Professional Documents

Culture Documents

BIR Clarifies Method For Calculating Tax On Real Property Capital Gains

Uploaded by

D GOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Clarifies Method For Calculating Tax On Real Property Capital Gains

Uploaded by

D GCopyright:

Available Formats

BIR clarifies method for

calculating tax on real property

capital gains

Posted on May 09, 2017

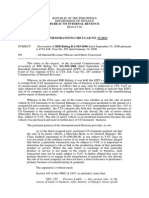

THE Bureau of Internal Revenue (BIR) said valuations based on comparable sales

of real property are not acceptable for calculating capital gains tax, saying the law

only allows the use of specific methods to value a real property.

“The six percent (6%) CGT (capital gains tax) is based on the gross selling price or fair market value

or zonal value of the subject property, whichever is higher,” the BIR said in a statement, referring to

memorandum circular 35-2017 issued earlier.

“The foregoing implies that in order to be liable for the payment of CGT, there must be presumed gain

from the sale, exchange or disposition of real property. The mere issuance of tax declaration without

any sale, exchange, or disposition is not subject to CGT. Likewise, there must be transfer of ownership

that resulted from the sale, disposition or conveyance of the real property,” the BIR said.

It added that the payment of capital gains tax is a direct consequence of the sale, meaning a mere

issuance of tax declaration in the absence of any sale, exchange, or other forms of conveyance is not

subject to the CGT.

Meanwhile, BIR’s spokesperson, lawyer Marissa O. Cabreros said in a phone interview that the

memorandum was “meant to clarify the basis for real property valuation, because some use a

comparable sale figure as a third basis for computation.”

She said that there were cases of buyers or sellers seeking to change the real property valuation in

their favor by using values generated by a comparable sale.

A comparable sale valuation is based on the recent sale of another property in the same location.

Ms. Cabreros said that real property sellers are justifying a higher selling price based on comparable

valuation to jack up the selling price.

The only bases for real property valuations are fair market value as determined by the Commissioner

of Internal Revenue, or the fair market value as shown in the schedule of values of the Provincial and

City Assessors, according to Section 6(E) of the National Internal Revenue Code.

“Thus, in no case shall revenue officials or employees apply any other basis for the imposition of

capital gains tax on sale/income tax/withholding tax on sale, or exchange or other disposition of real

property,” the BIR memorandum read.

“The Commissioner is clarifying that comparative sale is not in the law,” Ms. Cabreros added.

You might also like

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- 171.real Property Zonal Valuation - fdd.11.25.10Document2 pages171.real Property Zonal Valuation - fdd.11.25.10evilsageNo ratings yet

- Properties Exempted From CGTDocument5 pagesProperties Exempted From CGTD GNo ratings yet

- The Concept of Fair Market Value'in Corporate LawDocument5 pagesThe Concept of Fair Market Value'in Corporate LawPCLS HNLU ChapterNo ratings yet

- Capital Gains Tax Delay - Who Stands To BenefitDocument5 pagesCapital Gains Tax Delay - Who Stands To Benefitom chandararithNo ratings yet

- CREBA vs. RomuloDocument1 pageCREBA vs. RomuloFlorence UdaNo ratings yet

- GST Authorities Quiz Auto Dealers On FakeDocument2 pagesGST Authorities Quiz Auto Dealers On FakeArun KumarNo ratings yet

- Revenue Regulation 6-2013 AnalysisDocument5 pagesRevenue Regulation 6-2013 AnalysissigfridmonteNo ratings yet

- 2018 02 Transfer Pricing Hungary EN Compressed PDFDocument13 pages2018 02 Transfer Pricing Hungary EN Compressed PDFAccaceNo ratings yet

- Final PPT On Valuation of AssetsDocument22 pagesFinal PPT On Valuation of AssetsRichik DadhichNo ratings yet

- Tax Refund On Rescinded Contracts - RSC 4 12 17Document3 pagesTax Refund On Rescinded Contracts - RSC 4 12 17Mikee Baliguat TanNo ratings yet

- BIR Ruling 27-02Document2 pagesBIR Ruling 27-02erikagcv100% (1)

- Chamber of Real Estate and Builder'S Associations, Inc. Exec Sec. Romulo, Et AlDocument28 pagesChamber of Real Estate and Builder'S Associations, Inc. Exec Sec. Romulo, Et AlJohanaflor MiraflorNo ratings yet

- A R Sebi: S Sebi': Bhijit Ajan V Upreme Court Curtails S Abuse OF PowerDocument3 pagesA R Sebi: S Sebi': Bhijit Ajan V Upreme Court Curtails S Abuse OF PowerYash BhatnagarNo ratings yet

- Calasanz V. Commissioner of Internal Revenue G.R. No. L-26284, October 9, 1986 FactsDocument13 pagesCalasanz V. Commissioner of Internal Revenue G.R. No. L-26284, October 9, 1986 FactsAngelie Fei CuirNo ratings yet

- Unauthorized LOADocument3 pagesUnauthorized LOAedong the greatNo ratings yet

- LGS GCP Course IVB Valuation of Rural Land Revised February 2011Document396 pagesLGS GCP Course IVB Valuation of Rural Land Revised February 2011Osagie AlfredNo ratings yet

