Professional Documents

Culture Documents

UNIT- 1

Uploaded by

Tesfaye Kebebaw0 ratings0% found this document useful (0 votes)

2 views40 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views40 pagesUNIT- 1

Uploaded by

Tesfaye KebebawCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 40

UNIT- 1

INTRODUCTION TO CORPORATE FINANCE

After study this unit, you will understand:

Corporate Finance – An Overview

Principles of Corporate Finance

Tools of Corporate Finance

The Objective in Corporate Finance

Agency Problem

Corporate Finance – An Overview

Imagine that you were to start your own business.

No matter what type you started, you would have

to answer the following three questions in some

form or another:

What long-term investments should you take on?

That is, what lines of business will you be in and

what sorts of buildings, machinery, and

equipment will you need?

Where will you get the long-term financing to pay

for your investment? Will you bring in other

owners or will you borrow the money?

How will you manage your everyday financial

activities such as collecting from customers and

paying suppliers?

These are not the only questions by any means,

but they are among the most important.

Corporate finance, broadly speaking, is the study

of ways to answer these three questions.

Therefore, corporate finance could then be

defined as any decisions made by a business that

affect its finances.

These decisions can be categorized into

investment decisions, financing decisions and

dividend decisions.

Corporate finance is the area of finance dealing

with

the sources of funding,

the capital structure of corporations and

the actions that managers take to increase the value of

the firm to the shareholders,

as well as the tools and analysis used to allocate

financial resources.

Corporate Finance is about decisions made by

corporations. Not all businesses are organized as

corporations.

Corporations have three distinct characteristics:

Corporations are legal entities, i.e. legally distinct from

Corporations

it owners and pay their own taxes,

Corporations have limited liability, which means that

shareholders can only loose their initial investment in

case of bankruptcy,

Corporations have separated ownership and control as

owners are rarely managing the firm.

The objective of the firm is to maximize

shareholder value by increasing the value of the

company's stock.

Although other potential objectives (survive,

maximize market share, maximize profits, etc.)

exist these are consistent with maximizing

shareholder value.

The Financial Manager and Corporation

A striking feature of large corporations is that the

owners (the stockholders) are usually not directly

involved in making business decisions, particularly

on a day-to-day basis.

Instead, the corporation employs managers to

represent the owners’ interests and make

decisions on their behalf.

In a large corporation, the financial manager

would be in charge of answering the three

questions as we raised in the above.

The financial management function is usually

associated with a top officer of the firm, such as a

vice president of finance or some other chief financial

officer (CFO).

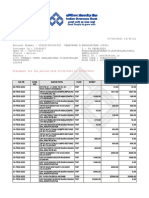

The chief financial officer of finance coordinates the

activities of the treasurer and the controller.

The controller’s office handles cost and financial

accounting, tax payments, and management

information systems.

The treasurer’s office is responsible for managing the

firm’s cash and credit, its financial planning, and its

capital expenditures. (see Figure-1)

These treasury activities are all related to the three

general questions raised earlier.

Principles of Corporate Finance

All of corporate finance is build on three such

principles, which we term the investment

principle, the financing principle, and the dividend

principle.

The Investment Principle:

This principle states simply that firms should

invest in assets only when they are expected to

earn a return greater than a minimum acceptable

return.

This minimum return, which we term a hurdle

rate, should reflect whether the money is raised

from debt or equity, and what returns those

investing the money could have made elsewhere

on similar investment.

The Financing Principle:

It posits that the mix of debt and equity chosen to

finance investments should maximize the value of

the investments made.

In the context of the hurdle rate specified in the

investment principle, choosing a mix of debt and

equity that minimize this hurdle rate allows the

firm to take more new investments and increase

the value of existing investments.

The dividend principle:

Firms some times cannot find investments that

earn their minimum required return or hurdle

rate.

If this shortfall persists, firms have to return any

cash they generate to the owners.

Tools of Corporate Finance

In the process of developing the models that can be

used to make sensible investment, financing and

dividend decisions, we will draw on a number of tools

that apply across all these decisions.

