Professional Documents

Culture Documents

Money Matters - Investigating Mental Accounting Proxies in Indonesia Through Behavioral Accounting Lens

Uploaded by

Sodiq Okikiola HammedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Money Matters - Investigating Mental Accounting Proxies in Indonesia Through Behavioral Accounting Lens

Uploaded by

Sodiq Okikiola HammedCopyright:

Available Formats

ISSN 2502-5430

Vol. 12, No. 2, September 2023, pp. 189-198 189

Money Matters: Investigating Mental Accounting Proxies in

Indonesia through Behavioral Accounting Lens

Ardimansyah a,1,*, Della Arnita Putri a,2, Hesty Safitri Wulandari a,3, Haryono a,4 Khristina Yunita a,5

a

Universitas Tanjungpura, Indonesia

1

ardimansyah005@gmail.com*; 2 dellaarnita@student.untan.ac.id; 3 b1031191017@student.untan.ac.id;

4

haryono_feuntan@yahoo.com; 5 khristina.yunita@ekonomi.untan.ac.id

* Corresponding author

ARTICLE INFO ABSTRACT

The main objective of this research is to provide a historical context for

Article history the development of mental accounting studies in Indonesia, specifically

Received: 25 February 2023 by analyzing how the field of mental accounting has evolved in Indonesia,

Revised : 30 June 2023 with a focus on the topics covered in the articles published in accredited

Accepted: 06 August 2023 accounting journals. Among the 72 accredited accounting journals and

those indexed in the Science and Technology Index (SINTA) ranking

second and third, a total of 8 articles representing accounting research in

Keywords Indonesia were identified. This study analyzes the development of the

Accredited Journal mental accounting field using the charting the field approach. The articles

Accounting Research or journals are classified in this research according to research topics,

Mental Accounting research methodologies, and publication years. Based on the mapping

conducted, articles with mental accounting topics were predominantly

based on quantitative methods. Research on mental accounting topics

Kata kunci needs to be continuously developed given its importance in everyday

Jurnal Terakreditasi implementation.

Riset Akuntansi

Akuntansi Mental

ABSTRAK

Tujuan utama dari penelitian ini adalah untuk memberikan konteks

sejarah bagi perkembangan kajian mental accounting di Indonesia secara

khusus menganalisis bagaimana bidang akuntansi mental telah

berkembang dari waktu ke waktu di Indonesia dengan fokus pada topik

artikel tersebut yang telah diterbitkan dalam jurnal akuntansi

terakreditasi. Di antara 72 jurnal akuntansi terakreditasi dan jurnal

akuntansi yang terindeks Science and Technology Index (SINTA) dengan

peringkat kedua dan tiga besar, yang memuat total 8 (delapan) artikel

yang mewakili penelitian akuntansi Indonesia. Studi ini menganalisis

bagaimana perkembangan bidang akuntansi mental melalui penggunaan

pendekatan charting the field. Artikel atau jurnal diklasifikasikan dalam

penelitian ini sesuai dengan topik penelitian, metodologi penelitian, dan

tahun publikasi. Berdasarkan hasil pemetaan yang dilakukan, artikel

dengan topik mental accounting didominasi oleh metode kuantitatif.

Penelitian dengan topik mental accounting harus terus dikembangkan

mengingat pentingnya dalam implementasi sehari-hari.

This is an open-access article under the CC–BY-SA license.

10.21831/nominal.v12i2.58906 https://journal.uny.ac.id/index.php/nominal nominal@uny.ac.id

190 Nominal Barometer Riset Akuntansi dan Manjemen ISSN 2502-5430

Vol. 12, No. 2, September 2023, pp. 189-198

1. Introduction

The existence of thoughts about new financial information related to excessive reactions and low

reactions to human judgment is a psychological influence on behavioral finance which will then have

an impact on decision making, especially in a financial context (Sewell, 2010). Within the realms of

economics and finance, various theories operate under the assumption that individuals possess the

cognitive capacity to arrive at rational decisions through the careful consideration of all relevant

information. However, when it comes to the practice of projecting finances, the significance of

accounting can be attributed to a concept that was developed in the field of behavioral accounting.

This particular area of study delves into the investigation of the interaction between human behavior

and financial records, seeking to better understand the psychological and behavioral factors that

influence financial decision-making. As such, behavioral accounting theory can provide a solid

foundation upon which to build research in a variety of related disciplines, including ethics, auditing,

accounting information systems, and financial accounting itself. By understanding the human element

that is integral to the accounting process, researchers can better contextualize the findings and develop

more comprehensive and accurate models of financial behavior and decision-making. Despite the

clear benefits of a behavioral accounting approach to research, however, the development of such

studies in Indonesia is still relatively new when compared to other areas of accounting research. While

progress is certainly being made, it is important to continue to promote and support research in this

critical area, to better understand the complex interplay between human behavior and financial

accounting practices, both in Indonesia and beyond.

Behavioral accounting is a subfield of management accounting that focuses on the study of human

behavior about accounting systems and accounting information. The purpose of behavioral accounting

is to explain, predict, and manage the impact of accounting procedures and accounting information on

human behavior. Behavioral accounting provides a significant effect on the market as an investigation

of the psychological impact on the behavior exhibited by financial analysts or investors regarding

separate decisions about what should, should be done, and combined (Patil et al., 2019). This study

includes the influence of human behavior on the design, construction, and use of accounting systems

in business, as well as how accounting systems affect human behavior, particularly in terms of

motivation, productivity, decision-making, job satisfaction, and cooperation. Within the scope of

behavioral accounting, three main aspects are considered. First, the study of the influence of human

behavior on the design, construction, and use of accounting systems used in business. This includes

how management attitudes and leadership styles influence the nature of accounting control and

organizational design. Second, the study of the impact of human behavior on the design, construction,

and use of accounting systems used in business. This aspect discusses how human behavior affects

the design of accounting systems and organizations. Finally, behavioral accounting also involves the

development of strategies to predict human behavior and methods to change it. This includes how

accounting systems can be used to influence behavior, such as by changing performance measurement

methods and motivating desired behavior through incentives and penalties. One activity related to this

behavior in a closely related way is mental accounting, which discusses how people process financial

information and make decisions based on how they categorize their financial resources.

