Professional Documents

Culture Documents

Statement of Account

Uploaded by

jwmemojstatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Account

Uploaded by

jwmemojstatCopyright:

Available Formats

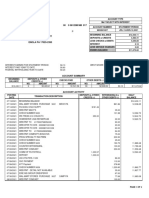

VALUE-ADDED TAX VATSA

Statement of Account

Enquiries should be addressed to SARS:

Contact Detail

SARS

BELLVILLE

RIOREX (PTY) LTD

7535

17 SALMON STREET

SILVER OAKS

Tel: 0800 00 7277 Website: www.sars.gov.za

KUILSRIVER

7580 Details

Registration Number: 4610289227 Always quote this reference number

when contacting SARS

Date: 2024/02/15

Statement period: 2023/03/01 to 2024/02/29

Summary Information

TRANSACTION YEAR 2024 -2 170 000.00

UNALLOCATED PAYMENTS 0.00

CLOSING BALANCE -2 170 000.00

Trading Name: NG DOORS

Transaction details

Transaction Transaction Transaction allocation information

Date Transaction description Account balance

Reference value Tax Penalty Interest

2023/10/09 4610289227VC2023047 RETURN 0.00 0.00 0.00 0.00 0.00

VAT BALANCE: TAX PERIOD 202304 0.00 0.00 0.00 0.00

2023/10/09 4610289227VC2023061 RETURN 0.00 0.00 0.00 0.00 0.00

VAT BALANCE: TAX PERIOD 202306 0.00 0.00 0.00 0.00

2023/10/15 4610289227VC2023085 RETURN 0.00 0.00 0.00 0.00 0.00

VAT BALANCE: TAX PERIOD 202308 0.00 0.00 0.00 0.00

2023/10/15 4610289227VC2023085 RETURN -425 496.96 -425 496.96 0.00 0.00 -425 496.96

2023/12/14 4610289227VC2023085 ASSESSMENT 425 496.96 425 496.96 0.00 0.00 0.00

DIESEL BALANCE: TAX PERIOD 202308 0.00 0.00 0.00 0.00

2024/01/08 4610289227VC2023100 RETURN -2 323 111.00 -2 323 111.00 0.00 0.00 -2 323 111.00

2024/01/12 4610289227VC2023100 ASSESSMENT 1 343 111.00 1 343 111.00 0.00 0.00 -980 000.00

VAT BALANCE: TAX PERIOD 202310 -980 000.00 0.00 0.00 -980 000.00

2024/01/12 4610289227VC2023124 RETURN -1 190 000.00 -1 190 000.00 0.00 0.00 -1 190 000.00

VAT BALANCE: TAX PERIOD 202312 -1 190 000.00 0.00 0.00 -1 190 000.00

CUMULATIVE BALANCE -2 170 000.00 0.00 0.00 -2 170 000.00

Unallocated payments excluded from the closing balance

Ageing - Transactions are aged according to original due date, including all related interest and penalties

Current 30 Days 60 Days 90 Days 120+ Days Total

-1 190 000.00 0.00 -980 000.00 0.00 0.00 -2 170 000.00

Compliance Information

Diesel Concession ON LAND Selected for Audit

Outstanding Returns

THIS STATEMENT REFLECTS ONLY THE LATEST PERIODS. PLEASE ACCESS YOUR COMPLIANCE STATUS ON YOUR COMPLIANCE DASHBOARD TO VIEW

YOUR OVERALL COMPLIANCE STATUS.

Registration Number: 4610289227 EMPSA_RO 2022.05.00 01/02

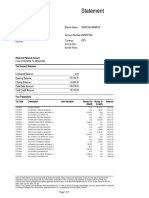

VALUE-ADDED TAX VATSA

Statement of Account

Statement of Account - General Information

1. Please take the following into account when interpreting this statement of account:

1.1This statement of account only reflects your consolidated VAT and Diesel liability/refund for the taxperiod(s) specified Within

transaction years (March to February). It does not reflect your full liability/refund payable across all transaction years for which

you are liable. Requests for a statement of account relating to the 2008 and subsequent transaction years may be made online

using SARS eFiling or by calling the SARS Contact Centre. Any Statement of Account relating to earlier transaction years must

be requested from the nearest SARS branch you.

