Professional Documents

Culture Documents

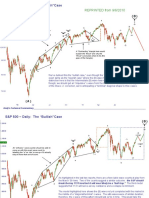

REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"Case

Uploaded by

AndysTechnicalsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"Case

Uploaded by

AndysTechnicalsCopyright:

Available Formats

S&P 500 ~ Daily: The “Bearish”Case

(B)

“y”

e

REPRINTED from 9/12/2010 c b

“b”

a c e

“w” a

g

a

e d

c

d

“x” b “a”

b

c f

This model was highlighted last week--it suggests that the “b” wave is concluding

right now. The requirements for this count would be a strong/impulsive move

lower this week. This model implies a market crash to the mid-800s over the

next two months.

d

a

Last week I wrote: “My main problem with this interpretation is the lack of

b ‘Fibonacci’ relationships between the alternating legs. There are no such

relationships present as there should be in such a set up. I’m open to the idea

that I’m “’missing something.’” Indeed, I was missing something. The c-wave

was 123.6% of a-wave and the d-wave was 78.6% of b-wave. So, Fibonacci

relationships do exist in the alternating legs. In other words, a triangle “b” wave is

a good possibility. The e-wave has violated the a-c line, which is allowable and

somewhat necessary as there can only be FOUR touch points on a triangle.

Unfortunately, it will take a violation of the the b-d line to confirm this model.

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily: “Bearish”Case

(B) This “bearish” model highlighted two weeks ago is actually still “alive,” though it’s running out of time. The e-

“y” wave of a contracting triangle cannot be the largest or most time-consuming leg of a contracting triangle,

e therefore it cannot exceed the top or side of the blue dashed box. In other words, this wave MUST be

completing right now and the market must begin impulsing lower immediately. Breaking above 1158 will kill

this model and open up wave counts that require more price action higher.

“b”

e

a

c

c d

“a”

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily: The “Bullish”Case

REPRINTED from 9/7/2010: This would be the wave count that

would remain if 1158 is bested. The market seems to be following the path (B)

highlighted on 9/7/2010, so no new chart was reproduced. a “y”

c

-5-

-3-

b

An “orthodox” wave counter should be able to “w” -1-

come up with this exact wave count by d

g

labelling the “w” an ‘abc’ move up--it’s actually -4-

easy to force that sort of count.

e

“x”

e

c

-2-

a

b

c f

A “Contracting” triangle here would

explain the “thrust” and why the

“thrust” concluded where it did (the

apex of the triangle.)

d

a

b

We’ve dubbed this the “bullish case,” even though the ‘effective’ price action could be the

exact same as the “bearish case” where the (B) wave has already peaked. The important

distinction here is that the Intermediate (B) wave has not yet concluded. In this model,

though, we should get an “impulsive” c-wave from the b-wave low. Because of the depth

of the Wave -2- correction, we’re anticipating a “terminal” diagonal shape to this c-wave.

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily: Support and Resistance

Highlighted here are the key support and resistance points for the week ahead. 1174 has been

on our radar screen for a few weeks now--this looks like the second level of resistance if 1158 is

bettered. Support comes in at 1129 and 1111, which are the 23.6% and 38.2% retrace of the

last leg higher. Those points also align well with classic support levels. Bulls who believe that

the Fed will continue to inflate asset prices through quantitative easing might want to use those

levels for stop-loss strategies.

Andy’s Technical Commentary__________________________________________________________________________________________________

LEFT

DXY (Weekly) SHOULDER

RIGHT

“d” SHOULDER

“b” (developing)

e

(A) 88.71

The strength of this retracement

means this is NOT a Wave-2 as

many EW’ers are calling it.

HEAD c

d

w

a

77.69

“a” 77.28

y

b “e”?

“c” (B)

I’m still counting the whole pattern as a “neutral” triangle where the “c” is the longest wave and the (B) has

not yet concluded. The move down from 88.71 is an “odd” shape that is best counted as a correction with an

x-wave. The bounce in the middle of the pattern was too short-lived to be considered the b-wave of a “zig-

zag” or a “flat.” There is support for the DXY between 77.69 and 77.28. The first level is the terminus of the

“a” wave while 77.28 is the 78.6% retrace of the entire advance, a level that will attract technical buying. We

are expecting bottoming action in the DXY within the next several trading days.