- 2021 Assessment-ManualDocument20 pages2021 Assessment-ManualjmarkgNo ratings yet

- ABAKADA Guro Party List vs. ErmitaDocument2 pagesABAKADA Guro Party List vs. Ermitayannie11No ratings yet

- Creba V. Executive Secretary G.R. No. 160756 March 9, 2010Document1 pageCreba V. Executive Secretary G.R. No. 160756 March 9, 2010ChugsNo ratings yet

- Creba vs. Romulo - MCITDocument1 pageCreba vs. Romulo - MCIThenzencameroNo ratings yet

- Best Evidence Obtainable Rule On Doubtful Validity Assessment - JAN 6.5.14Document2 pagesBest Evidence Obtainable Rule On Doubtful Validity Assessment - JAN 6.5.14MarkEguicoNo ratings yet

- Letter of Authority: Does It Matter? LN Not ValidDocument3 pagesLetter of Authority: Does It Matter? LN Not ValidAvelino Garchitorena Alfelor Jr.100% (1)

- 2020 117 Taxmann Com 742 Article Reversal of Trade in Securities Analysing SEBI S StanDocument3 pages2020 117 Taxmann Com 742 Article Reversal of Trade in Securities Analysing SEBI S StanJennifer WingetNo ratings yet

- ISLAMABAD: The Government May Double The Tax Burden of Sellers and Purchasers On TransferDocument12 pagesISLAMABAD: The Government May Double The Tax Burden of Sellers and Purchasers On TransferShahbaz AliNo ratings yet

- 2019 Transfer Pricing Overview For HungaryDocument13 pages2019 Transfer Pricing Overview For HungaryAccaceNo ratings yet

- Case Digest Remedies Part 1Document23 pagesCase Digest Remedies Part 1Aprille S. AlviarneNo ratings yet

- Recent Jurisprudence TaxDocument17 pagesRecent Jurisprudence TaxMark Regidor MenorcaColegioNo ratings yet

- 07 Chamber of Real Estate vs. Secretary Alberto RomuloDocument4 pages07 Chamber of Real Estate vs. Secretary Alberto RomuloCharmaine Ganancial SorianoNo ratings yet

- Jurnal - PPH & BPHTB Pada PPJBDocument20 pagesJurnal - PPH & BPHTB Pada PPJBBaiq HusnulNo ratings yet

- Article - GST On Onlime Gaming - GOM Proposals CLEANDocument3 pagesArticle - GST On Onlime Gaming - GOM Proposals CLEANabhishek2607No ratings yet

- The Regalia Group Corporation: BIR RULING (DA-295-08)Document4 pagesThe Regalia Group Corporation: BIR RULING (DA-295-08)Johnallen MarillaNo ratings yet

- Tax Assessments Burden of ProofDocument3 pagesTax Assessments Burden of ProofblessaraynesNo ratings yet

- A Project By:: Prof. Chetan KadamDocument9 pagesA Project By:: Prof. Chetan KadamAniq Syed100% (1)

- Recent Jurisprudence TaxDocument17 pagesRecent Jurisprudence TaxGrenalyn AlcantaraNo ratings yet

- Rural Property Tax Search User GuideDocument12 pagesRural Property Tax Search User Guidestep.up.nation469No ratings yet

- TAX 2 - Criminal ActionDocument8 pagesTAX 2 - Criminal ActionJesús LapuzNo ratings yet

- Tax Treatment of Disposition of Shares of Stock: BDB Law's "Tax Law For Business" Business MirrorDocument2 pagesTax Treatment of Disposition of Shares of Stock: BDB Law's "Tax Law For Business" Business MirrorDenise CasteloNo ratings yet

- BIR Ruling No. 1397-18Document4 pagesBIR Ruling No. 1397-18SGNo ratings yet

- Chile: Transfer Pricing GuideDocument7 pagesChile: Transfer Pricing GuideSebastián Torres SeguelNo ratings yet

- CREBA v. Romulo 614 SCRA 605 (Creditable Withholding Tax MCIT)Document7 pagesCREBA v. Romulo 614 SCRA 605 (Creditable Withholding Tax MCIT)Lyra ValdezNo ratings yet

- Case Digest Tax Remedies 1Document23 pagesCase Digest Tax Remedies 1Carlos JamesNo ratings yet

- Due Process DigestDocument12 pagesDue Process DigestChugsNo ratings yet

- My Case Digest - Chamber of Real Estate and Builders' Associations, Inc. vs. THE HON. EXECUTIVE SECRETARY ALBERTO ROMULODocument6 pagesMy Case Digest - Chamber of Real Estate and Builders' Associations, Inc. vs. THE HON. EXECUTIVE SECRETARY ALBERTO ROMULOGuiller MagsumbolNo ratings yet

- Tax DigestsDocument6 pagesTax DigestsAtheena Marie PalomariaNo ratings yet

- Time To Update Customs Valuation SystemDocument4 pagesTime To Update Customs Valuation SystemMohammad Shahjahan SiddiquiNo ratings yet