1.2All returns, assessments and payments processed up to the issue date of this statement of account that are related/assigned to

the specified transaction year are included in processing date order and categorised by the tax period. As there is an

unavoidable delay between the date of payment and the date of processing of the payment to your account, any receipts issued

to you after the issue date of this statement of account have not been taken into account.

1.3All unallocated payments at the issue date of this statement of account are reflected under "Unallocated payments excluded

from the cumulative balance". Unallocated payments are payments that have not been assigned to a tax period, and as a

result, to a specific transaction year. This may have resulted from an incorrect payment reference being specified or to

differences below payment filing. Procedures to correct payment allocations may be obtained from the nearest SARS branch.

Alternatively, visit www.sarsefiling.co.za or www.sars.gov.za (under the "How to allocate my payment" link).

1.4The word "Continue" is printed in the event that the number of transactions relating to a transaction year exceeds a specified

limit. The statement of account will however still display the full transaction value for the selected period under the "Cumulative

Balance". In order to receive all transactional details, please reduce the tax periods within your statement of Account request.

1.5Any amount representing a credit balance is preceded by a minus (-) sign.

1.6Compliance information

1.6.1 Diesel Concession: Indicates the registered Diesel concession type(s).

1.6.2 Outstanding VAT201s: Indicates declarations that are currently outstanding. Please file such declarations urgently. The

word "Continue" is printed in the event that the number of compliance failures exceeds a specified limit. Details of all

compliance failures may be obtained from the SARS branch nearest you.

2. All declarations, returns and assessments may be subject to an audit which could result in the issuing of a revised assessment.

3. "Caveat": A decision by the Commissioner of the South African Revenue Service to temporarily write off an amount owing does not

absolve the employer from the liability, and the debt may be reinstated at any time.

4. "Interest: Interest has been calculated on the rate determined by the Minister of Finance in terms of the Public Finance

Management Act, 1999. All VAT and Diesel amounts that remain unpaid will accrue interest at the prescribed rate for each month

or part of a month from the first day of a month following the month during which the period, allowed for payment of tax, ended.

5. "Late payment penalty": A late payment penalty will be levied on all late payments and/or underpayments at a rate of ten percent

of the amount underpaid.

6. "Payment allocation and payment reference numbers (PRN)": Always quote the unique payment reference number (PRN) when

making payment. Payments will be allocated to your account as follows: firstly penalties, secondly interest and thirdly tax. Payment

allocations to tax periods are based on specific allocation rules linked to the unique PRN used on each VAT201 filed. These rules

may be viewed on www.sarsefiling.co.za or on www.sars.gov.za.

7. Electronic payments are recommended. (mandatory for Category C vendors). SARS does not accept cheques exceeding

R50 000. Any payment made, placed in a SARS drop box, on a business day must be received no later than 15h00.

8. Change of address and banking details: Notify the SARS branch nearest you immediately of any change of registered particulars.

9. Refund of amounts of less than R100 will not refunded but carried forwarded to the next tax period. However, these amounts will

accrue interest as described in point 4 above.

10. Your obligation to pay any amount due is not suspended by any objection or appeal. However, SARS will consider a motivated

application for the suspension of payment pending the finalisation of an objection or appeal as stipulated within the relevant Act.

Registration Number: 4610289227 EMPSA_RO 2022.05.00 02/02

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Knysna Soa - 2023.11.01Document3 pagesKnysna Soa - 2023.11.01njabstradingNo ratings yet

- GetNotice AspxDocument2 pagesGetNotice Aspxmaria matundaNo ratings yet

- GetNotice PDFDocument2 pagesGetNotice PDFMabeke NdlelaNo ratings yet

- Et Monkwe 0067 Zone 6 (Blackrock Section) Ngobi Hammanskraal 0408Document2 pagesEt Monkwe 0067 Zone 6 (Blackrock Section) Ngobi Hammanskraal 0408EstherNo ratings yet

