Professional Documents

Culture Documents

Worksheet - Source Documents

Worksheet - Source Documents

Uploaded by

d8xsvf8dsxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worksheet - Source Documents

Worksheet - Source Documents

Uploaded by

d8xsvf8dsxCopyright:

Available Formats

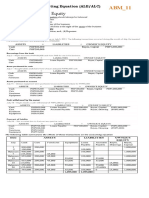

SOURCE DOCUMENTS

Accounting entries are made from source documents. Remember: A source document provides

details of a transaction and the evidence that the transaction has occurred.

Typical source documents used in business are:

SOURCE DOCUMENT EVIDENCE PROVIDED

Receipts Receipt of money

Cheques Payment of money

Cash Register Docket Individual cash sale

Cash Register Summary Total cash sales for the day for the business

Bank Statement Electronic funds transfer and bank charges

Tax Invoice Sale or service provided, plus applicable GST

Adjustment/Credit Note Return or allowances, plus GST refund

From source documents to journals:

If the complete accounting process is followed, information about a transaction is collected on a source

document, then this information is analysed and entered into a journal.

RECEIPTS

COMPONENTS OF THE

SOURCE DOCUMENT

1) Date of transaction

2) Receipt number

3) Amount received in

words and numerals

4) Name of business

receiving the money

5) Party paying the money

6) Purpose of the

transaction

7) Method of payment

When is this source document

used?

_________________________________________________________

Activity 1

Transaction Analysis:

What is the date of the transaction? __________________________________________________________

What is the receipt number of the transaction? ______________________________________________

What was the purpose of the transaction? ____________________________________________________

What was the amount? ________________________________________________________________

What is the GST amount? ________________________________________________________________

Who paying the money? ________________________________________________________________

Write the transaction:

________________________________________________________________________________________

The General Journal Entry for this transaction would be:

DATE PARTICULARS Ref DEBIT CREDIT

Apr 9 Cash at Bank 660.00

GST Collected 60.00

Service Fees Revenue 600.00

(Received cash for service performed)

CHEQUES

COMPONENTS OF THE

SOURCE DOCUMENT

1) Date of transaction

2) Cheque number

3) Amount paid in words

and numerals

4) Name of business

paying the money

5) Party the cheque is

being paid to

6) Purpose of the

transaction

7) Bank name

When is this source document used? _________________________________________________________

Activity 2

Transaction Analysis:

What is the date of the transaction? __________________________________________________________

What is the cheque number of the transaction? ______________________________________________

What was the purpose of the transaction? ____________________________________________________

What was the amount? ________________________________________________________________

What was the amount of GST? __________________________________________________________

Who is being paid? ______________________________________________________________________

Write the transaction:

________________________________________________________________________________________

The General Journal Entry for this transaction would be:

DATE PARTICULARS Ref DEBIT CREDIT

Apr 2 Stationery 70.00

4

GST Credits Received 7.00

Cash at Bank 77.00

(Paid for stationery with cash)

CASH REGISTER SUMMARY

COMPONENTS OF THE

SOURCE DOCUMENT

1) Date of transaction

2) Name of source

document

3) GST amount

4) Cost price of goods sold

5) Net amount of the goods

sold

6) Gross amount of the TOTAL - $440

goods sold

When is this source document used? _________________________________________________________

Activity 3

Transaction Analysis:

What is the date of the transaction? __________________________________________________________

What was the purpose of the transaction? ____________________________________________________

What was the amount? ________________________________________________________________

What was the cost price of the goods sold? ____________________________________________________

Write the transaction:

________________________________________________________________________________________

The General Journal Entry for this transaction would be:

DATE PARTICULARS Ref DEBIT CREDIT

Apr 1 Cash at Bank 675.00

4

Sales 675.00

(Sold inventories for cash)

Cost of goods sold 400.00

Inventories 400.00

(Cost of goods sold)

TAX INVOICE

COMPONENTS OF THE

SOURCE DOCUMENT

1) Date of transaction

2) Name of source document

3) Business selling the goods

4) Invoice number

5) Items purchased

6) If GST has been included

7) Customer name and

address

8) Total cost of the goods

9) Address of the seller

When is this source document used?