Mental accounting is a field of study that is closely related to the disciplines of psychology and

behavioral accounting, which enables individuals and groups to utilize cognitive operations in

encoding, categorizing, and evaluating financial transactions. Three main aspects shape mental

accounting, namely, the way outcomes are perceived and experienced, the allocation of activities to

specific accounts, and the frequency of evaluation of those accounts (Thaler, 1999). In addition,

elements such as framing effect, specific accounts, self-control, decision-making, self-report, and

treadmill hedonism also influence mental accounting. In the context of daily activities, both

individuals and organizations can derive significant benefits from enhancing their ability to perform

mental accounting. For example, mental accounting can help individuals make more rational and

effective financial decisions, such as prioritizing expenses, managing debt, or saving money.

Additionally, mental accounting can assist organizations in managing their finances better, such as

monitoring expenses and income, estimating profits and losses, or evaluating investments. In this

regard, improving mental accounting skills not only benefit individuals and organizations in making

better financial decisions but also helps them achieve long-term financial goals more effectively and

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

ISSN 2502-5430 Nominal Barometer Riset Akuntansi dan Manjemen 191

Vol. 12, No. 2, September 2023, pp. 189-198

efficiently. Therefore, individuals and organizations need to understand and utilize mental accounting

as a useful tool in their daily financial activities.

Numerous scientific articles on accounting have been published in reputable and non-reputable

journals. However, research on mental accounting in Indonesia is still relatively scarce. Various

authors have classified the theories underlying mental accounting from different perspectives. Putri &

Setiawan (2018) used prospect theory and behavioral finance theory to examine the impact of mental

accounting on tax evasion through accounting students as their research subjects. Brata et al (2022)

used the triangulation theory to classify theories from psychology, mental health, religiosity, and

feminism in understanding the meaning of happiness and coping strategies that can reduce the

effectiveness of mental accounting on work. According to Eldista et al (2020), mental accounting has

been applied to college students living in boarding houses to understand financial decision-making in

daily life framed by the meaning of happiness.

In the context of academic research in Indonesia, the bibliographic approach has proven to be a

useful tool for analyzing the development of specific themes across different domains. A notable

example of this can be seen in the work of Wilandari (2021) who utilized bibliographic analysis to

map the evolution of studies on international trade in Indonesia, Herawati & Bandi (2017, 2019) used

bibliographic analysis to review tax research over twenty years. These studies demonstrate the efficacy

of the bibliographic approach in providing a comprehensive overview of research trends and themes

within specific domains. In this vein, the present study represents a topical expansion of previous

research findings by examining the concept of mental accounting through the bibliographic analysis

approach. By exploring the existing literature on mental accounting in Indonesia, this study provides

a deeper understanding of the theoretical and methodological issues related to this construct,

highlighting the ongoing relevance and importance of this topic in the field of behavioral accounting.

The findings of this study not only contribute to the existing literature on mental accounting but also

demonstrate the utility of bibliographic analysis as a tool for examining complex constructs and

research trends in various domains.

The overarching objective of this research endeavor is to undertake a comprehensive examination

of the behavioral accounting research landscape, with a particular emphasis on exploring the subject

of mental accounting in the Indonesian context. This is achieved using a bibliographic study approach

that takes into account the theoretical and methodological issues associated with mental accounting,

thereby enabling a more nuanced and sophisticated understanding of this complex and multifaceted

topic. This research commences the search for relevant topics on mental accounting in accredited

journals in Indonesia, starting from the theory proposed by Richard Thaler until the end of 2022. By

referring to research studies that have undergone the selection and evaluation process of accredited

journals, a more profound understanding of the development of mental accounting studies in Indonesia

can be obtained. This, in turn, enables innovative applications of this field for future research. Given

the ever-growing significance of mental accounting as a salient feature of everyday life, the successful

completion of this research holds paramount importance for both academic and practical domains

alike. Within an academic context, the study endeavors to facilitate a profound comprehension of the

theories and methodologies germane to behavioral accounting, with a specific focus on the intricate

nuances of mental accounting in the Indonesian setting, informed by the most recent and cutting-edge

literature review. Conversely, within a practical context, the insights and findings from this research

endeavor hold immense potential as a valuable reference or guide for further research in the domains

of behavioral accounting and mental accounting, thus contributing to the development of a more

nuanced and sophisticated understanding of this crucial area of inquiry.

2. Literature Review

2.1. Prospect Theory

Prospect theory, first introduced by Kahneman and Tversky in 1979, is a psycho-economic theory

that integrates concepts from psychology and economics (Kahneman & Tversky, 1979). It provides

insights into decision-making processes and is particularly relevant in risk and uncertainty situations.

The theory is based on the idea that individuals do not always make rational decisions and that their

preferences are influenced by psychological factors. In decision-making, prospect theory takes a

descriptive approach and highlights the role of psychological biases and heuristics. Dwi & Basuki

(2022) emphasize the relevance of prospect theory in decision-making processes, as it accounts for

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

192 Nominal Barometer Riset Akuntansi dan Manjemen ISSN 2502-5430

Vol. 12, No. 2, September 2023, pp. 189-198

the way individuals perceive and evaluate potential outcomes. The theory acknowledges that decision-

makers are not always risk-averse or risk-seeking consistently. Instead, their risk preferences may

vary depending on the framing and reference points.

According to Tversky & Kahneman (1980), individuals tend to be risk-seeking in situations

involving potential losses, while they exhibit risk aversion when faced with potential gains. This

phenomenon is known as loss aversion. Nurul & Hamidah (2021) confirm these findings, stating that

individuals are more willing to take risks to avoid losses and more inclined to avoid risks when the

possibility of gains is at stake. This asymmetry in risk preferences has been widely observed and is a

key element of prospect theory. Prospect theory recognizes that individuals' financial decisions are

not solely based on rational calculations. Instead, emotions, biases, and cognitive factors play a

significant role. Mahastanti (2012) suggests that these psychological factors influence the way

individuals perceive gains and losses, leading to decision outcomes that may deviate from traditional

economic models.

