Professional Documents

Culture Documents

Bollinger Band and Ichimoku2003

Uploaded by

Gấu Trúc100%(1)100% found this document useful (1 vote)

291 views40 pagesCopyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

291 views40 pagesBollinger Band and Ichimoku2003

Uploaded by

Gấu TrúcCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 40

Bollinger Band

Thng thng dy Bollinger band

gm 3 ng:

- Mt ng trung bnh ng gia

(hay cn gi l ng trung tuyn)

- Mt ng bin trn

- Mt ng bin di

Khi nim

ng Bollinger gip cho ngi dng so snh

bin ng v mc gi tng i ca mt chng

khon hay gi hng ho, tin t theo mt thi

gian quan st c th. Cc ng bin c to

nn t ng trung bnh v mt lch chun

c p dng xung quanh ng trung bnh ny.

Thng thng mc nh ca ng trung bnh l

20 ngy v lch chun l 2. Bi v lch

chun dng o lng bin ng nn Bollinger

Bands tr nn mt cng c linh ng c th iu

chnh m rng hay hp li da trn mc bin

ng tht s ca th trng.

Gii thch

ng John Bollinger sng ch ra ch bo ny, n

thng c s dng chung vi ng gi nhng

chng ch c xem l mt indicator (dng c ch bo),

n rt ging ng bao ca gi. y l ch bo c

nht v n c tc dng l th hin chnh xc nhng thay

i hay giao ng ca th trng. N l 1 php tan

cng tr ca 2 ln s chnh lch ca ng trung bnh

gi MA. Khi th trng rung ng mnh n s phn nh

giao ng bng cch m rng cc di (bands). Ngc

li khi s giao ng suy yu n phn nh th trng

trm lng th cc di c khuynh hng co hp li.

Cch s dng

S dng Bollinger Band rt hiu qu v n phn nh ng cc din bin ca

th trng, iu ny c cc chuyn gia thng k thm nh mc

tin cy ca ch s Bollinger Band l rt cao.

Bollinger Band giao ng mc nh n xc nhn gi t bin i

hn.

Khi ng gi that ra khi ci di (band) th n c khuynh hng

s tip tc.

Khi th trng nh hay y, u tin ng gi that ra khi

di v sau n s tr li vo trong di. Th trng lc s i ngc li

vi xu hng ang tn ti.

S di chuyn ca ng gi nu bt u t 1 di thp hoc cao n

s tip tc i n di i din.

Sau y l v d minh ha: mi tn th 1 l th trng ang tin n

di trn v tn hiu mua c pht ra trong giai an ny. Tn hiu bn

trong c pht ra cho n khi v tr mi tn s 3, mt ci nh that

ra khi di mi tn s 2 nhng sau l s tr vo di ca ng

gi. ti mi tn s 3 l s di chuyn ca gi n di thp v tr mi tn

s 4

Cc ng Dng Ca Bollinger Band

a/ Ch ra th trng ang tnh trng

overbought/oversold: gi gn bin di tc th

trng ang oversold, ngc li l overbought

b/ Dng kt hp vi ng RSI, Stochastic ch ra

du hiu mua/ bn: Du hiu mua/bn xut hin khi

Bollinger cho thy du hiu overbought/oversold,

trong khi RSI, Stochastic cho thy du hiu phn kz

(divergence)

c/ Ch ra du hiu cnh bo sp c mt s bin ng

gi mnh: nhng ng bin (bands) thng hp

trc khi bt u mt s bin ng gi mnh

Tm li

- Dy Bollinger Band c th a ra du hiu th trng ang tnh

trng overbought hay oversold. im c bit da vo dy Bollinger

Band c th cho chng ta mt range gi (khung gi hay cn go bin

) gii hn ti thi im xem xt.

- Dy Bollinger Band hon chnh s chia ra lm 02 phn: bin trn v

bin di c ngn cch bi ng trung bnh ng gia (hay

cn gi l ng trung tuyn), trong trng hp khng c ng

trung tuyn c th dng ng trung bnh 20 (MA 20) xc nh.

