Professional Documents

Culture Documents

Valuing Compulsorily Convertible Debentures Example

Uploaded by

PRITEE0 ratings0% found this document useful (0 votes)

281 views3 pagesThe document discusses the valuation of compulsorily convertible debentures (CCDs) using an example. It provides the issue price, par value, conversion price, interest rate, redemption terms and expected returns to calculate the value to the investor and cost to the issuer. The CCDs issued at Rs. 500 per debenture provide an overall return of 10.2% to the investor. For the issuer, the cost of issuing the CCDs works out to 7.6% per annum.

Original Description:

Original Title

CCD

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the valuation of compulsorily convertible debentures (CCDs) using an example. It provides the issue price, par value, conversion price, interest rate, redemption terms and expected returns to calculate the value to the investor and cost to the issuer. The CCDs issued at Rs. 500 per debenture provide an overall return of 10.2% to the investor. For the issuer, the cost of issuing the CCDs works out to 7.6% per annum.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

281 views3 pagesValuing Compulsorily Convertible Debentures Example

Uploaded by

PRITEEThe document discusses the valuation of compulsorily convertible debentures (CCDs) using an example. It provides the issue price, par value, conversion price, interest rate, redemption terms and expected returns to calculate the value to the investor and cost to the issuer. The CCDs issued at Rs. 500 per debenture provide an overall return of 10.2% to the investor. For the issuer, the cost of issuing the CCDs works out to 7.6% per annum.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 3

VALUING COMPULSORILY CONVERTIBLE DEBENTURES

Example

Issue price of CCD – Rs. 500

Par value of CCD – Rs. 500

Issue date – 1 Jan 2014

Convertible portion

50% of the par value convertible

Conversion date – 1 Jul 2015

Conversion price – Rs. 25 per share (CMP – Rs. 22.5 per share)

Conversion ratio – 10:1

Interest rate – 8% p.a. payable semi-annually

Non-convertible portion to be redeemed in two equal instalments at the end of 4 and 5 years.

Expected return on debt – 10%

Expected return on equity – 15%

Tax rate – 30%

CF2, PGP1, TERM 3, IIMU 1

VALUING COMPULSORILY CONVERTIBLE DEBENTURES

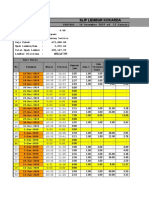

COMPULSORILY CONVERTIBLE DEBENTURES EXAMPLE - VALUE TO INVESTOR

Rs

Interest Redemption Equity shares Total

Value to investor 99 163 225 487

Discount rate/ Rate of return 10.0% 10.0% 15.0% 10.2%

01-Jan-14 - - - (500.00)

30-Jun-14 20.00 - - 20.00

31-Dec-14 20.00 - - 20.00

30-Jun-15 20.00 - 277.21 297.21

31-Dec-15 10.00 - - 10.00

30-Jun-16 10.00 - - 10.00

31-Dec-16 10.00 - - 10.00

30-Jun-17 10.00 - - 10.00

31-Dec-17 10.00 125.00 - 135.00

30-Jun-18 5.00 - - 5.00

31-Dec-18 5.00 125.00 - 130.00

CF2, PGP1, TERM 3, IIMU 2

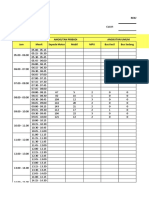

VALUING COMPULSORILY CONVERTIBLE DEBENTURES

COMPULSORILY CONVERTIBLE DEBENTURES EXAMPLE - COST TO ISSUER

Rs

Interest (post- Redemption Equity shares Total

tax)

Cost to issuer 7.6%

01-Jan-14 - - - 500.00

30-Jun-14 (14.00) - - (14.00)

31-Dec-14 (14.00) - - (14.00)

30-Jun-15 (14.00) - (277.21) (291.21)

31-Dec-15 (7.00) - - (7.00)

30-Jun-16 (7.00) - - (7.00)

31-Dec-16 (7.00) - - (7.00)

30-Jun-17 (7.00) - - (7.00)

31-Dec-17 (7.00) (125.00) - (132.00)

30-Jun-18 (3.50) - - (3.50)

31-Dec-18 (3.50) (125.00) - (128.50)

CF2, PGP1, TERM 3, IIMU 3

You might also like

- Bahbood Savings Certificates Profit RatesDocument2 pagesBahbood Savings Certificates Profit Ratesadnan haiderNo ratings yet

