Professional Documents

Culture Documents

Excel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 2 of 8

Uploaded by

Dante CardonaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 2 of 8

Uploaded by

Dante CardonaCopyright:

Available Formats

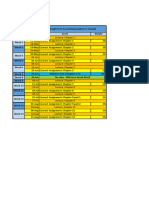

Exercise 9-2

The marketing department of Graber Corporation has submitted the following sales forecast for the upcoming fiscal year.

Quarters

First Second Third Fourth

Budgeted sales in units 16,000 15,000 14,000 15,000

The selling price of the company’s product is $22.00 per unit. Management expects to collect 75% of sales in the quarter in which the

sales are made and 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts

receivable, all of which is expected to be collected in the first quarter, is $66,000.

Selling price per unit

Sales collections:

In the quarter of sales

In the quarter following sales

Uncollectible

Accounts receivable - beginning

The company expects to start the first quarter with 3,200 units in finished goods inventory. Management desires an ending finished

goods inventory in each quarter equal to 20% of the next quarter’s budgeted sales. The desired ending finished goods inventory for the

fourth quarter is 3,400 units.

Inventory to start first quarter units

Desired ending inventory of next quarter's budgeted sales

Ending inventory fourth quarter units

Required:

1. Prepare the company’s sales budget and schedule of expected cash collections.

2. Prepare the company’s production budget for the upcoming fiscal year.

1 Graber Corporation

Sales Budget

For the year ending December 31, 20XX

First Second Third Fourth Total

Total Sales

$ -

Graber Corporation

Schedule of Cash collections

For the year ending December 31, 20XX

First Second Third Fourth Total

Total Cash Collections

2 Graber Corporation

Production Budget

For the year ending December 31, 20XX

First Second Third Fourth Total

Required production in units

Accounts receivable - beginning of year

Add desired ending inventory

Budgeted sales in units

First Quarter Sales

Fourth Quarter Sales

Less beginning inventory

Second Quarter Sales

Selling price per unit

Third Quarter Sales

Total needs

Exercise 9-3

Micro Products Inc. has developed a very powerful electronic calculator. Each calculator requires 3 small chips that cost $3 each and are purchased from an overseas

supplier. Micro Products has prepared a production budget for the calculator by quarters for year 2 and for the first quarter of year 3, as shown below:

Year 2 Year 3

First Second Third Fourth First

Required production in calculators 60,000 90,000 150,000 100,000 80,000

Raw material - Number of chips per calculator

Cost of raw material per chip

The chip used in production of the calculator is sometimes hard to get, so it is necessary to carry large inventories as a precaution against stock-outs. For this reason,

the inventory of chips at the end of a quarter must be equal to 20% of the following quarter’s production needs. A total of 36,000 chips will be on hand to start the

first quarter of year 2.

Desired ending raw material inventory of following quarter's production needs

Raw material inventory at beginning of First Quarter chips

Required:

Prepare a direct materials purchases budget for chips, by quarter and in total, for year 2. At the bottom of your budget, show the dollar amount of purchases for each

quarter and for the year in total

Micro Products Inc

Direct Materials Budget

For the 12 months ending Year 2

Year 2 Year 3

First Second Third Fourth TOTAL First

Raw materials to be purchased- chips

Cost of raw materials to be purchased

Add desired ending inventory- chips

Less beginning inventory- chips

Number of chips per calculator

Required production in calculators

Total needs- chips

Total production needs- chips

Exercise 9-3

Micro Products Inc. has developed a very powerful electronic calculator. Each calculator requires 3 small chips that cost $3 each and are purchased from an overseas

supplier. Micro Products has prepared a production budget for the calculator by quarters for year 2 and for the first quarter of year 3, as shown below:

Year 2 Year 3

First Second Third Fourth First

Required production in calculators 60,000 90,000 150,000 100,000 80,000

Raw material - Number of chips per calculator 3

Cost of raw material $3.00 per chip

The chip used in production of the calculator is sometimes hard to get, so it is necessary to carry large inventories as a precaution against stock-outs. For this reason,

the inventory of chips at the end of a quarter must be equal to 20% of the following quarter’s production needs. A total of 36,000 chips will be on hand to start the

first quarter of year 2.