- Nu gi nm bin trn chng t th trng ang v th tng;

cng gn cn trn th chng t th trng ang tnh trng

overbought.

- Nu gi nm bin di chng t th trng ang v th gim;

v cng gn cn di th chng t th trng ang tnh trng

oversold.

- Dy Bollinger Band c s dng tt nht khi th

trng khng c xu hng r rng (sideway market)

- Cnh bo du hiu bin ng ln: khi hai bin

Bollinger ngy cng hp li (do dao ng gi nh i),

thng thng cnh bo trc mt kh nng gi bin

ng sp ti.

- Dy Bollinger Band ch l tn hiu ch bo i sau do

thng phn ng chm hn din bin th trng,

chnh v th cn kt hp cc ng ch bo khc cng

nh cc cch phn tch k thut khc mi c th xc

nh r xu hng, d bo bin dao ng d kin,

cc mc chn k thut

- Quy lut bt thnh vn

Gi t cn di hng ln ng trung

tuyn --> xu hng tng

Gi t ng trung tuyn hng ln cn

trn --> xu hng tng

Gi t cn trn hng xung ng trung

tuyn --> xu hng gim

Gi t ng trung tuyn hng xung cn

di --> xu hng gim

Cn trn v cn di cng hp (khong cch cng

gn) cnh bo gi c th sp bin ng mnh khi

"bung nt c chai" (t lng trong PTKT)

Gii thiu i nt v th Ichimoku Kinko Hyo

L mt k thut th ca ngi Nht c to ra trc th chin th 2

v c s dng ngm v chn dung. N c th nh c hng i

tip theo ca ng gi v khi n s bo cho chng ta khi no nhy vo

hay that ra khi th trng. y l ch bo c lp khng cn s gip

ca cc k thut phn tch no khc.

Ci t Ichimoku c ngha l "ci nhn thang qua", Kinko c ngha l "trng

thi cn bng" gia gi v thi gian cn Hyo theo ting Nht c ngha l

" th". Ichimoku Kinko Hyo c ngha l "Ci nhn thang qua v s cn

bng ca th gia gi v thi gian". N c ci nhn bao qut v gi v d

an hng i n 1 v tr mi kh vng chc.

Ch s ny c sng ch bi 1 phng vin bo ca Nht vi bt danh l

"Ichimoku Sanjin" n c ngha l "ngi n ng vt ni". th

Ichimoku tr thnh cng c kh ph thng cho cc nh u t Nht,

khng ch ring cho th trng c phiu m n cn c s dng cho

currency, bond, futures, commodity v options markets cng rt tt. y

l 1 k thut c cng b cch y 30 nm nhng trong nhng nm gn

y mi tht s gy c ch bi li ch m n em li.

th Ichimoku gm c 5 ng. Tnh tan ch yu cho 4 ng

ny bao hm: im gia, cao, thp v ng trung bnh n

gin. By gi n gin ha, th c han tt phi phn

nh c trin vng ca s bin ng gi.

1. Tenkan-Sen = Conversion Line = (Highest High + Lowest Low) / 2, s dng cho 9 phin

2. Kijun-Sen = Base Line = (Highest High + Lowest Low) / 2, s dng cho 26 phin

3. Chikou Span = Lagging Span = Gi ng ca hm nay, c v cho 26 phin sau

4. Senkou Span A = Leading Span A = (Tenkan-Sen + Kijun-Sen) / 2, c v cho 26 phin u

5. Senkou Span B = Leading Span B = (Highest High + Lowest Low) / 2, s dng cho 52 phin,

c v cho 26 phin u.

Kumo = Cloud = Area between Senkou Span A and B.

Ichimoku s dng 3 phin ch yu theo chun: 9, 26 v 52. Khi xa Ichimoku c to ra (vo

nm 1930) lc 1 tun giao dch 6 ngy v chun c chn tng ng l: 1tun ri, 1 thng

v 2 thng. Nhng by gi 1 tun hin ch giao dch c 5 ngy th chun c chn thay i

tng ng l: 7, 22 v 44 phin.