The application of prospect theory in the context of mental accounting is valuable. Mental

accounting refers to how individuals categorize and allocate their financial resources. Prospect theory

provides a framework for understanding how individuals' attitudes and behaviors influence their

financial decisions. By considering the psychological biases and heuristics that shape individuals'

perceptions of gains and losses, mental accounting can be better understood within the context of

prospect theory. In summary, prospect theory offers valuable insights into decision-making processes,

particularly in situations involving risk and uncertainty. It recognizes that individuals' preferences are

influenced by psychological factors and not solely based on rational calculations. The theory

highlights the asymmetry in risk preferences, with individuals being more risk-seeking in situations

of potential loss and risk-averse in situations of potential gain. In the context of mental accounting,

prospect theory helps explain how individuals' attitudes and behaviors shape their financial decisions.

2.2. Behavioral Finance Theory

Behavioral finance theory explores the influence of psychology on an individual's financial

behavior. Shefrin & Statman (2000) argue that behavioral finance theory explains the phenomena that

affect financial decisions, taking into account the cognitive biases and emotional factors that shape

human behavior in financial contexts. Unlike traditional economics, which assumes rationality as the

dominant trait in decision-making, behavioral finance acknowledges that individuals often exhibit

irrational behavior and deviate from rational expectations.

The theory emphasizes that human behavior in financial matters is learned and influenced by

various factors. Nofsinger (2001) highlights that behavioral finance theory focuses on the attitudes

and beliefs individuals have regarding financial regulations and norms. These attitudes are shaped by

cultural, social, and individual factors, and play a crucial role in decision-making processes. Moreover,

behavioral finance recognizes that financial decisions can have both positive and negative impacts.

Tjandrasa (2014) suggests that decisions influenced by behavioral finance may initially seem

favorable but ultimately result in negative outcomes, or vice versa. This reflects the complex interplay

between psychological factors, biases, and the actual financial consequences of decisions.

2.3. Mental Accounting

Mental accounting, discovered by Thaler in 1985, focuses on how individuals' attitudes and

behaviors in decision-making are influenced by financial transactions. The concept of mental

accounting encompasses various aspects of financial management, including identifying,

categorizing, and budgeting the inflow and outflow of monetary resources to gain profit (Kresnawati

et al., 2019). It highlights that individuals may have different approaches to financial management,

which can impact their attitudes and behaviors when making financial decisions. Mental accounting

involves the evaluation of cash flow and expense control, encompassing activities such as recording,

summarizing, analyzing, and disclosing financial transactions (Rospitadewi & Efferin, 2017). The

concept is based on the understanding that individuals have specific attitudes, behaviors, or thought

patterns in categorizing their finances based on the source of income (Thaler, 1999). This

categorization influences how individuals allocate and prioritize their financial resources, leading to

different decision-making outcomes.

Research conducted by Putri & Setiawan (2018) highlights the significance of mental accounting

as a theoretical foundation for making financial decisions, particularly when individuals are faced with

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

ISSN 2502-5430 Nominal Barometer Riset Akuntansi dan Manjemen 193

Vol. 12, No. 2, September 2023, pp. 189-198

multiple alternatives to choose from. Understanding how individuals mentally categorize and account

for their financial resources can provide valuable insights into their decision-making processes,

helping researchers and practitioners design more effective strategies to promote better financial

decision-making.

3. Research Methods

The rationale behind selecting the "charting the field" research strategy lies in its suitability for the

identification of articles that can be classified based on predefined criteria. This method, pioneered by

Hesford et al (2006), entails conducting a thorough search of articles online and subsequently

categorizing them according to their content. In the present study, this approach was adopted to locate

articles pertaining to mental accounting in accounting journals that were indexed in SINTA 2 and

SINTA 3. To accomplish this task, the researchers utilized the SINTA website

(https://sinta.kemdikbud.go.id) to filter and identify accounting journals that were relevant to the topic

under investigation. As shown in Table 1, the identified accounting journals were further grouped

based on their H5-Index, Citations, and Institutions, to provide a comprehensive overview of SINTA

2 and SINTA 3 indexed accounting journals that had published articles on mental accounting. This

methodical approach, therefore, ensured that the researchers were able to access and analyze a large

volume of data from reputable sources, thereby enhancing the validity and reliability of their findings.

Table 1. List of SINTA 2 and SINTA 3 Journals with Articles Publishing Mental Accounting Topics

H5-

No Journal SINTA Citations Institution Articles Percentage

Index

1 Journal of 2 4352 32 Universitas 1 12,5%

Accounting and Muhammadiyah

Investment Yogyakarta

2 (JASF) Journal of 2 393 11 Universitas 1 12,5%

Accounting and Pembangunan

Strategic Finance Nasional

3 The Indonesian 2 1531 19 Sekolah Tinggi 1 37,5%

Accounting Ilmu Ekonomi

Review Perbanas Surabaya

4 Jurnal Akuntansi 2 3831 26 Universitas 3 12,5%

Multiparadigma Brawijaya

5 Jurnal Akuntansi 3 1915 12 STIE AAS 1 12,5%

dan Pajak Surakarta

6 Reviu Akuntansi 3 482 13 Universitas 1 12,5%

dan Bisnis Muhammadiyah

Indonesia Yogyakarta

Source: Processed Data, 2023

The process of selecting articles as research samples involves several stages, each of which plays

an important role in ensuring the validity and reliability of the data collected. These stages, depicted

in the accompanying picture, can be described as follows:

Stage 1. The researcher conducts an online search for accounting journals indexed in SINTA 2

and SINTA 3 by applying filters on the website https://sinta.kemdikbud.go.id.

Stage 2. The researcher sequentially accesses the journal portal to ensure a comprehensive search

for relevant articles.

Stage 3. Once the portal is accessed, the researcher proceeds to conduct a search using the

relevant keywords, in this case, "mental accounting," in the search field to obtain a list

of articles related to the research topic.

Stage 4. The researcher downloads the articles to verify whether the title and content of the

articles are relevant to the research topic.

Stage 5. The researcher performs data tabulation.

4. Results and Discussion

Before proceeding with the classification of articles and journals, the findings and discussions must

encompass information about a representative sample of publications. Such a representative sample

must account for critical subcategories such as the study topic, research methodology, and year of

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

194 Nominal Barometer Riset Akuntansi dan Manjemen ISSN 2502-5430

Vol. 12, No. 2, September 2023, pp. 189-198

publication, which collectively aid in the effective classification of relevant articles and journals.

