Professional Documents

Culture Documents

QB - 5e - Question 12.7 P 123

QB - 5e - Question 12.7 P 123

Uploaded by

yolandamunzhedziOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QB - 5e - Question 12.7 P 123

QB - 5e - Question 12.7 P 123

Uploaded by

yolandamunzhedziCopyright:

Available Formats

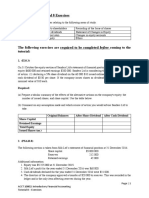

Chapter 12: Companies 123

QUESTION 12.7 (B)

(21 marks: 26 minutes)

Assume a company tax rate of 28% and a dividend tax rate of 20%.

Fidelio Ltd is a small record company. They have a December financial year-end.

The equity of Fidelio at 1 January 2008 comprised the following:

Share capital Class A 1 250 000

15% Class B shares of R2 each 200 000

Retained earnings 250 000

Revaluation surplus 100 000

The authorised share capital of the company is 2 million Class A Shares and 500 000 15%

Class B shares of R2 each.

Issued Class A shares at 31 December 2007 amounted to 1000000 and 100000 Class B shares

as at 31 December 2007.

The following transactions occurred during the year ended 31 December 2008:

1. 300 000 ordinary shares were issued at R3 per share on 30 April 2008.

2. 100 000 15 Class B shares were issued at R2 each on 1 January 2008.

3. Share issue expenses to the value of R50 000 were written off to the Share Capital:

Class A account.

4. The directors are authorised by special resolution, dated 1 December 2008, to issue 100

000 Class A shares of R1 before 31 December 2009.

5. An interim Class A dividend of R0.30 per share was declared on 31 March 2008.

6. A final Class A dividend of R0.20 per share was declared on 31 December.

7. 30% of the shareholders are South African resident companies.

8. The total comprehensive income for the year was equal to R800 000.

9. There was a revaluation of the company’s land and buildings equal to R200 000.

10. The company tax charge of R160 000 should be accrued for the current financial year.

11. The company received an assessment from the South African Revenue Services for the

2007 year of assessment. The assessment stated that a refund of R40 000 was due to

the company. The balance on the South African Revenue Services account at 1 January

2008 was a debit of R10 000. All prior tax years, except for 2007, had been finalised

before 1 January 2008.

YOU ARE REQUIRED TO:

1. Prepare the statement of changes in equity for the year ended 31 December 2008.

(12 marks)

2. Prepare the share capital note to the annual financial statements for the year ended

31 December 2008. (5 marks)

3. Calculate the company tax charge for the 2008 year of assessment. (4 marks)

9780190439507_Financial_Accounting_QB_5e_Masterset_Jan2020.indb 123 2020/01/29 01:43:37 PM

You might also like

- Tax Flow ChartDocument2 pagesTax Flow ChartAutochthon GazetteNo ratings yet

- Bfc44602 Engineering Economy: Title: Development of A New Private College Worth RM100 MillionDocument64 pagesBfc44602 Engineering Economy: Title: Development of A New Private College Worth RM100 Millionyap chee keongNo ratings yet

- DQ at (F) KaDocument12 pagesDQ at (F) KaKurt dela Torre100% (1)

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- 47 - Financial Reporting and Changing PricesDocument3 pages47 - Financial Reporting and Changing PricesYvonne Joy Mondano TehNo ratings yet

- FAR-06 Earnings Per ShareDocument4 pagesFAR-06 Earnings Per ShareKim Cristian Maaño50% (2)

- Chapter 27 Earnings and Book Value Per ShareDocument19 pagesChapter 27 Earnings and Book Value Per ShareNhel AlvaroNo ratings yet

- Exercise ProblemsDocument6 pagesExercise ProblemsDianna Rose Vico100% (1)

- Audit of Financial Statement PresentationDocument7 pagesAudit of Financial Statement PresentationHasmin Saripada Ampatua100% (1)

- MAAAAAAAAAAMMMMMMMMMADocument15 pagesMAAAAAAAAAAMMMMMMMMMAMaurice Agbayani100% (2)

- Case Presentation - Woodland Furniture LTDDocument16 pagesCase Presentation - Woodland Furniture LTDLucksonNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Seminar 8 PART BDocument3 pagesSeminar 8 PART BGaba RieleNo ratings yet

- Quiz SHEEDocument2 pagesQuiz SHEEJhoana Marie Agawa MallariNo ratings yet

- CXC Principles of Accounts Past Paper Jan 2009Document8 pagesCXC Principles of Accounts Past Paper Jan 2009lordNo ratings yet

- Ac2091 ZB - 2019Document15 pagesAc2091 ZB - 2019duong duongNo ratings yet

- Statement of Cash Flow Set-3Document5 pagesStatement of Cash Flow Set-3vdj kumarNo ratings yet

- Companies Accounting Class Execises - Williams LTDDocument2 pagesCompanies Accounting Class Execises - Williams LTDndilimotuwilika001No ratings yet

- Case Study Accounting Policy, Changes in Accounting Estimate, and ErrorsDocument2 pagesCase Study Accounting Policy, Changes in Accounting Estimate, and ErrorsHAO HUYNH MINH GIANo ratings yet