Vn dng th Ichimoku Kinko Hyo vo

biu 4H v ngy

Xt th 4H:

ng Tenkan-sen vng 938.29 c th xem y l

vng h tr 1

ng Kijun-sen vng 927.91 c th xem y l

vng h tr 2

Gi nm trn m my l Up Kumo v xu hung

thin v chiu ln

Xt th ngy

ng Tenkan-sen vng 909.49 c th xem y l vng

h tr 1

ng Kijun-sen vng 901.37 c th xem y l vng

h tr 2

Gi nm trn m my, tuy nhin y l m my gim

(Down Kumo) v th xu hung ln nhng lc yu (bi l y

ch l tn hiu mua bn bnh thng xy ra do ng gi

nm ln cn vi m my gim Down Kumo v nm trong

m my tng Up Kumo)

Nu kt hp th Ichimoku Kinko Hyo biu 4H v ngy iu ny cho thy

trong ngn hn chiu hng ln ca gi vng th gii vn cn, tuy nhin ng

lng tng gi mnh c gii hn; gi c th d xy ra o chiu xu hng khi

tip cn c mc tiu. Hin ti mc tiu ca gi vng th gii ri vo cc vng nh

947-950; 953-955, xa hn l 960 nu s dng cc cch phn tch khc.

NG CH BO STOCHASTICS (PKS)

+ Khi gi tng, gi ng ca c khuynh hng tin gn n

bin trn ca mt khung gi(price range)

+ Khi gi gim, gi ng ca c khuynh hng tin gn

n bin di ca mt khung gi (price range)

* Mi ng Stochastic s dng hai ng, % K v %D

C hai ng Stochastic: Slow Stochastic v Fast Stochastic.

S khc bit ca hai ng ny c th hin cch tnh

hai ng %K v %D. ng Slow Stochastic chm v nhn

hn ng Fast Stochastic.

Cng thc tnh

Cng thc tnh:

(Close Lowest Low(n))

% K= 100 x

(Highest High(n)-Lowest

Low(n)

% D = 3-periods moving average of %K

(n) = Number of periods used in calculation

% K= 100x(115.38-109.13)/(119.94-109.13) =

57.81

Cc ng Dng PKS

1/ Ch ra tnh trng overbought/oversold:

+ Trn ng 80 - th trng overbought

+ Di ng 20 - th trng oversold

2/ Ch ra du hiu mua/bn:

+ %K v %D ct xung t vng trn 80- du hiu bn

+ %K v %D ct ln t vng di 20- du hiu mua

Ch ra s phn kz tng gi v gim gi:

- S phn k tng gi(Bullish Divergence):khi

th gi hnh thnh nhng y thp hn trong khi

Stochastic li hnh thnh nhng im y cao

hn.

- S phn k gim gi (Bearish divergence): khi

th gi hnh thnh nhng nh cao hn trong khi

Stochastic li hnh thnh nhng im nh thp

hn.

Tm li: da vo PKS xc nh du hiu mua-bn,

tnh trng th trng.

Nu PKS nm trn vng 80 th trng ang trng thi

mua qu mc (overbought). Ch a ra lnh bn khi

ng PKS c du hiu quay u, ngha l ng %K ct

ng %D t trn xung vng 80, thng thng khi hai

ng a ra du hiu ct nhau l du hiu th trng

ang bn ra.

Ngc li nu PKS nm di vng 20 cho thy th trng

ang trng thi bn qu mc (oversold). Ch a ra lnh

mua khi ng PKS c du hiu quay u, , ngha l

ng %K ct ng %D t trn di ln vng 20, thng

thng khi hai ng a ra du hiu ct nhau l th

trng ang mua vo.