Drawing upon insights from previous research, the process of categorizing articles necessitates a

systematic approach whereby research papers or articles are separated based on predetermined

classifications, which may encompass a range of factors such as research design, study population, or

analytical techniques, among others. In contrast, the classification system for journals involves a more

nuanced approach that seeks to differentiate journal portals or OJS based on the article classification

approach employed, as well as additional factors such as the rigor of peer-review processes, the quality

of editorial board members, or the frequency and scope of journal publication, to name a few. As such,

the classification of articles and journals necessitates a rigorous and meticulous approach that takes

into account multiple factors, to facilitate the systematic and comprehensive analysis of the literature.

The mapping of eight relevant articles on mental accounting led to the identification of six distinct

journal outlets that have contributed to the literature on this subject in Indonesia. Specifically, the

Journal of Accounting and Investment, Journal of Accounting and Strategic Finance (JASF), The

Indonesian Accounting Review, Jurnal Akuntansi Multiparadigma, Jurnal Akuntansi dan Pajak, and

Reviu Akuntansi dan Bisnis Indonesia are the six accredited journals that have published articles

related to mental accounting. While the Journal of Accounting and Investment, JASF, and The

Indonesian Accounting Review each have published one article on this subject matter, the Jurnal

Akuntansi Multiparadigma stands out with three published articles, demonstrating a higher degree of

focus on the topic of mental accounting. Additionally, the Jurnal Akuntansi dan Pajak and the Reviu

Akuntansi dan Bisnis Indonesia each have contributed one article to the literature on this subject,

further indicating the need for more research in this area to expand upon the limited existing body of

knowledge.

Table 2. List of Articles Publishing Mental Accounting Topics as a Sample

No Article Title, Author, Year of Publication Journal

1 “Mental Accounting Experiment: Mode of Payment Effect on Journal of Accounting and

Treating Money (Kresnawati et al., 2019)” Investment

2 “Mental Accounting and Business Decision Making within SMEs: A (JASF) Journal of Accounting and

Covid-19 Pandemic Phenomenon (Puspita & Wardani, 2022)” Strategic Finance

3 “The Impact of Mental Accounting on Tax Evasion (An The Indonesian Accounting Review

Experimental Study in Accounting Students) (Putri & Setiawan,

2018)”

4 “Malleable Mental Accounting dan Makna Kebahagiaan Selama Jurnal Akuntansi Multiparadigma

Pandemi Covid-19 (Brata et al., 2022)”

5 “Makna Investasi Berdasarkan Mental Accounting dan Gender Jurnal Akuntansi Multiparadigma

(Nurul & Hamidah, 2021)”

6 “Mental Accounting dan Ilusi Kebahagiaan: Memahami Pikiran dan Jurnal Akuntansi Multiparadigma

Implikasinya bagi Akuntansi (Rospitadewi & Efferin, 2017)”

7 “Pandemi Covid-19: Pengaruh Perilaku Konsumtif dan Mental Jurnal Akuntansi dan Pajak

Accounting Terhadap Pengelolaan Keuangan Mahasiswa FKIP

UKSW (Cristanti et al., 2021)”

8 “Analisis Pengaruh Financial Literacy, Religiusitas, Mental Reviu Akuntansi dan Bisnis

Accounting, dan Norma Subyektif Terhadap Minat Dosen Fakultas Indonesia

Ekonomi Menggunakan Kartu Kredit Syariah (Asniyati & Yaya,

2020)”

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

ISSN 2502-5430 Nominal Barometer Riset Akuntansi dan Manjemen 195

Vol. 12, No. 2, September 2023, pp. 189-198

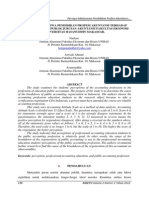

Figure 1. Mapping of Journals Publishing Articles related to Mental Accounting

In Figure 1, a comprehensive mapping of journals that published articles on the topic of mental

accounting is presented, with each journal's contribution to the literature presented as a percentage of

the total. The mapping reveals that Jurnal Akuntansi Multiparadigma (JAMAL) published the highest

number of articles, with a total of 3 articles, representing 37.5% of the total. The Journal of Accounting

and Investment, Journal of Accounting and Strategic Finance (JASF), The Indonesian Accounting

Review, Jurnal Akuntansi dan Pajak, and Reviu Akuntansi dan Bisnis Indonesia also published articles

on the topic of mental accounting, with each journal's contribution to the literature accounting for

12.5% of the total. It is noteworthy that during the mapping period from 2017 to 2022, only 8 articles

related to mental accounting were published in these 6 journals, indicating that research in this area is

still in its infancy in Indonesia. Furthermore, the number of articles published each year varied, with

only one article published each year in 2017, 2018, 2019, and 2020, while two articles were published

in both 2021 and 2022. These findings suggest that there is a need for more research in the area of

mental accounting, particularly in Indonesia, to provide a deeper understanding of the concept and its

relevance in accounting research.

2,5

1,5

0,5

0

2017 2018 2019 2020 2021 2022

Figure 2. Mapping Years of Publishing Articles Related to Mental Accounting

The research findings of this study provide an interesting insight into the research methods

employed by scholars investigating the topic of mental accounting within the Indonesian context. The

utilization of quantitative, qualitative, or mixed research methods is a crucial aspect of the research

process as it shapes the nature of the data collected and analyzed, as well as the findings and

implications of the research. According to the results presented in Figure 3, it can be observed that out

of the eight articles on the subject of mental accounting, the majority employed quantitative or

qualitative research methods, while only one article utilized mixed research methods. The journals

that published articles using quantitative research methods, including the Journal of Accounting and

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

196 Nominal Barometer Riset Akuntansi dan Manjemen ISSN 2502-5430

Vol. 12, No. 2, September 2023, pp. 189-198

Investment, The Indonesian Accounting Review, Jurnal Akuntansi dan Pajak, and Reviu Akuntansi

dan Bisnis Indonesia, are considered leading accounting journals in Indonesia. On the other hand, the

journals that published articles on the topic of mental accounting using qualitative research methods

are all from the Jurnal Akuntansi Multiparadigma (JAMAL), which emphasizes the importance of

multi-paradigmatic approaches in accounting research. It is worth noting that each research method

has its strengths and weaknesses and that the choice of research method should be based on the

research questions and objectives. Therefore, future research on mental accounting in Indonesia

should consider various research methods to expand the existing knowledge and understanding of this

subject.