Andy’s Technical Commentary__________________________________________________________________________________________________

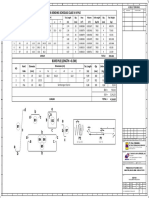

Sugar #11 - Daily (Non-Log)

Sugar, once the “hottest” commodity on the board, has now fallen 50%.

However, there are some signs that this current washout is coming to a

“2” conclusion. The markets seems to be breaking down out of a triangle

-2- formation, which suggest that the next leg down might be the conclusion of

this move. The entire wave resembles an “impulsive” five wave structure. If

the final Wave “5” looks like “1”, then we should get a bottom near 14c/lb in

the next several days.

-4-

“1” -1-

-3-

2

REPRINTED from 4/25/2010

The light blue line would be the

Elliott Wave Channel for the

proposed “impulse” lower. -5-

1 4

a

-b-

3 c

“4”

5 e

“3”

-a-

d

-c-

b

Andy’s Technical Commentary__________________________________________________________________________________________________

Sugar #11 - Daily (Non-Log)

(B)

b “c”

5

(2)

Our last look at Sugar highlighted the triangular nature of the market as it

a (1) (4) prepared for the last leg lower. We were expecting the initial (A) wave to 3

conclude very shortly. Indeed, that it was what occurred. The overall

move lower from the all time highs is now best counted as “double.” The 4

(3)

-2- subsequent rebound appears to be a (B) wave involving a powerful

running triangle “b”-wave.

1

-1- b d

-4- 2

a

“a”

e

-3- c “b”

-5- “x” c Given the powerful reversal of the

c e last two days, Sugar is probably in

“w” b the early stages of a (C) wave which

d should send Sugar as low as 17c/lb.

a This looks like a “sell rallies”

b

market for awhile.

c Truncated c-wave

“y”

a

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocument7 pagesREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsNo ratings yet

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- S&P 500 Update 25 Apr 10Document7 pagesS&P 500 Update 25 Apr 10AndysTechnicalsNo ratings yet

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- Market Update 29 Aug 10Document13 pagesMarket Update 29 Aug 10AndysTechnicalsNo ratings yet

- Sugar Nov 28 2009Document9 pagesSugar Nov 28 2009AndysTechnicalsNo ratings yet

- IMSLP553061-PMLP146961-Hume - Duke John of Polland His Galiard, No.39 - Music NotationDocument1 pageIMSLP553061-PMLP146961-Hume - Duke John of Polland His Galiard, No.39 - Music Notationmichel kowalevskyNo ratings yet

- Duke John of Polland His Galiard: Tenor ViolDocument1 pageDuke John of Polland His Galiard: Tenor ViolLeandro MarquesNo ratings yet

- T.311 Ref BbsDocument1 pageT.311 Ref BbsAditya AjiNo ratings yet

- T.300 Ref BbsDocument1 pageT.300 Ref BbsAditya AjiNo ratings yet

- For Architectural & Construction Design - Scale Sheet No. Owner Name: Land NoDocument1 pageFor Architectural & Construction Design - Scale Sheet No. Owner Name: Land NoAuto IndustryNo ratings yet

- Abc Pirates B Island Worksheet Color Write Circle PDFDocument1 pageAbc Pirates B Island Worksheet Color Write Circle PDFevaNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- Sample Data For SalesforceDocument3 pagesSample Data For SalesforceVarun DongreNo ratings yet

- T.318 Ref BbsDocument1 pageT.318 Ref BbsAditya AjiNo ratings yet

- Proporcion Ultimo de Los UltimosDocument1 pageProporcion Ultimo de Los UltimosBRUGNERA DURAN SOL STEFANIA FADU - UBANo ratings yet

- T.309 Ref BbsDocument1 pageT.309 Ref BbsAditya AjiNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- Live Worksheets AnswersDocument1 pageLive Worksheets AnswersVeselin PavlovNo ratings yet

- Manual Brahum Minipimer 5Document16 pagesManual Brahum Minipimer 5Tito NavasNo ratings yet

