment EvidenceDocument4 pagesRisk Assessment EvidenceBlister PatchNo ratings yet

- HIRA - Height WorkDocument2 pagesHIRA - Height Worksrinu degalaNo ratings yet

- Thyssenkrupp Elevator Qatar: Risk AssessmentDocument5 pagesThyssenkrupp Elevator Qatar: Risk AssessmentMahran MastouriNo ratings yet

- ALBAZ General RA - Construction Well Pads-Rev A.Document2 pagesALBAZ General RA - Construction Well Pads-Rev A.Ali HadiNo ratings yet

- RA - EIA ErgonomicsDocument2 pagesRA - EIA ErgonomicsعمروNo ratings yet

- Thyssenkrupp Elevator Qatar: Risk AssessmentDocument5 pagesThyssenkrupp Elevator Qatar: Risk AssessmentMahran Mastouri100% (4)

- Moving Convoy Wide Load - RA-R9-01-014-01Document2 pagesMoving Convoy Wide Load - RA-R9-01-014-01cmrig74No ratings yet

- TRA-Fire Alarm Installation Work at MSF LCR Room (1,2,3,4)Document5 pagesTRA-Fire Alarm Installation Work at MSF LCR Room (1,2,3,4)vivekNo ratings yet

- HIRA - Stripping Soil at BUP SouthDocument1 pageHIRA - Stripping Soil at BUP SouthThe PhenomenonNo ratings yet

- ESH Risk Management MotorDocument2 pagesESH Risk Management MotorknabpshoNo ratings yet

- Pressurization Fan Dismantling & Installation Risk AssessmentDocument1 pagePressurization Fan Dismantling & Installation Risk Assessmentbelhareth seifeddineNo ratings yet

- 2020 Risk Management Bruny Island CruisesDocument6 pages2020 Risk Management Bruny Island Cruisesapi-297737638No ratings yet

- Risk Assessment Register: Prepared By: Toolpusher / Hse AdvisorDocument1 pageRisk Assessment Register: Prepared By: Toolpusher / Hse Advisorcmrig740% (1)

- EMP - Environmental Risk RegisterDocument23 pagesEMP - Environmental Risk RegisterNaveen ChaudharyNo ratings yet

- HIRA - Hot WorkDocument2 pagesHIRA - Hot WorkPrithika AnbuNo ratings yet

- HIRA ExcavationDocument2 pagesHIRA ExcavationPrithika AnbuNo ratings yet

- Compaction Risk AssessmentDocument5 pagesCompaction Risk AssessmentKashif RehmanNo ratings yet

- Risk Assessment Register: Prepared By: Toolpusher / Hse AdvisorDocument1 pageRisk Assessment Register: Prepared By: Toolpusher / Hse Advisorcmrig74No ratings yet

- JHA - Cape East - N2 Purging - Rev 0Document8 pagesJHA - Cape East - N2 Purging - Rev 0athirapvc133No ratings yet

- Enterprise Risk ManagementDocument13 pagesEnterprise Risk Managementmiradhilaa05100% (2)

- Deluge Foam System: Task Risk Assessment WorksheetDocument7 pagesDeluge Foam System: Task Risk Assessment WorksheetnathisonsNo ratings yet

- JSA .Hendra Pouring Congcrete by Mixer TruckDocument2 pagesJSA .Hendra Pouring Congcrete by Mixer TruckMuhamad Rizki AzisNo ratings yet

- District - Project - Risk WorkshopDocument5 pagesDistrict - Project - Risk WorkshopDarlenis RodriguezNo ratings yet

- FMEA - Chromeleon - v3Document3 pagesFMEA - Chromeleon - v3Harimohan SinghNo ratings yet

- HIRA-Rig Maintenance WORKDocument2 pagesHIRA-Rig Maintenance WORKPrithika AnbuNo ratings yet

- Jsa - RavscoDocument13 pagesJsa - Ravscoathirapvc133No ratings yet

- 23 Risk Assessment Scaffold Erection Dismantling - HVACDocument5 pages23 Risk Assessment Scaffold Erection Dismantling - HVACBalongNo ratings yet

- AMB-172-003 Insulation WorksDocument2 pagesAMB-172-003 Insulation WorksRues AgNo ratings yet

- Risk Assessment - 8040278 - Higginsville Concrete RemediationDocument6 pagesRisk Assessment - 8040278 - Higginsville Concrete RemediationMohammed EssamNo ratings yet

- Mapeamento de Máquinas NR12 2020 - Rev.1Document26 pagesMapeamento de Máquinas NR12 2020 - Rev.1Marcelo Wilson AraújoNo ratings yet

- Conducting Drop Object Inspection - RA-R9-01-017-01Document1 pageConducting Drop Object Inspection - RA-R9-01-017-01cmrig74No ratings yet

- Step 1: Risk Identification Step 2: Risk Assessment Step 3: Risk Response Step 4: Monitor & ControlDocument28 pagesStep 1: Risk Identification Step 2: Risk Assessment Step 3: Risk Response Step 4: Monitor & ControlAnbuNo ratings yet

- RA - Concrete PouringDocument1 pageRA - Concrete PouringعمروNo ratings yet

- GIS-RA-4061E-004 Risk Assessment For Road Crossing Area (Rev.00)Document6 pagesGIS-RA-4061E-004 Risk Assessment For Road Crossing Area (Rev.00)Ajas Aju100% (1)