Research Method

5

4 4

3 3

1 1

0

Qualitative Quantitative Mix Method

Figure 3. Distribution of Articles Based on Research Methods

Based on theories, journals that publish articles on mental accounting have different theories, such

as mental accounting theory, prospect theory, behavioral finance theory, theory triangulation, classical

economic theory, and the theory of reasoned action. There are two articles that use mental accounting

theory, namely "Mental Accounting Experiment: Mode of Payment Effect on Treating Money

(Kresnawati et al., 2019)" and "Mental Accounting dan Ilusi Kebahagiaan: Memahami Pikiran dan

Implikasinya bagi Akuntansi (Rospitadewi & Efferin, 2017)". The article that uses prospect theory

and behavioral finance theory is "The Impact of Mental Accounting on Tax Evasion (an Experimental

Study in Accounting Students) (Putri & Setiawan, 2018)". The article that uses theory triangulation is

"Malleable Mental Accounting dan Makna Kebahagiaan Selama Pandemi Covid-19 (Brata et al.,

2022)". The article that uses classical economic theory is "The Meaning of Investment Based on

Mental Accounting and Gender", while the article that uses the theory of reasoned action is "Analisis

Pengaruh Financial Literacy, Religiusitas, Mental Accounting, dan Norma Subyektif Terhadap Minat

Dosen Fakultas Ekonomi Menggunakan Kartu Kredit Syariah (Asniyati & Yaya, 2020)”.

However, out of the 8 articles, 2 articles do not mention the theories used. The articles that do not

mention the theories are "Mental Accounting and Business Decision-Making within SMEs: A Covid-

19 Pandemic Phenomenon (Puspita & Wardani, 2022)" and "Pandemic Covid-19: Pengaruh Perilaku

Konsumtif dan Mental Accounting Terhadap Pengelolaan Keuangan Mahasiswa FKIP UKSW

(Cristanti et al., 2021)”.

5. Conclusion

Despite the growing recognition of the relevance and significance of mental accounting as a critical

component of behavioral accounting, research on this topic remains relatively limited in the

Indonesian context, which is only limited to the mapping of SINTA-accredited journals that occupy

the second and third positions with dominant research paradigms being restricted to the mental

accounting theory, prospect theory, and behavioral finance theory. In particular, future research could

consider a broader range of journals and sources, as well as incorporate additional elements such as

research variable classifications, to provide a more comprehensive understanding of the mental

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

ISSN 2502-5430 Nominal Barometer Riset Akuntansi dan Manjemen 197

Vol. 12, No. 2, September 2023, pp. 189-198

accounting construct in the Indonesian context. Furthermore, the findings of this research serve as a

critical foundation for future studies by providing a roadmap for exploring the topic of mental

accounting further and novel methodologies to investigate this topic comprehensively. Looking ahead,

this study is believed to have significant potential for further development in the coming years. By

leveraging the insights gained from six years of previous research related to the mental accounting

subject, particularly within the timeframe starting in 2017 and ending in 2022, future studies can

continue to refine our understanding of this complex construct, leading to significant advancements

in the field of behavioral accounting in Indonesia and beyond.

References

Asniyati, A., & Yaya, R. (2020). Analisis pengaruh financial literacy, religiusitas, mental accounting,

dan norma subyektif terhadap minat dosen fakultas ekonomi menggunakan kartu kredit syariah.

Reviu Akuntansi Dan Bisnis Indonesia, 4(2), 1–14.

https://doi.org/https://doi.org/10.18196/rabin.v4i2.10706

Brata, H., Hartiningsih, D. M., & Dosinta, N. F. (2022). Malleable Mental Accounting dan Makna

Kebahagiaan Selama Pandemi COVID-19. Jurnal Akuntansi Multiparadigma, 13(1), 16–31.

https://doi.org/10.21776/ub.jamal.2021.13.1.02

Cristanti, I. L., Luhsasi, D. I., & Sitorus, D. S. (2021). Pandemi Covid-19: Pengaruh Perilaku

Konsumtif dan Mental Accounting Terhadap Pengelolaan Keuangan Mahasiswa FKIP UKSW.

Jurnal Akuntansi Dan Pajak, 22(1), 128. https://doi.org/10.29040/jap.v22i1.2690

Dwi, D. R., & Basuki, T. I. (2022). Financial Literacy and Mental Accounting Analysis of Financial

Decisions and Shopping Interests In the Covid-19 Pandemic Era. JBFEM, 5(1), 1–12.

https://doi.org/10.32770/jbfem.vol51-12

Eldista, E., Sulistiyo, A. B., & Hisamuddin, N. (2020). Mental Accounting: Memaknai Kebahagiaan

Dari Sisi Lain Gaya Hidup Mahasiswa Kos. Jurnal Akuntansi Universitas Jember, 17(2), 123–

130. https://doi.org/10.19184/jauj.v17i2.15393

Herawati, N., & Bandi, B. (2017). Dua Puluh Tahun Riset Perpajakan dalam Akuntansi: Suatu Studi

Bibliografi. Jurnal Akuntansi Dan Keuangan, 19(2), 102–121.

https://doi.org/10.9744/jak.19.2.102-121

Herawati, N., & Bandi, B. (2019). Telaah Riset Perpajakan di Indonesia: Sebuah Studi Bibliografi.

Jurnal Dinamika Akuntansi Dan Bisnis, 6(1), 103–120.

https://doi.org/10.24815/jdab.v6i1.13012

Hesford, J. W., Lee, S.-H. (Sam), Van der Stede, W. A., & Young, S. M. (2006). Management

Accounting: A Bibliographic Study (pp. 3–26). https://doi.org/10.1016/S1751-3243(06)01001-

7

Kahneman, & Tversky. (1979). Prospect theory: An analysis of decision under risk. Econometrica,

47(2).