- Type-A Type-B Type-C Type-H Type-S: Dimensions (MM) Radius Total Length Notes A B C D e (MM) (M) Cutting Length (MM)Document2 pagesType-A Type-B Type-C Type-H Type-S: Dimensions (MM) Radius Total Length Notes A B C D e (MM) (M) Cutting Length (MM)ybm987No ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- ELP Worksheet 17 - NVRDocument9 pagesELP Worksheet 17 - NVRMrs N GaniNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- Footing Reinforcement: D19 - 200 (60 BESI) ADocument1 pageFooting Reinforcement: D19 - 200 (60 BESI) AAHMAD VALHEINNo ratings yet

- 9 Thbiochp 3Document2 pages9 Thbiochp 3Dezi ShahNo ratings yet

- Solar ControlDocument5 pagesSolar ControlTaehyun KangNo ratings yet

- Slab at First FloorDocument1 pageSlab at First Floorsudha ojhaNo ratings yet

- Calculo de AceroDocument1 pageCalculo de AceroChecoValenciaNo ratings yet

- Kiesha Locklear Portfolio 2020Document17 pagesKiesha Locklear Portfolio 2020Kiesha LocklearNo ratings yet

- Complete Score (Tablature)Document2 pagesComplete Score (Tablature)simantonstefanNo ratings yet

- Bios Form Outlines, Outcomes, OrganizersDocument2 pagesBios Form Outlines, Outcomes, OrganizersBarangay Pariancillo VillaNo ratings yet

- BenedictusDocument2 pagesBenedictusCarsten12345No ratings yet

- S&P 500 Update 19 Mar 10Document8 pagesS&P 500 Update 19 Mar 10AndysTechnicalsNo ratings yet

- 9 Thbio 40 Maks 1 STDocument1 page9 Thbio 40 Maks 1 STDezi ShahNo ratings yet

- SpikedStar A4 ByverticeesDocument5 pagesSpikedStar A4 ByverticeesFlorencia GiangarraNo ratings yet

- SpikedStar Letter ByVerticeesDocument5 pagesSpikedStar Letter ByVerticeesFlorencia GiangarraNo ratings yet

- Form 3 Review 5 Vocabulary WorksheetDocument1 pageForm 3 Review 5 Vocabulary Worksheetiimango miaiiNo ratings yet

- CAE Exam Practice WorksheetDocument1 pageCAE Exam Practice WorksheetVeselin PavlovNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Um Brinde À AmizadeDocument2 pagesUm Brinde À Amizadesorriso8No ratings yet

- T.298 Ref BbsDocument1 pageT.298 Ref BbsAditya AjiNo ratings yet

- Al Saad General Contracting: Project Name: BCC Engineer: SKP Zone: 3 Type: STAIRS ST01 B1 To L2Document3 pagesAl Saad General Contracting: Project Name: BCC Engineer: SKP Zone: 3 Type: STAIRS ST01 B1 To L2TONY BOULOSNo ratings yet

- Graphalgorithms-Bfs and DfsDocument14 pagesGraphalgorithms-Bfs and Dfsjayit sahaNo ratings yet

- I Do Not Recommend That You Be A Gossipy Person. in This Case Just Discreetly Tell Your Friend To Talk To His Brother and Advise HimDocument1 pageI Do Not Recommend That You Be A Gossipy Person. in This Case Just Discreetly Tell Your Friend To Talk To His Brother and Advise Himrafael gomezNo ratings yet

- Remote Workers Work Longer, Not More Efficiently - The EconomistDocument4 pagesRemote Workers Work Longer, Not More Efficiently - The EconomistmemorableNo ratings yet

- Remote Workers Work Longer, Not More Efficiently - The EconomistDocument4 pagesRemote Workers Work Longer, Not More Efficiently - The EconomistmemorableNo ratings yet

- Poilygon 1Document1 pagePoilygon 1Nunsavath ajay AjayNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Recercada Sobre La SpagnaDocument2 pagesRecercada Sobre La Spagnapiao_chengNo ratings yet

- PlanesDocument2 pagesPlaneskillerk5555No ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Technical Sheet Vacuum Tube Collectors CVTDocument2 pagesTechnical Sheet Vacuum Tube Collectors CVTgonzalez2678No ratings yet

- Seinfelt - The CheesecakeDocument31 pagesSeinfelt - The Cheesecakeseinfelt100% (2)

