Professional Documents

Culture Documents

GR 173088 Aparejo Report On LTD Final

Uploaded by

marlon0 ratings0% found this document useful (0 votes)

11 views8 pagesLand Titles & Deeds

Original Title

GR 173088 Aparejo Report on LTD Final

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLand Titles & Deeds

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views8 pagesGR 173088 Aparejo Report On LTD Final

Uploaded by

marlonLand Titles & Deeds

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 8

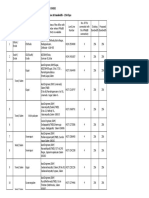

REPUBLIC OF THE PHILIPPINES,

petitioner

vs.

IMPERIAL CREDIT CORPORATION,

respondent

G.R. No. 173088

June 25, 2008

Facts of the Case:

• Respondent purchased from a certain Jose Tajon a parcel of land

situated in

Barrio Colaique (now Brgy SanRoque), Antipolo City, Rizal for the

sum of P17,986.00 as evidenced by a Deed of Sale with Mortgage.

Respondent filed before the RTC of Antipolo City an application for

registration of a parcel of land, containing an area of 8,993sq.m. The

application alleged, among others, that respondent “subrogated

former owner Jose Tajon, who has been in OCEN possession and

occupation of the parcel of land, being a part of the A/D lands of

the public domain, under a bona fide claim of ownership since 12

June 1945, by virtue of Deed of Sale with Mortgage executed on 07

March 1966. After respondent presented evidence establishing the

jurisdiction facts, the RTC issued an order of general default against

the whole world allowing respondent to present its

evidence ex parte.

• On November 21, 2002 RTC rendered judgment

granting respondent’s application for registration.

• Petitioner thru OSG, seasonably appealed RTC’s

decision to the CA contending that respondent

failed to present incontrovertible evidence that

respondent & its predecessor-in-interest had been

in OCEN possession & occupation of the property

since 12 June 1945 or earlier.

• On June 2 2006, CA dismissed the appeal. Hence,

this petition.

ISSUE:

Whether or not the respondent

have enough evidence to prove his

ownership of the subject land.

RULING:

• The petition is meritorious.

• RTCS’s decision concluded that respondent’s evidence satisfied all the

conditions under Section 14, para(1) of PD 1529. Moreover, the SC finds

that respondent’s evidence on its alleged OCEN possession &

occupation of the property falls short of the requirements under the

law.

• While a tax declaration by itself is not sufficient to prove ownership, it

may serve as sufficient basis for inferring possession. However,

respondent submitted only one tax declaration filed belatedly in the

year 1993. If respondent genuinely & consistently believed its claim of

ownership, it should have regularly complied with its real estate tax

obligations from the start of its alleged occupation.

• Respondent failed to discharge the burden of proving that respondent

or its predecessor-in-interest had occupied & possessed the property in

an OCEN manner since June 12, 1945 or earlier. (essential for a grant of

an application for judicial confirmation of imperfect title)

RULING:

• While CA held that since respondent has been in possession

of the property in the concept of an owner since 1966, it

acquired ownership thereof after a lapse of thirty years &

therefore qualified for registration under para(2) of section

14 of PD 1529, the SC finds that provision inapplicable

because the property sought to be registered has not been

clearly shown to be a private land.

• Under the Regalian doctrine, the State is the source of any

asserted right to ownership of land. This is premised on the

basic doctrine that all lands not otherwise appearing to be

clearly within private ownership are presumed to belong to

the State. Any applicant for confirmation of imperfect title

bears the burden of proving that he is qualified to have the

land titled in his name.

• Neither respondent nor its predecessor-in-

interest failed to present sufficient evidence to

prove its uninterrupted adverse possession of

the property for 30 years. (length of time

required for prescription to set in)

• The petition is GRANTED and the decision of the

C.A. is REVERSED & SET ASIDE. The petition in

the RTC is hereby DISMISSED.

THANK YOU FOR LISTENING!

Keep Safe & God Bless!