- Tutorial Questions Borrowing Costs - 2019Document7 pagesTutorial Questions Borrowing Costs - 2019Noah MigealNo ratings yet

- F2 Questions November 2010Document20 pagesF2 Questions November 2010Robert MunyaradziNo ratings yet

- FR 2018 Sepdec Sample QDocument5 pagesFR 2018 Sepdec Sample QfatehsalehNo ratings yet

- MBA-5107, Short QuestionsDocument2 pagesMBA-5107, Short QuestionsShajib GaziNo ratings yet

- 2009-Financial Reporting Main EQP and CommentariesDocument46 pages2009-Financial Reporting Main EQP and CommentariesBryan SingNo ratings yet

- CAC1101200904 Financial Accounting IADocument6 pagesCAC1101200904 Financial Accounting IAGift MoyoNo ratings yet

- Institute of Financial Accountants January 2011 Examination P1. Financial Accounting and Ifrs For SmesDocument11 pagesInstitute of Financial Accountants January 2011 Examination P1. Financial Accounting and Ifrs For SmesColleen BosmanNo ratings yet

- Deferred Tax QsDocument4 pagesDeferred Tax QsDaood AbdullahNo ratings yet

- Grade 12 Class Test Company 70 Minutes 120 MarksDocument11 pagesGrade 12 Class Test Company 70 Minutes 120 MarksStars2323100% (1)

- FIA 324 - June 2013 - QuestionsDocument8 pagesFIA 324 - June 2013 - Questionspopla poplaNo ratings yet

- Summer Exam-2018 Pakistan Institute of Public Finance AccountantsDocument19 pagesSummer Exam-2018 Pakistan Institute of Public Finance Accountantsfareha riazNo ratings yet

- 04 Additional Exercises On InvestmentsDocument3 pages04 Additional Exercises On InvestmentsMaxin TanNo ratings yet

- 1st Test DPA30053 Jun2020QDocument2 pages1st Test DPA30053 Jun2020QPremalatha DevindranNo ratings yet

- Change in Accounting Policy 2Document1 pageChange in Accounting Policy 2Ncebakazi DawedeNo ratings yet

- Se O Nly: Work Sheet ADocument6 pagesSe O Nly: Work Sheet Asanjay blakeNo ratings yet

- Mar 2019 Paper 2A Questions EngDocument10 pagesMar 2019 Paper 2A Questions EngTerry MaNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- T6int 2009 Jun QDocument9 pagesT6int 2009 Jun QRana KAshif GulzarNo ratings yet

- 1 March Live Lesson WorksheetDocument6 pages1 March Live Lesson Worksheetnikiwe mathebulaNo ratings yet

- Tutorial 3 QDocument2 pagesTutorial 3 QBraham Rahul Ram JamnadasNo ratings yet

- ACCT10002 Tutorial 8 ExercisesDocument5 pagesACCT10002 Tutorial 8 ExercisesJING NIENo ratings yet

- "A" Level AccountingDocument4 pages"A" Level AccountingTARMAK MC LYONNo ratings yet

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- CH 10Document9 pagesCH 10Tien Thanh DangNo ratings yet

- Cma December-2018 Examination Management Level Subject: F2. Financial ManagementDocument11 pagesCma December-2018 Examination Management Level Subject: F2. Financial ManagementRashed AliNo ratings yet

- Accgr12ssipsessions12 15tn2013book31Document55 pagesAccgr12ssipsessions12 15tn2013book31siyabongaNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- Accounting p1 Prep Sept 2022 QP EngDocument13 pagesAccounting p1 Prep Sept 2022 QP Engrifumo579No ratings yet

- Activity 1Document2 pagesActivity 1Harold Beltran DramayoNo ratings yet

- Practice Paper Business, Accounting and Financial Studies Paper 2A Accounting ModuleDocument10 pagesPractice Paper Business, Accounting and Financial Studies Paper 2A Accounting Modulenw08042No ratings yet

- Accounting For Business Combinations Final Term ExaminationDocument3 pagesAccounting For Business Combinations Final Term ExaminationJasper LuagueNo ratings yet

- Pract 1 - Exam1Document8 pagesPract 1 - Exam1MimiNo ratings yet

- FAR-2 Mock September 2021 FinalDocument8 pagesFAR-2 Mock September 2021 FinalMuhammad RahimNo ratings yet

- Socf Ii SMNR Q Q2.1. The Financial Reports of Jim LTD For The Years Ended 31 March 2007 andDocument2 pagesSocf Ii SMNR Q Q2.1. The Financial Reports of Jim LTD For The Years Ended 31 March 2007 andTakudzwa LanceNo ratings yet

- March, 2008. Particulars Rs. Particulars Rs. 2,000Document1 pageMarch, 2008. Particulars Rs. Particulars Rs. 2,000Sanjeev BhardwajNo ratings yet

- AFR Mid TermDocument8 pagesAFR Mid TermRizviNo ratings yet

- Toaz - Info Far Vol 2 Chapter 22 25docx PRDocument22 pagesToaz - Info Far Vol 2 Chapter 22 25docx PRVivialyn PalimpingNo ratings yet