- Traffic Count at JunctionDocument101 pagesTraffic Count at JunctionDhurbaNo ratings yet

- JNN1Document8 pagesJNN1Jorge Hebert Terceros GarronNo ratings yet

- Daily schedule and activities documentDocument5 pagesDaily schedule and activities documenthassan84No ratings yet

- Daily, Weekly, Monthly Rig Performance (July 2012)Document14 pagesDaily, Weekly, Monthly Rig Performance (July 2012)Hasrika 017No ratings yet

- Repayment ModelDocument18 pagesRepayment ModelUmair GardeziNo ratings yet

- Tabel. Volume Lalu Lintas Di Jalan Poros Ke Desa Pangadaala Dan Arah Ke Kecamatan LuyoDocument2 pagesTabel. Volume Lalu Lintas Di Jalan Poros Ke Desa Pangadaala Dan Arah Ke Kecamatan LuyoLukmanul HakimNo ratings yet

- Time Agenda Raport ActivitateDocument2 pagesTime Agenda Raport ActivitateadyNo ratings yet

- Producción de PL y DL-14122020Document15 pagesProducción de PL y DL-14122020Luis Gustavo Soto BardalesNo ratings yet

- Final Data Count Sheet Edited 1Document30 pagesFinal Data Count Sheet Edited 1angelojonard71No ratings yet

- CASTRO, Worksheet 2 My Target Heart RateDocument4 pagesCASTRO, Worksheet 2 My Target Heart RateEnrico Nathanielle CastroNo ratings yet

- PBA W.E.F 12 04 23Document2 pagesPBA W.E.F 12 04 23Rashid AhmadaniNo ratings yet

- Contoh LemburDocument4 pagesContoh Lemburade luthfiNo ratings yet

- PT Refined Bangka Tin generator operation dataDocument148 pagesPT Refined Bangka Tin generator operation datagenset unitedNo ratings yet

- Daimon SWP Tebar 1 Desember 2022 Meeting, Simulasi Cost, Pak Ismu Program Pakan 12 Jan 2023Document1,192 pagesDaimon SWP Tebar 1 Desember 2022 Meeting, Simulasi Cost, Pak Ismu Program Pakan 12 Jan 2023richoo RibuNo ratings yet

- LHR 12 APRIL 2024Document95 pagesLHR 12 APRIL 2024pyonarendra777No ratings yet

- Monthly Sales Report For Traditional BingoDocument1 pageMonthly Sales Report For Traditional BingoJP De La PeñaNo ratings yet

- Industrial PageDocument1 pageIndustrial PageEdAchadoNo ratings yet

- PTC FACULTY LOAD 2022-2023.xlsx - BAHOYODocument1 pagePTC FACULTY LOAD 2022-2023.xlsx - BAHOYOreagan ricafortNo ratings yet

- PMP Practice Exams and AnswersDocument36 pagesPMP Practice Exams and AnswersAmeni HaguiNo ratings yet

- Tabel Data Survei Volume Lalu Lintas JL.Document9 pagesTabel Data Survei Volume Lalu Lintas JL.Andi Putri Aulya UtamiNo ratings yet

- Time Table w27 (01st July - 07th July) - 1Document1 pageTime Table w27 (01st July - 07th July) - 1Abhay ChauhanNo ratings yet

- Rekap TC SamratulangiDocument10 pagesRekap TC SamratulangiTYOCLALUGUANTENGNo ratings yet

- Planilha Gerenciamento de RiscoDocument49 pagesPlanilha Gerenciamento de RiscoThi GeneralNo ratings yet

- Analisis Curah HujanDocument3 pagesAnalisis Curah HujanLutfi RagerisNo ratings yet

- December 27, 2020 - January 2, 2021: Dec 21 Dec 22 Dec 23 Dec 24 Dec 25 Dec 26 Friday SaturdayDocument54 pagesDecember 27, 2020 - January 2, 2021: Dec 21 Dec 22 Dec 23 Dec 24 Dec 25 Dec 26 Friday SaturdaySusan ShenNo ratings yet

- Jadwal MengajarDocument9 pagesJadwal MengajarAlex BrianNo ratings yet

- JL - Kartini 3Document83 pagesJL - Kartini 3anjayp396No ratings yet

- Individual & Combined Summary of P807 & P854 March 2021 - August 2023 Concrete ProductionDocument3 pagesIndividual & Combined Summary of P807 & P854 March 2021 - August 2023 Concrete ProductionMymp MympopNo ratings yet