Reporter:

Marlon N. Aparejo

Teacher:

Atty. Fe Simborio

Subject:

Land Titles & Deeds

You might also like

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- Ownership CasesDocument30 pagesOwnership CasesGoody100% (1)

- Criminal Law Test BankDocument260 pagesCriminal Law Test BankClif Mj Jr.No ratings yet

- LTD Case DigestDocument2 pagesLTD Case Digestmaginoo69No ratings yet

- Islamic CoinsDocument11 pagesIslamic Coinsmsciwoj_slaviaNo ratings yet

- Ong Vs RepublicDocument3 pagesOng Vs RepublicGean Pearl Pao IcaoNo ratings yet

- Leave The Natural People Alone!: Jus PrecariumDocument7 pagesLeave The Natural People Alone!: Jus PrecariumWen' George Bey100% (2)

- Webb vs. de LeonDocument31 pagesWebb vs. de LeonChristopher Martin GunsatNo ratings yet

- Digest - Land Titles (Noval, IAC and Rovancy)Document5 pagesDigest - Land Titles (Noval, IAC and Rovancy)Alvin Niño100% (1)

- Property Digest 1-5Document4 pagesProperty Digest 1-5Francis MoraledaNo ratings yet

- Revivals Golden KeyDocument113 pagesRevivals Golden KeyArnel Añabieza GumbanNo ratings yet

- Family Law II - All Long AnswersDocument61 pagesFamily Law II - All Long AnswersGSAINTSSA100% (3)

- Form and Contents DigestedDocument6 pagesForm and Contents DigestedFran JaramillaNo ratings yet

- Aranda vs. RepublicDocument2 pagesAranda vs. RepublicammeNo ratings yet

- CIVLTD 2017 (GR. No. 170316 Republic vs. Noval)Document3 pagesCIVLTD 2017 (GR. No. 170316 Republic vs. Noval)Michael Parreño VillagraciaNo ratings yet

- Luigi Reyes - Writing Sample (CONTRACT To SELL)Document3 pagesLuigi Reyes - Writing Sample (CONTRACT To SELL)Luigi ReyesNo ratings yet

- Republic vs. Tsai (Proof of Classification)Document1 pageRepublic vs. Tsai (Proof of Classification)John Baja GapolNo ratings yet

- Aranda vs. Republic of The Philippines GR. No. 172331 Villarama, JR., J.: FactsDocument1 pageAranda vs. Republic of The Philippines GR. No. 172331 Villarama, JR., J.: FactsEPZ RELANo ratings yet

- Republic of The Philippines Vs Imperial Credit CorporationDocument1 pageRepublic of The Philippines Vs Imperial Credit CorporationIda DawsonNo ratings yet

- San Roque Realty vs. Republic DigestDocument3 pagesSan Roque Realty vs. Republic Digestremoveignorance100% (1)

- GR 173808 Arbias v. RepDocument3 pagesGR 173808 Arbias v. RepMarisse CastañoNo ratings yet

- Land Titles Case Digested FinalDocument63 pagesLand Titles Case Digested FinalAllenMarkLuperaNo ratings yet

- Director, LMB V. Ca and Aquilino L. Carino G.R. No. 112567 February 7, 2000Document6 pagesDirector, LMB V. Ca and Aquilino L. Carino G.R. No. 112567 February 7, 2000ABDUL RAHIM G. ACOONNo ratings yet

- PropDocument14 pagesPropKristina CabugaoNo ratings yet

- Republic Vs Nicolas (PD 1529)Document6 pagesRepublic Vs Nicolas (PD 1529)Dax MonteclarNo ratings yet

- Republic Vs de GuzmanDocument2 pagesRepublic Vs de GuzmanAxel Gonzalez100% (1)

- Palanca v. Republic, GR No. 151312, Aug. 30, 2006Document2 pagesPalanca v. Republic, GR No. 151312, Aug. 30, 2006Jamiah Obillo HulipasNo ratings yet

- Republic-vs-Naguit Case Digest GR No. 144057Document2 pagesRepublic-vs-Naguit Case Digest GR No. 144057Maria Fiona Duran MerquitaNo ratings yet

- Republic v. Munoz - Digest.doc JomDocument3 pagesRepublic v. Munoz - Digest.doc JomjomgonziNo ratings yet

- Land Titles Case DigestDocument22 pagesLand Titles Case Digestidko2wNo ratings yet