The first of these tools is the time value of the money,

which allows us to compare cash received or paid at

different points in time and to weight them based on

when they occur.

The second tool is an understanding of financial

statements, since much of the information that we

get and provide in finance comes from these

statements.

The third tool is an understanding of how to value an

asset.

Not only the above tools but also using the

following tools can help your corporation control

its finances, which will lead to greater efficiencies.

Risk and return,

Futures,

Forwards, and

Options.

The Objective in Corporate Finance

An objective specifies what a decision maker is trying to

accomplish, and by so doing, it provides measures that can

be used to choose between alternatives.

In most firms, it is the managers of the firm, rather than the

owners, who make the decisions about where to invest or

how to raise funds for an investment.

Thus, if stock price maximization is the objective, a

manager choosing between two alternatives will choose

the one that increases stock price more.

In most cases, the objective is stated in terms of maximizing

some function or variable (profits, size, value, social

welfare) or minimizing some function or variable (risk,

costs).

This part of the unit will take you through the models

developed in corporate finance to maximize stakeholders’

wealth.

The need for an objective

Overtime, there had been this controversy over the ‘right’

objective to use in corporate finance, though this may seem

somehow difficult to develop.

Sometimes, questions could arise, why do one objective, why

not have multiple objectives that try to satisfy all sides.

In the midst of all these competing objectives, an option came

which try to explain the differences using the following reasons:

If an objective is not chosen, it will be difficult to have

alternative to decision rules.

In corporate finance, the net present value (NPV) is the

best approach to selecting projects.

In this wise, NPV is the objective of maximizing

stakeholders’ wealth.

Without an objective, there would be several approaches

for selecting projects ranging from reasonable ones to

absurd ones.

If multiple objectives are chosen, we would be faced

with numerous problems.

A theory developed around multiple objectives of equal

weight will create quandaries when it comes to making

decisions.

To illustrate, assume that a firm chooses as its objectives

maximizing market share and maximizing current earnings.

If a project increases both market share and current

earnings, the firm will encounter no problems, but what if

the project being analyzed increases market share while

reducing current earnings?

The firm should not invest in the project if the current

earnings objective is considered, but it should invest in it

based on the market share objective.

If objectives are prioritized, we are faced with the same

stark choices as in the choice of single objective.

Should the top priority be maximizing current

earnings, or should it be maximizing market share?

Because there is no gain from having multiple

objectives, and developing theory becomes much

more difficult with multiple objectives, we should

argue that there should be only one objective.

The characteristics of the ‘Right’ objective

When it comes to decision making, a firm can

choose between a number of different objectives.

How can it know whether the objective it has

chosen is the “right” objective?

A good objective should have the following

characteristics.

It must be clear and unambiguous:

An ambiguous objective will lead to decision rules

that vary from case to case and from decision

maker to decision maker.

Consider, for instance, a firm whose objective is to

increase growth in the long-term.

This is an ambiguous objective since it does not

answer at least two questions.

The first is growth in what variable?

Is it in revenue, operating earnings, net income,

or earnings per share?

The second is in the definition of the long-term: is

it three years, five years, or a longer period?

It must come with a clear and timely measure:

That can be used to evaluate the success or failure of

decisions.

Objectives that sound good but do not come with a

measurement mechanism are likely to fail.

For instance, consider a retail firm that defines its

objective as maximizing customer satisfaction.

Exactly how is customer satisfaction defined, and

how is it to be measure?

If no good mechanism exists for measuring

customers’ satisfaction with their purchases, not only

will managers be unable to make decisions based on

this objective, but the firm will also have no way of

holding them accountable for any decisions they do

make.

It does not create costs for other entities or

groups:

That erase firm-specific benefits and leave society

worse off overall.

As an example, assume that a tobacco company

defines its objective to be revenue growth.

Managers of this firm will then be inclined to

Managers

increase advertising to teenagers, since it will

increase sales.

