Professional Documents

Culture Documents

Unit 5. Payment. L2

Uploaded by

halam290519970 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

UNIT 5. PAYMENT. L2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesUnit 5. Payment. L2

Uploaded by

halam29051997Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

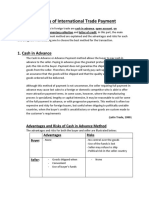

UNIT 5. PAYMENT.

LESSON 2

What to Consider When Choosing an International Payment Method

1. Pros and Cons of ______________

Pros Cons

Buyer None Affects cash flow.

Risk of not receiving shipment or no

recourse for damaged goods.

Seller Payment is made before goods are Not a competitive advantage.

received.

2. Pros and Cons of ______________

Pros Cons

Buyer Enhanced cashflow because None

payment not due until goods are

received.

Seller Can increase sales as this payment No guarantee of payment.

option is advantageous to the buyer. No protection against cancelled order.

3. Pros and Cons of ______________

Pros Cons

Buyer Payment is made only after goods Relies on good faith that the seller will ship

are received and sold. the goods.

Seller Can reduce the costs of managing Delays payment and increases potential of

and storing inventory in a foreign not receiving payment.

country.

4. Pros and Cons of ______________

Pros Cons

Buyer Less costly than letters of credit. Payment is made before goods can be

Payment is made only once goods checked – relies on seller to ship goods as

are delivered. specified.

Seller Seller retains the title to goods until No guarantee of payment.

paid. No protection against cancellations.

Risk of having to pay for return transport if

the buyer cannot pay.

5. Pros and Cons of ______________

Pros Cons

Buyer Payment made after goods are Expensive.

received. Relies on seller to ship goods as specified.

Terms can be customized. Time consuming to manage.

Expiration dates.

Currency fluctuations can make the cost rise.

Seller Low risk of default because the sale Strict documentary requirements to prove

is secured by the buyer's bank. what was contracted was provided.

Terms can be customized. Currenty fluctuations can make profit fall.

You might also like

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesFrom EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNo ratings yet

- Unit 4. Lesson 2Document2 pagesUnit 4. Lesson 2K59 Phan Ai ThuyenNo ratings yet

- Common Methods of International PaymentDocument7 pagesCommon Methods of International PaymentTewodros SetargieNo ratings yet

- Reflection Paper-Ba233N IFTransactionDocument7 pagesReflection Paper-Ba233N IFTransactionJoya Labao Macario-BalquinNo ratings yet

- Customer Credit: Reasons For Giving CreditDocument4 pagesCustomer Credit: Reasons For Giving CreditAshraf A RaheemNo ratings yet

- Unit 2 PAYMENT METHODS IN INTERNATIONAL TRADEDocument20 pagesUnit 2 PAYMENT METHODS IN INTERNATIONAL TRADEJeyvinNo ratings yet

- Unit 5. Payment. L3Document2 pagesUnit 5. Payment. L3halam29051997No ratings yet

- Unit 4. Lesson 2 (Cont)Document2 pagesUnit 4. Lesson 2 (Cont)K59 Phan Ai ThuyenNo ratings yet

- SSS 2 Commerce Notes Second TermDocument31 pagesSSS 2 Commerce Notes Second Termfabulousfareedah232No ratings yet

- Đinh Thị Mỹ Duyên - 1911115108 Chapter 2: Payment I. Question & answerDocument4 pagesĐinh Thị Mỹ Duyên - 1911115108 Chapter 2: Payment I. Question & answerPhương OanhNo ratings yet

- Methods of International Trade PaymentDocument7 pagesMethods of International Trade PaymentGechoGechoNo ratings yet

- Chapter 5Document22 pagesChapter 5syahiir syauqiiNo ratings yet

- Procurement EditedDocument31 pagesProcurement Editedrobelarega1010No ratings yet

- Trade Service and Import Training ManualDocument114 pagesTrade Service and Import Training Manualmekonnin tadesseNo ratings yet