-PKS l ch bo i sau (d bo bin ng sau

din bin th trng); ch bo ny ch p dng

ng n (hiu qu) cho th trng khng c

xu hng r rng. Nu th trng ang din

theo xu hng th du hiu theo xu hng th

trng s ng tin cy hn. Ch bo ny khng

c hu dng nhiu trong trng hp th

trng ang trong tnh trng , khi gi dao

ng trong mt bin hp v th hai ng

%K v %D c th ct nhau nhiu ln v du

hiu a ra khng r rng.

Xy dng m hnh Double Stochastic

M hnh Double Stochastic s dng quy tc giao

ct (crossover) ca 2 ng tn hiu Stochastic

2 h thng Stochastic Oscillator vi nhng thng

s khc nhau cho nhng tn hiu mua hoc

bn tt hn mt h thng Stochastic Oscillator

ring l. Khi gp i h thng Stochastic

Oscillator th chnh xc trong giao dch cng

tng gp i.

Khung thi gian: H1, Daily.

H thng ch bo: Full Stochastic (21,

9, 9) v Full Stochastic (9, 3, 3).

Quy tc vo trng thi (Entry) v thot

trng thi (Exit)

- Entry: Khi im giao ct (crossover) ca 2 ng PKS

Stochastic (21, 9, 9) xut hin th vo trng thi. Quan st

Stochastic (9, 3, 3) d on cc im Swing trong xu

hng chnh v vo trng thi b sung. Khng cn ch

nhng dao ng ngn hn Stochastic (9, 3, 3) thng to

nhng du hiu Exit gi. Ch Exit khi Stochastic (21, 9, 9) to

du hiu r rng.

- Exit: Exit ti im giao ct k tip ch bo Stochastic (21,

9, 9).

im mnh: S dng 2 ch bo Stochastic gip

theo di su st xu hng chnh v nhng

im Swing trong , dn n nhng im

vo trng thi v thot trng thi chnh xc

hn.

im yu: H thng ny cn phi c gim

st thng xuyn v d sao Stochastic vn l

ch bo c tr nht nh.

NG CH BO RSI :(RELATIVE

STRENGTH INDEX)

L ch s sc mnh tng quan (hay cn gi

RSI l ch s o lng cng ca s vn

ng ca gi). L ch s t l gia trung bnh

s ngy tng gi so vi mc gi trung bnh ca

nhng ngy gim gi trong mt giai on nht

nh

Cng thc tnh

RSI =100- 100/(1+RS)

Average Gain = Total Gains/n

Average Loss = Total Losses/n

First RS = (Average Gain/Average Loss)

Smoothed RS=[(previous Average Gain)*13+Current Gain]/14

[(previous Average Gain)*13+ Current Gain]/14

Smoothed RS=

[(previous Average Loss)*13+ Current Loss]/14

n = number of RSI periods

Cc ng Dng RSI

Ch ra tnh trng overbought/oversold:

Nu ng RSI trn 70 th cho thy th trng ang tnh trng overbought, ngc li, nu RSI

di 30 cho thy th trng tnh trng oversold

(mt s ti liu khng ly chun 70-30 m ly 80-20 do c th thm mt khi nim: Nu ng

RSI trn 80 th cho thy th trng ang tnh trng overbought, ngc li, nu RSI di 20 cho

thy th trng tnh trng oversold

2/ Ch ra du hiu mua/bn:

Du hiu bn: Khi ng RSI t trn nh ct xung di 70 ch ra du hiu bn.