Doing so, however, may create significant costs for

society that will overwhelm any benefits arising

from the objective.

Why corporate finance focuses on stock price

maximization

Even though stock price maximization as an objective

is the narrowest of the value maximization objectives,

it is the most prevalent one.

There are three reasons for the focus on stock price

maximization in traditional corporate finance.

The first is that stock prices are the most observable

of all measures that can be used to judge the

performance of a firm.

Unlike earnings or sales, which are updated once

every quarter or year, stock prices are updated

constantly to reflect new information coming out

about the firm.

Thus, managers receive instantaneous feedback on

every action they take from investors in markets.

The second reason is that stock prices, in a market

with rational investors, reflect the long-term

effect of the firm’s decisions.

Unlike accounting measures such as earnings or

sales measures such as market share, which

examine the effects of the firm’s decisions on

current operations, the stock price reflects the

long-term effects of this decisions on value.

In a rational market, the stock price represents

the investors’ attempt to measure this value.

Finally, the stock price is a real measure of

stockholder wealth, since stockholders can sell

their stock and receive the price now.

Thus, when firms maximize stock prices,

stockholders can cash in on the gain immediately,

if they so desire.

When is stock price maximization the only

objective a firm needs?

In classical corporate finance, the managers of

firms need to concentrate only on maximizing

stock prices and can set aside all other concerns

they might have for other claim holders.

Although this single-mindedness sounds extreme

and may actually be damaging to other claim

holders in the firm (lenders, employees, and

society), it is appropriate if the following

assumptions hold.

1. The managers of the firm put aside their own

objectives and focus on maximizing stockholder

wealth as measured by the stock prices.

This might occur either because they are terrified

of the power stockholders have to replace them

or because they own enough stock in the firm

that maximizing stockholder wealth becomes

their primary objective as well.

2. The lenders to the firm feel secure that their interests

will be protected and that the firm will live up to its

contractual obligations.

This might occur for one of two reasons.

The first is that stockholders might be concerned

about the damage to the firm’s reputation if they

take actions that hurt lenders and about the

consequence of that damage for future borrowing.

The second is that lenders might be able to protect

themselves fully when they lend by writing in the

restrictions (covenants) that proscribe the firm’s

taking any actions that hurt the lenders.

3. The managers of the firm do not attempt to

mislead or lie to financial markets about their

future prospects, and there is sufficient

information for markets to make judgments about

the effects the firm’s actions on its value.

Markets are assumed to be reasoned and rational

in their assessment of these actions and the

consequent effects on stock price.

4. There are no burdens that are created for society,

in the form of health, pollution, or infrastructure

costs, in the process of stockholders wealth

maximization.

All costs created by firm in its pursuit of

stockholder wealth maximization can be traced

and charged to the firm.

With these assumptions, no other group is hurt as

stockholders maximize wealth, and stock prices

reflect stockholders wealth.

Consequently, managers can concentrate on one

objective-maximizing stock prices.

Agency Problem

The relationship between stockholders and

management is called an agency relationship.

Such a relationship exists whenever someone (the

principal) hires another (the agent) to represent

his/her interests.

For example, you might hire someone (an agent)

to sell a car that you own while you are away at

the place.

In all such relationships, there is a possibility of

conflict of interest between the principal and the

agent.

Such a conflict is called an agency problem.

Suppose that you hire someone to sell your car

and that you agree to pay that person a flat fee

when he/she sells the car.

The agent’s incentive in this case is to make the

sale, not necessarily to get you the best price.

If you offer a commission of, say, 10 percent of the

sales price instead of a flat fee, then this problem

might not exist.

In a large corporation, for example, the managers

may enjoy many fringe benefits, such as golf club

memberships, access to private jets, and company

cars.

These benefits (also called perquisites, or “perks”)

may be useful in conducting business and may help

attract or retain management personnel, but there is

room for abuse.

What if the managers start spending more time at

the golf course than at their desks?

What if they use the company jets for personal

travel?