Desired ending raw material inventory 20% of following quarter's production needs

Raw material inventory at beginning of First Quarter 36,000 chips

Required:

Prepare a direct materials purchases budget for chips, by quarter and in total, for year 2. At the bottom of your budget, show the dollar amount of purchases for each

quarter and for the year in total

Micro Products Inc

Direct Materials Budget

For the 12 months ending Year 2

Year 2 Year 3

First Second Third Fourth TOTAL First

Correct Required production in calculators 60,000 90,000 150,000 100,000 400,000 80,000

Correct Number of chips per calculator 3 3 3 3 3 3

Correct Total production needs- chips 180,000 270,000 450,000 300,000 1,200,000 240,000 Correct

Correct Add desired ending inventory- chips 54,000 90,000 60,000 48,000 48,000

Correct Total needs- chips 234,000 360,000 510,000 348,000 1,248,000

Correct Less beginning inventory- chips 36,000 54,000 90,000 60,000 36,000

Raw materials to be purchased- chips 198,000 306,000 420,000 288,000 1,212,000

Cost of raw materials to be purchased $ 594,000 $ 918,000 $ 1,260,000 $ 864,000 $ 3,636,000

Correct Correct Correct Correct Correct

Add desired ending inventory- chips

Less beginning inventory- chips

Number of chips per calculator

Required production in calculators

Total needs- chips

Total production needs- chips

Exercise 9-2

The marketing department of Graber Corporation has submitted the following sales forecast for the upcoming fiscal year.

Quarters

First Second Third Fourth

Budgeted sales in units 16,000 15,000 14,000 15,000

The selling price of the company’s product is $22.00 per unit. Management expects to collect 75% of sales in the quarter in which the

sales are made and 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts

receivable, all of which is expected to be collected in the first quarter, is $66,000.

Selling price per unit $22.00

Sales collections:

In the quarter of sales 75%

In the quarter following sales 20%

Uncollectible 5%

Accounts receivable - beginning $66,000

The company expects to start the first quarter with 3,200 units in finished goods inventory. Management desires an ending finished

goods inventory in each quarter equal to 20% of the next quarter’s budgeted sales. The desired ending finished goods inventory for the

fourth quarter is 3,400 units.

Inventory to start first quarter 3,200 units

Desired ending inventory 20% of next quarter's budgeted sales

Ending inventory fourth quarter 3,400 units

Required:

1. Prepare the company’s sales budget and schedule of expected cash collections.

2. Prepare the company’s production budget for the upcoming fiscal year.

1 Graber Corporation

Sales Budget

For the year ending December 31, 20XX

First Second Third Fourth Total

Correct Budgeted sales in units 16,000 15,000 14,000 15,000 60,000

Correct Selling price per unit $22 $22 $22 $22 $22

Total Sales $ 352,000 $ 330,000 $ 308,000 $ 330,000 ###

Correct Correct Correct Correct Correct

$ 334,400

Graber Corporation

Schedule of Cash collections

For the year ending December 31, 20XX

First Second Third Fourth Total

Correct Accounts receivable - beginning of year $ 66,000 $ 66,000

Correct First Quarter Sales 264,000 70,400 334,400

Correct Second Quarter Sales 247,500 66,000 313,500

Correct Third Quarter Sales 231,000 61,600 292,600

Correct Fourth Quarter Sales 247,500 247,500

Total Cash Collections $ 330,000 $ 317,900 $ 297,000 $ 309,100 ###

Correct Correct Correct Correct Correct

2 Graber Corporation

Production Budget

For the year ending December 31, 20XX

First Second Third Fourth Total

Correct Budgeted sales in units 16,000 15,000 14,000 15,000 60,000 Correct

Correct Add desired ending inventory 3,000 2,800 3,000 3,400 3,400 Correct

Correct Total needs 19,000 17,800 17,000 18,400 63,400 Correct

Correct Less beginning inventory 3,200 3,000 2,800 3,000 3,200 Correct

Required production in units 15,800 14,800 14,200 15,400 60,200 Correct

Correct Correct Correct Correct Correct

44,800

Accounts receivable - beginning of year

Add desired ending inventory

Budgeted sales in units

First Quarter Sales

Fourth Quarter Sales

Less beginning inventory

Second Quarter Sales

Selling price per unit

Third Quarter Sales

Total needs

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Worksheet 2 - Master BudgetDocument2 pagesWorksheet 2 - Master BudgetJhunnie LoriaNo ratings yet

- Budget MA1Document8 pagesBudget MA1Sheena CalderonNo ratings yet

- Direct Materials BudgetDocument2 pagesDirect Materials BudgetRegine Pahigo HilladoNo ratings yet

- Exercise Production N Material Budget Gaeber Industries QDocument2 pagesExercise Production N Material Budget Gaeber Industries Qwww.harinihariniNo ratings yet

- Exercise 1 Strategic Cost BudgetingDocument2 pagesExercise 1 Strategic Cost BudgetingSamantha Nicole Dela CruzNo ratings yet