Du hiu mua: Khi ng RSI t di y ct ln trn 30 ch ra du hiu mua

3/ Ch ra s phn kz tng/gim gi:

-Phn kz gim gi (Bearish Divergence):khi th gi hnh thnh nhng im cao hn trong khi RSI

li hnh thnh nhng im cao thp hn

-Phn kz tng gi (Bullish Divergence):khi th gi hnh thnh nhng y thp hn trong khi RSI li

hnh thnh nhng im y cao hn

Nu RSI nm trn vng 70-80 th trng ang

trng thi mua qu mc (overbought). Ch

a ra lnh bn khi ng RSI c du hiu

quay u (t trn nh ct xung di

ng 80 hay 70)

Ngc li nu RSI nm di vng 20-30 cho

thy th trng ang trng thi bn qu

mc (oversold). Ch a ra lnh mua khi

ng RSI c du hiu quay u (t y

hng ln ct ng 20 hay 30)

-RSI l ch bo i trc (d bo bin ng trc din

bin th trng); ch bo ny ch p dng ng n

(hiu qu) cho th trng khng c xu hng r rng)

(ch trng hp khi th trng ang din tin theo

mt xu hng mnh, RSI c th nm rt cao hoc

xung rt su trong mt khong thi gian m gi vn

khng o chiu. Nhng thi im ny RSI ch n

gin ch cho ta bit th trng ang rt mnh hay rt

yu v khng c qu trnh o chiu xy ra. Tuy nhin

c th p dng bin php sau: v d khi th trng

ang theo xu hng tng c th ch gi iu chnh

tr li khi RSI xung di vng 20-30 ri bt u to

trng thi mua v ngc li).

-Cc kz quan st, mc nh n=14 c th theo

di chu kz n=7 hay n=9

* ng ch bo RSI ch l tn hiu ch bo i

trc do RSI thng phn ng kh nhanh

d dn ti du hiu sai lch xut hin, chnh

v th cn kt hp cc ng ch bo khc

cng nh cc cch phn tch k thut khc

mi c th xc nh r xu hng, d bo

bin dao ng d kin, cc mc chn k

thut

S dng RSI trong h thng mua bn (trading system)

Cc mc ca RSI: 70% (thng dng l 80%) l mc m nh u

t bn qu nhiu (overbought), 30% (thng dng l 20%) l mc

m nh u t mua qu nhiu (oversold). Mua khi th trng

mc oversold v bn khi th trng overbought lu ch p dng

iu ny cho 1 thi kz bin ng cn khi ang hnh thnh 1 xu

hng th s khng ng.

EMA nh l vai tr ca ng h tr hay khng c (support or

resistance). Mua khi RSI tng ln trn EMA v bn khi RSI ri xung

di EMA. EMA l 1 tnh hiu tr v thng a ra tn hiu mua khi

vt qua thi kz uptrend.

Bullish divergence (tn hiu phn kz mua): tn hiu mua khi ng

gi ang i xung trong khi RSI th ang tng, tng t bearish

divergence (tn hiu phn kz bn): tn hiu bn khi ng gi tng

trong khi ng RSi th li gim. Mt hn ch ca s phn kz

(divergence) l chng c gng bo trc 1 xu hng o chiu thay

v xc nh theo 1 xu hng.

B cc ca RSI v Bollinger Bands: Chng ta p dng Bollinger Bands (BB) nghin

cu ch bo RSI. Tn hiu mua xy ra khi RSI rt xung di di di ca BB (lower BB),

tn hiu mua xut hin khi RSI tng vt qua di trn ca BB (upper BB). y l nhng

ch bo tng phn xu hng v chng ta cn phi s dng thm vi b lc ca xu

hng. Chng ta c th thm vo ch bo MACD vo b lc xu hng nh sau: nu

MACD > 0 th xu hng i ln.

AVERAGE DIRECTIONAL INDEX

y l mt h thng dng xc nh xu

hng v kim tra xu hng. Dng h thng

ny gip ta chm dt vic phi vt c d bo

xu hng v cng c th dng xc nhn xu

hng.

H thng ny gm 3 ng: ADX, DI+, DI-. (hay ADX, DMI+, DMI-).

ng ADX dng xc nh th trng c ang din ra xu hng

hay khng(khng quan trng th trng trong xu hng tng hay

gim). Khi ADX tng trn 25 ch ra th trng ang din ra theo xu

hng v di 20 ch ra th trng khng c xu hng no c.

ADX cng o lng sc mnh ca mt xu hng, ADX cng cao,

xu hng cng mnh.