What if they buy company cars for their teenagers to

drive?

The abuse of perquisites imposes costs on the

firm—and ultimately on the owners of the firm.

There is also a possibility that managers who feel

secure in their positions may not bother to

expend their best efforts toward the business.

This is referred to as shirking, and it too imposes a

cost to the firm.

Another possibility that managers will act in their

own self-interest, rather than in the interest of

the shareholders when those interests clash.

Finally, to see how management and stockholder

interests might differ, imagine that the firm is

considering a new investment.

The new investment is expected to favorably impact

the share value, but it is also a relatively risky

venture.

The owners of the firm will wish to take the

investment (because the stock value will rise), but

management may not because there is the possibility

that things will turn out badly.

If management does not take the investment, then

the stockholders may lose a valuable opportunity.

This is one example of an agency cost.

To mitigate the agency problem, the following

agency costs may incur:

1. Monitoring costs are costs incurred by the

principal to monitor or limit the actions of the

agent.

In a corporation, shareholders may require

managers to periodically report on their activities

via audited accounting statements, which are sent

to shareholders.

The accountants’ fees and the management time

lost in preparing such statements are monitoring

costs.

2. Bonding costs are incurred by agents to assure

principals that they will act in the principal’s best

interest.

The name comes from the agent’s promise or

bond to take certain actions.

A manager may enter into a contract that

requires him or her to stay on with the firm even

though another company acquires it.

3. Executive Compensation. Incentives may be

offered in the form of cash bonus and perks that

are linked to certain performance targets.

Stock options that grant managers the right

purchase equity shares at a certain price thereby

giving them a stake in ownership when certain

goals are achieved, and so on.

You might also like

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookFrom EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNo ratings yet

- Industry trends private equity investors considerDocument7 pagesIndustry trends private equity investors considerhelloNo ratings yet

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Document1 pageDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)GolamMostafaNo ratings yet

- What Is Corporate FinanceDocument12 pagesWhat Is Corporate FinanceAyush GargNo ratings yet

- 246680920-G-5-Calculation-DetailsDocument104 pages246680920-G-5-Calculation-DetailsTesfaye KebebawNo ratings yet

- Illumination NotesDocument16 pagesIllumination NotesANIL KUMARNo ratings yet

- Quiz Chapter-10 She-Part-1 2021Document4 pagesQuiz Chapter-10 She-Part-1 2021Hafsah Amod DisomangcopNo ratings yet

- 11 The Cost of CapitalDocument43 pages11 The Cost of CapitalMo Mindalano MandanganNo ratings yet

- Investor in PuneDocument66 pagesInvestor in PuneMooh SinghNo ratings yet

- Illumination FundDocument48 pagesIllumination FundAbhijeet Chaudhari100% (2)

- Role of A Financial ManagerDocument13 pagesRole of A Financial ManagerpratibhaNo ratings yet

- 101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Document3,032 pages101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Adwait BowlekarNo ratings yet

- FINANCE MANAGEMENT FIN420chp 1Document10 pagesFINANCE MANAGEMENT FIN420chp 1Yanty IbrahimNo ratings yet

- The Goal of Financial ManagementDocument6 pagesThe Goal of Financial ManagementFantayNo ratings yet

- Chapter 1 - Overview of Financial ManagementDocument11 pagesChapter 1 - Overview of Financial ManagementJoyluxxiNo ratings yet

- BSIS 2 Financial Management Week 3 4Document8 pagesBSIS 2 Financial Management Week 3 4Ace San GabrielNo ratings yet

- Introduction to Financial Management ChapterDocument13 pagesIntroduction to Financial Management Chapterriajul islam jamiNo ratings yet

- Aims of Finance FunctionDocument56 pagesAims of Finance FunctionBV3S100% (1)

- Understanding StrategiesDocument17 pagesUnderstanding StrategiesAfrilianiNo ratings yet

- Understand Finance to Make Better Business DecisionsDocument5 pagesUnderstand Finance to Make Better Business Decisionskazi A.R RafiNo ratings yet