- Chaliyama Steel Plant-Rungta Mines Limited Hazard Identification & Risk AssessmentDocument3 pagesChaliyama Steel Plant-Rungta Mines Limited Hazard Identification & Risk AssessmentCPP EI DSpNo ratings yet

- 23 Risk Assessment Scaffold Erection Dismantling Fire FightingDocument5 pages23 Risk Assessment Scaffold Erection Dismantling Fire FightingBalongNo ratings yet

- Evaluasi Peta ProvinsiDocument1 pageEvaluasi Peta ProvinsikapussaNo ratings yet

- C3.Hiradec - ONLINE BOLT TIGHTENING (FLANGES & UNION JOINTS-GLANDS OF MOV-MCV-MIV-PCV)Document1 pageC3.Hiradec - ONLINE BOLT TIGHTENING (FLANGES & UNION JOINTS-GLANDS OF MOV-MCV-MIV-PCV)Pankaj PandeyNo ratings yet

- Information and Software Technology: Shalinka Jayatilleke, Richard LaiDocument23 pagesInformation and Software Technology: Shalinka Jayatilleke, Richard Laiimam riyadiNo ratings yet

- Sas Supply Risk Management Workshop 20074131Document23 pagesSas Supply Risk Management Workshop 20074131mushtaque61No ratings yet

- 信安基金- 投資報告Document20 pages信安基金- 投資報告ming fungNo ratings yet

- Ins. Agents The Big AppleDocument501 pagesIns. Agents The Big AppleWaf EtanoNo ratings yet

- Resume Sample For Data EntryDocument7 pagesResume Sample For Data Entryonguiqekg100% (1)

- Risk Assessement For AAES ProductsDocument4 pagesRisk Assessement For AAES ProductsAzhar Shaikh100% (1)

- Kathmandu University School of Medical Sciences Dhulikhel, KavreDocument43 pagesKathmandu University School of Medical Sciences Dhulikhel, Kavrerojina poudelNo ratings yet

- M. Navya - MEP 111Document7 pagesM. Navya - MEP 111Navya MahalingappaNo ratings yet

- MC 206 FDocument18 pagesMC 206 Fthella deva prasadNo ratings yet

- Appendix P - HSE Management PlanDocument28 pagesAppendix P - HSE Management PlanSaji Thomas100% (1)

- Rohit TradeDocument14 pagesRohit Tradearpit200407No ratings yet

- NACO-TI Migrants Operational GuidelinesDocument140 pagesNACO-TI Migrants Operational GuidelinestntimigrantsNo ratings yet

- 13 Things Mentally Strong People DonDocument3 pages13 Things Mentally Strong People DonVigneshwaraNo ratings yet

- Portfolio Management: 2024 Level III Topic OutlinesDocument6 pagesPortfolio Management: 2024 Level III Topic OutlineshimanshubkkNo ratings yet

- An Ethical Approachto Data Privacy ProtectionDocument10 pagesAn Ethical Approachto Data Privacy Protectionnuraida hakikiNo ratings yet

- Cfin 3 3rd Edition Besley Test BankDocument21 pagesCfin 3 3rd Edition Besley Test Bankcleopatrasang611py100% (38)

- Summative Assessment Brief - Project Management EssentialsDocument15 pagesSummative Assessment Brief - Project Management EssentialsMaryam KhanNo ratings yet

- Sheffield City Council Strategic Flood Risk Assessment (SFRA) Level 2Document5 pagesSheffield City Council Strategic Flood Risk Assessment (SFRA) Level 2Tony CarrollNo ratings yet

- CCNA Security: Chapter 9 Managing A Secure NetworkDocument97 pagesCCNA Security: Chapter 9 Managing A Secure NetworkAissa ChaabiNo ratings yet

- Relevance of Weather Insurance in Indian AgricultureDocument5 pagesRelevance of Weather Insurance in Indian AgriculturePhabhat MallickNo ratings yet

- Chap 6Document52 pagesChap 6Danial HemaniNo ratings yet

- ASHP Cold Chain Management Resource Guide 2Document16 pagesASHP Cold Chain Management Resource Guide 2suhaime tshNo ratings yet

- Assessment of Quality Risk Management Implementation PDFDocument10 pagesAssessment of Quality Risk Management Implementation PDFsameh qanadiloNo ratings yet

- 2015 Rexam Sustainability Report FinalDocument30 pages2015 Rexam Sustainability Report FinalMatt MaceNo ratings yet

- A Supervisor's Guide To Safety LeadershipDocument129 pagesA Supervisor's Guide To Safety Leadershipaccentechserv.nigltd100% (1)

- OceanofPDF - Com Inclusion - Harvard Business ReviewDocument72 pagesOceanofPDF - Com Inclusion - Harvard Business ReviewFERDYNANDUS . (00000101246)No ratings yet

- Pallavi TS Project ReportDocument33 pagesPallavi TS Project ReportPrem KumarnNo ratings yet

- ReviewDocument2 pagesReviewHoward VillegasNo ratings yet

- Lessons Learned On Language Model Safety and MisuseDocument6 pagesLessons Learned On Language Model Safety and MisuseasddsaasdNo ratings yet

- Management Accounting Paper 12Document604 pagesManagement Accounting Paper 12sarvan kumar100% (2)