- LTD Case Digest For MidtermsDocument4 pagesLTD Case Digest For MidtermsRodeleine Grace C. MarinasNo ratings yet

- Land TitlesDocument21 pagesLand TitlesCharlotte GallegoNo ratings yet

- Second Division G.R. No. 186961, February 20, 2012: Supreme Court of The PhilippinesDocument16 pagesSecond Division G.R. No. 186961, February 20, 2012: Supreme Court of The PhilippinesFJ Valerio - LumioNo ratings yet

- Director of Lands VsDocument3 pagesDirector of Lands VsniccoNo ratings yet

- MINDA S. GAERLAN, Petitioner vs. REPUBLIC OF THE PHILIPPINES, RespondentDocument1 pageMINDA S. GAERLAN, Petitioner vs. REPUBLIC OF THE PHILIPPINES, RespondentSamantha LiNo ratings yet

- Second Division (G.R. No. 186961: February 20, 2012) Republic of The Philippines, Petitioner, vs. East Silverlane Realty Development Corporation, Respondent. DecisionDocument16 pagesSecond Division (G.R. No. 186961: February 20, 2012) Republic of The Philippines, Petitioner, vs. East Silverlane Realty Development Corporation, Respondent. DecisionRonnie Garcia Del RosarioNo ratings yet

- Egargo LtdcasedigestDocument10 pagesEgargo LtdcasedigestMamerto Egargo Jr.No ratings yet

- LTD Case DigestsDocument3 pagesLTD Case Digestshedwig87No ratings yet

- Property DigestsDocument8 pagesProperty DigestsStephanie ArtagameNo ratings yet

- LTDDocument3 pagesLTDYang D. F.No ratings yet

- Digested LTDDocument7 pagesDigested LTDJaniceNo ratings yet

- G.R. No. 177637, July 26, 2010 Dr. Dioscoro Carbonilla vs. Marcelo Abier FactsDocument2 pagesG.R. No. 177637, July 26, 2010 Dr. Dioscoro Carbonilla vs. Marcelo Abier FactsJennica Gyrl G. DelfinNo ratings yet

- Director of Lands V SantiagoDocument22 pagesDirector of Lands V SantiagoKelvin CulajaráNo ratings yet

- Republic V Bibonia DigestDocument2 pagesRepublic V Bibonia DigestHeart NuqueNo ratings yet

- G.R. No. 202414 June 4, 2014 Josephine Wee vs. Felicidad MardoDocument4 pagesG.R. No. 202414 June 4, 2014 Josephine Wee vs. Felicidad MardocloudNo ratings yet

- CD 11Document28 pagesCD 11chelloNo ratings yet

- Ten Forty Realty vs. CruzDocument16 pagesTen Forty Realty vs. CruzronhergamboaNo ratings yet

- Land Titles and Deeds Case2Document6 pagesLand Titles and Deeds Case2SFar AbasNo ratings yet

- Property Brief DigestsDocument10 pagesProperty Brief Digestspokeball002No ratings yet

- East SilverlaneDocument6 pagesEast SilverlaneLornaNatividadNo ratings yet

- Ten Forty RealtyDocument12 pagesTen Forty RealtyMichelle Muhrie TablizoNo ratings yet

- Republic v. NicolasDocument7 pagesRepublic v. NicolasJhuniven OrantesNo ratings yet

- Property 452 Reviewer-Digests p3Document8 pagesProperty 452 Reviewer-Digests p3cezar delailaniNo ratings yet

- HeirsofLVvs CADocument6 pagesHeirsofLVvs CAvickimabelliNo ratings yet

- Facts:: Minda S. Gaerlan V. Republic of The PhilippinesDocument1 pageFacts:: Minda S. Gaerlan V. Republic of The PhilippinesJona ReyesNo ratings yet

- GaerlanDocument2 pagesGaerlanRegina CoeliNo ratings yet

- Republic v. Rizalvo, Jr.Document7 pagesRepublic v. Rizalvo, Jr.AnnieNo ratings yet

- DigestDocument6 pagesDigestJonil CaninoNo ratings yet

- Nadela Vs City of Cebu (Digest)Document2 pagesNadela Vs City of Cebu (Digest)G S100% (1)

