Professional Documents

Culture Documents

Ashish Banjit5

Uploaded by

api-2570821100 ratings0% found this document useful (0 votes)

11 views1 pageAshish's income is A$81,852 which he earns from teaching at redlands, however a certain amount of this money goes to tax. According to the PAYG income tax rates 2012 - 2013, A$17, 547 is taxed from his income. Ashish also gives 37c to each A$1 over A$80,000, giving a total of A$18,232 or 29% of he's income being taxed.

Original Description:

Original Title

ashish banjit5

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAshish's income is A$81,852 which he earns from teaching at redlands, however a certain amount of this money goes to tax. According to the PAYG income tax rates 2012 - 2013, A$17, 547 is taxed from his income. Ashish also gives 37c to each A$1 over A$80,000, giving a total of A$18,232 or 29% of he's income being taxed.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageAshish Banjit5

Uploaded by

api-257082110Ashish's income is A$81,852 which he earns from teaching at redlands, however a certain amount of this money goes to tax. According to the PAYG income tax rates 2012 - 2013, A$17, 547 is taxed from his income. Ashish also gives 37c to each A$1 over A$80,000, giving a total of A$18,232 or 29% of he's income being taxed.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Ashish Banjit

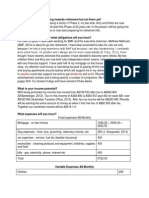

Ashishs income is A$81,852 (Department of Education, 2015) which

he earns from teaching at Redlands, however he doesnt keep all

this many, a certain amount of this money goes to tax (the part of

our income taken by the government to pay for collective goods and

services). The personal income tax is money taxed by the

government from how much you earn. Because Ashish earns

A$81,852, according to the PAYG income tax rates 2012 2013,

A$17, 547 is taxed from his income because he earns between

A$80,000 and A$180,000.

Ashish also gives 37c to each A$1 over A$80,000, giving a total of

A$18,232 or 29% of hes income being taxed (ASIC, 2014).

Australian taxpayers pay 2.0 percent of their taxable income, in

order to have access to heath care, this tax is called Medicare levy.

Ashish pays a Medicare levy of A$1,637 (ASIC, 2014). In total 37% of

Ashishs income is taxed leaving him with A$61,983 after tax.

When Ashish started working for Redlands, he was asked for his Tax

File Number (TFN). Tax file numbers are used to pay taxes and are

required to lodge your annual tax return. At the end of the financial

year 30 June, individuals lodge an annual tax return to ATO

providing information on income and liabilities and can claim any

deductions or offsets.

As a teacher, Ashish has many work-related expenses that they can

claim such as; motor vehicle, self-education, Clothing related to

work, and electronics; phone, computer, computer software and

educational aid (Australian Taxation Office, 2014). Ashish has

lodged his tax return online and so will have to wait 12 business

days to receive his return (Australian Taxation Office, 2014)

You might also like

- Shreha Shah (Ba LLB Vii)Document7 pagesShreha Shah (Ba LLB Vii)Shreha VlogsNo ratings yet

- MATH PROJECT TOPIC 2 (Income Tax)Document7 pagesMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- Indian Tax Structure ExplainedDocument7 pagesIndian Tax Structure ExplainedHarshita MarmatNo ratings yet

- Judd Mahalo5Document1 pageJudd Mahalo5api-257082110No ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Document5 pagesTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgNo ratings yet

- Various Sections For Tax SavingsDocument3 pagesVarious Sections For Tax SavingsJayakrishnan MarangattNo ratings yet

- Payroll Deductions ExplainedDocument11 pagesPayroll Deductions ExplainedheenimNo ratings yet

- Aish Tipsheet Employment IncomeDocument2 pagesAish Tipsheet Employment IncomePhilip CherianNo ratings yet

- Hrconnect Total CompDocument2 pagesHrconnect Total CompFatima SaeedNo ratings yet

- HSA GuideDocument4 pagesHSA GuideTininNo ratings yet

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerDocument21 pagesTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerNo ratings yet

- Advanced Taxation CH - 1Document9 pagesAdvanced Taxation CH - 1Mekuriaw MezgebuNo ratings yet

- Tax Slab RatesDocument12 pagesTax Slab RatesTony JosephNo ratings yet

- Sample tax calculation questionsDocument2 pagesSample tax calculation questionsPeper12345No ratings yet

- Details of Investment Declaration For The Financial Year 2014-2015Document1 pageDetails of Investment Declaration For The Financial Year 2014-2015Abhinav AgnihotriNo ratings yet

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocument19 pagesIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharNo ratings yet

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- Taxation Flow PresentationDocument73 pagesTaxation Flow PresentationMohan ChoudharyNo ratings yet

- Tax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreDocument5 pagesTax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreAjay MagarNo ratings yet

- Kate Upton5Document1 pageKate Upton5api-257082110No ratings yet

- Tax ExemptionDocument3 pagesTax ExemptionShubhangi Dhawale0% (1)

- Taxation LawDocument67 pagesTaxation LawAdv Sheetal SaylekarNo ratings yet

- Individual Taxation (Ay 2019-20)Document29 pagesIndividual Taxation (Ay 2019-20)Mudit SinghNo ratings yet

- Indian Income Tax deductions explained: Sections 80C, 80D, 80DD, 80E, 80GG and 80GDocument4 pagesIndian Income Tax deductions explained: Sections 80C, 80D, 80DD, 80E, 80GG and 80GDivyanshu ShekharNo ratings yet