- Master Budget ExercisesDocument11 pagesMaster Budget Exercisescejay angusNo ratings yet

- Our Lady of The Pillar College - CauayanDocument5 pagesOur Lady of The Pillar College - CauayanLu CioNo ratings yet

- Review Myron Corporation's seasonal product sales budget and production requirementsDocument8 pagesReview Myron Corporation's seasonal product sales budget and production requirementsmohammad bilalNo ratings yet

- Act121: Strategic Cost Management Assignment Topic: Master Budgeting DEADLINE: OCTOBER 4, 2020 (SUNDAY), 11:59PMDocument3 pagesAct121: Strategic Cost Management Assignment Topic: Master Budgeting DEADLINE: OCTOBER 4, 2020 (SUNDAY), 11:59PMBella RonahNo ratings yet

- Chapter 8 Applying Excel Student FormDocument3 pagesChapter 8 Applying Excel Student Formbawa shah100% (1)

- EXERCISE 9-3 Direct Materials BudgetDocument2 pagesEXERCISE 9-3 Direct Materials BudgetNABILAH KHANSA 1911000089100% (1)

- FA - II - Project Work 2020Document3 pagesFA - II - Project Work 2020Yohanes DebeleNo ratings yet

- BudgetingDocument23 pagesBudgetingAbdul HaleemNo ratings yet

- Chapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) BudgetDocument35 pagesChapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) Budgetፍቅር እስከ መቃብርNo ratings yet

- Practice Problems 1Document16 pagesPractice Problems 1James AguilarNo ratings yet

- Accounting Principles 8th Edition - Exercises Chapter23Document6 pagesAccounting Principles 8th Edition - Exercises Chapter23bulealiyi71No ratings yet

- Bella Beauty Salon Adjusting Journal EntriesDocument7 pagesBella Beauty Salon Adjusting Journal EntriesFawad ShahNo ratings yet

- Master Budget Answer KeyDocument10 pagesMaster Budget Answer KeyChin FiguraNo ratings yet

- Budgeting 26 MarchDocument13 pagesBudgeting 26 MarchUzair FeerozeNo ratings yet

- Chapter 8Document5 pagesChapter 8StevenkyNo ratings yet

- Accountancy and Auditing-2017Document5 pagesAccountancy and Auditing-2017Jassmine RoseNo ratings yet

- 2019 11 30 Acc222 Exercises01Document1 page2019 11 30 Acc222 Exercises01Primitivo Suasin Bangahon Jr.No ratings yet

- Master Budget BreakdownDocument45 pagesMaster Budget BreakdownJay Mark AbellarNo ratings yet

- Exercises: Set B: Unit Sales Product Quarter 1 Quarter 2Document7 pagesExercises: Set B: Unit Sales Product Quarter 1 Quarter 2Ran CastiloNo ratings yet

- MA Discussion Forum Week 5Document4 pagesMA Discussion Forum Week 5Ahmad HafezNo ratings yet

- Explanation of Sales Budget For Hampton Freeze IncDocument13 pagesExplanation of Sales Budget For Hampton Freeze IncJerline Mae PolboNo ratings yet

- BudgetDocument13 pagesBudgetJuhi SharmaNo ratings yet

- Rift Valley University Yeka Campus Department of Accounting and Finance Assignment Of: Cost and ManagementiiDocument8 pagesRift Valley University Yeka Campus Department of Accounting and Finance Assignment Of: Cost and ManagementiiGet HabeshaNo ratings yet

- Shredder Manufacturing Has The Following Projected Unit Sales ADocument1 pageShredder Manufacturing Has The Following Projected Unit Sales AAmit PandeyNo ratings yet

- Management Accounting 9mrQc9m4HBDocument3 pagesManagement Accounting 9mrQc9m4HBMadhuram SharmaNo ratings yet

- Master Budget Exercises for Patrick IncDocument10 pagesMaster Budget Exercises for Patrick IncLuigi Enderez BalucanNo ratings yet

- 2nd Week - The Master Budget ExercisesDocument5 pages2nd Week - The Master Budget ExercisesChin FiguraNo ratings yet

- Master Budget Exercises for Planning and ControlDocument5 pagesMaster Budget Exercises for Planning and ControlLuigi Enderez BalucanNo ratings yet

- Quiz On BudgetDocument2 pagesQuiz On BudgetShamittaaNo ratings yet

- Operational Budget Assignment IIIDocument7 pagesOperational Budget Assignment IIIzeritu tilahunNo ratings yet