Kresnawati, E., Wahib, A. B., & Pertiwi, R. R. (2019). Mental Accounting Experiment: Mode of

Payment Effect on Treating Money. Journal of Accounting and Investment, 20(3).

https://doi.org/10.18196/jai.2003133

Mahastanti, L. A. (2012). Mental Accounting dan Variabel Demografi: Sebuah Fenomena Pada

Penggunaan Kartu Kredit. Kinerja, 16(2). https://doi.org/10.24002/kinerja.v16i2.360

Nofsinger, J. R. (2001). The impact of public information on investors. Journal of Banking &

Finance, 25(7), 1339–1366. https://doi.org/10.1016/S0378-4266(00)00133-3

Nurul, M., & Hamidah, H. (2021). Makna Investasi Berdasarkan Mental Accounting dan Gender.

Jurnal Akuntansi Multiparadigma, 12(2). https://doi.org/10.21776/ub.jamal.2021.12.2.17

Patil, P., Joshi, S., & Verma, A. (2019). Behavioral Finance: A Conceptual Review. 7(1).

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

198 Nominal Barometer Riset Akuntansi dan Manjemen ISSN 2502-5430

Vol. 12, No. 2, September 2023, pp. 189-198

Puspita, M. E., & Wardani, B. K. (2022). Mental Accounting and Business Decision-Making within

SMEs: A Covid-19 Pandemic Phenomenon. Journal of Accounting and Strategic Finance, 5(1),

151–177. https://doi.org/10.33005/jasf.v5i1.228

Putri, A. K., & Setiawan, A. R. (2018). The Impact of Mental Accounting on Tax Evasion (An

Experimental Study in Accounting Students). The Indonesian Accounting Review, 8(1), 36.

https://doi.org/10.14414/tiar.v8i1.1579

Rospitadewi, E., & Efferin, S. (2017). Mental Accounting dan Ilusi Kebahagiaan: Memahami Pikiran

dan Implikasinya bagi Akuntansi. Jurnal Akuntansi Multiparadigma.

https://doi.org/10.18202/jamal.2017.04.7037

Sewell, M. (2010). Behavioural Finance. In University of Cambridge. working paper.

Shefrin, H., & Statman, M. (2000). Behavioral Portfolio Theory. The Journal of Financial and

Quantitative Analysis, 35(2), 127. https://doi.org/10.2307/2676187

Thaler, R. H. (1999). Mental accounting matters. Journal of Behavioral Decision Making, 12(3),

183–206.

Tjandrasa, B. B. (2014). Perkembangan Behavioral Finance di Indonesia dan Mancanegara. Forum

Manajemen Indonesia, 6.

Tversky, A., & Kahneman, D. (1980). The framing of decisions and the rationality of choice:

Stanford Univ Ca Dept of Psychology.

Wilandari, A. (2021). Pemetaan Publikasi Riset Perdagangan Internasional dengan Pendekatan Studi

Bibliografi. Jurnal Perspektif, 19(2), 122–130. https://doi.org/10.31294/jp.v19i2.11223

Ardimansyah et.al (Money Matters: Investigating Mental Accounting….)

You might also like

- Value Creation in Management Accounting and Strategic Management: An Integrated ApproachFrom EverandValue Creation in Management Accounting and Strategic Management: An Integrated ApproachNo ratings yet

- A Structured Perspective On Behavioral Accounting ResearchDocument6 pagesA Structured Perspective On Behavioral Accounting ResearchNur Hidayah K FNo ratings yet

- Jurnal Akuntansi Dan Auditing Indonesia Mapping The Results of Management Accounting Research in IndonesiaDocument13 pagesJurnal Akuntansi Dan Auditing Indonesia Mapping The Results of Management Accounting Research in IndonesiaOva NamusNo ratings yet

- Financial Report Analysis As A Profit Planning Tool at The Ministry of Social Affairs Office in MedanDocument7 pagesFinancial Report Analysis As A Profit Planning Tool at The Ministry of Social Affairs Office in MedanFani AnggitaNo ratings yet

- Regulatory Approach To Formulate Accounting Theory: Literature Study of Developed CountriesDocument7 pagesRegulatory Approach To Formulate Accounting Theory: Literature Study of Developed CountriesMumeen Adeshina AbdulazeezNo ratings yet

- Behaviour Accounting ResearchDocument9 pagesBehaviour Accounting ResearchAnonymous yMOMM9bsNo ratings yet

- Behavior Aspect of Public Sector Planning and BudgDocument3 pagesBehavior Aspect of Public Sector Planning and Budgcats singhNo ratings yet

- Nonpositivism in Behavioral Accounting Research: Initiated A Collaboration of ParadigmDocument6 pagesNonpositivism in Behavioral Accounting Research: Initiated A Collaboration of ParadigmmutiNo ratings yet

- Group 8 - Q4 PDFDocument15 pagesGroup 8 - Q4 PDFGhoulNo ratings yet

- Teoris ContabioidadDocument6 pagesTeoris Contabioidadjairo cuenuNo ratings yet

- Regulatory Approach To Formulate Accounting Theory: Literature Study of Developed CountriesDocument6 pagesRegulatory Approach To Formulate Accounting Theory: Literature Study of Developed CountriesAchmad ArdanuNo ratings yet

- Meta-Analisis Penelitian Akuntansi Di Indonesia PERIODE TAHUN 2014-2016Document11 pagesMeta-Analisis Penelitian Akuntansi Di Indonesia PERIODE TAHUN 2014-2016Fabiel RobbiNo ratings yet

- SS202211005Document8 pagesSS202211005aryanNo ratings yet

- Financial Report Analysis As A Profit Planning Tool at The Ministry of Social Affairs Office in MedanDocument8 pagesFinancial Report Analysis As A Profit Planning Tool at The Ministry of Social Affairs Office in MedanFani AnggitaNo ratings yet

- Article Review On Financial Literacy, Financial Education, and Downstream Financial BehaviorsDocument6 pagesArticle Review On Financial Literacy, Financial Education, and Downstream Financial Behaviorswondafrash TekolaNo ratings yet

- Sukoharsono - The Sufficient Sense The Value On The Concept of Income - SpiritualismDocument9 pagesSukoharsono - The Sufficient Sense The Value On The Concept of Income - SpiritualismShoufilNo ratings yet

- 4 PBDocument20 pages4 PBbaehaqi17No ratings yet

- Jurusan Akuntansi, Fakultas Ekonomi Dan Bisnis Universitas CenderawasihDocument6 pagesJurusan Akuntansi, Fakultas Ekonomi Dan Bisnis Universitas CenderawasihAgnes PutriNo ratings yet