- Retirement Savings Account StatementDocument1 pageRetirement Savings Account Statementmissionmovement29No ratings yet

- Directors Rates and TaxesDocument3 pagesDirectors Rates and TaxesinfoNo ratings yet

- 05-ReportBillAdjustmentDetails-18269130950103-15 April 24Document1 page05-ReportBillAdjustmentDetails-18269130950103-15 April 24Hafiz muhammad zeshanNo ratings yet

- Comprobte ArbitriosDocument1 pageComprobte ArbitriosMilagros AponteNo ratings yet

- Printreciept RequestDocument1 pagePrintreciept RequestJohn Francis KanwaiNo ratings yet

- Bank StatementDocument1 pageBank StatementGotosa InvestmentsNo ratings yet

- Cdo V1093Document2 pagesCdo V1093Daisy E SolivaNo ratings yet

- Type Meter Number: Account NoDocument1 pageType Meter Number: Account NoCharleenNo ratings yet

- Statement For Account 0005509885Document2 pagesStatement For Account 0005509885Siyabonga MjwaraNo ratings yet

- Financial Transaction Report For: Bank of IndiaDocument2 pagesFinancial Transaction Report For: Bank of IndiajrgbcsputtasaraNo ratings yet

- BP Top 21-M0601-00006Document1 pageBP Top 21-M0601-00006Bplo CaloocanNo ratings yet

- كشف حساب حتي تاريخ 20-5-2023Document1 pageكشف حساب حتي تاريخ 20-5-2023Mohamed Sayed FouadNo ratings yet

- DownloadDocument1 pageDownloadalmamun20142016No ratings yet

- Irpf A 2022 2021 RecDocument3 pagesIrpf A 2022 2021 RecandersonNo ratings yet

- Isu PDF Gen 1 EmailDocument2 pagesIsu PDF Gen 1 EmailMandlakayise MabizelaNo ratings yet

- Get NoticeDocument3 pagesGet NoticeJo anne Jo anneNo ratings yet

- MVL0004BDocument1 pageMVL0004BnobuhleNo ratings yet

- Fetch Statementand NoticesDocument3 pagesFetch Statementand NoticessweigartmarianNo ratings yet

- Statement PDFDocument1 pageStatement PDFTakunda MuchuchuNo ratings yet

- Water Bill Jan 01Document1 pageWater Bill Jan 01buildingplans2008No ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- Operation PDFDocument7 pagesOperation PDFJosé RaposoNo ratings yet

- Axis BankDocument2 pagesAxis BankBrijesh EnterprisesNo ratings yet

- Statement - THABANI 3 MONTHSDocument14 pagesStatement - THABANI 3 MONTHSvelyassetsNo ratings yet

- Transaction History 3Document3 pagesTransaction History 3layanalshre1399No ratings yet

- Cust 1-247694200538 20210901Document2 pagesCust 1-247694200538 20210901Rogers Gift100% (1)

- City of Windhoek: Please Save Water!Document1 pageCity of Windhoek: Please Save Water!Lazarus Kadett NdivayeleNo ratings yet

- City of Windhoek: Please Save Water!Document1 pageCity of Windhoek: Please Save Water!Lazarus Kadett Ndivayele50% (2)

- City of Windhoek: Please Save Water!Document1 pageCity of Windhoek: Please Save Water!Lazarus Kadett NdivayeleNo ratings yet

- Absa - Statement BwinaDocument1 pageAbsa - Statement BwinaAllan NgetichNo ratings yet

- TDS39229 2021Document1 pageTDS39229 2021Alika DebNo ratings yet

- Adobe Scan 21 Aug 2023Document8 pagesAdobe Scan 21 Aug 2023elvahaskNo ratings yet

- Practica en Aspel-CoiDocument32 pagesPractica en Aspel-CoilizbethNo ratings yet

- Profit and Loss Statement 31.12.20Document1 pageProfit and Loss Statement 31.12.20Si HadiNo ratings yet