- Guideline On ITDocument19 pagesGuideline On ITmikekikNo ratings yet

- Income Tax Consultants in HyderabadDocument51 pagesIncome Tax Consultants in Hyderabadav consaltansNo ratings yet

- Basics of Employee Provident FundDocument9 pagesBasics of Employee Provident FundVarsha Murhe NagpureNo ratings yet

- Tax Relief Program ExplainedDocument17 pagesTax Relief Program ExplainedJo LouiseNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- Income Tax Basics & DeductionsDocument16 pagesIncome Tax Basics & DeductionsAbhishek BaliarsinghNo ratings yet

- Individual Income Tax Formula ExplainedDocument2 pagesIndividual Income Tax Formula ExplainedHenry ZhuNo ratings yet

- Income Tax Rules ExplainedDocument59 pagesIncome Tax Rules ExplainedKuldeep SinghNo ratings yet

- CHAPTERDocument20 pagesCHAPTERsanchitNo ratings yet

- Employee Health Assistance FundDocument6 pagesEmployee Health Assistance Fundkatiejones26No ratings yet

- (Q2) BS MATH Mod 3Document3 pages(Q2) BS MATH Mod 3Duhreen Kate CastroNo ratings yet

- Taxation ProjectDocument23 pagesTaxation ProjectAkshata MasurkarNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Nursing Home Residents and Stimulus ChecksDocument2 pagesNursing Home Residents and Stimulus ChecksDavid BlevingsNo ratings yet

- Basics of EPF, EPS and EDLISDocument53 pagesBasics of EPF, EPS and EDLISAnjaneyulu ReddyNo ratings yet

- Individual Txation FY 2019 20 With Demo of Return FilingDocument73 pagesIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PNo ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- The Financial Kaleidoscope - Feb 2021 (Eng)Document9 pagesThe Financial Kaleidoscope - Feb 2021 (Eng)MdNo ratings yet

- Tabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Document3 pagesTabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Benjamin PangNo ratings yet

- Tax Bracket List (WorkingCopy)Document2 pagesTax Bracket List (WorkingCopy)Riyan AnggraeniNo ratings yet

- Kashia Epa 2018-19Document1 pageKashia Epa 2018-19api-249595469No ratings yet

- Employees Tax - Pay As You Earn (PAYE) SystemDocument2 pagesEmployees Tax - Pay As You Earn (PAYE) SystembelindaNo ratings yet

- Employees' Provident Funds & Misc. Provisions Act. 1952Document21 pagesEmployees' Provident Funds & Misc. Provisions Act. 1952Harshit Kumar SinghNo ratings yet

- Employee Providend FundDocument13 pagesEmployee Providend FundshitalzeleNo ratings yet

- 2013 Tax RatesDocument4 pages2013 Tax Ratesapi-241405153No ratings yet

- Benefits To Salary Employees in Lieu of Budget 2018Document16 pagesBenefits To Salary Employees in Lieu of Budget 2018Rashi GuptaNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- 80GDocument4 pages80GmahamayaviNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- Hannahjune 6Document1 pageHannahjune 6api-257082110No ratings yet

- RflectDocument4 pagesRflectapi-257082110No ratings yet

- BibliographyDocument6 pagesBibliographyapi-257082110No ratings yet

- Judd Mahalo6Document1 pageJudd Mahalo6api-257082110No ratings yet

- Hannahjune 4Document1 pageHannahjune 4api-257082110No ratings yet

- Judd Mahalo3Document1 pageJudd Mahalo3api-257082110No ratings yet

- Hannahjune 2Document1 pageHannahjune 2api-257082110No ratings yet

- Hannahjune 5Document1 pageHannahjune 5api-257082110No ratings yet

- Judd Mahalo2Document1 pageJudd Mahalo2api-257082110No ratings yet

- Hannahjune 3Document1 pageHannahjune 3api-257082110No ratings yet

- Juddmahalo 1Document1 pageJuddmahalo 1api-257082110No ratings yet

- Ashish Banjit3Document1 pageAshish Banjit3api-257082110No ratings yet

- Kate Upton6Document1 pageKate Upton6api-257082110No ratings yet

- Judd Mahalo4Document1 pageJudd Mahalo4api-257082110No ratings yet

- Kate Upton4Document1 pageKate Upton4api-257082110No ratings yet

- Kate Upton5Document1 pageKate Upton5api-257082110No ratings yet

- Ashish Banjit4Document1 pageAshish Banjit4api-257082110No ratings yet

- Kate Upton1Document1 pageKate Upton1api-257082110No ratings yet

- Kate Upton2Document1 pageKate Upton2api-257082110No ratings yet

- Phase 4Document3 pagesPhase 4api-257082110No ratings yet

- Ashish Banjit2Document1 pageAshish Banjit2api-257082110No ratings yet

- Ashish Banjit6Document1 pageAshish Banjit6api-257082110No ratings yet

- Kate Upton3Document1 pageKate Upton3api-257082110No ratings yet

- Ashish Banjit1Document2 pagesAshish Banjit1api-257082110No ratings yet

- Phase 3Document3 pagesPhase 3api-257082110No ratings yet

- Phase 2Document3 pagesPhase 2api-257082110No ratings yet

- Phase 1Document3 pagesPhase 1api-257082110No ratings yet

- Phase 5Document2 pagesPhase 5api-257082110No ratings yet