- Research MethodologiesDocument6 pagesResearch MethodologiesVaibhav GoyalNo ratings yet

- Analisis Problem Pengembangan Perbankan Syariah Di Indonesia: Aplikasi Metode Analytic Network ProcessDocument11 pagesAnalisis Problem Pengembangan Perbankan Syariah Di Indonesia: Aplikasi Metode Analytic Network ProcessFega LiandaNo ratings yet

- Teory NewDocument3 pagesTeory NewsanjuladasanNo ratings yet

- Accounting Theory ConstructionDocument8 pagesAccounting Theory Constructionandi TenriNo ratings yet

- 8148 33151 1 PBDocument15 pages8148 33151 1 PBMegawati DarisNo ratings yet

- Lesson 1 What Is ResearchDocument24 pagesLesson 1 What Is ResearchKC MonteroNo ratings yet

- Critical Analysis On Accounting Information Based On Pancasila ValueDocument7 pagesCritical Analysis On Accounting Information Based On Pancasila ValueHariKusumaDharmawanNo ratings yet

- 2072Document8 pages2072Azriel Putra Adri PratamaNo ratings yet

- 1 s2.0 S1045235422000053 MainDocument20 pages1 s2.0 S1045235422000053 MainAurin CahyaraniNo ratings yet

- Parshwa 2010143 CIA3 MADocument2 pagesParshwa 2010143 CIA3 MAParshw TurakhiaNo ratings yet

- The Classroom As A Community of InterpretationDocument26 pagesThe Classroom As A Community of InterpretationBona SamosirNo ratings yet

- Persepsi Mahasiswa Pendidikan Profesi Akuntansi Terhadap Profesi Akuntan Publik Jurusan Akuntansi Fakultas Ekonomi Universitas Hasanuddin MakassarDocument14 pagesPersepsi Mahasiswa Pendidikan Profesi Akuntansi Terhadap Profesi Akuntan Publik Jurusan Akuntansi Fakultas Ekonomi Universitas Hasanuddin MakassarMuhammad Zahidin Nizar ANo ratings yet

- 4 Unit I Introduction To Accounting ResearchDocument30 pages4 Unit I Introduction To Accounting ResearchEmmanuelle RojasNo ratings yet

- Dimensi Kritis Pemikiran Akuntansi Yang TeralienasDocument24 pagesDimensi Kritis Pemikiran Akuntansi Yang TeralienasjoesandrianoNo ratings yet

- Review Article: Conceptual Framework For The Strategic Management: A Literature Review-DescriptiveDocument21 pagesReview Article: Conceptual Framework For The Strategic Management: A Literature Review-DescriptiveDayse MendesNo ratings yet

- Pemilihan Karir Sebagai Akuntan Publik Bagi MahasiDocument12 pagesPemilihan Karir Sebagai Akuntan Publik Bagi MahasiDwi RahmawatiNo ratings yet

- AccountingDocument5 pagesAccountingsemonNo ratings yet

- Supplement Reading - THEORYDocument7 pagesSupplement Reading - THEORYyhatiqraidahNo ratings yet

- Key Account Management: A Study of Mid-Sized Organisations With and Without Implemented Key Account ManagementDocument55 pagesKey Account Management: A Study of Mid-Sized Organisations With and Without Implemented Key Account ManagementJavierNo ratings yet

- Penerapanstandarakuntansinasional 1352 3712 1 SMDocument12 pagesPenerapanstandarakuntansinasional 1352 3712 1 SMAndika SetiawanNo ratings yet

- 369-Article Text-822-1-10-20200805Document10 pages369-Article Text-822-1-10-20200805Alifia GaneshiNo ratings yet

- Anteneh Article 2Document5 pagesAnteneh Article 2Abatneh mengistNo ratings yet

- Eco Project Sem 3Document24 pagesEco Project Sem 3Gaurav SomaniNo ratings yet

- The Limits of The Balanced ScorecardDocument7 pagesThe Limits of The Balanced ScorecardAmuaku Sakyi AndyNo ratings yet

- Review Jurnal 9 10 11 Seminar Ak SyariahDocument10 pagesReview Jurnal 9 10 11 Seminar Ak SyariahShafira Husdini pertiwiNo ratings yet

- Effectiveness of Financial Analysis To The Survival Rate of The Small, Medium Enterprises in Batangas CityDocument5 pagesEffectiveness of Financial Analysis To The Survival Rate of The Small, Medium Enterprises in Batangas CityandengNo ratings yet

- Critical Thinking in Accounting TextbooksDocument9 pagesCritical Thinking in Accounting TextbooksJournal of Education and LearningNo ratings yet

- Accounting TheoryDocument18 pagesAccounting TheoryOnline CornerNo ratings yet

- Cognitive-Contingency Theory and The Study of Ethics in AccountingDocument9 pagesCognitive-Contingency Theory and The Study of Ethics in AccountingKinanti AuroraNo ratings yet

- Jurnal 2016Document3 pagesJurnal 2016Ichsan Muhammad AbduhNo ratings yet

- Analysis of Accounting Research Development of Behavioral Studies in The Journal of Behavioral Research in AccountingDocument15 pagesAnalysis of Accounting Research Development of Behavioral Studies in The Journal of Behavioral Research in AccountingAlhamdulillah HirrabbilngalaminNo ratings yet

- Baag and Kavitha2017 - Philosophies and Tradition of Accounting ResearchDocument37 pagesBaag and Kavitha2017 - Philosophies and Tradition of Accounting ResearchrieswandhaNo ratings yet

- RPS Akuntansi KeperilakuanDocument4 pagesRPS Akuntansi KeperilakuanNIWAYANRADHANo ratings yet

- Ana Mar 170320 1225PM 327657 RW1Document10 pagesAna Mar 170320 1225PM 327657 RW1Sk Jayed AliNo ratings yet

- Group 5 Summary Accounting Theory 12th Meeting Behavioural Research in AccountingDocument9 pagesGroup 5 Summary Accounting Theory 12th Meeting Behavioural Research in AccountingEggie Auliya HusnaNo ratings yet

- Gaffikin, M., & Lindawati, A. (2012) - The Moral Reasoning of Public Accountants in The. Australasian Accounting, Business and Finance Journal.Document29 pagesGaffikin, M., & Lindawati, A. (2012) - The Moral Reasoning of Public Accountants in The. Australasian Accounting, Business and Finance Journal.M rezky DNo ratings yet