By our Business:

____________________________________________________________________

By other Businesses: ________________________________________________________________

Activity 4

Transaction Analysis:

What is the date of the transaction? __________________________________________________________

What is the tax invoice number? __________________________________________________________

What was the purpose of the transaction? ____________________________________________________

What was the amount? ________________________________________________________________

What was the amount of GST? __________________________________________________________

Who is required to pay this tax invoice? ____________________________________________________

Write the transaction:

________________________________________________________________________________________

The General Journal entry for this transaction would be:

DATE PARTICULARS Fo DEBIT CREDIT

May 1 A/C Receivable – Frank and Co 495.00

4

GST Collected 45.00

Sales 450.00

(Sale of GST inclusive inventories on credit)

Activity 5

Transaction Analysis:

What is the date of the transaction? __________________________________________________________

What is the tax invoice number? __________________________________________________________

What was the purpose of the transaction? ____________________________________________________

What was the amount? ________________________________________________________________

What was the GST amount? ________________________________________________________________

Who is required to pay this tax invoice? ____________________________________________________

Write the transaction:

________________________________________________________________________________________

This is the General Journal Entry for this transaction:

DATE PARTICULARS Fo DEBIT CREDIT

May 4 Inventories 10 000.00

GST Credits Received 1 000.00

A/C Payable – Motoroil Ltd 11 000.00

(Purchased of GST inclusive inventories on credit)

ADJUSTMENT NOTE/CREDIT NOTE

COMPONENTS OF THE

SOURCE DOCUMENT

1) Date of transaction

2) Name of source document

3) Business selling the goods

4) Adjustment note number

5) Items returned

6) If GST has been included

7) Customer name and

address

8) Total cost of the goods

9) Address of the seller

When is this source document used?

_________________________________ __

Activity 6

Transaction Analysis:

What is the date of the transaction? __________________________________________________________

What is the adjustment note number? ____________________________________________________

What was the purpose of the transaction? ____________________________________________________

What was the amount? ________________________________________________________________

Was GST involved in this transaction? ____________________________________________________

Who returned the goods? ________________________________________________________________

Write the transaction:

________________________________________________________________________________________

This is the General Journal Entry for this transaction:

DATE PARTICULARS Ref DEBIT CREDIT

Apr 1 A/C Payable – Freshfood Ltd 200.00

3

Inventories 200.00

(Purchased of GST inclusive inventories on credit)

You might also like

- Funding KitDocument91 pagesFunding KitTiffany Hall100% (5)

- Loan Application Form With CollateralDocument4 pagesLoan Application Form With CollateralIBP Bohol ChapterNo ratings yet

- Business/Trust Account ApplicationDocument3 pagesBusiness/Trust Account ApplicationPro SixNo ratings yet

- New Application Form (11!23!2010)Document2 pagesNew Application Form (11!23!2010)Jessel Recelestino-EsculturaNo ratings yet

- Semi Annual Report Jul Dec 2009Document5 pagesSemi Annual Report Jul Dec 2009Mykka ArtillagaNo ratings yet

- Tally-1Document61 pagesTally-1vidya gubbala50% (2)

- Books of AccountsDocument18 pagesBooks of AccountsFrances Marie TemporalNo ratings yet

- Accounting Equation (Abm)Document43 pagesAccounting Equation (Abm)EasyGaming100% (1)

- The Diagnosis and Treatment of Hair PDFDocument11 pagesThe Diagnosis and Treatment of Hair PDFSpica AdharaNo ratings yet

- Internal Control QuestionnaireDocument8 pagesInternal Control QuestionnaireRizza Mae RaferNo ratings yet

- MMC 2007 Gr6 RegDocument2 pagesMMC 2007 Gr6 RegLyndon B. PaguntalanNo ratings yet

- Grade 9 EMS Learner Workbook For 2020Document60 pagesGrade 9 EMS Learner Workbook For 2020GodfreyFrankMwakalingaNo ratings yet

- Notice of Call For Accreditation - NgoDocument4 pagesNotice of Call For Accreditation - NgoToneng Regis100% (1)

- Journal: What Is A Journal?Document14 pagesJournal: What Is A Journal?Sourabh Sabat100% (1)

- Taxpayer Information Sheet: BIR Form No. April 2006Document1 pageTaxpayer Information Sheet: BIR Form No. April 2006Judith50% (2)

- Fabm1 Module 6Document20 pagesFabm1 Module 6Randy Magbudhi100% (4)

- Metamorphosis TranscriptDocument15 pagesMetamorphosis TranscriptJascha KoubaNo ratings yet

- Language Test 5A: Unit 5Document1 pageLanguage Test 5A: Unit 5Rebecca Moran80% (5)

- Fundamentals of ABM Module 5Document14 pagesFundamentals of ABM Module 5Loriely De GuzmanNo ratings yet

- 3.02 Key TermsDocument25 pages3.02 Key Termsapi-262218593No ratings yet

- Capital Registration FormDocument3 pagesCapital Registration FormKidest AbateNo ratings yet

- Chapter 12Document12 pagesChapter 12arorayug90No ratings yet

- Business Plan Format EnglishDocument8 pagesBusiness Plan Format Englishnuura biixiNo ratings yet