- LHR Data Lalin KedungcinoDocument20 pagesLHR Data Lalin KedungcinoAbel AgustaNo ratings yet

- Palyabeosztas 2021.12.20 26 - 1Document3 pagesPalyabeosztas 2021.12.20 26 - 1fishNo ratings yet

- 1 Liq. Pesos 305 Actualizada A Noviembre de 2018Document13 pages1 Liq. Pesos 305 Actualizada A Noviembre de 2018Danilo Acosta PerezNo ratings yet

- Saturday Sunday Monday Tuesday Wednesday Thursday FridayDocument4 pagesSaturday Sunday Monday Tuesday Wednesday Thursday FridayXai MishimoraNo ratings yet

- Rekapitulasi Survei Pencacahan Lalu LintasDocument64 pagesRekapitulasi Survei Pencacahan Lalu LintasRiscealNo ratings yet

- Content by Title: 758 Page Titles Were Viewed A Total of 1,794 TimesDocument14 pagesContent by Title: 758 Page Titles Were Viewed A Total of 1,794 TimesCyno PhagieNo ratings yet

- Executive Chef / Executive Sous Chef Sr. Sous Chef / Sous Chef Jr. Sous Chef/Sr. CDPDocument8 pagesExecutive Chef / Executive Sous Chef Sr. Sous Chef / Sous Chef Jr. Sous Chef/Sr. CDPapi-3749066No ratings yet

- Classified Vehicular CountDocument14 pagesClassified Vehicular Countangelojonard71No ratings yet

- Tim, e TableDocument4 pagesTim, e Table陳富豪No ratings yet

- EmploiDocument1 pageEmploielbaine chaimaeNo ratings yet

- Tabel Dan Grafik DataDocument73 pagesTabel Dan Grafik DataAndi Nur IchsanNo ratings yet

- Traffic survey recap on Jl Abdurahman Saleh 2 streetDocument21 pagesTraffic survey recap on Jl Abdurahman Saleh 2 streetzaima maghfirohNo ratings yet

- Turno DIA Turno Noche: Consumo de ReactivosDocument8 pagesTurno DIA Turno Noche: Consumo de ReactivosCHARLES DANIEL JACAY LINONo ratings yet

- Data Pengoprasian Genset 2021Document30 pagesData Pengoprasian Genset 2021genset unitedNo ratings yet

- Genset operation monitoring formDocument30 pagesGenset operation monitoring formgenset unitedNo ratings yet

- Planilha Gerenciamento de RiscoDocument49 pagesPlanilha Gerenciamento de RiscoJosiane SilvaNo ratings yet

- Biometric Attendence SheetDocument3 pagesBiometric Attendence Sheetai terminalNo ratings yet

- Monthly Gaming Revenue ReportDocument1 pageMonthly Gaming Revenue ReportJP De La PeñaNo ratings yet

- Acaschedule IIDocument2 pagesAcaschedule IIArun ShrivasanNo ratings yet

- Traffic and Rainfall Report for Carolina - Salcipuedes RoadDocument3 pagesTraffic and Rainfall Report for Carolina - Salcipuedes RoadWilbert ComunNo ratings yet

- Os Per 31 Okt 2017Document284 pagesOs Per 31 Okt 2017Mo MakaroniNo ratings yet

- December 29, 2019 - January 4, 2020: Dec 30 Dec 31 Jan 2 Jan 3Document53 pagesDecember 29, 2019 - January 4, 2020: Dec 30 Dec 31 Jan 2 Jan 3Michella HutaurukNo ratings yet

- Jurnal PKLDocument2 pagesJurnal PKLFerdinan Yuli SetiawanNo ratings yet

- Tentative Bidding CalculationDocument2 pagesTentative Bidding CalculationSunny RathNo ratings yet

- Anova Ancova Aman-SeenDocument32 pagesAnova Ancova Aman-SeenmulerstarNo ratings yet

- Assignment 2 - Jose PosadaDocument9 pagesAssignment 2 - Jose Posadajposada66No ratings yet