- Asy2p Yszj2 PDFDocument4 pagesAsy2p Yszj2 PDFShashank KumarNo ratings yet

- General LedgerDocument322 pagesGeneral LedgerMario CungkringNo ratings yet

- Migration From Paper (Physical) Statements To E-Statements And/Or InvoicesDocument4 pagesMigration From Paper (Physical) Statements To E-Statements And/Or InvoicesLesh GaleonneNo ratings yet

- Annexure 1B PDFDocument1 pageAnnexure 1B PDFFolaNo ratings yet

- Non Resident Account: Tax InvoiceDocument2 pagesNon Resident Account: Tax InvoiceEmanuelsön Caverä BreezÿNo ratings yet

- LCBDocument2 pagesLCBHeera Hospitality Private LimitedNo ratings yet

- Abdul Aleem Awubi AFRICAN BANK NEWDocument4 pagesAbdul Aleem Awubi AFRICAN BANK NEWDon MadzivaNo ratings yet

- L00368bi 20231227 85232 0001094215Document1 pageL00368bi 20231227 85232 0001094215Vikas NimbranaNo ratings yet

- Electronic Credit LedgerDocument1 pageElectronic Credit LedgerShyamsunder SharmaNo ratings yet

- Informe General de Facturación-20210505183014Document3 pagesInforme General de Facturación-20210505183014omar perezNo ratings yet

- 4632XXXXXXXXXX69 20-10-2023 UnlockedDocument3 pages4632XXXXXXXXXX69 20-10-2023 UnlockedManthan ShahNo ratings yet

- Amani Boniface AsseyDocument4 pagesAmani Boniface AsseyHeet PatelNo ratings yet

- Electronic Account Statements - 2915075275 - 1-1-2023 - 3-31-2023 - Elena In-Home Catering LLC - 364992205 - 050 - 00667 - 4-1-2023Document3 pagesElectronic Account Statements - 2915075275 - 1-1-2023 - 3-31-2023 - Elena In-Home Catering LLC - 364992205 - 050 - 00667 - 4-1-2023Naiver Arias MartinezNo ratings yet

- So A Addu Cul Royce CA LagosDocument1 pageSo A Addu Cul Royce CA LagosAzlynn Courtney FernandezNo ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- Telephone Number Amount Payable Due Date: Pay NowDocument3 pagesTelephone Number Amount Payable Due Date: Pay NowIT Team ParkAMRCNo ratings yet

- Tushar Enterprises - 2024-03-31Document1 pageTushar Enterprises - 2024-03-31Hansraj DeshkarNo ratings yet

- StateDocument23 pagesStateFaces Forex Academy “Tshepobasson”No ratings yet

- Web Payslip 266675 202306Document2 pagesWeb Payslip 266675 202306prabhat.finnproNo ratings yet

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproNo ratings yet

- Self Billed Invoice and Subcontractor Payment CertificateDocument1 pageSelf Billed Invoice and Subcontractor Payment CertificatehongNo ratings yet

- RSRM RiorexDocument2 pagesRSRM RiorexjwmemojstatNo ratings yet

- Brits LOIDocument4 pagesBrits LOIjwmemojstatNo ratings yet

- Kroondal - City Deep LOIDocument4 pagesKroondal - City Deep LOIjwmemojstatNo ratings yet

- Khwezi Hospitality Assignment 4Document4 pagesKhwezi Hospitality Assignment 4jwmemojstatNo ratings yet

- Idtknqt24doepsp0134-Qs Quotation DocumentDocument54 pagesIdtknqt24doepsp0134-Qs Quotation Documentntandoyenkosi mkhwanaziNo ratings yet

- IT-ELEC-03-G01 - How To Complete The Company Income Tax Return ITR14 EFiling - External GuideDocument39 pagesIT-ELEC-03-G01 - How To Complete The Company Income Tax Return ITR14 EFiling - External GuideOyama MosianeNo ratings yet

- Request For Quotation - Hire of Tipper TruckDocument28 pagesRequest For Quotation - Hire of Tipper TruckbuntumarketNo ratings yet

- Efiling Registration OutcomeDocument1 pageEfiling Registration OutcomeVovo SolutionsNo ratings yet

- Enotice of RegistrationDocument1 pageEnotice of RegistrationsenwamadimmatshepoNo ratings yet