- Master BudgetDocument23 pagesMaster BudgetAryanNo ratings yet

- Soal 1 (LO3 10%) : Tugas Personal Ke-2 Week 7Document16 pagesSoal 1 (LO3 10%) : Tugas Personal Ke-2 Week 7Nadilla Nur100% (2)

- Chapt.6 Budgeting For Profit Planning-DikonversiDocument9 pagesChapt.6 Budgeting For Profit Planning-DikonversiRahma NiaNo ratings yet

- Basic Operating BudgetDocument6 pagesBasic Operating BudgetalyNo ratings yet

- Lecture-7 Overhead (Part 1)Document22 pagesLecture-7 Overhead (Part 1)Nazmul-Hassan Sumon100% (2)

- Homework # 3 FSADocument5 pagesHomework # 3 FSAOsayd BzootNo ratings yet

- Particulars April May June Quarter in Total Budget Sales in Unit 50,000 75,000 90,000 21,5,000 Inventory 7,500 9,000 8,000 8,000Document9 pagesParticulars April May June Quarter in Total Budget Sales in Unit 50,000 75,000 90,000 21,5,000 Inventory 7,500 9,000 8,000 8,000Srawar Jahan TareqNo ratings yet

- CMA Individual Assignment 1 & 2Document3 pagesCMA Individual Assignment 1 & 2Abdu YaYa Abesha100% (2)

- Wey MGRL 9e ExProbB Ch09 Budgetary-PlanningDocument8 pagesWey MGRL 9e ExProbB Ch09 Budgetary-PlanningElleana YauriNo ratings yet

- ACC102 Chapter7newDocument26 pagesACC102 Chapter7newSuryadinata SamuelNo ratings yet

- Sol Ass3Document5 pagesSol Ass3risvana rahimNo ratings yet

- ACC705 Tutorial 1 SCDocument2 pagesACC705 Tutorial 1 SCLyle BulehiteNo ratings yet

- Chapter 8Document41 pagesChapter 8umer khanNo ratings yet

- DepreciationDocument11 pagesDepreciationisheikhNo ratings yet

- Sha1 ACT 202 FINAL EXAM-Fall 2020: Answer The Following Questions and Remember To Show All Necessary WorkingsDocument5 pagesSha1 ACT 202 FINAL EXAM-Fall 2020: Answer The Following Questions and Remember To Show All Necessary WorkingsMahi100% (1)

- Budgeting ExercisesDocument3 pagesBudgeting ExercisesMaan Caboles100% (1)

- Ch1 - Master BudgetDocument38 pagesCh1 - Master BudgetProf. Nisaif JasimNo ratings yet

- Man MockDocument7 pagesMan MockFrederick GbliNo ratings yet

- Classroom Code: 3A/: A. B. Smaller Than The Operating Income Reported Under The Absorption Costing ConceptDocument4 pagesClassroom Code: 3A/: A. B. Smaller Than The Operating Income Reported Under The Absorption Costing ConceptRochelle MartirezNo ratings yet

- Lesson 3 Sales Budget and Schedule of Expected Cash CollectionDocument18 pagesLesson 3 Sales Budget and Schedule of Expected Cash CollectionZybel RosalesNo ratings yet

- National University of Modern Languages Department of Management SciencesDocument2 pagesNational University of Modern Languages Department of Management SciencesAre EbaNo ratings yet

- Exercice - 01Document2 pagesExercice - 01aldira jasmineNo ratings yet

- Inboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryFrom EverandInboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Excel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 1 of 8Document29 pagesExcel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 1 of 8Dante CardonaNo ratings yet

- 22S Csi Acc1205Document3 pages22S Csi Acc1205Dante CardonaNo ratings yet

- Connect Assignment Settings For ACC1205Document1 pageConnect Assignment Settings For ACC1205Dante CardonaNo ratings yet

- ACC1205 Course Schedule 2022SDocument1 pageACC1205 Course Schedule 2022SDante CardonaNo ratings yet

- AA03 Program Council - ACET Approved, October 14, 20201Document7 pagesAA03 Program Council - ACET Approved, October 14, 20201Dante CardonaNo ratings yet

- 2022-2023 SBH Academic Procedures - Aug29.22Document10 pages2022-2023 SBH Academic Procedures - Aug29.22Dante CardonaNo ratings yet

- French III - M3Document12 pagesFrench III - M3Dante CardonaNo ratings yet

- Chapter 1 Class Notes Capital Budgeting Fall2016Document4 pagesChapter 1 Class Notes Capital Budgeting Fall2016Dante CardonaNo ratings yet

- Hymns 000 Hymns Made Easy EngDocument90 pagesHymns 000 Hymns Made Easy Engpuntomid100% (1)