- Maximizing shareholder wealth through financial management decisionsDocument12 pagesMaximizing shareholder wealth through financial management decisionsCarlo B CagampangNo ratings yet

- ACCOUNTING AND FINANCE FOR MANAGERS: OVERVIEW OF CORPORATE FINANCEDocument54 pagesACCOUNTING AND FINANCE FOR MANAGERS: OVERVIEW OF CORPORATE FINANCEHafeezNo ratings yet

- Introduction To Corporate FinanceDocument5 pagesIntroduction To Corporate FinanceToru KhanNo ratings yet

- 1st Midterm PDFDocument10 pages1st Midterm PDFMD Hafizul Islam HafizNo ratings yet

- Nombrado, Sean Lester CBET - 01 - 303A Review Questions Concept Review Questions Test QuestionsDocument5 pagesNombrado, Sean Lester CBET - 01 - 303A Review Questions Concept Review Questions Test QuestionsSean Lester S. NombradoNo ratings yet

- Chapter 1. The Financial Management FunctionDocument31 pagesChapter 1. The Financial Management Functionuroki galamatNo ratings yet

- Financial Management DBA1654Document130 pagesFinancial Management DBA1654Anbuoli ParthasarathyNo ratings yet

- FM Notes - Unit - 1Document17 pagesFM Notes - Unit - 1Shiva JohriNo ratings yet

- Objectives FM & Area of F.decisionDocument10 pagesObjectives FM & Area of F.decisionKashyapNo ratings yet

- Board of Directors Key to Corporate PolicymakingDocument5 pagesBoard of Directors Key to Corporate PolicymakingAnthony DeeNo ratings yet

- Financial Management NotesDocument70 pagesFinancial Management NotesSalmanJamilNo ratings yet

- CH 01Document20 pagesCH 01Thiện ThảoNo ratings yet

- Finance Theory: (Suitable For CFM / FAM & CF Candidates) Corporate FinanceDocument7 pagesFinance Theory: (Suitable For CFM / FAM & CF Candidates) Corporate FinanceLal LalNo ratings yet

- Need of Knowing Finance - A Managerial Perspective: Unit - 1 FINANCIAL MANAGEMENT (Corporate Finance)Document24 pagesNeed of Knowing Finance - A Managerial Perspective: Unit - 1 FINANCIAL MANAGEMENT (Corporate Finance)shaik masoodNo ratings yet

- The Scope of Corporate FinanceDocument2 pagesThe Scope of Corporate FinanceooitzandyooNo ratings yet

- Summary Corporate Finance (David Hillier, Lain Clacher, Stephen Ross, Randolph Westerfield, Bradford Jordan)Document44 pagesSummary Corporate Finance (David Hillier, Lain Clacher, Stephen Ross, Randolph Westerfield, Bradford Jordan)Akash JhaNo ratings yet

- Introduction To Finance - Week 1Document20 pagesIntroduction To Finance - Week 1Jason DurdenNo ratings yet

- MBA Finance Principles and ConceptsDocument17 pagesMBA Finance Principles and ConceptsmaheswaranNo ratings yet

- Financial ManagementDocument8 pagesFinancial Managementmandeep_kaur20No ratings yet

- Financial ManagementDocument7 pagesFinancial ManagementSarah SarahNo ratings yet

- FM Notes CFM 200Document72 pagesFM Notes CFM 200Nickson ulamiNo ratings yet

- Damodaran IntroductionDocument2 pagesDamodaran IntroductionmanjushreeNo ratings yet

- Christine Joy M. Digno - BSA3 Review QuestionsDocument3 pagesChristine Joy M. Digno - BSA3 Review QuestionsChristine DignoNo ratings yet

- FINANCIAL MANAGEMENT OBJECTIVES BEYOND PROFITDocument18 pagesFINANCIAL MANAGEMENT OBJECTIVES BEYOND PROFITsreelakshmisureshNo ratings yet

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document7 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloNo ratings yet