- New Zimbabwe Epaper 2022 09 03 05Document20 pagesNew Zimbabwe Epaper 2022 09 03 05Amon KhosaNo ratings yet

- Capturing The MessageDocument35 pagesCapturing The MessageRJNo ratings yet

- Slides - SARSDocument191 pagesSlides - SARSCedric PoolNo ratings yet

- RFQ012-2023-24 (RFQ Document)Document42 pagesRFQ012-2023-24 (RFQ Document)david selekaNo ratings yet

- Feedback For Introduction To Law ITL152 2023 02 AFDocument4 pagesFeedback For Introduction To Law ITL152 2023 02 AFMagrethNo ratings yet

- Framework Agreement For Contractors RFQ - 02 April 2023-LEBOWAKGOMO LEGISLATURE CHAMBERDocument70 pagesFramework Agreement For Contractors RFQ - 02 April 2023-LEBOWAKGOMO LEGISLATURE CHAMBERKomborero MagurwaNo ratings yet

- Evidence Leaders QuestionsDocument119 pagesEvidence Leaders QuestionsKrash KingNo ratings yet

- Friday Re-Gravelling of Damaged Roads in Nkomazi East Villages in Nkomazi Municipality Nko 22-2023Document170 pagesFriday Re-Gravelling of Damaged Roads in Nkomazi East Villages in Nkomazi Municipality Nko 22-2023Zimkhitha GugusheNo ratings yet

- Phala Phala Final ReportDocument249 pagesPhala Phala Final Reportjanet100% (1)

- SARS INCOME TAX Notice of RegistrationDocument2 pagesSARS INCOME TAX Notice of RegistrationLame DudeNo ratings yet

- SARS Tax ClearenceDocument1 pageSARS Tax ClearenceLelo MkhizeNo ratings yet

- Account Number Account Description Balance As at 28 February 2023 Total Credit Interest Total Debit InterestDocument1 pageAccount Number Account Description Balance As at 28 February 2023 Total Credit Interest Total Debit InterestBakang Brian MothobiNo ratings yet

- Gold Leaf Tobacco - SARS Claims Billions From Sasfin in Money Laundering DebacleDocument27 pagesGold Leaf Tobacco - SARS Claims Billions From Sasfin in Money Laundering Debacleewriteandread.businessNo ratings yet

- Efiling Registration OutcomeDocument1 pageEfiling Registration OutcomeJabu MtoloNo ratings yet

- Muyonjo Amanda Elizabeth 2018Document77 pagesMuyonjo Amanda Elizabeth 2018abongilePandula16 YvonneNo ratings yet

- FNB Tax GuideDocument9 pagesFNB Tax GuideJambo SekgobelaNo ratings yet

- Get LetterDocument1 pageGet LetterMACPRAISE HOLDINGSNo ratings yet

- Part 6 Vol 2 - Judicial Commission of Inquiry Into State Capture ReportDocument503 pagesPart 6 Vol 2 - Judicial Commission of Inquiry Into State Capture ReportMbatha PhumzileNo ratings yet

- Eskom Pension and Provident Fund Vs Brian MolefeDocument20 pagesEskom Pension and Provident Fund Vs Brian MolefeMolefe SeeletsaNo ratings yet

- SARS Confirmation LetterDocument1 pageSARS Confirmation Letterpmo41973No ratings yet

- RFB - COGTA 02-2022 - TEnder Doc Data Cleansing Management-SignedDocument46 pagesRFB - COGTA 02-2022 - TEnder Doc Data Cleansing Management-SignedThapelo LegotloNo ratings yet

- PIN IssuedDocument1 pagePIN IssuedMacPraise HoldingsNo ratings yet

- EJC161937Document2 pagesEJC161937Katlego MosehleNo ratings yet

- Introduction SARS Tax Practitioner Readiness ProgrammeDocument12 pagesIntroduction SARS Tax Practitioner Readiness ProgrammeCedric PoolNo ratings yet

- Sars Tax NumberDocument1 pageSars Tax Numberthembinkutha22No ratings yet