- Group Assignment Chapter 3Document2 pagesGroup Assignment Chapter 3Phạm Phước TrungNo ratings yet

- Asignment Chap 2Document12 pagesAsignment Chap 2Diệu LinhNo ratings yet

- Recovery in Credit GrantedDocument21 pagesRecovery in Credit GrantedMaria Ysabella Yee80% (5)

- Islamic Banking Tijarah Product (Musawamah)Document28 pagesIslamic Banking Tijarah Product (Musawamah)Yasir HameedNo ratings yet

- Hire Purchase: Property SaleDocument7 pagesHire Purchase: Property SaleAman JainNo ratings yet

- International Trade Training: Make It HappenDocument19 pagesInternational Trade Training: Make It HappenVikram SuranaNo ratings yet

- Payment MethodDocument36 pagesPayment MethodNazneen SabinaNo ratings yet

- Group 7 QuestionnaireDocument3 pagesGroup 7 QuestionnaireKristina Cassandra CababatNo ratings yet

- Terms of PaymentDocument14 pagesTerms of PaymentAnkit VermaNo ratings yet

- Incoterms: Different Types of International Payment MethodsDocument4 pagesIncoterms: Different Types of International Payment Methodsbabita_27No ratings yet

- Chapter 2Document58 pagesChapter 2linhtrinhpersonalbizNo ratings yet

- ĐỀ CƯƠNG THANH TOÁN QUỐC TẾDocument9 pagesĐỀ CƯƠNG THANH TOÁN QUỐC TẾHuỳnh Nguyễn PhướcNo ratings yet

- Types of Securities.Document18 pagesTypes of Securities.Radha maiNo ratings yet

- GENERAL FUNCTIONS in Credit ReviewerDocument1 pageGENERAL FUNCTIONS in Credit ReviewerJAM CLNo ratings yet

- IFCP - Class 4Document16 pagesIFCP - Class 4Jamal NasirNo ratings yet

- Obligations of The Vendee WHEN Are The Goods Considered Accepted?Document4 pagesObligations of The Vendee WHEN Are The Goods Considered Accepted?RedNo ratings yet

- CH 07 Accounting For Murabahah FinancingDocument35 pagesCH 07 Accounting For Murabahah FinancingMOHAMMAD BORENENo ratings yet

- Chapter 2 - Export Pricing PolicyDocument40 pagesChapter 2 - Export Pricing PolicyHang NguyenNo ratings yet

- Types of SecuritiesDocument8 pagesTypes of SecuritiesA U R U M MDNo ratings yet

- Law - Obligation of The VendeeDocument3 pagesLaw - Obligation of The VendeeIris Grace CulataNo ratings yet

- Consumer Credit o Level Notes BruneiDocument7 pagesConsumer Credit o Level Notes Bruneideekay.ameerah.pmyNo ratings yet

- Elleine Maling - E-TIVITY 1 IA2Document8 pagesElleine Maling - E-TIVITY 1 IA2Rose MalingNo ratings yet

- Law On Sales Agency & Credit Transactions (Reviewer)Document3 pagesLaw On Sales Agency & Credit Transactions (Reviewer)Yana100% (1)

- Murabaha TrainingDocument19 pagesMurabaha TrainingMinhaj AliNo ratings yet

- SYBBA Unit 4Document40 pagesSYBBA Unit 4idea8433No ratings yet

- Hansa A4 Dokmaksed Eng UUS PDFDocument51 pagesHansa A4 Dokmaksed Eng UUS PDFmackjblNo ratings yet

- Credit Trading NotesDocument5 pagesCredit Trading NotesellengaoneNo ratings yet

- UIB2612 1630 LECTURE 6 MurabahahDocument32 pagesUIB2612 1630 LECTURE 6 MurabahahSyahirah ArifNo ratings yet

- Specific Contracts (2023) - Topic 2 - Contract of Sale - Part 3Document21 pagesSpecific Contracts (2023) - Topic 2 - Contract of Sale - Part 3Michaela BezerNo ratings yet