- CLASSE 1-CE-X08-C Cours Du Jour: Cbc-Bruxelles Imprimé Le 12/08/2021Document1 pageCLASSE 1-CE-X08-C Cours Du Jour: Cbc-Bruxelles Imprimé Le 12/08/2021Gaëtan PoquetNo ratings yet

- LHR 9 APRIL 2024Document90 pagesLHR 9 APRIL 2024pyonarendra777No ratings yet

- Time Sheet - Dec'22Document1 pageTime Sheet - Dec'22Sydney DorairajNo ratings yet

- Log Sheet BH-1Document6 pagesLog Sheet BH-1dimas redindaNo ratings yet

- Walter and Gordon Models - ExamplesDocument4 pagesWalter and Gordon Models - ExamplesPRITEENo ratings yet

- Standing Order ActDocument13 pagesStanding Order ActPRITEENo ratings yet

- Class 01 (A) Masih - IIM-Microsoft Advanced Excel TrainingDocument85 pagesClass 01 (A) Masih - IIM-Microsoft Advanced Excel TrainingPRITEENo ratings yet

- CF-II Notes PDFDocument24 pagesCF-II Notes PDFPRITEENo ratings yet

- DCF Valuation - ExampleDocument8 pagesDCF Valuation - ExamplePRITEENo ratings yet

- RedBrandCannersExhibits StudentDocument8 pagesRedBrandCannersExhibits StudentPRITEENo ratings yet

- Coverage and Related Ratios - CompletedDocument8 pagesCoverage and Related Ratios - CompletedPRITEENo ratings yet

- Relative Valuation - Example PDFDocument1 pageRelative Valuation - Example PDFPRITEENo ratings yet

- MertonTruckCompanyCaseExhibit StudentDocument7 pagesMertonTruckCompanyCaseExhibit StudentPRITEENo ratings yet

- EBIT-EPS ANALYSISDocument2 pagesEBIT-EPS ANALYSISKuntalDekaBaruahNo ratings yet

- Cell Name Original Value Final ValueDocument4 pagesCell Name Original Value Final ValuePRITEENo ratings yet

- Session #7: Analyzing Bran Production and Costing at Lilac Flour MillsDocument8 pagesSession #7: Analyzing Bran Production and Costing at Lilac Flour MillsPRITEENo ratings yet

- Devesh OR Notes - Quiz 2 PDFDocument13 pagesDevesh OR Notes - Quiz 2 PDFPRITEENo ratings yet

- CF 2Document2 pagesCF 2PRITEENo ratings yet

- Texago Corporation Case ExhibitDocument7 pagesTexago Corporation Case ExhibitPRITEENo ratings yet

- OR Assignment - 2Document8 pagesOR Assignment - 2PRITEENo ratings yet

- Case Problem 3Document11 pagesCase Problem 3PRITEENo ratings yet

- Finance Quiz - 1 2019 SET A: (3 Marks)Document2 pagesFinance Quiz - 1 2019 SET A: (3 Marks)PRITEENo ratings yet

- Brand Name: Cadbury Dairy Milk Product Category: ChocolateDocument15 pagesBrand Name: Cadbury Dairy Milk Product Category: ChocolatePRITEE100% (1)

- Devesh OR Notes - Quiz 2 PDFDocument13 pagesDevesh OR Notes - Quiz 2 PDFPRITEENo ratings yet

- Day 1 Liquid ChemicalsDocument2 pagesDay 1 Liquid ChemicalsPRITEENo ratings yet

- COLORSCOPE 2019 (SV)Document15 pagesCOLORSCOPE 2019 (SV)PRITEENo ratings yet

- BRAND: Frito-Lay PRODUCT: Lay's: Missed ImagesDocument2 pagesBRAND: Frito-Lay PRODUCT: Lay's: Missed ImagesPRITEENo ratings yet

- Excel Solver Report for Integer OptimizationDocument6 pagesExcel Solver Report for Integer OptimizationPRITEENo ratings yet

- Joint Cost ProblemDocument1 pageJoint Cost ProblemNonuNo ratings yet

- Macro NotesDocument29 pagesMacro NotesPRITEENo ratings yet

- ME Quiz 3 PDFDocument15 pagesME Quiz 3 PDFPRITEENo ratings yet

- Chapter 1: An Overview: What Is An Organization?Document13 pagesChapter 1: An Overview: What Is An Organization?PRITEENo ratings yet

- Destin Brass 2019 (SV)Document11 pagesDestin Brass 2019 (SV)PRITEENo ratings yet