- 2023 Grade 12 Controlled Test 1 QPDocument5 pages2023 Grade 12 Controlled Test 1 QPannabellabloom282007No ratings yet

- Adv3 FinalsDocument7 pagesAdv3 FinalsMylscheNo ratings yet

- Questions On Accounting StandardsDocument6 pagesQuestions On Accounting StandardsDEENo ratings yet

- Quiz Chapter 11 Advance AccountingDocument5 pagesQuiz Chapter 11 Advance Accounting20174112008 HERI AHMAD FAUZINo ratings yet

- What Amount Should Be Reported As Diluted Earnings Per Share?Document6 pagesWhat Amount Should Be Reported As Diluted Earnings Per Share?carinaNo ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- Financial Managerial Accounting SB611 Dec 2008 MBA PT-FTDocument16 pagesFinancial Managerial Accounting SB611 Dec 2008 MBA PT-FTyeunzi socialNo ratings yet

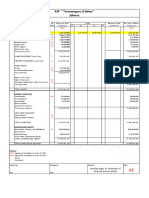

- KAP " Tarumanagara & Rekan" Jakarta: TB'20 TB'19 C E.1 E.2 F G.1 G.2 HDocument2 pagesKAP " Tarumanagara & Rekan" Jakarta: TB'20 TB'19 C E.1 E.2 F G.1 G.2 HAprijanti MalinoNo ratings yet

- UNIT 2-Managerial Remuneration Under Companies ActDocument6 pagesUNIT 2-Managerial Remuneration Under Companies ActGovind GovindNo ratings yet

- Dissertation Titles For Banking and FinanceDocument7 pagesDissertation Titles For Banking and FinanceBuyCheapPapersCanada100% (1)

- Transfer PricingDocument20 pagesTransfer Pricingabhi2244inNo ratings yet

- Revenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Document13 pagesRevenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Cuayo JuicoNo ratings yet

- Cashflow and Fund FlowDocument17 pagesCashflow and Fund FlowHarking Castro ReyesNo ratings yet

- Statement of Comprehensive Income: Basic Financial Statements IiDocument5 pagesStatement of Comprehensive Income: Basic Financial Statements IiEurica LimNo ratings yet

- Financial Management TEAM NETFLIX Midterm Exam TheoryDocument4 pagesFinancial Management TEAM NETFLIX Midterm Exam TheorykvelezNo ratings yet

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- Corporate Tax Planning Activities: Overview of Concepts, Theories, Restrictions, Motivations and ApproachesDocument10 pagesCorporate Tax Planning Activities: Overview of Concepts, Theories, Restrictions, Motivations and ApproachesSanjay G SNo ratings yet

- Weekly Summary: Weekly Statement Feb 21, 2022 4 AM - Feb 23, 2022 11 AMDocument4 pagesWeekly Summary: Weekly Statement Feb 21, 2022 4 AM - Feb 23, 2022 11 AMCarlos MolinaNo ratings yet

- Sample SEP Project ProposalDocument110 pagesSample SEP Project ProposalTonish LangthasaNo ratings yet

- What Is Cash Accounting?Document2 pagesWhat Is Cash Accounting?Jonhmark AniñonNo ratings yet

- Emp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANDocument1 pageEmp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANGanesh PrasadNo ratings yet

- Quiz 2 - Statement of Changes in Equity-CompressedDocument4 pagesQuiz 2 - Statement of Changes in Equity-CompressedJm BalessNo ratings yet

- Eg. Class Notes, Research Papers, Presentations: My Heart Went OpsDocument2 pagesEg. Class Notes, Research Papers, Presentations: My Heart Went OpsEnzoGarciaNo ratings yet

- CPAR Taxation PreweekDocument38 pagesCPAR Taxation PreweekAndrei Nicole RiveraNo ratings yet

- Chapter 11Document5 pagesChapter 11张心怡No ratings yet

- Survey Questionnaire BREM1Document6 pagesSurvey Questionnaire BREM1Steven Andrei MallarNo ratings yet

- BASF Factbook 2023Document84 pagesBASF Factbook 2023youxin.cuiNo ratings yet

- ACF L 4 ExamDocument5 pagesACF L 4 ExamJemal SeidNo ratings yet

- Tutorial - 1: Corporate Finance (Sec E & F)Document16 pagesTutorial - 1: Corporate Finance (Sec E & F)Vivekananda RNo ratings yet

- Development Budget Coordination Committee: Republic of The PhilippinesDocument71 pagesDevelopment Budget Coordination Committee: Republic of The PhilippinesHayjackNo ratings yet

- BIBM Math WrittenDocument158 pagesBIBM Math WrittenIqBal HossaiNNo ratings yet

- Revenue Regulations No. 19-86: Taxation of Leases All Internal Revenue Officers and Others Concerned PurposeDocument23 pagesRevenue Regulations No. 19-86: Taxation of Leases All Internal Revenue Officers and Others Concerned PurposeyakyakxxNo ratings yet