- Credit Fundamentals ReviewerDocument2 pagesCredit Fundamentals ReviewerJAM CLNo ratings yet

- Credit FinalsDocument4 pagesCredit FinalsJane Alyssa SevillaNo ratings yet

- 1.bank Credit 2.loans & Advances 3.cash Credit 4.overdraft 5.bills DiscountingDocument11 pages1.bank Credit 2.loans & Advances 3.cash Credit 4.overdraft 5.bills DiscountingPriyanka AdivarekarNo ratings yet

- Understanding and Using LC, PIIDocument5 pagesUnderstanding and Using LC, PIIsamaanNo ratings yet

- What Is Trade FinanceDocument6 pagesWhat Is Trade FinanceAhmed Mohamed HamdyNo ratings yet

- Aasignment On Hire Purchase Finance and Consumer CreditDocument14 pagesAasignment On Hire Purchase Finance and Consumer Creditchaudhary92100% (3)

- Documents of The Title of GoodsDocument23 pagesDocuments of The Title of GoodsAlina TahirNo ratings yet

- Understanding and Using Letters of Credit: PurposeDocument7 pagesUnderstanding and Using Letters of Credit: PurposePhani KumarNo ratings yet

- Sale of Goods Act-1930Document15 pagesSale of Goods Act-1930Umar Shabir BaigNo ratings yet

- Documentary Credit BrochureDocument8 pagesDocumentary Credit BrochurehabchiNo ratings yet

- Recievables - Credit ManagementDocument14 pagesRecievables - Credit ManagementDrusti M SNo ratings yet

- Audit of Receivables Lecture NotesDocument10 pagesAudit of Receivables Lecture NotesDebs Fanoga100% (1)

- Basic Collection ProceduresDocument4 pagesBasic Collection Proceduresrosalyn mauricioNo ratings yet

- Unit - 3 Consignment: Learning OutcomesDocument36 pagesUnit - 3 Consignment: Learning OutcomesPrathamesh KambleNo ratings yet

- Unit 4 - Finance - Lesson 1 - KeyDocument2 pagesUnit 4 - Finance - Lesson 1 - Keyhalam29051997No ratings yet

- Unit 5. EthicsDocument4 pagesUnit 5. Ethicshalam29051997No ratings yet

- UNIT 2 - What Is The Right Supply Chain For Your ProductDocument5 pagesUNIT 2 - What Is The Right Supply Chain For Your Producthalam29051997No ratings yet

- Unit 3 - Marketing - Lesson 1Document6 pagesUnit 3 - Marketing - Lesson 1halam29051997No ratings yet

- Unit 5. Ethics. Further ReadingDocument2 pagesUnit 5. Ethics. Further Readinghalam29051997No ratings yet

- Unit 2 - Writing PracticeDocument2 pagesUnit 2 - Writing Practicehalam29051997No ratings yet

- Unit 4 - Lesson 3 - AccountingDocument2 pagesUnit 4 - Lesson 3 - Accountinghalam29051997No ratings yet

- UNIT 1. Further Reading - Think Global Act LocalDocument4 pagesUNIT 1. Further Reading - Think Global Act Localhalam29051997No ratings yet

- Unit 4 - Unit QuizDocument4 pagesUnit 4 - Unit Quizhalam29051997No ratings yet

- Unit 5. Payment. L3Document2 pagesUnit 5. Payment. L3halam29051997No ratings yet

- Unit 5. Lesson 1Document2 pagesUnit 5. Lesson 1halam29051997No ratings yet

- Overview of Ventilation CalculationDocument47 pagesOverview of Ventilation CalculationDixter CabangNo ratings yet

- Problem StatementDocument2 pagesProblem StatementKanthan AmalNo ratings yet

- Terminating A Swap ContractDocument2 pagesTerminating A Swap Contractravi_nyseNo ratings yet