- Particle FilterDocument16 pagesParticle Filterlevin696No ratings yet

- JICA Helmya DCC Building FFDocument4 pagesJICA Helmya DCC Building FFMuhammad ElbarbaryNo ratings yet

- Usp3 ComDocument5 pagesUsp3 ComMike MelgaNo ratings yet

- Mrr2 Why The Future Doesnt Need UsDocument3 pagesMrr2 Why The Future Doesnt Need UsSunshine Glory EgoniaNo ratings yet

- Public Area Attendant ServicingDocument12 pagesPublic Area Attendant ServicingLawrence Cada Nofies100% (2)

- Zielinski AnArcheology For AnArchivesDocument10 pagesZielinski AnArcheology For AnArchivesPEDRO JOSENo ratings yet

- Freeman Has Been A Partner in A Commercial Construction CompanyDocument1 pageFreeman Has Been A Partner in A Commercial Construction CompanyMuhammad ShahidNo ratings yet

- Air Defence Systems: Export CatalogueDocument105 pagesAir Defence Systems: Export CatalogueserrorysNo ratings yet

- Monorail Hoist SystemDocument17 pagesMonorail Hoist SystemypatelsNo ratings yet

- Unit-I Basic Concepts: Course Code: BTCS9504 Course Name: Network Operating SystemsDocument17 pagesUnit-I Basic Concepts: Course Code: BTCS9504 Course Name: Network Operating SystemsPradeep BediNo ratings yet

- ECE3073 P4 Bus Interfacing Answers PDFDocument3 pagesECE3073 P4 Bus Interfacing Answers PDFkewancamNo ratings yet

- December 2022 Issue: More Transparency, P S An R T e R o M, y C en Ar P P, y PDocument24 pagesDecember 2022 Issue: More Transparency, P S An R T e R o M, y C en Ar P P, y Pwpp8284No ratings yet

- Subordination, Non - Disturbance and Attornment AgreementDocument7 pagesSubordination, Non - Disturbance and Attornment AgreementDavid CromwellNo ratings yet

- A-Health Advance - Application Form With InstructionsDocument14 pagesA-Health Advance - Application Form With InstructionsExsan OthmanNo ratings yet

- Module 1-Mathematics As A Language: Maribel D. Cariñ0Document4 pagesModule 1-Mathematics As A Language: Maribel D. Cariñ0KhalidNo ratings yet

- Nickel 200 201 PDFDocument20 pagesNickel 200 201 PDFwdavid81No ratings yet

- 4th - STD - MM - Kerala Reader Malayalam Vol 1Document79 pages4th - STD - MM - Kerala Reader Malayalam Vol 1Rajsekhar GNo ratings yet

- 3.3 (B) Mole N MassDocument20 pages3.3 (B) Mole N MassFidree AzizNo ratings yet

- Manual de Caja Eaton Fuller ET20113Document22 pagesManual de Caja Eaton Fuller ET20113Juan Gomez100% (3)

- Iraqi Portal of Knowledge and Heritage With Format Edits - 11-21-2023Document6 pagesIraqi Portal of Knowledge and Heritage With Format Edits - 11-21-2023محمد الكربلائيNo ratings yet

- Brochure Mastertile TilingDocument48 pagesBrochure Mastertile TilingMaha Mufleh100% (1)

- Mindset For IELTS Level 1 Student's Book PDF English As A Second or Foreign Language International English Language TestinDocument1 pageMindset For IELTS Level 1 Student's Book PDF English As A Second or Foreign Language International English Language TestinhiNo ratings yet

- Y2V7 Full With SSDocument294 pagesY2V7 Full With SSAyanokoji KyotakaNo ratings yet

- Fulltext PDFDocument454 pagesFulltext PDFVirmantas JuoceviciusNo ratings yet

- Augusta Issue 1145 - The Jail ReportDocument24 pagesAugusta Issue 1145 - The Jail ReportGreg RickabaughNo ratings yet

- Logical Database Design ModelingDocument2 pagesLogical Database Design ModelingGio Agudo100% (1)

- Cure Jealousy WorksheetsDocument20 pagesCure Jealousy WorksheetsSelina CothrenNo ratings yet

- Unit-4.Vector CalculusDocument32 pagesUnit-4.Vector Calculuskhatua.deb87No ratings yet