DI+ v DI- dng to du hiu mua bn. Mt du hiu mua xut

hin khi DI+ ct ln trn DI-. Mt du hiu bn xut hin khi DI-

ct ln trn DI+.

ADX cn c dng nh l mt du hiu cnh bo sm v vic

dng hay chm dt mt xu hng. Khi ADX bt u di chuyn

xung thp hn t mc cao nht ca n th xu hng hin ti c

th chm dt hoc tm dng. l du hiu n lc thot

khi trng thi hin ti v ch i tn hiu r rng hn t DI+ v

DI-

Directional Movement (DM): hnh thnh bi s so snh gia range

gi t cao n thp ca ngy hm nay so vi range gi ca ngy

hm trc, nu ln hn ngy trc th l DM+ , ngc li l DM-

True Range (TR): lun lun l s dng, l s ln nht ca :

+ Khong cch gia gi cao nht so vi gi thp nht hm nay

+ Khong cch gia gi cao nht hm nay so vi gi ng ca hm

trc

+ Khong cch gia gi thp nht hm nay so vi gi ng ca

ngy hm trc.

Directional Indicators (DI+ , DI- ): DI+ bng 0 ngha l ngy khng

c xu hng tng gi, DI- bng 0 ngha l ngy khng c xu

hng gim gi.

You might also like

- ICHIMOKUDocument15 pagesICHIMOKUMinh Lê100% (1)

- Hệ thống SMC của ICTDocument189 pagesHệ thống SMC của ICTvothuyfx.91No ratings yet

- Ichimoku Bản TVDocument17 pagesIchimoku Bản TVBaba Tori100% (1)

- Chỉ báo ichimokuDocument31 pagesChỉ báo ichimokuThuy Nguyen Thi NgocNo ratings yet

- Cách Kết Hợp Bollinger Band Và RSI- Song Kiếm Hợp BíchDocument10 pagesCách Kết Hợp Bollinger Band Và RSI- Song Kiếm Hợp BíchTruong NguyenNo ratings yet

- Bài 7 - RSI Và MACDDocument10 pagesBài 7 - RSI Và MACDHong NguyenNo ratings yet

- HỆ THỐNG GIAO DỊCH CUỐI CÙNGDocument5 pagesHỆ THỐNG GIAO DỊCH CUỐI CÙNGLê Hữu Nam100% (1)

- 15-Giao Trinh ICHIMOKU Co BanDocument60 pages15-Giao Trinh ICHIMOKU Co BanThanh Vu Quang100% (2)

- Bài 8 - Các Mô Hình Đảo Chiều & Tích LũyDocument13 pagesBài 8 - Các Mô Hình Đảo Chiều & Tích LũyHung LeNo ratings yet

- Ichimoku Kinko HyoDocument20 pagesIchimoku Kinko HyoMinh MinhNo ratings yet

- S D NG Đám Mây IchimokuDocument20 pagesS D NG Đám Mây IchimokuQuyên NguyễnNo ratings yet

- Tai Lieu ICHIMOKUDocument60 pagesTai Lieu ICHIMOKUNguyễnQuangNgọc100% (1)

- ICHIMOKU Co Ban Va Nang CaoDocument38 pagesICHIMOKU Co Ban Va Nang Caodingobk67% (3)

- PTKT VSA TuanNN MAY16Document62 pagesPTKT VSA TuanNN MAY16Quang Huy NguyenNo ratings yet

- Sonic R ManualDocument24 pagesSonic R Manualdhungtn100% (3)

- Bài 1 Ichimoku - Cái Nhìn Thoáng QuaDocument5 pagesBài 1 Ichimoku - Cái Nhìn Thoáng QuaNGUYEN VAN GIANGNo ratings yet

- Giao Dịch Bollinger Band - Indicator KhácDocument68 pagesGiao Dịch Bollinger Band - Indicator KhácHai DangNo ratings yet