- Acc1 Lesson Week9Document20 pagesAcc1 Lesson Week9KeiNo ratings yet

- Business Studies Chapter 7 - Grade 10Document7 pagesBusiness Studies Chapter 7 - Grade 10Maneesha DulanjaliNo ratings yet

- Transaction Dispute FormDocument3 pagesTransaction Dispute Formebook.kolkata.pdfNo ratings yet

- Accounting RecordDocument66 pagesAccounting Recordvidya gubbalaNo ratings yet

- "The I " "The Reporting Date" "The Reporting Period"Document4 pages"The I " "The Reporting Date" "The Reporting Period"Sofonias TagesuNo ratings yet

- Books of Accounts Week 5Document45 pagesBooks of Accounts Week 5Mariah Cielo DaguroNo ratings yet

- FileDocument11 pagesFileRiza GallardoNo ratings yet

- Business DocumentsDocument17 pagesBusiness DocumentsJoy SantosNo ratings yet

- Business Plan Format EnglishDocument11 pagesBusiness Plan Format EnglishChrstina AlazarNo ratings yet

- Questionniare Business OwnersDocument6 pagesQuestionniare Business OwnersMichaela De GuzmanNo ratings yet

- FABM1TGhandouts L7 Accounting-EquationDocument4 pagesFABM1TGhandouts L7 Accounting-EquationKarl Vincent DulayNo ratings yet

- 282 B-CR NewDocument4 pages282 B-CR Newwrite2ashishmalik6269100% (1)

- Horngrens Accounting The Financial Chapters 10Th Edition Nobles Solutions Manual Full Chapter PDFDocument68 pagesHorngrens Accounting The Financial Chapters 10Th Edition Nobles Solutions Manual Full Chapter PDFsaturnagamivphdh100% (6)

- AF Study Material and Practice Questions - Pre Mid TermDocument71 pagesAF Study Material and Practice Questions - Pre Mid TermAkshat Jain100% (1)

- FABM 1 Module 3 FINALDocument33 pagesFABM 1 Module 3 FINALLol LmaoNo ratings yet

- Soneri Traders Karachi.: Debit / Credit VoucherDocument4 pagesSoneri Traders Karachi.: Debit / Credit Voucherashfaq ahmedNo ratings yet

- Source of Funds - QuestionnaireDocument1 pageSource of Funds - Questionnairebolivar sanchezNo ratings yet

- Application EngDocument8 pagesApplication EngHassan AmintuNo ratings yet

- Notes On Account Payable by AKDocument35 pagesNotes On Account Payable by AKanithegreatNo ratings yet

- Form DVAT 09 Cover Page: Application For Cancellation of Registration Under Delhi Value Added Tax Act, 2004Document4 pagesForm DVAT 09 Cover Page: Application For Cancellation of Registration Under Delhi Value Added Tax Act, 2004hhhhhhhuuuuuyyuyyyyyNo ratings yet

- LARGE Inventory Slides 2019Document80 pagesLARGE Inventory Slides 2019Clyde G. CairelNo ratings yet

- Business Plan Workbook 101607Document7 pagesBusiness Plan Workbook 101607Cori WhiteNo ratings yet

- 31.07.2023 KILLA PrintPaymentAdviceDocument1 page31.07.2023 KILLA PrintPaymentAdviceVishmarajDeyNo ratings yet

- Partners Application FormDocument3 pagesPartners Application FormPriya FuNo ratings yet

- Payout Form1Document2 pagesPayout Form1Ramchandra PujariNo ratings yet

- Annex A.1.1 - Taxpayers AttestationsDocument3 pagesAnnex A.1.1 - Taxpayers AttestationssheilaNo ratings yet

- Payment VoucherDocument1 pagePayment Vouchergeologistdepartment.apmcNo ratings yet

- Self Declaration For Financial DetailsDocument2 pagesSelf Declaration For Financial DetailsKrishnaswmy PrasadNo ratings yet

- Investment Application Form 2018Document5 pagesInvestment Application Form 2018Ferdee FerdNo ratings yet

- Acconts Preliminary Paper 2Document13 pagesAcconts Preliminary Paper 2AMIN BUHARI ABDUL KHADERNo ratings yet

- VE EFB2 Tests ProgressTest03Document3 pagesVE EFB2 Tests ProgressTest03DamMayXanhNo ratings yet

- Application Form For Business LicenseDocument3 pagesApplication Form For Business LicenseberhanNo ratings yet

- Sub-Merchant Account Linking Form For Settlement - SBIDocument2 pagesSub-Merchant Account Linking Form For Settlement - SBIAmit GanjiNo ratings yet