- Finance (QUES)Document14 pagesFinance (QUES)Yeasin TusherNo ratings yet

- Financial Management ReviewerDocument9 pagesFinancial Management ReviewerApril Joy ObedozaNo ratings yet

- SampleDocument6 pagesSampleMaya JoshiNo ratings yet

- ACC19 Financial Management: College of Accountancy and Business AdministrationDocument4 pagesACC19 Financial Management: College of Accountancy and Business Administrationjelyn bermudezNo ratings yet

- Unit I Financial MGT & Corporate GovernanceDocument15 pagesUnit I Financial MGT & Corporate GovernanceMiyonNo ratings yet

- Financial management objectives and sources of financeDocument9 pagesFinancial management objectives and sources of financeJie Yin SiowNo ratings yet

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document7 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloNo ratings yet

- Decision Analysis ModelingDocument6 pagesDecision Analysis ModelingSolve AssignmentNo ratings yet

- Corporate Finance Is The Area of Finance Dealing With Monetary Decisions That Business Enterprises Make and The Tools and Analysis Used To Make These DecisionsDocument4 pagesCorporate Finance Is The Area of Finance Dealing With Monetary Decisions That Business Enterprises Make and The Tools and Analysis Used To Make These DecisionsPoorva ModiNo ratings yet

- NATURE AND SCOPE OF STRATEGIC FINANCIAL MANAGEMENTDocument26 pagesNATURE AND SCOPE OF STRATEGIC FINANCIAL MANAGEMENTRahat JaanNo ratings yet

- Finance Compendium PartI DMS IIT DelhiDocument29 pagesFinance Compendium PartI DMS IIT Delhinikhilkp9718No ratings yet

- Financial Management Goals and Decision AreasDocument3 pagesFinancial Management Goals and Decision AreasAira MalinabNo ratings yet

- Escobal, Al Bsba - Finman 1 - FinalsDocument3 pagesEscobal, Al Bsba - Finman 1 - FinalsAlden EscobalNo ratings yet

- CORPORATE FINANCE TOPICSDocument8 pagesCORPORATE FINANCE TOPICSAbdallah SadikiNo ratings yet

- MFRD EssayDocument6 pagesMFRD Essaydoll3kittenNo ratings yet

- Introduction To Financial ManagementDocument6 pagesIntroduction To Financial ManagementDrveerapaneni SuryaprakasaraoNo ratings yet

- FMDocument22 pagesFMFiona MiralpesNo ratings yet

- Formulation of Financial StrategyDocument52 pagesFormulation of Financial Strategyarul kumarNo ratings yet

- Chapter 1 Introduction - Chapter 2 Industrial ProfileDocument74 pagesChapter 1 Introduction - Chapter 2 Industrial Profilebalki123No ratings yet

- Fundamentals of Finance and Financial ManagementDocument4 pagesFundamentals of Finance and Financial ManagementCrisha Diane GalvezNo ratings yet

- UNIT- 7Document37 pagesUNIT- 7Tesfaye KebebawNo ratings yet

- 9Document7 pages9Tesfaye KebebawNo ratings yet

- PeachtreeDocument179 pagesPeachtreeTesfaye KebebawNo ratings yet

- Bba 104Document418 pagesBba 104Alma Landero100% (1)

- Accounting For State and Local Governmental Units - Governmental FundsDocument53 pagesAccounting For State and Local Governmental Units - Governmental FundsJamaNo ratings yet

- Basic Home Office Electrical Electronic Equipment ServicingDocument48 pagesBasic Home Office Electrical Electronic Equipment ServicingTesfaye KebebawNo ratings yet

- Lecture - Notes On PayrollDocument20 pagesLecture - Notes On Payrollkemmys100% (1)

- chapter 1 Fund accounting handoutDocument7 pageschapter 1 Fund accounting handoutTesfaye KebebawNo ratings yet

- Basic Electrical Electronic Equipment ServicingDocument50 pagesBasic Electrical Electronic Equipment ServicingTesfaye KebebawNo ratings yet