- 14-Giáo trình Ichimoku Full bản tiếng việt PDFDocument33 pages14-Giáo trình Ichimoku Full bản tiếng việt PDFThanh Liêm Nguyễn100% (1)

- Xác Định Xu HướngDocument7 pagesXác Định Xu HướngLê Hữu Nam100% (1)

- Các Thành Phần Của IchimokuDocument36 pagesCác Thành Phần Của IchimokuAlexandre Vux100% (3)

- ICHIMOKU PHẦN NÂNG CAO (KiemCoin)Document10 pagesICHIMOKU PHẦN NÂNG CAO (KiemCoin)Tung Lam NguyenNo ratings yet

- Tổng Hợp Các Phương Pháp Giao Dịch Scalping Hay Và Hiệu Quả Nhất - Tập 3Document29 pagesTổng Hợp Các Phương Pháp Giao Dịch Scalping Hay Và Hiệu Quả Nhất - Tập 3Tran TamNo ratings yet

- Phương pháp ichimoku để giao dịchDocument16 pagesPhương pháp ichimoku để giao dịchĐăng Nguyễn100% (1)

- Ly Thuyet Thoi Gian Trong IchimokuDocument34 pagesLy Thuyet Thoi Gian Trong IchimokuRuồi SữaNo ratings yet

- PHẦN NÂNG CAO SÓNG ELLIOTDocument10 pagesPHẦN NÂNG CAO SÓNG ELLIOTHuy PhạmNo ratings yet

- Tất Tần Tật Về Fibonacci - Tập 4Document27 pagesTất Tần Tật Về Fibonacci - Tập 4Hoàng Ngọ ChíNo ratings yet

- Ky Thuat Luot Song CP - Hieu Hoang VPSDocument5 pagesKy Thuat Luot Song CP - Hieu Hoang VPSHuy PhạmNo ratings yet

- Theo xu hướng và tiền sẽ theo bạnDocument11 pagesTheo xu hướng và tiền sẽ theo bạnLê HùngNo ratings yet

- How To Trade With Price Action - Kickstarter. Galen WoodsDocument145 pagesHow To Trade With Price Action - Kickstarter. Galen WoodsNgoa Long100% (1)

- Price Action từ cơ bản đến nâng cao PDFDocument91 pagesPrice Action từ cơ bản đến nâng cao PDFpanda22tgmailcom100% (1)

- 3-Phương Pháp Wyckoff Về Độ SâuDocument170 pages3-Phương Pháp Wyckoff Về Độ SâuRaven Ly100% (1)

- Chien Luoc Ichimoku DAS PDFDocument8 pagesChien Luoc Ichimoku DAS PDFNgaHang100% (1)

- Ichimoku1 thầy chóDocument6 pagesIchimoku1 thầy chótrang trầnNo ratings yet

- Ival MACDDocument13 pagesIval MACDHub Kiếm TiềnNo ratings yet

- Kien Thuc Volume Trading - GrabtraderDocument79 pagesKien Thuc Volume Trading - GrabtraderDIDINo ratings yet

- Price Action Chuyên Sâu - Các Phương Pháp Giao Dịch Theo Price Action - Phần 1, Kỳ 3Document7 pagesPrice Action Chuyên Sâu - Các Phương Pháp Giao Dịch Theo Price Action - Phần 1, Kỳ 3panda22tgmailcom100% (1)

- Ichimoku Sasaki Tieng VietDocument154 pagesIchimoku Sasaki Tieng VietJason MarkNo ratings yet

- Phương pháp Wyckoff về độ sâuDocument170 pagesPhương pháp Wyckoff về độ sâuvanthai06996No ratings yet

- bollinger band dảiDocument12 pagesbollinger band dảihuệ trầnNo ratings yet

- Phương Pháp Giao Dịch TT Tài Chính Forex bản DemoDocument131 pagesPhương Pháp Giao Dịch TT Tài Chính Forex bản DemoMinh LêNo ratings yet