- How Much WoodDocument1 pageHow Much WoodDante CardonaNo ratings yet

- Revit Quiz 1 ReviewerDocument13 pagesRevit Quiz 1 ReviewerLanz RamosNo ratings yet

- Chapter Arithmetic and Geometric Progressions 024005Document14 pagesChapter Arithmetic and Geometric Progressions 024005ravichandran_brNo ratings yet

- ASTM C1019 GroutingDocument4 pagesASTM C1019 GroutingTrung Hieu NguyenNo ratings yet

- Branding and Marking GuideDocument15 pagesBranding and Marking GuideJhonNagaNo ratings yet

- Troubleshooting Edge Quality: Mild SteelDocument14 pagesTroubleshooting Edge Quality: Mild SteelAnonymous U6yVe8YYCNo ratings yet

- Bank Automation ProjectDocument75 pagesBank Automation Projectyathsih24885No ratings yet

- Presentation MolesworthDocument13 pagesPresentation Molesworthapi-630754890No ratings yet

- Frontal - Cortex Assess Battery FAB - ScaleDocument2 pagesFrontal - Cortex Assess Battery FAB - Scalewilliamsa01No ratings yet

- 2GIG ZWave CT30e Thermostat Installation GuideDocument19 pages2GIG ZWave CT30e Thermostat Installation Guideyamimaker2002No ratings yet

- Chemistry SyllabusDocument9 pagesChemistry Syllabusblessedwithboys0% (1)

- No+bake+ing +vol+iiDocument132 pagesNo+bake+ing +vol+iiEugeny TikhomirovNo ratings yet

- Alumni Speaks... : Axay GandhiDocument4 pagesAlumni Speaks... : Axay GandhiSajal MorchhaleNo ratings yet

- Cultural Dimensions & EthnocentrismDocument38 pagesCultural Dimensions & EthnocentrismKatya Alexis SalitaNo ratings yet

- Ibrahim Fibers Limited ReportDocument47 pagesIbrahim Fibers Limited ReportKhaqan Majeed100% (1)

- Intolrableboss IIMB DisplayDocument2 pagesIntolrableboss IIMB DisplayMansi ParmarNo ratings yet

- Handbook Valve Technology 03.04.2020Document132 pagesHandbook Valve Technology 03.04.2020Ramazan YaşarNo ratings yet

- Test Paper Trigonometric Functions and Equations PDFDocument9 pagesTest Paper Trigonometric Functions and Equations PDFkaushalshah28598No ratings yet

- Object Oriented Programming (OOPS) : Java Means Durga SirDocument2 pagesObject Oriented Programming (OOPS) : Java Means Durga SirROHIT JAINNo ratings yet

- BROCHURE ODE Bassa - Valv para Maq CaféDocument7 pagesBROCHURE ODE Bassa - Valv para Maq Caféjf2003No ratings yet

- Evaluation of Earthquake-Induced Cracking of Embankment DamsDocument21 pagesEvaluation of Earthquake-Induced Cracking of Embankment DamsMARCOS ABRAHAM ALEJANDRO BALDOCEDA HUAYASNo ratings yet

- BJT AmplifiersDocument21 pagesBJT AmplifiersAligato John RayNo ratings yet

- Robinair Mod 10324Document16 pagesRobinair Mod 10324StoneAge1No ratings yet

- Pytania Do Obrony Spoza Pracy Dyplomowej Filologia Angielska Studia I StopniaDocument5 pagesPytania Do Obrony Spoza Pracy Dyplomowej Filologia Angielska Studia I StopniabartNo ratings yet

- Articol S.brînza, V.stati Pag.96Document154 pagesArticol S.brînza, V.stati Pag.96crina1996No ratings yet

- 1 s2.0 S1877042816311582 MainDocument8 pages1 s2.0 S1877042816311582 MainAilyn rodilNo ratings yet

- KaduwaDocument34 pagesKaduwaRohini WidyalankaraNo ratings yet

- AlumaCore OPGWDocument1 pageAlumaCore OPGWlepouletNo ratings yet

- Pate, M. B., Evaporators and Condensers For Refrigeration and Air-Conditioning Systems, in Boilers, Evaporators andDocument1 pagePate, M. B., Evaporators and Condensers For Refrigeration and Air-Conditioning Systems, in Boilers, Evaporators andpete pansNo ratings yet

- hts336555 Philips Manual PDFDocument35 pageshts336555 Philips Manual PDFSalomão SouzaNo ratings yet

- BS en 13035-9-2006 + A1-2010Document24 pagesBS en 13035-9-2006 + A1-2010DoicielNo ratings yet