- Artikel 3Document19 pagesArtikel 3May anne CaetunaNo ratings yet

- ProceedingCelscitech NurulDyah - En.idDocument12 pagesProceedingCelscitech NurulDyah - En.idRha Ira Suryani100% (1)

- Term Paper 3Document16 pagesTerm Paper 3Bright Alohan100% (1)

- Behavioral Accounting: A Logical Extension of Accounting'S Traditional RoleDocument6 pagesBehavioral Accounting: A Logical Extension of Accounting'S Traditional RoleNovi Ratna NeedNo ratings yet

- Department of Commerce University of Jaffna-Sri Lanka Programme Title: Third in Bachelor of Commerce - 2016/2017Document6 pagesDepartment of Commerce University of Jaffna-Sri Lanka Programme Title: Third in Bachelor of Commerce - 2016/2017ajanthahnNo ratings yet

- Theories of Crime ActivitiesDocument12 pagesTheories of Crime ActivitiesSodiq Okikiola HammedNo ratings yet

- Module 12 Piecemeal AcquisitionsDocument15 pagesModule 12 Piecemeal AcquisitionsSodiq Okikiola HammedNo ratings yet

- Terms of AgreementDocument3 pagesTerms of AgreementSodiq Okikiola HammedNo ratings yet

- Saje ThesisDocument17 pagesSaje ThesisSodiq Okikiola HammedNo ratings yet

- Burnout: From Popular Culture To Psychiatric Diagnosis in SwedenDocument21 pagesBurnout: From Popular Culture To Psychiatric Diagnosis in SwedenRajan PandaNo ratings yet

- Application of Artificial Intelligence in Marketing: A Narrative Literature ReviewDocument8 pagesApplication of Artificial Intelligence in Marketing: A Narrative Literature ReviewPrasanth s100% (1)

- 384-Article Text-1254-2-10-20220513Document6 pages384-Article Text-1254-2-10-20220513Dave Lachica De PedroNo ratings yet

- Letter of RecommendationDocument2 pagesLetter of Recommendationtricia0910No ratings yet

- The Characteristics of Mathematical Creativity PDFDocument16 pagesThe Characteristics of Mathematical Creativity PDFeasy_astronautNo ratings yet

- A Mosaic of Black FeminismDocument21 pagesA Mosaic of Black FeminismDeryn Patin100% (1)

- BPSY95 - Experimental Psychology (Learning Guide)Document5 pagesBPSY95 - Experimental Psychology (Learning Guide)Jhunar John TauyNo ratings yet

- National Culture and International Business - A Path ForwardDocument18 pagesNational Culture and International Business - A Path ForwardViệtTrầnKhánhNo ratings yet

- Course:: Research Methodology (MGT 602)Document28 pagesCourse:: Research Methodology (MGT 602)Anabia ChodryNo ratings yet

- Full Download Introduction To Sociology 11th Edition Giddens Test BankDocument35 pagesFull Download Introduction To Sociology 11th Edition Giddens Test Bankrucaizatax100% (41)

- Homework Machine by Shel SilversteinDocument7 pagesHomework Machine by Shel Silversteinera3v3ks100% (1)

- English Thesis DartmouthDocument8 pagesEnglish Thesis Dartmouthgjhs9pz8100% (2)

- DR Manish BhatnagarDocument6 pagesDR Manish BhatnagarAnonymous CwJeBCAXpNo ratings yet

- Request For Validation of Research Questions QuantitativeDocument3 pagesRequest For Validation of Research Questions QuantitativeMaryWyne CedeñoNo ratings yet

- Factors Affecting The Performance of Teachers at Higher Secondary Level in PunjabDocument143 pagesFactors Affecting The Performance of Teachers at Higher Secondary Level in PunjabSirajudinNo ratings yet

- Social Media Marketing in The Pharmaceutical Sector Opportunities and Challenges in Mangalore City AreaDocument5 pagesSocial Media Marketing in The Pharmaceutical Sector Opportunities and Challenges in Mangalore City AreaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- University of Hertfordshire School of Computer ScienceDocument60 pagesUniversity of Hertfordshire School of Computer ScienceSINDHUPRIYA SAGINo ratings yet

- Final YearDocument25 pagesFinal YearHarry RoyNo ratings yet

- 07 Chapter 2Document32 pages07 Chapter 2JJMuthukattilNo ratings yet

- Resume, Blog PDFDocument2 pagesResume, Blog PDFJarret RuminskiNo ratings yet

- Rooting The Main Cause - Linking Anxiety of Young Adults To Fake NewsDocument59 pagesRooting The Main Cause - Linking Anxiety of Young Adults To Fake Newsdanna fernandezNo ratings yet

- PHENOMENOLOGYDocument54 pagesPHENOMENOLOGYsrimalathiNo ratings yet

- 2FAQ in STATISTICS. September 2 2018Document59 pages2FAQ in STATISTICS. September 2 2018PELINA, Carlos Jade L.No ratings yet

- Chapter 6. Qualitative and Quantitative Research MethodsDocument5 pagesChapter 6. Qualitative and Quantitative Research MethodsMariana BarreraNo ratings yet

- Filipinos Teachers Working AbroadDocument38 pagesFilipinos Teachers Working AbroadJessa Fernandez PaggaoNo ratings yet

- Barratt Hacking Et Al. - 2016 - The International Mindedness Journey School Pract PDFDocument237 pagesBarratt Hacking Et Al. - 2016 - The International Mindedness Journey School Pract PDFalexstipNo ratings yet

- Applied Social Sciences Education SciencesDocument264 pagesApplied Social Sciences Education SciencesroninNo ratings yet

- Course Code: 8604 Unit 8 Course Code: 8604 Unit 8Document28 pagesCourse Code: 8604 Unit 8 Course Code: 8604 Unit 8Islam Din RahimoonNo ratings yet

- Ku Leuven Thesis DeadlinesDocument6 pagesKu Leuven Thesis Deadlinesfjda52j0100% (2)

- How To Read An ACADEMIC JOURNALDocument18 pagesHow To Read An ACADEMIC JOURNALNaufal Fadli AmzarNo ratings yet