- Hướng Dẫn Toàn Diện Về Chỉ Báo StochasticDocument27 pagesHướng Dẫn Toàn Diện Về Chỉ Báo StochasticHub Kiếm Tiền100% (1)

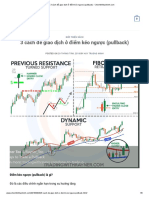

- 3WAYS- điểm kéo ngược (pullback) PDFDocument8 pages3WAYS- điểm kéo ngược (pullback) PDFTung Le TheNo ratings yet

- VOLUME #TradervietDocument15 pagesVOLUME #TradervietTung Le TheNo ratings yet

- Luận về PTKT Phương Đông.Document7 pagesLuận về PTKT Phương Đông.Võ Tấn ĐứcNo ratings yet

- Phân tích giá và khối lượng-Anna CoullingDocument61 pagesPhân tích giá và khối lượng-Anna CoullingTran Vuong HoangNo ratings yet

- Ival GiaoDichTheoHanhViGia PDFDocument104 pagesIval GiaoDichTheoHanhViGia PDFHub Kiếm Tiền100% (1)

- Bài 3 Chikou SpanDocument6 pagesBài 3 Chikou SpanNGUYEN VAN GIANGNo ratings yet

- Làm CH Hành Đ NG Giá Trong 20h-Rayner TeoDocument30 pagesLàm CH Hành Đ NG Giá Trong 20h-Rayner TeoĐỗ SơnNo ratings yet

- 1 Market StructureDocument11 pages1 Market StructureNgọc Tân NguyễnNo ratings yet

- Lư T Sóng M5Document3 pagesLư T Sóng M5Lê Hữu NamNo ratings yet

- 5 bước chiến lược gd đa khung thời gian PDFDocument3 pages5 bước chiến lược gd đa khung thời gian PDFLạc TrôiNo ratings yet

- 1-THE PIN BAR SIGNAL CHUYÊN SÂU VÀ GIAO DỊCH TỪNG TÌNH HUỐNGDocument27 pages1-THE PIN BAR SIGNAL CHUYÊN SÂU VÀ GIAO DỊCH TỪNG TÌNH HUỐNGTriều Nguyễn Lê ThanhNo ratings yet

- Các đề mục: Bản chất của RSI Đừng áp dụng RSI một cách máy móc Những nguyên tắc căn bản với RSI để sống sótDocument20 pagesCác đề mục: Bản chất của RSI Đừng áp dụng RSI một cách máy móc Những nguyên tắc căn bản với RSI để sống sótHồng TháiNo ratings yet

- Cơ Bản Về Hệ Thống Sonic RDocument34 pagesCơ Bản Về Hệ Thống Sonic RHub Kiếm TiềnNo ratings yet

- Các Mô Hình Nến Báo ĐáyDocument9 pagesCác Mô Hình Nến Báo ĐáyNông Dân100% (1)

- Chiến Lược Giao Dịch Theo Hỗ Trợ Và Kháng Cự Hướng Dẫn Cao CấpDocument15 pagesChiến Lược Giao Dịch Theo Hỗ Trợ Và Kháng Cự Hướng Dẫn Cao CấpHub Kiếm TiềnNo ratings yet

- The Technical IndicatorsDocument37 pagesThe Technical IndicatorsNguyen Thuy LoanNo ratings yet

- PHÂN TÍCH KĨ THUẬT TRONG ĐẦU TƯDocument22 pagesPHÂN TÍCH KĨ THUẬT TRONG ĐẦU TƯPhương ĐỗNo ratings yet

- Bài 8-Bollingger Band, RSI, MFI, Chỉ Báo Sơm Và Chỉ Báo MuộnDocument29 pagesBài 8-Bollingger Band, RSI, MFI, Chỉ Báo Sơm Và Chỉ Báo Muộnquochien.a3No ratings yet

- B8 - Ichimoku KinkouDocument4 pagesB8 - Ichimoku KinkouVinhQuangNo ratings yet