- CREBA, Inc. v. Romulo - TOODocument1 pageCREBA, Inc. v. Romulo - TOORalph Ryan TooNo ratings yet

- MTF Tax Journal November 2021Document15 pagesMTF Tax Journal November 2021Christine Jane RodriguezNo ratings yet

- Beaumont Holdings Corporation vs. Reyes, 834 SCRA 477, August 07, 2017Document36 pagesBeaumont Holdings Corporation vs. Reyes, 834 SCRA 477, August 07, 2017LenefaNo ratings yet

- Microsoft Philippines V CIR-fullDocument3 pagesMicrosoft Philippines V CIR-fullLucky JavellanaNo ratings yet

- Capital Gains Taxation v.1Document24 pagesCapital Gains Taxation v.1shie ramirezNo ratings yet

- Historical Cost Vs Fair Market ValueDocument4 pagesHistorical Cost Vs Fair Market Valueoliver smithNo ratings yet

- Tax Abq 6Document1 pageTax Abq 6jinnanNo ratings yet

- Article Reviews.Document11 pagesArticle Reviews.EmshawNo ratings yet

- Tax DigestDocument6 pagesTax DigestVirgilio Tiongson Jr.No ratings yet

- GST BILL Highlights of Draft Model GST LawDocument6 pagesGST BILL Highlights of Draft Model GST LawS Sinha RayNo ratings yet

- RMC No 15-2011Document3 pagesRMC No 15-2011Eric DykimchingNo ratings yet

- Ungab Doctrine and Fortune Tobacco Doctrine TAXDocument2 pagesUngab Doctrine and Fortune Tobacco Doctrine TAXGeorge PandaNo ratings yet

- Section 4 Section 4Document1 pageSection 4 Section 4gs randhawaNo ratings yet

- EQUAL P2Document4 pagesEQUAL P2D GNo ratings yet

- EQUAL P4Document5 pagesEQUAL P4D GNo ratings yet

- EQUAL P1Document7 pagesEQUAL P1D GNo ratings yet

- Requirements TitlingDocument4 pagesRequirements TitlingD GNo ratings yet

- How To Apply For Certificate of Registration in The PhilippinesDocument5 pagesHow To Apply For Certificate of Registration in The PhilippinesD GNo ratings yet

- Requirements For Agricultural Free Patent ApplicationDocument1 pageRequirements For Agricultural Free Patent ApplicationD GNo ratings yet

- POLICE POWER 3Document5 pagesPOLICE POWER 3D GNo ratings yet

- 2 Cases Illegal Possession of FA Animus PossedendiDocument11 pages2 Cases Illegal Possession of FA Animus PossedendiD GNo ratings yet

- Authentication CCTVDocument12 pagesAuthentication CCTVD GNo ratings yet

- Requirements Accion PublicianaDocument1 pageRequirements Accion PublicianaD GNo ratings yet

- Notes - Jurisprudence - 5 Bad Decisions of The Supreme CourtDocument3 pagesNotes - Jurisprudence - 5 Bad Decisions of The Supreme CourtD GNo ratings yet

- Notice of Vacancies 03 March 2023Document3 pagesNotice of Vacancies 03 March 2023D GNo ratings yet

- Illegal Possession FADocument9 pagesIllegal Possession FAD GNo ratings yet

- Illegal Possession of Fa Must Show Proof LicenseDocument7 pagesIllegal Possession of Fa Must Show Proof LicenseD GNo ratings yet

- Rfpa-Application FormDocument1 pageRfpa-Application FormD GNo ratings yet

- Commission On Audit-Attorney IvDocument1 pageCommission On Audit-Attorney IvD GNo ratings yet

- Bench Book For Trial Court Judges Criminal ProcedureDocument55 pagesBench Book For Trial Court Judges Criminal ProcedureD GNo ratings yet

- Notice of Vacancies 22 September 2022Document6 pagesNotice of Vacancies 22 September 2022D GNo ratings yet

- Jurisprudence HoaDocument20 pagesJurisprudence HoaD GNo ratings yet

- Rfpa AffidavitDocument1 pageRfpa AffidavitD GNo ratings yet

- 2023 TOYOTA FORTUNER 4X4 2.8 LTD FinDocument3 pages2023 TOYOTA FORTUNER 4X4 2.8 LTD FinD GNo ratings yet

- Reply Letter To Atty. Dumlao, CabalteraDocument1 pageReply Letter To Atty. Dumlao, CabalteraD GNo ratings yet

- Imprescriptibility of A Void Extra Judicial Settlement of EstateDocument11 pagesImprescriptibility of A Void Extra Judicial Settlement of EstateD GNo ratings yet

- Rfpa ChecklistDocument2 pagesRfpa ChecklistD GNo ratings yet

- DRAFT-inter Company Side Agreement Rich Global-MarissaDocument5 pagesDRAFT-inter Company Side Agreement Rich Global-MarissaD GNo ratings yet

- Rfpa-Affidavit of The ApplicantDocument1 pageRfpa-Affidavit of The ApplicantD GNo ratings yet