- Bank of India Borrower ProfileDocument4 pagesBank of India Borrower ProfileSanjay KumarNo ratings yet

- Schedule of Fees & Charges November 2021 (English)Document1 pageSchedule of Fees & Charges November 2021 (English)Tabish JazbiNo ratings yet

- Vocabulary 8A - Money and FinanceDocument12 pagesVocabulary 8A - Money and FinanceChristian BorjaNo ratings yet

- CIR v. CIADocument2 pagesCIR v. CIAEmmanuel Princess Zia SalomonNo ratings yet

- Terminal - Fa20: COMSATS University Islamabad, Lahore CampusDocument2 pagesTerminal - Fa20: COMSATS University Islamabad, Lahore CampusALEEM MANSOORNo ratings yet

- Short Term FinanceDocument26 pagesShort Term FinanceBharti JoisorNo ratings yet

- Tom Lives On An Island and Has 20 Coconut TreesDocument1 pageTom Lives On An Island and Has 20 Coconut Treestrilocksp SinghNo ratings yet

- Partnership LiquidationDocument5 pagesPartnership LiquidationChristian PaulNo ratings yet

- Equb, Idir, Banks, InsurancesDocument3 pagesEqub, Idir, Banks, InsurancessccrNo ratings yet

- Introduction To Accounting (Sheet.1)Document9 pagesIntroduction To Accounting (Sheet.1)Rithvik SangilirajNo ratings yet

- XII ACC 1st Online Pre-Board Exam QP 2020-21Document11 pagesXII ACC 1st Online Pre-Board Exam QP 2020-21Melvin CristoNo ratings yet

- Taxation II Tutorial 8: Calculating Industrial Building AllowanceDocument3 pagesTaxation II Tutorial 8: Calculating Industrial Building Allowanceathirah jamaludinNo ratings yet

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- Slides 2Document43 pagesSlides 2Talal HamzehNo ratings yet

- IA1 Cash and Cash Equivalents 1Document5 pagesIA1 Cash and Cash Equivalents 1Steffanie OlivarNo ratings yet

- Ultimate Reward Current Account GuideDocument96 pagesUltimate Reward Current Account GuideAnthony BoocockNo ratings yet

- Slides Session 1Document41 pagesSlides Session 1Fabio BarbosaNo ratings yet

- GAM - FS (1)Document30 pagesGAM - FS (1)Aubrey Shaiyne OfianaNo ratings yet

- Making Cents of Business EbookDocument31 pagesMaking Cents of Business EbookJawan StarlingNo ratings yet

- Memorandum of Agreement With Acknowledgement of ObligationDocument3 pagesMemorandum of Agreement With Acknowledgement of ObligationJosemarie AntonioNo ratings yet

- Hybrid annuity projects – Risk mitigation for stakeholdersDocument11 pagesHybrid annuity projects – Risk mitigation for stakeholdersSumitAggarwal100% (1)

- BWFF2033 - Topic 5 - Time Value of Money - Part 1Document17 pagesBWFF2033 - Topic 5 - Time Value of Money - Part 1ZiaNaPiramLiNo ratings yet

- Gateway Timeshares: Down Payment Rate Credit Score APRDocument3 pagesGateway Timeshares: Down Payment Rate Credit Score APRBrennan FelmanNo ratings yet

- Partnership-WPS OfficeDocument3 pagesPartnership-WPS OfficeRanelene CutamoraNo ratings yet

- Universal College Grade 11 Fundamentals of Accounting 2 Exam ReviewDocument7 pagesUniversal College Grade 11 Fundamentals of Accounting 2 Exam ReviewDin Rose Gonzales50% (2)

- Grade 10 Business and Accounting Studies 2nd Term Test Paper 2019 English Medium - North Western ProvinceDocument11 pagesGrade 10 Business and Accounting Studies 2nd Term Test Paper 2019 English Medium - North Western ProvinceMalinima RanuthmiNo ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- 3.03 Personal FinanceDocument3 pages3.03 Personal FinanceObed AlmodovarNo ratings yet

- 5Document11 pages5Youssef MohammedNo ratings yet

- FR M4 - Module Quiz 2: Total Marks: 1 Marks Obtained 1Document10 pagesFR M4 - Module Quiz 2: Total Marks: 1 Marks Obtained 1Nah HamzaNo ratings yet