- 5 Wee Vs MardoDocument9 pages5 Wee Vs MardoIvan Montealegre ConchasNo ratings yet

- RP v. Herbieto Crim ProDocument3 pagesRP v. Herbieto Crim ProRegina CoeliNo ratings yet

- Republic Vs NovalDocument3 pagesRepublic Vs NovalAnnievin HawkNo ratings yet

- FLORES VS BAGAOISAN (G.R. No. 173365, April 15, 2010)Document4 pagesFLORES VS BAGAOISAN (G.R. No. 173365, April 15, 2010)Datu TahilNo ratings yet

- Josephine Wee vs. Felicidad MardoDocument5 pagesJosephine Wee vs. Felicidad MardoGarri AtaydeNo ratings yet

- G.R. No. 192717 NatresDocument4 pagesG.R. No. 192717 NatresRoseChanNo ratings yet

- REPUBLIC v. CA-WPS OfficeDocument2 pagesREPUBLIC v. CA-WPS OfficeMichelleNo ratings yet

- Patent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeFrom EverandPatent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeNo ratings yet

- VSB Docket HearingDocument4 pagesVSB Docket HearingWSLSNo ratings yet

- Petition For Expungement of Records (Alabama)Document6 pagesPetition For Expungement of Records (Alabama)ShamaNo ratings yet

- Temps de Lecture Estimé: 10 Mins: Stoics PeopleDocument3 pagesTemps de Lecture Estimé: 10 Mins: Stoics PeoplecorNo ratings yet

- Untitled DocumentDocument40 pagesUntitled DocumentVee Jay DeeNo ratings yet

- Fahrenheit 451 Book ReviewDocument3 pagesFahrenheit 451 Book ReviewBuluc George PaulNo ratings yet

- 57 Interesting Facts About SudanDocument5 pages57 Interesting Facts About SudanIbrahimNo ratings yet

- Bh. GitaDocument20 pagesBh. GitaAkshat SinghNo ratings yet

- Shakespeare in UrduDocument9 pagesShakespeare in UrduSaad AshrafNo ratings yet

- Banking Law Lecture 4Document10 pagesBanking Law Lecture 4hannahlouiseisobelNo ratings yet

- 25 M Fast Supply Vessel Swe v1Document2 pages25 M Fast Supply Vessel Swe v1Sebastian RentschNo ratings yet

- The Estate of The Late Juan B Gutierrez vs. Heirs of Spouses Jose and Gracita CabangonDocument9 pagesThe Estate of The Late Juan B Gutierrez vs. Heirs of Spouses Jose and Gracita CabangonRustom IbañezNo ratings yet

- ErodeDocument26 pagesErodeRamesh SakthyNo ratings yet

- Seagull & J.Blunt Press ReleaseDocument1 pageSeagull & J.Blunt Press Releasedhaval2911No ratings yet

- 5Document1 page5gauravNo ratings yet

- Professional Profile:: Dr. C.V. Ananda BoseDocument7 pagesProfessional Profile:: Dr. C.V. Ananda BoseGokul KrishnanNo ratings yet

- Canaris v. McMaster Et AlDocument38 pagesCanaris v. McMaster Et AlEllie ParkerNo ratings yet

- Special Power of Attorney (Representation)Document2 pagesSpecial Power of Attorney (Representation)Samantha ReyesNo ratings yet

- 21st Cent Lesson 3Document77 pages21st Cent Lesson 3Sheryl FaelnarNo ratings yet

- U.P. Urban Buildings (Regulation of Letting, Rent and Eviction) Act, 1972Document25 pagesU.P. Urban Buildings (Regulation of Letting, Rent and Eviction) Act, 1972lokesh4nigamNo ratings yet

- Labour Law Case AnalysisDocument8 pagesLabour Law Case AnalysisPaavni JainNo ratings yet

- CRCC Fall NewsletterDocument6 pagesCRCC Fall NewsletterHouseDemCommNo ratings yet

- Juvenile Delinquency 1.1 Juvenile: Article 1, UNCRC, 1989Document13 pagesJuvenile Delinquency 1.1 Juvenile: Article 1, UNCRC, 1989Sabir Saif Ali ChistiNo ratings yet