- An Efficient Secured System by Using Blowfish With Block Chain TechnologyDocument11 pagesAn Efficient Secured System by Using Blowfish With Block Chain TechnologygestNo ratings yet

- Berbers of MoroccoDocument16 pagesBerbers of MoroccoDAHBI NouraNo ratings yet

- Osmanabadi Goat Breed Status PaperDocument7 pagesOsmanabadi Goat Breed Status PaperShaikh Tausif AhmedNo ratings yet

- Tim Ferriss' 3 Day Fasting ProtocolDocument13 pagesTim Ferriss' 3 Day Fasting ProtocolbullNo ratings yet

- Angoltanmenet5 OsztDocument23 pagesAngoltanmenet5 OsztSzimonetta BándoliNo ratings yet

- Matholympiad ListDocument6 pagesMatholympiad Listhongnh-1No ratings yet

- Woerner Central Lubrication Grease 2008Document12 pagesWoerner Central Lubrication Grease 2008Ahmed AttallaNo ratings yet

- The 12 Pillars of CompetitivenessDocument6 pagesThe 12 Pillars of Competitivenessmalinici1No ratings yet

- Stats 2022-2Document6 pagesStats 2022-2vinayakkNo ratings yet

- 4 Performance.4xDocument14 pages4 Performance.4xAnto PadaunanNo ratings yet

- OscillatorsDocument3 pagesOscillatorsDanley Rodrigues DantasNo ratings yet

- 3D Electrocatalysts For Water Splitting: Kaustubh Saxena July 18, 2017Document21 pages3D Electrocatalysts For Water Splitting: Kaustubh Saxena July 18, 2017Yash BansodNo ratings yet

- Iste Certification Alignment MapDocument12 pagesIste Certification Alignment Mapapi-665015818No ratings yet

- CW 8Document49 pagesCW 8Guediri AimenNo ratings yet

- Avianca Fuel Saving PolicyDocument95 pagesAvianca Fuel Saving PolicyMarco MartinezNo ratings yet

- CA Inter Costing Blast From The Past by Rahul Garg SirDocument88 pagesCA Inter Costing Blast From The Past by Rahul Garg SirPRATHAM AGGARWALNo ratings yet

- CASE STUDY - LeapfrogDocument3 pagesCASE STUDY - Leapfrogpakol4funNo ratings yet

- Factors Affecting Online Buying BehaviorDocument17 pagesFactors Affecting Online Buying BehaviorJohn DoeNo ratings yet

- Wave AlphaDocument116 pagesWave AlphaListedlee LeeNo ratings yet

- Fs1-Episode 11Document22 pagesFs1-Episode 11Jamille Nympha C. BalasiNo ratings yet

- 2021 Camanche Recreation Use FeesDocument9 pages2021 Camanche Recreation Use FeesBrian HarrisonNo ratings yet

- DM - Basic SPoken ENglishDocument4 pagesDM - Basic SPoken ENglishFeriyanto MuhammadNo ratings yet

- Lepsius R - Discoveries in Egypt, Ethiopia, and The Peninsula of Sinai in The Years 1842 To 1845 - 1853Document486 pagesLepsius R - Discoveries in Egypt, Ethiopia, and The Peninsula of Sinai in The Years 1842 To 1845 - 1853Keith JundeaconNo ratings yet

- Performance: Task in MarketingDocument4 pagesPerformance: Task in MarketingRawr rawrNo ratings yet

- Eico 685 Operating ManualDocument29 pagesEico 685 Operating ManualkokoromialosNo ratings yet

- Concept of Statistical Quality ControlDocument51 pagesConcept of Statistical Quality ControlTehmeena BegumNo ratings yet

- Tungo Sa Bayang Magiliw - 3: Ating Karapatan Sa Batas at Pananagutang PanlipunanDocument25 pagesTungo Sa Bayang Magiliw - 3: Ating Karapatan Sa Batas at Pananagutang PanlipunanAxel GalaNo ratings yet