- OS BEE L1Document50 pagesOS BEE L1Tesfaye KebebawNo ratings yet

- Lecture (3d) - Calculating Illuminance LevelsDocument19 pagesLecture (3d) - Calculating Illuminance LevelsNuno HenriquesNo ratings yet

- Basic Electronic Communication and Multimedia Equipment ServicingDocument56 pagesBasic Electronic Communication and Multimedia Equipment ServicingTesfaye KebebawNo ratings yet

- Home Design BookletDocument30 pagesHome Design BookletfredliveNo ratings yet

- 49NANO85UNADocument71 pages49NANO85UNATesfaye KebebawNo ratings yet

- HDFC Small Cap Fund - Regular PlanDocument1 pageHDFC Small Cap Fund - Regular Planmrm26702No ratings yet

- Partnership FARDocument22 pagesPartnership FARAngel Mae SalvadorNo ratings yet

- Assignment 1Document9 pagesAssignment 1Seemab KanwalNo ratings yet

- Accounting FinanceDocument4 pagesAccounting FinanceAni ChristyNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Home Office Core Competency Framework ReviewDocument18 pagesHome Office Core Competency Framework ReviewBambi SantosNo ratings yet

- Midterm - Quiz - AEC6Document4 pagesMidterm - Quiz - AEC6aprilNo ratings yet

- Statement 028201000028352Document6 pagesStatement 028201000028352Saravanan 75No ratings yet

- Chapter 8 Financial StatementDocument34 pagesChapter 8 Financial StatementMuhammad AfzalNo ratings yet

- Chapter 1 - Solution Manual PDFDocument32 pagesChapter 1 - Solution Manual PDFNatalie ChoiNo ratings yet

- ASSET 2019 Mock Boards - AFARDocument8 pagesASSET 2019 Mock Boards - AFARKenneth Christian Wilbur0% (1)

- Test Bank For Fundamentals of Investing 12th Edition Scott B Smart Lawrence J Gitman Michael D JoehnkDocument24 pagesTest Bank For Fundamentals of Investing 12th Edition Scott B Smart Lawrence J Gitman Michael D JoehnkKathyChristiancxpy100% (42)

- HO - 01 Audit of Cash (20230331100112)Document3 pagesHO - 01 Audit of Cash (20230331100112)Roque LestieNo ratings yet

- Faysal Ahmed ResumeDocument2 pagesFaysal Ahmed ResumeFaysal AhmedNo ratings yet

- PT Florist Gump December 2020 Financial StatementDocument9 pagesPT Florist Gump December 2020 Financial StatementSu MiniNo ratings yet

- e-StatementBRImo 365101028091534 Jul2023 20230719 170434-1Document6 pagese-StatementBRImo 365101028091534 Jul2023 20230719 170434-1Nyonya OvieNo ratings yet

- Grace SalesDocument10 pagesGrace SalesJoy Angelique JavierNo ratings yet

- Principles of AccountsDocument38 pagesPrinciples of AccountsRAMZAN TNo ratings yet

- Final Exam for English IV ClassDocument3 pagesFinal Exam for English IV ClassDavid CarbajalNo ratings yet

- Montajes - Joelyn Grace 117848 Seatwork 2Document9 pagesMontajes - Joelyn Grace 117848 Seatwork 2Joelyn Grace MontajesNo ratings yet

- Ciq Financials MethodologyDocument25 pagesCiq Financials Methodologysanti_hago50% (2)

- Construction Contract Accounting QuestionsDocument5 pagesConstruction Contract Accounting QuestionsCarlo ParasNo ratings yet

- Exercicios Do Capitulo 4 (Finanças Empresariais)Document3 pagesExercicios Do Capitulo 4 (Finanças Empresariais)Gonçalo AlmeidaNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisKamran Ali AnsariNo ratings yet

- Ls 5 Business FinanceDocument5 pagesLs 5 Business FinanceDimple McTurtleNo ratings yet