- Payment Challan PDFDocument4 pagesPayment Challan PDFdtdcbf256No ratings yet

- Term paper-ACTDocument33 pagesTerm paper-ACTSayed MahmudNo ratings yet

- Journal Ledger and Trial BalenceDocument14 pagesJournal Ledger and Trial BalenceMd. Sojib KhanNo ratings yet

- Accounting Information SystemsDocument42 pagesAccounting Information SystemsRati Singh100% (1)

- Mastercard Cardholder Complain and Dispute FormDocument2 pagesMastercard Cardholder Complain and Dispute FormLobusta RyanNo ratings yet

- Credit Application (New 1) - 14.12.2023Document1 pageCredit Application (New 1) - 14.12.2023GAYANHNA gUNARATNo ratings yet

- BS Book 4 Lesson Notes-1Document89 pagesBS Book 4 Lesson Notes-1Geoffrey ObongoNo ratings yet

- CRM PPT - 1Document10 pagesCRM PPT - 1Ranjita SermaNo ratings yet

- NLP 2019-20Document36 pagesNLP 2019-20Akshay TyagiNo ratings yet

- Melchor Vs COADocument6 pagesMelchor Vs COAJohney Doe100% (1)

- BOQ-Caramat PG 2-5Document17 pagesBOQ-Caramat PG 2-5Jim Bryan RazNo ratings yet

- Erika Joy L. Aquino Bsa - IiiDocument4 pagesErika Joy L. Aquino Bsa - IiiFaye Angela Luistro AquinoNo ratings yet

- Lesson 18 elementary-english-review-2-units-10-17LPDocument11 pagesLesson 18 elementary-english-review-2-units-10-17LPcinkapankaNo ratings yet

- S 205060 W 7080 Wservicesysteminterconnectdiagramprelimv 228 Jun 171628381144100Document1 pageS 205060 W 7080 Wservicesysteminterconnectdiagramprelimv 228 Jun 171628381144100estiven zapata garciaNo ratings yet

- Offering Letter C02 - 2023Document1 pageOffering Letter C02 - 2023Eka SeptianNo ratings yet

- Ada Lovelace Lesson PlanDocument3 pagesAda Lovelace Lesson PlanTony AppsNo ratings yet

- Different Types of TriageDocument28 pagesDifferent Types of Triageanda3003No ratings yet

- Introduction To Spi CommunicationDocument5 pagesIntroduction To Spi Communicationjoyal jose100% (2)

- Full Download Book Copper in N Heterocyclic Chemistry PDFDocument41 pagesFull Download Book Copper in N Heterocyclic Chemistry PDFpatti.thomas223100% (16)

- Gen FuncsDocument8 pagesGen FuncsAndrew PhungNo ratings yet

- George Darte Funeral Chapel Inc. Price ListDocument20 pagesGeorge Darte Funeral Chapel Inc. Price ListrobNo ratings yet

- DP10 VisaDocument5 pagesDP10 VisaAzhar HasanNo ratings yet

- Buffer Preparation For Lab 1Document6 pagesBuffer Preparation For Lab 1Norshafiqa SalimNo ratings yet

- Simatic Net: Installation InstructionsDocument35 pagesSimatic Net: Installation InstructionssanjayswtNo ratings yet

- Posmo A Quickstart e EnuDocument4 pagesPosmo A Quickstart e EnuDeMen NguyenNo ratings yet

- Direct Current Motor Electrical Evaluation With Motor Circuit AnalysisDocument6 pagesDirect Current Motor Electrical Evaluation With Motor Circuit AnalysisCarlos VásquezNo ratings yet

- MKTG3002 Course Outline Summer 2023Document6 pagesMKTG3002 Course Outline Summer 2023Khadejai LairdNo ratings yet

- F.A.L. Conducive Engineering Review Center: 2 Floor, Cartimar Building, C.M. Recto Avenue, Sampaloc, ManilaDocument3 pagesF.A.L. Conducive Engineering Review Center: 2 Floor, Cartimar Building, C.M. Recto Avenue, Sampaloc, ManilaJejomar MotolNo ratings yet

- Ad 2000-08-07Document2 pagesAd 2000-08-07locoboeingNo ratings yet

- Full Download Test Bank For Managerial Accounting For Managers 5th Edition Eric Noreen Peter Brewer Ray Garrison PDF Full ChapterDocument36 pagesFull Download Test Bank For Managerial Accounting For Managers 5th Edition Eric Noreen Peter Brewer Ray Garrison PDF Full Chapterlutation.liddedrztjn100% (24)

- Resumeoct 17Document1 pageResumeoct 17api-376436821No ratings yet

- Thesis Help PhilippinesDocument8 pagesThesis Help PhilippinesJackie Gold100% (2)